Transfection Technologies Market Size, Share, Trends and Forecast by Product Type, Application, Transfection Method, Technology, End-User, and Region, 2025-2033

Transfection Technologies Market Size and Share:

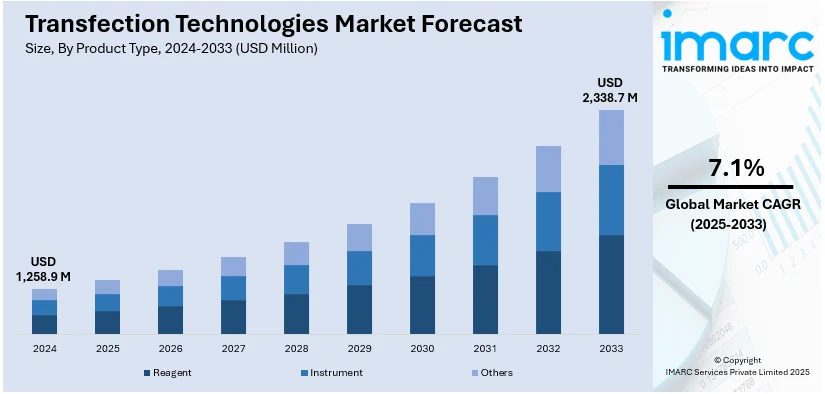

The global transfection technologies market size was valued at USD 1,258.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,338.7 Million by 2033, exhibiting a CAGR of 7.1% from 2025-2033. North America currently dominates the market, holding a market share of 39.3% in 2024. The transfection technologies market share is growing because of strong research infrastructure, high healthcare spending, widespread adoption of advanced genomic tools, significant biotech and pharma presence, and supportive government funding for genetic research and drug discovery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,258.9 Million |

|

Market Forecast in 2033

|

USD 2,338.7 Million |

| Market Growth Rate 2025-2033 | 7.1% |

Continuous progress in gene therapy and regenerative medicine is driving the need for effective and scalable transfection techniques. Transfection plays a crucial role in delivering genetic material into cells in therapeutic development, particularly in chimeric antigen receptor (CAR)-T cell therapies and stem cell engineering. Additionally, the advancement of biologics, monoclonal antibodies, and nucleic acid-based vaccines, which significantly depends on transfection technologies for protein expression and cell line development, is fueling the market growth. Furthermore, collaborations among academic institutions, contract research organizations (CROs), and biotech companies are enhancing research productivity. Numerous firms delegate molecular biology functions to expert suppliers, broadening the global reach of transfection technology providers.

The United States plays a vital role in the market, fueled by significant investments in life sciences research that necessitate sophisticated transfection technologies, as labs aim for accurate tools for gene editing and data verification. In 2024, the Howard Hughes Medical Institute (HHMI) revealed AI@HHMI, a $500 million initiative over 10 years designed to incorporate artificial intelligence into life sciences research. Based at the Janelia Research Campus, the initiative utilized an “AI-in-the-Loop” strategy to speed up discoveries among over 300 connected laboratories. Besides this, US-based companies are at the forefront of developing novel non-viral transfection technologies, including electroporation systems, nanoparticle-based delivery, and advanced lipid formulations. These innovations are rapidly commercialized and adopted in academic, industrial, and clinical labs, expanding the domestic market.

Transfection Technologies Market Trends:

Rising Cases of Cancer

The increasing prevalence of cancer globally is notably heightening the need for transfection technologies, especially in cancer biology studies, gene therapy, and tailored oncology approaches. As reported by the World Health Organization (WHO), there were 20 million new cancer cases worldwide in 2022. This figure is projected to grow to 35 million by 2050, indicating a 77% rise. This concerning increase in cancer cases is encouraging extensive investigation into molecular processes, genetic predispositions, and innovative treatment strategies. Transfection technologies play a crucial role in these initiatives, enabling the accurate insertion of nucleic acids into cancer cells to investigate gene function, identify drug targets, or administer therapeutic agents. Scientists are employing both transient and stable transfection techniques to create tumor models, discover oncogenes, and evaluate small interfering ribonucleic acid (siRNA) or clustered regularly interspaced short palindromic repeats (CRISPR)-based treatments. The growing number of cancer cases is driving the need for ex vivo gene-modified cell therapies, like CAR-T cell treatments, that depend on highly effective transfection platforms. As healthcare systems and pharmaceutical firms face demands for innovative and more efficient cancer therapies, transfection tools that enhance preclinical discovery and facilitate therapeutic development are experiencing significant adoption, positioning oncology as a major catalyst for market expansion. As part of the broader transfection technologies market analysis, oncology remains one of the most influential and high-growth application areas driving innovation and investment.

Rapid Expansion of Cell Therapy

The rapid expansion of the worldwide cell therapy market is influencing the need for sophisticated transfection technologies. According to a report from the IMARC Group, the worldwide cell therapy market size hit USD 15.68 Billion in 2024 and is projected to expand at a CAGR of 14.51% from 2025 to 2033. Cell therapies depend significantly on gene modification methods to improve cell behavior, functionality, and therapeutic results, with transfection being a crucial step in this procedure. Successful transfection is crucial for therapeutic effectiveness, whether it involves modifying T cells in CAR-T therapy, engineering stem cells for tissue regeneration, or altering immune cells to enhance disease targeting. This expanding market demands more efficient, scalable, and secure gene delivery techniques, particularly for challenging-to-transfect primary cells. Techniques that are non-viral, such as electroporation and lipid-based transfection, are becoming popular because they can manage large-scale modifications while reducing cytotoxic effects. Biotech firms and research entities focused on creating autologous and allogeneic cell therapies are investing in advanced transfection systems to enhance clinical-grade cell processing. With the rise in regulatory approvals and the introduction of new treatment protocols, the expanding presence of cell therapy is emerging as a key factor shaping the transfection technologies market outlook, highlighting its role in advancing gene-modified therapies and accelerating clinical adoption.

Transfection Technologies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transfection technologies market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, transfection method, technology, and end-user.

Analysis by Product Type:

- Reagent

- Instrument

- Others

Reagent dominates the market, holding 51.5% market share because of their extensive usage, simplicity of application, and compatibility with various cell types and experimental protocols. These chemical or lipid-based formulations are created for effective nucleic acid delivery with limited equipment needs, rendering them a suitable option for both standard and intricate experiments. Reagents provide versatility for high-throughput screening, gene expression research, and cell line development, and are favored in research settings where rapid setup and consistency are crucial. Their formulation undergoes continuous optimization to boost transfection efficiency and minimize cytotoxicity, making them more attractive for sensitive and primary cells. Additionally, reagents can be obtained in scalable formats appropriate for both small academic research and larger industrial applications. The convenient and versatile characteristics of transfection reagents enhance their high demand, playing a key role in their dominance in the market segment.

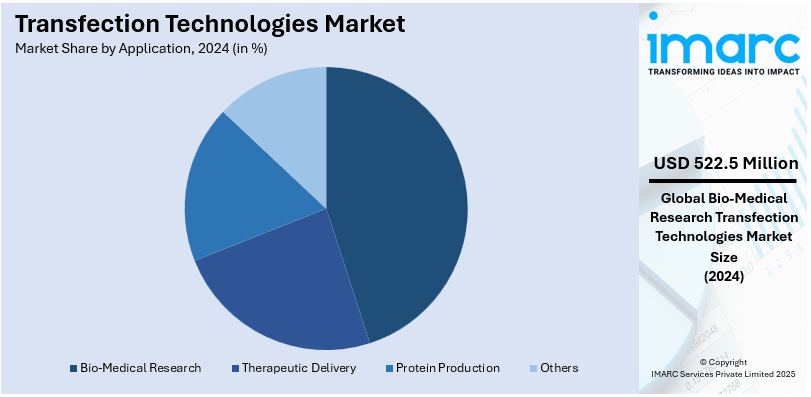

Analysis by Application:

- Therapeutic Delivery

- Bio-Medical Research

- Protein Production

- Others

Bio-medical research stands as the largest component in 2024, holding 41.5% of the market. It leads the market because of its essential role in clarifying cellular mechanisms, gene functions, and disease pathways. Transfection techniques are essential in molecular biology research, enabling scientists to alter gene expression and investigate protein interactions in both healthy and diseased cells. This is essential for identifying possible drug targets, confirming biomarkers, and creating new therapeutic approaches. The increasing focus on functional genomics, gene regulation research, and CRISPR-based genome editing is driving the need for effective transfection tools in research laboratories. Educational institutions, research entities, and drug companies regularly depend on transfection methods for preclinical research and validation experiments. The growing range of biomedical research in fields like cancer, neurodegenerative diseases, metabolic disorders, and rare genetic conditions persists in creating a demand for efficient, dependable transfection systems.

Analysis by Transfection Method:

- Lipofection

- Eletroporation

- Nucleofection

- Cotransfection

- Cationic Lipid Transfection

- In-Vivo Transfection

- Others

Eletroporation represents the largest segment, accounting 20.9% of market share, driven by its exceptional effectiveness in introducing nucleic acids into various cell types, encompassing challenging primary and stem cells. This method forms temporary openings in cell membranes through electrical pulses, allowing for accurate and controlled absorption of deoxyribonucleic acid (DNA), RNA, or other substances without depending on chemical agents or viral carriers. Its adaptability for both in vitro and in vivo uses make it exceptionally versatile in research and therapeutic contexts. Electroporation is especially preferred in gene editing, cell therapy, and vaccine development because it can attain high transfection rates with low cytotoxicity when properly optimized. Furthermore, the approach enables reproducibility and scalability, both of which are crucial in laboratory research and clinical-level manufacturing settings. Ongoing enhancements in device design and tailored protocols promote its extensive use.

Analysis by Technology:

- Physical Transfection

- Biochemical Based Transfection

- Viral-Vector Based Transfection

Biochemical based transfection leads the market with 53.5% of market share in 2024, because of its wide-ranging applicability, simplicity, and compatibility with different cell types and experimental configurations. This approach usually employs lipid-based agents, polymers, or calcium phosphate to assist in transporting genetic material into cells. These reagents are readily accessible, economical, and can be seamlessly integrated into standard lab procedures without the need for specialized tools. Scientists prefer biochemical techniques owing to their scalability and flexibility in handling both adherent and suspension cells, which makes them ideal for a variety of applications, ranging from fundamental gene expression research to high-throughput screening and the production of therapeutic proteins. Ongoing advancements in reagent formulations are improving transfection efficiency and lowered cytotoxic effects, further promoting their widespread use. The capability to tailor these techniques for particular cell lines or nucleic acid types is establishing biochemical transfection as a preferred option for academic, clinical, and industrial research within the global life sciences field

Analysis by End-User:

- Research Centers and Academic Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

Research centers and academic institutes conduct extensive studies in gene expression, functional genomics, cell signaling, and disease modeling, all of which require precise and efficient gene delivery methods. Transfection tools are widely used in laboratory experiments for analyzing gene function, creating transgenic models, and supporting molecular biology education. The continuous flow of research grants and collaborations with biotech companies further drives the use of transfection reagents, instruments, and kits in these settings.

Hospitals and clinics represent a vital segment, particularly with the rising clinical applications of gene therapy, immunotherapy, and personalized medicine. Transfection technologies support ex vivo gene modification in cell therapies and are used in translational research that bridges laboratory findings with patient care. Clinical labs within hospitals may also rely on transfection for biomarker validation and functional diagnostics.

Pharmaceutical and biotechnology companies are major users of transfection technologies due to their application in drug discovery, development, and production. These companies utilize transfection tools for high-throughput screening, protein production, assay development, and creation of stable cell lines. Efficient gene delivery methods are essential for testing drug interactions at the cellular level and engineering therapeutic proteins or monoclonal antibodies.

Others include CROs, diagnostic labs, and governmental or nonprofit research bodies. CROs use transfection methods to support outsourced drug development and testing services for sponsors in pharma and biotech. Diagnostic labs may apply transfection in the development and validation of molecular diagnostics. Government labs and nonprofit organizations often use these technologies in public health research, vaccine development, or agricultural biotechnology.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held for the largest market share of 39.3% attributed to its strong foundation in biomedical and genetic research, bolstered by significant public and private funding. The area hosts numerous prominent biotechnology and pharmaceutical firms that are engaged in the active development of cutting-edge gene therapies, biologics, and personalized medicines, all of which significantly depend on effective transfection methods. Educational institutions and research entities play a vital role in innovation through their advanced research in genomics and cell biology. According to IMARC Group, the size of the genomics market in the United States attained USD 13.1 Billion in 2024. Besides this, the availability of expert professionals, robust regulatory structures, and sophisticated laboratory facilities facilitates the swift advancement and implementation of innovative transfection methods. Government efforts encouraging precision medicine and genomics research persist in driving the need for dependable and scalable transfection technologies. Moreover, the heightened focus on cancer research, stem cell treatments, and vaccine creation is resulting in a greater application of transfection tools in preclinical and clinical research.

Key Regional Takeaways:

United States Transfection Technologies Market Analysis

In North America, the market portion held by the United States was 89.10%, driven by the rapid advancements in personalized medicine and the growing need for targeted therapies. With increasing recognition of the potential of gene therapies, transfection technologies are becoming essential tools for delivering therapeutic genetic material into cells with high precision. According to the IMARC Group, the United States gene therapy market is forecasted to reach USD 3,697.8 Million by 2033, growing at a CAGR of 12.1% from 2025-2033. Moreover, the rise of viral and non-viral delivery methods, such as lipid nanoparticles, electroporation, and polyplexes, is expanding the capabilities of gene editing, driving the adoption of transfection technologies. Additionally, the rise in research focusing on cell-based therapies and tissue engineering are catalyzing the demand for transfection methods to modify cells for clinical applications. Furthermore, the growing number of biotech startups and collaborations within the life sciences industry is propelling innovations in transfection technologies as they strive to create more efficient and safer gene delivery systems. These trends, coupled with recent developments in gene editing platforms and delivery systems, are reinforcing the leadership position of US in the transfection technologies market.

Europe Transfection Technologies Market Analysis

The market in Europe is growing, fueled by the rising focus on personalized medicine, advancements in gene therapy, and increasing research in regenerative medicine. As personalized medicine becomes more prevalent, the demand for efficient gene delivery systems is growing, as transfection technologies play a vital role in the development of tailored treatments. The rise of gene therapies for genetic disorders, cancers, and infectious diseases is also significantly boosting the need for advanced transfection techniques. Moreover, the strong pharmaceutical and biotechnology sectors in Europe are investing heavily in cell-based therapies, which require efficient genetic modifications of cells, further fueling the adoption of transfection technologies. Reports indicate that the production of pharmaceutical products reached a peak of €44 billion, underscoring the strong pharmaceutical industry in the area. In addition to this, regulatory frameworks such as the EU’s approval of gene therapies are also creating a favorable environment for market growth, encouraging biopharmaceutical companies to adopt cutting-edge transfection technologies for clinical and research applications. Furthermore, the increasing focus of Europe on stem cell research and tissue engineering is leading to greater need for tools that can efficiently deliver genes into a variety of cell types, supporting overall industry expansion. These trends are broadening the transfection technologies market scope across Europe, especially in clinical translation, therapeutic development, and advanced research domains.

Asia Pacific Transfection Technologies Market Analysis

The Asia Pacific market is expanding due to the rapid growth of the biotechnology and pharmaceutical sectors, increasing demand for gene therapies, and a rise in research and development (R&D) activities. Reports indicate that by 2050, Southeast Asia is expected to see 2.03 million new cancer cases each year, reflecting an 89.2% rise in men and a 65.6% rise in women compared to 2022. As countries such as China, Japan, and India expand their healthcare infrastructure, there is a greater focus on developing innovative treatments, such as gene-based therapies for cancer, genetic disorders, and viral infections, which rely heavily on efficient transfection methods. For example, according to the Press Information Bureau, in FY24, overall spending on healthcare in India rose to 1.9% of the nation’s GDP, expanding at a CAGR of 15.8%. Additionally, the adoption of non-viral transfection methods, such as lipid nanoparticles and electroporation, is increasing because of their lower immunogenicity and higher safety profiles. Growing investments from both government and private sectors, along with collaborations between academic institutions and biopharmaceutical companies, are further contributing to market expansion. Among the transfection technologies market key takeaways for Asia Pacific is the region’s accelerating shift toward gene-based therapies, supported by surging healthcare investment and a strong focus on local biopharma innovation.

Latin America Transfection Technologies Market Analysis

The Latin America market is driven by the increasing prevalence of chronic diseases and the need for more effective treatments, which is driving the demand for gene therapies. As the region experiences significant growth in its healthcare and biotechnology sectors, there is a higher focus on innovative approaches for disease treatment and prevention. For example, Brazil allocates 9.47% of its GDP to healthcare, amounting to USD 161 Billion, which establishes the nation as the largest healthcare market in Latin America, according to the International Trade Administration (ITA). Furthermore, the adoption of personalized medicine and the growing emphasis on targeted therapies are creating new opportunities for transfection technologies in drug development. Additionally, the expansion of contract research organizations (CROs) and clinical trial activities in Latin America is fostering the development and application of transfection technologies for various therapeutic and research applications.

Middle East and Africa Transfection Technologies Market Analysis

The market in the Middle East and Africa region is majorly propelled by increasing investments in healthcare infrastructure, particularly in countries such as the UAE, Saudi Arabia, and South Africa, which are focused on advancing their biotechnology sectors. Moreover, the growing focus on precision medicine and personalized healthcare in the region is leading to greater need for efficient gene delivery systems. Recent industry reports indicate that the precision medicine market in the Middle East is expected to expand at a CAGR of 6.96% between 2024 and 2032. Additionally, rising awareness about the importance of advanced diagnostic tools and treatments for genetic disorders and cancer is catalyzing the demand for transfection technologies. These trends reflect the evolving transfection technologies market dynamics and key market drivers across the Middle East and Africa, particularly the intersection of healthcare modernization, precision medicine, and cross-border research initiatives.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges via ongoing R&D to improve the effectiveness, safety, and precision of transfection techniques. They are engaging in strategic partnerships with academic institutions, biotech firms, and pharmaceutical companies to speed up innovation and expand application fields. Numerous individuals are also highlighting the advancement of new non-viral delivery systems to tackle the shortcomings linked to conventional techniques. Initiatives are underway to enhance manufacturing efficiency, boost scalability, and facilitate tailored solutions for gene therapy, vaccine creation, and cell-centric research. Furthermore, firms are reinforcing their global distribution systems and upgrading client support to enhance accessibility and adoption of their technologies throughout research and clinical environments. In 2024, Kytopen launched its Flowfect® Technology Access Program (TAP), offering early access to its transfection-based manufacturing system for therapeutic developers. The Flowfect® platform used electric fields and fluid flow for efficient, non-viral transfection of cells. TAP included support from an expanded applications team to help partners scale from R&D to clinical manufacturing.

The report provides a comprehensive analysis of the competitive landscape in the transfection technologies market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Altogen Biosystems

- Amsbio

- Bio-RAD Laboratories Inc.

- Lonza Group AG

- Maxcyte Inc.

- Mirus Bio LLC

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- SignaGen Laboratories

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- December 2024: CellFE, an exclusive modern non-viral, non-electroporative transfection technology, announced numerous critical system deployments with significant pharmaceutical and biotech businesses, as well as top clinical research institutes in the cell treatment sector, for its technologies. These placements come after the corporation's primary cellular engineering system, Infinity MTx, was successfully launched, and convincing proof of concept was generated in 2024, highlighting the platform's effectiveness and potential to improve the manufacture of cell therapies.

- October 2024: Opencell Technologies, a pioneer in expandable and ongoing cell transfection technologies, entered into an alliance with Adva Biotechnology, a leading provider of automated cell production solutions, to revolutionize the gene and cell therapy landscape. Through this partnership, Adva's extremely versatile ADVA X3® platform and Opencell's exclusive Softporation technology, an incredibly mild transfection method, will be combined to provide a revolutionary end-to-end production system for the swiftly evolving bioprocessing sector.

- August 2024: Leading scientific and technological corporation Merck successfully completed the acquisition deal of Mirus Bio for approximately USD 600 Million. Mirus Bio is a leading developer of transfection reagents, such as the TransIT-VirusGEN. With this acquisition, Merck's upstream portfolio is strengthened due to the inclusion of the exceptional transfection reagents from Mirus Bio, which now enables a comprehensive viral vector production option.

- July 2024: STEMCELL Technologies officially introduced the CellPore Transfection System commercially. The CellPore Transfection System is a revolutionary new technology that can advance cell engineering research and the creation of innovative cell treatments to treat illnesses.

Transfection Technologies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Reagent, Instrument, Others |

| Applications Covered | Therapeutic Delivery, Bio-Medical Research, Protein Production, Others |

| Transfection Methods Covered | Lipofection, Eletroporation, Nucleofection, Cotransfection, Cationic Lipid Transfection, In-Vivo Transfection, Others |

| Technologies Covered | Physical Transfection, Biochemical Based Transfection, Viral-Vector Based Transfection |

| End-Users Covered | Research Centers and Academic Institutes, Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Altogen Biosystems, Amsbio, Bio-RAD Laboratories Inc., Lonza Group AG, Maxcyte Inc., Mirus Bio LLC, Promega Corporation, QIAGEN N.V., Sartorius AG, SignaGen Laboratories, Takara Bio Inc., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transfection technologies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global transfection technologies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transfection technologies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The transfection technologies market was valued at USD 1,258.9 Million in 2024.

The transfection technologies market is projected to exhibit a CAGR of 7.1% during 2025-2033, reaching a value of USD 2,338.7 Million by 2033.

The transfection technologies market is driven by increasing gene therapy research, rising demand for cell-based assays, advancements in biotechnology, and expanding applications in cancer and infectious disease research. Supportive government funding, growing adoption of personalized medicine, and innovation in non-viral transfection methods further boost market growth across pharmaceutical and academic sectors.

North America currently dominates the transfection technologies market, accounting for a share of 39.3%. The dominance of the region is because of strong research infrastructure, high healthcare spending, widespread adoption of advanced genomic tools, significant biotech and pharma presence, and supportive government funding for genetic research and drug discovery.

Some of the major players in the transfection technologies market include Agilent Technologies Inc., Altogen Biosystems, Amsbio, Bio-RAD Laboratories Inc., Lonza Group AG, Maxcyte Inc., Mirus Bio LLC, Promega Corporation, QIAGEN N.V., Sartorius AG, SignaGen Laboratories, Takara Bio Inc., Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)