Transfection Reagents and Equipment Market Report by Product (Reagents, Equipment), Technology (Biochemical Based Transfection, Physical Transfection, Viral-Vector Based Transfection), Application (Biomedical Research, Protein Production, Therapeutic Delivery), End User (Pharmaceutical and Biotechnology Companies, Academics and Research Institutes), and Region 2026-2034

Market Overview:

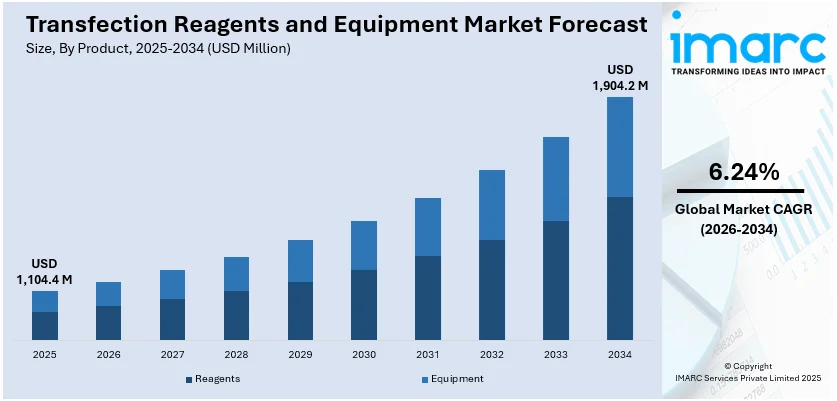

The global transfection reagents and equipment market size reached USD 1,104.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,904.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,104.4 Million |

|

Market Forecast in 2034

|

USD 1,904.2 Million |

| Market Growth Rate (2026-2034) | 6.24% |

Transfection reagents and equipment help modulate gene expression in eukaryotic cells in vitro and in vivo. They allow researchers to generate stable cell lines and introduce deoxyribonucleic acid (DNA) plasmids possessing gene inserts for expression and small interfering RNA (siRNA). They are currently being used as viable analytical tools for protein synthesis, cell growth and development, and facilitating the study of genetic functions. Besides this, as they provide cost-effective and rapid production of recombinant human therapeutic proteins in sufficient quantities, transfection reagents and equipment are also gaining traction in producing r-proteins, antibodies, and viral vectors for vaccines.

To get more information on this market Request Sample

Transfection Reagents and Equipment Market Trends:

Due to the outbreak of coronavirus disease (COVID-19) globally, governing agencies of numerous countries are focusing on accelerating the vaccination drive. However, due to the emergence of new variants, the protection and immunity that these vaccines provide are short-lived. As a result, there is a rise in the need of transfection reagents and equipment to develop innovative strategies or alternatively repurpose existing treatments to fight against virus infection. Apart from this, rapid detection of new cancer variants, coupled with the escalating demand for precision medicine and high-quality oncology care, are driving the adoption of transfection reagents and equipment in cancer research and drug development. Moreover, the emerging use of gene therapies to treat rare diseases caused by genetic problems is impelling the market growth. Furthermore, due to the growing number of fatal road accidents across the globe, there is a significant rise in the demand for tissue engineering to develop functional substitutes for damaged tissues. This, in turn, is propelling the market growth. Besides this, recent advancements in transfection technologies, along with increasing investments in pharmaceutical and biotechnology sectors, are anticipated to drive the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global transfection reagents and equipment market report, along with forecasts at the global, regional and country level from 2026-2034. Our report has categorized the market based on product, technology, application and end user.

Breakup by Product:

- Reagents

- Equipment

Breakup by Technology:

- Biochemical Based Transfection

- Physical Transfection

- Viral-Vector Based Transfection

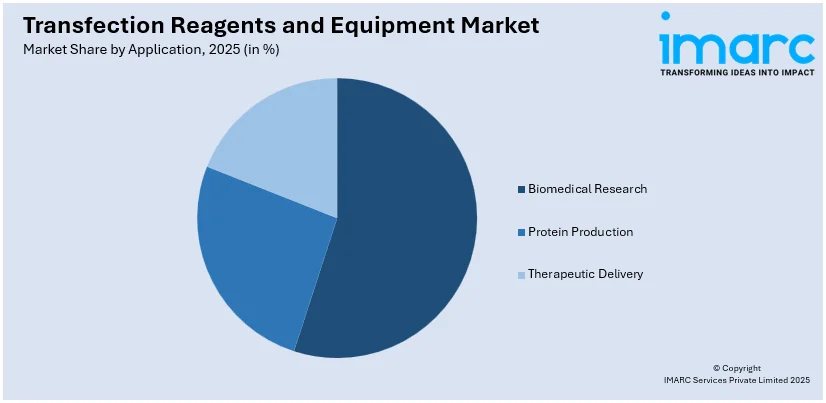

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Biomedical Research

- Protein Production

- Therapeutic Delivery

Breakup by End User:

- Pharmaceutical and Biotechnology Companies

- Academics and Research Institutes

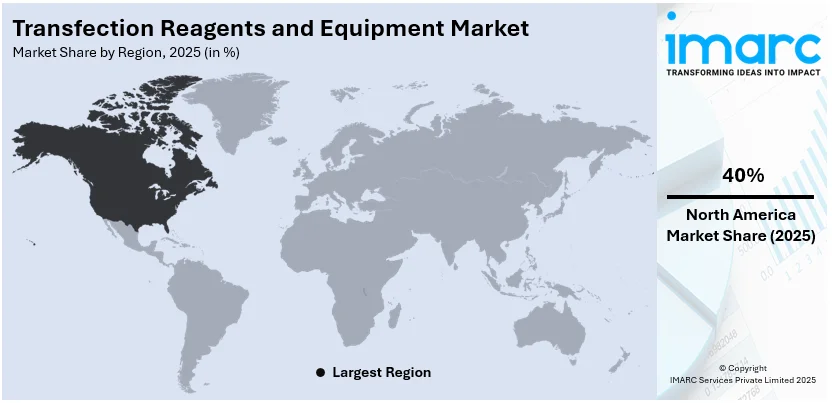

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the global transfection reagents and equipment market with detailed profiles of all major companies, including:

- Bio-Rad Laboratories, Inc

- Lonza Group AG

- MaxCyte

- Merck Life Science

- OriGene Technologies, Inc.

- Promega Corporation

- Qiagen N.V.

- Revvity, Inc.

- Sartorius AG

- SBS Genetech

- Takara Bio Inc

- Thermo Fisher Scientific Inc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product, Technology, Application, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bio-Rad Laboratories, Inc, Lonza Group AG, MaxCyte, Merck Life Science, OriGene Technologies, Inc., Promega Corporation, Qiagen N.V., Revvity, Inc., Sartorius AG, SBS Genetech, Takara Bio Inc, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global transfection reagents and equipment market was valued at USD 1,104.4 Million in 2025.

We expect the global transfection reagents and equipment market to exhibit a CAGR of 6.24% during 2026-2034.

The increasing demand for transfection reagents and equipment to produce r-proteins, antibodies, and viral vectors for vaccines is primarily driving the global transfection reagents and equipment market.

The sudden outbreak of the COVID-19 pandemic and the emergence of new variants have led to the widespread adoption of transfection reagents and equipment for accelerating the vaccination drive and protecting the immunity of individuals.

Based on the product, the global transfection reagents and equipment market has been divided into reagents and equipment, where reagents currently exhibit a clear dominance in the market.

Based on the technology, the global transfection reagents and equipment market can be categorized into biochemical based transfection, physical transfection, and viral-vector based transfection. Currently, biochemical based transfection accounts for the majority of the total market share.

Based on the application, the global transfection reagents and equipment market has been segregated into biomedical research, protein production, and therapeutic delivery. Among these, biomedical research currently holds the largest market share.

Based on the end user, the global transfection reagents and equipment market can be bifurcated into pharmaceutical and biotechnology companies and academics and research institutes. Currently, academics and research institutes exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global transfection reagents and equipment market include Bio-Rad Laboratories, Inc, Lonza Group AG, MaxCyte, Merck Life Science, OriGene Technologies, Inc., Promega Corporation, Qiagen N.V., Revvity, Inc., Sartorius AG, SBS Genetech, Takara Bio Inc, and Thermo Fisher Scientific Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)