Trade Credit Insurance Market Size, Share, Trends and Forecast by Component, Coverage, Enterprises Size, Application, Industry Vertical, and Region, 2026-2034

Trade Credit Insurance Market Size and Trends:

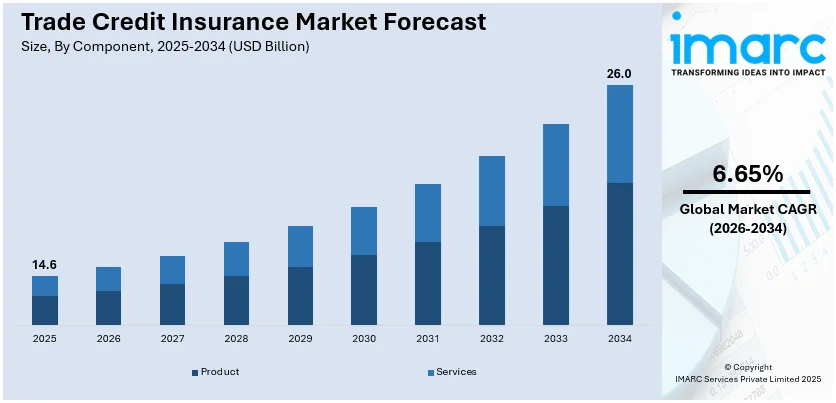

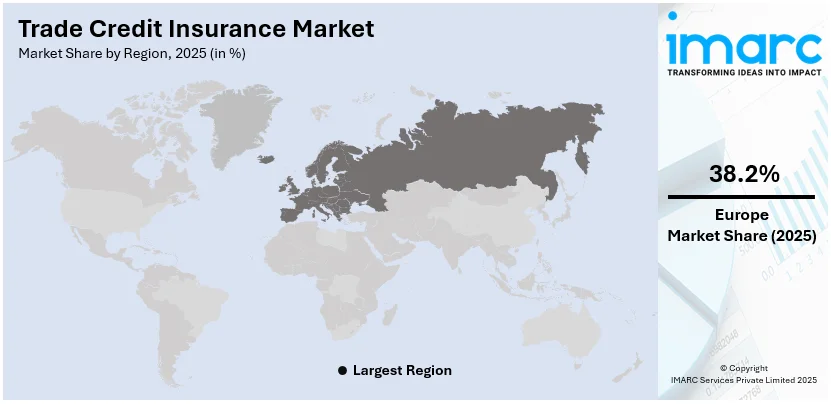

The global trade credit insurance market size was valued at USD 14.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 26.0 Billion by 2034, exhibiting a CAGR of 6.65% from 2026-2034. Europe currently dominates the market, holding a market share of over 38.2% in 2025. The trade credit insurance market share is driven by rising global trade activities, increasing awareness of risk mitigation solutions, and growing demand from SMEs for financial protection against payment defaults. Additionally, economic uncertainties and fluctuating geopolitical scenarios are prompting businesses to adopt credit insurance to safeguard receivables and maintain cash flow stability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 14.6 Billion |

|

Market Forecast in 2034

|

USD 26.0 Billion |

| Market Growth Rate 2026-2034 | 6.65% |

One of the key drivers in the trade credit insurance industry is the increasing demand for risk management as global economic uncertainties continue to rise. Companies are becoming increasingly vulnerable to payment defaults and insolvencies because of uncertain market conditions, geopolitical tensions, and volatile trade dynamics. Trade credit insurance provides a security blanket in that it guards businesses against non-payment risks, ensuring business continuity and financial stability. This is especially important for exporters and small and medium-sized enterprises (SMEs), who usually have low capital buffers. Therefore, increasing numbers of organizations are taking up credit insurance as a strategic weapon to deal with credit exposure effectively.

To get more information on this market Request Sample

In the U.S. trade credit insurance market, growth is fueled by increasing demand from businesses seeking protection against customer payment defaults amid economic fluctuations along with the 87.00% market share. Companies across sectors, particularly SMEs, are increasingly adopting trade credit insurance to protect receivables and ensure liquidity amid rising financial risks and growing domestic and international trade. This demand is being met by U.S. insurers offering flexible, tailored policies suited to diverse business needs. A key example of regulatory and institutional support is the U.S. Export-Import Bank (EXIM), which provides export credit insurance covering up to 100% of risks like currency inconvertibility, bankruptcy, and political instability. By reducing exposure to non-payment in high-risk markets, EXIM enables businesses to expand confidently. Such initiatives are reinforcing the U.S. position as a leading player in the trade credit insurance market.

Trade Credit Insurance Market Trends:

Rising Adoption Among Small and Medium Enterprises (SMEs)

A growing trend in the trade credit insurance market is the rising adoption among SMEs. Traditionally used by large corporations, credit insurance is gaining traction with smaller businesses that face higher vulnerability to payment defaults due to limited capital buffers and heavy reliance on receivables. In the euro area, trade credit accounts for €3.2 trillion of non-financial corporations’ liabilities, ranking second after loans, and 28% of SMEs cite it as a key financing source. This growing exposure underscores the need for risk mitigation. Trade credit insurance provides a financial cushion, helping SMEs maintain liquidity and secure better credit terms from lenders. Insurers are also tailoring offerings to make policies simpler and more affordable for smaller firms. As awareness spreads, SME participation is expected to reshape the customer profile of the trade credit insurance sector, driving trade credit insurance market demand.

Integration of Advanced Technologies and Data Analytics

Another significant trend is the incorporation of sophisticated technologies such as artificial intelligence (AI), machine learning, and predictive analytics in the trade credit insurance market. Such tools are revolutionizing risk analysis and underwriting activities by allowing for better credit profiling and monitoring of buyer activities in real-time. Insurers can now examine massive data sets to identify early indicators of impending defaults, provide dynamic policy modification, and enhance the efficiency of claim management. Digital platforms are also making the issuance of policies and servicing of customers more efficient, offering an enhanced end-user experience. This technological change is not just streamlining the operations but also instilling confidence and transparency between insurers and companies, thereby fostering greater adoption and competitiveness in the trade credit insurance sector.

Growing Emphasis on Global Trade Risk Mitigation

With growing global trade complexities, companies are becoming more aware of the need for hedging cross-border credit risks. Trade tensions, currency volatility, policy changes, and geopolitical tensions have increased uncertainty surrounding international transactions. Consequently, firms are actively seeking trade credit insurance as a hedge against non-payment and to maintain uninterrupted cash flow. Exporters, for one, are relying on credit insurance to venture into new and high-risk markets with more confidence. Insurers, too, are responding with specialized global coverage policies and country-by-country risk analyses. This increased focus on global trade risk reduction is broadening the scope of trade credit insurance relevance, turning it into a must-have aspect of international business strategy.

Trade Credit Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global trade credit insurance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, coverage, enterprises size, application, and industry vertical.

Analysis by Component:

- Product

- Services

The product segment holds the majority share of 68.1% in the trade credit insurance market, reflecting its critical role in driving industry growth. This dominance is attributed to the high demand for insurance products that protect businesses from non-payment risks and customer insolvencies. Companies are increasingly relying on structured credit insurance products to secure their accounts receivables and ensure consistent cash flow, especially amid economic uncertainties. These products offer comprehensive coverage and are tailored to meet varying business requirements, making them highly attractive across industries. Additionally, insurers are enhancing product offerings through customization, flexible terms, and digital integration, further strengthening market penetration. The continued preference for robust credit insurance products underscores their importance in financial risk management strategies.

Analysis by Coverages:

- Whole Turnover Coverage

- Single Buyer Coverage

According to the trade credit insurance market forecast, the whole turnover coverage represents the majority share of 76.7% in the trade credit insurance market due to its comprehensive protection and broad applicability across business sectors. This type of coverage insures a company’s entire portfolio of receivables rather than individual transactions, making it a preferred choice for businesses seeking holistic credit risk management. It offers greater efficiency, simplifies administration, and ensures protection against widespread customer defaults, which is especially valuable in volatile economic environments. Companies benefit from improved cash flow stability and enhanced credit control. The growing preference for this model is also driven by its ability to support credit management strategies and facilitate better financing terms from banks, reinforcing its dominance in the overall trade credit insurance landscape.

Analysis by Enterprises Size:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Large enterprises account for 60.8% of the trade credit insurance market share due to their higher exposure to credit risks and broader trade volumes. These organizations typically operate with extensive customer bases and complex supply chains, making them more vulnerable to payment defaults and insolvencies. As a result, they prioritize comprehensive credit insurance coverage to protect their receivables and ensure financial stability. Large firms also possess the resources to invest in tailored insurance solutions and advanced credit risk management tools. Additionally, insurers often target these clients with customized offerings and strategic support services, further driving adoption. The significant trade activities and financial stakes of large enterprises continue to reinforce their dominant position in the trade credit insurance market outlook.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Domestic

- International

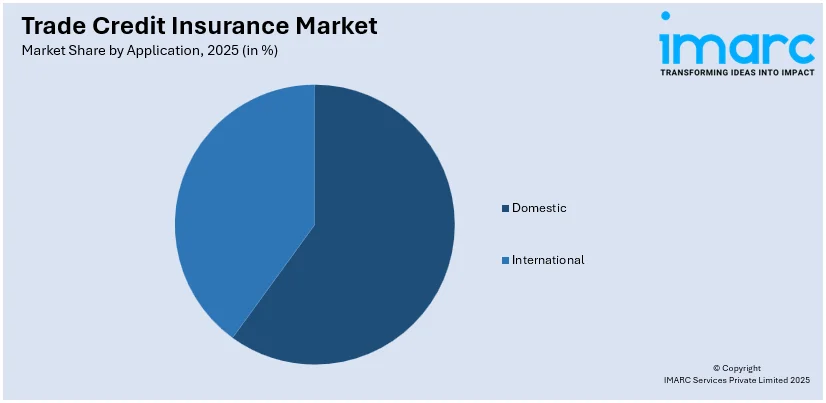

Domestic trade credit insurance accounts for the majority share of 62.2%, driven by the growing focus of businesses on securing local receivables and managing internal credit risks. Companies operating within domestic markets often face challenges such as delayed payments, customer defaults, and financial instability of buyers, prompting them to seek protection through credit insurance. Domestic policies are easier to administer and align well with national trade regulations, making them more accessible and cost-effective, especially for small and medium enterprises. Additionally, the rising number of domestic transactions and the need to maintain uninterrupted cash flow are reinforcing the demand for such coverage. This trend highlights the increasing reliance on credit insurance to ensure financial resilience within home markets.

Analysis by Industry Vertical:

- Food and Beverages

- IT and Telecom

- Metals and Mining

- Healthcare

- Energy and Utilities

- Automotive

- Others

The IT and telecom sector dominates market demand with a 20.3% share in the Trade Credit Insurance market, driven by its high volume of credit-based transactions and complex customer networks. Companies in this sector often extend credit terms to clients, making them vulnerable to delayed payments and defaults. The rapid pace of technological advancement and intense competition further elevate financial risk, prompting firms to adopt credit insurance as a safeguard. Additionally, the sector’s global reach and reliance on recurring service contracts increase exposure to payment uncertainties. Trade credit insurance helps IT and Telecom businesses secure revenue streams, maintain cash flow stability, and strengthen financial planning, fueling its leading role in market demand.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe dominates the trade credit insurance market with a 38.2% share, primarily due to its well-established export-oriented economy and strong emphasis on credit risk mitigation. Businesses across the region, from large corporations to small and medium enterprises, actively adopt credit insurance to safeguard receivables and maintain cash flow stability. The presence of advanced financial infrastructure, experienced insurers, and a favorable regulatory environment further supports widespread market penetration. Additionally, European companies frequently engage in cross-border transactions, increasing their exposure to payment risks and driving higher demand for credit insurance solutions. The region’s focus on financial security, risk management, and economic resilience continues to fuel its leadership position in the global trade credit insurance market.

Key Regional Takeaways:

North America Trade Credit Insurance Market Analysis

The North America trade credit insurance market is experiencing steady growth, driven by increasing awareness of credit risk management and the need for financial protection against customer payment defaults. Businesses across various sectors are adopting trade credit insurance to safeguard receivables, maintain liquidity, and ensure operational continuity amid economic uncertainties. The region’s robust trade activity, combined with rising insolvency risks and supply chain disruptions, has reinforced the importance of credit insurance as a strategic risk mitigation tool. Small and medium enterprises are emerging as key adopters, supported by simplified policy structures and improved accessibility. Technological advancements such as AI-driven credit assessment tools and digital platforms are enhancing underwriting efficiency and claim management processes. Furthermore, evolving regulatory frameworks and favorable economic policies are supporting market expansion. Insurers in the region are focusing on offering customized and flexible solutions to meet the diverse needs of businesses. With a mature financial ecosystem and growing emphasis on financial resilience, North America continues to be a prominent and influential market for trade credit insurance solutions.

United States Trade Credit Insurance Market Analysis

The trade credit insurance (TCI) market in the United States is expanding as businesses seek protection against financial risks, economic uncertainties, and supply chain disruptions. In line with this, rising inflationary pressures and interest rates have the heightened demand for credit protection, especially among SMEs and exporters. According to U.S. Labor Department data, the annual inflation rate in the United States reached 3% for the 12 months ending January, slightly up from the previous increase of 2.9%. The retail, manufacturing, and technology sectors are key users of TCI, securing receivables against payment defaults. Similarly, the B2B e-commerce boom is further accelerating product adoption, as digital trade requires secure transactions. Total e-commerce sales in 2024 reached USD 1,192.6 Billion, an 8.1% increase from 2023, while total retail sales grew 2.8% year-over-year, according to the Census Bureau. E-commerce accounted for 16.1% of total retail sales, up from 15.3% in 2023. Furthermore, insurers are leveraging AI-driven risk assessment tools to streamline underwriting efficiency, while government-backed export credit insurance is ensuring U.S. businesses remain globally competitive. The rise of InsurTech firms is also transforming the market, introducing digital-first solutions that render TCI policies more accessible and customizable for businesses of all sizes, reinforcing the trade credit insurance market growth.

Europe Trade Credit Insurance Market Analysis

The European trade credit insurance market is well-established, with Germany, France, and the UK leading adoption due to their export-driven economies. According to UK trade statistics from the Office for National Statistics, total exports of goods increased by EUR 2.3 Billion (7.6%) in June 2024, with exports to the EU rising by EUR 1.4 Billion (9.6%) and exports to non-EU countries growing by EUR 0.9 Billion (5.7%). This rise in cross-border trade has amplified the need for credit insurance, particularly in the automotive, energy, and industrial manufacturing sectors, where companies seek to safeguard their supply chain transactions. Additionally, ongoing geopolitical tensions and shifting trade regulations continue to pose risks, further supporting market demand. The EU’s Green Deal and sustainability policies are also influencing the market, pushing businesses toward eco-friendly operations and requiring customized insurance coverage to manage environmental risk factors. Meanwhile, digital transformation is reshaping the sector, with insurers adopting real-time risk monitoring and automated claims processing to enhance efficiency and transparency. As cross-border trade complexities increase, TCI providers are expanding multi-jurisdictional coverage, ensuring that businesses remain protected from payment risks in both EU and non-EU markets, further strengthening the region’s trade resilience.

Asia Pacific Trade Credit Insurance Market Analysis

The Asia-Pacific trade credit insurance market is experiencing significant growth, driven by increasing cross-border trade, economic uncertainties, and the need for businesses to mitigate credit risks. A recent survey indicates that 70% of Asian companies anticipate a surge in demand for trade credit insurance in the coming months, highlighting a strong commitment to addressing payment challenges arising from business-to-business (B2B) trade. Key markets, including China, Japan, India, Australia, and South Korea, are witnessing higher adoption, particularly in industries like manufacturing, retail, and financial services. The market is further supported by government initiatives, the rising use of digital platforms for underwriting and claims, and advancements in AI-driven risk assessment.

Latin America Trade Credit Insurance Market Analysis

The Latin American trade credit insurance market is growing steadily, propelled by rising exports, commodity trade, and economic reforms. Brazil, Mexico, and Argentina are seeing growing demand for credit insurance, particularly in agriculture, mining, and manufacturing, where long payment cycles heighten financial risks. Furthermore, the region’s economic volatility has made credit insurance essential for cross-border trade, especially with North America, Europe, and Asia. According to the Fintech in Latin America and the Caribbean report, the fintech ecosystem grew over 340%, from 703 companies in 18 countries in 2017 to 3,069 in 26 countries by 2023. This rise in fintech solutions is improving market accessibility, as insurers integrate digital tools for risk assessment and claim management. While high premium costs and SME awareness challenges persist, government-led trade finance initiatives are expected to accelerate market penetration in the coming years.

Middle East and Africa Trade Credit Insurance Market Analysis

The Middle East and Africa market is expanding as businesses seek protection from economic fluctuations, geopolitical risks, and currency volatility. Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are leading adoption due to diversified economies and large-scale infrastructure investments. As per an industry report, by 2024, Saudi Arabia invested SR4.9 Trillion (USD 1.3 Trillion) in infrastructure, adding over a million residential units and expanding retail and office spaces by 7 million sq. meters each. Trade credit insurance is now essential for construction, oil & gas, and international trade. In Africa, regional trade agreements like AfCFTA are driving demand for credit insurance, ensuring protection against default risks. Besides this, insurers are partnering with governments and development banks to expand SME access, while digitalization, AI, and data analytics are enhancing risk assessment and policy pricing for emerging businesses.

Competitive Landscape:

The competitive landscape of the trade credit insurance market is characterized by the presence of several well-established providers offering a wide range of products tailored to diverse business needs. Market players are focusing on enhancing underwriting capabilities, improving risk assessment models, and delivering customized solutions to retain and expand their customer base. Technological advancements, such as digital platforms and data-driven insights, are becoming key differentiators among competitors. Additionally, insurers are targeting niche segments like SMEs and exporters through simplified policies and flexible coverage terms. Strategic partnerships with financial institutions and expansion into emerging markets are further shaping competition. The market remains dynamic, with innovation, customer service, and global reach playing critical roles in defining market leadership and competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the trade credit insurance market with detailed profiles of all major companies, including:

- American International Group Inc.

- Aon plc

- Axa S.A.

- China Export & Credit Insurance Corporation

- Chubb Limited (ACE Limited)

- Coface

- Euler Hermes (Allianz SE)

- Export Development Canada

- Nexus Underwriting Management Ltd.

- QBE Insurance Group Limited

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

Latest News and Developments:

- August 2024: Brown & Brown (Europe) Limited acquired CI Group, a trade credit insurance specialist protecting EUR 6 Billion in trade turnover. CI Group’s E-Bonded platform enhances lender and SME services.

- July 2024: Brokerslink launched a Trade Credit Insurance (TCI) practice to meet rising global demand, providing brokers access to specialized expertise. Led by five regional ambassadors, the initiative supports international trade credit accounts, expands market reach, and strengthens cross-border collaboration in a USD 11 Billion+ industry growing 10-30% annually.

- June 2024: London-based InsurTech Bondaval launched its first trade credit insurance product in the UK and EU, backed by Great American International Insurance. The S&P A+ rated solution simplifies credit risk management, reducing administrative burdens for credit managers through an intelligent, user-friendly platform with automated policy guidance.

- April 2024: Arthur J. Gallagher & Co. acquired Australia-based Prasidium Credit Insurance, expanding its trade credit capabilities. The Prasidium team will join Gallagher’s Australian offices, enhancing its services across the region. Terms of the transaction were not disclosed.

- April 2024: Allianz Trade launched its next-generation trade credit insurance product in the UK & Ireland, enhancing cover, efficiency, and international growth opportunities. New features include retrospective buyer risk coverage, political risk protection, and simplified documentation.

Trade Credit Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Product, Services |

| Coverages Covered | Whole Turnover Coverage, Single Buyer Coverage |

| Enterprises Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Applications Covered | Domestic, International |

| Industry Verticals Covered | Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American International Group Inc., Aon plc, Axa S.A., China Export & Credit Insurance Corporation, Chubb Limited (ACE Limited), Coface, Euler Hermes (Allianz SE), Export Development Canada, Nexus Underwriting Management Ltd., QBE Insurance Group Limited, Willis Towers Watson Public Limited Company and Zurich Insurance Group Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the trade credit insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global trade credit insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the trade credit insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The trade credit insurance market was valued at USD 14.6 Billion in 2025.

The trade credit insurance market was valued at USD 26.0 Billion in 2034, exhibiting a CAGR of 6.65% during 2026-2034.

Key factors driving the trade credit insurance market include rising global trade activities, increasing awareness of credit risk management, and growing demand from SMEs. Additionally, economic uncertainties, geopolitical tensions, and the need to safeguard cash flow against customer defaults are prompting businesses to adopt trade credit insurance for financial protection.

Europe dominates the trade credit insurance market with a 38.2% share due to its strong export-driven economy, mature financial infrastructure, and high awareness of credit risk management. The presence of established insurers, coupled with widespread adoption among SMEs and large enterprises, further strengthens the region’s market leadership in this sector.

Some of the major players in the trade credit insurance market include American International Group Inc., Aon plc, Axa S.A., China Export & Credit Insurance Corporation, Chubb Limited (ACE Limited), Coface, Euler Hermes (Allianz SE), Export Development Canada, Nexus Underwriting Management Ltd., QBE Insurance Group Limited, Willis Towers Watson Public Limited Company and Zurich Insurance Group Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)