Traction Transformers Market Size, Share, Trends, and Forecast by Type, Rolling Stock, Mounting Position, Overhead Line Voltage, and Region, 2025-2033

Traction Transformers Market Size and Share:

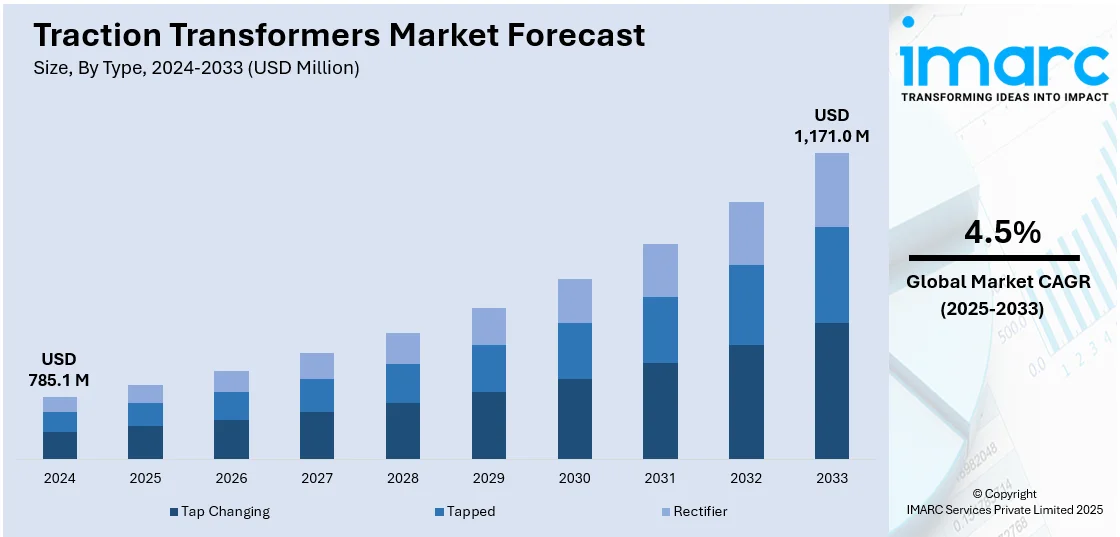

The global traction transformers market size was valued at USD 785.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,171.0 Million by 2033, exhibiting a CAGR of 4.5% from 2025-2033. Asia Pacific currently dominates the traction transformers market share in 2024. The market in the region is driven by the increasing cross-border rail connectivity, expanding electrification of freight corridors, rising government funding, and growing adoption of smart grid technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 785.1 Million |

|

Market Forecast in 2033

|

USD 1,171.0 Million |

| Market Growth Rate (2025-2033) | 4.5% |

The global traction transformer market growth is driven by the rising railway electrification projects worldwide, as the increasing demand for efficient traction transformers, supports sustainable transportation. For instance, San Bernardino, California, unveiled the Zero-Emission Multiple Unit (Zemu), North America's first hydrogen-powered, zero-emissions passenger train. This innovation underscores the growing shift toward sustainable rail solutions, necessitating advanced transformer technologies. In addition, the rapid urbanization and expansion of metro and high-speed rail networks are fueling the market demand, as they require advanced power conversion solutions. Moreover, stringent energy efficiency regulations are encouraging manufacturers to develop lightweight, high-performance transformers with minimal energy losses, providing an impetus to the market. Besides this, ongoing technological advancements in smart monitoring and predictive maintenance are improving operational efficiency and reliability, supporting the market growth. Furthermore, increased investments in sustainable rail infrastructure align with global carbon reduction goals while retrofitting aging railway systems with modern transformers is impelling the market growth.

The United States traction transformer market demand is driven by federal investments in railway modernization under infrastructure bills, which is boosting the electrification projects, and increasing demand for advanced traction transformers. For example, California has introduced two new electric commuter trains operated by Caltrain, running between San Jose and San Francisco. This development marks a significant step toward railway electrification in the U.S., contributing to the demand for specialized traction transformers. In line with this, the rising adoption of hybrid and battery-electric locomotives is creating a need for specialized transformers to enhance energy efficiency, providing an impetus to the market. Besides this, the growing focus on freight rail electrification to reduce emissions is driving transformer innovations, boosting the market demand. Furthermore, continuous technological advancements in high-voltage traction systems are improving performance in long-haul rail applications and strengthening the market share. Also, the integration of renewable energy (RE) sources into rail networks is boosting demand for adaptable traction transformers, supporting the market growth. Apart from this, the increasing private sector investments in high-speed rail projects are thereby propelling the market forward.

Traction Transformers Market Trends:

Increased Adoption by High-Net-Worth Individuals

The traction transformers market trends are being influenced by the growth of the high-speed rail sector and significant advancements in railway infrastructure. According to reports by the China State Railway Group Co., Ltd. reported that railway sector fixed-asset investment during January-November 2022 reached 711.7 Billion yuan equivalent to 99 Billion U.S. dollars which demonstrated an 11.1 percent elevation from January-November 2021. The worldwide demand for traction transformers will rise because of rapid rail network electrification. The length of electrified railway lines in EU countries increased to 115,000 kilometers (km) during 2022 while remaining 31% greater than the original 88,000 km measurement from 1990. Emerging nation governments have started implementing favorable policies to enhance their transportation facilities while optimizing rail systems. Moreover, modern and traditional locomotive manufacturers continue adopting traction transformers to support faster networks and the increasing passenger numbers and route diversity which boosts their product demand. Furthermore, the world is adopting AC transformers at an increased rate because people are now more aware of using energy-efficient products to minimize environmental problems from old technology. These transformers work independently from conventional power sources including crude oil and coal, so they provide both environmentally friendly and convenient options. As a result, the market is growing due to ongoing developments in equipment technology which reduce noise levels along with carbon footprint, power waste, and operating costs.

Shift Toward Energy-Efficient and Eco-Friendly Designs

The traction transformer market outlook is witnessing a strong shift toward energy-efficient and environmentally friendly designs. For instance, Hitachi Energy stated that its transformation business unit is struggling to keep pace with the surging demand for grid equipment, which risks delaying infrastructure projects designed to integrate renewable energy into the power grid. This supply-demand imbalance is driving market growth, as manufacturers accelerate innovation in transformer technologies to enhance efficiency and production capacity. The rising need for high-performance transformers, fueled by data center expansion and advancements in artificial intelligence, is further pushing the industry toward energy-efficient designs and advanced materials, strengthening the traction transformers market share. The transformer market experiences weight reduction and operational loss minimization through the application of advanced materials which include amorphous core metals and high-temperature superconductors. In addition to this, the marketplace is adopting dry-type transformers since these devices avoid oil insulation while delivering both environmental benefits and better security standards. Moreover, manufacturers integrate forced air and liquid cooling technologies into their designs to enhance transformer efficiency as well as service lifetime. Furthermore, governments and regulatory bodies establish demanding energy efficiency requirements for manufacturers to build solutions that minimize power wastage as part of railway network sustainability initiatives, thus impelling the market growth.

Digitalization and Smart Monitoring Integration

The adoption of digital technologies in traction transformers is revolutionizing railway electrification systems. The market displays a new trend toward smart monitoring solutions that unite IoT sensors with real-time data analytics. These technologies perform predictive maintenance through continuous transformer performance evaluation and fault detection methods that cut down operational delays. For example, ABB Electrification Service launched a digital monitoring solution for power and distribution transformers, aiming to enhance performance, reliability, and equipment availability. The sensor is designed for quick and easy installation, requiring no screws or tools. This innovation is driving market demand by enabling railway operators to streamline maintenance, reduce downtime, and extend transformer lifespan. These technologies perform predictive maintenance through continuous transformer performance evaluation and fault detection methods that cut down operational delays. The combination of cloud-based platforms and artificial intelligence (AI)-driven analytics leads to improved asset management and optimized energy usage thereby enhancing operational efficiency. Besides this, positive trends emerge in the railway industry regarding remote monitoring because operators want to reduce maintenance expenses while improving system integrity. Apart from this, the upcoming generation of traction transformers will use digitalization as a key element for efficient integration with contemporary railway systems because of advancing automation technology and smart grids, thereby driving the market forward.

Traction Transformers Industry Segmentation:

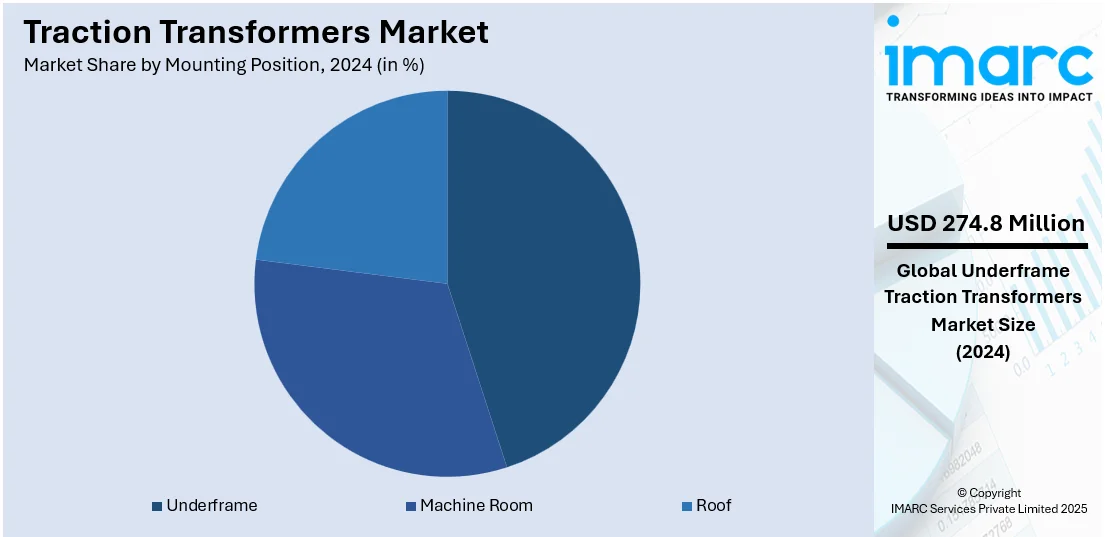

IMARC Group provides an analysis of the key trends in each segment of the global traction transformers market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, rolling stock, mounting position, and overhead line voltage.

Analysis by Type:

- Tap Changing

- Tapped

- Rectifier

Tapped traction transformers have fixed voltage taps, providing efficient power distribution for railway applications with consistent load requirements. Their simple design enhances reliability and cost-effectiveness, making them suitable for urban transit systems and conventional rail networks with relatively stable power demands. These transformers ensure stable voltage regulation, reducing energy losses and maintenance needs. These transformers exist in metro transportation networks as well as suburban rail and cargo lines that maintain steady voltage levels. The manufacturing sector focuses on transformer durability and efficiency while following strict industry requirements. Furthermore, electrified rail infrastructure development initiatives worldwide sustain a rising market for tapped traction transformers thus advancing sustainable rail transport systems.

Analysis by Rolling Stock:

- Electric Locomotives

- High-Speed Trains

- Metros

- Others

Traction transformers in electric locomotives provide efficient power conversion for freight and passenger rail operations. They ensure reliable energy transmission, supporting high-performance locomotives in long-haul and heavy-duty applications, while advancements in lightweight designs enhance efficiency and reduce operational costs. The transformers provide automatic voltage regulation which improves energy efficiency and locomotive operational efficiency. Moreover, the increasing use of electricity in railway systems results in growing demand for high-capacity traction transformers. Manufacturers work on creating durable transformers with smart monitoring systems and effective thermal management approaches for better reliability. Additionally, government investments in sustainable rail transport create conditions that favor adoption thus making electric locomotives a priority segment in traction transformers markets.

Analysis by Mounting Position:

- Underframe

- Machine Room

- Roof

Underframe-mounted traction transformers are widely used in locomotives and high-speed trains, optimizing space utilization. Their robust design ensures durability against vibrations and harsh environmental conditions. Additionally, lightweight materials and efficient cooling systems enhance performance while maintaining stability in high-speed and heavy-haul applications. The transformers help create trains with lowered center of gravity that enhance both stability and safety standards. Modern insulation systems with thermal management components make equipment more reliable and extend product lifetime. Besides this, the rising implementation of high-speed and metro rail projects leads to increased market demand for traction transformers installed on underframes. Concurrently, managers in the industry focus on developing more efficient equipment with small designs and intelligent diagnostic systems to satisfy changing railway power requirements, which is impelling the market growth.

Analysis by Overhead Line Voltage:

- Alternative Current (AC) Systems

- Direct Current (DC) Systems

In AC systems traction transformers serve to decrease high-voltage power from overhead lines for train propulsion applications. High-speed rail systems and networks that use long-distance routes depend on AC transformers to optimize energy performance as well as reduce power transmission losses. Besides this, the implementation of new insulation techniques coupled with enhanced cooling solutions enhances equipment reliability and light-weight structural enhancements boost traction efficiency and operational effectiveness. Furthermore, enhanced thermal management achievements are enabled through these ongoing technological advancements for steady operation in rail environments. As a result, the implementation of railway electrification together with technological advancements promotes the use of AC traction transformers as they improve sustainability measurements and energy efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the traction transformers market with a significant market share. The demand in this region is driven by rapid railway electrification, high-speed rail expansion, and metro system development across China, India, and Japan. Government initiatives supporting sustainable transport, increasing urbanization, and infrastructure investments further boost the market growth. For example, in the fiscal year leading up to January 2025, Indian Railways allocated more than $22 billion towards projects aimed at expanding capacity, enhancing travel speed, and improving safety. This investment is part of India's broader goal to achieve net-zero carbon emissions in railways by 2030. Moreover, strong manufacturing capabilities and continuous technological advancements in power electronics enhance efficiency and performance. Also, the rising demand for energy-efficient and lightweight traction transformers aligns with stringent environmental regulations. Furthermore, ongoing high-speed rail projects, coupled with expanding suburban rail networks, contribute to sustained market growth, making Asia Pacific the largest and fastest-growing regional market.

Key Regional Takeaways:

North America Traction Transformers Market Analysis

The North America traction transformers market is significantly growing, as investors focus their efforts on railway electrification projects and metro development as well as high-speed rail development. Modernization initiatives across U.S. and Canadian rail infrastructure work to improve efficiency and cut down emissions output. Moreover, governments enforce policies to advance sustainable transportation along with electrical infrastructure. For instance, the U.S. federal government allocated $2.4 billion in grants for 122 railroad projects across 41 states and Washington D.C. in 2024. These funds aim to enhance rail infrastructure, improve safety, and explore cleaner alternatives to diesel-powered trains. Besides this, key market participants develop advanced transformer solutions that consume less energy. Furthermore, the market demands traction transformers that combine weight reduction with high performance due to upgraded efficiency requirements. Besides this, ongoing technological developments including digital monitoring systems and predictive maintenance capabilities are also fostering the market growth. As a result, the demand for railway electrification in the region continues to rise due to the rapid urbanization and intercity rail projects, thereby propelling the market forward.

United States Traction Transformers Market Analysis

The United States observes traction transformers adoption growth because of rising railway infrastructure investment. Every year freight rail companies through the Association of American Railroads (AAR) put USD 23 Billion into developing and updating their nationwide privately-owned rail networks. New attention on railway modernization arises from government and private sector understanding that transportation efficiency increases. The upgrade of rail infrastructure requires modern equipment where traction transformers function as essential tools for improving energy efficiency and operational effectiveness. The rising investment in rail projects will drive up traction transformer demand because rail operators require more capacity along with energy-efficient solutions. This rising investment creates an advantageous circumstance for traction transformers to spread across railway networks which enables sustainable rail system operations and performance improvement.

Europe Traction Transformers Market Analysis

In Europe, the adoption of traction transformers is largely driven by the region’s commitment to reducing carbon emissions and promoting sustainable railway options. For instance, the EU established its 2030 greenhouse gas (GHG) emission reduction target at 55 % net reduction. Rail systems transform their power systems to greener and more energy-efficient options due to increasing environmental concerns. The rising trend toward electric trains depends on traction transformers because they establish vital infrastructure to operate electric trains and reduce environmental impact. The drive for sustainable transportation solutions has led various countries to invest heavily in green rail technology, advanced traction systems, and electric train infrastructure. The market trend motivates the quick adoption of traction transformers because these power devices lower rail network carbon emissions while enhancing environmental performance.

Asia Pacific Traction Transformers Market Analysis

The Asia-Pacific region is rapidly adopting traction transformers because rail networks are undergoing electric conversion. According to reports, rail electrification in India expanded to 40,000km from 2014 to the present but previously maintained only 21,801km between 2014 and all prior years. The railway network stands at a 94% electrification rate as of January 1st, 2024. The environmental sustainability initiatives of regional countries make electrical train systems necessary to reduce emissions and enhance energy efficiency. Also, traction transformers maintain vital roles in rail electrification systems because they perform the vital task of transforming electrical power to match the requirements for train operations. The rising investment in electrification projects will boost the market demand for advanced traction transformers. Furthermore, the implementation of electrified rail networks acts as a primary factor behind increasing traction transformer adoption across Asia-Pacific while helping the region achieve sustainability targets.

Latin America Traction Transformers Market Analysis

The rising number of passengers throughout Latin America has accelerated the market adoption of traction transformers. As of 2021, the railway passenger activity across two countries reached 602 Million times kilometers while Chile achieved 738 Million and Mexico reached 466 Million. Rail networks require expansion to handle population growth which brings about an escalating need for more efficient high-capacity train systems. Traction transformers act as essential elements that maintain reliable and efficient operation of electrical systems that power trains. Besides this, the growing railway passenger demand requires rail infrastructure improvement and traction transformers serve as essential components to supply energy for expanded networks. As a result, the increasing number of passengers drives Latin America toward traction transformer adoption which enhances power system reliability and operational capacity.

Middle East and Africa Traction Transformers Market Analysis

The increasing railway network development across the Middle East and Africa region drives regional adoption of traction transformers. The rail expansion plan of Saudi Arabia under Vision 2030 outlines the development of thousands of kilometers of new rail lines to create a larger network of 5,500 km. Additionally, the region is highly investing in updated transport infrastructure which makes railway systems central to its development strategy. Rail network expansion needs effective power distribution systems that rely on traction transformers to maintain reliable train operations. The expanding Middle East and African markets for sustainable transportation systems drive the requirement for advanced traction transformers. Furthermore, rail infrastructure expansion serves as a primary reason behind the rising traction transformer adoption in the Middle East and Africa region as it advances regional infrastructure development initiatives.

Competitive Landscape:

The traction transformer market is experiencing heightened competition due to the growing electrification of rail networks and advancements in energy-efficient technologies. Market players are focusing on developing lightweight, high-performance transformers with eco-friendly insulation materials to improve efficiency. Strategic partnerships, mergers, and acquisitions are shaping the industry, with companies investing in smart grid integration and digital monitoring solutions. The shift toward sustainable rail transport is driving innovation in alternative cooling techniques and higher voltage capabilities. Additionally, the demand for retrofitting aging railway infrastructure with advanced traction transformers is creating new growth opportunities. Regional manufacturers are also expanding their presence to compete with established global players, further intensifying market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the traction transformers market with detailed profiles of all major companies, including:

- ABB Limited

- Alstom Holdings

- EMCO Limited

- Hind Rectifiers Limited

- International Electric Corporation Limited

- JST Transformateurs

- Schneider Electric SA

- Setrans Holding AS

- Siemens Aktiengesellschaft

- Wilson Transformer Company

Latest News and Developments:

- January 2025: Hitachi Energy will supply 360 RESIBLOC Rail traction transformers to Siemens Mobility for Munich’s new S-Bahn trains. The transformers will improve energy efficiency, enhance safety, and reduce environmental impact. This collaboration aims to boost service capacity, sustainability, and passenger comfort.

- January 2025: Alstom has secured approximately USD 155.52 Million contract to supply traction components and maintenance services for 17 Vande Bharat Sleeper trainsets in India. The components will be engineered and manufactured at Alstom’s Indian sites, with maintenance services provided at railway depots across the country. This initiative aligns with India’s Make-in-India and Atmanirbhar Bharat visions.

- September 2024: Hitachi Energy is showcasing its advanced transformer solutions at InnoTrans 2024 in Berlin, highlighting Scott-connected and V-connected transformers for rail infrastructure. The company emphasizes innovation and sustainability, with solutions that reduce energy consumption and cost of ownership.

- April 2024: Hitachi Energy celebrates the inaugural Transformer Components Days 2024 in Ludvika, Sweden, on March 20-21. The event showcased the company's broad portfolio of transformer components, emphasizing safety, reliability, and sustainability. Attendees engaged with experts to explore technological trends, future investments, and lifecycle optimization for a sustainable energy transition.

- March 2024: The Australian Queensland Train Manufacturing Program (QTMP) awarded ABB a USD 150 Million contract to supply traction packages with traction transformers for 65 six-car trains. The trains will start operation before the Brisbane 2032 Olympic and Paralympic Games take place. Additionally, the Traction Center of Excellence in Fraser Coast will receive USD 6 Million in investments from ABB for production and service support.

Traction Transformers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tap Changing, Tapped, Rectifier |

| Rolling Stocks Covered | Electric Locomotives, High-Speed Trains, Metros, Others |

| Mounting Positions Covered | Underframe, Machine Room, Roof |

| Overhead Line Voltages Coverage | Alternative Current (AC) Systems, Direct Current (DC) Systems |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Limited, Alstom Holdings, EMCO Limited, Hind Rectifiers Limited, International Electric Corporation Limited, JST Transformateurs, Schneider Electric SA, Setrans Holding AS, Siemens Aktiengesellschaft, Wilson Transformer Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the traction transformers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global traction transformers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the traction transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The traction transformers market was valued at USD 785.1 Million in 2024.

IMARC estimates the traction transformers market to exhibit a CAGR of 4.5% during 2025-2033, expecting to reach USD 1,171.0 Million by 2033.

The traction transformer market is driven by increasing railway electrification, rising demand for energy-efficient transportation, surging government investments in rail infrastructure, continuous advancements in high-voltage traction systems, increasing integration of renewable energy (RE) into rail networks, and the expansion of metro, high-speed, and freight rail projects globally.

Asia Pacific currently dominates the market, driven by rapid railway electrification, high-speed rail expansion, expanding urban metro projects, increasing government investments in sustainable transport, and strong manufacturing capabilities in China and India.

Some of the major players in the traction transformers market include ABB Limited, Alstom Holdings, EMCO Limited, Hind Rectifiers Limited, International Electric Corporation Limited, JST Transformateurs, Schneider Electric SA, Setrans Holding AS, Siemens Aktiengesellschaft, and Wilson Transformer Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)