Traction Control System Market Report by Type (Mechanical Linkage, Electrical Linkage), Component (Hydraulic Modulators, ECU, Sensors, and Others), Vehicle Type (ICE Vehicles, Electric Vehicles), Distribution Channel (OEM, Aftermarket), and Region 2025-2033

Traction Control System Market Size:

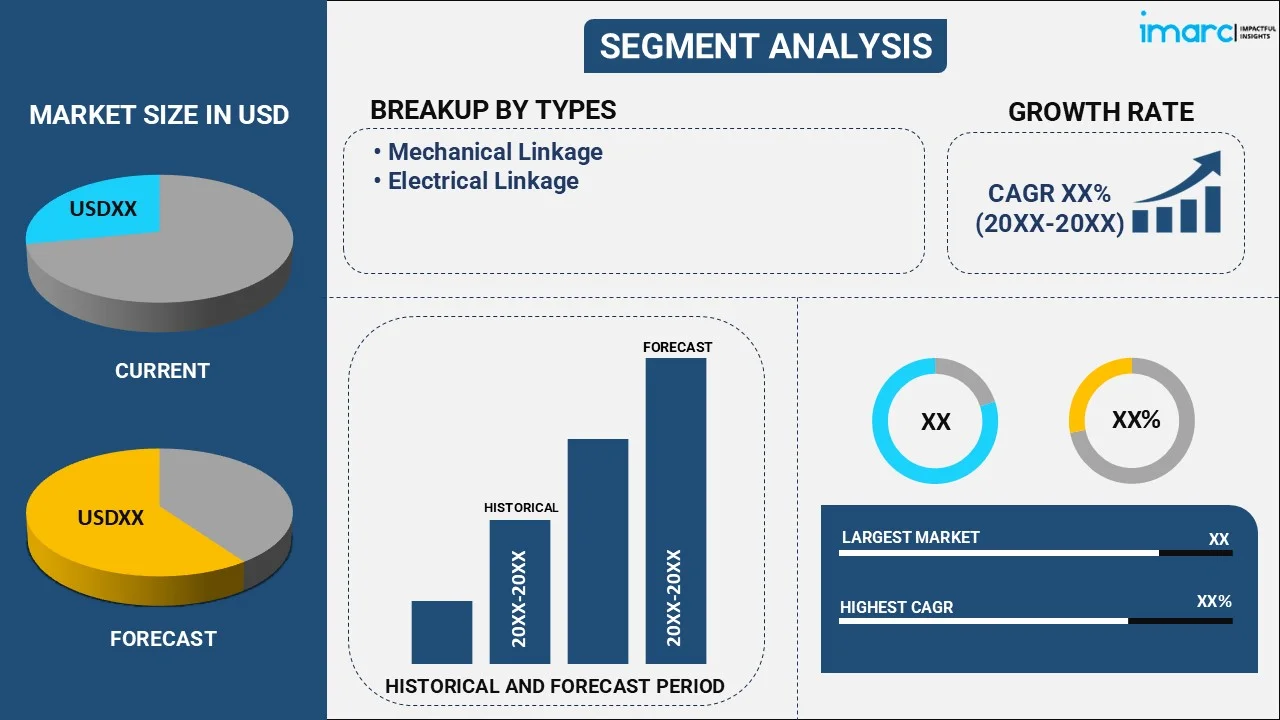

The global traction control system market size reached USD 41.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 64.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The rising expenditure capacities of consumers, the increasing demand for safety features in vehicles, and extensive research and development (R&D) activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 41.1 Billion |

|

Market Forecast in 2033

|

USD 64.1 Billion |

| Market Growth Rate 2025-2033 | 5.05% |

Traction Control System Market Analysis:

- Major Market Drivers: The escalating demand for vehicle safety and regulatory policies aimed at lowering the cases of road accidents is one of the crucial drivers supporting the expansion of traction control system market size. Moreover, the heightening adoption of cutting-edge driver assistance systems (ADAS) in commercial fleets as well as passenger vehicles is significantly bolstering the market growth. In addition, growing consumer awareness regarding vehicle safety features and the demand for improved control and stability, especially in challenging driving conditions, are spurring the demand for traction control systems. Besides this, ongoing technological innovations in automotive electronics and the rapid incorporation of safety systems in both mass-market and premium vehicles are further facilitating the market expansion.

- Key Market Trends: The increasing integration of traction control with other advanced safety systems, such as electronic stability control (ESC) and anti-lock braking systems (ABS), is one the key traction control system market trends. Moreover, manufacturers are currently focusing on developing systems that offer a seamless driving experience with improved handling and safety. Apart from this, the growing adoption of electric vehicles (EVs) and hybrid cars, which require advanced traction control to manage torque distribution and ensure vehicle stability, is also gaining momentum. Additionally, the expansion of autonomous vehicle technologies is driving innovation in traction control solutions.

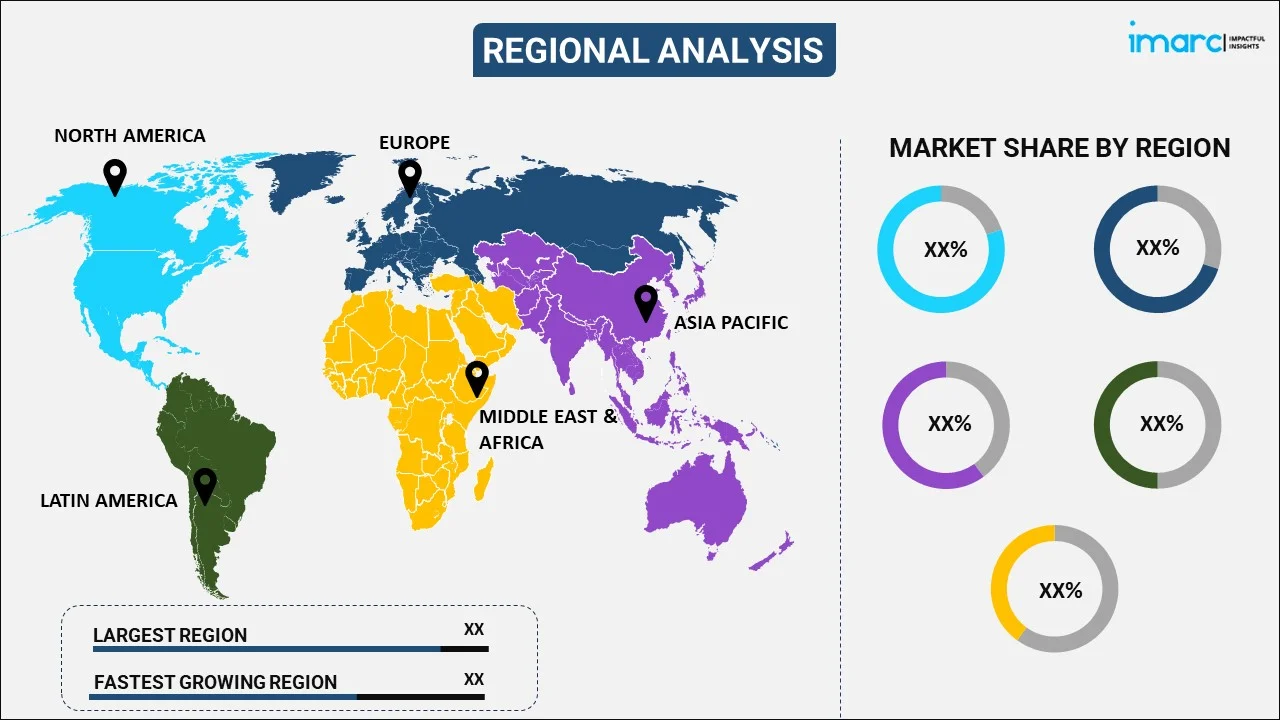

- Geographical Trends: Asia Pacific has established itself as the leading regional market for traction control system, predominantly driven by the rapid growth of the automotive industry, particularly in countries like China, India, and Japan. Moreover, increasing vehicle production, coupled with rising disposable incomes and shifting consumer preferences for enhanced safety features, is bolstering demand in the region. Additionally, government regulations mandating the use of safety systems in vehicles, along with the expansion of electric vehicles in China and India, are also contributing to market growth. Asia Pacific’s role as a hub for automotive manufacturing further strengthens its position in the global market.

- Competitive Landscape: Some of the major market players in the traction control system industry include Advics Co. Ltd. (AISIN CORPORATION), Continental AG, Denso Corporation, Hyundai Motor Group, Mahle Gmbh, Robert Bosch GmbH, ZF Friedrichshafen AG, among many others.

- Challenges and Opportunities: The market experiences challenges such as the elevated cost of advanced safety systems and the complexities of incorporating such systems into low-cost vehicles. In addition, economic contractions in major regions can hinder the market growth. However, there are substantial opportunities present, especially with the escalating requirement for both autonomous and electric vehicles that can effectively support the expansion of the traction control system market share. Furthermore, as automakers strive for improved safety features in their vehicles, the development of cost-efficient traction control solutions offers a significant growth opportunity. Moreover, stringent regulatory frameworks enforcing the utilization of safety systems provide further potential for industry players to capture new demand.

Traction Control System Market Trends:

The increasing demand for safety features in vehicles across the globe is one of the key factors driving the market growth. TCS regulates wheel spin and maintains optimal traction, ensuring smooth turns around corners. In line with this, the rising demand for passenger and commercial vehicles is favoring the market growth. TCS is widely adopted as it enhances the vehicle's performance, stability, and safety and offers safety on slippery surfaces by reducing the likelihood of skidding or spinning and improving traction. Apart from this, the introduction of TCS with advanced sensors that helps monitor and control the traction of the vehicle in real-time is providing an impetus to the market growth. Moreover, manufacturers are focusing on the launch of wireless accelerometers in TCS systems that are easy to install, improve reliability, reduce weight and complexity, and help to process data quickly, which, in turn, aids in making more accurate decisions and enhancing the performance and capabilities of the TCS system. This is acting as another growth inducing factor. Additionally, the widespread adoption of TCS systems in high-end and luxurious vehicles, as it enhances the vehicle's handling and responsiveness and reduces the risk of accidents, is positively influencing the market growth. Other factors, including the rising expenditure capacities of consumers, widespread adoption of electric vehicles due to the growing environmental consciousness, increasing awareness about the benefits of TCS systems among consumers, and the implementation of various government initiatives to enhance safety features in vehicles and prevent road accidents, are creating a positive traction control system market outlook.

Traction Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, component, vehicle type, and distribution channel.

Breakup by Type:

- Mechanical Linkage

- Electrical Linkage

Electrical linkage accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes mechanical and electrical linkage. According to the report, electrical linkage represented the largest segment.

Breakup by Component:

- Hydraulic Modulators

- ECU

- Sensors

- Others

ECU holds the largest share of the industry

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hydraulic modulators, ECU, sensors, and others. According to the report, ECU accounted for the largest market share.

Breakup by Vehicle Type:

- ICE Vehicles

- Electric Vehicles

ICE vehicles represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes ICE and electric vehicles. According to the report, ICE vehicles represented the largest segment.

Breakup by Distribution Channel:

- OEM

- Aftermarket

OEM exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket. According to the report, OEM accounted for the largest market share.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest traction control system market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for traction control system.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the traction control system industry include Advics Co. Ltd. (AISIN CORPORATION), Continental AG, Denso Corporation, Hyundai Motor Group, Mahle Gmbh, Robert Bosch GmbH, and ZF Friedrichshafen AG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Traction Control System Market News:

- In February 2024, Kawasaki India launched Z650RS, a sports bike, with a new addition of traction control system, offering two modes which riders can switch according to their convenience.

- In February 2023, Yamaha, a prominent Japan-based mobility company, announced that its 149cc-155cc motorcycle range in India will feature traction control system (TCS) as a standard offering.

Traction Control System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Linkage, Electrical Linkage |

| Components Covered | Hydraulic Modulators, ECU, Sensors, Others |

| Vehicle Types Covered | ICE Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advics Co. Ltd. (AISIN CORPORATION), Continental AG, Denso Corporation, Hyundai Motor Group, Mahle Gmbh, Robert Bosch GmbH, ZF Friedrichshafen AG, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global traction control system market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global traction control system market?

- What is the impact of each driver, restraint, and opportunity on the global traction control system market?

- What are the key regional markets?

- Which countries represent the most attractive traction control system market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the traction control system market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the traction control system market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the traction control system market?

- What is the breakup of the market based on distribution channel?

- Which is the most attractive distribution channel the traction control system market?

- What is the competitive structure of the global traction control system market?

- Who are the key players/companies in the global traction control system market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the traction control system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global traction control system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the traction control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)