Track and Trace Solutions Market Size, Share, Trends and Forecast by Product, Technology, Application, End Use Industry, and Region, 2025-2033

Track and Trace Solutions Market Size and Share:

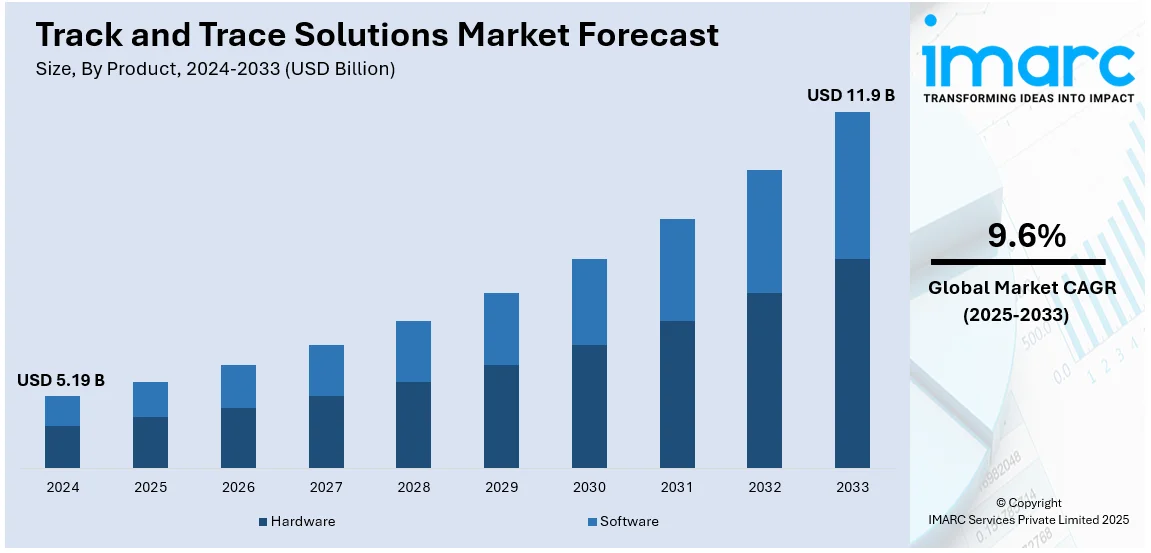

The global track and trace solutions market size was valued at USD 5.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.9 Billion by 2033, exhibiting a CAGR of 9.6% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. The growing number of counterfeit products, especially in pharmaceuticals, electronics, and luxury goods, the expanding e-commerce sector adding complexity to shipping and logistics, and continuous advancements are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.19 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Market Growth Rate (2025-2033) | 9.6% |

The global track and trace solutions market is propelled by increasing regulatory requirements for serialization and traceability in pharmaceuticals, medical devices, and food safety. Rising concerns over counterfeit products and the need for supply chain transparency further drive adoption. The integration of advanced technologies, such as IoT, blockchain, and cloud-based solutions, enables real-time tracking and enhances operational efficiency. Additionally, the growth of e-commerce and stringent compliance standards across industries contribute to the market’s expansion, as businesses seek to safeguard product authenticity, improve logistics, and meet consumer demands for secure and traceable goods, thus creating a positive track and trace solutions market outlook.

The United States is a key contributor to the global track and trace solutions industry, mainly impacted by stricter regulatory policies in critical sectors, typically encompassing food safety, pharmaceuticals, and medical devices. The accelerating requirement for supply chain transparency and magnifying incidences of counterfeit products further fuel need for such services. In addition, extensive utilization of cloud-based systems, IoT, or blockchain, along with upgraded technological infrastructure, improve the nation’s domination in deploying leading-edge tracking systems. For instance, Amazon Web Services, one of the leading cloud services providers, is U.S.-based and have millions of active users globally. Furthermore, heavy investments in adherence-driven serialization and traceability services and establishment of leading market players solidify the United States' dominant market position.

Track and Trace Solutions Market Trends:

Regulatory Compliance and Government Initiatives

The escalating requirement for safety as well as transparency within a supply chain network has resulted in several regulatory bodies and governments deploying stringent standards and policies. In critical sectors, encompassing food and beverages, and pharmaceuticals, compliance to track and trace standards is requisite to guarantee product authenticity, safety, as well as quality. Countries across the globe are increasingly adopting regulations that necessitate the use of traceability systems to combat counterfeit products and maintain the integrity of the supply chain. Government initiatives promoting standardization and the adoption of advanced tracking technologies are acting as key drivers in the industry. The global smart tracker market size reached USD 605.9 Million in 2024. These regulations push organizations to invest in robust track and trace solutions to meet compliance requirements, monitor the movement of goods, and provide real-time visibility. Failure to comply with these regulations can result in legal actions, fines, and damage to brand reputation. Consequently, the demand for advanced track and trace solutions that ensure regulatory compliance is rising, fueling the industry's growth.

Technological Advancements and Integration

Technological innovation is playing a crucial role in driving the track and trace solutions industry. Along with this. the integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Radio Frequency Identification (RFID), and blockchain has transformed the capability of tracking systems. According to reports, the number of connected IoT devices reached 16.6 Billion by the end of 2023, reflecting a 15% growth compared to 2022. These technologies enable real-time tracking, analytics, and reporting, leading to more accurate and timely information. In addition, the increased automation reduces manual errors, enhances efficiency, and allows seamless communication across different stages of the supply chain. Furthermore, cloud-based solutions are providing scalability and flexibility to small and large enterprises alike. By investing in these technologies, companies can enhance their operational efficiency, achieve higher customer satisfaction, and gain a competitive edge. The continuous development and adoption of these cutting-edge technologies are propelling the growth of the track and trace solutions market share.

Globalization and Increasing Complexity of Supply Chains

The growth of international trade and the rising intricacy of supply chain networks have underscored the critical importance of advanced tracking and tracing technologies. According to WTO, in 2023, global trade in goods and services reached USD 30.5 Trillion, with goods trade declining by 5% and services trade growing by 9%. As companies expand their operations across borders, they must manage more intricate supply chain networks involving multiple stakeholders, transportation modes, and jurisdictions. This complexity demands advanced tracking systems capable of providing visibility, coordination, and control across different regions and cultures. Track and trace solutions offer a means to manage this complexity by providing real-time information, aiding in decision-making, reducing risks, and ensuring timely delivery. They also facilitate international trade compliance, customs clearance, and minimize delays. Moreover, the growing interconnectivity of global markets, coupled with the increasing need for managing multifaceted supply chains, is a substantial driver impacting the track and trace solutions market demand.

Track and Trace Solutions Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global track and trace solutions market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, application, and end use industry.

Analysis by Product:

- Hardware

- Printing and Marking Solutions

- Monitoring and Verification Solutions

- Labelling Solutions

- Others

- Software

- Plant Manager Software

- Line Controller Software

- Bundle Tracking Software

- Others

Software stands as the largest product in 2024. Key factors driving the track and trace solutions market growth, especially within the software product segment, include influential market drivers. Additionally, the increasing complexity of regulatory requirements across various industries is strongly encouraging the adoption of robust track and trace systems, with software playing a pivotal role in this expansion. In addition, the intensifying emphasis on supply chain transparency and consumer well-being has amplified the demand for sophisticated software solutions that adeptly monitor and trace product lifecycles. The increasing recognition of counterfeit goods, coupled with the rising consumer demand for genuine products, has further driven the implementation of software-based track and trace systems. In unison, these drivers highlight the pivotal role of software products in empowering industries to navigate the intricate web of track and trace. Simultaneously, they position industry stakeholders to thrive in this dynamic ecosystem, ensuring a secure, compliant, and efficient product journey from origin to end-consumer.

Analysis by Technology:

- Barcode

- RFID

- Others

Barcode leads the market with around 57.8% of market share in 2024. The mounting regulatory mandates spanning diverse sectors, necessitating precise identification and monitoring of products throughout their lifecycle via barcode-enabled systems is positively influencing the market. Additionally, the growing need for enhanced supply chain visibility and consumer assurance propels the demand for advanced barcode solutions that seamlessly capture and transmit critical product information. Along with this, the increasing instances of counterfeiting and the resultant consumer demand for authenticity have further catalyzed the integration of barcode technology in track and trace systems. These factors collectively highlight the critical importance of barcode technology in managing the complexities of tracking and tracing processes. By aligning with these drivers, industry stakeholders can fortify their position in this competitive landscape, ensuring the integrity, security, and traceability of products from inception to consumption.

Analysis by Application:

- Serialization Solutions

- Bottle Serialization

- Label Serialization

- Carton Serialization

- Others

- Aggregation Solutions

- Bundle Aggregation

- Case Aggregation

- Pallet Aggregation

Sterilization solutions lead the market by application in 2024. The proliferation of serialization solutions applications within the track and trace solutions sector is based on factual insights and exerts a profound influence on the industry. A key driver is the escalating web of regulations spanning diverse sectors, mandating the meticulous serialization and monitoring of products through advanced tracking technologies. This regulatory pressure compels industries to adopt serialization solutions to ensure compliance and product authenticity. Along with this, the intensifying focus on supply chain transparency and consumer safety fuels the demand for sophisticated serialization applications that seamlessly capture, store, and relay crucial product data. In addition, the rising instances of counterfeiting and consumer demand for product genuineness further accelerate the integration of serialization technology in track and trace systems. These drivers collectively emphasize the critical role of serialization solutions in navigating the complexities of track and trace. By aligning with these drivers, industry participants can enhance their competitive standing, assuring the credibility, security, and traceability of products from source to consumption.

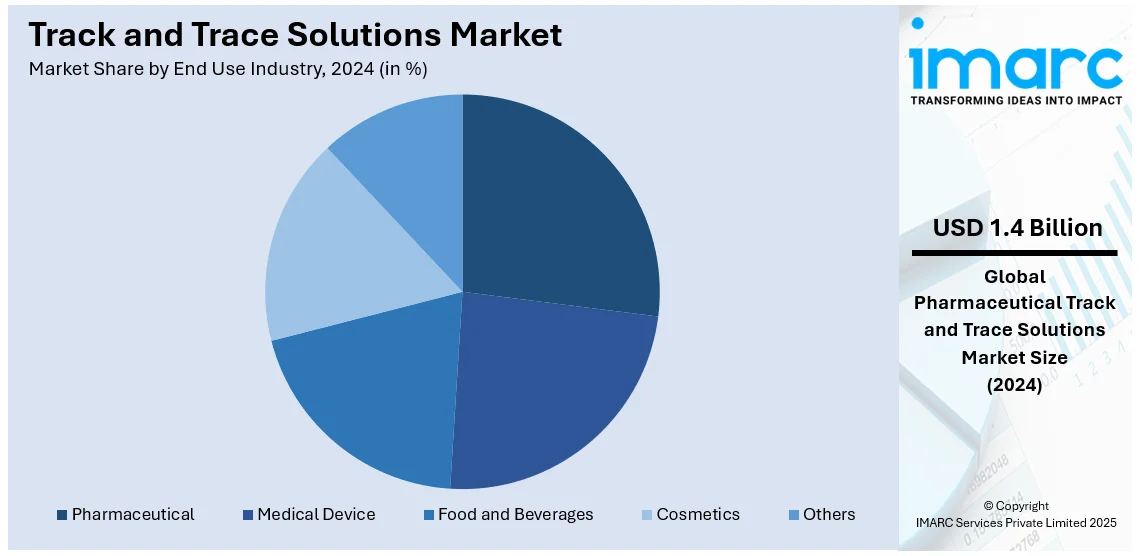

Analysis by End Use Industry:

- Pharmaceutical

- Medical Device

- Food and Beverages

- Cosmetics

- Others

Pharmaceutical leads the market with around 26.8% of market share in 2024. The pharmaceutical end-use industry is driven by compelling factors within the track and trace solutions sector, grounded in factual insights that significantly shape industry dynamics. A central driver is the stringent regulatory framework imposed across various regions, necessitating the implementation of robust track and trace solutions to ensure compliance, product safety, and patient well-being. In confluence with this, the accelerating demand for supply chain visibility and the ability to authenticate pharmaceutical products drive the need for advanced track and trace technologies that facilitate seamless monitoring and tracing of product journeys. Apart from this, the growing concern over counterfeit drugs and the imperative for product authenticity further propel the adoption of track and trace solutions in the pharmaceutical sector. These market drivers collectively underscore the vital role of track and trace solutions in safeguarding the integrity and transparency of pharmaceutical supply chains. By embracing these drivers, industry stakeholders can enhance their competitive edge while assuring the delivery of genuine and safe pharmaceutical products to patients worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%. The North America track and trace solutions industry is strongly influenced by market drivers rooted in factual trends, shaping its trajectory in a significant manner. A pivotal driver is the stringent regulatory landscape across diverse sectors in the region, necessitating the widespread adoption of track and trace technologies to ensure compliance, product authenticity, and consumer safety. Along with this, the rising instances of product recalls and the pressing need to enhance supply chain visibility drive the demand for advanced track and trace solutions that provide real-time monitoring and traceability. For instance, according to the U.S. Food & Drug Administration, in January 2025 alone, animal and veterinary, pet food, food and beverages, cheese and cheese products were the product types that were recalled.

Additionally, the increasing consumer awareness regarding product origins and ethical sourcing bolsters the adoption of these solutions. The heightened focus on combating counterfeiting and unauthorized distribution further accelerates the integration of track and trace technologies. These drivers collectively highlight the crucial role of track and trace solutions in North America, offering industries a means to navigate complex challenges while upholding regulatory standards and delivering transparent, genuine, and safe products to the market.

Key Regional Takeaways:

United States Track and Trace Solutions Market Analysis

In 2024, United States accounted for 83.90% of the market share in North America. In 2024, United States accounted for xx% of the market share in 2024. The track and trace solutions market in the United States is driven by technological advancements, stringent regulatory frameworks, and the need for supply chain transparency. The U.S. government and regulatory bodies, including the FDA and the Drug Enforcement Administration, enforce strict guidelines that require the use of advanced track and trace solutions, particularly in sectors such as pharmaceuticals and healthcare. For example, the Drug Supply Chain Security Act (DSCSA) mandates the tracking of pharmaceuticals, fueling the adoption of serialization and tracking technologies. Additionally, the growing U.S. food service market, valued at USD 1,423 Billion in 2023, is driving the demand for track and trace solutions in food safety and traceability. As the food service industry embraces these technologies, the need to ensure product safety, traceability, and compliance with food safety regulations becomes paramount. Moreover, the booming e-commerce sector also requires real-time shipment tracking, increasing demand for technologies such as GPS, RFID, and barcode systems. Cloud-based solutions, offering scalability and cost-efficiency, are further driving market growth. With the integration of AI and machine learning, track and trace solutions in the U.S. are set to evolve, enhancing operational efficiency and security, thus ensuring future market expansion.

Asia Pacific Track and Trace Solutions Market Analysis

The track and trace solutions market in the Asia-Pacific (APAC) region is driven by rapid industrialization, increasing e-commerce adoption, and stringent regulatory requirements across sectors like pharmaceuticals, food and beverage, and logistics. The region's vast manufacturing base and growing export activities demand enhanced supply chain transparency and product tracking. For instance, India’s pharmaceutical market is expected to reach USD 61.36 Billion in 2024, driving the need for serialization and anti-counterfeiting measures in the sector. Additionally, as countries like China and India implement serialization regulations to combat counterfeiting, the demand for track and trace technologies increases. The rising focus on product safety and fraud reduction in industries like food and beverage further propels market growth. As cloud computing and IoT technologies evolve, the APAC market is set to grow, with innovations in tracking solutions meeting the region's expanding needs.

Europe Track and Trace Solutions Market Analysis

The track and trace solutions market in Europe is driven by stringent regulatory frameworks, technological advancements, and the increasing demand for supply chain transparency. Regulatory requirements, particularly in the pharmaceutical sector, are major growth drivers. The European Union’s Falsified Medicines Directive (FMD) mandates the serialization and tracking of medicinal products to combat counterfeit drugs, which has led to widespread adoption of track and trace technologies such as RFID, barcode systems, and serialization solutions. In addition to pharmaceuticals, industries like food and beverage are increasingly implementing these solutions to meet food safety regulations and enhance product traceability. A growing focus on sustainability also encourages companies to use track and trace technologies to optimize resource usage and reduce waste in the supply chain. Moreover, the adoption of artificial intelligence (AI) is gaining momentum across European enterprises. According to the European Commission, 8% of EU enterprises with 10 or more employees used AI technologies in 2023, further promoting innovations in tracking and monitoring systems. As digitalization and e-commerce continue to rise, the integration of AI and cloud-based solutions is expected to boost the market, enhancing supply chain agility, security, and predictive capabilities.

Latin America Track and Trace Solutions Market Analysis

The track and trace solutions market in Latin America is driven by the increasing demand for supply chain visibility and regulatory compliance across industries such as pharmaceuticals and food. The region's expanding pharmaceutical sector is adopting serialization to prevent counterfeiting. Additionally, the online grocery market in Latin America, which reached USD 3.4 Billion in 2023, is driving demand for real-time tracking solutions to ensure efficient delivery and product traceability. The growing focus on food safety and the need for effective product recalls further accelerate the adoption of track and trace technologies, fostering market growth in the region.

Middle East and Africa Track and Trace Solutions Market Analysis

The track and trace solutions industry in the Middle East and Africa is rapidly proliferating, chiefly because of the notable requirement for regulatory adherence, improved transiency in supply chain, and product safety. The pharmaceutical sector, particularly with the growing generic drug market in Latin America, valued at USD 35.0 Billion in 2023, is driving demand for serialization and anti-counterfeiting measures. Additionally, industries like food and beverage are increasingly adopting track and trace solutions to meet safety standards. As e-commerce grows in the region, real-time shipment tracking also becomes essential, further propelling the market. Technological advancements continue to support this growth.

Competitive Landscape:

The industry is intensely competitive, with a multitude of participants delivering diverse technologies such as barcode solutions, RFID systems, and GPS-based platforms. Key market participants include major companies alongside specialized firms focusing on software-driven solutions. The market is fueled by the growing need for greater visibility within supply chains, adherence to regulatory requirements, and strengthened security measures. Companies differentiate themselves through innovation, service offerings, and strategic partnerships. For instance, in July 2024, Praxis Packaging Solutions collaborated with Systech, a major traceability and digital identification services provider for the pharmaceutical sector, to leverage its track and trace platform to facilitate the supply chain transparency. This deal offers Praxis customers gateway to product tracing solutions and aggregation that cam adhere to the global guidelines. In addition, the notable incorporation of emerging techniques, mainly including blockchain or IoT, is significantly steering the competitive ecosystem as well as allowing for enhanced operation efficacy, along with facilitating precise tracking. Consequently, market competition remains elevated, with industry leaders actively navigating to gain an advantage in technological domination.

The report provides a comprehensive analysis of the competitive landscape in the tack and trace solutions market with detailed profiles of all major companies, including:

- ACG Worldwide

- Antares Vision S.p.A.

- Axway

- Mettler-Toledo International Inc.

- Optel Vision Inc.

- Robert Bosch GmbH

- Seidenader Maschinenbau GmbH (Körber AG)

- Siemens AG

- Sys-Tech Solutions Inc. (Dover Corporation)

- TraceLink Inc.

- Uhlmann Group

- Zebra Technologies Corporation

Latest News and Developments:

- November 2024: Airgain, Inc. has launched the AT-Flight asset tracker for real-time monitoring of temperature-sensitive assets in healthcare and life sciences. With automated flight mode compliance, extended battery life, and operation in temperatures as low as -20°C, it supports cold chain logistics for goods like vaccines. Certified by PTCRB, FCC, and DO-160, Airgain is seeking airline approvals in the U.S. and Europe, aligning with its strategy to expand in high-value IoT markets.

- April 2024: Clarivate Plc in partnership with Global Health Intelligence, has launched a LatAm market tracking solution to provide detailed analysis of the medical device market in Latin America. The solution leverages comprehensive datasets and the Clarivate device catalog to cover over 100 medical devices and 500 product categories across countries including Brazil, Colombia, and Argentina.

- October 2024: EH Group has launched the EH-TRACE M-250kW Fuel Cell System, tailored for high-power applications requiring precise track and trace capabilities. Featuring advanced stack technology and AI/ML-based control, it ensures reliable performance, scalability, and efficiency with a minimum electrical efficiency of >50%. The modular design supports scalability up to 3MW in a 40ft container, making it ideal for data centers, micro-grids, and backup power. It also meets stringent maritime safety standards and has earned Approval in Principle from DNV.

- April 2024: UPS has launched a healthcare-focused cross-docking facility in Hyderabad, designed with track and trace capabilities to enhance pharmaceutical logistics. The facility ensures precise temperature control, maintaining the integrity of sensitive products within required ranges. It can store 15 pallets at +15°C to +25°C, 7 pallets at +2°C to +8°C, and 50 pallets in ambient conditions. This setup improves distribution efficiency while enabling real-time tracking of critical shipments, ensuring their safety and protection even during contingency situations.

Track and Trace Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Technologies Covered | Barcode, RFID, Others |

| Applications Covered |

|

| End Use Industries Covered | Pharmaceutical, Medical Device, Food and Beverages, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACG Worldwide, Antares Vision S.p.A., Axway, Mettler-Toledo International Inc., Optel Vision Inc., Robert Bosch GmbH, Seidenader Maschinenbau GmbH (Körber AG), Siemens AG, Sys-Tech Solutions Inc. (Dover Corporation), TraceLink Inc., Uhlmann Group, Zebra Technologies Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the track and trace solutions market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global track and trace solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the track and trace solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The track and trace solutions market was valued at USD 5.19 Billion in 2024.

IMARC estimates the market to reach USD 11.9 Billion by 2033, exhibiting a CAGR of 9.6% during 2025-2033

The rising utilization of track and trace solutions across various industries, such as pharmaceuticals, food, and consumer goods, as these help to reduce errors and help in quickly identifying and rectifying any discrepancies or issues in the supply chain, is primarily driving the global track and trace solutions market.

North America currently dominates the track and trace solutions market, accounting for a share exceeding 39%. This dominance is due to its leading-edge technological infrastructure, stringent regulatory policies, and the robust presence of crucial industry players bolstering advancements in supply chain management.

Some of the major players in the track and trace solutions market include ACG Worldwide, Antares Vision S.p.A., Axway, Mettler-Toledo International Inc., Optel Vision Inc., Robert Bosch GmbH, Seidenader Maschinenbau GmbH (Körber AG), Siemens AG, Sys-Tech Solutions Inc. (Dover Corporation), TraceLink Inc., Uhlmann Group, Zebra Technologies Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)