Tourette Syndrome Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

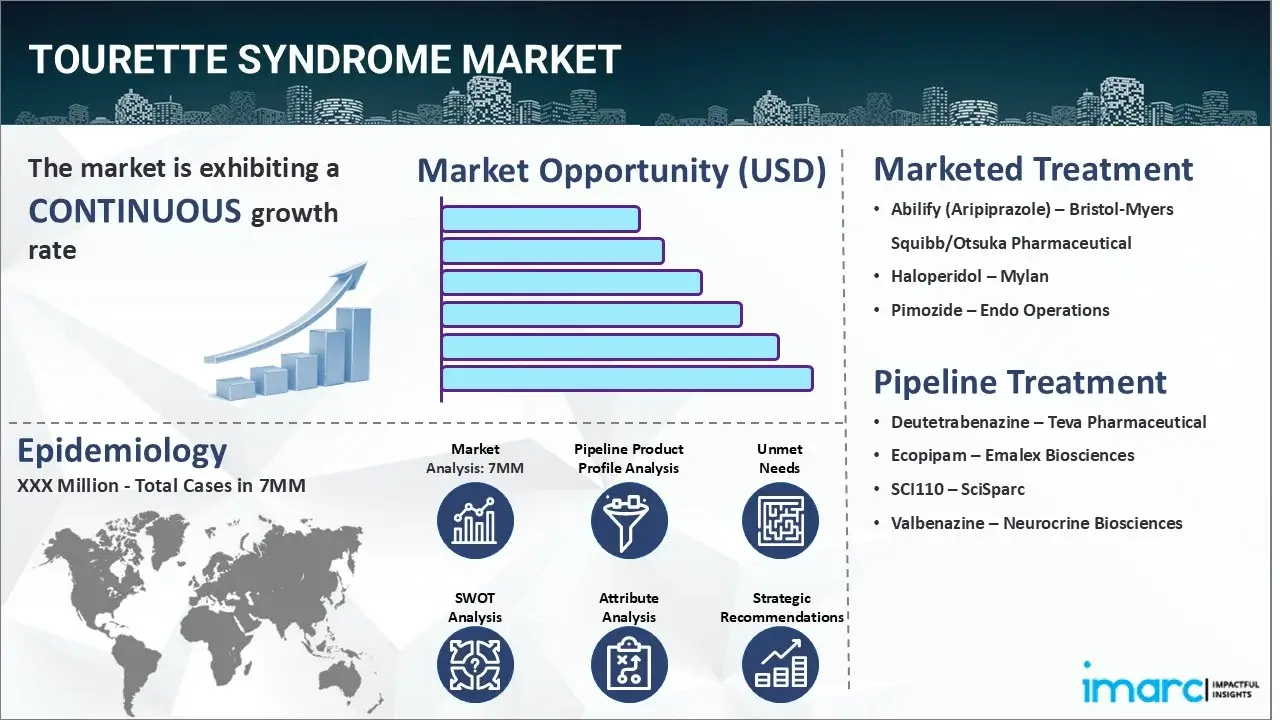

The Tourette syndrome market reached a value of USD 1,885.4 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 2,924.5 Million by 2035, exhibiting a growth rate (CAGR) of 4.1% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 1,885.4 Million |

|

Market Forecast in 2035

|

USD 2,924.5 Million |

|

Market Growth Rate 2025-2035

|

4.1% |

The Tourette syndrome market has been comprehensively analyzed in IMARC's new report titled "Tourette Syndrome Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Tourette syndrome (TS) is a neurological disorder characterized by repetitive, involuntary movements, and vocalizations called tics. These tics can be either motor tics or vocal tics, including eye blinking, facial grimacing, shoulder shrugging, throat clearing, grunting, etc. Tourette syndrome often begins in childhood and continues into adulthood, although the severity of symptoms may decrease over time for some individuals. In addition to tics, they may also experience other conditions, such as attention deficit hyperactivity disorder (ADHD) and obsessive-compulsive disorder (OCD). The diagnosis of the ailment is based on a thorough evaluation of the patient's symptoms and medical history. To be diagnosed with TS, an individual must have both motor and vocal tics that have been present for at least one year, with onset before age 18. The tics must be involuntary and not the result of other medical conditions, such as a medication side effect or another neurological disorder. The healthcare professional may also use diagnostic tools, including imaging studies or blood tests, to rule out other possible causes of the symptoms.

To get more information on this market, Request Sample

The increasing prevalence of inherited neurological disorders and the rising cases of delivery complications, such as meconium-stained amniotic fluid and premature rupture of the membranes, are primarily driving the Tourette syndrome market. Moreover, the escalating utilization of medications, including antipsychotics and alpha-adrenergic agonists, to help reduce the frequency and severity of tics, as well as treat any co-occurring conditions, such as OCD and ADHD, is also bolstering the market growth. Besides this, the widespread adoption of deep brain stimulation (DBS) as a treatment option for Tourette syndrome since it assists in regulating abnormal brain activity associated with tics is further creating a positive outlook for the market. Additionally, several key players are making extensive investments in research activities to introduce novel therapies for Tourette syndrome, including new medications and non-invasive brain stimulation techniques. This, in turn, is acting as another significant growth-inducing factor. Apart from this, the launch of numerous initiatives by government bodies aimed at supporting research and development and improving access to care for individuals with Tourette syndrome is also augmenting the market growth. These initiatives are helping to increase awareness, improve diagnosis rates, and expand treatment options. Furthermore, the emerging popularity of behavioral therapies, such as cognitive-behavioral therapy (CBT) and habit reversal therapy (HRT), which assist patients in identifying and replacing tic-related behaviors with more adaptive ones, is expected to drive the Tourette syndrome market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the Tourette syndrome market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool for Tourette syndrome and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Tourette syndrome market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Tourette syndrome market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Tourette syndrome market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current tourette syndrome marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Abilify (Aripiprazole) | Bristol-Myers Squibb/Otsuka Pharmaceutical |

| Haloperidol | Mylan |

| Pimozide | Endo Operations |

| Deutetrabenazine | Teva Pharmaceutical |

| Ecopipam | Emalex Biosciences |

| SCI110 | SciSparc |

| Valbenazine | Neurocrine Biosciences |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Tourette syndrome market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Tourette syndrome across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Tourette syndrome across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Tourette syndrome across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Tourette syndrome by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Tourette syndrome by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Tourette syndrome by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Tourette syndrome across the seven major markets?

- What is the size of the Tourette syndrome patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Tourette syndrome of?

- What will be the growth rate of patients across the seven major markets?

Tourette Syndrome: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Tourette syndrome drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Tourette syndrome market?

- What are the key regulatory events related to the Tourette syndrome market?

- What is the structure of clinical trial landscape by status related to the Tourette syndrome market?

- What is the structure of clinical trial landscape by phase related to the Tourette syndrome market?

- What is the structure of clinical trial landscape by route of administration related to the Tourette syndrome market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)