Toilet Paper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Toilet Paper Market Size and Share:

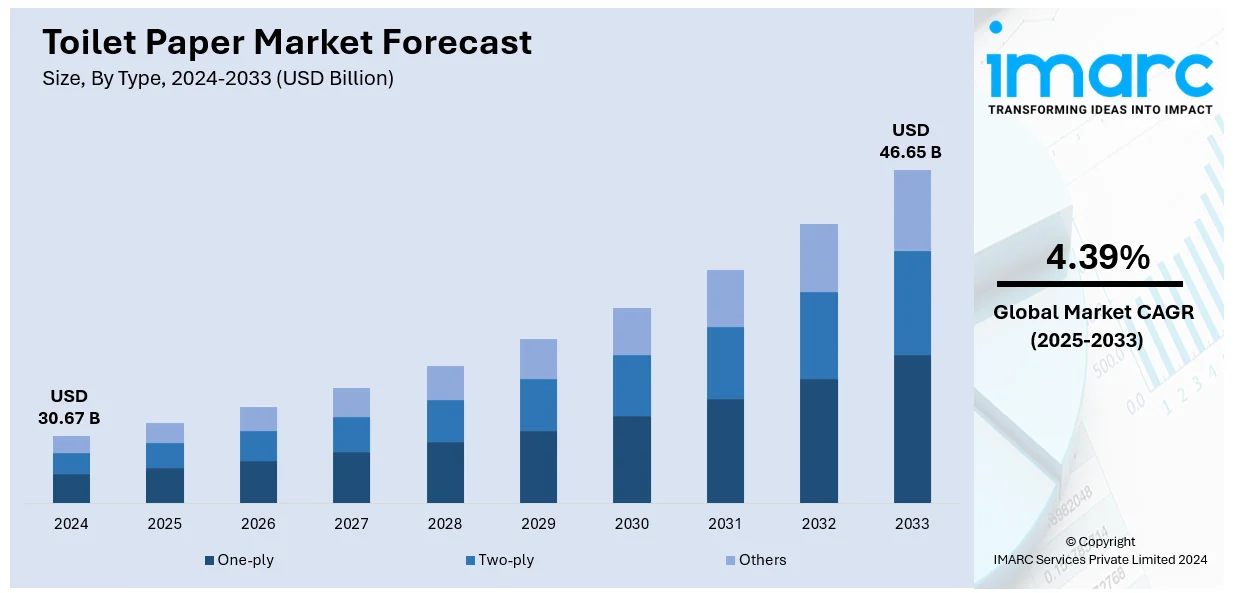

The global toilet paper market size was valued at USD 30.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.65 Billion by 2033, exhibiting a CAGR of 4.39% during 2025-2033. North America currently dominates the market, holding a significant market share of 44.3% in 2024. The growing awareness about personal health and hygiene among the masses and thriving travel and tourism industry propels the market growth. Besides this, rising utilization of convenient hygiene products among individuals are some of the major factors driving toilet paper market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.67 Billion |

| Market Forecast in 2033 | USD 46.65 Billion |

| Market Growth Rate (2025-2033) |

4.39%

|

Government and public health efforts are crucial in propelling the worldwide market growth. Sanitation initiatives promote understanding of hygiene and cleanliness behaviors. Regulatory bodies in various nations are allocating resources to develop sanitation facilities, promoting the use of hygiene items, such as toilet paper. Financial aid and funding for hygiene items enhance availability for low-income families in developing areas. Policies requiring better sanitation in educational and work settings promote bulk buying of toilet paper items. Public health organizations highlight toilet paper's role in maintaining cleanliness, influencing individual behavior toward hygiene. Awareness programs emphasize proper handwashing and sanitation, indirectly increasing demand for complementary products like toilet paper. Governments collaborate with manufacturers to distribute hygiene kits, often including toilet paper, in underserved communities. Global organizations like WHO promote hygiene awareness, creating a ripple effect on the demand for toilet paper.

The United States stands out as a key market disruptor, driven by the expansion of retail and e-commerce channels. Major retailers ensure widespread availability of toilet paper nationwide. In May 2024, Who Gives A Crap, a sustainable D2C toilet paper brand, entered US retail via Whole Foods. The brand’s 100% recycled toilet paper is available in 4-roll and 8-roll packages nationwide. This marks its first retail expansion in the US, complementing its online presence. E-commerce platforms, offer convenient access to diverse toilet paper products. Subscription services on e-commerce platforms provide hassle-free, recurring deliveries, enhancing convenience and loyalty. Retailers offer bulk-packaged products at discounted prices, appealing to cost-conscious households and institutional buyers. Innovative online features like product reviews and comparisons empower people in making better decisions regarding a purchase. Same-day and next-day delivery options by e-commerce giants ensure swift access to essential hygiene products. Digital marketing campaigns by toilet paper brands reach broader audiences, increasing product visibility and demand. Physical retail stores frequently host promotions and loyalty programs, which result in rising number of repeat purchases, especially from existing customers.

Toilet Paper Market Trends:

Rising awareness about personal health and hygiene

The growing health and hygiene awareness among the masses around the world is driving the demand for toilet paper. The WHO claims that each dollar funded for sanitation offers a return on investment for society of USD 5.50 because of reduced health costs, better productivity, and fewer premature deaths. People are becoming conscious of the significance of maintaining good hygiene and cleanliness in daily life. They are aiming for public and personal hygiene and adopting numerous practices like handwashing, and hygiene products. In addition, they are practicing hygiene to not let viruses and bacteria spread around. Increased literacy and education in developing countries is further increasing consciousness about hygiene. Educational and healthcare facilities highlight the importance of cleanliness, leading to bulk purchases of hygiene products. Eco-friendly practices align with health, and individuals tend to choose environmentally friendly toilet paper.

Changing individual preferences

The demand for toilet paper is increasing because of shifting preferences. Individuals are progressively choosing convenient, sanitary, and comfortable items in their everyday routines. The increasing need for cleaner, softer, more absorbent, and superior products that provide enjoyable experiences is driving market expansion. Individuals are choosing branded and high-end toilet paper alternatives that offer superior quality and dependability. There is a rise in the demand for eco-friendly and biodegradable products among environmentally aware individuals. In addition to this, manufacturers are consistently innovating toilet paper to satisfy these changing preferences, which is providing a favorable market outlook. In September 2024, for instance, Master Roll, a company based in the UK, introduced eco-friendly toilet paper made entirely from bamboo to combat global deforestation. The innovative product seeks to minimize environmental harm caused by conventional toilet paper, resulting in the annual loss of millions of trees. Emphasizing sustainability and quality, Master Roll offers people a solution for minimizing their environmental footprint. This effort is vital for fighting deforestation and reducing climate change impacts.

Thriving travel and tourism industry

There is a rise in the demand for toilet paper due to the thriving travel and tourism industry. According to UN Tourism, international arrivals reached 98% of 2019 levels in January-September 2024. People are increasingly traveling in groups or individually from one location to another for leisure, recreation, business, or other purposes. This industry comprises various forms of travel like domestic and international tourism, business travel, adventure tourism, and cultural exploration. In addition, the wide availability and accessibility of toilet paper in hotels, restaurants, flights, and other commercial places to maintain hygiene is offering a positive market outlook. Apart from this, people are seeking comfortable, safe, and environmentally friendly options to maintain hygiene at public places, which is catalyzing the demand for toilet paper.

Toilet Paper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global toilet paper market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, and distribution channel.

Analysis by Type:

- One-ply

- Two-ply

- Others

One-ply toilet paper leads the market with 45.8% of market share in 2024. One-ply toilet paper dominates the market due to its affordability and widespread availability across regions. People living in cost-sensitive markets prefer it as an economical option for everyday use. Its lower manufacturing cost allows companies to price it competitively, increasing its market penetration. Many institutions, such as schools and public facilities, opt for one-ply paper to reduce procurement expenses. The high demand from these institutional buyers contributes significantly to the segment's growth. One-ply paper also uses less raw material, aligning with efforts to reduce production waste. Its lighter weight makes transportation cheaper, allowing companies to distribute it more efficiently. In regions with limited purchasing power, one-ply is considered a suitable choice for most households. While premium multi-ply options exist, one-ply continues to cater to budget-conscious customers. Its compatibility with high-capacity dispensers in commercial spaces further supports its market growth.

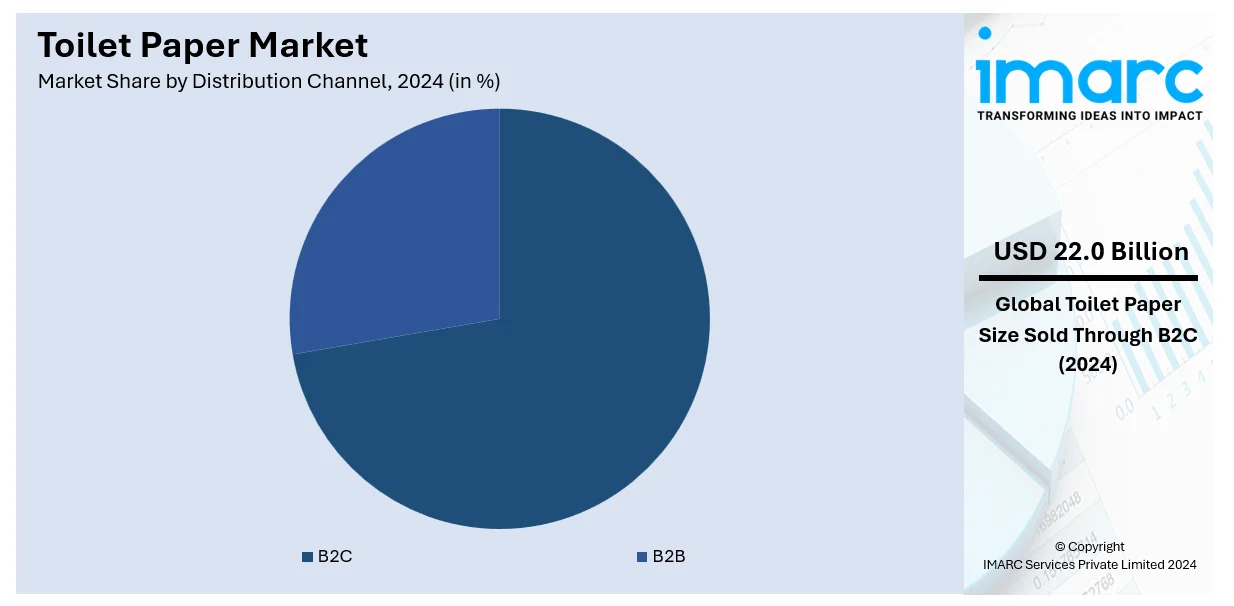

Analysis by Distribution Channel:

- B2B

- B2C

B2C dominates the market with 71.8% of market share in 2024. The B2C segment holds the largest market share due to the frequent toilet paper purchases by households. Retail outlets, such as supermarkets and convenience stores, drive substantial sales within this segment. People often prefer to purchase toilet paper during routine grocery shopping trips, which further strengthens its market growth. Online platforms are also influencing the B2C sales, offering convenience and subscription-based delivery services. The rising number of e-commerce users are expanding direct-to-consumer (D2C) distribution in urban and rural areas. Individual buyers prioritize product accessibility, making B2C channels the most convenient purchasing option. Promotions and discounts offered by retailers further encourage purchases within the B2C segment. Brand loyalty and individual preferences play a significant role in the dominance of this distribution channel. Packaging designed for household use makes B2C products more appealing than bulk commercial options. The segment benefits from higher margins compared to bulk sales in institutional or industrial markets.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the highest market share, reaching 44.3%. North America dominates the market because of its elevated per capita consumption levels. The region's developed infrastructure guarantees steady availability of top-notch products in both urban and rural locations. People in the United States and Canada emphasize high-quality, multi-ply, and eco-friendly toilet paper. The North American market advantages itself with sophisticated manufacturing skills and robust distribution systems. Retail chains like Walmart and Costco are crucial in ensuring consistent product availability. Elevated hygiene expectations and disposable income influence the inclination towards premium brands of toilet paper. According to information released by The American Cleaning Institute, in March 2024, 87% of Americans think that a tidy home improves mental and physical health. Around 70% experience a feeling of achievement from tidy environments, whereas 66% percent claim enhanced mood. In addition, eco-conscious efforts in the area have influenced the need for recycled and sustainable toilet paper choices. The supremacy is additionally bolstered by advancements, like biodegradable and bamboo-derived toilet paper products.

Key Regional Takeaways:

United States Toilet Paper Market Analysis

The United States hold 87.80% of the market share in North America. The rising need for toilet paper in the United States is largely fueled by the heightened emphasis on personal health and cleanliness. A survey indicates that most people are hoarding toilet paper, with 77% of Americans doing so, while 34% have also purchased additional necessities in the last two weeks. Heightened awareness regarding cleanliness has resulted in a preference for hygiene products. This is particularly evident in the post-pandemic era, as cleanliness has become a top concern for numerous individuals. As individuals recognize the role of toilet paper in their daily hygiene practices, the need arises. Moreover, the availability of various kinds of toilet paper, ranging from ultra-soft to antimicrobial, enables individuals to select a product that meets their specific preferences. The consciousness of personal hygiene is impacting buying choices and is expanding the use of toilet paper across various sectors, from homes to public restrooms across the globe.

Asia Pacific Toilet Paper Market Analysis

In the Asia-Pacific area, the rising use of toilet paper is linked to the expanding reach of online sales channels. As per India Brand Equity Foundation, the Indian e-commerce sector is expected to grow at a CAGR of 27% to hit USD 163 Billion by 2026. E-commerce platforms are greatly altering how individuals buy everyday necessities, such as toilet paper. The ease of home delivery options, combined with the capability to compare prices and view reviews, is making the acquisition of hygiene products like toilet paper more attainable. The growth of online shopping has also exposed individuals to a broader selection of products, addressing various preferences, including eco-friendly choices or high-end varieties. Furthermore, the growing use of mobile internet and digital wallets is influencing the demand in this sector, allowing people to purchase toilet paper from the comfort of their homes.

Europe Toilet Paper Market Analysis

In Europe, there is a noticeable shift in toilet paper adoption driven by growing individua preference for eco-friendly and sustainable products. For instance, the European Commission’s eco-innovation index increased by 27.5% from 2014 to 2024, mainly driven by improvements in resource efficiency. With heightened awareness of environmental issues, many people are looking for products that sync with their values, such as biodegradable or recycled toilet paper. This preference is being supported by brands that are increasingly committed to sustainability, offering eco-conscious options that use fewer resources and produce less waste. The growing trend toward reducing environmental impact has prompted both manufacturers and retailers to offer products that meet these demands, making it easier for individuals to opt for greener alternatives. As more people are becoming environmentally conscious, the adoption of sustainable toilet paper is expected to rise, particularly in countries where sustainability efforts are strongly emphasized.

Latin America Toilet Paper Market Analysis

In Latin America, the growing adoption of toilet paper is being driven by changing individual preferences influenced by increasing disposable income. For instance, total disposable income in Latin America is set to rise by nearly 60% in real terms over 2021-2040. As individuals and families experience economic improvements, they can shift their spending habits toward higher-quality household products, including premium quality toilet paper. This transition is evident as more people are opting for softer, thicker, and more luxurious toilet paper options, something they may not have been able to afford previously. Rising disposable income allows people to prioritize comfort and quality in their everyday purchases, leading to an uptick in demand for toilet paper. The growing middle class in the region is further influencing this trend, as more households are adopting better living standards and improved hygiene practices.

Middle East and Africa Toilet Paper Market Analysis

In the Middle East and Africa, the rising trend in tourism is contributing to the growing demand for toilet paper, particularly in hotels, resorts, and other hospitality sectors. According to Dubai Department of Economy and Tourism, Dubai welcomed 16.79 Million international tourists during the first 11 months 2024 between January and November, an increase of 9 per cent compared to the same period last year. As the tourism industry continues to expand in the region, there is a greater need for essential sanitary products in accommodations catering to both international and local visitors. These establishments prioritize hygiene standards to meet the expectations of travelers, leading to an increased demand for high-quality toilet paper in public and private facilities. Additionally, the influx of tourists has prompted businesses to use more sustainable practices like adoption of eco-friendly toilet paper. The growth in the tourism sector is expected to drive the demand for toilet paper, as more people travel to the region for leisure and business purposes, requiring these essential hygiene products in hospitality settings.

Competitive Landscape:

Major participants greatly impact the market via innovation, manufacturing, and distribution approaches. They allocate resources to research and development (R&D) to create environmentally friendly, biodegradable, and premium products that attract customers. Major corporations guarantee global product availability by sustaining robust supply chains and distribution systems. Strategic partnerships with retailers increase market reach and improves accessibility for both household and institutional purchasers. Market leaders invest significant funds in marketing campaigns, fostering brand loyalty across various customer segments. Their economies of scale facilitate cost-efficient manufacturing, which permits competitive pricing for both high-end and affordable choices. Major stakeholders advocate for sustainability through the use of renewable resources, recycled paper, and eco-friendly packaging options. Product design innovations including comfort and durability, address the changing preference for environmentally friendly products. Investing in cutting-edge equipment enhances production effectiveness, addressing the rising worldwide demand for toilet papers. In December 2024, Suzano opened the largest single-line pulp mill in the world in Ribas do Rio Pardo, Brazil. This will improve the availability of top-grade pulp, an essential raw material for producing toilet paper. Enhanced production capability guarantees a steadier supply chain, bolstering market growth for tissue products.

The report provides a comprehensive analysis of the competitive landscape in the toilet paper market with detailed profiles of all major companies, including:

- ABC Tissue Products Pty Ltd

- Absormex CMPC Tissue S.A. de CV

- Caprice Paper Products Pty Ltd

- Essity Aktiebolag (publ)

- Georgia-Pacific LLC (Koch Industries Inc)

- Hengan International Group Company Limited

- Kimberly-Clark Worldwide Inc.

- Kruger Inc.

- Naturelle Consumer Products LTD

- Orchids Tissue Paper Products

- Procter & Gamble Company

- Sofidel Group

- Suzano

- WEPA Hygieneprodukte GmbH

Latest News and Developments:

- August 2024: Kong Rolls, a new toilet paper brand, is transforming the industry with its eco-friendly bamboo-based tissue. Founded by university students Jimmy Ayash and Carlos Polo, the company aims to promote sustainability by offering products made from recycled materials. This innovative approach is set to revolutionize the market.

- July 2024: Yarn’n, an Australian First Nations-owned company, has launched a 100% recycled toilet tissue made from FSC-certified forests. The product promotes sustainability by using 50% less water and 90% less energy than traditional methods. Yarn’n emphasizes its commitment to sustainable forestry practices, supporting indigenous rights and local wildlife protection. The company also attained FSC Promotional Licence Holder status in 2023 to combat biodiversity loss and climate change.

- May 2024: Sofidel Group launched its Regina Rotoloni toilet paper maxi rolls in key European markets, including Poland, the Netherlands, Spain, Hungary, and Romania. The product, designed to meet customer demand, offers rolls twice the length of standard ones while occupying half the shelf space. Sofidel aims to increasing demand in the value category with this high-quality offering.

- April 2024: Bamboo Story launched a 48-pack of unbleached bamboo toilet paper, prioritizing both health and environmental responsibility. Made from sustainably harvested bamboo, it’s ideal for sensitive skin, such as eczema or dermatitis. The product’s plastic-free packaging aligns with the company’s eco-friendly commitment. Bamboo Story emphasizes its dedication to individual health and planetary protection.

Toilet Paper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One-ply, Two-ply, Others |

| Distribution Channels Covered | B2B, B2C |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABC Tissue Products Pty Ltd, Absormex CMPC Tissue S.A. de CV, Caprice Paper Products Pty Ltd, Essity Aktiebolag (publ), Georgia-Pacific LLC (Koch Industries Inc), Hengan International Group Company Limited, Kimberly-Clark Worldwide Inc., Kruger Inc., Naturelle Consumer Products LTD, Orchids Tissue Paper Products, Procter & Gamble Company, Sofidel Group, Suzano, WEPA Hygieneprodukte GmbH , etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, toilet paper market outlook, and dynamics of the market from 2019-2033.

- The toilet paper market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the toilet paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The toilet paper market was valued at USD 30.67 Billion in 2024.

IMARC estimates the toilet paper market to exhibit a CAGR of 4.39% during 2025-2033.

The market growth can be attributed to population growth and rising hygiene awareness among masse across the globe. Sustainability trends encourage individuals to choose recycled or bamboo-based options, promoting environmentally conscious production. Advances in manufacturing technology improves quality, softness, and durability, meeting evolving customer preferences. Distribution innovations, including online platforms and subscription services, enhance accessibility and convenience. Additionally, institutional buyers like schools and offices ensure steady demand, impelling the market's growth across diverse segments and regions.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the toilet paper market include ABC Tissue Products Pty Ltd, Absormex CMPC Tissue S.A. de CV, Caprice Paper Products Pty Ltd, Essity Aktiebolag (publ), Georgia-Pacific LLC (Koch Industries Inc), Hengan International Group Company Limited, Kimberly-Clark Worldwide Inc., Kruger Inc., Naturelle Consumer Products LTD, Orchids Tissue Paper Products, Procter & Gamble Company, Sofidel Group, Suzano, WEPA Hygieneprodukte GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)