Tobacco Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Tobacco Market Size and Share:

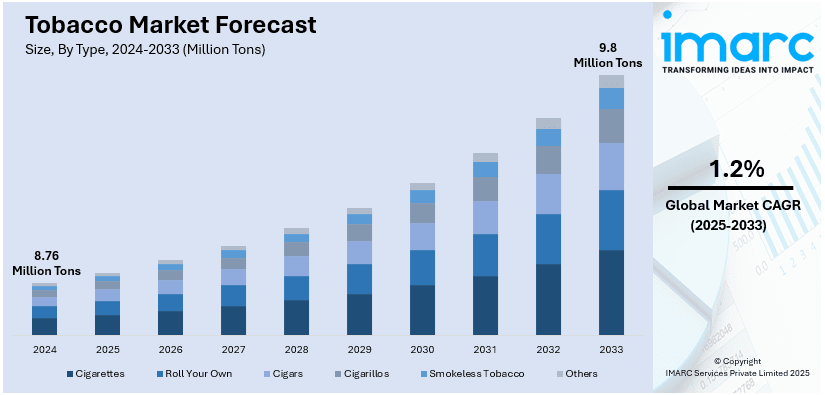

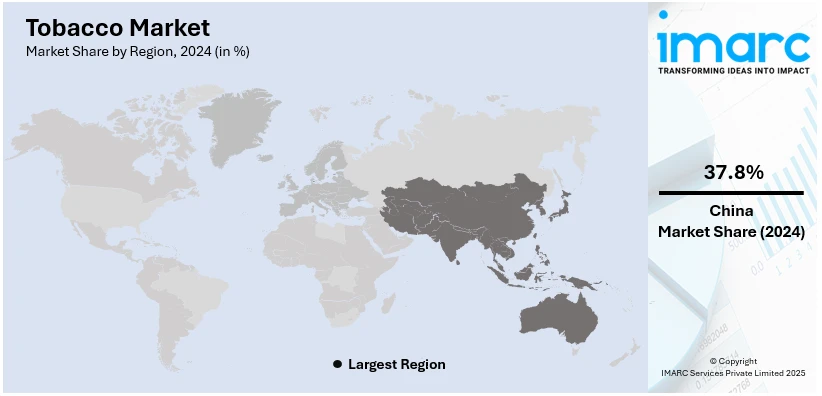

The global tobacco market size was valued at 8.76 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 9.8 Million Tons by 2033, exhibiting a CAGR of 1.2% during 2025-2033. China currently dominates the market, holding a significant market share of over 37.8% in 2024. The increasing execution of persuasive campaigns to attract consumers , growing social norms and cultural acceptance, and introduction of innovative tobacco products such as heat-not-burn tobacco products and e-cigarettes represent some of the key factors propelling the tobacco market share across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

8.76 Million Tons |

|

Market Forecast in 2033

|

9.8 Million Tons |

| Market Growth Rate (2025-2033) | 1.2% |

The market is driven by several key factors, including government policies, taxation, and regulations that shape industry dynamics. Cultural acceptance and social habits play a significant role, as smoking remains ingrained in many societies. High smoking rates, particularly in developing countries, fuel tobacco market demand. Tobacco prices remain low in certain regions which enhances accessibility yet major brand promotions through advertising affect how people use tobacco products. The rise of e-cigarettes and alternative nicotine products also contributes to market expansion. Additionally, economic growth and increasing disposable income in emerging markets support tobacco consumption. Despite growing health awareness and anti-smoking campaigns, industry innovations, such as flavored tobacco and smokeless alternatives, help sustain demand. Tax revenues generated from tobacco sales further incentivize governments to regulate rather than ban tobacco products.

The tobacco market in the United States is driven by several key factors, including consumer demand, evolving regulations, and product innovation. For instance, in October 2024, British American Tobacco (BAT) announced the introduction of a version of its Velo nicotine pouches with synthetic nicotine in the United States. Smoking alternatives such as vapes from major tobacco businesses, notably BAT, typically contain naturally occurring nicotine extracted from the tobacco plant, whereas synthetic nicotine is created in a laboratory using chemicals. While smoking rates have declined due to health awareness, the rise of alternative nicotine products, such as e-cigarettes and smokeless tobacco, has sustained market growth. Government policies, including taxation and advertising restrictions, shape industry dynamics, while strong brand loyalty and marketing strategies influence consumer choices. The affordability and availability of tobacco products, particularly in certain demographics, contribute to continued demand. Additionally, the role of convenience stores and online sales channels supports market expansion. Despite increasing regulatory pressure and anti-smoking campaigns, the tobacco industry adapts through reduced-risk products, menthol variants, and nicotine alternatives, maintaining its presence in the U.S. market.

Tobacco Market Trends:

The Growing Social and Cultural Acceptance

The increasing tobacco consumption due to deeply ingrained social norms and traditions is influencing market growth. In addition, smoking is often perceived as a symbol of social status or a means of bonding during social gatherings which is an accepted practice among peers and communities, particularly in regions with a long history of tobacco use, thus augmenting the market growth. According to the World Health Organization (WHO), nearly 1.3 billion people globally smoked in 2020, with more than 80% of them residing in low- and middle-income countries. Moreover, the portrayal of smoking in popular culture, movies, and media contributes to its acceptance among young audiences representing another major growth-inducing factor. Along with this, celebrity endorsements and depictions of tobacco use in movies are creating a perception of glamour and attractiveness, encouraging experimentation among impressionable individuals, thus propelling market growth. Furthermore, in some cultures, tobacco is employed in religious rituals, traditional ceremonies, or as a symbol of hospitality, thus propelling market growth.

The Introduction of Several Innovative Tobacco Products

The market is witnessing several product innovations and diversifications to cater to changing consumer preferences. In addition, the introduction of electronic cigarettes or e-cigarettes and vaping devices is influencing the market growth. These devices offer an alternative to traditional tobacco products. According to the Centers for Disease Control and Prevention (CDC), menthol cigarettes accounted for about 37% of all cigarettes sold in the U.S. in 2020. Moreover, the incorporation of flavored tobacco products, including menthol cigarettes and flavored smokeless tobacco represents another major growth-inducing factor. Besides this, the development of numerous smokeless tobacco products, such as snus and dissolvable tobacco to appeal to a broader consumer base is accelerating the market growth. These smokeless alternatives are promoted as convenient and discreet options for tobacco consumption. Along with this, the emergence of heat-not-burn tobacco products that heat tobacco instead of burning it, producing an aerosol for inhalation as an alternative to smoking cigarettes is creating a positive tobacco market outlook.

The Increasing Marketing and Advertising Campaigns

Tobacco companies invest substantial resources in designing and executing persuasive campaigns to attract consumers and create brand loyalty. According to the U.S. Federal Trade Commission (FTC), tobacco advertising expenditures in the U.S. reached USD 8.06 billion in 2021 alone. These campaigns employ various tactics to create a positive perception of tobacco products and influence consumer behavior. In addition, strategic product placement in movies, television shows, and music videos subtly integrates tobacco use into popular culture, making it appear appealing and socially desirable, thus influencing market growth. Also, celebrity endorsements by well-known figures further reinforce this image, associating tobacco use with success, attractiveness, and glamour, thus augmenting the market growth. Moreover, the integration of colorful packaging, eye-catching designs, and innovative product formats are utilized to create a strong visual appeal and distinguish several brands representing another major growth-inducing factor. These elements aim to make tobacco products more attractive to potential consumers, especially among younger age groups. Furthermore, the emerging digital marketing and social media platforms are reaching a broader audience, particularly the youth with engaging content, contests, and promotions propelling the market growth.

Tobacco Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tobacco market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on type.

Analysis by Type:

- Cigarettes

- Roll Your Own

- Cigars

- Cigarillos

- Smokeless Tobacco

- Others

Cigarettes leads the market with around 51.2% of the market share in 2024. Cigarettes are the most widely consumed tobacco product globally, accounting for a significant share of the industry's revenue. In addition, the widespread adoption of cigarettes due to easy availability, convenience, and cost-effectiveness is influencing the market growth. Moreover, continuous product innovation and flavor diversification with the introduction of flavored cigarettes and novel packaging designs attract new consumers and reinforce brand loyalty among existing customers representing another major growth-inducing factor. Besides this, the extensive investment in marketing and advertising campaigns promoting cigarettes by targeting numerous consumers, including the youth, through strategic product placements and appealing branding are providing a positive thrust to the market growth, Furthermore, the increasing use of cigarettes in many cultures and societies, as an integral part of social norms and daily routines are contributing to the market growth. Along with this, cigarettes offer convenience and portability, making them a preferred choice for on-the-go consumption thus propelling the market growth.

Regional Analysis:

- China

- India

- Brazil

- United States

- EU 15

- Others

In 2024, China accounted for the largest tobacco market share of over 37.8%. The increasing demand for tobacco products in China is influencing the market growth. In addition, rapid urbanization, the growing population, hectic work schedules, and the rising working population are contributing to market growth. Also, China has a long history of tobacco consumption, with smoking deeply ingrained in its social fabric and traditions propelling the market growth. The market is characterized by several products, including traditional cigarettes, cigars, and smokeless tobacco. China National Tobacco Corporation (CNTC), a state-owned enterprise, controls a substantial portion of the market, with an extensive distribution network and a diverse portfolio of tobacco brands. Moreover, China's economic growth and rising disposable income are escalating the demand for tobacco products. Besides this, the aggressive marketing campaigns and the presence of numerous regional and local tobacco companies are further contributing to the market growth.

Key Regional Takeaways:

China Tobacco Market Analysis

China is still the world's largest tobacco industry in terms of production and consumption levels. China produced approximately 37.9% of global unmanufactured tobacco production, as reported by the Lancet in 2022. Its tobacco industry has state control over production, as dominated by the China National Tobacco Corporation (CNTC). The government's taxation policies on tobacco have supported the consistent stream of revenue, even though attempts in recent years to reduce smoking using public health promotions and legislation have caused growth to slow. The efforts notwithstanding, China's extensive consumer base and deeply rooted habit of smoking mean a huge and stable market for tobacco.

India Tobacco Market Analysis

India's tobacco industry is large, fueled by local consumption as well as exports. India's exports of tobacco amounted to a value of USD 1,449.54 million in 2023-24, as reported by the Press Information Bureau (PIB), which is the highest ever for the nation. The tobacco industry accounted for a revenue of USD 13 billion in 2022. Although the incidence of smoking is slowly reducing owing to growing health awareness and government policies, India is still a top exporter of unmanufactured tobacco. Regulations like the prohibition of the advertisement of tobacco products and banning smoking at public places pose challenges to the market. The expansion of the smokeless tobacco segment is offsetting these challenges.

Brazil Tobacco Market Analysis

Brazil's tobacco market is the most extensive in South America, motivated by both home consumption and exporting activities. An estimated 21.1 million tobacco product users were in Brazil during 2022, comprising 13.1 million males and 8.0 million females aged 15 years and over. This ranks the nation at the 8th largest position in the whole world and at the 2nd position within the WHO Region of the Americas in terms of tobacco user counts. During the same year, Brazil exported around 667.3 thousand tons of unmanufactured tobacco, which comprised around 11.5% of the worldwide production of 5.8 million tons and made Brazil the 3rd largest tobacco-producing country in the world. Strict anti-smoking legislation by the government, including high taxes and advertising prohibitions, has driven down smoking volumes, yet the market continues to be strong with the demand for low-cost cigarettes keeping domestic demand alive.

United States Tobacco Market Analysis

In 2024, the United States accounted for over 87.60% of tobacco market in North America. The United States tobacco market is among the largest globally, but it has been declining over the past few years because of health issues and regulations. Based on the Centers for Disease Control and Prevention (CDC), in 2021, about 11.5% of American adults aged 18 years and above were current cigarette smokers. As per an industrial report, in 2021, the overall retail sales of tobacco products in the U.S. were approximately USD 120 billion. The market is moving towards alternatives like smokeless tobacco and e-cigarettes, with Altria and Philip Morris USA investing heavily in these products. The regulatory environment, such as the Food and Drug Administration's (FDA) regulation of tobacco products, is crucial in determining the future of the market.

EU 15 Tobacco Market Analysis

The EU 15 tobacco market is experiencing a gradual but constant decrease in cigarette use. Cigarette sales decreased to 65.8 billion units in Germany in the year 2022, an 8.3% drop from the last year, as per an industrial report. This is one of the examples of a general trend throughout the region, as smoking levels continue to decline. As per a 2024 article by Euronews, close to a quarter (24%) of the population in the EU smokes, with merely a one-point decline in smokers since 2020. The gradual decline in usage is evidence of the efficacy of anti-smoking measures and increased health consciousness, though tobacco continues to be a major market, especially among nations with more intensive smoking rates.

Competitive Landscape:

At present, key players in the market are employing various strategies to strengthen their positions and retain their market dominance. They are continuously innovating and diversifying their product portfolios to cater to changing consumer preferences and introduce novel tobacco products including the development of smokeless tobacco products, e-cigarettes, and flavored tobacco options. Moreover, they are focusing on building and strengthening their distribution networks to ensure their products are widely available and accessible to consumers including collaborations with wholesalers, retailers, and online platforms. Besides this, companies are investing in research and development (R&D) of reduced-risk products, such as heated tobacco products and smokeless alternatives, positioning them as potentially less harmful options to traditional cigarettes. Furthermore, key players are focusing on engaging with consumers through loyalty programs, digital platforms, and social media to create a sense of community around their brands fostering brand loyalty and repeat purchases.

The report provides a comprehensive analysis of the competitive landscape in the tobacco market with detailed profiles of all major companies, including:

- China National Tobacco Corporation

- Phillip Morris International

- British America Tobacco

- Japan Tobacco International

- Imperial Tobacco Group

Recent Developments:

- March 2024: Philip Morris International (PMI) celebrates the 10th anniversary of IQOS, launching the IQOS ILUMA i, a new smoke-free product. PMI aims for over two-thirds of net revenue to come from smoke-free products by 2030. IQOS, now the leading tobacco heating system, has accelerated cigarette decline, especially in Japan, with nearly one-third of smokers using it.

- February 2023: Imperial Brands has launched the Pulze 2.0 heated tobacco device, featuring a compact design and offering up to 25 sessions per charge. Paired with iD sticks in 10 flavors, it provides a potentially less harmful alternative to combustible cigarettes. Pulze 2.0 is initially available in Italy, Poland, the Czech Republic, and Greece.

- November 2022: Phillip Morris International introduced its latest heat-not-burn tobacco heating system, BONDS by IQOS, featuring a unique combination of custom-designed tobacco sticks called BLENDS that aim to offer consumers a distinct and enhanced tobacco experience with its advanced heating technology.

- July 2022: British American Tobacco (BAT) revealed the debut of gloTM hyper X2, the newest addition to its rapidly expanding global heated tobacco brand, gloTM, in Japan. The product boasts a 'barrel styling' design, incorporating innovative user-friendly features, shaped by valuable consumer insights.

- August 2021: Japan Tobacco International launched Ploom X, a cutting-edge heated tobacco device, in the market, which is conveniently available at various convenience stores and select tobacco retail outlets across Japan.

Tobacco Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Cigarettes, Roll Your Own, Cigars, Cigarillos, Smokeless Tobacco, Others |

| Regions Covered | China, India, Brazil, United States, EU 15, Others |

| Companies Covered | China National Tobacco Corporation, Phillip Morris International, British America Tobacco, Japan Tobacco International, Imperial Tobacco Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tobacco market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tobacco market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the tobacco industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tobacco market was valued at 8.76 Million Tons in 2024.

The tobacco market is projected to exhibit a CAGR of 1.2% during 2025-2033, reaching a value of 9.8 Million Tons by 2033.

The market is driven by government policies, cultural acceptance, high smoking rates, low prices, social habits, tax revenue, rural demand, marketing strategies, and the rise of e-cigarettes. Additionally, economic growth, population size, and innovations in tobacco products contribute to market expansion, despite increasing health awareness and regulatory pressures.

China currently dominates the tobacco market, accounting for a share of 37.8%. Government monopoly, strong cultural acceptance, high smoking rates, low prices, rural demand, social habits, tax revenue, and growing e-cigarette market.

Some of the major players in the tobacco market include China National Tobacco Corporation, Phillip Morris International, British America Tobacco, Japan Tobacco International, Imperial Tobacco Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)