Time and Attendance Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Time and Attendance Software Market Size and Share:

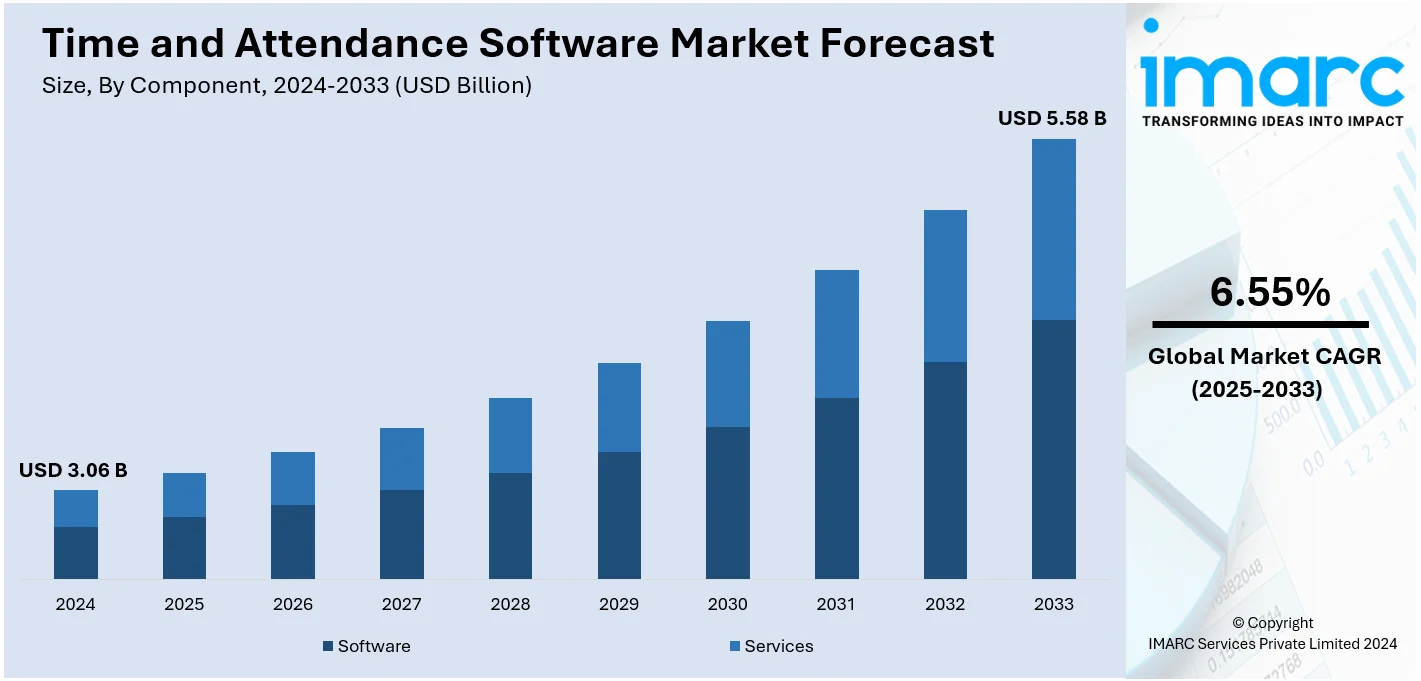

The global time and attendance software market size was valued at USD 3.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.58 Billion by 2033, exhibiting a CAGR of 6.55% during 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The market share is driven by the need for efficient workforce management, rising adoption of cloud-based solutions, compliance with labor laws, and the growth of remote and hybrid work models. Technological advancements like AI integration and system interoperability further enhance market demand across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.06 Billion |

|

Market Forecast in 2033

|

USD 5.58 Billion |

| Market Growth Rate 2025-2033 | 6.55% |

Managing people is one pressure that organizations bear constantly, even as businesses move globally. Manual methods, like traditional punch cards or spreadsheets, are prone to errors and inefficiencies, leading to problems such as inaccurate payroll, compliance issues, and wasted administrative hours. Time and attendance software automates these processes, reducing errors and freeing up time for human resource (HR) teams to focus on strategic tasks. By offering real-time tracking of employee hours, attendance, and productivity, these solutions help businesses optimize labor costs and ensure compliance with labor laws. By 2023, 88% of large organizations and 56% of small-to-medium businesses adopted workforce management solutions, highlighting a significant shift towards automation. The global shift toward remote and hybrid work models has further amplified this need, as employers seek tools to monitor employees effectively regardless of location.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor with 89.50% share in North America. This growth is fueled by the rising adoption of remote and hybrid work models across various industries. As per industry reports, 65% of companies offered some kind of work flexibility in the year 2024, which is a 14% rise from 2023. This has made it difficult to keep track of employees' hours and attendance. Time and attendance software bridges the gap by enabling managers to monitor remote workers' activities accurately, track productivity, and ensure fair compensation. Many solutions include features like geofencing and global positioning system (GPS) tracking to validate employee locations during work hours. As remote work continues to grow, the demand for reliable attendance tracking tools is expected to rise in parallel.

Time and Attendance Software Market Trends:

Workforce Management Efficiency

As per the time and attendance software market forecast, the need to streamline workforce management is a considerable drive factor. Solutions such as time and attendance software automatically track work hours, manage leave, and scheduling, thus cutting errors and administrative workloads to a considerable extent. Organizations learn from such software to make their operations more efficient, increase productivity in employees, and address labor laws and regulations. For example, the health sector alone employed over 17 million workers in 2023. This is the country's biggest source of employment sector, as it has been concluded by the Bureau of Health Workforce. Such a huge workforce requires effective time and attendance management systems that can handle complex scheduling and compliance requirements.

Remote and Hybrid Work Models

The emerging trend of remote and hybrid work models is now a key major factor for the global time and attendance software market growth. With flexible work arrangements becoming increasingly mainstream in the business world, it is witnessing significant demand from cloud-based and adaptable time-tracking solutions. It's helping organizations closely track their employees' hours of work, employee attendance, and productivity outside and inside offices and provides timely reporting with effortless integration with payroll. The shift toward remote work, because of the COVID-19 pandemic, has additionally evolved to redefine workplace dynamics. The Bureau of Labor Statistics indicates that the work-from-home rate, which was elevated during the pandemic, stayed steady at 28% as of June 2023. The sustained trend here reflects the growing demand for efficient time and attendance software that meets the requirements of location-independent work environments, leading to market growth. With developments in remote and hybrid working models, the global demand for effective, scalable time-tracking solutions will also increase.

Technological Advancements and Integration Capabilities

Innovations such as AI-powered analytics, biometric authentication, and mobile app-based tracking are driving the global time and attendance software market demand. Such developments improve the efficiency and accuracy of time-tracking systems in business organizations to help better manage workforces. Further, the interoperability of time and attendance solutions with other enterprise systems, like HR management, payroll, and Enterprise Resource Planning (ERP), allows for effective data exchange across systems, ensuring these solutions form a vital component of the current business infrastructure. In this scenario, as firms look for effective ways to better manage their workforces, time and attendance solutions that are integral to broader enterprise systems will increase in demand. Industry reports further predict that the ERP software market will grow at a CAGR of around 10% between 2025 and 2030, and hence, there is an increasing adoption of integrated time and attendance software by businesses seeking unified and automated solutions for operational efficiency.

Time and Attendance Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global time and attendance software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size and end user.

Analysis by Component:

- Software

- Services

As per the time and attendance software market trends, software leads the market by component in 2024, driven by its widespread adoption across industries. Organizations increasingly rely on software to streamline workforce management, enhance productivity, and reduce administrative errors. Advanced software solutions offer features such as real-time tracking, data analytics, cloud-based accessibility, and integration with payroll and HR systems. The growing preference for software-as-a-service (SaaS) models further fuels this segment’s growth, as businesses of all sizes leverage cost-effective and scalable solutions. The demand is especially strong among small and medium enterprises (SMEs), which value the cost-effectiveness and adaptability of cloud-based platforms.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based leads the market with around 65.5% of market share in 2024, reflecting a shift in organizational preferences toward flexible, scalable, and cost-efficient solutions. Businesses across all industries are moving to cloud-based systems because these systems provide immediate access to information from anywhere and are, therefore, best suited for managing remote and hybrid workforces. Cloud-based solutions eliminate the need for expensive hardware and maintenance, making them attractive for small and medium-sized enterprises (SMEs). Additionally, they offer seamless integration with other business systems such as payroll and HR management software, enhancing operational efficiency. The rapid advancements in data security and the increasing demand for software-as-a-service (SaaS) models further bolster the adoption of cloud-based solutions globally.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

According to the time and attendance software market outlook, large enterprises lead the industry in 2024. This growth is driven by their need for sophisticated workforce management solutions that can handle extensive employee bases and complex operational requirements. These organizations need sophisticated capabilities, including multi-location tracking, compliance management, and seamless integration with enterprise resource planning (ERP) and human resource management systems (HRMS). The scalability of modern solutions allows large enterprises to manage diverse and dispersed workforces efficiently while ensuring accuracy in payroll and compliance with labor regulations. The adoption of cloud-based and AI-powered tools is particularly high in this segment, as these features enable real-time data analytics, predictive scheduling, and enhanced decision-making, further solidifying their dominance in the market.

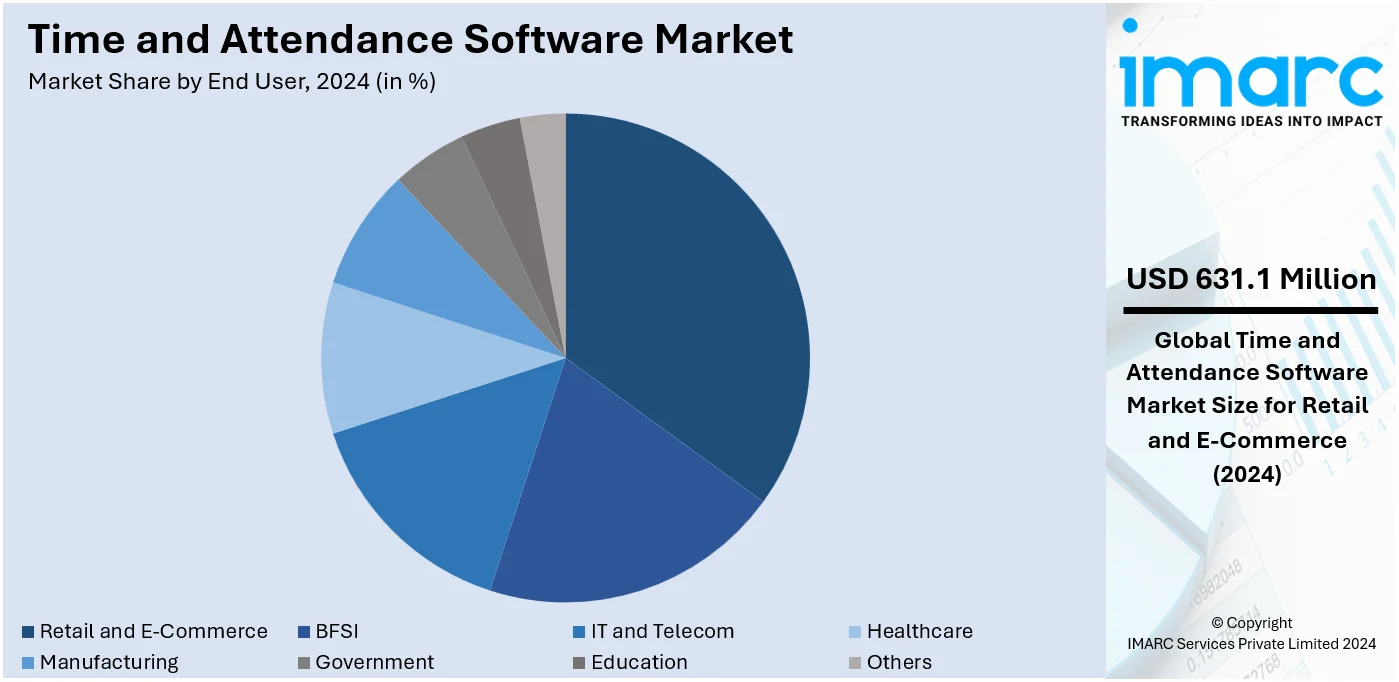

Analysis by End User:

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-Commerce

- Manufacturing

- Government

- Education

- Others

Retail and e-commerce lead the time and attendance software market share with 20.6% in 2024. This dominance is driven by its unique workforce management needs. These industries often operate with large, diverse, and geographically dispersed employee bases, including part-time, seasonal, and shift workers. Time and attendance software helps businesses streamline scheduling, accurately monitor attendance, and maintain compliance with labor regulations across various regions. With the rapid growth of e-commerce and the demand for 24/7 operations, the need for robust workforce management tools has become even more critical. Features such as mobile access, real-time data analytics, and integration with payroll systems are particularly valued, helping these businesses manage labor costs effectively while maintaining high operational efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%. This growth is driven by the region's early adoption of advanced technologies and a strong focus on workforce management efficiency. Businesses across the United States and Canada are increasingly implementing time and attendance solutions to streamline operations, reduce errors, and ensure compliance with stringent labor laws. The high penetration of cloud-based systems, coupled with advancements in artificial intelligence and machine learning, has further propelled growth in this region. North America’s market is supported by the presence of major software providers and a robust IT infrastructure. The rise of remote and hybrid work models has also played a significant role, as organizations seek flexible and scalable tools to manage dispersed teams effectively. This trend is expected to continue as more companies prioritize automation and integration in their workforce management strategies.

Key Regional Takeaways:

United States Time and Attendance Market Analysis

A key driver of growth in the time and attendance software market in the US is the growth of remote working in the United States. Indeed, the US Career Institute indicated that by 2025, at least 36.2 million American employees will have transitioned into working remotely. Moreover, by the end of 2025, it is estimated that 14% of the U.S. adult population will have remote jobs, which is five times more than before the pandemic, when only 7 million Americans worked from home, as per reports. This change is driving a need for flexible and cloud-based time-tracking solutions that allow businesses to track hours, productivity, and attendance of employees from anywhere. As remote work becomes a permanent fixture in many industries, time and attendance software will continue to play a crucial role in helping organizations optimize workforce management, improve operational efficiency, and ensure compliance with labor regulations in a decentralized work environment.

Europe Time and Attendance Market Analysis

Some of the major factors contributing to the European time and attendance software market emphasize the evolution of remote work and foreign-trained professionals. The European Commission published findings showing that there was an increase of 8.0% in the share of employed people within the EU who are regularly working from home in 2019-2021. In the trend of growing remote work, the need for flexible solutions that are cloud-based for time-tracking while assisting the businesses in monitoring productivity and attendance, irrespective of location has increased. Alongside this, OECD states reported that foreign-trained doctors into European countries increased 17% in 2022 compared to 2019. Such an increase in this international talent pool across various sectors is further adding to the need for efficient time and attendance management systems with labor code compliance features and enhanced workforce productivity optimization. These factors are driving the adoption of advanced time and attendance solutions across Europe.

Asia Pacific Time and Attendance Market Analysis

The Asia Pacific time and attendance software market is growing due to the need for better workforce management and digital transformation. Nearly half or 48% of workers in the region learned new technologies and tools in 2023 due to a changing workforce environment caused by the business shift towards digitalizing operations. Such changes in the workplace add complexity in terms of efficient management of the workforce and are prompting organizations to look for automated solutions that can help streamline tasks, such as tracking, attendance, and scheduling. This also creates the higher need for solutions like time and attendance software because of their efficiency in managing labor costs, complying with labor laws, and increasing employee productivity. Innovative features associated with advanced technologies such as AI, biometric authentication, and mobile tracking have further increased the need for organizations to keep up with a dynamic and dispersed workforce.

Latin America Time and Attendance Market Analysis

As teleworking and hybrid work models gain popularity in the region, the market for time attendance software has been growing steadily. According to the Brazilian Institute of Geography and Statistics (IBGE), in 2022 there were 7.4 million teleworkers in Brazil who worked either regularly or occasionally or 7.7% of the total employment. Continuous shift towards work from home is pushing customers to adopt cloud time and attendance systems in order for management to monitor employee working hours in any possible location. It is being increasingly availed by the manufacturing industry, retail industry, and healthcare industry, among others, as they seek ways of streamlining operations and remain compliant with labor regulations. As the digital transformation speeds up throughout Latin America, the demands for seamless integration of time and attendance solutions in payroll and HR systems will keep growing, leading to further growth in the Latin American time and attendance software market in the coming years.

Middle East and Africa Time and Attendance Market Analysis

There exists tremendous growth in the Middle East and Africa time and attendance software market by the improvement of key sectors such as healthcare. For example, within the UAE, statistics show over 181,000 health care professionals, comprising doctors, nurses, as well as other allied health workers, which significantly portrays an increase in their workforce since the country heavily spends in the health care infrastructure, as reported by industry statistics. Healthcare organizations are scaling up their operations and adjusting to the rapid growth in the workforce, which is causing a growing demand for efficient time and attendance management solutions to track employee hours, manage shifts, and ensure compliance with labor regulations. This trend, however, extends to various other sectors, including retail, manufacturing, and education. The growth in the Middle East and Africa time and attendance software market will continue to be influenced by the focus of the region on digital transformation and workforce optimization, along with the adoption of cloud-based, AI-powered, and mobile-enabled time tracking solutions.

Competitive Landscape:

The key players are focusing on innovation, strategic partnerships, and geographic expansion in order to improve their market position. Key leaders such as have integrated the use of AI, ML, and predictive analytics to their platform so that workforce management solutions will be more precise and efficient. Many are resorting to cloud-based models in a bid to respond to the need for scalable and cost-effective tools, where demand is high among small and medium-sized enterprises. Partnerships and acquisitions are also a primary focus, whereby firms form partnerships to enrich their product portfolios and push into emerging markets. For instance, providers are increasingly targeting industries such as retail, health, and manufacturing, where workforce management complexities drive high demand for such solutions. In addition, the vendors are focusing on mobile-first platforms and user-friendly interfaces for better adoption and customer satisfaction. These strategies enable market leaders to better adapt to evolving customer needs while staying competitive in the dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the time and attendance software market with detailed profiles of all major companies, including:

- ADP, Inc.

- Dayforce

- Fingercheck, LLC

- nettime solutions

- Oracle

- Paychex Inc.

- Paycom Payroll LLC

- Paycor Inc.

- SAP SE

- UKG Inc.

- Workday Inc.

- Zebra Technologies Corp.

Latest News and Developments:

- June 2024: Patriot Software launched its My Patriot mobile app, which is a modern solution to the problem of easy tracking and management of work hours. This application is available for salaried and hourly employees whose employers are using Patriot's Time and Attendance software.

- May 2024: Dell launched an office-attendance policy tracking of the employees, which is engaged in a hybrid model of working. It bases the system on electronic badge scans, VPN log-ins, and color-coded tracking of employee attendance.

- February 2024: Poll Everywhere launched its Attendance Management feature, allowing faculty to track student attendance using geolocation technology.

Time and Attendance Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, IT and Telecom, Healthcare, Retail and E-Commerce, Manufacturing, Government, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADP, Inc., Dayforce, Fingercheck, LLC, nettime solutions, Oracle, Paychex Inc., Paycom Payroll LLC, Paycor Inc., SAP SE, UKG Inc., Workday Inc., Zebra Technologies Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the time and attendance software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global time and attendance software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the time and attendance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Time and attendance software refers to a digital tool that helps businesses track and manage employee work hours, attendance, and schedules. It automates tasks like clock-ins, leave management, and payroll integration, ensuring accuracy and compliance with labor laws, and efficient workforce management across various industries and work environments.

The time and attendance software market was valued at USD 3.06 Billion in 2024.

IMARC estimates the global time and attendance software market to exhibit a CAGR of 6.55% during 2025-2033.

The key factors driving the global time and attendance software market include the rising demand for workforce management efficiency, adoption of cloud-based solutions, compliance with labor regulations, remote and hybrid work models, and the integration of attendance systems with payroll and HR platforms.

According to the report, software represented the largest segment by component, due to its ability to automate workforce management, reduce errors, and provide real-time insights into employee attendance.

Cloud-based leads the market by deployment mode as they offer flexibility, remote accessibility, and cost-effectiveness.

Large enterprises is the leading segment by organization size, as they require advanced time and attendance solutions to manage extensive workforces and ensure compliance with complex labor laws.

Retail and e-commerce are the leading segment by end user, due to its reliance on managing large, diverse, and shift-based workforces.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global time and attendance software market include ADP, Inc., Dayforce, Fingercheck, LLC, nettime solutions, Oracle, Paychex Inc., Paycom Payroll LLC, Paycor Inc., SAP SE, UKG Inc., Workday Inc. and Zebra Technologies Corp.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)