Tilt Sensor Market Size, Share, Trends and Forecast by Housing Material, Technology, Application, and Region, 2025-2033

Tilt Sensor Market Size and Share:

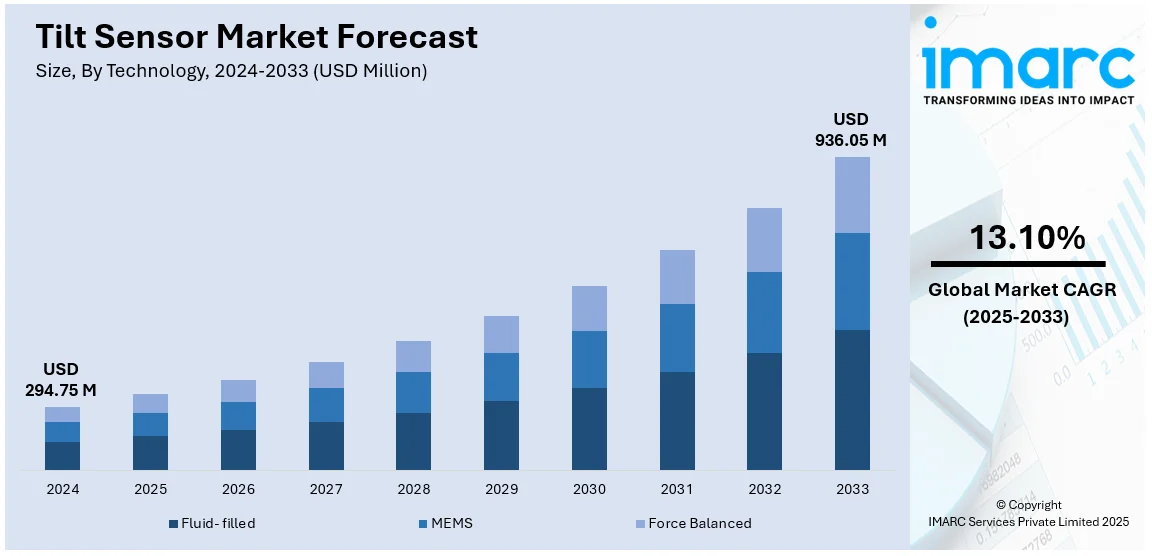

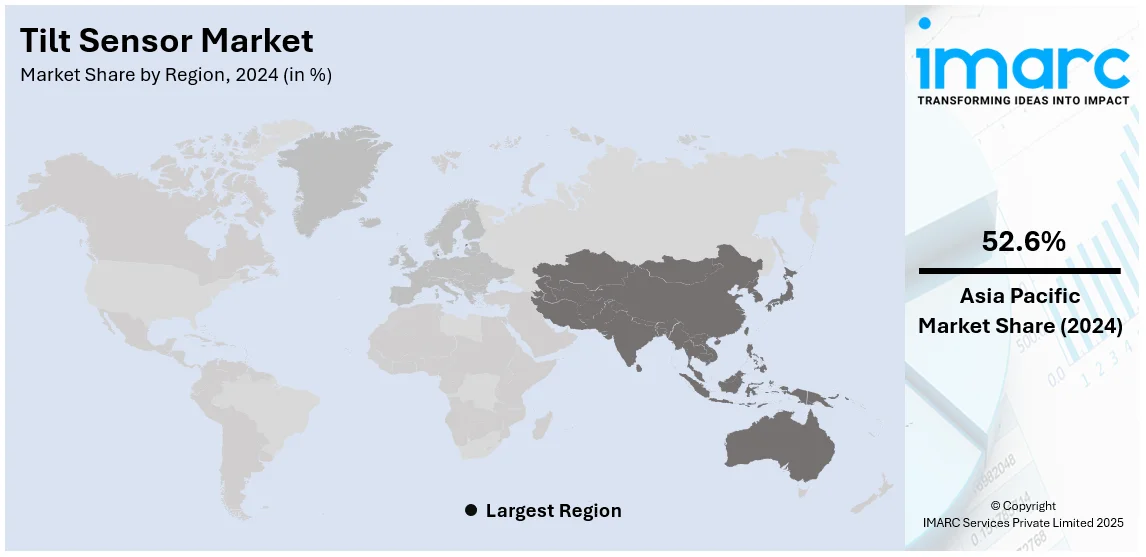

The global tilt sensor market size was valued at USD 294.75 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 936.05 Million by 2033, exhibiting a CAGR of 13.10% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 52.6% in 2024. The market is majorly driven by continual advancements in positioning technologies, growing demand in automotive stability systems, increasing use in renewable energy systems, rising adoption in automation and robotics, expanding applications in construction and mining and the rapid integration of MEMS technology for precision and compact designs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 294.75 Million |

| Market Forecast in 2033 | USD 936.05 Million |

| Market Growth Rate (2025-2033) | 13.10% |

The global market is primarily driven by the advanced positioning and measurement technologies, where machines and equipment can be accurately monitored and controlled. Additionally, the increasing adoption of these sensors in the automotive industry for stability control and rollover detection is further propelling market growth. Furthermore, the growing use of tilt sensors in consumer electronics, supporting device orientation and gaming applications, is acting as a significant growth-inducing factor for the market. Moreover, an enhanced focus on automation and robotics, which requires accurate angle measurement, is positively influencing the market. Besides this, the increasing installation of tilt sensors in renewable energy systems such as wind turbines and solar trackers is expanding the market horizon. For instance, a Science Direct article highlights tilt sensors, such as inclinometers and MEMS accelerometers, for monitoring tree biomechanics, with a sampling rate of 20 Hz and ±0.01° tilt angle accuracy. Recommended sensor placement includes specific tree heights, and up to 29 inclinometers are used in studies, reflecting growing demand for precision monitoring technologies.

The United States is a key regional market, driven by the rising use of tilt sensors in agricultural machinery, providing efficient farming practices. Additionally, the growing investments in industrial automation and smart manufacturing are increasing the demand for accurate sensing technologies, which is expanding the regional market. According to a NASSCOM report, by 2025 digital technologies will be utilized for 40% of the total expenditure in manufacturing, while this share in 2021 was about 20%. The areas of AI and ML have been implemented across various industries such as automobiles, electronics, chemicals & pharmaceuticals, and textiles that lead to increased process efficiency and productivity. Moreover, the growing defense and aerospace industries, which are using tilt sensors for navigation and control, are contributing to the overall growth of the market. Furthermore, the growing emphasis on safety and stability in transportation systems is promoting the use of tilt sensors, which is further developing the regional market.

Tilt Sensor Market Trends:

Ongoing Advancements in MEMS Technology

The market is driven by the rapidly increasing incorporation of MEMS technology into tilt sensors. The MEMS-based tilt sensors provide increased precision, reduced size, and low power consumption, which render them ideal for consumer electronics, automotive systems, and industrial machinery applications. The miniaturization associated with MEMS technology allows integration into compact devices such as smartphones and wearable gadgets, improving user experience through features such as screen rotation and motion detection. For instance, on December 26, 2024, MEMS Drive Hong Kong Ltd announced the development of advanced MEMS actuators for mobile imaging in portable electronics. Their proprietary MEMS design enables CMOS sensors to achieve swift and precise 'SensorShift,' implementing 5-axis stabilization in mobile cameras. This technology enhances image resolution and stability across various applications, including smartphones, wearable tech, and autonomous vehicles. Apart from this, in the automotive sector, MEMS tilt sensors are contributing to advanced driver-assistance systems (ADAS) by giving accurate measurements of tilt, thereby improving vehicles' stability and safety. Additionally, ongoing developments in MEMS fabrication technology continue to cut production costs, which in turn is lowering the price of these sensors for mass usage in numerous sectors and contributing to growth in the market.

Renewable Energy Integration

The market is being driven by the growing demand for tilt sensors due to the increasing adoption of renewable energy technologies, especially in solar and wind energy technologies. Tilt sensors are utilized in photovoltaic tracking systems in solar power installations to optimize the angle of solar panels relative to the sun, thereby ensuring the maximum efficiency of energy production. In wind turbines, tilt sensors monitor the angle of inclination of turbine blades and nacelle for optimal alignment with the wind direction for improved power generation. Apart from this, the accelerating investments in renewable energy infrastructure globally, is contributing to the expansion of the market. For instance, on June 28, 2024, the World Bank approved additional financing of USD1.5 Billion to help India transition to low-carbon energy. The financing will help to develop a green hydrogen market, increase renewable energy capacity, and increased investment in low-carbon technologies. The program is expected to generate at least 450,000 metric tons of green hydrogen annually to help India meet its net-zero emissions target.

Growing Emphasis on Industrial Automation

The market is driven by an enhanced emphasis on industrial automation. For instance, on August 21, 2024, Olis Robotics introduced new Programmable Logic Controller (PLC) capabilities for industrial automation cells at the International Manufacturing Technology Show (IMTS). These improvements enable seamless integration of Olis' remote robot management software with existing industrial automation systems, improving operational efficiency and reducing downtime. The new features are compatible with a wide range of PLCs, facilitating broader adoption across various manufacturing environments. Apart from this, in automated manufacturing environments, the accurate angle and position measurements are essential for the proper functioning of robotic arms, conveyor systems, and other machinery. Tilt sensors provide real-time data that enable improved control and efficiency in these automated processes. The escalating trend toward smart factories, which integrate advanced sensors and Internet of Things (IoT) devices for improved operational insights, is further amplifying the need for reliable tilt sensing solutions. Moreover, the growing shift towards automation and smart manufacturing is acting as a significant growth inducing factor for the market.

Tilt Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tilt sensor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on housing material, technology, and application.

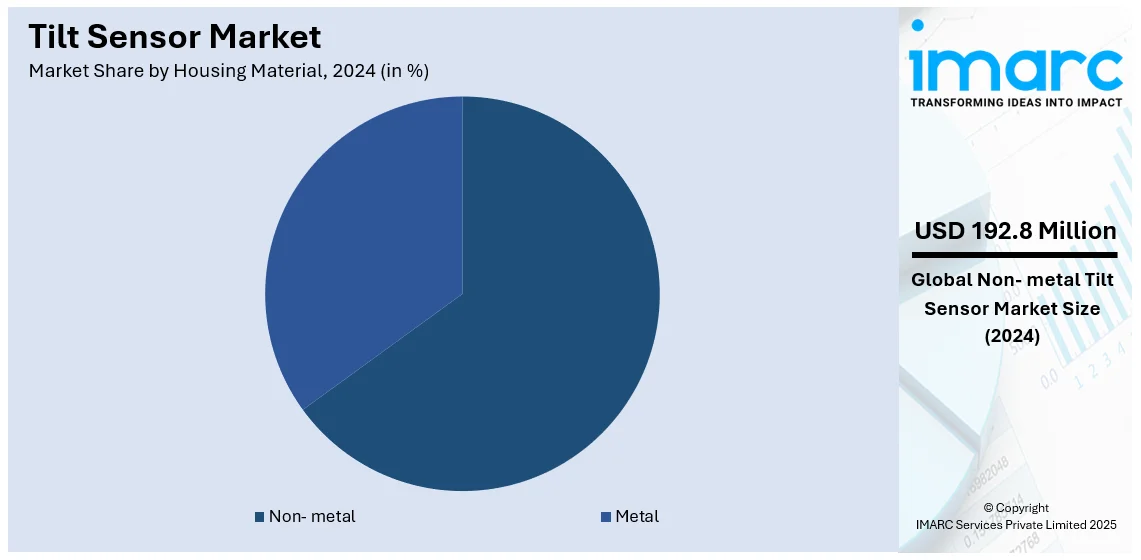

Analysis by Housing Material:

- Non- metal

- Metal

Non- metal leads the market in 2024, accounting for a share of around 65.4%. Non-metals are an essential element of the tilt sensor market. The use of non-metals allows for designs that are both light and corrosion resistant. For instance, plastics and ceramics are often used in sensor housings and components for durability in challenging environments. Their non-conductive properties are also important to ensure accurate signal processing, especially in high-frequency or high-temperature applications. Non-metals enable manufacturers to produce compact, cost-effective designs without having to sacrifice performance. Moreover, they are versatile in manufacturing processes. They can be manufactured in 3D printing, which enables quick prototyping and customization. The increasing demand for non-metal components as it satisfies the growing needs of modern tilt sensors, mainly in industries that require resistance, accuracy, and minimum environmental impact.

Analysis by Technology:

- Fluid- filled

- MEMS

- Force Balanced

MEMS leads the market in 2024. Micro-Electro-Mechanical Systems (MEMS) are changing the nature of the tilt sensor industry due to their small size, low power consumption, and high accuracy. MEMS technology integrates mechanical elements with electronics at a microscopic scale, allowing advanced capabilities in tilt sensing. This is very useful in portable devices, automotive systems, and industrial automation where space and power efficiency are a challenge. MEMS-based tilt sensors can withstand vibrations and operate reliably under harsh conditions, making them ideal for dynamic environments. Besides, their scalability and cost efficiency support mass-scale implementation across consumer and professional applications. The flexibility of MEMS technology allows for continuous development, ensuring that tilt sensors will always be flexible to dynamically advancing trends and demands in different industries.

Analysis by Application:

- Construction and Mining

- Automotive and Transportation

- Aerospace and Defense

- Telecommunications

- Others

Construction and Mining leads the market in 2024, accounting for a share of around 33.6%. Tilt sensors play a vital role in construction and mining. There must be safety and precision in the right and appropriate application of heavy machinery, cranes, and drilling equipment. In construction, the appropriate design of bridges and high-rise buildings can be ensured, which ensures long-term stability. In mining, it allows for safer navigation of underground vehicles and monitoring unstable areas. The rugged design of tilt sensors makes them suitable for dusty, wet, and high-vibration conditions commonly found in these industries. Their reliability and accuracy provide critical data that allows operators to make informed decisions, thereby increasing productivity while minimizing hazards in demanding environments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

Asia- Pacific leads the market in 2024, accounting for a share of around 52.6%due to rapid industrialization, infrastructure development, and technological advancement. The diversity of industries, such as automotive, construction, and electronics, requires reliable tilt sensing solutions, which creates demand in this region. As a hub for manufacturing activities, China, Japan, and South Korea are some of the countries that take the lead in developing and adopting new tilt sensor technologies. Additionally, the region’s focus on automation and smart systems accelerates the integration of tilt sensors into robotics and industrial equipment. As Asia-Pacific continues to invest in innovation and modernization, the tilt sensor market benefits from a dynamic ecosystem of suppliers, manufacturers, and end-users collaborating to meet changing application needs.

Key Regional Takeaways:

United States Tilt Sensor Market Analysis

The United States accounts for 80.70% of the North America tilt sensor market share in 2024. This growth is fueled by advanced technological adoption and strong demand across sectors like construction, aerospace, automotive, and healthcare. The rise in automation and precision in industrial processes also increased the integration of tilt sensors in machinery and robotics. Additionally, the expanding use of MEMS technology enhances performance and reliability in applications involving autonomous vehicles and smart devices. For instance, on September 19, 2024, Knowles Corporation entered a definitive agreement to divest its Consumer MEMS Microphones (CMM) business to Syntiant Corp for USD 150 Million. This strategic divestiture aligns with Knowles' transformation into a leading industrial technology company focusing on its Precision Devices and MedTech & Specialty Audio segments catering to the aerospace, defense, industrial, medtech, and electrification sectors. Modernization projects related to infrastructure further improve demand for tilt sensors in the construction and civil engineering fields. The presence of major companies and a robust research system supports continuous innovation, so the U.S. continues to be a leading innovator in tilt sensor technology. Apart from that, strict regulations that promote safety as well as efficiency in certain industries push the implementation of tilt sensing solutions further.

Europe Tilt Sensor Market Analysis

The market in Europe is driven by its powerful industrial and automotive sectors. Countries such as Germany, the UK, and France are the front-runners in this region, highly adopting advanced tilt sensor technologies in manufacturing and transportation. An enhanced emphasis on sustainable construction practices is also fueling their application in monitoring building and infrastructural projects. For instance, on December 17, 2024, ABB's Smart Buildings Division announced a partnership with the World Green Building Council's European Regional Network to advance sustainable, energy-efficient building practices across Europe. The partnership is intended to reduce the massive environmental impact that buildings have on the world, as they consume around 30% of final energy and produce 26% of global greenhouse gas emissions. The initiative leverages the expertise of ABB in electrical and automation technologies for the advancement of low-carbon, energy-efficient buildings in line with the sustainability goals of Europe. Moreover, the country’s focus upon automation and robotics is combining tilt sensors in industrial machineries and smart systems, thereby supporting the market demand. The region's set of regulations regarding worker safety as well as operational efficiency leads to the acceptance of latest sensing solutions that will give way to a steady rate of market growth. Also, the research-oriented nature of Europe also influences the development of cutting-edge tilt sensor applications.

Asia Pacific Tilt Sensor Market Analysis

The Asia-Pacific region is driven by rapid industrialization, infrastructure expansion, and technological innovation. A recent AHK World Business Outlook survey of approximately 820 German companies in the Asia-Pacific region shows 51% of those based in India plan to increase investments within the next 12 months. This highlights India's role as a major driver of industrial growth and innovation in the Asia-Pacific region's rapid industrialization. . Additionally, manufacturing hubs in China, Japan, and South Korea are principal contributors to the production and utilization of modern tilt sensors. It is mainly dominated by construction, automotive, and consumer electronics applications which enjoy strong support from regional focus on automation and smart technologies. Moreover, increasing investments in robotics and Industry 4.0 projects is propelling the demand for tilt sensors, wherein increased infrastructure projects in emerging markets such as India is growing their penetration in various sectors.

Latin America Tilt Sensor Market Analysis

The Latin American market is growing at a steady pace due to its increasing investments in construction and mining industries. For instance, on September 19, 2024, Hitachi Construction Machinery Co., Ltd. and Marubeni Corporation announced to form ZAMine Service Brasil Limitada, a joint venture to be focused on the sales and servicing of mining machinery in Brazil. The two companies will hold a 50% stake each in the special purpose corporation, with a view to strengthening their positions in South America's increasingly large mining sector, including copper, iron ore, and gold extraction. This is part of Hitachi Construction Machinery's "BUILDING THE FUTURE 2025" plan, aiming for sales revenues exceeding 300 billion yen in the Americas by fiscal year 2025, thereby propelling the market. Alongside such investments, countries such as Brazil, Mexico, and Chile are using tilt sensors for monitoring machinery and infrastructure, thereby improving safety and efficiency Additionally, rising adoption of automation in industrial processes is further increasing the demand for these sensors. Apart from this, operational standards are being improved across the region, which helps in integrating tilt sensors into various applications despite the country-specific economic conditions.

Middle East and Africa Tilt Sensor Market Analysis

The Middle East and Africa tilt sensor market is shaped by growing construction and oil and gas industries. For instance, on July 16, 2024, ADNOC Gas PLC awarded engineering, procurement, and construction contracts worth USD 550 Million to Galfar Engineering & Contracting WLL Emirates and NMDC Energy PJSC for the ESTIDAMA project, targeting an expansion of the UAE's natural gas pipeline network from around 3,200 kilometers to over 3,500 kilometers and improving gas transportation capacity to the Northern Emirates. Additionally, tilt sensors are vital for monitoring equipment in harsh environments, ensuring safety and precision. Countries such as the UAE, Saudi Arabia, and South Africa lead in adopting these technologies, especially in infrastructure development. While economic challenges exist, the region’s increasing focus on modernization and safety regulations sustains demand for tilt sensors across key sectors.

Competitive Landscape:

The market for is highly competitive with many players competing to gain a better position in the Industry. This competitive environment is highly innovative, and companies are investing heavily in research and development to introduce more advanced sensor technologies that offer higher precision, reliability, and integration capabilities. Moreover, the market is experiencing strategic collaborations and partnerships aimed at expanding product portfolios and entering new application areas. Price competitiveness remains one of the most significant factors, and manufacturers will optimize production processes and cut costs without compromising quality. With growing demand for tilt sensors in automotive, construction, and consumer electronics industries, the competition is more acute as companies are competing to meet diverse customer requirements and capitalize on emerging opportunities. .

The report provides a comprehensive analysis of the competitive landscape in the tilt sensor market with detailed profiles of all major companies, including:

- Balluff Automation India Pvt. Ltd

- elobau GmbH & Co. KG

- Jewell Instruments

- Level Developments Ltd

- Murata Manufacturing Co., Ltd

- Pepperl+Fuchs SE

- SICK AG

- TE Connectivity

- The Fredericks Company

Latest News and Developments:

- On April 10, 2024, Sony Electronics introduced the BRC-AM7, a 4K 60p pan-tilt-zoom (PTZ) camera with AI-based Auto Framing for precise subject tracking. As the world's smallest and lightest integrated lens PTZ camera, it offers enhanced installation flexibility for challenging locations. Utilizing tilt sensors for accurate vertical movement, the BRC-AM7 integrates seamlessly with Sony's professional ecosystem, ensuring consistent, high-quality video production.

- On September 30, 2024, FLIR, a Teledyne Technologies company, introduced the TrafiBot Dual AI multispectral camera system featuring a built-in tilt sensor to enhance interurban traffic safety, particularly in tunnels and on bridges. This advanced camera utilizes proprietary AI models and a patented 3D world tracker to detect incidents, anticipate vehicle movements, and provide early fire detection, thereby improving response times and reducing false alarms.

- On August 27, 2024, GE Vernova and Systems With Intelligence (SWI) signed a memorandum of understanding (MoU) on August 27, 2024, to develop advanced substation monitoring solutions. This collaboration aims to integrate technologies such as gas sensing, bushing monitoring, and infrared thermography, enhanced by AI and machine learning, to improve diagnostics and asset management for utilities and transmission system operators. The initial product from this collaboration, integrating SWI's pan/tilt substation infrared sensors with GE Vernova's DGA 900 Plus system, is slated for commercial release in early 2025.

Tilt Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Housing Materials Covered | Non- Metal, Metal |

| Technologies Covered | Fluid- filled, MEMS, Force Balanced |

| Applications Covered | Construction and Mining, Automotive and Transportation, Aerospace and Defense, Telecommunications, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, , China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Balluff Automation India Pvt. Ltd, elobau GmbH & Co. KG, Jewell Instruments, Level Developments Ltd, Murata Manufacturing Co., Ltd, Pepperl+Fuchs SE, SICK AG, TE Connectivity, The Fredericks Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tilt sensor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tilt sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tilt sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global tilt sensor market was valued at USD 294.75 Billion in 2024.

The global tilt sensor market is estimated to reach USD 936.05 Million by 2033, exhibiting a CAGR of 13.10% from 2025-2033.

The market is driven by advancements in positioning technologies, growing adoption in automotive stability systems, increasing use in renewable energy systems, and rising demand for automation and robotics. Additionally, tilt sensors are essential in precision-driven sectors like construction, mining, and aerospace.

Asia Pacific currently dominates the global tilt sensor market. The dominance is driven by rapid industrialization, significant growth in the construction and mining sectors, and increasing adoption of automation technologies in countries like China, Japan, and South Korea.

Some of the major players in the global tilt sensor market include Balluff Automation India Pvt. Ltd, elobau GmbH & Co. KG, Jewell Instruments, Level Developments Ltd, Murata Manufacturing Co., Ltd, Pepperl+Fuchs SE, SICK AG, TE Connectivity and The Fredericks Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)