Tilapia Market Size, Share, Trends and Forecast by Farmed Vs Wild Capture, Species, Product, Sector, and Region, 2025-2033

Tilapia Market Size and Share:

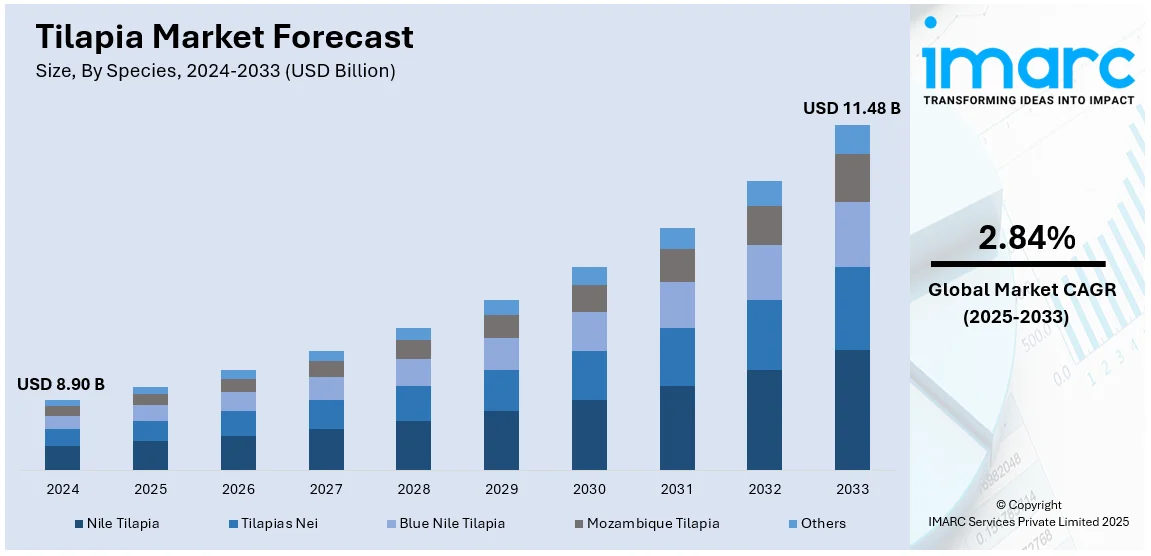

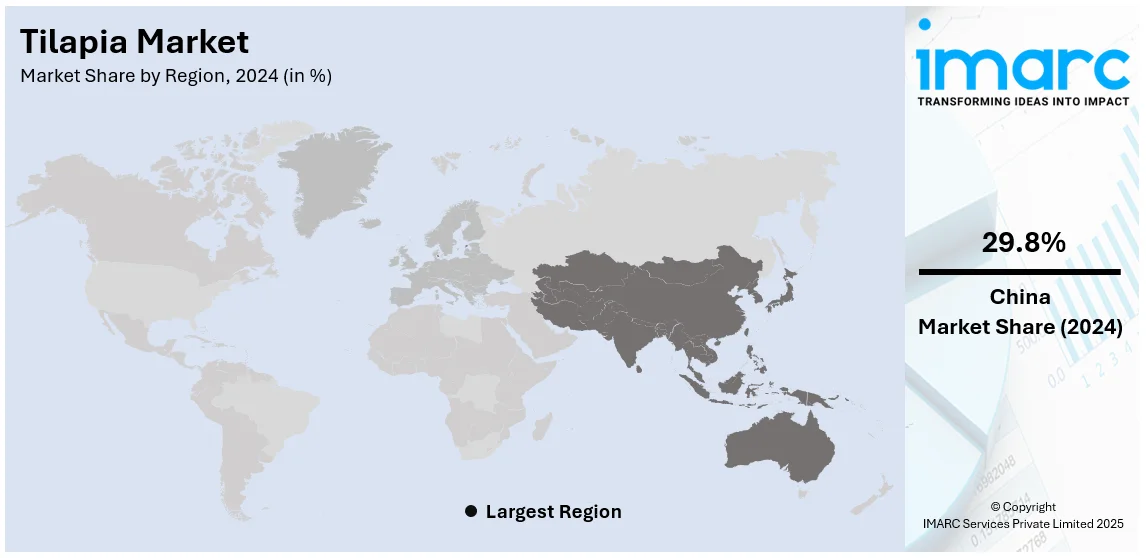

The global tilapia market size was valued at USD 8.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.48 Billion by 2033, exhibiting a CAGR of 2.84% during 2025-2033. China currently dominates the market, holding a significant market share of over 29.8% in 2024. The market is experiencing steady growth driven by the demand for affordable, high-protein food sources, particularly in developing countries, the rising supportive government policies, encompassing subsidies and export incentives, and continuous technological advancements in aquaculture across the globe. These factors, collectively, are increasing the tilapia market share significantly across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.90 Billion |

|

Market Forecast in 2033

|

USD 11.48 Billion |

| Market Growth Rate (2025-2033) | 2.84% |

The key drivers in the tilapia market are the increasing global demand for affordable and protein-rich food sources driven by population growth and changing dietary preferences. Tilapia is adaptable to diverse farming conditions and has a fast growth rate making it a preferred choice for aquaculture. Increasing health awareness about its low-fat content and nutritional value further boosts its consumption. Advances in aquaculture technologies and feed optimization have improved production efficiency and lowered costs supporting market expansion. Growing exports especially from key producers in Asia and government initiatives promoting sustainable aquaculture practices are also contributing significantly to the market's growth trajectory. For instance, in September 2024, FAI, Egypt's Central Lab for Aquaculture Research (CLAR) and Ethical Seafood Research launched a partnership to enhance tilapia welfare in Egypt. Formalized through a Memorandum of Understanding the initiative aims to improve fish welfare assessment and management supporting sustainable growth in the country's tilapia farming sector. These factors are creating a positive tilapia market outlook further across the world.

Key drivers in China's tilapia market include its status as a global leader in tilapia production and export which is supported by favorable climatic conditions and government support for aquaculture. Increasing domestic demand for affordable high-protein food sources is another significant factor since tilapia is a staple in Chinese diets. Increased exports to major markets such as the United States and Europe further boost growth. For instance, in May 2024, Amyco Foods, a Hainan-based exporter announced its plans to expand its European market for high-quality and affordable Chinese tilapia. Increasing awareness among consumers regarding the health benefits of tilapia like low fat and high nutrition content contributes to further expansion of the market within China.

Tilapia Market Trends:

Growing Demand for Affordable Protein Sources

The global market is experiencing significant growth, driven largely by the increasing demand for affordable protein sources. Tilapia, known for its low fat and high protein content, emerges as a cost-effective alternative to more expensive meats. This demand is particularly pronounced in developing regions where expanding population base and growing middle classes seek nutritious, budget-friendly food options. According to reports, India's middle class is projected to nearly double, reaching 61% by 2046-47. Additionally, its adaptability to diverse culinary practices also contributes to its widespread popularity, making it a staple in various cultural diets. Along with this, the ease of farming, requiring relatively low inputs, complements its appeal to producers, particularly in areas where resources for more intensive aquaculture are limited.

Advancements in Aquaculture Practices

The market is further propelled by significant advancements in aquaculture practices. The global aquaculture market size was valued at 82.8 Million Tons in 2024. Innovations in breeding techniques, feed efficiency, and disease control have considerably improved tilapia farming efficiency, leading to higher yields and better-quality fish. These advancements are critical in meeting the escalating global demand while ensuring sustainable practices. In addition, enhanced aquaculture technology is enabling farmers to minimize environmental impact, a factor increasingly important to consumers and regulatory bodies. Furthermore, the development of genetically improved strains of tilapia is resulting in faster growth rates and improved resistance to diseases, making its farming more economically viable and attractive to investors and new entrants in the market.

Supportive Government Policies and Export Incentives

Governments across various nations have recognized the potential of the market to enhance economic growth and food security. As a result, there has been an increase in supportive policies, including subsidies, research funding, and training programs for tilapia farmers. According to the FAO, tilapia is now farmed in over 140 countries worldwide. These initiatives aim to enhance production capacity and market competitiveness. In confluence with this, export incentives have been crucial in expanding the reach of tilapia products to international markets. Countries with abundant resources are leveraging export-oriented strategies to penetrate high-demand regions, thereby fostering global trade relationships. These government interventions stimulate domestic tilapia industries and contribute to stabilizing global food supplies, particularly in areas prone to protein scarcity.

Tilapia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global family offices market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on farmed vs wild capture, species, product, and sector.

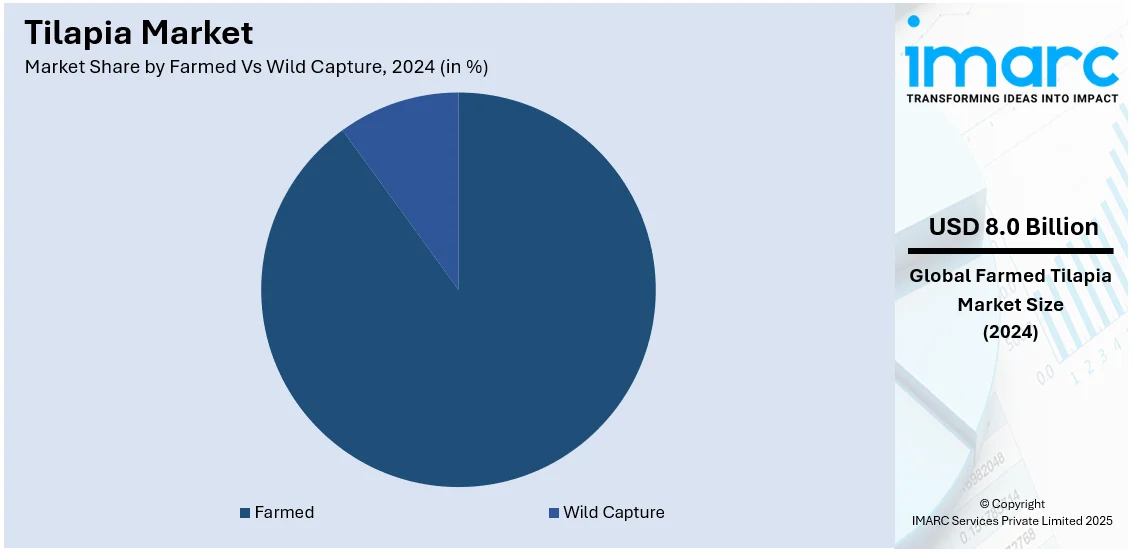

Analysis by Farmed Vs Wild Capture:

- Farmed

- Wild Capture

Farmed leads the market in 2024, holding around 90.00% of the market. The farmed segment dominates the market accounting for a substantial majority of the total production and consumption. This segment's growth can be supported by the controlled and efficient production methods in aquaculture farms which allow for consistent quality and supply. Farmed benefit from advancements in aquaculture technology including improved breeding techniques, feed formulations and disease management leading to higher yields and cost-effectiveness. The scalability of its farming is enabling producers to meet the growing global demand particularly in areas with rising protein consumption. Farming practices are evolving to address environmental and sustainability concerns with innovations such as recirculating aquaculture systems and integrated farming approaches.

Analysis by Species:

- Nile Tilapia

- Tilapias Nei

- Blue Nile Tilapia

- Mozambique Tilapia

- Others

Nile Tilapia is the leading species within the market highly favored for its rapid growth, adaptability to various farming environments and pleasant taste. This species is predominant in both intensive and semi-intensive aquaculture systems due to its hardiness and efficiency in converting feed into protein. Its widespread cultivation is attributed to its tolerance to a range of water quality conditions and its resistance to many common fish diseases. Its dominance in farming is also bolstered by extensive research and genetic improvements making it a preferred choice for commercial aquaculture operations seeking reliable yields and consistent quality.

"Tilapias nei" is a term used in fishery statistics to categorize tilapia species not individually reported often encompassing various lesser-known or locally farmed species. This segment is more prevalent in small-scale, artisanal or traditional fishing practices particularly in regions where specific species have not been extensively studied or selectively bred.

The Blue Nile Tilapia though less commonly farmed than the Nile Tilapia holds its niche in the market. This species is known for its robustness and is often farmed in areas with suboptimal conditions. It can tolerate lower oxygen levels and cooler temperatures making it suitable for regions with varying environmental conditions.

Mozambique Tilapia is another key species in the market renowned for its ability to thrive in brackish and saline waters a trait not commonly found in other species. This characteristic makes it particularly suitable for coastal and estuarine aquaculture. It is often favored in subsistence and small-scale commercial farming especially in regions where salinity is a limiting factor for other tilapia species.

Analysis by Product:

- Frozen Fillets

- Whole Fish

- Fresh Fillets

- Others

The frozen fillets segment occupies a significant portion of the market, appealing largely to consumers seeking convenience and longer shelf life. They offer versatility and ease of preparation making them a popular choice in both retail and food service sectors. This segment benefits from advanced freezing technologies that preserve the fish's quality, nutritional value and flavor. Its global distribution is facilitated by efficient cold chain logistics enabling this segment to reach a broad international market. Its prominence is further supported by the growing consumer preference for ready-to-cook seafood products which aligns well with the busy lifestyles of many urban consumers.

The whole fish segment of the market caters to consumers who prefer traditional and cultural methods of fish preparation. This form is particularly popular in regions where fresh seafood is a dietary staple and where consumers value the authenticity of preparing and cooking fish in its entirety. It is often sold fresh or live in these markets especially in local fish markets and in regions close to tilapia farms. The demand for whole fish is also supported by specific culinary practices that favor cooking the fish whole either for flavor or presentation purposes.

Fresh fillets represent a premium segment in the market particularly appealing to health-conscious consumers and high-end food service establishments. This segment emphasizes the freshness and quality of the product often commanding a higher price point. They are preferred for their texture and flavor considered superior to frozen alternatives by many consumers. The distribution of fresh fillets is more geographically limited due to the need for rapid transport and refrigeration to maintain quality making this segment more prevalent in regions with ready access to tilapia production facilities.

Analysis by Sector:

- Institutional

- Retail

The institutional sector of the market encompasses a wide range of entities such as schools, hospitals, military bases and food service providers for large organizations. This segment demands bulk quantities of it often prioritizing cost-effectiveness and consistent supply over specific product attributes. Its versatility in terms of preparation and its nutritional profile makes it a preferred choice in these settings particularly where health and dietary considerations are important. Institutional buyers may opt for various forms including frozen fillets and whole fish depending on their specific preparation and storage capabilities. This sector is also influenced by governmental and organizational policies such as those promoting healthy eating or sustainable sourcing which is driving the tilapia market demand.

The retail sector in the market is primarily composed of supermarkets, grocery stores and specialty fish markets catering directly to the end consumer. This segment offers a range of products including fresh and frozen fillets, whole fish and value-added products such as seasoned or breaded fillets. Consumer preferences in the retail sector are diverse influenced by factors such as convenience, health consciousness culinary trends and price sensitivity. Retailers play a crucial role in influencing consumer choices through marketing, product placement and providing information about the origins and sustainability of the products.

Country Analysis:

- China

- Indonesia

- Egypt

- Bangladesh

- Philippines

- Brazil

- Thailand

- Others

In 2024, China accounted for the largest tilapia market share of over 29.8%. China is the largest segment in the global market both as a producer and a consumer. The country's extensive aquaculture industry supported by favorable government initiatives and advancements in farming technologies is making it a world leader. Chinese consumers have a strong preference for freshwater fish, which is often consumed as whole fish in traditional dishes. The domestic market is complemented by a significant export sector supplying tilapia to international markets. China is at the forefront of research and development in its breeding, disease control and sustainable farming practices further solidifying its dominant position in the market.

Key Regional Takeaways:

China Tilapia Market Analysis

China stands as the world's largest producer, consumer and exporter of tilapia significantly influencing the global market. The nation's extensive aquaculture industry benefits from favorable climatic conditions and substantial freshwater resources facilitating large-scale tilapia farming. According to the FAO, about 4.3 Million rural workers are directly employed in aquaculture which plays a crucial role in rural economies. Government initiatives have bolstered the sector through investments in infrastructure, research and development enhancing production efficiency and sustainability. The growing middle class has increased domestic demand for protein-rich foods like tilapia further stimulating tilapia market growth. China’s strategic export policies and trade agreements have expanded its reach to international markets solidifying its position in global seafood trade. These factors collectively propel China’s dominance in the tilapia market contributing to its substantial share in global production and consumption.

Indonesia Tilapia Market Analysis

Indonesia’s tilapia market is driven by its extensive archipelago which provides ideal conditions for freshwater and brackish water aquaculture. According to industry reports, the aquaculture sector is a major contributor to the country's fish production accounting for 69.5% which is more than twice that of capture fisheries. Industry reports highlight that aquaculture production grew at an annual rate of 11.47% from 2012 to 2017. Tilapia farming is vital for rural economies supporting food security and providing livelihoods. The market includes a mix of small-scale, traditional farms and large-scale and commercial operations. Increasing domestic demand for tilapia and the rising popularity of value-added products further drive market growth. Government initiatives such as investments in infrastructure and farmer training programs have helped improve farming practices and boost production efficiency. These factors position Indonesia as a growing force in the tilapia market with significant prospects for continued expansion.

Egypt Tilapia Market Analysis

Egypt is a key player in the tilapia market particularly in the context of the Middle East and Africa. The country benefits from the fertile waters of the Nile Delta and Valley making it ideal for tilapia farming. According to FAO data, Egypt accounts for 940,000 metric Tons of Africa’s total aquaculture production of 1.2 Million metric Tons in 2017 representing 80% of the continent's output. Tilapia is a staple in the Egyptian diet and is widely consumed as whole fish. Government support for aquaculture development including investments in fish farming infrastructure and training programs has further enhanced production capabilities. Egypt's strategic location also facilitates access to both domestic and international markets promoting trade and export opportunities. These factors have solidified Egypt's position as the largest producer of tilapia in Africa contributing significantly to its dominance in the global market.

Bangladesh Tilapia Market Analysis

In Bangladesh tilapia farming has seen significant growth becoming an important component of the country's aquaculture industry. Tilapia is valued for its affordability and nutritional benefits making it popular among consumers. According to the FAO's March 2024 report, the current per capita annual fish consumption in Bangladesh is around 26.6 kg as of 2019, which is more than the minimum requirement of 18 kg per year. This reflects that Bangladesh has significantly improved fish consumption and nutritional needs. The market is characterized by a mix of smallholder farms and emerging commercial operations. Government support for aquaculture development focusing on infrastructure and training has positively impacted the growth of the tilapia sector. Additionally, advancements in farming techniques and disease management have improved production efficiency. These developments have positioned Bangladesh as a notable contributor to the global tilapia market with strong potential for further growth in both domestic consumption and export.

Phillippines Tilapia Market Analysis

The Philippines has a significant tilapia market with its extensive inland water bodies providing ideal conditions for aquaculture. Tilapia is a popular choice among Filipinos due to its mild taste and versatility in local cuisines. According to data from the Philippine Statistics Authority (PSA), aquaculture production in the country reached 2.38 Million Tons in 2023, underscoring the sector's importance. The industry is supported by government initiatives aimed at increasing production and improving farming techniques. Furthermore, the Philippines’ strategic location in Southeast Asia facilitates trade and export opportunities expanding its presence in the regional market. These factors combined with growing domestic demand contribute to the Philippines' strengthening position in the tilapia industry enhancing both its domestic market share and international exports.

Competitive Landscape:

The competitive landscape of the tilapia market is composed of large-scale producers and small to medium enterprises targeting domestic and export markets. Leading producers emphasize efficient aquaculture techniques, advanced breeding practices and feed optimization in order to maximize productivity and lower costs. The market players also invest in sustainable farming practices responding to increased consumer demand for ecofriendly seafood. The increasing usage of value-added products for example, fillets and ready-to-cook items intensifies competition amongst suppliers. Key players leverage supply chain improvement and collaboration with retail and food service sectors for market share gain.

The report provides a comprehensive analysis of the competitive landscape in the tilapia market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: A state agency in Chennai is culling invasive tilapia in Adyar Creek to protect native species. Tilapia spread quickly due to its adaptability and high reproductive rate, with the introduction of Genetically Improved Farmed Tilapia (GIFT) worsening the issue. The Chennai River Restoration Trust (CRRT) has launched a culling operation to remove adult tilapia and safeguard local biodiversity.

- July 2024: Aller Aqua and IDH launched a partnership to support out-grower tilapia farming in Kenya’s Homabay and Migori counties. The project aims to improve smallholder aquaculture by providing quality inputs, training, and market access. With over 250 farmers at the launch, the initiative promotes sustainable, inclusive aquaculture practices, offering farmers two production cycles annually and fostering entrepreneurship and gender equality.

- May 2024: Regal Springs has introduced "Natural Additions," a new business unit focused on maximizing the use of tilapia by-products. Announced at the Seafood Expo Global in Barcelona, the initiative reflects the company’s commitment to achieving 100% utilization of its tilapia production by 2030.

- February 2024: GenoMar Genetics Group, a global leader in tilapia genetics, has launched its GenoMar line in Brazil. This marks the entry of its highly developed tilapia genetics, refined over 30 years and previously exclusive to Asia, into the Brazilian market. The expansion is supported by a biosecure breeding center in Tocantins and the importation of the strain, enabling the company to manage its breeding program from the Americas and enhance supply chain security for the industry.

Tilapia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Farmed Vs Wild Captures Covered | Farmed, Wild Capture |

| Species Covered | Nile Tilapia, Tilapias Nei, Blue Nile Tilapia, Mozambique Tilapia, Others |

| Products Covered | Frozen Fillets, Whole Fish, Fresh Fillets, Others |

| Sectors Covered | Institutional, Retail |

| Countries Covered | China, Indonesia, Egypt, Bangladesh, Philippines, Brazil, Thailand, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tilapia market from 2019-2033.

- The tilapia market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tilapia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tilapia market was valued at USD 8.90 Billion in 2024.

IMARC estimates the tilapia market to reach USD 11.48 Billion exhibiting a CAGR of 2.84% during 2025-2033.

Key drivers include rising global demand for affordable protein-rich food, advancements in aquaculture technology, growing health awareness about tilapia's nutritional value, and supportive government policies promoting sustainable aquaculture and export incentives.

China accounts for the largest share in the global tilapia market holding over 29.8% as of 2024. The country dominates due to its extensive aquaculture industry, supported by favorable climatic conditions, freshwater resources, and government initiatives. China’s dual role as the leading producer and exporter, along with strong domestic demand driven by its large population and dietary preferences, reinforces its market leadership, thereby creating a positive tilapia market outlook across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)