Third-Party Banking Software Market Size, Share, Trends and Forecast by Product, Deployment Type, Application, End User, and Region, 2025-2033

Third-Party Banking Software Market Size and Share:

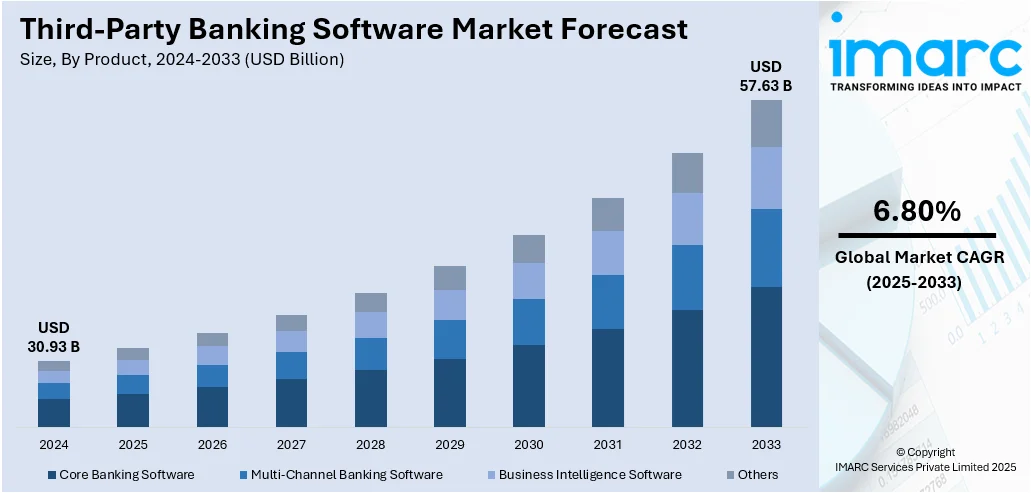

The global third-party banking software market size was valued at USD 30.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 57.63 Billion by 2033, exhibiting a CAGR of 6.80% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.6% in 2024. The market is experiencing growth driven by the rising demand for secure, scalable solutions and the increasing adoption of cloud-based technologies. Moreover, regulatory compliance requirements further fuel this trend, contributing to the expansion of the third-party banking software market share across various financial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30.93 Billion |

|

Market Forecast in 2033

|

USD 57.63 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

The growth in the market is being fueled extensively by the rising use of cloud technology in the banking industry. Cloud solutions are gaining traction among banks and other financial institutions because they can help cut down on operational expenditures as well as enhance scalability. These platforms enable banks to utilize advanced features and advancements in technology without having to incur massive funds as initial investments in infrastructure. Moreover, these platforms can also improve their agility, increase data protection, and lower the maintenance cost, with the transition of banks to the cloud, thereby enhancing resource allocation. In addition, cloud technology allows for easy integration with current systems, allowing third-party software providers to provide customized solutions. With more banks and financial institutions moving to the cloud, third-party banking software solutions are likely to witness greater demand, thereby influencing the overall market growth.

To get more information on this market, Request Sample

In the United States, the trends in the third-party banking software market are significantly driven by the continuous regulatory developments and changing competitive dynamics. In addition, the latest regulations, including those from the Consumer Financial Protection Bureau (CFPB), are compelling banks to give consumers simpler access to their financial information. It has been a major step in the evolution of open banking, which will make the competition among financial institutions grow and enable consumers to combine their banking services with new financial applications. In addition, this transition is encouraging an increasing number of financial institutions to pursue third-party software solutions that are able to support compliance with new data-sharing regulations and provide a seamless integration with third-party platforms.

Third-Party Banking Software Market Trends:

The banking, financial services, and insurance (BFSI) sector is experiencing significant growth, which is driving the expansion of the market. As of July 2024, there were 602 banks using UPI, with total digital transactions reaching 15.08 Billion, valued at Rs. 2,10,000 Crore, according to IBEF. This surge is largely attributed to the increasing adoption of digital platforms. Moreover, the integration of cloud-based applications into banking software is accelerating market development. Unlike traditional manual methods, there is a growing preference for automated accounting systems for managing finances and transactions. Consumers are also shifting toward digital platforms, using smartphones, laptops, and tablets to access accounts and conduct transactions. This transition is evident in the expected increase in digital banking users in the US, which is forecast to reach 216.8 Million by 2025, according to recent studies. Furthermore, advancements in technology, such as the incorporation of big data analytics into third-party banking software, are positively influencing the market. These analytics tools process vast data sets, supporting businesses in making data-driven decisions to boost profitability and identify emerging trends. With cybercrime costs projected to hit USD 10.5 Trillion by 2025, as per the World Economic Forum and Cybersecurity Ventures, the demand for secure, adaptable banking solutions is higher than ever. Additionally, the increasing focus on customer-centric banking and the demand for standardized processes will continue to propel market growth. These developments reflect the evolving third-party banking software market trends, pushing financial institutions to adopt innovative solutions.

Strategic Acquisitions Driving Innovation in Banking Software

The third-party banking software market has seen a marked shift towards strategic acquisitions that drive both innovation and competitiveness. As financial institutions face increasing pressure to comply with regulatory requirements, enhance operational efficiency, and offer innovative digital solutions, the role of acquisitions becomes crucial. These acquisitions allow companies to integrate advanced technologies, providing more robust solutions for financial institutions. For example, in October 2024, Axway's acquisition of Sopra Banking Software (SBS) exemplified this trend, significantly boosting its capabilities in the open banking space. The integration of SBS’s advanced technology strengthened Axway’s platform, enabling it to meet the newly introduced CFPB regulations while also enhancing its ability to securely manage data. This development ensures financial institutions can provide faster, more efficient services while remaining compliant with stringent regulations. With enhanced API management and a more streamlined data architecture, Axway empowered its clients to unlock new business opportunities and improve revenue streams. The acquisition also positioned Axway as a market leader in providing flexible, scalable solutions, which cater to the evolving needs of modern banks. Through acquisitions like this, companies are setting themselves up to lead the way in transforming the banking industry, pushing for greater innovation, security, and customer-centric solutions across the market. These strategic moves are expected to drive the third-party banking software market growth, as more banks seek advanced, adaptable solutions.

Rising Partnerships for Enhanced Customer Experience

Partnerships within the third-party banking software market are driving significant advancements in customer experience, marking a shift toward more collaborative and integrated solutions. As customer expectations evolve, financial institutions are focusing on partnerships to enhance service delivery and operational efficiency. These collaborations enable companies to combine their strengths and offer more comprehensive, user-friendly banking solutions. For instance, in May 2025, Tietoevry Banking entered a strategic partnership with Lokalbank to deliver a comprehensive, tailored banking platform for the Norwegian market. This partnership focused on providing a scalable, secure solution that integrates core banking services with mobile and online banking, payment systems, card services, and anti-financial crime tools. The partnership freed up resources for Lokalbank, allowing them to focus on customer advisory services and sales by streamlining operations and automating key processes. The platform’s modern digital interface further enhanced the customer experience by providing seamless access to services and improving engagement. The collaboration was designed to reduce operational complexity, enhance security, and simplify integration, which is vital for staying competitive in the digital-first banking world. This trend illustrates how strategic partnerships are becoming essential for delivering high-quality banking experiences, enabling financial institutions to meet market demands for speed, security, and customer-centric services.

Third-Party Banking Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global third-party banking software market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, deployment type, application, and end user.

Analysis by Product:

- Core Banking Software

- Multi-Channel Banking Software

- Business Intelligence Software

- Others

As per the third-party banking software market outlook, in 2024, the core banking software segment led the market, accounting for a market share of 37.3%, driven by the growing demand for integrated, efficient banking solutions. As financial institutions work toward enhancing operational efficiency and improving customer experience, there is a strong push for seamless integration across all banking operations. Core banking systems enable banks to streamline daily transactions, account updates, and centralized data management, allowing them to provide real-time, accurate services. Furthermore, regulatory pressures are motivating banks to adopt more advanced systems that ensure compliance with stringent regulations and data protection laws. The need for scalability and flexibility in banking operations, coupled with technological advancements, is driving widespread adoption of core banking solutions across the financial sector.

Analysis by Deployment Type:

- On-premises

- Cloud-based

In 2024, the on-premises led the third-party banking software market, accounting for a market share of 82.4% as many banks prioritize control over their IT infrastructure. On-premises software gives financial institutions the ability to manage their systems and data internally, offering them enhanced security, privacy, and compliance capabilities, which are critical in the banking sector. This model also provides the flexibility to customize solutions according to the specific needs of an organization. Given the rising concerns around data breaches and increasing cybersecurity threats, many banks prefer to keep sensitive data on-site. Furthermore, on-premises software allows for smooth integration with existing legacy systems and enables institutions to adhere to local data protection regulations, ensuring both operational efficiency and regulatory compliance.

Analysis by Application:

- Risk Management

- Information Security

- Business Intelligence

- Others

Based on the third-party banking software market forecast, in 2024, the risk management segment led the market, accounting for a market share of 41.6%, driven by the growing complexity and volatility in financial markets. Banks are increasingly focused on risk mitigation to protect against various financial threats, including credit, market, operational, and cyber risks. Risk management software helps institutions proactively detect, assess, and address potential risks in real-time, minimizing financial exposure and enhancing decision-making. The rise of digital banking and the integration of artificial intelligence (AI) and machine learning in risk management software have further revolutionized the ability to identify patterns and predict risks before they escalate. Regulatory pressures and the need to ensure financial stability also drive banks to invest in cutting-edge risk management tools, leading to higher adoption rates in the market.

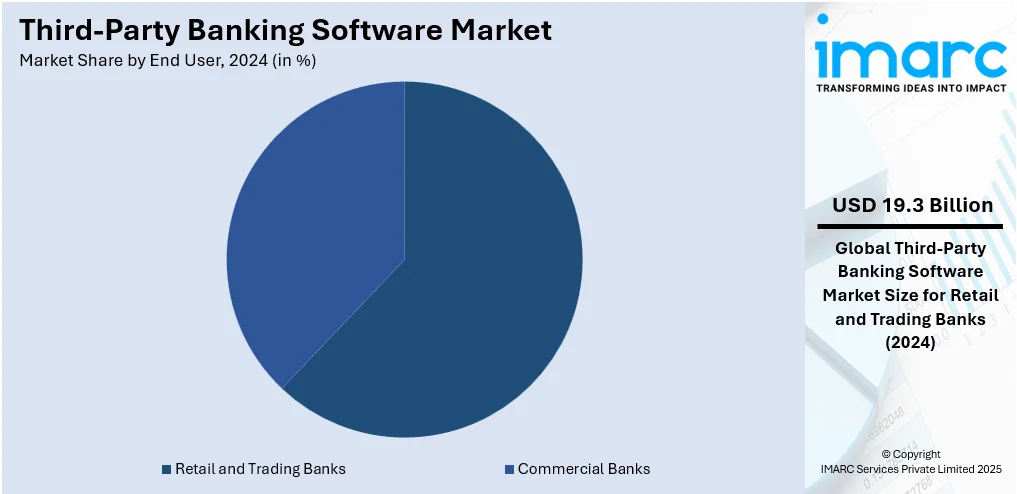

Analysis by End User:

- Commercial Banks

- Retail and Trading Banks

In 2024, the retail and trading banks led the market, accounting for a market share of 62.3%, driven by the demand for specialized solutions to enhance service delivery and operational efficiency. Retail banks focus on delivering personalized, seamless services to customers, improving engagement through digital channels. This has led to a surge in demand for advanced customer relationship management (CRM) software and omnichannel solutions. Trading banks, on the other hand, require sophisticated software solutions for real-time market analysis, trading platforms, and portfolio management. Both sectors benefit from the integration of artificial intelligence, machine learning, and data analytics, which enable more accurate decision-making and better risk management. These innovations empower banks to stay competitive, deliver better services, and address regulatory requirements, accelerating the growth of software solutions in both retail and trading banking sectors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America led the third-party banking software market, accounting for a market share of 36.6%, driven by the region's advanced technological infrastructure and high adoption rates of digital banking solutions. The demand for cutting-edge software in the region is fueled by a growing need for financial institutions to deliver personalized services, streamline operations, and enhance customer experience. North American banks are increasingly investing in digital transformation, adopting cloud-based and AI-driven software to remain competitive and compliant with stringent regulations. The region's regulatory environment also encourages the use of secure, scalable banking software to protect sensitive financial data. North America remains a key driver of innovation and growth in the third-party banking software market with the presence of leading banking institutions, technology providers, and a robust fintech ecosystem.

Key Regional Takeaways:

United States Third-Party Banking Software Market Analysis

In 2024, the United States accounted for 90.60% of the third-party banking software market in North America, driven by multiple factors. The market in the United States is experiencing robust growth, driven by the country's high digital adoption rate and increasing demand for personalized financial services. The rapid expansion of fintech ecosystems is accelerating the integration of advanced software platforms for customer relationship management, transaction automation, and data analytics. According to recent reports, U.S. bank executives plan to increase IT and tech spending by at least 10% in 2025 to enhance security measures following multiple data breaches in 2024. This emphasis on cybersecurity and infrastructure fortification is propelling investments in third-party platforms equipped with advanced security protocols. Additionally, the growing reliance on open banking frameworks is encouraging financial institutions to adopt modular third-party solutions to enhance operational efficiency. The shift toward cloud-native architectures and API-based platforms is facilitating seamless upgrades and integration with emerging technologies. Moreover, the evolving regulatory environment is compelling for banks to deploy agile and scalable software solutions. As banks focus on building ecosystem partnerships and leveraging data-driven strategies, the market is expected to witness sustained growth in the coming years.

Europe Third-Party Banking Software Market Analysis

The third-party banking software market in Europe is progressing steadily, fueled by the region’s commitment to digital transformation and sustainable finance practices. The implementation of unified financial data standards enhances cross-border interoperability, prompting financial institutions to embrace standardized third-party platforms. According to the European Investment Bank, the EIB Group signed nearly USD 96.6 Billion in new financing for over 900 projects in 2024, mobilizing around USD 380 Billion in investment and supporting approximately 5.8 Million jobs. These large-scale investments are accelerating digitization efforts, further boosting demand for scalable software solutions. Additionally, the widespread use of mobile banking and digital wallets is encouraging the adoption of user-centric software. There is a growing trend toward integrating ESG considerations within banking systems, driving demand for analytical tools offered by third-party providers. As financial players focus on agile innovation and open finance initiatives, vendors providing embedded services and modular solutions are gaining traction, shaping a promising outlook for the European market.

Asia Pacific Third-Party Banking Software Market Analysis

The Asia Pacific third-party banking software market is witnessing dynamic growth, primarily driven by rapid urbanization and the expansion of digital ecosystems. The rising penetration of internet and mobile devices is accelerating the demand for mobile-first banking solutions offered by third-party vendors. As per the India Brand Equity Foundation, India’s fintech industry is currently valued at approximately USD 111 Billion and projected to reach USD 421 Billion by 2029, making it the third-largest fintech ecosystem globally. This significant growth trajectory is pushing financial institutions across the region to adopt agile software for serving digitally native consumers. The growing popularity of real-time payment platforms and multilingual digital onboarding tools is encouraging the deployment of scalable third-party systems. Additionally, the focus on financial inclusion is prompting banks to implement inclusive and localized solutions. As regional institutions modernize legacy systems and embrace predictive analytics and cloud-native tools, the third-party software market is expected to maintain strong momentum.

Latin America Third-Party Banking Software Market Analysis

The Latin American third-party banking software market is expanding steadily, fueled by the growing digital engagement of consumers and the shift toward cashless economies. Financial institutions are increasingly adopting third-party solutions to automate processes and expand digital channels, especially in underserved areas. Reports state that over 70% of Brazilians now use digital banking services, while financial institutions are accelerating their adoption of technology-driven solutions. This digital shift is prompting greater investment in third-party platforms that enable real-time transactions and user-centric features. The demand for software supporting alternative credit assessments and gamified financial services is rising, aligned with goals of expanding financial access. With a growing appetite for fintech integration and scalable platforms, third-party software continues to emerge as a strategic enabler of financial modernization across the region.

Middle East and Africa Third-Party Banking Software Market Analysis

The third-party banking software market in the Middle East and Africa is gaining momentum due to the increasing push for digital financial services and infrastructure modernization. The region’s young and tech-savvy population is driving demand for mobile-optimized banking experiences, encouraging adoption of agile third-party platforms. According to IMARC Group, the Saudi Arabian digital banking market was valued at USD 87.60 Million in 2024 and is projected to reach USD 278.19 Million by 2033, growing at a CAGR of 12.70%. This expansion highlights growing investment in software that supports scalable, cloud-based solutions with robust features like biometric authentication and AI analytics. As financial institutions embrace digital identity frameworks and expand into underbanked areas, the role of flexible and secure third-party platforms is becoming increasingly central to regional banking strategies.

Competitive Landscape:

Companies in the third-party banking software market are adopting advanced strategies to meet evolving technological demands and manage diverse workflows. They are leveraging automation tools and creation platforms to streamline software development, reduce manual tasks, and ensure consistent quality across various formats. By optimizing integration with publishing, analytics, and collaboration systems, organizations are ensuring seamless operations from design to deployment. Additionally, they are enhancing real-time editing and feedback capabilities, enabling quick adjustments based on performance data. These initiatives improve efficiency, maintain brand consistency, and support data-driven decision-making, minimizing risks of outdated messaging or inefficient workflows across digital platforms.

The report provides a comprehensive analysis of the competitive landscape in the third-party banking software market with detailed profiles of all major companies, including:

- Accenture

- Capgemini

- Deltek, IBM

- Infosys

- Microsoft Corporation

- NetSuite Inc.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services

Latest News and Developments:

- April 2025: Backbase introduced an AI-powered banking platform integrating real-time data insights and modular Agentic AI for task automation. It unified digital sales and customer service while emphasizing responsible AI deployment. The AI Factory delivery model helped banks implement solutions faster, accelerating their shift from legacy systems to AI-driven operations.

- April 2025: Candescent opened a larger office in Bangalore, India, to expand its innovation capabilities and accelerate digital banking software development. The site supported over 200 employees focused on next-gen user experiences. The firm aims to hire across product, design, and engineering to enhance customization and fintech integration for its platform.

- February 2025: Galoy launched Lana, enabling banks to issue bitcoin-backed loans while using open-source software. The platform offered customization for loan terms, collateral monitoring, and risk management, supporting banks’ entry into crypto lending. Galoy aimed to reduce borrowing costs and expand access by addressing regulatory shifts and integrating open banking tools.

Third-Party Banking Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Core Banking Software, Multi-Channel Banking Software, Business Intelligence Software, Others |

| Deployment Types Covered | On-premises, Cloud-based |

| Applications Covered | Risk Management, Information Security, Business Intelligence, Others |

| End Users Covered | Commercial Banks, Retail and Trading Banks |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture, Capgemini, Deltek, IBM, Infosys, Microsoft Corporation, NetSuite Inc., Oracle Corporation, SAP SE and Tata Consultancy Services |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the third-party banking software market from 2019-2033.

- The third-party banking software market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the third-party banking software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The third-party banking software market was valued at USD 30.93 Billion in 2024.

The third-party banking software market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 57.63 Billion by 2033.

The third-party banking software market is driven by the increasing demand for digital transformation in financial institutions. As banks seek to enhance operational efficiency, improve customer experiences, and ensure compliance with regulations, the adoption of advanced, scalable software solutions has become essential for sustaining growth.

In 2024, North America dominated the third-party banking software market accounting for the market share of 36.6%, driven by its advanced technological infrastructure and the presence of major financial institutions. The region's strong regulatory framework, high digital banking adoption, and growing demand for secure, innovative banking solutions significantly contribute to its market leadership.

Some of the major players in the global third-party banking software market include Accenture, Capgemini, Deltek, IBM, Infosys, Microsoft Corporation, NetSuite Inc., Oracle Corporation, SAP SE and Tata Consultancy Services, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)