Thin Film Solar Cell Market Report by Type (Cadmium Telluride, Amorphous Thin-Film Silicon, Copper Indium Gallium Selenide, Microcrystalline Tandem Cells, Thin-Film Polycrystalline Silicon, and Others), Installation (On-Grid, Off-Grid), End User (Residential, Commercial, Utility), and Region 2025-2033

Global Thin Film Solar Cell Market:

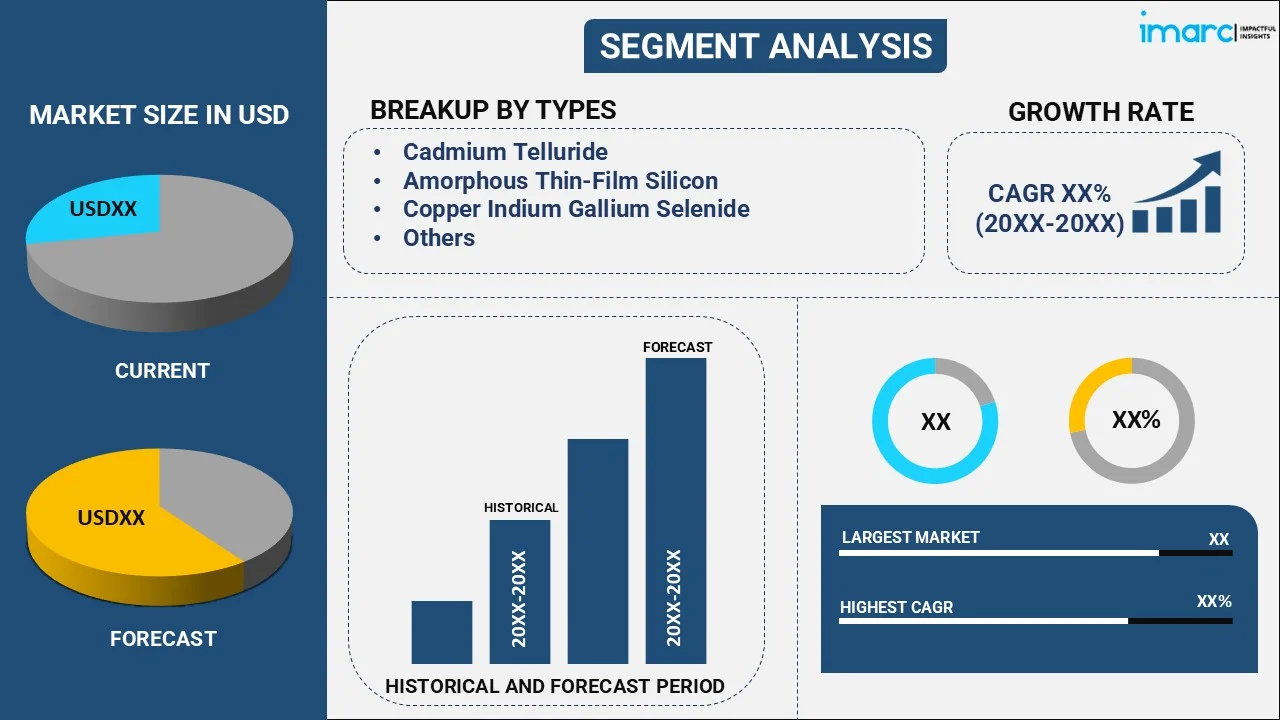

The global thin film solar cell market size reached USD 17.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 44.2 Billion by 2033, exhibiting a growth rate (CAGR) of 10.2% during 2025-2033. The increasing adoption of renewable energy sources due to the rising environmental concerns among the masses is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.7 Billion |

|

Market Forecast in 2033

|

USD 44.2 Billion |

| Market Growth Rate (2025-2033) | 10.2% |

Global Thin Film Solar Cell Market Analysis:

- Major Market Drivers: The increasing adoption of renewable energy sources, on account of the rising environmental concerns, is primarily driving the market growth. In addition to this, the support provided by government bodies through favorable policies and the elevating focus of key players on enhancing efficiency and minimizing costs are also creating a positive outlook for the global thin film solar cell market.

- Key Market Trends: Ongoing advancements in solar panel efficiency and production processes are propelling the thin film solar cell market. Moreover, the integration of thin film solar cells (TFSC) with artificial intelligence and smart technologies is making solar energy more efficient, which is anticipated to bolster the thin film solar cell market over the forecasted period.

- Geographical Trends: Asia-Pacific dominated the market across the world, with the majority of the demand coming from countries, such as China and Japan. This can be attributed to the increasing deployment of solar panels in utility-scale, commercial, and residential applications.

- Competitive Landscape: Some of the leading players in the global thin film solar cell market include Ascent Solar Technologies Inc., First Solar Inc., Flisom, Hanergy Thin Film Power EME B.V., Kaneka Corporation, Miasole (Hanergy Holding Group Ltd.), Oxford Photovoltaics Limited, Trony Solar Holdings Company Limited, and Wuxi Suntech Power Co. Ltd., among many others.

- Challenges and Opportunities: Some of the primary challenges in the thin film solar cells market are the increasing requirement for enhanced energy storage solutions and the rising competition with traditional energy sources. However, significant opportunities, including ongoing innovations in energy storage and the escalating adoption of novel technologies and materials to improve the cost-effectiveness and efficiency of thin film solar cells, will continue to propel the global market over the forecasted period.

Global Thin Film Solar Cell Market Trends:

Increasing Initiatives by Government Authorities

The thin film solar cell market is witnessing significant growth, owing to the rising adoption of renewable energy as a primary fuel. In addition to this, government authorities of various nations are taking initiatives to minimize greenhouse emissions and increase environmental benefits in the long run, which is creating a positive outlook for the global thin film solar cell market. For instance, in February 2024, the Government of India launched the Rooftop Solar/PM Surya Ghar Muft Bijli Yojana. Under the Rooftop Solar Scheme, the government will provide subsidies for installing solar panels for up to 2 kW - Rs. 30,000 per kW and additional capacity up to 3 kW - Rs. 18,000 per kW. This installation will decrease reliance on grid-connected electricity, leading to cost savings. Similarly, in September 2023, the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) released the advancing U.S. thin-film solar photovoltaics funding opportunity, which awarded US$ 36 Million for R&D activities and demonstration projects on two major thin-film photovoltaic (PV) technologies. These policies and incentives are bolstering the adoption of solar panels and increasing the thin film solar cell market share.

Integration of Thin Film Solar Cells into Building Materials

The emerging trend towards the integration of thin-film solar cells into building materials, also known as building-integrated photovoltaics (BIPV), is further catalyzing the growth of the market. These films are increasingly being utilized in building materials, such as windows, facades, and roofs. Thin film solar cells offer design flexibility and can seamlessly integrate with various building materials and even with transparent surfaces of the building. Moreover, building accounts for almost 40% of global energy consumption, so in order to minimize this, BIPVs are widely being adopted, which is anticipated to offer significant growth opportunities to the overall market. Additionally, various government authorities of numerous developing nations are investing extensively in the development of sustainable and smart cities which will further propel the application of thin film solar cells.

Numerous Technological Advancements

Numerous innovations, such as advancements in the efficiency of solar panels, which enable more electricity to be generated from the same amount of sunlight, are acting as other significant growth-inducing factors. Various key market players are extensively investing in the production of advanced solar cells, which is positively impacting the market growth. For instance, Verde Technologies, a U.S.-based spinoff of the University of Vermont, developing lightweight and flexible perovskite solar modules, has made progress with its thin film coating technology in a pilot with Verico Technology, a contract manufacturer located in Connecticut. Moreover, Copper indium gallium selenide (CIGS), a type of semiconductor used to manufacture thin-film solar cells, has reached 21.7% efficiency in laboratory settings and 18.7% efficiency in the field, making CIGS a leader among alternative cell materials and a promising semiconducting material in thin-film technologies. Such innovations are anticipated to further drive the thin film solar cell market growth in the coming years.

Global Thin Film Solar Cell Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thin film solar cell market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, installation, and end user.

Breakup by Type:

- Cadmium Telluride

- Amorphous Thin-Film Silicon

- Copper Indium Gallium Selenide

- Microcrystalline Tandem Cells

- Thin-Film Polycrystalline Silicon

- Others

Cadmium telluride accounts for the majority of the global market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes cadmium telluride, amorphous thin-film silicon, copper indium gallium selenide, microcrystalline tandem cells, thin-film polycrystalline silicon, and others. According to the report, cadmium telluride accounts for the majority of the global market share.

Cadmium Telluride (CdTe) thin film solar cells are manufactured at low costs, as cadmium can be generated as a byproduct of mining, smelting, and refining of zinc, lead, and copper. Among all solar energy technologies, cadmium telluride requires the least amount of water for production. CdTe thin-film PV solar cells have higher cell efficiencies up to 16.7% than other thin-film technologies. Moreover, the National Renewable Energy Laboratory (NREL) in the United States has been at the forefront of research and development (R&D) in this area.

Breakup by Installation:

- On-Grid

- Off-Grid

On-grid currently exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the installation. This includes on-grid and off-grid. According to the report, on-grid currently exhibits a clear dominance in the market.

On-grid systems are gaining traction, owing to their cost-effectiveness, simplicity, and the ability to use the grid as a virtual battery, thereby eliminating the need for energy storage in batteries. Consequently, government bodies are also encouraging the use of on-grid thin film solar cells, which is augmenting the market growth in this segment.

Breakup by End User:

- Residential

- Commercial

- Utility

Currently, the utility sector holds the largest market share

Based on the end user, the global thin film solar cell market can be bifurcated into residential, commercial, and utility. Currently, the utility sector holds the largest market share.

The utility sector can be further categorized into military, power plant applications, defense, and industrial applications. Thin film solar cells are widely used in the utility sector, owing to their higher electricity generation at a lower cost. Thin film solar cells are widely adopted to build large-scale solar farms, where vast areas are covered with solar panels to generate electricity. These solar farms can be connected to the utility grid to provide electricity to various industries.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific currently dominates the global market

On a regional level, the market has been classified into North America (United States and Canada), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia and Others), Europe (Germany, France, United Kingdom, Italy, Spain, Russia and Others), Latin America (Brazil, Mexico and Others), and Middle East and Africa. According to the report, Asia-Pacific currently dominates the global market.

Asia-Pacific dominated the market across the world with the majority of the demand coming from the countries, such as China and Japan. This can be attributed to the increasing deployment of solar panels in utility-scale, commercial, and residential applications.

In 2018, China's National Development and Reform Commission (NDRC) had written a draft policy that would increase the renewable energy target from 20% to 35%, by 2030. This, in turn, will augment the demand for thin film solar cells in the country. Around 40 GW of new renewable capacity was connected to the grid in 2019, with around 50% of the new capacity expected to come from large-scale solar plants. With factors, such as the upcoming utility-scale project, along with supportive policies and subsidies, the thin-film solar PV market in the Asia Pacific is expected to witness significant growth over the forecasted period.

Leading Key Players in the Thin Film Solar Cell Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ascent Solar Technologies Inc.

- First Solar Inc.

- Flisom

- Hanergy Thin Film Power EME B.V.

- Kaneka Corporation

- Miasole (Hanergy Holding Group Ltd.)

- Oxford Photovoltaics Limited

- Trony Solar Holdings Company Limited

- Wuxi Suntech Power Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Thin Film Solar Cell Market News:

- April 2024: Uppsala University has set a new world record in the generation of electrical energy from CIGS solar cells, achieving an efficiency rate of 23.64%. An independent institute verified this achievement and the findings have been published in the esteemed journal, Nature Energy.

- February 2024: LONGi entered a collaboration with Australia Curtin University and Jiangsu University of Science and Technology to manufacture the first crystalline silicon heterojunction solar cell with high power-to-weight ratio and enhanced high flexibility.

Global Thin Film Solar Cell Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Installation, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ascent Solar Technologies Inc., First Solar Inc., Flisom, Hanergy Thin Film Power EME B.V., Kaneka Corporation, Miasole (Hanergy Holding Group Ltd.), Oxford Photovoltaics Limited, Trony Solar Holdings Company Limited, Wuxi Suntech Power Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thin film solar cell market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thin film solar cell market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thin film solar cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global thin film solar cell market was valued at USD 17.7 Billion in 2024.

We expect the global thin film solar cell market to exhibit a CAGR of 10.2% during 2025-2033.

The growing demand for thin film solar cell, as it is a sustainable, renewable, clean, and reliable energy source that generates power without creating noise pollution or producing Greenhouse Gases (GHGs), is primarily driving the global thin film solar cell market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous production activities for thin film solar cells.

Based on the type, the global thin film solar cell market can be categorized into cadmium telluride, amorphous thin-film silicon, copper indium gallium selenide, microcrystalline tandem cells, thin-film polycrystalline silicon, and others. Among these, cadmium telluride accounts for the majority of the global market share.

Based on the installation, the global thin film solar cell market has been segregated into on-grid and off-grid, where on-grid currently exhibits a clear dominance in the market.

Based on the end user, the global thin film solar cell market can be bifurcated into residential, commercial, and utility. Currently, the utility sector holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global thin film solar cell market include Ascent Solar Technologies Inc., First Solar Inc., Flisom, Hanergy Thin Film Power EME B.V., Kaneka Corporation, Miasole (Hanergy Holding Group Ltd.), Oxford Photovoltaics Limited, Trony Solar Holdings Company Limited, and Wuxi Suntech Power Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)