Thermoplastic Vulcanizates Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Thermoplastic Vulcanizates Market Size and Share:

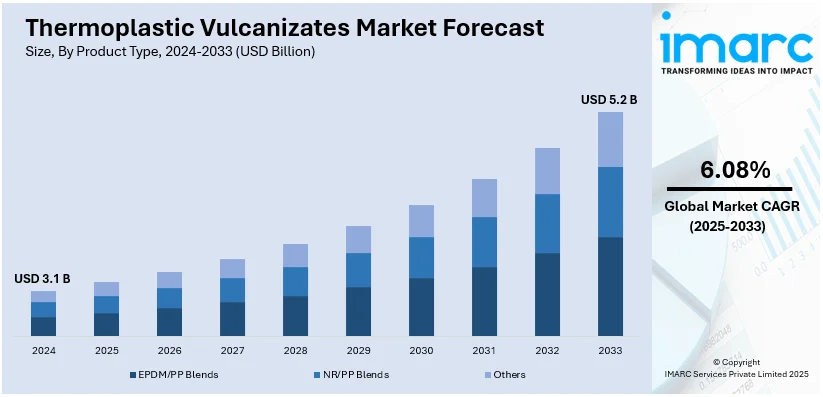

The global thermoplastic vulcanizates market size was valued at USD 3.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.2 Billion by 2033, exhibiting a CAGR of 6.08% from 2025-2033. North America currently dominates the market holding a significant thermoplastic vulcanizates market share of 34.0% due to an increasing demand for lightweight and durable materials in automotive and construction industries, rising awareness about advancements in material science, and emerging attention towards environmental sustainability and advanced processing technologies are supporting thermoplastic vulcanizates market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.1 Billion |

|

Market Forecast in 2033

|

USD 5.2 Billion |

| Market Growth Rate (2025-2033) | 6.08% |

One major driver in the thermoplastic vulcanizates (TPV) market is the growing demand for lightweight and durable materials in the automotive industry. TPVs are increasingly used as substitutes for traditional materials like rubber and metal due to their superior performance, including enhanced elasticity, thermal resistance, and recyclability. The growing transition to electric vehicles (EVs), coupled with strict regulatory standards aimed at enhancing fuel efficiency and cutting emissions, is driving their increased adoption. Applications in sealing systems, interior components, and under-the-hood parts highlight their versatility. Moreover, the capability of TPVs to enhance design flexibility supports the automotive industry's emphasis on innovation and sustainability.

The United States plays a significant role in the TPV market due to its advanced automotive and construction industries with 82.50% market share. The region's focus on lightweight, fuel-efficient vehicles drives the adoption of TPVs in automotive applications, such as weather seals and interior components. Additionally, stringent environmental regulations encourage manufacturers to use recyclable and sustainable materials like TPVs. The U.S. construction sector also utilizes TPVs for roofing membranes, window seals, and insulation materials, leveraging their durability and weather resistance. Continuous technological progress and increased investments in research and development (R&D) are expanding the production capabilities and application potential of TPVs across various industries in the U.S.

Thermoplastic Vulcanizates Market Trends:

Increasing Demands in the Automotive Industry

TPVs have benefits over the normal rubber and the thermosets, such as improved durability and resistance to heat, chemicals, and weathering, together with ease in processing. As a result of these advantages, it has recently gained popularity among the automotive segments, including gaskets, seals, hoses, and under the hood applications. As per statistics, 2022-23 saw the manufacturing of around 25,931,867 number of automotive vehicles. With the increasing demand of automotive vehicles coupled with a concentrated industry on achieving lightweighting as well as rising fuel efficiency with stringent regulatory standards and also consumer demands, TPVs stand out as preferred material options for this booming market.

Increasing applications in consumer goods and industrial practices

TPVs are gaining wide usage in many consumer products such as grips, handles, sporting goods, and footwear. They offer excellent grip, comfort, and durability compared to conventional materials. This is acting as another major growth-inducing factor. With China leading the footwear consumption at 17.9%, followed by the U.S.A. at 12.2% in 2023, the global demand for TPV is surging. Apart from their application in consumer goods, these products are also appreciated in industrial applications such as conveyor belts, industrial hoses, and gaskets due to their strong mechanical qualities and flexibility, and the ability to resist abrasion, oils, and chemicals, which is further impelling the thermoplastic vulcanizates market demand.

Focus on Sustainable and Recyclable Materials

With the growing environmental concerns and regulations aimed at reducing carbon footprint and promoting circular economy principles, there is a rising demand for materials that offer eco-friendly attributes and can be recycled or reused at the end of their lifecycle. TPVs are gaining interest as sustainable alternatives to traditional rubber as they can be recycled and processed using standard thermoplastic techniques. As noted by PwC, nearly 85% of consumers claim to be experiencing the disruptive influence of climate change in their personal lives, hence placing more significance on sustainability as a factor of purchasing decisions, and manufacturers are investing in developing bio-based TPVs from renewable feedstocks as well as recycled TPVs obtained from post-consumer or post-industrial sources thus creating a positive thermoplastic vulcanizates market outlook for market expansion.

Thermoplastic Vulcanizates Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thermoplastic vulcanizates market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- EPDM/PP Blends

- NR/PP Blends

- Others

Based on the thermoplastic vulcanizates market forecast, NR/PP blends stands as the largest component in 2024 due to their superior performance characteristics. These blends combine the flexibility and elasticity of natural rubber with the processability and chemical resistance of polypropylene, making them highly versatile. Their lightweight nature and excellent thermal and weather resistance drive their adoption in automotive applications, including weather seals and interior components. Furthermore, NR/PP blends are widely preferred in the consumer goods and construction sectors due to their durability and cost-efficiency. The increasing focus on sustainable and recyclable materials further supports their demand, as they align with global environmental initiatives and regulatory standards, ensuring their continued market dominance.

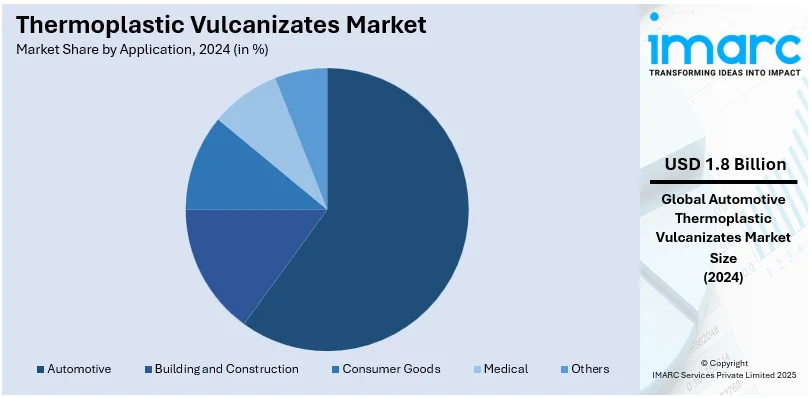

Analysis by Application:

- Automotive

- Building and Construction

- Consumer Goods

- Medical

- Others

Automotive leads the market due to its extensive use in vehicle manufacturing along with the 59.8% market share. The growing popularity of TPVs in automotive applications, including weather seals, gaskets, and interior components, is primarily attributed to their lightweight, durability, and flexibility. Fuel efficiency improves, while emissions reduce, thus satisfying severe environmental requirements and the electric vehicle shift. They are under-hood component friendly, offering recyclability as well as heat and chemical resistance. Demand for advanced materials in enhancing vehicle design, performance, and sustainability drives the popularity of TPVs in the automotive industry, helping to spur the thermoplastic vulcanizates market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest thermoplastic vulcanizates market share driven by strong demand from major industries, including automotive, construction, and consumer goods with 34.0% market share. Advanced automotive is one of the sectors dominating the region and TPVs are used in mass production of light-weight, rugged parts such as weather seals and interior parts that will be able to make fuel efficiency with the stringent emission regulations. Also, the construction industry uses TPVs for roofing membranes, window seals, etc. because of its resistance to weather and durability. Significant investments in research and development further improve the quality and broaden the application range of TPVs in the region. Favorable regulatory policies promoting recyclable and sustainable materials bolster their market growth in North America.

Key Regional Takeaways:

United States Thermoplastic Vulcanizates Market Analysis

One of the primary drivers of the U.S. thermoplastic vulcanizates (TPVs) market is the rising demand for lightweight, high-performance materials within the automotive sector holding 82.50% market share in the market. TPVs offer an optimum solution for manufacturers looking to enhance fuel efficiency and reduce weight as they are a combination of the benefits available from both thermoplastics and elastomers. In addition, strict environmental regulations and increasing consumer demand for eco-friendly products are pushing industries to adopt greener alternatives, enhancing the appeal of TPVs. As per the U.S. Census Bureau, construction spending in November 2024 was estimated at a seasonally adjusted annual rate of USD 2,152.6 billion. This is manifestation of continued growth in the construction industry as it expands demand for long-lasting and weather-resistant materials, such as TPVs, in seals, gaskets, or roofing applications. Moreover, the uses of TPVs in medical devices, consumer products, and industrial applications further spur the growth of this market. Improvements in material science-chemical resistance, thermal stability, and processing ease are also spurring wider usage in various industries. The U.S. market is driven through strong technological abilities, robust manufacturing structures, and the substantial investments towards research and development, thereby promising continuous developments with TPV material.

Europe Thermoplastic Vulcanizates Market Analysis

The automotive industry is the primary driver of the TPVs market in Europe, as there is a significant focus on reducing vehicle weight to meet stringent emissions regulations. TPVs are commonly utilized in automotive seals, gaskets, and fuel system components because of their unique blend of flexibility, durability, and resistance to chemicals. Electric vehicles, another new trend, increase the need for TPVs since electric cars are manufactured with lightweight material for energy efficiency and improved range in driving. In 2023, new car registrations of electric cars registered in Europe total almost 3.2 Million with an increase of nearly 20% from 2022. In the European Union alone, sales amounted to 2.4 Million, demonstrating similar growth rates. The rising adoption of electric vehicles (EVs) is driving the increased demand for high-performance materials such as TPVs. Additionally, the European construction industry, particularly in northern countries, is driving TPV demand for roofing materials, seals, and window profiles, where the material’s resistance to weather conditions and thermal stability are valued. Regulatory pressure surrounding environmental sustainability is also a significant factor, with TPVs offering a more eco-friendly alternative to traditional rubber and thermoplastic materials. The increasing focus on recycling and the development of recyclable TPVs is further propelling market growth in Europe.

Asia Pacific Thermoplastic Vulcanizates Market Analysis

The thermoplastic vulcanizates (TPVs) market in the Asia-Pacific (APAC) region is experiencing significant growth, driven by rapid industrialization and urbanization. According to the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This rapid urbanization is fueling the demand for TPVs, particularly in the automotive and construction sectors. In the automotive industry, countries like China and India are adopting TPVs for lightweight and durable components that improve fuel efficiency and reduce emissions. The increasing shift towards electric vehicles (EVs) in the region further boosts TPV demand. Additionally, the growing construction sector is driving the use of TPVs in seals, gaskets, and roofing materials due to their flexibility, thermal stability, and weather resistance. As sustainability takes center stage, the eco-friendly and recyclable properties of TPVs make them an increasingly preferred option. These trends are anticipated to keep driving the market growth in the APAC region.

Latin America Thermoplastic Vulcanizates Market Analysis

In Latin America, the thermoplastic vulcanizates (TPVs) market is being fueled by rising demand from the automotive and construction industries. Urbanization in Latin American countries has reached around 80%, according to researches, which is higher than most other regions. This urbanization is fueling demand for durable, weather-resistant materials in construction, such as TPVs for seals, roofing, and windows. Furthermore, the automotive sector is increasingly utilizing TPVs for lightweight and fuel-efficient applications. The rising awareness of environmental sustainability also supports the shift toward eco-friendly materials like TPVs, further boosting their adoption in the region.

Middle East and Africa Thermoplastic Vulcanizates Market Analysis

The thermoplastic vulcanizates (TPVs) market in the Middle East and Africa (MEA) is experiencing substantial growth, fueled by the expanding construction and automotive sectors. TPVs are increasingly being used in construction applications, such as seals, gaskets, and roofing materials, due to their durability and resistance to extreme weather conditions. The UAE construction market, valued at USD 69.5 Billion in 2024, exemplifies this growth and further drives the demand for TPVs in the region. In the automotive sector, the increasing demand for lightweight, fuel-efficient materials is further driving the adoption of TPVs. As the region embraces sustainable development, the preference for eco-friendly, recyclable materials like TPVs continues to rise.

Competitive Landscape:

The competitive landscape of the thermoplastic vulcanizates (TPV) market is marked by a mix of established players and new entrants, all focused on innovation and expanding their market share. Companies focus on developing advanced TPV materials with superior properties such as enhanced durability, elasticity, and thermal resistance to meet diverse industry demands. Strategic actions such as mergers, acquisitions, and collaborations are common in the industry, aimed at enhancing production capabilities and expanding geographic reach. Research and development efforts prioritize sustainable and recyclable TPV solutions, aligning with global environmental regulations. The market also sees competition in pricing strategies, customization capabilities, and technical support services to cater to end-users in automotive, construction, and consumer goods industries, ensuring competitive differentiation and customer retention.

The report provides a comprehensive analysis of the competitive landscape in the thermoplastic vulcanizates market with detailed profiles of all major companies, including:

- Arkema S.A.

- Asahi Kasei Corporation

- BASF SE

- China Petroleum & Chemical Corporation

- DuPont de Nemours Inc.

- Exxon Mobil Corporation

- JSR Corporation

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Tosoh Corporation

Latest News and Developments:

- In November 2024, GEON® Performance Solutions launched a new thermoplastic elastomer (TPE) manufacturing line in Ramos Arizpe, Mexico, enhancing its polymer production capabilities. The line will produce TPE and thermoplastic vulcanizate (TPV) to meet rising customer demand. This expansion comes after GEON’s acquisition of PolymaxTPE in December 2023 and complements its existing TPE production facilities in the U.S. and China, reinforcing the efficiency of its global supply chain.

- In April 2024, Celanese Corporation qualified a specialty compounder in China for Santoprene® Thermoplastic Vulcanizate (TPV) production, strengthening its supply network in Asia. The product, available from Q2 2024, builds on over 46 years of expertise in high-performance materials. The move aims to enhance supply security and flexibility for custom compounding in the China market.

- In August 2023, Teknor Apex introduced the Sarlink® RX 3100B Series of Thermoplastic Vulcanizates (TPVs), featuring up to 40% post-industrial recycled (PIR) content, promoting sustainability in automotive applications. Available in 84 and 94 Shore A grades, these materials offer similar performance to virgin TPVs while reducing reliance on petroleum-based plastics.

- In November 2022, Mitsui Chemicals reached a basic agreement to establish a Chemical Reaction Design Innovation Department at Hokkaido University's ICReDD. This collaboration aims to pioneer new chemical reaction design methodologies, leveraging academia-industry synergy to advance innovation in chemical processes, materials, and applications.

Thermoplastic Vulcanizates Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | EPDM/PP Blends, NR/PP Blends, Others |

| Applications Covered | Automotive, Building and Construction, Consumer Goods, Medical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., Asahi Kasei Corporation, BASF SE, China Petroleum & Chemical Corporation, DuPont de Nemours Inc., Exxon Mobil Corporation, JSR Corporation, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc. Tosoh Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thermoplastic vulcanizates market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thermoplastic vulcanizates market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thermoplastic vulcanizates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermoplastic vulcanizates market was valued at USD 3.1 Billion in 2024.

IMARC Group estimates the market to reach USD 5.2 Billion by 2033, exhibiting a CAGR of 6.08% from 2025-2033.

Thermoplastic vulcanizates (TPVs), thermoplastic elastomers, dynamic vulcanization, elasticity, rubber, processability, plastics, durability, flexibility, recyclability, automotive applications, construction materials, consumer goods, sealing systems, lightweight materials, thermal resistance, weather resistance, fuel efficiency, sustainability, advanced materials, innovation, energy efficiency, environmental regulations, rubber-plastic blend, manufacturing.

North America currently dominates the market due to the widespread product utilization in the automotive industry for the mass production of light-weight, rugged parts such as weather seals and interior parts that will be able to make fuel efficiency with the stringent emission regulations

Some of the major players in the thermoplastic vulcanizates market include Arkema S.A., Asahi Kasei Corporation, BASF SE, China Petroleum & Chemical Corporation, DuPont de Nemours Inc., Exxon Mobil Corporation, JSR Corporation, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc. Tosoh Corporation., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)