Thermoplastic Polyurethane (TPU) Market Size, Share, Trends and Forecast by Type, Raw Material, Application, End Use Industry, and Region, 2025-2033

Thermoplastic Polyurethane (TPU) Market Size and Share:

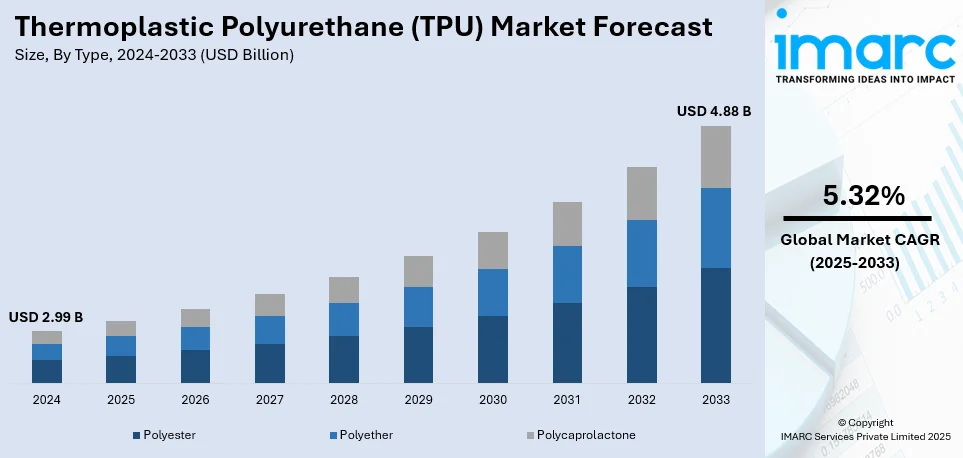

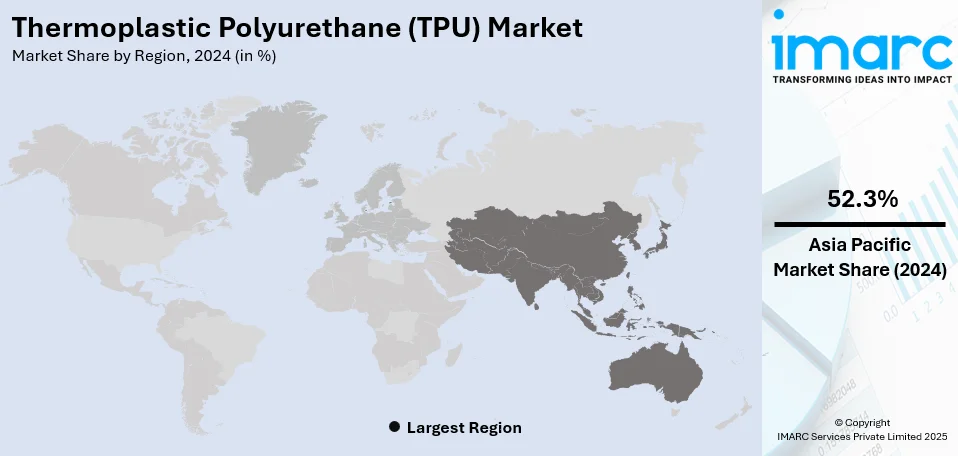

The global thermoplastic polyurethane (TPU) market size was valued at USD 2.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.88 Billion by 2033, exhibiting a CAGR of 5.32% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 52.3% in 2024. The expanding use of TPU-based sealants and adhesives, the rising demand for biodegradable plastics, and the increasing need for automotive component production are among the key factors fueling the thermoplastic polyurethane (TPU) market share in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.99 Billion |

|

Market Forecast in 2033

|

USD 4.88 Billion |

| Market Growth Rate (2025-2033) | 5.32% |

The global thermoplastic polyurethane (TPU) market is witnessing substantial growth, driven by rising demand across industries such as footwear, automotive, electronics, and healthcare. The rising preference for lightweight, durable, and flexible materials in automotive applications, such as interior components and cables, is a key driver. Additionally, the booming footwear industry, particularly in sports and casual wear, is fueling TPU adoption due to its superior abrasion resistance and elasticity. The expanding electronics sector is also leveraging TPU for protective casings and cables. Furthermore, growing environmental concerns and stringent regulations are accelerating the shift toward bio-based and recyclable TPU variants. Rapid advancements in manufacturing technologies, coupled with the rising demand for TPU in medical applications, further contribute to thermoplastic polyurethane (TPU) market growth.

The United States is emerging as a key region with 83.60% shares, driven by increasing demand across multiple sectors. In January 2025, new vehicle sales increased by 3.7% year-over-year, marking the fourth consecutive month of gains, driven by strong performances from brands like Honda, Hyundai, and Kia, particularly in the electric vehicle segment. The ongoing expansion of the automotive industry plays a crucial role in driving the TPU market, as the material is widely used for lightweight components that improve fuel efficiency and overall performance. Additionally, the footwear sector leverages TPU's flexibility and durability, leading to a substantial market share in this segment. The medical device industry also plays a crucial role, adopting TPU for its biocompatibility and versatility in applications such as tubing and protective films. Collectively, these factors underscore the dynamic growth trajectory of the TPU market in the United States.

Thermoplastic Polyurethane (TPU) Market Trends:

Growing Demand for Lightweight Materials

The automotive and aerospace industries are witnessing an increased need for fuel efficiency, and so, lightweight material demand is seeing a high degree of growth. TPU with its outstanding flexibility, durability, and low density has emerged as a key material in this trend. TPU also offers the reduction of overall vehicle weight without compromise on strength or impact resistance and, therefore is an ideal solution for applications within automotive interiors, under-the-hood components, and exterior parts. Furthermore, the increasing trend of TPU usage in footwears-sole and uppers-is evidence of the inclination towards lighter and more comfortable products. Its incorporation into various consumer goods such as bags, sporting equipment, and electronics further contributes to the increasing demand. Additionally, according to an industrial report, the footwear industry has seen a surge in TPU usage, with global footwear production increasing by 8.6% in 2021, surpassing 22 billion pairs. This trend is projected to persist, further driving the demand for TPU in the years ahead. As industries continue to emphasize sustainability and performance, TPU's unique characteristics perfectly align with the need for lightweight materials that improve energy efficiency without compromising on quality or durability.

Sustainability and Eco-friendly Products

As the focus of globalization shifts to sustainability, corporations search for solutions with little environmental effect. In an effort to provide these alternatives, TPU producers are creating more environmentally friendly TPU formulations, such as recyclable and bio-based materials. Because bio-based TPU is derived from renewable resources, it has a lower carbon footprint during manufacture and is less dependent on petroleum-based raw ingredients. Additionally, as businesses and consumers look for materials that can be reused or used, recyclable TPU items are becoming more popular. This reduces the waste and develops the circular economy. The medical, footwear, and automotive sectors are adopting this eco-friendly TPU because it provides performance without compromising sustainability. According to the European Commission, the worldwide market for bio-based plastics, including TPU, is likely to develop dramatically, with Europe setting ambitious plastic recycling objectives of 55% by 2025. Brands who care about the environment are using eco-friendly TPU in the manufacturing of a wide range of products, including medical equipment, garments, and packaging, while underlining the trend toward green options in material choices. This speaks to the rise of environmental concerns in the international market.

Technological Advancements in TPU Production

Technological advancement in TPU manufacturing is changing its capabilities and therefore opens new ways for application along with improving the efficiency. With the advancement in 3D printing technology, the market for TPU has changed drastically by allowing manufacturers to produce customized products with accurate shape and structure according to industries in automotive, health care, and consumer electronics. The properties that are unique to TPU include flexibility, high abrasion resistance, and chemical stability, thus making it suitable for 3D-printed parts used in functional parts and consumer goods. According to the U.S. Department of Energy, the global 3D printing market is expected to expand from USD 13.7 billion in 2022 to USD 34.8 billion by 2028. Materials like TPU are playing a crucial role in this growth due to their flexibility and high-performance characteristics. Furthermore, innovations in polymer blending and compounding improved the characteristics of TPU, which can then be modified for specific applications such as medical implants, protective films, or automotive seals. Such developments in manufacturing further widen the usage of TPU within high-performance sectors in aerospace and robotics. The evolution of technology is expected to propel TPU in the global market, providing solutions that are advanced, efficient, and sustainable for a wide variety of industries.

Thermoplastic Polyurethane (TPU) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thermoplastic polyurethane (TPU) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, raw material, application, and end use industry.

Analysis by Type:

- Polyester

- Polyether

- Polycaprolactone

Polyester-based TPU leads the industry, accounting for 45.0% of total market share, owing to better mechanical qualities, chemical resistance, and adaptability. Polyester TPU, which is widely used in automotive, footwear, and industrial applications, has great abrasion resistance, flexibility, and durability, making it an ideal material for high-performance goods. The car industry uses it extensively for interior components, seals, and tubes, while the footwear industry benefits from its lightweight yet strong character. Furthermore, the growing demand for bio-based polyester TPU, driven by sustainability trends and severe environmental laws, is accelerating its acceptance. The increasing usage of polyester TPU in consumer electronics and medical equipment leads to its market domination, strengthening its position in the sector.

Analysis by Raw Material:

- Polyols

- Diisocyanate

- Diols

Polyols dominate the TPU industry. Because polyols are essential in establishing the mechanical, flexible, and long-lasting qualities of TPU, they control 43.6% of the market. Both polyester and polyether polyols are often utilized in the manufacturing of TPU, however polyether polyols are favored for uses like medical tubing and footwear that demand a high level of hydrolysis resistance. Polyester polyols, on the other hand, are perfect for industrial and automotive applications because of their improved resilience to chemicals and abrasion. This market is being further strengthened by the rising demand for bio-based polyols brought on by sustainability efforts and regulatory laws. Furthermore, the need for high-performance TPU is being fueled by the quick growth of end-use sectors including electronics, consumer goods, and construction, which is solidifying polyols' market dominance.

Analysis by Application:

- Extruded Products

- Injection Molded Products

- Adhesives

- Others

Extruded products lead the thermoplastic polyurethane (TPU) market due to their widespread use across industries such as electronics, construction, automotive, and healthcare. TPU's flexibility, resilience, and resistance to chemicals and abrasion make it excellent for extrusion procedures that result in high-performance films, sheets, tubes, and profiles. Extruded TPU is widely used in the automobile industry for protective coatings, seals, and cable wrapping, hence increasing vehicle durability and economy. Furthermore, rising demand for TPU-based medical tubing and industrial hoses is fueling market expansion. Manufacturers are growing their TPU-based extruded product portfolios as infrastructural development and technological improvements in extrusion processes continue, enhancing this segment's market dominance even further. The growing trend for biodegradable and recyclable TPU materials is also driving demand.

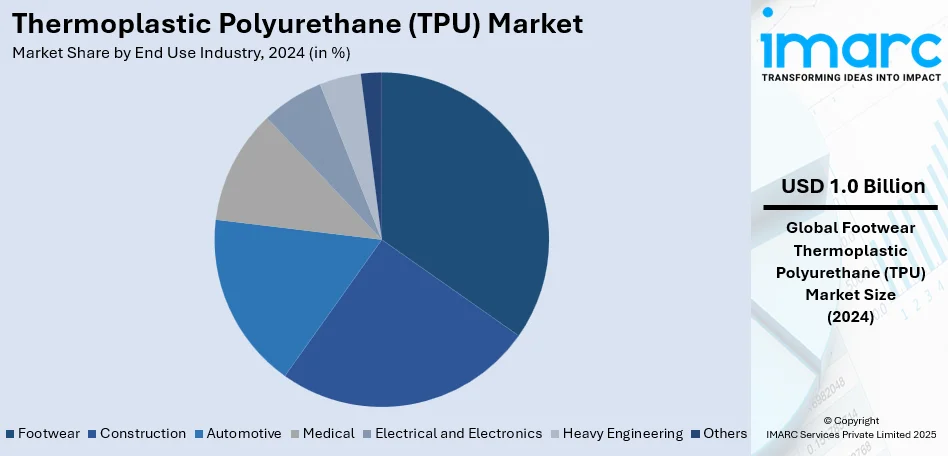

Analysis by End Use Industry:

- Construction

- Automotive

- Footwear

- Medical

- Electrical and Electronics

- Heavy Engineering

- Others

Footwear is a leading sector in terms of market share, which amounts to 34.6%, driven by growing demand for light, long-lasting, and high-performance materials. TPU, due to excellent flexibility, abrasion resistance, and shock absorption qualities, finds wide applications in athletic, casual, and safety footwear. TPU uppers, outsoles, and midsoles are gaining increasing popularity from major international footwear manufacturers for increased comfort and durability. Other drivers of innovations in bio-based TPU are moving toward recyclable and biodegradable materials in the creation of environmentally friendly footwear. Sports and outdoor activities continue to become popular, and through developments in 3D printing and injection molding, TPU remains the material of choice for next-generation footwear.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the thermoplastic polyurethane (TPU) market, accounting for 52.3% of overall market share, driven by increasing industrialization, a thriving footwear industry, and significant demand from the automotive and electronics sectors. China, India, and South Korea are significant contributors, owing to large-scale manufacturing, cost-effective production, and expanding consumer demand. The region's rising construction and infrastructure industries drive up TPU utilization in coatings, adhesives, and sealants. Furthermore, an increasing move toward sustainable and bio-based TPU, aided by government laws and environmental efforts, is driving market expansion. With increased expenditures in research & development, as well as breakthroughs in TPU processing methods, Asia Pacific remains the primary center for TPU production and consumption, cementing its market leadership.

Key Regional Takeaways:

North America Thermoplastic Polyurethane (TPU) Market Analysis

The North American thermoplastic polyurethane (TPU) market is witnessing substantial growth, fueled by its diverse applications across multiple industries. The automotive sector's increasing demand for lightweight and durable materials has led to a higher adoption of TPU in components like interior panels and cable sheathing. Additionally, the construction industry's expansion has bolstered the use of TPU in applications such as insulation and sealants. In the United States, private construction investment increased by 0.9% in December 2024, with residential construction rising by 1.5%. Despite higher mortgage rates affecting new projects, this growth continues to drive the TPU market forward. The medical field also contributes to the rising thermoplastic polyurethane (TPU) market demand, utilizing TPU for its biocompatibility in devices like catheters and tubing. Furthermore, the electronics industry benefits from TPU's flexibility and resilience, applying it in protective casings and cable insulation. Collectively, these factors underscore the dynamic expansion of the TPU market in North America.

United States Thermoplastic Polyurethane (TPU) Market Analysis

The U.S. market for thermoplastic polyurethane is gradually increasing due to the expansion of applications in automotive, electronics, and medical sectors. According to CEIC, the U.S. automotive sector manufactured around 10.6 million vehicles in 2023, with increased demand for light-weight, tough materials like TPU for the interior of the vehicle. This growth is further supported by the medical sector as well, wherein TPU finds application in the medical field through tubing and catheters. Further innovations in TPU formulations for ultimate flexibility and durability are spurring market advancements. Its key players, such as BASF and Covestro, dominate the U.S. TPU market due to its position through high performance products that would meet diverse industrial needs.

Europe Thermoplastic Polyurethane (TPU) Market Analysis

The TPU market of Europe is growing, driven by the needs of automotive, footwear, and industrial applications in advanced materials. The automotive industry, with leading nations such as Germany and France, has a goal to reduce vehicle weight, and this is what is pushing for TPU adoption. According to ACEA, electric vehicles made up 14.6% of new car registrations in 2023, further driving demand for sustainable and high-performance materials such as TPU. The European market also has a strong R&D infrastructure, with companies such as Covestro investing in green TPU technologies. Environmental regulations are also pushing for more eco-friendly alternatives, contributing to the positive thermoplastic polyurethane (TPU) market outlook.

Asia Pacific Thermoplastic Polyurethane (TPU) Market Analysis

Asia Pacific, led by its massive industrial application, has significant demand for consumer goods. This factor has spurred a fast rate of growth for TPU markets. According to CEIC, in 2022, the number of automobiles manufactured in China hit 27.5 million vehicles and, subsequently, added pressure on the usage of lightweight material in TPU. Electronics and the medical devices industries are two big sectors currently observing significant growth and require high amounts of flexible components, including the use of TPU. Increased TPU production capacities through investments by both global and local players are driving the competition, but investment for sustainable production of TPU is in priority in countries like Japan and South Korea.

Latin America Thermoplastic Polyurethane (TPU) Market Analysis

Latin America is increasingly seeing the expansion of the TPU market because of the high demand from the automotive, footwear, and packaging industries. The industrial report revealed that in 2023, Brazil produced nearly 2.32 million motor vehicles, wherein 77% were passenger cars. This indicates that the automobile sector is using a lot of lightweight materials to save on weight. Footwear companies in Latin America are using more TPU than ever, not only for superior performance but also for designing and making unique designs. The rising middle class and improving infrastructure are stimulating demand for consumer goods, and local TPU manufacturers are enhancing their capabilities to meet the growing market needs.

Middle East and Africa Thermoplastic Polyurethane (TPU) Market Analysis

The Middle East and Africa market for TPU will grow because of the increasing rate of industrialization and the demand for more durable materials. The automobile and construction industries are the key drivers, and TPU is used in different applications such as coatings and seals. According to an industrial report, in 2023, the United Arab Emirates sold around 225,390 new passenger cars, up 31.5% from the previous year, thereby increasing the demand for lightweight materials such as TPU. Furthermore, growth in local production capacities of TPU is also reducing dependence on imports, while further collaborations with international players are likely to enhance innovation and expand the market in the region.

Competitive Landscape:

The worldwide TPU market is extremely competitive, with major players focusing on innovation, sustainability, and growth to increase their market position. Market dominance is achieved by top corporations through strategic alliances, acquisitions, and intensive R&D. To satisfy expanding environmental concerns and legal restrictions, these companies are investing in recyclable and bio-based TPU solutions. Manufacturers are also increasing their manufacturing facilities, especially in Asia Pacific, to meet the growing demand from the medical, automotive, and footwear sectors. The existence of localized firms providing reasonably priced TPU solutions further exacerbates competition. Product differentiation is being fueled by technological developments in processing techniques like 3D printing and injection molding. Additionally, businesses are giving priority to TPU formulations tailored to individual customers in order to improve performance and application adaptability.

The report provides a comprehensive analysis of the competitive landscape in the thermoplastic polyurethane (TPU) market with detailed profiles of all major companies, including:

- American Polyfilm Inc.

- BASF SE

- Coim Group

- Covestro AG

- Epaflex Polyurethanes Spa

- Hexpol AB

- Huntsman International LLC

- Kuraray Co. Ltd.

- Mitsui Chemicals Inc.

- Sumei Chemical Co. Ltd.

- The Lubrizol Corporation (Berkshire Hathaway Inc.)

- Wanhua Chemical Group Co. Ltd.

Latest News and Developments:

- January 2025: The Lubrizol Corporation is set to present its medical-grade thermoplastic polyurethane (TPU) solutions at MD&M West 2025 in Anaheim, CA, from February 4 to 6. Lubrizol’s experts will highlight TPU applications in interventional vascular, ophthalmic, and drug delivery markets, reinforcing its role in advancing medical device innovation.

- November 2024: Wanhua Chemical unveiled polyurethane foam recycling technology at COP29, enabling 30% polyol recovery without degradation. Its bio-based TPU and HDI-type TPU enhance comfort in sports applications, while medical-grade TPU meets healthcare demands. These innovations reinforce sustainable materials' role in reducing carbon emissions across industries.

- November 2024: Lubrizol and Polyhose signed an MoU to expand medical tubing production in Chennai, increasing capacity five-fold. The facility will produce high-performance thermoplastic polyurethane (TPU) tubing for neurovascular and cardiovascular applications, supporting local manufacturing and global exports. Operations are set to begin in 2026.

- October 2024: BASF introduced Elastollan® 1400, a new ether-based TPU series with excellent hydrolysis resistance and mechanical properties. It offers superior burst pressure, aging stability, and improved sustainability with a lower carbon footprint. Ideal for various industries, including transportation, footwear, and industrial manufacturing, the TPU is available for sampling after two years of research.

- September 2024: Covestro is building a new Thermoplastic Polyurethane (TPU) application development center in Guangzhou, China, set to open in 2025. The center will enhance customer proximity, foster innovation, and support industries such as electronics, footwear, and mobility. This expansion follows the construction of Covestro's largest TPU plant in nearby Zhuhai.

Thermoplastic Polyurethane (TPU) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyester, Polyether, Polycaprolactone |

| Raw Materials Covered | Polyols, Diisocyanate, Diols |

| Applications Covered | Extruded Products, Injection Molded Products, Adhesives, Others |

| End Use Industries Covered | Construction, Automotive, Footwear, Medical, Electrical and Electronics, Heavy Engineering, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Polyfilm Inc., BASF SE, Coim Group, Covestro AG, Epaflex Polyurethanes Spa, Hexpol AB, Huntsman International LLC, Kuraray Co. Ltd., Mitsui Chemicals Inc., Sumei Chemical Co. Ltd., The Lubrizol Corporation (Berkshire Hathaway Inc.), Wanhua Chemical Group Co. Ltd., etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thermoplastic polyurethane (TPU) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thermoplastic polyurethane (TPU) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thermoplastic polyurethane (TPU) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermoplastic polyurethane (TPU) market was valued at USD 2.99 Billion in 2024.

IMARC estimates the thermoplastic polyurethane (TPU) market to exhibit a CAGR of 5.32% during 2025-2033.

The TPU market is driven by increasing demand from the automotive, footwear, and medical industries due to its flexibility, durability, and abrasion resistance. Growing adoption of sustainable and bio-based TPU, advancements in processing technologies, and rising infrastructure development further fuel market expansion.

Asia Pacific currently dominates the TPU market due to rapid industrialization, strong manufacturing capabilities, and high demand from automotive, footwear, and electronics sectors. Countries like China, India, and South Korea lead in TPU production and consumption, supported by cost-effective production, technological advancements, and increasing infrastructure investments.

Some of the major players in the thermoplastic polyurethane (TPU) market include American Polyfilm Inc., BASF SE, Coim Group, Covestro AG, Epaflex Polyurethanes Spa, Hexpol AB, Huntsman International LLC, Kuraray Co. Ltd., Mitsui Chemicals Inc., Sumei Chemical Co. Ltd., The Lubrizol Corporation (Berkshire Hathaway Inc.), Wanhua Chemical Group Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)