Thermal Spray Coating Market Size, Share, Trends and Forecast by Product, Technology, Application, and Region, 2025-2033

Thermal Spray Coating Market Size and Share:

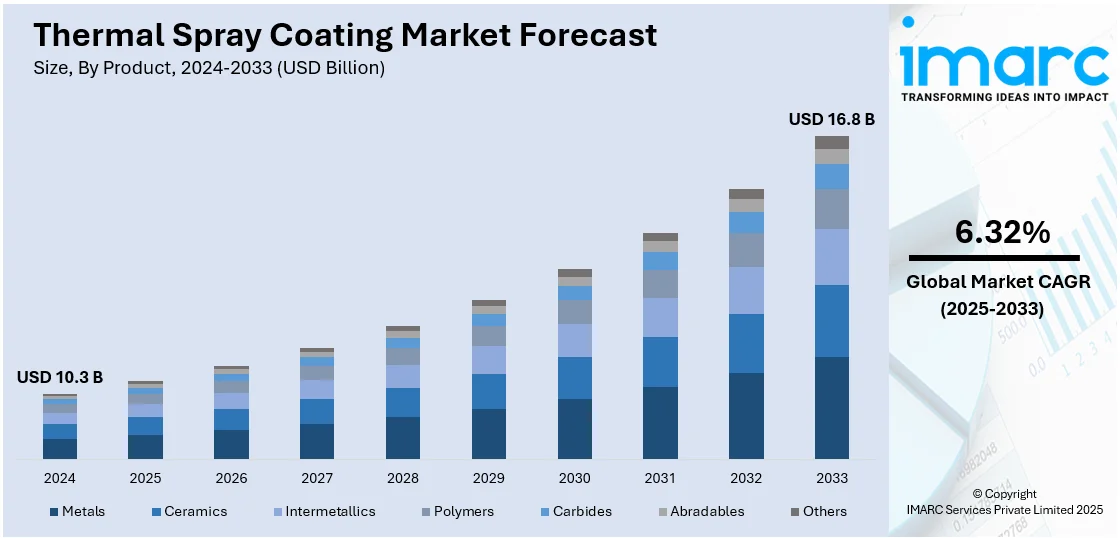

The global thermal spray coating market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.8 Billion by 2033, exhibiting a CAGR of 6.32% from 2025-2033. North America currently dominates the market, holding a market share of over 34.7% in 2024. The region is experiencing growth because of the robust aerospace and automotive industries, which extensively utilize thermal spray coatings for enhanced component performance and durability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.3 Billion |

|

Market Forecast in 2033

|

USD 16.8 Billion |

| Market Growth Rate 2025-2033 | 6.32% |

The rising use of thermal spray coatings in the aerospace sector to enhance the durability and performance of engine components and airframe parts represents one of the key factors propelling the market growth. These coatings provide resistance to high temperatures, wear, and corrosion, which is critical in harsh operational environments. Additionally, there is an increase in the usage of these coatings in the automotive industry for elongating the lifespan of different components like brake, suspension systems and engine parts. These coatings help lower friction and enhance thermal resistance, supporting the trend of lightweight and energy-efficient vehicles. Apart from this, the increasing utilization of thermal spray coatings in medical equipment, including orthopedic implants, because of their biocompatibility and ability to improve wear resistance is contributing to the market growth.

The United States plays a vital role in the market, propelled by the increasing use of thermal spray coatings in the automotive industry for engine components, brake systems, and suspension parts. The focus on boosting fuel efficiency, lowering emissions, and increasing component lifespan corresponds with the strengths of thermal spray coatings. In addition to this, the United States, a world leader in aerospace and defense production, is driving the need for thermal spray coatings to enhance the durability, corrosion resistance, and thermal stability of vital components such as those found in missile systems and aircraft. Recent agreements, like Lockheed Martin's $176 million deal for manufacturing Long Range Anti-Ship Missiles in November 2023, underscored the rise in government defense spending, thereby promoting the adoption of thermal spray technologies for both advanced military and commercial uses.

Thermal Spray Coating Market Trends:

Increasing Demand in Aerospace and Defense Industries

The rising need for thermal spray coatings in the aerospace and defense sectors is a key factor of supporting the market growth. These industries need superior coatings that can endure elevated temperatures, abrasion, and corrosion. Thermal coatings provide essential protection for turbine blades, aircraft engines, landing gear, and various structural components. An industry report suggests that worldwide air traffic is projected to grow at a 4.3% CAGR until 2030, leading to a higher demand for high-performance coatings. In addition, as defense budgets rise from the allocated USD 842 billion for US defense in 2024, there is an increase in need for durable coatings to safeguard military aircraft, helicopters, and naval ships. The aerospace sector is greatly gaining from thermal coatings because they offer improved fuel efficiency via sophisticated barriers that boost engine performance. Moreover, the defense industry relies on these coatings for improved protection of military aircraft, helicopters, and naval ships against adverse conditions and intense usage, which are offering a favorable market outlook.

Advancements in Thermal Spray Technologies

The ongoing advancement of thermal spray technologies, including plasma spraying and high-velocity oxy-fuel (HVOF) coating, is propelling growth of the market. These improvements enable enhanced accuracy, productivity, and the capability to apply coatings to intricate shapes. New methods are enhancing the adhesion and longevity of coatings, allowing them to be appropriate for a broader variety of materials, such as ceramics and composites. The incorporation of automation and robotics in thermal spray operations further boosts productivity, lowering expenses for industries. Additionally, in 2024, Hardide Coatings launched a new range of pre-coated copper nozzles designed for HVOF thermal spray applications. Featuring a CVD coating made from tungsten/tungsten carbide, the nozzles extended lifespan by 5 to 40 times and improved spray quality by decreasing material pickup. This advancement sought to improve efficiency and lower operational costs for HVOF equipment users.

Growing Utilization in the Automotive Sector

Thermal spray coating is widely used to enhance the performance, durability, and efficiency of critical automotive components. They provide superior resistance to wear, corrosion, and high temperatures, ensuring the reliability of engine parts, exhaust systems, and transmission components under extreme operating conditions. The increasing emphasis on sustainable and energy-efficient solutions in automotive manufacturing is driving the demand for these coatings. Additionally, as automakers focus on lightweight materials to reduce vehicle weight and improve fuel efficiency, thermal spray coatings play a key role in protecting these materials without adding substantial weight. The growing adoption of electric and hybrid vehicles is catalyzing the demand for thermal spray coatings for improving the efficiency and lifespan of electric motors and battery components. According to the IMARC Group, the worldwide electric vehicle industry is projected to grow from USD 786 Billion in 2024 to USD 3,877.2 Billion by 2032.

Thermal Spray Coating Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thermal spray coating market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, and application.

Analysis by Product:

- Metals

- Ceramics

- Intermetallics

- Polymers

- Carbides

- Abradables

- Others

Ceramics leads the market with around 30.1% of the market share in 2024. Ceramics are gaining traction in the market as they offer various advantages over other types of coatings, including high wear resistance, high hardness, and excellent thermal insulation properties. These qualities make ceramic coatings highly sought after in industries, like aerospace, energy, and healthcare. In the aerospace industry, turbine blades and engine components are treated with them to guarantee durability and efficiency in harsh environments. The energy sector benefits from ceramic coatings in gas turbines and power generation equipment, where their ability to withstand high temperatures and corrosive environments is critical. Ceramics in medical devices improve the performance of implants and surgical tools by offering biocompatibility and durability. Moreover, ceramic coatings enhance energy efficiency by decreasing heat loss and shielding equipment from wear and oxidation.

Analysis by Technology:

- Cold

- Flame

- Plasma

- High-Velocity Oxy-Fuel (HVOF)

- Electric Arc

- Others

Plasma leads the market with around 32.7% of market share in 2024. Plasma technology offers numerous advantages over other types of thermal spray coating processes, including versatility and superior performance. Plasma spraying allows for the creation of coatings that are of superior quality, consistency, and adhesion, making it appropriate for challenging uses in sectors such as aerospace, healthcare, and energy. It accommodates a wide range of materials, such as ceramics, metals, and composites, allowing for highly customized solutions tailored to specific needs. The process is also environment-friendly, as it minimizes waste generation and supports the use of recycled feedstock materials, aligning with sustainability goals. Additionally, plasma spraying offers remarkable efficiency, capable of achieving high deposition rates while maintaining precise control over coating properties. Industries gain advantages from the capability of the technology to produce strong protective coatings that can endure high temperatures, corrosion, and physical strain, guaranteeing durability and improved efficiency for crucial parts.

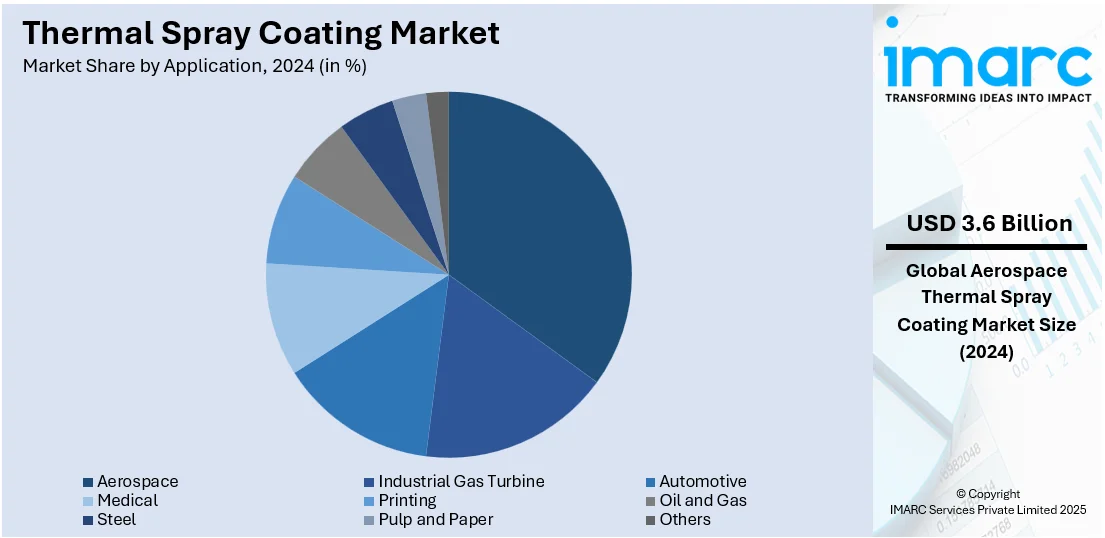

Analysis by Application:

- Aerospace

- Industrial Gas Turbine

- Automotive

- Medical

- Printing

- Oil and Gas

- Steel

- Pulp and Paper

- Others

Aerospace leads the market with around 35% of market share in 2024. Thermal spray coatings are essential for protecting airframe components from corrosion and wear, thereby enhancing the reliability and durability of aircraft. These coatings are typically produced using materials, such as aluminum, titanium, and stainless steel, which contribute to extending the lifespan of airframe components and reducing the need for frequent repairs and replacements, ultimately lowering maintenance costs. Additionally, ceramic coatings are widely employed to protect engine components from extreme temperatures, wear, and corrosive environments. By providing robust thermal barriers, these coatings enhance the performance and operational longevity of critical engine parts, including turbine blades, contributing to improved efficiency and reduced operating expenses. The aerospace industry is prioritizing lightweight materials, fuel efficiency, and sustainability, which is encouraging the adoption of advanced thermal spray coating technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.7%. Some of the factors driving the North America thermal spray coating market include the presence of advanced industrial base and extensive adoption across key industries, such as aerospace, automotive, healthcare, and energy. The dominance is attributed to the robust presence of well-established manufacturing and technology providers, alongside rising investments in research and development (R&D). The aerospace industry, a major end-user of thermal spray coatings, plays a pivotal role in North America's leadership position. The region is a hub for the production and maintenance of aircraft, with thermal spray coatings widely used to enhance the durability and performance of airframe and engine components. Additionally, strategic investments and facility expansions by key industry players in the region are supporting the market growth. For instance, in 2024, Flame Spray North America announced a $2.5 million expansion of its Fountain Inn, South Carolina facility, adding 40 new jobs and advanced thermal spray coating technologies. This investment supports its focus on serving industrial gas turbine and aerospace markets.

Key Regional Takeaways:

United States Thermal Spray Coating Market Analysis

The United States is a leading market for thermal spray coatings, accounting for 84.4%. This dominance is driven by heightened demand across aerospace, automotive, healthcare, and defense sectors. In the aerospace industry, thermal spray coatings are extensively applied to jet engine components to enhance durability and resistance to high temperatures, ensuring optimal performance and reduced maintenance. The automotive sector benefits from these coatings, particularly in improving the wear resistance of gears and crankshafts, thereby extending the lifespan of critical components. In healthcare, innovations led by companies such as Praxair Surface Technologies are introducing advanced coatings for medical implants, enhancing biocompatibility and durability. The U.S. government’s emphasis on sustainable manufacturing practices is further encouraging the adoption of eco-friendly thermal spray coatings, aligning with environmental regulations and corporate sustainability goals. Additionally, increasing investment in the defense sector supports the growth of this market, with thermal spray technologies being employed to improve the performance and reliability of military equipment.

Europe Thermal Spray Coating Market Analysis

The aerospace sector serves as a major driver of the thermal spray coating market in Europe, with companies such as Airbus leveraging these coatings to enhance engine performance, reduce maintenance costs, and improve fuel efficiency. Germany leads the region, owing to its well-established automotive industry, where thermal spray coatings are widely used to increase the efficiency, durability, and longevity of engine components and critical automotive parts. France and the UK are also key contributors, particularly due to advancements in renewable energy technologies, where coatings play a vital role in protecting wind turbine components from wear and corrosion in harsh environmental conditions. Additionally, the European Union’s stringent environmental regulations are encouraging the development and adoption of eco-friendly coating solutions. This is leading to innovations, such as Oerlikon Metco's low-emission thermal spray systems, which align with the EU's sustainability objectives and support a wide range of industrial applications.

Asia Pacific Thermal Spray Coating Market Analysis

China accounts for the majority of the market share, with its booming automotive and aerospace sectors incorporating thermal spray coatings to enhance wear resistance and durability. Additionally, the country's high-speed rail systems benefit from these coatings in critical components, ensuring longevity and performance. India’s “Make in India” initiative is further driving the demand in the region, particularly in heavy machinery and power plants, where thermal spray coatings improve efficiency and reduce maintenance needs. Japan, a leader in electronics manufacturing, relies on advanced coatings to enhance the strength and durability of semiconductors. Companies like Toshiba developed a thermal spray coating for turbine blades, reducing power plant energy losses. These developments, combined with increased R&D by companies such as Linde and Nippon Steel, are gaining traction for this market in Asia-Pacific.

Latin America Thermal Spray Coating Market Analysis

Latin America's market is encouraged by increasing applications in oil & gas and automotive industries. Brazil and Mexico are at the forefront, supported by rapid industrialization and government incentives to increase manufacturing activities. The region's growing focus on energy infrastructure and automotive production is driving the demand for coatings that enhance the durability and efficiency of critical components. Latin America is expected to account for 8.0% of the global market by 2032 as the adoption of advanced coating technologies continues to rise steadily.

Middle East and Africa Thermal Spray Coating Market Analysis

In 2023, thermal spray coating market in Middle East and Africa accounted for 5.6% of the global market. The market growth is driven by increasing infrastructure developments and the growing demand in the oil and gas sector. Countries like Saudi Arabia and the UAE play a pivotal role, with notable investments in industrial and energy projects. Government-led initiatives, including Saudi Arabia's Vision 2030, are fostering industrial modernization and diversification, enhancing the adoption of advanced coating technologies for applications in pipelines, machinery, and turbines. Additionally, increased focus on renewable energy and desalination projects is catalyzing the demand for durable and corrosion-resistant thermal coatings in the region.

Competitive Landscape:

Technological advancements, strategic collaborations, and product innovations are some of the strategies adopted by the key market players. They are keen to improve the performance of coatings through new material development. New materials include ceramic and carbide-based coatings that offer better wear and corrosion resistance. Moreover, R&D investments are enabling the production of more efficient and eco-friendly coating solutions, which enhance the market edge for key players and foster growth in the market. Furthermore, the acquisitions and mergers along with partnerships give them the ability to expand their global reach and serve the markets even wider across industries such as aerospace, automotive, and healthcare. In July 2024 US-based manufacturing firm Wall Colmonoy announced its acquisition of Canadian hard-facing solutions provider Indurate Alloys. The acquisition is expected to significantly bolster Wall Colmonoy's product offerings and strengthen its market position. By incorporating Indurate Alloys' extensive customer base, high-quality thermal spray products, and well-established vendor relationships, Wall Colmonoy aims to enhance and expand its current portfolio.

The report provides a comprehensive analysis of the competitive landscape in the thermal spray coating market with detailed profiles of all major companies, including:

- Air Products and Chemicals Inc.

- American Roller Company LLC

- Durum Verschleißschutz GmbH

- Lincotek Rubbiano S.p.A

- Metallizing Equipment Co. Pvt. Ltd.

- Montreal Carbide Co. Ltd.

- Powder Alloy Corporation

- Praxair Surface Technologies Inc. (Linde plc)

- Progressive Surface Inc.

- Wall Colmonoy Corporation

Latest News and Developments:

- September 2024: Electroninks, a prominent name in metal organic decomposition (MOD) inks for additive manufacturing and cutting-edge semiconductor packaging, revealed that it has introduced advanced copper ink for these applications. Utilizing spray coating and additional techniques, the ink lowers expenses, improves ESG performance, and substitutes conventional PVD and electroless plating methods, providing excellent performance for thermal management in semiconductor applications.

- August 2024: PPG introduced PPG Pitt-Therm 909, a silicone-based insulation coating that can be sprayed on for use in high-heat settings. It offers temperature resistance up to 500°F, minimizes corrosion risks, enhances safety, and shortens insulation time due to needing fewer coats, ultimately resulting in improved efficiency for industrial uses.

- June 2024: Oerlikon announced the establishment of an Advanced Coating Technology Center in Westbury, NY, aimed at enhancing technologies for the aerospace and gas turbine industries. This center integrates thermal spray and physical vapor deposition (PVD) expertise from its Metco and Balzers brands, respectively, to develop innovative coating solutions tailored to industry needs. The center will accelerate the development of high-temperature materials and coatings, addressing challenges like durability and performance in demanding environments.

Thermal Spray Coating Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Metals, Ceramics, Intermetallics, Polymers, Carbides, Abradables, Others |

| Technologies Covered | Cold, Flame, Plasma, High-Velocity Oxy-Fuel (HVOF), Electric Arc, Others |

| Applications Covered | Aerospace, Industrial Gas Turbine, Automotive, Medical, Printing, Oil and Gas, Steel, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Products and Chemicals Inc., American Roller Company LLC, Durum Verschleißschutz GmbH, Lincotek Rubbiano S.p.A, Metallizing Equipment Co. Pvt. Ltd., Montreal Carbide Co. Ltd., Powder Alloy Corporation, Praxair Surface Technologies Inc. (Linde plc), Progressive Surface Inc., Wall Colmonoy Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thermal spray coating market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thermal spray coating market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thermal spray coating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Thermal spray coating is an advanced protective layer applied to surfaces to improve resistance to wear, corrosion, and extreme temperatures. It is essential in industries like aerospace, automotive, and healthcare, where it enhances the durability, performance, and lifespan of critical components. It also supports energy efficiency and sustainability by reducing maintenance and material waste.

The global thermal spray coating market was valued at USD 10.3 Billion in 2024.

IMARC estimates the global thermal spray coating market to exhibit a CAGR of 6.32% during 2025-2033.

The market is driven by increasing demand in aerospace and automotive sectors, where thermal spray coatings improve component durability, corrosion resistance, and performance under extreme conditions. Advancements in coating technologies, including plasma and HVOF, enable greater precision and adhesion. Additionally, growing applications in medical equipment, such as implants and surgical tools, enhance durability and biocompatibility.

In 2024, ceramics represented the largest segment by product, driven by their high wear resistance, thermal insulation, and ability to withstand extreme temperatures, making them ideal for aerospace, energy, and medical applications.

Plasma leads the market by technology owing to its versatility, superior coating quality, and suitability for a wide range of materials, including metals and ceramics, while offering precise application and high thermal resistance.

Aerospace is the leading segment by application, driven by the need for corrosion resistance, durability, and thermal protection in airframe and engine components, ensuring improved performance, reduced maintenance, and extended operational life of aircraft.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global thermal spray coating market include Air Products and Chemicals Inc., American Roller Company LLC, Durum Verschleißschutz GmbH, Lincotek Rubbiano S.p.A, Metallizing Equipment Co. Pvt. Ltd., Montreal Carbide Co. Ltd., Powder Alloy Corporation, Praxair Surface Technologies Inc. (Linde plc), Progressive Surface Inc., Wall Colmonoy Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)