Thermal Interface Materials Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Thermal Interface Materials Market Size, Share & Trends:

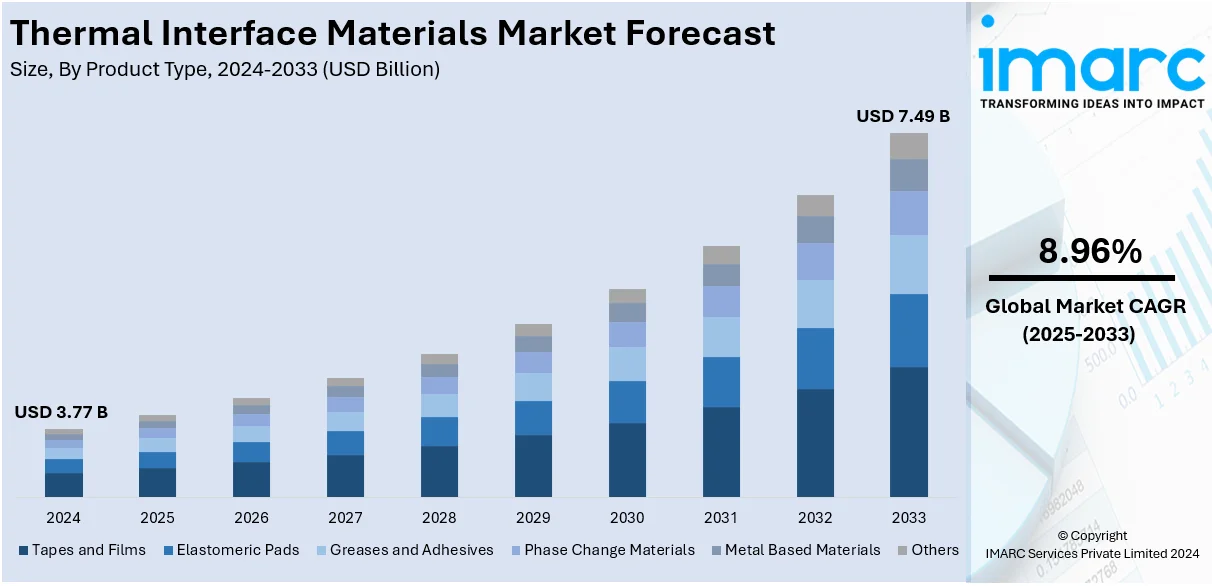

The global thermal interface materials market size was valued at USD 3.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.49 Billion by 2033, exhibiting a CAGR of 8.96% during 2025-2033. Asia Pacific currently dominates the market. The market is majorly driven by significant growth in the consumer electronics sector, rising investments in renewable energy, continual advancements in automotive technology, increasing adoption of 5G technology, rapid expansion in aerospace and defence sectors, and an enhanced focus on medical device innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.77 Billion |

|

Market Forecast in 2033

|

USD 7.49 Billion |

| Market Growth Rate (2025-2033) | 8.96% |

As electronic devices become more compact and powerful, they generate more heat, necessitating effective thermal management solutions, including thermal interface materials (TIMs). The increased usage of smartphones, laptops, and gaming consoles, all of which require advanced TIMs to maintain optimal performance and prevent overheating is leading to the surge in the market demand. Also, the growing adoption of wearable devices and the Internet of Things (IoT) gadgets further amplifies the need for efficient thermal management solutions. A study shows that US households spent an average of approximately US$760 on acquiring connected devices in the year 2023. This adoption rate has amplified the need for thermal interface materials.

The United States stands out as a key market disruptor driven by widespread digital transformation initiatives across diverse sectors, increasing adoption of electric vehicles (EVs), and growth in renewable energy sectors. The U.S. electric vehicle market is expanding rapidly, with revenues expected to reach 386.5 billion in 2032. It is also growing at a rapid pace of 27.5%. This growth is caused by increasing consumer demand for sustainable transportation and supportive government policies. EVs create a huge amount of heat in their batteries and power electronics, making effective thermal management crucial for safety and performance. The adoption of renewable energy systems, such as solar panels and wind turbines, is also accelerating in the U.S. It has been estimated that by 2050, 404 GW of cumulative wind capacity would meet 35% of U.S. electricity demand. Alongside this, solar capacity has grown at an average rate of 22% annually during the last ten years. A record 32.4 GW was installed in 2023 which has raised the total capacity to almost 180 GW. These systems rely on electronic components for power conversion and storage, which generate heat during operation. Effective thermal management using TIMs is critical to maintain efficiency and reliability.

Thermal Interface Materials Market Trends:

Significant growth in the consumer electronics sector

The rising demand for high-performance electronic devices among the masses is driving the market. According to an industrial report, the global revenue from the consumer electronics market will reach an impressive USD 950.0 Billion in 2024. As electronic devices become more compact and powerful, effective heat dissipation is crucial to maintain their performance and longevity. TIMs are essential elements in managing heat by improving thermal conductivity between the components and heatsinks. This need is especially noticeable in the consumer electronics, automotive, and telecom industries where modern-day TIMs ensure greater reliability and efficiency. All of these trends are empowering the demand for advanced thermal management solutions, in addition to high-performance computing devices and gaming. As a result, the thermal interface materials market forecast remains positive, with continuous advancements driving its expansion.

Rising Investments in Renewable Energy

The growing investments made for the development of renewable energy sources are supporting the market growth. According to an industrial data, as the investment in clean energy soars—doubling between 2018 and 2023 to reach USD 248 Billion—it is in this investment arena, too, where investments in thermal management solutions are being speeded up. Indeed, large progress is anticipated in the coming year, pushing this momentum even more to meet the ever-increasing demands of TIMs. The transition towards renewable energy, such as solar and wind power, involves the deployment of sophisticated electronic systems that require efficient thermal management. The power electronics equipment such as solar inverters, wind turbine controllers and other associated devices produce considerable amount of heat in course of operation and hence, require the usage of high-performance TIMs to meet the performance requirement. This is due to the continuing interest for sustainable energy and the global trend towards utilizing renewable energy to reduce carbon footprint, thus stimulating the usage of thermal interface materials for renewable energy projects. With the growth of renewable energy sectors, demand for high-tech thermal management solutions is continuously increasing and consequently propelling the thermal interface materials demand significantly.

Continual Advancements in Automotive Technology

Emerging innovations in the development of new vehicles are a significant factor impelling the global market. The rising popularity of electric vehicles and self-driving vehicles has led to the augmenting demand for effective thermal management solutions. Thermal management is particularly crucial for electric vehicles as batteries and ECUs need stringent control of temperature. The use of TIMs is vital in regulating the thermal design of these components and increasing the efficiency and safety of EVs. Also, modern vehicles incorporate features such as ADAS and infotainment that require good thermal management in their operation. According to a report, the deployment of ADAS in the U.S. is speeding up, with more than 60% of new vehicles sold in 2023 coming with ADAS technologies onboard. This trend is further contributing to the thermal interface materials market growth.

Thermal Interface Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thermal interface materials market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Tapes and Films

- Elastomeric Pads

- Greases and Adhesives

- Phase Change Materials

- Metal Based Materials

- Others

Greases and adhesives dominate the market due to their high thermal conductivity and easy-to-apply properties. Greases offer high thermal performance and can fill small gaps between surfaces to ensure efficient heat transfer. Adhesives, in contrast, have a combination of thermal conductivity and mechanical bonding capacity, making them suitable for different applications. As a result, these products have a major market share in the TIMs market due to their performance and versatility. On account of the increasing demand for high-performance devices in various industries, greases and adhesives are expected to continue generating high thermal interface materials market revenue.

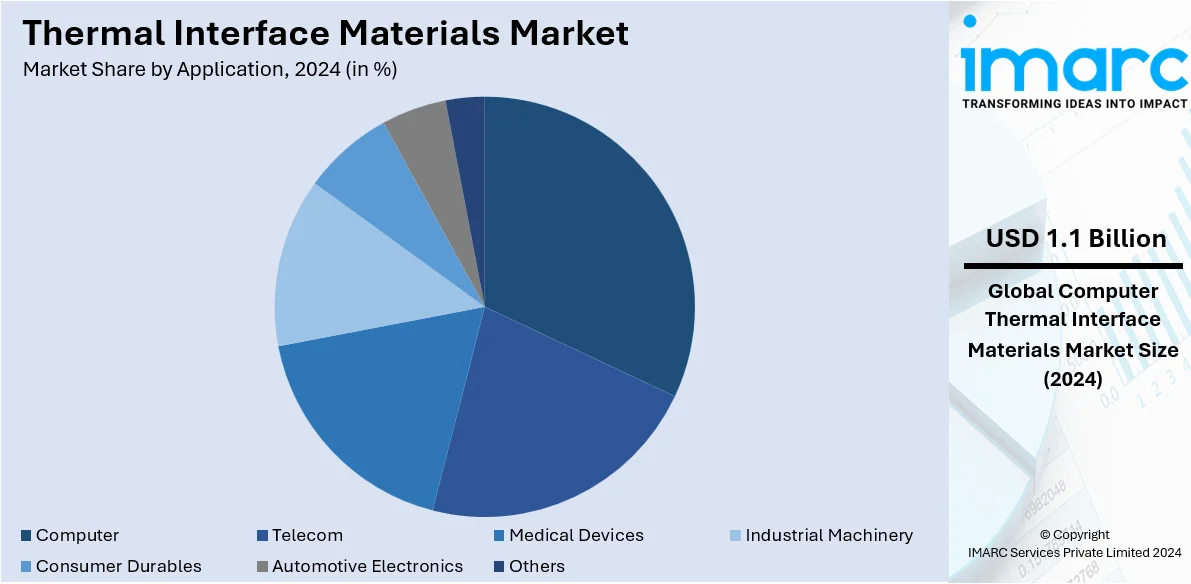

Analysis by Application:

- Telecom

- Computer

- Medical Devices

- Industrial Machinery

- Consumer Durables

- Automotive Electronics

- Others

The computer segment holds the largest share of the market. Growing demand for high-performance computing (HPC) and the miniaturization of electronic modules drive heat removal innovations. With ongoing advancements in computer processors, including the development of faster processors and more powerful graphics cards, the demand for effective thermal management solutions is rising. Furthermore, the growing usage of gaming PCs, workstations, and data centers further accelerates the demand for high-performance TIMs. The thermal interface materials market outlook remains favorable due to these technological advancements and the increasing complexity of computer systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific holds the largest segment in the market due to the region’s rapid industrialization, significant growth of the electronics industries, and the expansion of major manufacturing hubs such as China, Japan, and South Korea. The increasing production of consumer electronics, automotive electronics, and other advanced technologies in this region also drives the demand for the product. Furthermore, continual investments by key players in the production of EVs and technological innovations are further playing a significant role in enhancing the thermal interface materials market.

Key Regional Takeaways:

North America Thermal Interface Materials Market Analysis

The thermal interface materials (TIMs) market in North America is experiencing significant growth because of advancements in electronics, renewable energy systems, and automotive technologies. The region's robust demand for high-performance consumer electronics, such as smartphones, laptops, and gaming devices, has increased the need for efficient thermal management solutions. Additionally, the rapid adoption of electric vehicles (EVs) and the expansion of renewable energy systems, such as solar panels and wind turbines, are key factors boosting TIM utilization. The region's thriving data center industry, driven by cloud computing and 5G network expansion, also plays a pivotal role, as TIMs are critical for maintaining server efficiency. North America's focus on technological innovation and sustainability makes it a leading contributor to the TIMs market globally.

United States Thermal Interface Materials Market Analysis

The U.S. thermal interface materials (TIM) market is growing, primarily in the electronics and automotive industries. The automotive sector is mainly dominated by the EV manufacturers that contribute a high amount of TIM requirements, and more than 1 million electric vehicles have been sold during 2023, according to an industrial report. Innovative materials include Graphene-enhanced TIM and phase-change materials are among the growth drivers. Leader companies such as 3M and Dow have innovations set in place, driving by nanotechnology advances which raise the performance. The sound amount of domestic R&D Funding and cooperation with university makes the development steady. With Energy-efficient devices incentives from U.S. government, development encourages the adoption of TIM further and, local production also strengthens the domestic supply chain away from imports.

Europe Thermal Interface Materials Market Analysis

Thermal interface materials in Europe are expected to grow steadily, given the growing renewable energy industry and sustainability focus. For example, in 2023 alone, SolarPower Europe adds 70.1 GW to the region's solar capacity, thereby increasing the utilization of TIMs in solar panels and inverters. The European Union regulations on energy efficiency are demanding high-performance TIMs from manufacturers, and companies like Henkel and Arctic Silver are leading eco-friendly TIMs with low thermal resistance and high conductivity. Government-backed programs like Horizon Europe support research in new materials, such as carbon-based composites, to strengthen Europe's leadership in TIM technologies.

Asia Pacific Thermal Interface Materials Market Analysis

Asia Pacific thermal interface materials market is growing with a rapid pace due to electronics manufacturing and the semiconductor industry. IDC predicts 6.2% growth for global smartphones in 2024 at 1.24 billion units, with Asia Pacific at a production lead. India's electric vehicle sector, supported by its USD 3.2 Billion FAME II scheme according to the Ministry of Heavy Industries, drives demand as well. Major players like Shin-Etsu Chemical and Panasonic dominate the market by developing new TIM products with high-performance devices. Heavy investment in nanotechnology and graphene-based TIMs can be attributed to next-generation electronics. Cross border collaborations such as semiconductor R&D between Japanese and Taiwanese companies, foster innovation. Government policies such as "Make in India" and "China 2025" promote localized manufacturing, and Asia Pacific continues to remain the most crucial hub for the development of TIM globally.

Latin America Thermal Interface Materials Market Analysis

Latin America's TIM market is growing, led by the electronics and automotive industries. An industrial report stated that Brazil produced 2.37 million vehicles in 2023. This is a testament to the need for efficient thermal management systems. The region's data centers are on the rise, with an increase in construction in Mexico, which further boosts the market since TIMs are necessary for server cooling systems. Government incentives for renewable energy consumption in countries like Chile drive more demand for TIM components in solar energy systems and wind turbines. Companies like Aavid Thermalloy focus on the Latin American market with cost-effective solutions. Partnerships with international firms increase local manufacturing capacity, while investments in training and development programs ensure a skilled workforce.

Middle East and Africa Thermal Interface Materials Market Analysis

Middle East and Africa TIM market is driven by higher demand in the renewable energy, defense sectors. International Renewable Energy Agency, IRENA indicated that Saudi Arabia's Renewable energy capacity rose to 3 GW in the year 2023 has increased demand for TIM into solar projects. Higher demand to implement smart city projects and data center infrastructure are expected to increase the demand in the region for advanced TIM. The rising automobile industry in Africa, particularly in South Africa, also contributes to market growth as key players such as Denka offer customized solutions. The incentive for local manufacturing and collaboration with international companies will help build capacity while government-led initiatives promote sustainable thermal management technologies.

Competitive Landscape:

Leading thermal interface materials companies are allocating significant amounts of resources towards research and development as they seek to develop newer and better TIMs characterized by better thermal conductivity, reliability, and installation. This comprises of preparing substrates, adhesives, and protective coatings with improved characteristics like reduced thermal resistance and increased thermal endurance to accommodate the increasing market requirements of different industries. Moreover, several companies are promoting businesses, mergers, and acquisitions to promote their global reach as these collaborations assist businesses in understanding the strength of the respective business partners, thus even helping them in bringing cutting-edge technology to thermal management solutions precisely. With reference to thermal interface materials market recent developments, some of the market players are launching environmentally friendly and sustainable TIMs. They are also paying special attention to digital and industrial advancement in production lines to achieve maximum returns on their investments. Additionally, the constant incorporation of advanced materials and technologies such as nanotechnology is also perceived to be on the rise, which is augmenting the market.

The report provides a comprehensive analysis of the competitive landscape in the thermal interface materials market with detailed profiles of all major companies, including:

- 3M Company

- Dow Inc.

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Indium Corporation

- Kitagawa Industries America Inc.

- Laird Technologies Inc.

- Momentive Performance Materials Inc.

- Parker-Hannifin Corporation

- Zalman Tech Co. Ltd.

Latest News and Developments:

- November 2024: Smart High Tech and Henkel announced a principal agreement to jointly pursue a partnership for Smart High Tech's GT-TIM® thermal interface material technology, as reported on November 27, 2024. This partnership will drive the adoption of the technology faster by combining Smart High Tech's innovation with Henkel's expertise and sales network.

- October 2024: New thermal interface materials unveiled by the Chomerics Division at Electronica 2024 included THERM-A-FORM™ CIP 60 cure-in-place material, THERM-A-GAP™ 80LO thermal gap pad, and THERM-GAP™ GEL 75VT dispensable gel. The company also introduced a rapid sampling and prototyping service.

- October 2024: Dow and Carbice announced that they will create a strategic partnership to drive TIM advancement for the electronics, mobility, and semiconductor sectors. Through combining Dow's silicone expertise and Carbice's CNT technology, the companies hope that their collaboration will further develop thermal management performance and reliability, with new products planned to emerge in 2025.

- March 2024: Resonac Corporation has revealed plans to enhance its ability to develop materials for high-performance semiconductor chips, which will be used as AI CPUs, by 3.5 to 5 times its current level. The company aims to escalate the production of non-conductive film (NCF) and thermal interface material (TIM). It intends to invest 15 billion yen in facilities to create these materials, with increased operations beginning in and beyond 2024.

- February 2023: Indium Corporation announced that it will feature its high-performance metal thermal interface materials (TIMs) for burn-in and test at TestConX during March 5th to 8th in Mesa, Arizona, U.S. The indium-containing TIMs offer superior thermal conductivity over non-metals with pure indium metal delivering 86W/mK. Its indium-containing TIMs are available as pure indium, indium-silver alloys, and indium-tin.

Thermal Interface Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tapes and Films, Elastomeric Pads, Greases and Adhesives, Phase Change Materials, Metal Based Materials, Others |

| Applications Covered | Telecom, Computer, Medical Devices, Industrial Machinery, Consumer Durables, Automotive Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Dow Inc., Henkel AG & Co. KGaA, Honeywell International Inc., Indium Corporation, Kitagawa Industries America Inc., Laird Technologies Inc. Momentive Performance Materials Inc., Parker-Hannifin Corporation, Zalman Tech Co. Ltd |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thermal interface materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global thermal interface materials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thermal interface materials industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Thermal interface materials are compounds or materials used to enhance heat transfer between surfaces, typically in electronic devices. They fill gaps or irregularities between heat-generating components, like processors, and heat-dissipating elements, such as heat sinks, ensuring efficient thermal conductivity and preventing overheating.

The thermal interface materials market was valued at USD 3.77 Billion in 2024.

IMARC estimates the global thermal interface materials market to exhibit a CAGR of 8.96% during 2025-2033.

The global thermal interface materials market is driven by the increasing demand for efficient thermal management in electronics, rapid adoption of electric vehicles, expansion of renewable energy systems, advancements in fifth-generation (5G) technology, growth in data centers, and innovations in medical device technologies.

According to the report, greases and adhesives represented the largest segment by product type, as they provide excellent thermal conductivity and adhesion.

Computer is the leading segment by application, as they generate significant heat due to high-performance processors and GPUs, requiring effective thermal management.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global thermal interface materials market include 3M Company, Dow Inc., Henkel AG & Co. KGaA, Honeywell International Inc., Indium Corporation, Kitagawa Industries America Inc., Laird Technologies Inc. Momentive Performance Materials Inc., Parker-Hannifin Corporation, and Zalman Tech Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)