Thailand Medical Cannabis Market Size, Share, Trends and Forecast by Cultivated Species, Derivatives, Application Areas, End-Use, and Route of Administration, 2025-2033

Thailand Medical Cannabis Market Size:

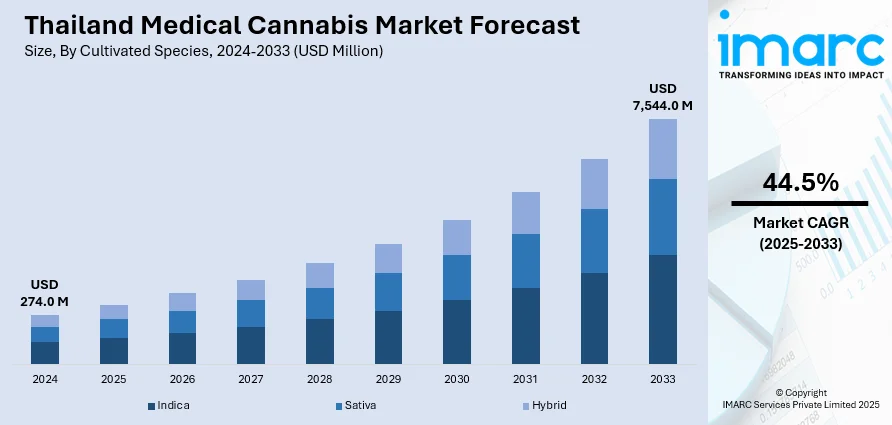

The Thailand medical cannabis market size reached USD 274.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,544.0 Million by 2033, exhibiting a growth rate (CAGR) of 44.5% during 2025-2033. The market is propelled by the favorable government regulatory framework, widespread acceptance of the product, rapid growth of cultivation facilities and production capacity, increasing research and development (R&D) activities by key players, rising international investments and partnerships, and rising prevalence of chronic diseases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024 |

| Market Size in 2024 | USD 274.0 Million |

| Market Forecast in 2033 | USD 7,544.0 Million |

| Market Growth Rate 2025-2033 | 44.5% |

Thailand Medical Cannabis Market Analysis:

- Major Market Drivers: Some of the major market drivers include rising government support, rising medical cannabis demand in Thailand, and the rising adoption of alternative treatments other than conventional methods.

- Key Market Trends: Better facilities for cultivation and production, increasing research and development (R&D) activities by key players, and increasing international investments and partnerships, are some of the major key market trends.

- Challenges and Opportunities: Challenges of this industry include compliance of stringent and complex regulations associated with the cultivation, production, and distribution of cannabis and the severe competitive market catering to individuals seeking alternative treatment methods. On the other hand, Thailand medical cannabis market recent opportunities include the rising international demand for Thai medical cannabis products and rising tourism associated with medical cannabis across Thailand.

To get more information on this market, Request Sample

Thailand Medical Cannabis Market Trends:

Rising Acceptance and Foreign Investments

The rising acceptance of the product, thus propelling the market growth. In December 2018, Thailand became the first South Asian country to allow the usage of marijuana for medical activities, further driving the market. This historic decision attracted domestic support along with positioning Thailand as a pioneer in the industry. A wide population across the region approves of the utilization of medical cannabis thus reflecting a wide-societal acceptance. Significant foreign investments have also been made possible as a result of the regulatory framework that is particularly favorable. Companies from other countries are eager to work together with Thai businesses in order to bring in cutting-edge technology and procedures that will improve the overall quality and productivity of the cannabis manufacturing process. These partnerships are advantageous for the domestic market, and they also establish Thailand as a competitive participant on the international arena with regard to international trade.

Increasing Number of Individuals Diagnosed with Chronic Diseases

The rising cases of chronic diseases in the region is creating a positive Thailand medical cannabis market outlook. Chronic diseases include illnesses such as diabetes, cancer, and cardiovascular issues which occur mostly due to lifestyle changes and a rising geriatric population. According to the UNITED NATIONS DEVEOPMENT PROGRAMME (UNDP), chronic diseases lead to approximately 74% deaths across the country. The report by the organization also states that 14% of Thai individuals possess the risk of succumbing to the four major chronic diseases before the age of 70. Medical cannabis are widely renowned for their healing attributed associated with chronic diseases, leading to a rising medical cannabis demand in Thailand. For instance, according to the NATIONAL INSTITUE OF HEALTH (NIH), cannabinoids release chronic pain, minimize inflammation, and enhance the quality of life for patients undergoing chemotherapy.

Favorable Regulatory Support Monitoring Quality Control

The regulatory support monitoring the quality of medical cannabis is leading to Thailand medical cannabis market growth. The Thai government has initiated regulations to safeguard efficacy, safety, and quality of these products. Post the amendment of the 1979 NARCOTICS ACT, the liberalization of cannabis began in the region of Thailand. These amendments allowed usage of the plant for medicinal purposes, regulated by the THAI FOOD AND DRUG ADMINISTRATION (THAI FDA), a government body functioning under the administration of the MINISTRY of PUBLIC HEALTH (MoPH). The regulatory body is liable for granting and administering licenses and post-marketing control for all products under its supervision. There has been an increase in trust among both domestic and foreign stakeholders as a result of the implementation of these regulatory measures.

Thailand Medical Cannabis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on cultivated species, derivatives, application areas, end-use, and route of administration.

Breakup by Cultivated Species:

- Indica

- Sativa

- Hybrid

Indica accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the cultivated species. This includes indica, sativa, and hybrid. According to the report, indica represented the largest segment.

With its well-documented medicinal effects, notably in the areas of pain reduction, insomnia medication, and anxiety management, the indica strain holds the largest Thailand medical cannabis market share. Indica strains are distinguished by their increased cannabidiol (CBD) content, which provides considerable therapeutic qualities without the euphoric effects that are linked with high tetrahydrocannabinol (THC) levels, which are experienced in sativa strains. On account of this, Indica is more suited for usage in medical settings, as it is in line with the requirements of patients who are seeking treatment for chronic diseases. Furthermore, the appropriate growing environment for this plant across the region boosts the cultivation efficiency of Indica, which further contributes to the domination of this strain in the market.

Breakup by Derivatives:

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

Tetrahydrocannabinol (THC) holds the largest share of the industry

A detailed breakup and analysis of the market based on the derivatives have also been provided in the report. This includes cannabidiol (CBD), tetrahydrocannabinol (THC), and others. According to the report, tetrahydrocannabinol (THC) accounted for the largest market share.

As a result of its powerful therapeutic characteristics and extensive application in the treatment of a wide range of medical diseases, such as glaucoma, insomnia, low appetite, nausea, pain, and others, tetrahydrocannabinol dominate the market. Another factor that contributes to its appeal for both medicinal and recreational purposes is the psychoactive properties that it possesses. Furthermore, the legal structure that the Thai government has established offers support for the controlled use of THC, which guarantees both its availability and its quality for use in medical applications, thus further generating a positive Thailand medical cannabis market revenue. THC is one of the most important component of the medical cannabis industry on account of the medicinal advantages it offers and the regulatory backing it receives.

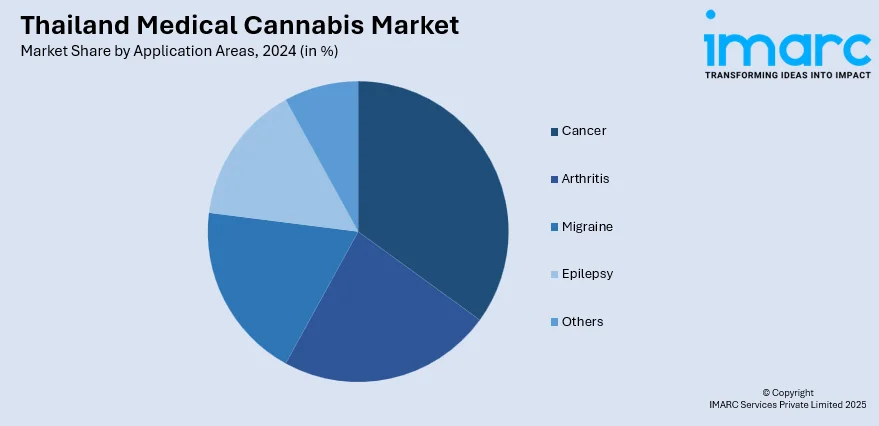

Breakup by Application Areas:

- Cancer

- Arthritis

- Migraine

- Epilepsy

- Others

Cancer represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application areas. This includes cancer, arthritis, migraine, epilepsy, and others. According to the report, cancer represented the largest segment.

The use of cannabis for medical purposes is being investigated as a possible supplemental therapy for cancer patients, thereby creating a positive Thailand medical cannabis market overview. Although cannabinoids do not directly treat cancer, it is believed that some cannabinoids, notably cannabidiol (CBD) and tetrahydrocannabinol (THC), may be beneficial in the management of symptoms and side effects associated with cancer and the therapies for it. It is possible that these cannabinoids can help decrease nausea, vomiting, and discomfort that are caused by chemotherapy, as well as increase appetite and the quality of sleep. In addition, it is possible that they have qualities that are anti-inflammatory and anti-anxiety, both of which might help to the general well-being of cancer patients. According to the UNITED NATIONS DEVELOPMENT PROGRAMME (UNDP), lung cancer causes 370 deaths across the region, annually. This substantial number is fostering the adoption of medical cannabis for the treatment of numerous chronic illnesses, along with cancer.

Breakup by End-Use:

- Pharmaceuticals

- Research and Development Centres

- Others

Pharmaceuticals exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes pharmaceuticals, research and development centres, and others. According to the report, pharmaceuticals accounted for the largest market share.

As per the Thailand medical cannabis market forecast, medical cannabis is rapidly gaining popularity in the pharmaceutical industry due to its potential therapeutic benefits. Pharmaceuticals produced from cannabis, such as synthetic cannabinoids or standardized plant extracts, are now being investigated to monitor whether or not they are effective in treating illnesses such as epilepsy, multiple sclerosis, and chronic pain. These products are subjected to extensive testing procedures in order to guarantee their safety, uniformity, and standardization of dose. Patients who may not respond well to traditional drugs may benefit from the alternative treatment that is provided by cannabis in pharmaceuticals.

Breakup by Route of Administration:

- Oral Solutions and Capsules

- Vaporizers

- Topicals

- Others

Oral solutions are the largest segment in the market

The Thailand medical cannabis market report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral solutions and capsules, vaporizers, topicals, and others. According to the report, oral solutions represented the largest segment.

Oral solutions and capsules are the most common means for consuming cannabis on account of their ease of use and precise dosing. Patients are required to consume monitored amounts of doses of the tinctures and drops, beneath the tongue as it assists quick absorption via the mucosal membranes. In addition to this, the capsules include pre-measured quantities of cannabis, which ensures that the intake is both uniform and under control. Both of these approaches involve meticulous consumption, which makes them appropriate for individuals who are seeking a safer experience, and avoid vaporizing or smoking.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Some of the detailed profiles of all major companies have also been provided.

- The leading medical cannabis companies in Thailand are making substantial investments in research and development, advanced cultivation technologies, and strategic partnerships. The cannabis industry is currently working on the development of high-quality, medical-grade products, with an emphasis on creating novel delivery modalities such as oils, tinctures, and capsules. The quality of the product and the market reach are both improved via the use of collaborative efforts with multinational companies. Furthermore, these players are participating in large educational programs with the goal of cultivating higher acceptance and demand for the product by increasing understanding about the advantages of cannabis for medical purposes

Thailand Medical Cannabis News:

- August 2023: CMU and Atlanta Medicare announced their investment of USD 28 Million for the construction of closed-system cannabis manufacturing facilities in Thailand. These facilities are expected to be ready for production by the start of 2024.

Thailand Medical Cannabis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cultivated Species Covered | Indica, Sativa, Hybrid |

| Derivatives Covered | Cannabidiol (CBD), Tetrahydrocannabinol (THC), Others |

| Application Areas Covered | Cancer, Arthritis, Migraine, Epilepsy, Others |

| End-Uses Covered | Pharmaceuticals, Research and Development Centres, Others |

| Route of Administrations Covered | Oral Solutions and Capsules, Vaporizers, Topicals, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand medical cannabis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand medical cannabis market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand medical cannabis industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Thailand medical cannabis market was valued at USD 274.0 Million in 2024.

We expect the Thailand medical cannabis market to exhibit a CAGR of 44.5% during 2025-2033.

The increasing utilization of medical cannabis for the treatment of numerous chronic diseases, such as cancer, chronic pain, depression, arthritis, etc., is primarily driving the Thailand medical cannabis market.

The sudden outbreak of the COVID-19 pandemic has led to the rising utilization of medical cannabis in RD activities to treat the mild symptoms of coronavirus infection, thereby positively influencing the market growth.

Based on the cultivated species, the Thailand medical cannabis market can be segmented into indica, sativa, and hybrid. Currently, indica holds the majority of the total market share.

Based on the derivatives, the Thailand medical cannabis market has been segregated into Cannabidiol (CBD), Tetrahydrocannabinol (THC), and others. Among these, Tetrahydrocannabinol (THC) currently exhibits a clear dominance in the market.

Based on the application areas, the Thailand medical cannabis market can be categorized into cancer, arthritis, migraine, epilepsy, and others. Currently, cancer accounts for the largest market share.

Based on the end use, the Thailand medical cannabis market has been divided into pharmaceuticals, research and development centres, and others. Among these, the pharmaceutical industry currently holds the majority of the total market share.

Based on the route of administration, the Thailand medical cannabis market can be divided into oral solutions and capsules, vaporizers, topicals, and others. Currently, oral solutions and capsules exhibit a clear dominance in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)