Thailand Aquafeed Market Size, Share, Trends and Forecast by End User, Ingredient, and Product Form, 2025-2033

Market Overview:

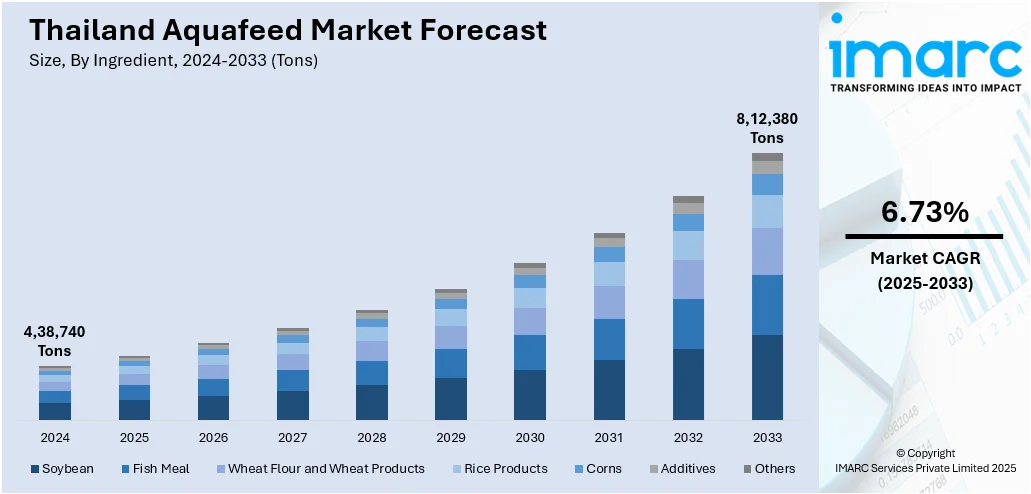

The Thailand aquafeed market size reached 4,38,740 Tons in 2024. Looking forward, IMARC Group expects the market to reach 8,12,380 Tons by 2033, exhibiting a growth rate (CAGR) of 6.73% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4,38,740 Tons |

|

Market Forecast in 2033

|

8,12,380 Tons |

| Market Growth Rate (2025-2033) | 6.73% |

Thailand has the most sophisticated commercial aquafeed manufacturing industry. It has one of the world's largest shrimp and fish production industries which play a significant role in the country’s economy. Rising exports of fishery products across various countries have increased the demand of aquafeed in the country. Moreover, all the required raw materials are easily available in the country that helps in the rapid development and production of fish feed such as corn, soybean, fish meal etc. Apart from this, rising awareness among consumers about the high-protein content of seafood has encouraged the farmers to use improved aquafeed. Additionally, new technologies are being introduced in the country to improve the feed quality in order to attain higher productivity. In addition, due to drug and chemical residue problems, farmers who culture freshwater shrimp have started using more commercial feed instead of on-farm mixed feed.

To get more information on this market, Request Sample

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Thailand aquafeed market report, along with forecasts at the period 2025-2033. Our report has categorized the market based on end user, ingredient and product form.

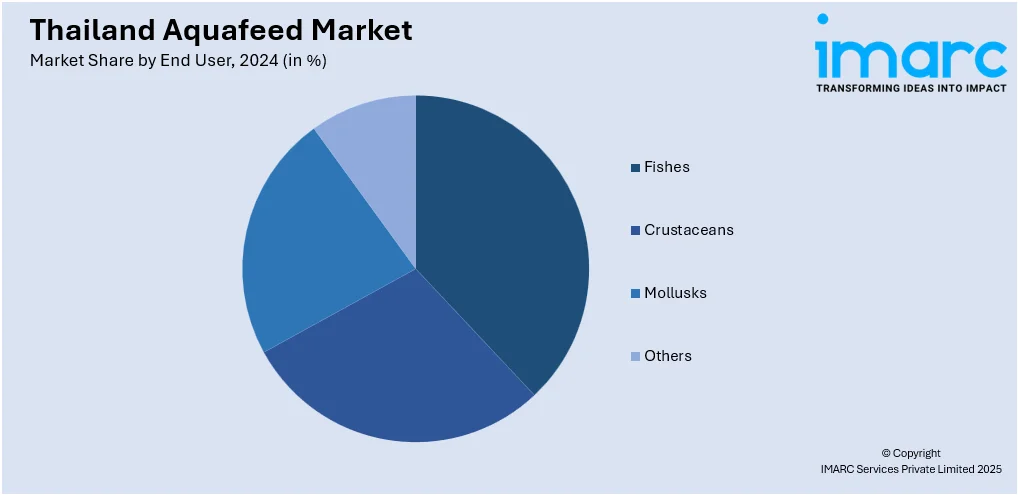

Breakup by End User:

- Fishes

- Tilapia

- Catfish

- Common Silver Barb

- Others

- Crustaceans

- Shrimp

- Others

- Mollusks

- Others

Fish currently accounts for the largest share in the market.

Breakup by Ingredient:

- Soybean

- Fish Meal

- Wheat Flour and Wheat Products

- Rice Products

- Corns

- Additives

- Vitamins and Minerals

- Amino Acids

- Feed enzymes

- Antioxidants

- Others

- Others

Amongst these, soybean accounts for the largest share.

Breakup by Product Form:

- Pellets

- Extruded

- Powdered

- Liquid

Pellets represent the biggest segment, accounting for the largest market share.

Competitive Landscape:

The report has also examined the competitive landscape of the market and provides the profiles of the key players operating in the industry:

- Charoen Pokphand Group

- Cargill Thailand

- Thai Luxe Enterprises (Thailand) Co., Ltd.

- Thai Union Feed mill Co., Ltd.

- Lee Feed Mill Public Company Limited

- Betagro Group

- Inteqc Feed Co., Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | 000' Tons |

| Segment Coverage | End User, Ingredient, Product Form |

| Companies Covered | Charoen Pokphand Group, Cargill Thailand, Thai Luxe Enterprises (Thailand) Co., Ltd. , Thai Union Feed mill Co., Ltd., Lee Feed Mill Public Company Limited, Betagro Group and Inteqc Feed Co., Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand aquafeed market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand aquafeed market based on the end user?

- What is the breakup of the Thailand aquafeed market based on the ingredient?

- What is the breakup of the Thailand aquafeed market based on the product form?

- What has been the impact of COVID-19 in the Thailand aquafeed market?

- What are the various stages in the value chain of the Thailand aquafeed market?

- What are the key driving factors and challenges in the Thailand aquafeed market?

- What is the structure of the Thailand aquafeed market and who are the key players?

- What is the degree of competition in the Thailand aquafeed market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)