TFT LCD Panel Market Size, Share, Trends and Forecast by Size, Technology, Application, and Region, 2026-2034

TFT LCD Panel Market Size and Share:

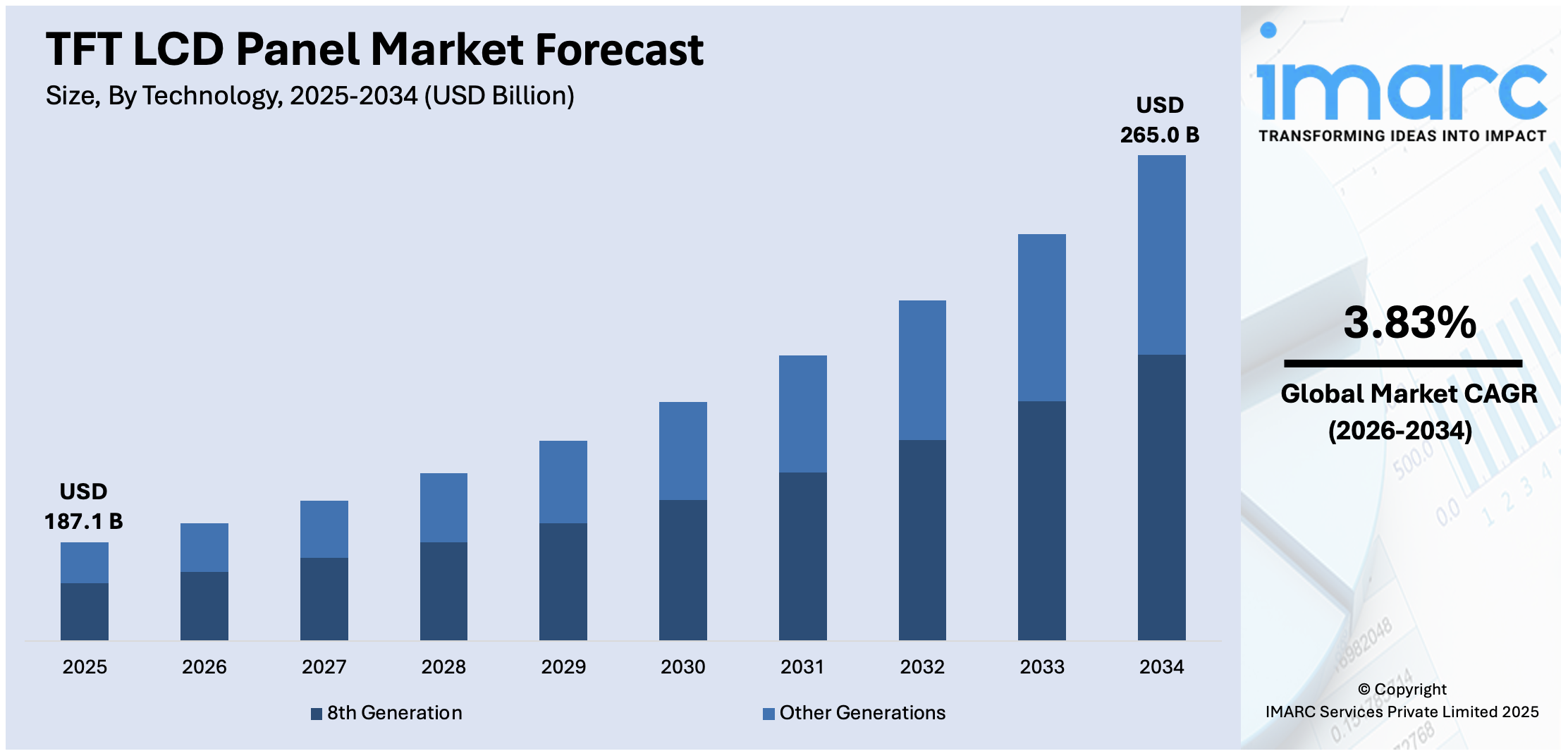

The global TFT LCD panel market size was valued at USD 187.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 265.0 Billion by 2034, exhibiting a CAGR of 3.83% during 2026-2034. North America currently dominates the market, holding a significant market share of over 33.4% in 2025. The rising demand for cost-effective, energy-efficient display solutions in consumer electronics, the growing adoption of digital instrument clusters in vehicles, increasing smartphone penetration, expanding usage in industrial and medical devices, and rapid advancements in panel technology are augmenting the TFT LCD panel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 187.1 Billion |

|

Market Forecast in 2034

|

USD 265.0 Billion |

| Market Growth Rate 2026-2034 |

3.83%

|

The market is primarily driven by the increasing penetration of ultra-high-definition content across digital signage, automotive displays, and public information systems, which is enhancing the demand for advanced TFT LCD panels. Additionally, rising investments in healthcare displays for diagnostic imaging and surgical visualization are also contributing to market expansion. Moreover, continual technological developments in high-brightness and anti-reflective panel designs are enabling better performance in outdoor and industrial settings. Besides this, the increasing production capacity of TFT-LCD panel manufacturing units is enabling suppliers to meet rising global demand across consumer electronics, automotive displays, and industrial applications, supporting market expansion. For example, on September 16, 2024, Laibao announced their aim to construct a new Gen 8.6 TFT LCD fab that will manufacture MEDs, or plasma displays, and a-Si TFT LCD panels.

To get more information on this market Request Sample

The market in the United States is witnessing significant growth, driven by the widespread deployment of advanced driver-assistance systems (ADAS) in vehicles, which is driving the use of high-resolution TFT LCD panels in the automotive sector. In addition to this, the growing adoption of home automation solutions is increasing the demand for integrated control panels featuring responsive LCD interfaces. According to an industry report, 55% of American workers are hybrid, and 26% are fully remote workers as of November 2024. The shift toward remote work is reinforcing sales of monitors and laptops with enhanced display performance, which is positively impacting the TFT LCD panel market outlook. Apart from this, rising consumer preference for customizable and touch-enabled panels in premium home appliances is influencing OEM strategies. Also, hospital infrastructure modernization is expanding procurement of medical-grade LCD monitors, especially in radiology and surgical environments requiring accurate image reproduction.

TFT LCD Panel Market Trends:

Emergence of AI Laptops Accelerating TFT LCD Panel Advancements

The growing adoption of AI-enabled laptops by leading OEMs is generating enhanced TFT LCD panels market demand. Industry data indicates that AI PCs are projected to account for 43% of all PC shipments by 2025, totaling approximately 114 Million units, which denotes a 165.5% rise from 2024. Within this category, AI laptops are expected to comprise 51% of total laptop shipments. By 2026, AI laptops are anticipated to become the preferred choice for large enterprises, increasing from under 5% in 2023, due to their ability to support more intelligent, efficient workflows and heightened productivity. In addition to this, AI laptops integrate on-device AI processing capabilities that support tasks such as image generation, speech recognition, and real-time language translation. These workloads require advanced displays with higher refresh rates, improved color accuracy, and enhanced resolution. Therefore, advanced TFT LCDs are widely used due to their cost efficiency and well-established production infrastructure, which is providing a boost to market growth. Panel manufacturers are actively enhancing TFT LCD specifications with features such as low blue light emission, adaptive refresh technology, and energy-efficient backlighting to align with AI laptop demands. This trend is driving increased adoption of premium TFT LCD panels with slim bezels, elevated screen-to-body ratios, and optimized compatibility for AI-driven touch and stylus inputs across key markets in North America, Europe, and Asia.

Growing Number of Mobile Phone Users Boosting TFT LCD Shipments

The global rise in mobile phone users, especially in emerging markets, is leading to increased demand for affordable smartphones equipped with TFT LCD screens. In 2024, industry reports estimate that approximately 4.88 billion people use smartphones globally, which amounts to 60.42% of the world's population. TFT LCD remains dominant in entry-level and mid-range segments due to its lower cost and established manufacturing infrastructure, which is supporting TFT LCD panel market growth. Countries in Asia-Pacific, Africa, and Latin America are witnessing rapid smartphone penetration, driven by rising disposable incomes and expanding digital access. Local brands in India, Southeast Asia, and Africa prefer TFT LCDs for their balance between quality and price. Moreover, feature phones and rugged industrial smartphones, which require durable and power-efficient screens, also rely on TFT LCDs. Panel suppliers are continuing to enhance TFT LCD characteristics like outdoor visibility and touch responsiveness to stay competitive. Besides this, government subsidies, 5G rollouts, and mobile-first user behavior are further sustaining this upward trend in TFT LCD deployment.

Expansion of Automotive Displays Integrating TFT LCD Technology

Automotive manufacturers are increasingly incorporating TFT LCD panels into digital instrument clusters, infotainment systems, and rear-seat entertainment units, which is an emerging TFT LCD market trend. This trend is gaining momentum alongside the transition to electric and connected vehicles, where digital interfaces are central to delivering navigation, vehicle diagnostics, and multimedia services. TFT LCD panels present a cost-effective solution, offering high readability, durability, and consistent performance across a wide range of temperatures and lighting conditions. They remain the preferred choice in mid-range and entry-level vehicle segments due to their affordability and proven long-term reliability compared to OLED alternatives. In addition to this, strategic collaborations are also shaping the market dynamics. For instance, on December 9, 2024, Kinetic Green Energy and Power Solutions Limited partnered with JioThings to integrate a Smart TFT-based digital display platform into electric two-wheelers. This platform features real-time navigation, call notifications, and nearby charging station updates, significantly enhancing user experience. Moreover, in order to meet evolving OEM requirements, suppliers are advancing automotive-grade TFT LCDs with improved viewing angles, enhanced contrast ratios, and higher resolutions.

TFT LCD Panel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global TFT LCD panel market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on size, technology, and application.

Analysis by Size:

- Large Size TFT-LCD Display Panel

- Medium and Small Size TFT-LCD Display Panel

Medium and small size TFT LCD display panel leads the market with around 73.7% of market share in 2025 driven by their widespread use in consumer electronics, automotive displays, industrial equipment, and medical devices. These panels, typically ranging from under 1 inch to around 10 inches, are essential in devices such as smartphones, tablets, smartwatches, digital cameras, portable gaming consoles, and vehicle infotainment systems. Their compact form factor, low power consumption, and improved visual performance make them ideal for applications requiring mobility, touch interface, and high-resolution output. The growing demand for smart wearables, internet of things (IoT) devices, and electric vehicles (EV) is accelerating the adoption of small and medium-sized displays. Additionally, continual technological advancements in panels, such as improved brightness, refresh rate, and flexibility, are enhancing their integration into emerging devices. This ongoing innovation and volume production facilitates sustained demand across global markets.

Analysis by Technology:

- 8th Generation

- Other Generations

8th generation leads the market in 2025. The Gen 8 technology is significant particularly for big-size displays such as those employed in TVs and monitors. Gen 8 production lines employ glass substrates of approximately 2200 x 2500 mm that enable good cutting of larger panels with high yield and lower manufacturing cost per unit. Gen 8 is optimized to manufacture 32-inch to 65-inch panels that fit the increasing consumer need for larger screens for home and commercial use. The productivity of Gen 8 fabs enables mass production without sacrificing panel quality, enabling economies of scale for display manufacturers. Gen 8 lines also provide better accuracy and consistency, enabling technologies such as 4K and 8K resolutions. With display manufacturers seeking profitability in a competitive market, the general use of 8th-generation technology improves their capacity to achieve volume demands while ensuring cost-effectiveness and high-performance output.

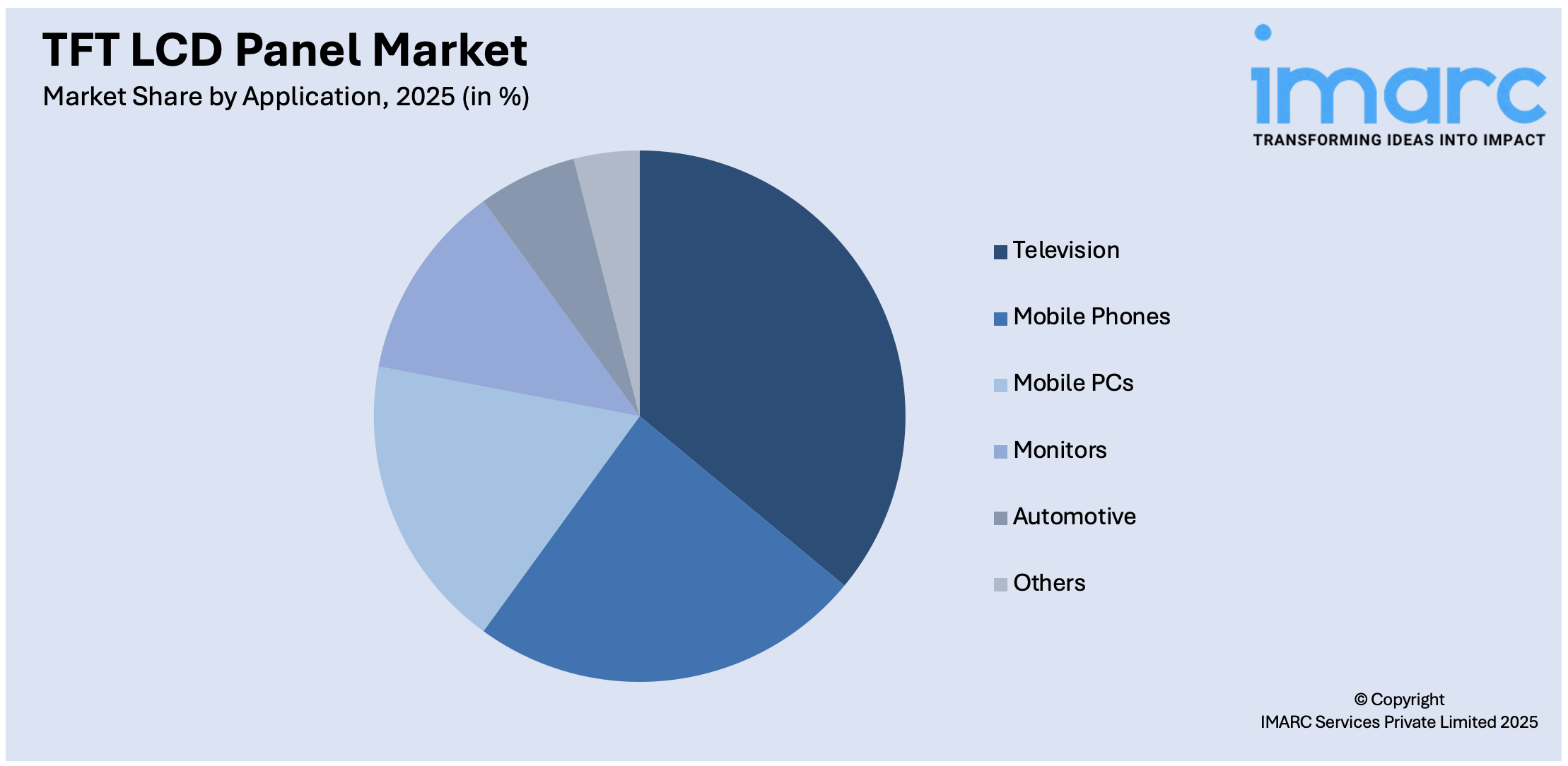

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Television

- Mobile Phones

- Mobile PCs

- Monitors

- Automotive

- Others

Television leads the market with around 35.9% of market share in 2025. The television segment holds the largest share both in terms of shipment volume and revenue. As consumers increasingly favor larger screens, higher resolutions, and smart functionality, TV makers are adopting TFT-LCD panels. These panels are cost-effective, offer high brightness, and provide wide viewing angles, making them a preferred choice for television applications. The growing availability of Full HD, 4K, and more recently, 8K televisions is driving demand for high-performance panels, particularly in sizes ranging from 32 to 75 inches. TFT-LCD panels effectively balance cost and performance, positioning them as an ideal solution for both mass-market and premium television models. In addition, the replacement cycle of old TVs and the popularity of streaming media still underpin steady demand. Consequently, the TV segment continues to be a major driver of innovation, size, and profitability in the TFT-LCD panel market.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of over 33.4% driven by robust demand in consumer electronics, automotive, and commercial display markets. The region has large technology and media firms that depend on high-quality display solutions for televisions, monitors, laptops, tablets, and digital signage. Consumer demand for bigger screens, increased resolutions, and improved user experience is driving consistent adoption of TFT-LCD panels, especially in 4K and 8K TV markets. Besides, industries such as healthcare, education, and retail are increasingly using LCD-based display systems for diagnostic purposes, distance learning, and billboards, respectively. The American automotive industry is also using TFT-LCD panels in infotainment systems, digital instrument clusters, and rear-seat entertainment. The region’s emphasis on premium devices and advanced display applications sustains its position in the evolving TFT-LCD market trends.

Key Regional Takeaways:

United States TFT LCD Panel Market Analysis

The United States holds a substantial share of the North America TFT LCD panel market with 89.90% in 2024. The TFT LCD panel market in the United States is experiencing strong growth, driven by demand in consumer electronics, automotive displays, and industrial applications. Similarly, the widespread adoption of high-resolution displays in smartphones, laptops, and gaming monitors is fueling expansion, while the automotive sector is integrating infotainment systems and digital instrument clusters that benefit from TFT LCD technology’s brightness and energy efficiency. The healthcare industry also plays a crucial role, with medical imaging and patient monitoring systems requiring high-quality displays. While OLED and Mini-LED alternatives are gaining traction, cost-effectiveness, and durability ensure the continued relevance of TFT LCDs. Furthermore, major manufacturers are expanding local production and strategic partnerships, to counter supply chain disruptions from geopolitical tensions, thereby positively influencing the market. Additionally, 5G connectivity and rising smart home device adoption are sustaining market growth. An industry report highlights that two-thirds of U.S. homeowners consider smart home devices essential, with 50% of households owning at least one. Around 23% of broadband consumers have three or more devices, and 77% report improved quality of life, operating at least two devices twice daily, often through smartphone apps (45%).

Europe TFT LCD Panel Market Analysis

The European market is changing with continual advancements in automotive displays, industrial automation, and consumer electronics. In line with this, leading countries such as Germany, France, and the UK are utilizing TFT LCD technology in high-end automotive applications, including heads-up displays (HUDs) and digital dashboards. The smart manufacturing sector is increasingly integrating TFT LCD control panels for real-time monitoring, further driving product adoption. Similarly, the gaming and entertainment industry is also expanding, with demand rising for high-refresh-rate gaming monitors, which is impelling the market. As per an industry report, in 2021, the EU gaming industry was valued at EUR 18.3 Billion, with a 10-12% CAGR projection that could push the market past EUR 400 Billion by 2030, requiring it to double to EUR 40 Billion. Growth plans include supporting 450 start-ups, founding 150 new companies, and increasing SME tech adoption by 1.25% by 2027, with a funding target of EUR 16 Million from private investors. Meanwhile, environmental regulations are encouraging manufacturers to develop energy-efficient, recyclable TFT LCD solutions. Despite OLED and emerging display technologies, cost-effectiveness, durability, and large-scale production capabilities keep TFT LCD panels competitive in Europe's shifting display market.

Asia Pacific TFT LCD Panel Market Analysis

Asia Pacific leads the global TFT LCD panel market, with China, Japan, South Korea, and Taiwan serving as major production hubs. China dominates volume production, supported by government investments and large-scale manufacturing, while South Korean and Japanese manufacturers focus on premium-quality panels for high-end applications. Additionally, rising demand for smartphones, smart TVs, and tablets, especially in India and Southeast Asia, is propelling the market expansion. According to the Ministry of Commerce, India’s smartphone exports grew by 42% in 2023-24, reaching USD 15.6 Billion, up from USD 11.1 Billion in 2022-23, which makes it as the fourth-largest export item from the country. The automotive sector also fuels growth, as automakers adopt advanced digital displays. Mini-LED backlighting and higher refresh rates enhance performance, keeping TFT LCDs competitive despite OLED and Micro-LED advancements. Besides this, 5G, IoT, and AI-driven devices are further boosting demand, solidifying Asia Pacific’s dominance in the industry.

Latin America TFT LCD Panel Market Analysis

The market in Latin America is steadily expanding, propelled by consumer electronics, smart TVs, mobile devices, and digital signage. Brazil and Mexico lead the region, supported by urbanization and rising disposable income. According to the Central Bank of Brazil, Brazil’s household disposable income hit a record BRL 751.19 Billion in December 2024, up from BRL 713.82 Billion in November 2024, with a long-term average of BRL 309.18 Billion since March 2003. Similarly, the automotive industry is also integrating digital displays into vehicles, which is stimulating the market appeal. However, import dependence on Asian manufacturers poses challenges due to supply chain disruptions and currency volatility. Despite growing OLED adoption, affordability keeps TFT LCD panels dominant. Moreover, e-commerce expansion and better internet infrastructure are further fueling demand for high-quality displays in gaming, education, and home entertainment.

Middle East and Africa TFT LCD Panel Market Analysis

The TFT LCD panel market in the Middle East and Africa is gradually expanding, driven by smart city investments, digital transformation, and entertainment technologies. Saudi Arabia leads the region, unveiling around 29 new entertainment investment opportunities through Invest Saudi, including amusement parks and e-gaming centers. With USD 64 Billion allocated to entertainment by 2035, the Kingdom aims to augment GDP by 4.2%. Qiddiya City, set to attract 48 Million annual visitors, awarded USD 2.6 Billion in contracts. Similarly, the rapid integration of TFT LCDs into digital billboards, interactive retail displays, and automotive applications, is impelling the market. While South Africa and Egypt see rising gaming and mobile device adoption, challenges such as high import costs and infrastructure gaps slow progress in some African regions. With continued economic diversification and digital transformation, MEA holds significant untapped potential for market growth.

Competitive Landscape:

The TFT LCD panel market is extremely competitive, with continual technological development, mass production capabilities, and ongoing price competition. Industry players are spending on research and development (R&D) activities to increase panel resolution, luminosity, and power efficiency while decreasing the cost of production. The market is also shifting toward bigger screen sizes and increased refresh rates across applications such as televisions, smartphones, and automotive displays. Strategic partnerships with downstream device makers and expansion of manufacturing bases in low-cost locations are typical. Panel makers are responding to volatile demand cycles and overcoming supply chain paralysis through inventory optimization and the use of automation in manufacturing. The competition also gets intense with the increased role of regional participants with low-cost alternatives, driving the established ones to innovate and differentiate based on value-added capabilities. Furthermore, environmental laws and the shift towards sustainable methods of production are also impacting the market's competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the TFT LCD panel market with detailed profiles of all major companies, including:

- Crystal Display Systems Limited

- HannStar Display Corporation

- InfoVision Optoelectronics

- Innolux Corporation

- Kingtech Group Co., Ltd.

- LG Display Co., Ltd

- Raystar Optronics

- Sharp Corporation

- Tricomtek Co., Ltd

- WINSTAR Display Co., Ltd

Latest News and Developments:

- December 2024: Japan Display Inc. (JDI), Innolux, and CarUX launched the eLEAP Strategic Alliance for advanced OLED technology. Innolux, a major TFT LCD manufacturer, and CarUX, an automotive display supplier, will co-develop 32-inch eLEAP automotive displays with 76% lower power consumption and 12% higher resolution than JDI’s existing TFT LCDs.

- November 2024: Ruixiang introduced a 21.5-inch TFT LCD panel (model RXCX0215008) featuring G+G construction, measuring 523.54mm x 315.01mm x 4.3mm, with a viewing area of 476.24mm x 267.71mm. The company offers customization options, including connectors and FPCs, and provides a 12-month warranty.

- October 2024: KTM unveils new V80 (8-inch) and H88 (8.8-inch) TFT dashboards with inductive touch, improved switchgear, and offline navigation. The CCU3.0 connectivity unit enables IoT, eSim, GPS, Bluetooth, Wi-Fi, and Android Automotive OS, supporting future over-the-air updates for a smarter, more immersive riding experience.

- September 2024: SCHOTT unveils Luminoir TFT, an advanced glass-ceramic cooktop enabling high-resolution, multicolor TFT displays while maintaining a deep black appearance. Developed in Germany, it enhances light transmission for interactive, elegant kitchen designs.

- July 2024: RJY Display introduced new Human-Machine Interface (HMI) products, including a 2.8-inch Serial Port TFT LCD Screen with 240×320 resolution and SPI interface, a 5.5-inch Serial Port TFT LCD Screen featuring 720×1280 resolution and RS232 interface, and an HMI motherboard paired with a 7-inch 1024×600 capacitive touch display.

TFT LCD Panel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units, Billion USD |

| Scope of the Region |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Large Size TFT-LCD Display Panel, Medium and Small Size TFT-LCD Display Panel |

| Technologies Covered | 8th Generation, Other Generations |

| Applications Covered | Television, Mobile Phones, Mobile PCs, Monitors, Automotive, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Companies Covered | Crystal Display Systems Limited, HannStar Display Corporation, InfoVision Optoelectronics, Innolux Corporation, Kingtech Group Co., Ltd., LG Display Co., Ltd, Raystar Optronics, Sharp Corporation, Tricomtek Co., Ltd, WINSTAR Display Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the TFT LCD panel market from 2020-2034.

- The TFT LCD panel market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the TFT LCD panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The TFT LCD panel market was valued at USD 187.1 Billion in 2025.

The TFT LCD panel market is projected to exhibit a CAGR of 3.83% during 2026-2034, reaching a value of USD 265.0 Billion by 2034.

The market is driven by the rising demand for consumer electronics like smartphones, televisions, and monitors, along with increased adoption in automotive and industrial displays. Technological advancements in display resolution, energy efficiency, and size, combined with declining panel prices and expanding digital signage applications, are also fueling the market growth.

North America currently dominates the TFT LCD panel market, accounting for a share of 33.4% in 2025. The dominance is fueled by high consumer spending on electronics, strong presence of display technology manufacturers, widespread use of advanced infotainment systems in vehicles, and rapid adoption of digital signage across retail and corporate sectors.

Some of the major players in the TFT LCD panel market include Crystal Display Systems Limited, HannStar Display Corporation, InfoVision Optoelectronics, Innolux Corporation, Kingtech Group Co., Ltd., LG Display Co., Ltd, Raystar Optronics, Sharp Corporation, Tricomtek Co., Ltd and WINSTAR Display Co., Ltd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)