Textured Soy Protein Market Size, Share, Trends and Forecast Nature, Source, Application, and Region, 2025-2033

Textured Soy Protein Market Size and Share:

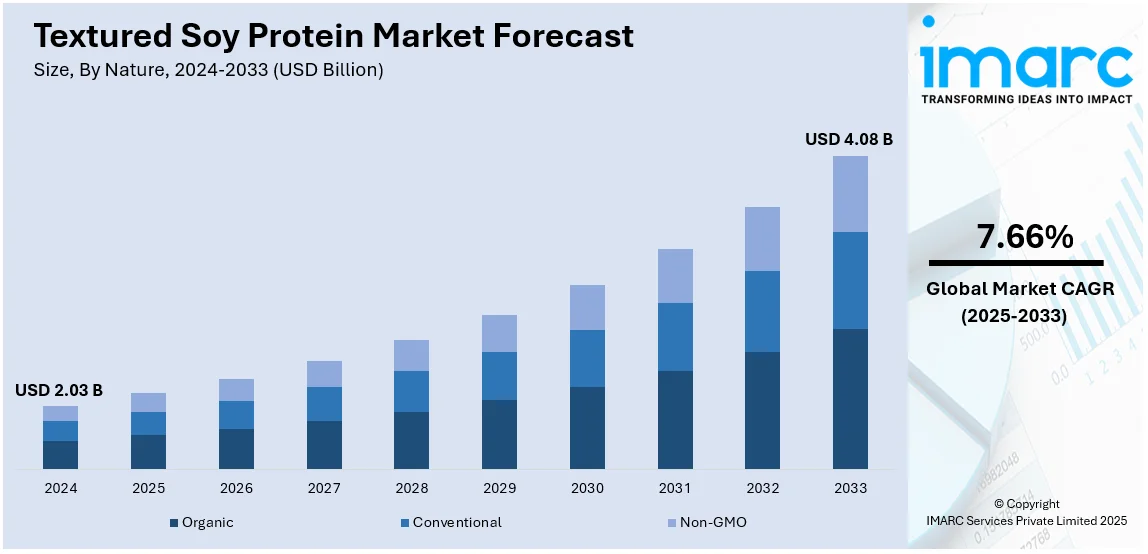

The global textured soy protein market size was valued at USD 2.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.08 Billion by 2033, exhibiting a CAGR of 7.66% from 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. The textured soy protein market share is expanding, driven by the growing consumption of plant-based food products among the masses, increasing occurrence of chronic diseases, and rising popularity of vegan diets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.03 Billion |

|

Market Forecast in 2033

|

USD 4.08 Billion |

| Market Growth Rate (2025-2033) | 7.66% |

Heightened need for plant-based protein alternatives, widening applications in food processing, and heightened consumer awareness regarding health and sustainability have significantly contributed to the market growth. Health awareness, ethical aspects over animal welfare, and environmental sustainability are the factors leading to the shift towards a plant-based diet across the globe. These consumers are looking for protein-based alternatives that have nutritional properties mostly similar to what a piece of meat provides with a match to diet expectations. The above consequence has resulted in food companies wanting to create plant-based products that form burgers, sausages, and nuggets based on textured soy proteins since it shares similar textures with animal-based commodities.

The United States has emerged as a major region in the market owing to several factors. The country's flexitarian consumer segment comprises those who have reduced their intake of meat for plant-based consumables, and the growth of such a consumer has been a critical driver contributing to the textured soy protein market growth. Textured soy protein, for its meat-like consistency and high levels of protein, has proved very valuable as a superb ingredient to businesses that make hybrid and plant-based, wholly meat substitutes. This aligns with the wider trend of more sustainable food selections, favored among younger demographics, such as the Millennials and Gen Z. In America, increasingly alarming rates of obesity, diabetes, and heart disease have attracted interest in more healthy food choices. According to the government statistics from 2024, more than 40 percent of adults in the US are obese, with obesity rates being nearly identical for both men and women. According to the report by the U.S. Centers for Disease Control and Prevention, the occurrence of obesity was also influenced by age and typically lessened with higher education levels.

Textured Soy Protein Market Trends:

Growing Consumption of Plant-Based Diets

Increasing health awareness, environmental issues, and ethical reasons are factors that have made plant-based highly popular among people. Health-conscious consumers and concerned citizens are turning toward vegetarian, vegan, and even flexitarian eating patterns. Such a diet has emerged to reduce various risks associated with heart disease, obesity, and diabetes and risk of certain types of cancers in people, particularly because it lowers saturated fats and cholesterol and is rich in fiber and antioxidants, while being a prime source of a variety of required nutrients. For health-conscious individuals seeking sustainable options for protein sourcing, vegan diets and vegetarianism are rising, propelling the increased usage of the textured soy protein. In July 2024, Nestlé introduced Maggi Rindecarne, a plant-based meat substitute used to complement meals in Chile. This mainly contributes to the market share of textured soy protein.

Rising Focus on Product Innovation

The growing focus on product innovation in the food and beverage sector is driven by changing consumer tastes, technological advancement, and an increased demand for healthier, sustainable, and convenient food choices. Businesses are investing in innovative formulations, substitute ingredients, and advanced processing techniques to enhance the flavor, consistency, and nutritional quality of their products, thereby driving the textured soy protein market demand. In the space of plant-based foods, breakthroughs have led to the development of meat and dairy alternatives via soy, pea protein, oat milk, and precision fermentation technologies. The textured soy protein market is growing rapidly as companies design unique textures and flavors for soy protein products to make them more sensory appealing, to meet diverse culinary preferences, and to increase market reach. For instance, in the last decade, an incredible amount of USD 14.2 billion has been invested in alternative protein technology categories across the globe. In May 2024, Otsuka Pharmaceutical Company, Limited. Otsuka and Korea Otsuka Pharmaceutical Company, Ltd. (KOP), an affiliate of Otsuka, announced the internet-based launch of the whole-soy nutritional bar SOYJOY, developed from gluten-free dough prepared with whole soybeans.

Widespread Awareness of Health and Nutrition Awareness

The healthy nutrition recognition had a very extreme effect on the consumer dieting behavior, putting a lot of focus on healthier and more nutritious food products. Epidemic rates of obesity, diabetes, heart disease, and other lifestyle disorders have made the masses pay much attention to diet rich in necessary nutrients, dietary fiber, and protein and avoided processed foods, unhealthy fats, and added sugars. Organic, non-genetically modified organism (GMO), and clean-label food products would be needed by consumers more than ever in the future, thus forcing them to demand natural and minimally processed food products. Knowledge of health benefits on plant-based proteins would shift their focus towards demanding more textured soy protein in the various food items. For instance, in July 2024, The Coconut Collab launched Protein Yog, a dairy-free yogurt with 10 grams of protein per serving.

Textured Soy Protein Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global textured soy protein market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on nature, source, and application.

Analysis by Nature:

- Organic

- Conventional

- Non-GMO

Non-GMO the market with around 55.9% of market share in 2024. Non-GMO textured soy protein has been in high demand among consumers who seek natural and less processed food options, even if they are not necessarily seeking organic certification. Non-GMO textured soy protein is derived from soybeans that are not genetically altered, which addresses concerns regarding food safety, biotechnology, and environmental sustainability, thereby offering a favorable textured soy protein market outlook. Many food companies market non-GMO verification labels to appeal to health-conscious consumers who prefer clean-label, traceable, and ethically sourced ingredients. The segment has witnessed rising acceptance for plant-based meat alternatives, protein snacks, and baby nutrition products in markets where GMO transparency is high and has tight regulatory oversight. As awareness regarding concerns related to genetically modified foods keeps rising, this area is also expected to continue growing further. The other factor for the demand for non-GMO textured soy protein is the growing distrust of consumers for genetically modified foods and their long-time effects on health and biodiversity.

Analysis by Source:

- Soy Protein Concentrates

- Soy Protein Isolates

- Soy Flour

Soy protein concentrates are one of the most widely used textured soy protein sources, containing 70%–80% protein after soluble carbohydrates have been removed from defatted soybeans. Soy protein concentrates provide excellent protein, fiber, and functional properties, which make it the ingredient of choice for meat alternatives, processed meats, bakery, and nutritional supplements.

Soy protein isolates (SPI) are the purest form of soy protein, with a protein content of 90% or more, making them ideal for high-protein food applications. SPI is produced by removing most of the fats and carbohydrates from soybeans, leaving behind a highly concentrated protein source. The other type of soy protein is mostly used in protein supplements, sports nutrition, meal replacements, and infant formulas since it has an entire amino acid profile, which is required for muscle growth and recovery.

Soy flour is the minimally processed source of soy proteins. It represents ground defatted soybeans, with the appearance of a fine powder, amounting to nearly 50% protein and an excellent nutrient source. It serves as a functional ingredient in baking, snack foods, and processed meats. Its enhanced dough stability, moisture retention, and enrichment in protein make it a functional ingredient in these applications. It's also used for textured soy production, as extruded soy products are based on soy flour, which is compared to soy protein concentrates and isolates. This type of product retains more components of the original soybean plant, such as carbohydrates and fiber, making soy flour a product of choice in whole-food applications.

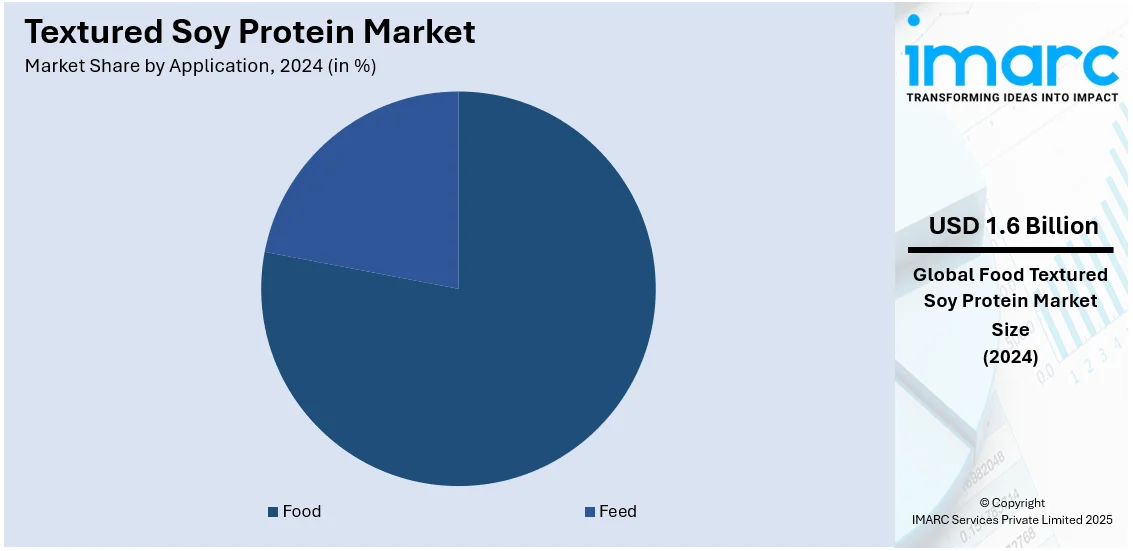

Analysis by Application:

- Food

- Feed

Food leads the market with around 78.3% of market share in 2024. The largest application area for textured soy protein is food, mainly because of the heightened demand for plant-based protein alternatives, meat substitutes, and high-protein food products on the consumer side. Textured soy protein is widely applied in meat analogs, processed foods, baked goods, snacks, and dairy alternatives due to its meat-like texture, high protein content, and excellent water absorption properties. Increasing demand for soy-based meat substitutions, such as burgers and sausages, nuggets, and ground meat alternatives, due to the increasing popularity of vegetarian, vegan, and flexitarian diets drives market growth. Functional food and sports nutrition markets also embrace textured soy protein bars, meal replacements, and fortified beverages to cater to health-conscious consumers. With growing awareness of sustainability, clean-label ingredients, and plant-based nutrition, the use of textured soy protein in the food industry is expected to expand further.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. One of the key factors driving the North American market is a growing demand for plant-based protein alternatives, which occur due to the increasing adoption of vegetarian, vegan, and flexitarian diets. This shift has been largely driven by a growing awareness about health benefits, environmental concerns, and ethical considerations with regards to animal agriculture. The plant-based movement is strong in the United States and Canada, where millennials and Generation Z consumers are driving the need for meat alternatives and protein-enriched plant-based food items. Textured soy protein is widely used in plant-based meat alternatives, such as burgers, sausages, meatballs, and nuggets, due to its meat-like texture, high protein content, and affordability. Major food companies have added soy protein-based formulations to their product portfolios to mimic the taste and texture of traditional meat products. Because the plant-based market continues to expand, food manufacturers are investing in the latest product innovations, thereby further fueling the demand for textured soy protein. Additionally, according to the IMARC Group, the US plant-based meat market is anticipated to attain USD 18.9 billion by 2033.

Key Regional Takeaways:

United States Textured Soy Protein Market Analysis

The United States leads the market, holding a share of 84.80% in North America. In the US, the growing inclination for healthier eating habits has greatly fueled the heightened interest in plant-based protein options, especially textured soy protein. A survey reveals that social media motivates 60% of Americans to adopt healthier eating habits, leading to an increase in the demand for vegan yogurt as a wholesome, plant-based option. Shoppers are increasingly aware of their health, with numerous individuals choosing plant-based alternatives to lower their consumption of saturated fats, cholesterol, and other detrimental compounds present in animal-derived products. This change in diet is driven by worries about heart health, weight control, and ecological sustainability. Textured soy protein, as a premium and adaptable protein source, fits perfectly with the increasing need for meat alternatives that provide nutritional advantages while maintaining excellent taste and texture. This trend is additionally reinforced by the growing accessibility of plant-based products in retail outlets and eateries, facilitating consumers' incorporation of textured soy protein into their meals.

Europe Textured Soy Protein Market Analysis

In Europe, the expanding food and drink industry has hastened the use of textured soy protein, fueled by changing consumer tastes for plant-based products. Reports indicate that the EU stands as the biggest exporter of food and beverages globally, with exports beyond the EU totaling around USD 196.56 Billion. The need for meat substitutes is at its peak as consumers are more frequently pursuing healthier and more sustainable dietary choices. Textured soy protein offers a compelling option for vegans and flexitarians alike, as it effectively resembles the taste and texture of meat. Producers in the area are taking advantage of this demand by creating a range of new and inventive products that include textured soy protein. With the ongoing evolution of the food and beverage sector towards healthier, environmentally friendly options, the need for plant-based proteins such as textured soy protein is anticipated to increase significantly, becoming essential in both mainstream and niche food markets.

Asia Pacific Textured Soy Protein Market Analysis

Utilization of the textured soy protein is rising in the Asia-Pacific region due to its growing interest in vegetarian and vegan lifestyles. According to the report, India tops the list with 38% of its total population defining themselves as vegetarians. As more people turn to a plant-based diet for moral, environmental, and health reasons, the demand for alternative protein sources has grown sharply. Textured soy protein, with its meat-like texture and high protein content, is an excellent alternative to traditional animal-based proteins. Many people in the region also seek plant-based foods to overcome concerns about food security and sustainability, which is further increasing demand for textured soy protein. In addition, the area of new food products that contain textured soy protein is making this ingredient more appealing for manufacturers and consumers.

Latin America Textured Soy Protein Market Analysis

The adoption of textured soy protein in Latin America is on the rise due to the expansion of e-commerce platforms. According to reports, there is 2.8X increase in sales value and a 3.1X rise in transactions from 2019-2023, highlighting the growing e-commerce sector in Latin America. With the increasing reliance on online shopping, consumers are gaining easier access to plant-based products, including textured soy protein, from the comfort of their homes. E-commerce provides a wide range of options for individuals seeking healthier food choices, enabling them to make informed decisions about their dietary preferences. Additionally, online platforms often feature convenient delivery services and subscription models, making it easier for consumers to maintain a consistent supply of plant-based protein sources. This increased accessibility is likely to drive further adoption of textured soy protein as part of a broader shift towards plant-based eating in the region.

Middle East and Africa Textured Soy Protein Market Analysis

In the Middle East and Africa, the growing tourism industry has contributed to the rise in popularity of textured soy protein. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. As more tourists visit the region, there is an increased demand for diverse culinary experiences, including plant-based options. Hotels, restaurants, and resorts catering to international travellers are expanding their menus to include more plant-based offerings, including dishes made with textured soy protein. This shift is driven by the desire to accommodate a growing number of tourists who are looking for healthier, sustainable food options. With the increased visibility of plant-based alternatives in the hospitality industry, textured soy protein is gaining recognition as an essential ingredient for catering to the evolving tastes of tourists.

Competitive Landscape:

Key market players are heavily investing in research operations to create improved textured soy protein formulations that enhance the taste, texture, and functionality of plant-based products. As consumer preferences shift towards realistic meat substitutes, companies are working on extrusion technologies to produce next-generation soy protein products with better texture and mouthfeel. To meet rising demand and expand their market presence, companies are scaling up production and building new manufacturing facilities. Increasing production capacity allows for greater supply chain efficiency, cost reduction, and the ability to serve new markets. Leading market players are developing strategic partnerships with food manufacturers, restaurant chains, and plant-based brands to enhance product development and market penetration. For instance, in 2024, Azelis announced the establishment of a new distribution agreement with Soy Austria, which is a major producer of eco-friendly, sustainable, soy-based products for the food industry.

The report provides a comprehensive analysis of the competitive landscape in the textured soy protein market with detailed profiles of all major companies, including:

- Archer-Daniels-Midland Company

- Bob's Red Mill Natural Foods

- Bunge Limited

- Cargill Incorporated

- CHS Inc.

- Crown Soya Protein Group Company

- International Flavors & Fragrances Inc.

- Fuji Oil Holdings Inc.

- Shandong Yuxin Biotechnology Co. Ltd.

- Sonic Biochem Extraction Pvt Ltd

- Wilmar International Limited

Latest News and Developments:

- November 2024: ICL Food Specialties and DAIZ Engineering have unveiled ROVITARIS® SprouTx™ Textured Soy Protein at Food Ingredients Europe 2024. This revolutionary protein, using patented germination technology, aims to transform plant-based meat and seafood with improved taste, texture, and nutrition. Designed to overcome sensory challenges, it eliminates the typical "beany" taste, enhancing consumer appeal. The innovation promises to redefine plant-based food formulations worldwide.

- October 2024: Nasoya is expanding its range of plant-based meats with Plantspired Plant-Based Chick’n, which includes pre-cut, pre-seasoned pieces made from textured soy protein. Building on its 2022 steak substitute, the latest product provides 22 grams of protein and 3.5 grams of fat for each serving. It is offered in two flavors inspired by Asian cuisine: Kung Pao and Bee-Free Honey Garlic. This launch signifies another advancement in Nasoya's expanding plant-based products. This launch marks another step in Nasoya’s growing plant-based offerings.

- February 2024: Amfora unveiled the first generation ultra-high plant protein products. The initial products include Amfora Ultra-High Protein Soy flour, Texturized Vegetable Protein and Crisps.

Textured Soy Protein Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Nature Covered | Organic, Conventional, Non-GMO |

| Sources Covered | Soy Protein Concentrates, Soy Protein Isolates, Soy Flour |

| Applications Covered | Food, Feed |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, Bob's Red Mill Natural Foods, Bunge Limited, Cargill Incorporated, CHS Inc., Crown Soya Protein Group Company, International Flavors & Fragrances Inc., Fuji Oil Holdings Inc., Shandong Yuxin Biotechnology Co. Ltd., Sonic Biochem Extraction Pvt Ltd, Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the textured soy protein market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global textured soy protein market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the textured soy protein industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textured soy protein market was valued at USD 2.03 Billion in 2024.

The textured soy protein market is projected to exhibit a CAGR of 7.66% from 2025-2033, reaching a value of USD 4.08 Billion by 2033.

The market is driven by the growing consumption of plant-based food products, increasing awareness of health and nutrition, and the rising prevalence of chronic diseases such as obesity, diabetes, and heart disease. Additionally, the demand for sustainable and clean-label protein sources and the expansion of plant-based food innovations are fueling market growth.

North America currently dominates the textured soy protein market, accounting for a share of 35.8%, driven by the heightened demand for plant-based protein alternatives, which occur due to the increasing adoption of vegetarian, vegan, and flexitarian diets.

Some of the major players in the textured soy protein market include Archer-Daniels-Midland Company, Bob's Red Mill Natural Foods, Bunge Limited, Cargill Incorporated, CHS Inc., Crown Soya Protein Group Company, International Flavors & Fragrances Inc., Fuji Oil Holdings Inc., Shandong Yuxin Biotechnology Co. Ltd., Sonic Biochem Extraction Pvt Ltd, Wilmar International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)