Test and Measurement Equipment Market Report by Product (General Purpose Test Equipment (GPTE), Mechanical Test Equipment (MTE)), Service Type (Calibration Services, Repair Services/After-Sales Services), End Use Industry (Automotive and Transportation, Aerospace and Defense, IT and Telecommunication, Education, Semiconductor and Electronics, and Others), and Region 2025-2033

Test and Measurement Equipment Market Size:

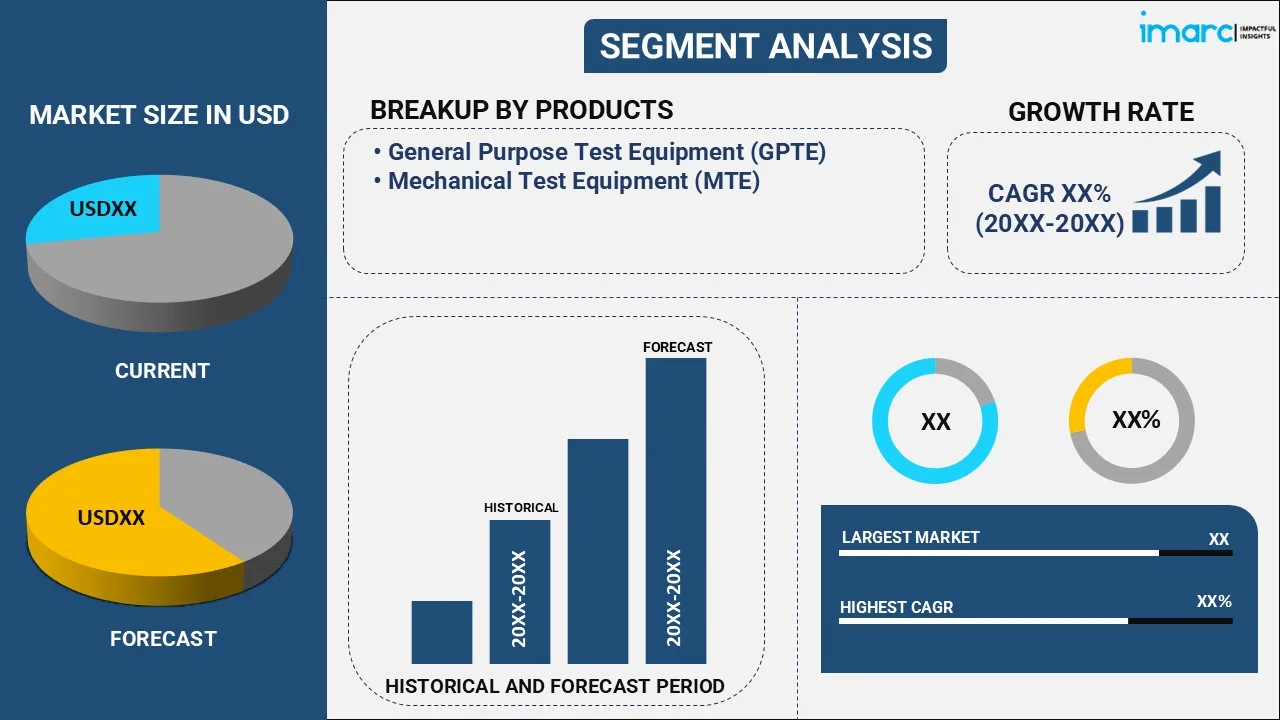

The global test and measurement equipment market size reached USD 26.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.86% during 2025-2033. Increasing demand across industries like telecommunications and automotive, rapid technological advancements, stringent regulatory requirements, trends towards miniaturization in electronics, Industry 4.0 initiatives, expanding applications in renewable energy and wireless communication, and the shift towards predictive maintenance in industrial operations are some of the factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.9 Billion |

| Market Forecast in 2033 | USD 38.5 Billion |

| Market Growth Rate 2025-2033 | 3.86% |

Test and Measurement Equipment Market Analysis:

- Major Market Drivers: The global test and measurement equipment market is increasingly driven by the fast-evolving electronics industry, resulting in a growing demand for precise, reliable testing equipment. The expanding adoption of Internet of Things (IoT) devices and connected solutions presents an opportunity for the handling of sophisticated tools, which is also driving the development of the test and measurement equipment market. The availability of smart devices and wearable technologies, as well as government policies and standards in various industries that require adequate testing and compliance, is also supporting a positive market scenario. On top of this, rising investments in research and development (R&D) activities in the semiconductor and aerospace sectors are enabling market growth.

- Key Market Trends: The test and measurement equipment market is witnessing emerging trends such as the integration of artificial intelligence (AI) & machine learning (ML) for improved data analytics and predictive maintenance. Industry needs are becoming more diverse as the trend is shifting towards flexible testing solutions. In line with this, the growing demand for real time data and monitoring in some industries, such as home automation, is providing a considerable thrust to the test and measurement equipment market demand. Additionally, a heightened emphasis on minimizing the size of test equipment for enhanced portability and ease of use is another catalyst for market growth. In addition to this, the need for cloud-based test and measurement solutions owing to their scalability and affordability, along with the increasing number of contracts between producers and end-users for customized testing solutions, are other significant trends in the test and measurement equipment market.

- Geographical Trends: The APAC region will continue to lead the worldwide test and measurement equipment market, fueled by a fast-growing industrial base, as well as considerable technological innovations witnessed particularly in countries like Japan, China, and South Korea. This is further supported by the high presence of semiconductor, electronics, and automotive industries within the region, further boosting the market share of test and measurement equipment. In addition, North America and Europe together have large market shares because of robust research and development (R&D) activities. They are also aided by the existence of large franchise owners and growing aerospace and defense sectors.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key test and measurement equipment companies, such as Advantest Corporation, Anritsu Corporation, EXFO Inc., Fortive, Keysight Technologies, Inc., National Instruments Corporation, Rohde & Schwarz GmbH & Co. KG, Teledyne Technologies Incorporated, Texas Instruments Incorporated, VIAVI Solutions Inc., Yokogawa Electric Corporation, etc.

- Challenges and Opportunities: The test and measurement equipment market is challenged by the high cost of sophisticated testing solutions, which becomes a hindrance for small and medium-sized enterprises (SMEs). The growing demand for rapid updates and changes, as well as rapid technological advancements, is making it difficult for manufacturers to match the pace of technology. In addition, the market is highly competitive and ubiquitous, with many players competing to achieve a competitive edge. However, the growing emphasis on quality and regulatory compliance in many industries holds significant growth potential. In addition, the advent of IoT, AI, and fifth generation (5G) technologies opens new avenues for innovation and market expansion.

Test and Measurement Equipment Market Trends:

Increasing Demand for Electronics and Semiconductor Devices

The test and measurement equipment market globally is mainly influenced by the demand for more electronics as well as semiconductor devices in many industries, including telecommunications, automotive, aerospace, and healthcare. The industries implement sophisticated electronics in their design, which necessitates stringent testing to validate components' conformity to high reliability and performance standards, further supporting the test and measurement equipment market scenario. The development in consumer electronics has increased the requirement for precision test equipment, and this is contributing to the market growth further. Besides thus, the increasing availability of IoT devices and the establishment of 5G networks increase the demand for advanced testing solutions that can provide complex functionalities as well as offer seamless connectivity.

Technological Advancements and Industry 4.0

Technological innovations, including IoT, AI, and 5G, are leading to significant transformations in industries, which has further increased the need for advanced test equipment. Since 5G networks are experiencing widespread adoption in the telecommunication sector, it has further increased the need for testing equipment that can analyze network quality and analyze time delay (latency) throughput results, which further ensures greater user experiences. Additionally, AI-based algorithms are aligning the arrival of intelligent manufacturing techniques with Industry 4.0, and automated testing platforms are at the forefront of enhancing the efficiency of production and quality assurance of goods, which is another market growth opportunity factor.

Stringent Regulatory Requirements and Standards

The strict regulatory standards and industry norms in industries like healthcare, automotive, and aerospace play a crucial role in fueling the use of advanced test and measurement equipment. In healthcare, for example, medical devices need to be thoroughly tested to meet safety and efficacy standards to ensure patient safety and regulatory compliance. Equally, the automobile sector needs test equipment to authenticate the performance and longevity of automotive parts, conforming to tight safety and environmental standards. Aerospace uses need precise testing equipment to guarantee reliability in critical systems and parts utilized in aircraft and spacecraft.

Test and Measurement Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product, service type, and end use industry.

Breakup by Product:

- General Purpose Test Equipment (GPTE)

- Oscilloscopes

- Signal Generators

- Multimeters

- Logic Analyzers

- Spectrum Analyzers

- Bert (Bit Error Rate Test)

- Network Analyzers

- Others

- Mechanical Test Equipment (MTE)

- Non-Destructive Test Equipment

- Machine Vision Inspection

- Machine Condition Monitoring

General purpose test equipment (GPTE) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes general purpose test equipment (GPTE) (oscilloscopes, signal generators, multimeters, logic analyzers, spectrum analyzers, bert (bit error rate test), network analyzers, others), mechanical test equipment (MTE) (non-destructive test equipment, machine vision inspection, machine condition monitoring). According to the report, general purpose test equipment (GPTE) represented the largest segment.

The GPTE (general-purpose test equipment) sector is experiencing growth due to the increasing need for versatile testing solutions across various industries. These tools are crucial for their ability to perform various testing functions and may address diverse applications, spanning from electronics to telecommunications. With the progression of technology through IoT, 5G, and AI, there is an increasing demand for testing equipment capable of handling intricate functionalities and high-performance standards. Furthermore, as sectors advance and innovate more while creating broader product lines, the need for adaptable testing solutions that can be modified to meet new specifications and requirements rises correspondingly. The emphasis on cost reduction and operational efficiency in testing is another significant factor, as businesses invest in tools that offer comprehensive testing functions without compromising accuracy or dependability. Aside from this, adherence to regulatory agencies is crucial, particularly in sectors like healthcare and the automotive industry, where following stringent regulations requiring highly reliable and precise testing instruments is essential. Additionally, the miniaturization of electronics drives the need for compact and portable testing solutions to accurately measure small components and devices.

Breakup by Service Type:

- Calibration Services

- Repair Services/After-Sales Services

Repair services/after-sales services accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service type. This includes calibration services and repair services/after-sales services. According to the report, repair services/after-sales services represented the largest segment.

The repair services/after-sales services segment is driven by product sophistication and complexity in various industries such as industrial equipment, automotive, and consumer electronics. Due to products more and more incorporating embedded technologies and components, there is higher demand for specialized repair services that diagnose and repair intricately complex issues efficiently. Customers increasingly require quick turnaround and efficient repair service, and businesses have to spend in high-quality after-sales service channels to guarantee customer satisfaction and loyalty. Moreover, regulatory and quality standards also compel the product to uphold certain performance and safety requirements even after sale, necessitating widespread after-sales support to remain compliant and mitigate risks. In addition, the expansion of leasing and subscription agreements in industries like health care and IT drives demand for efficient repair services to maximize asset utilization and minimize downtime.

Breakup by End Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- IT and Telecommunication

- Education

- Semiconductor and Electronics

- Others

Automotive and transportation accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive and transportation, aerospace and defense, IT and telecommunication, education, semiconductor and electronics, others. According to the report, automotive and transportation represented the largest segment.

The automotive and transport sector is fueled by the increasing demand for mobility solutions across the world. With the increasing rate of urbanization, the demand for efficient and sustainable transport solutions is increasing, which is why electric vehicles (EVs) and hybrid vehicles are being used across the globe. This shift towards cleaner energy sources is promoted by stringent regulations for reducing carbon emissions and environmental sustainability. Also, technology advances in autonomous vehicles and connected vehicles are revolutionizing the automotive industry, enhancing safety, efficiency, and user experience. Not only are these technologies transforming vehicle design and manufacturing processes but also stimulating investments in smart transportation networks and infrastructure. Also, the growth of mobility-as-a-service (MaaS) and ridesharing platforms is changing consumer behavior, requiring more flexible, on-demand transport solutions.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest test and measurement equipment market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The North American regional market is driven by the increasing demand for renewable energy sources, particularly solar and wind power. Authorities across the region are promoting renewable energy initiatives to reduce carbon emissions and achieve sustainability goals. This has led to significant investments in solar and wind energy projects, boosting the demand for related equipment such as solar panels, wind turbines, inverters, and energy storage systems. Moreover, improvements in renewable energy technology have increased efficiency and reduced expenses, making these sources more economically viable. In addition to environmental benefits, switching to renewable energy enhances energy security and reduces dependence on fossil fuels. Government initiatives, such as tax breaks and grants, motivate consumers and companies to adopt renewable energy sources, enhancing market growth in North America. Moreover, progress in healthcare technology is a significant factor influencing the North America regional market, especially in medical devices and healthcare IT services. The area features a strong healthcare system and significant healthcare spending, encouraging innovation and the embrace of advanced medical technologies.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the test and measurement equipment include Advantest Corporation, Anritsu Corporation, EXFO Inc., Fortive, Keysight Technologies, Inc., National Instruments Corporation, Rohde & Schwarz GmbH & Co. KG, Teledyne Technologies Incorporated, Texas Instruments Incorporated, VIAVI Solutions Inc., Yokogawa Electric Corporation, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Major participants in the market are actively involved in strategic efforts focused on improving their market standing and competitiveness. These initiatives generally involve substantial funding in research and development (R&D) to create innovative products and technologies, thus remaining ahead of market trends and addressing changing consumer needs. Businesses are prioritizing the expansion of their international presence via mergers, acquisitions, and partnerships, seeking to enhance their distribution systems and enter new markets. Moreover, there is a significant focus on sustainable practices, as players are progressively incorporating eco-friendly solutions into their operations to comply with environmental regulations and cater to consumer preferences. Additionally, enhancing operational effectiveness through process enhancement and digitalization remains a priority, enabling companies to streamline production, reduce costs, and enhance overall profitability. Customer-centric strategies, such as customized marketing strategies and improved customer service initiatives, are being embraced to establish brand loyalty and enhance customer satisfaction.

Test and Measurement Equipment Market News:

- January 2025: VBox Automotive launched a new testing solution for validating Intelligent Speed Assist (ISA) and Speed Limit Information Function (SLIF) systems. The system uses the VBox Touch platform, including an SLIF app and event marker box, to simplify testing and ensure compliance with EU regulations.

- November 2024: Metrel launched the MI 3114 PV Tester, designed for testing photovoltaic systems with up to 1500 V and 40 A short circuit current. It features an auto-test function for IEC/EN 62446 category 1 tests, wireless remote units for measuring irradiation and temperature, and a comprehensive PV module database. This tester aims to streamline and improve efficiency for photovoltaic system testing.

- November 2024: Pickering Electronics introduced its Series 125 miniature double-pole, single-throw reed relays. These relays feature high packing density, supporting up to 1 A and 20 W switching power. With improved magnetic screening, they are designed for test and measurement applications, enabling up to 80% more relays on printed circuit boards (PCBs).

- October 2024: MBJ Solutions, a German testing equipment specialist, launched two new products: the MBJ Steady State Sun Simulator for small perovskite module characterization and the MBJ Light Soaking Unit for aging tests and preconditioning of perovskite devices. These tools are designed for perovskite solar cell developers, offering advanced testing and measurement capabilities.

- May 2024: Advantest Corporation introduced the DC Scale XHC32, a new 32-channel power supply for the V93000 EXA Scale SoC test platform. This power supply supports up to 640A, meeting the increasing power demands of AI accelerators, HPC chips, GPUs, and other high-current devices. It offers features like flexible channel ganging, fast response, and extended profiling, ensuring efficient high-power device testing while reducing the cost of testing by protecting probe cards and test sockets.

Test and Measurement Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Service Types Covered | Calibration Services, Repair Services/After-Sales Services |

| End Use Industries Covered | Automotive and Transportation, Aerospace and Defense, IT and Telecommunication, Education, Semiconductor and Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advantest Corporation, Anritsu Corporation, EXFO Inc., Fortive, Keysight Technologies, Inc., National Instruments Corporation, Rohde & Schwarz GmbH & Co. KG, Teledyne Technologies Incorporated, Texas Instruments Incorporated, VIAVI Solutions Inc., Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the test and measurement equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global test and measurement equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the test and measurement equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global test and measurement equipment market was valued at USD 26.9 Billion in 2024.

We expect the global test and measurement equipment market to exhibit a CAGR of 3.86% during 2025-2033.

The rising integration of connected devices with the Internet of Things (IoT) and Machine-to-Machine (M2M) interaction systems, as these offer portable and embedded testing and measurement solutions with remote troubleshooting capabilities and interactive interfaces, is primarily driving the global test and measurement equipment market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for test and measurement equipment.

Based on the product, the global test and measurement equipment market can be segmented into General Purpose Test Equipment (GPTE) and Mechanical Test Equipment (MTE). Currently, General Purpose Test Equipment (GPTE) holds the majority of the total market share.

Based on the service type, the global test and measurement equipment market has been divided into calibration services and repair services/after-sales services, where repair services/after-sales services currently exhibit a clear dominance in the market.

Based on the end use industry, the global test and measurement equipment market can be categorized into automotive and transportation, aerospace and defense, IT and telecommunication, education, semiconductor and electronics, and others. Among these, automotive and transportation accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global test and measurement equipment market include Advantest Corporation, Anritsu Corporation, EXFO Inc., Fortive, Keysight Technologies, Inc., National Instruments Corporation, Rohde & Schwarz GmbH & Co. KG, Teledyne Technologies Incorporated, Texas Instruments Incorporated, VIAVI Solutions Inc., and Yokogawa Electric Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)