Test Environment as a Service Market Report by Type (Cloud-Based Test Environment Management Solutions, Testing as a Service (TaaS) Offerings), End-User (Small and Medium Enterprises, Large Enterprises), and Region 2026-2034

Test Environment as a Service Market Size:

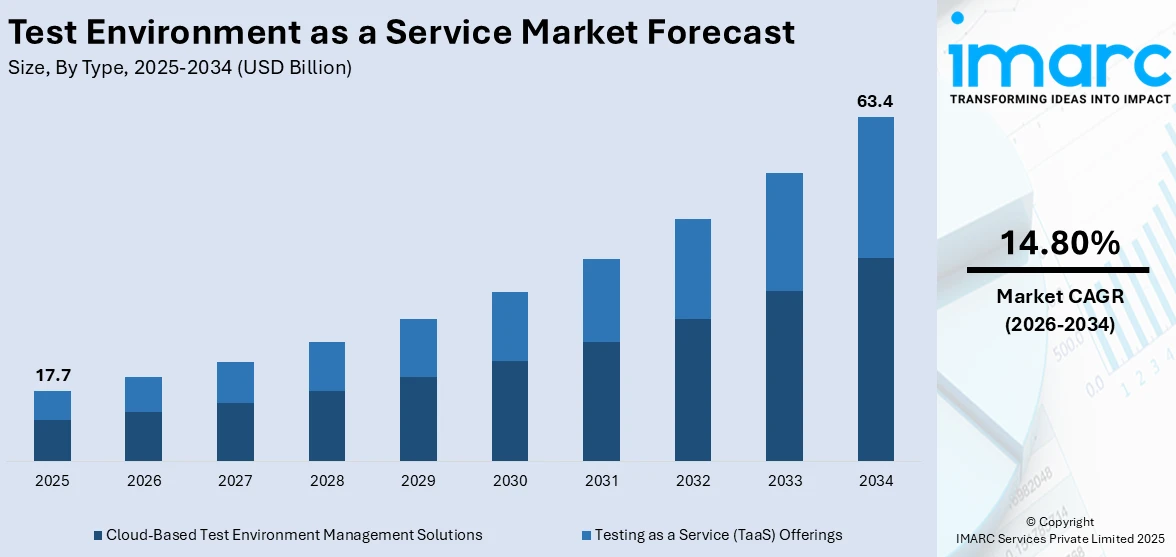

The global test environment as a service market size reached USD 17.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 63.4 Billion by 2034, exhibiting a growth rate (CAGR) of 14.80% during 2026-2034. The global market is primarily driven by its cost-effective scalability, essential support for Agile and DevOps methodologies, heightened focus on cybersecurity and compliance, integration with cutting-edge technologies, and the increasing necessity for remote accessibility and environmentally sustainable practices in a technologically advancing business landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 17.7 Billion |

|

Market Forecast in 2034

|

USD 63.4 Billion |

| Market Growth Rate 2026-2034 | 14.80% |

Test Environment as a Service Market Analysis:

- Market Growth and Size: The market is experiencing significant growth, driven by the increasing demand for efficient and scalable testing solutions. This growth is reflected in expanding market size, with large enterprises being the most substantial contributors, followed by small and medium-sized businesses.

- Major Market Drivers: Key drivers include the need for cost efficiency and scalability offered by TEaaS, especially appealing to organizations looking to minimize capital expenditure. The growing adoption of Agile and DevOps methodologies in software development, which require flexible and dynamic testing environments, further fuels market growth.

- Technological Advancements: Rapid advancements in technology, particularly in areas, including AI, IoT, and blockchain, necessitate sophisticated testing environments. TEaaS providers are continuously updating their offerings to include these latest technologies, ensuring that clients have access to state-of-the-art testing resources.

- Industry Applications: TEaaS is widely applied across various industries, including IT, telecom, finance, healthcare, and government sectors. Its ability to ensure compliance with regulatory standards and security protocols makes it particularly valuable in industries dealing with sensitive data.

- Key Market Trends: There is an increasing focus on integrating TEaaS with emerging technologies and a shift towards cloud-based solutions. The market is also witnessing a trend toward environmentally sustainable practices, resonating with the global push for eco-friendly business operations.

- Geographical Trends: North America leads the market, attributed to its advanced IT infrastructure and rapid adoption of new technologies. The Asia Pacific region shows significant growth potential, driven by digital transformation and IT sector expansion, while Europe maintains steady growth due to its focus on innovation and quality in software development.

- Competitive Landscape: The market features a mix of established players and emerging companies. Key players are engaging in strategic partnerships, mergers, and acquisitions, alongside heavy investments in R&D to enhance their service capabilities and expand market reach.

- Challenges and Opportunities: Challenges include keeping pace with rapidly evolving technologies and adapting to diverse industry needs. However, these challenges present opportunities for market players to innovate and offer customized solutions. The growing global demand for efficient testing environments also opens up new markets, particularly in regions with developing IT infrastructure.

To get more information on this market Request Sample

Test Environment as a Service Market Trends:

Cost efficiency and scalability

TEaaS allows organizations to rent testing environments rather than investing in their own infrastructure, leading to significant reductions in capital and operational expenses. This service model offers the flexibility to scale up or down based on testing needs, which is particularly beneficial for companies with fluctuating demand. By leveraging TEaaS, businesses can avoid the costs associated with maintaining and updating their own testing hardware and software, thereby optimizing resource allocation, and focusing on core competencies. Additionally, this scalability ensures that companies of all sizes can access high-quality testing environments without the need for substantial upfront investment, democratizing access to advanced testing tools.

Rapid technological advancements

A software and application development processes evolve, the need for sophisticated and diverse testing environments grows. TEaaS providers continuously update their offerings to include the latest technologies and testing frameworks, ensuring clients have access to state-of-the-art testing resources. This is crucial for companies looking to stay competitive in a market where technological obsolescence is a significant risk. The ability to test applications in advanced environments that mimic real-world scenarios is invaluable for ensuring software quality and performance. Furthermore, the integration of emerging technologies, such as AI and machine learning in testing environments enables more efficient and accurate testing processes, thus enhancing the overall appeal of TEaaS.

Growing demand for Devops and agile practices

The increasing adoption of DevOps and Agile methodologies in software development significantly fuels the demand for TEaaS. These methodologies emphasize continuous integration, continuous delivery, and quick feedback loops, necessitating more dynamic and flexible testing environments. TEaaS aligns perfectly with these methodologies by providing on-demand testing services that can be rapidly scaled and configured. This flexibility allows for more frequent and thorough testing throughout the software development lifecycle, leading to higher quality software and faster time-to-market. Additionally, TEaaS supports the collaborative nature of DevOps and agile practices by providing a shared, centralized testing environment accessible to cross-functional teams, thus facilitating better coordination and efficiency in the testing process.

Test Environment as a Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type and end-user.

Breakup by Type:

- Cloud-Based Test Environment Management Solutions

- Testing as a Service (TaaS) Offerings

Cloud-based test environment management solutions accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes cloud-based test environment management solutions and testing as a service (TaaS) offering. According to the report, cloud-based test environment management solutions represented the largest segment.

Cloud-based test environment management solutions segment encompasses platforms and tools that facilitate the creation, management, and deployment of software testing environments in the cloud. The dominance of this segment can be attributed to its inherent flexibility, scalability, and cost-effectiveness, which are highly valued in today’s fast-paced and variable tech industry. Organizations leverage these cloud-based solutions to simulate real-world scenarios, manage test data, and ensure consistent testing experiences across various teams and projects.

On the other hand, the TaaS segment refers to the outsourcing of testing activities to third-party service providers who offer a wide range of testing services, from functional testing to specialized testing for performance, security, and compliance. TaaS is particularly beneficial for organizations lacking in-house testing expertise or resources. Companies opting for TaaS benefit from the expertise of specialized testers and access to advanced testing tools without the need for significant capital investment.

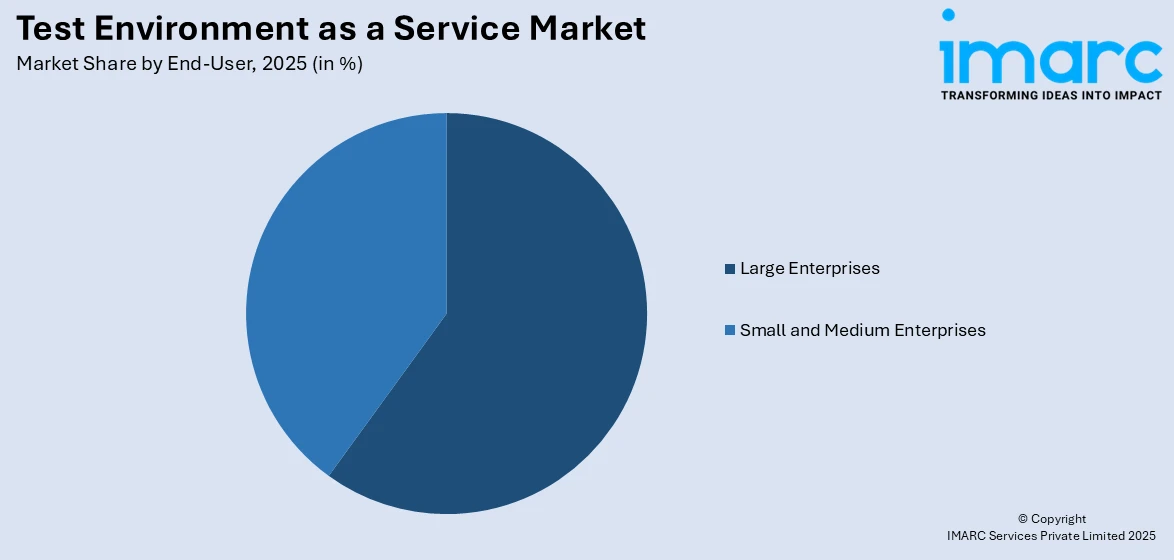

Breakup by End-User:

Access the comprehensive market breakdown Request Sample

- Small and Medium Enterprises

- Large Enterprises

Large enterprises holds the largest share in the industry

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes small and medium enterprises and large enterprises. According to the report, large enterprises accounted for the largest market share.

As the largest segment in the market, large enterprises represent a substantial portion of the demand. These organizations typically have complex and extensive software development needs, making the scalability and advanced capabilities of TEaaS highly beneficial. Large enterprises often engage in multiple, concurrent software projects, necessitating a robust and versatile testing environment that can handle varied and intensive workloads. TEaaS provides these companies with the necessary resources to efficiently manage and execute their testing strategies across different teams and geographies.

On the contrary, in the TEaaS market, small and medium enterprises (SMEs) form a critical segment, albeit smaller than large enterprises. SMEs are increasingly adopting TEaaS due to its cost-effectiveness and the minimal requirement for upfront investment in infrastructure. This segment typically faces resource constraints and may lack specialized in-house testing expertise. TEaaS addresses these challenges by providing SMEs with access to sophisticated testing environments and tools, which would otherwise be financially prohibitive.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest test environment as a service market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America, as the largest segment in the market, demonstrates significant growth due to the region's robust technological infrastructure and the presence of major IT and software development companies. This market dominance is further bolstered by the region's quick adoption of advanced technologies such as AI, IoT, and cloud computing, which necessitate comprehensive testing environments. The prevalence of large enterprises with extensive software development requirements in North America also contributes to the high demand for TEaaS. Additionally, the region's stringent regulatory standards regarding data security and privacy drive the need for TEaaS solutions that can ensure compliance.

On the other hand, the Asia Pacific region is experiencing rapid growth in the TEaaS market, driven by the increasing digitization of businesses and the expansion of IT services. The region's growing emphasis on digital transformation across various industries, including finance, healthcare, and retail, further propels the demand for efficient testing services.

On the contrary, in Europe, the TEaaS market is driven by the region's strong focus on innovation and quality in software development. The presence of numerous global enterprises, particularly in countries, such as Germany, the UK, and France, contributes to the demand for advanced testing environments. Europe's stringent regulations on data protection and privacy, such as the general data protection regulation (GDPR), necessitate robust testing solutions that can ensure compliance.

Additionally, the TEaaS market in Latin America is growing steadily, influenced by the region's increasing digitalization and adoption of cloud-based solutions. Countries, including Brazil, Mexico, and Argentina are progressively investing in IT infrastructure, which translates into growing opportunities for TEaaS providers. The market in this region is particularly driven by SMEs seeking cost-effective and scalable testing solutions.

Moreover, the Middle East and Africa (MEA) region is showing promising growth potential. This growth is primarily driven by the rapid expansion of the IT sector and the increasing focus on digital transformation in various countries. The region's burgeoning startup ecosystem, coupled with government initiatives to promote technological innovation, particularly in areas like fintech and e-commerce, is fostering the adoption of TEaaS.

Leading Key Players in the Test Environment as a Service Industry:

Key players in the market are actively engaged in a variety of strategic initiatives to strengthen their market position. These include investments in research and development to enhance their service offerings, particularly focusing on incorporating advanced technologies, including AI, machine learning, and cloud computing. They are also forming strategic partnerships and collaborations with other technology providers and enterprises to expand their service capabilities and reach new customer segments. Additionally, many are focusing on improving user experience and service customization to cater to the specific needs of different industries. Mergers and acquisitions are another common strategy, allowing these companies to rapidly acquire new technologies and expand their market presence.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accenture Plc

- Atos SE

- CA Technologies

- Capgemini SE

- Cognizant

- HCL Technologies Limited

- HP Development Company L.P

- International Business Machines

- Infosys Limited

- KPIT Technologies

- QA Infotech

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- 08 January 2024: Accenture Plc. has completed its acquisition of OnProcess Technology, a provider of supply chain managed services, which helps organizations refine processes, improve the way inventory is managed and solve complex service challenges.

- 30 November 2023: Infosys Limited announced its collaboration with Shell New Energies UK Ltd (“Shell”), an international energy company, to accelerate adoption of immersion cooling services for data centers. Through this strategic engagement, Infosys and Shell will bring together their capabilities in digital and energy, respectively, and an eco-system of partners, to create an integrated offering for green data centers.

- 07 June 2023: HCL Technologies Limited launched advanced testing facility for 5G infrastructure OEMs. The facility is equipped with high-end scanners that enable global OEMs to test large cellular base stations as well as small form factor antennas used in mobile phones, smart gadgets, health monitoring systems and remote surveillance systems.

Test Environment as a Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cloud-Based Test Environment Management Solutions, Testing as A Service (Taas) Offerings |

| End-Users Covered | Small and Medium Enterprises, Large Enterprises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture, Atos SE, CA Technologies, Capgemini, Cognizant, HCL Technologies Limited, HP Development Company L.P, International Business Machines, Infosys Limited, KPIT Technologies, QA Infotech, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the test environment as a service market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global test environment as a service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the test environment as a service industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global test environment as a service market was valued at USD 17.7 Billion in 2025.

We expect the global test environment as a service market to exhibit a CAGR of 14.80% during 2026-2034.

The rising adoption of test environment as a service across several organizations, as it is a highly reliable, scalable, and cost-effective testing solution that can be customized according to the requirements of the user, is primarily driving the global test environment as a service market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing deployment of test environment as a service model, as it enables developers and testers to build high-quality software products and applications, during the remote working scenario.

Based on the type, the global test environment as a service market has been segregated into cloud-based test environment management solutions and Testing as a Service (TaaS) Offerings, where cloud-based test environment management solutions currently hold the largest market share.

Based on the end-user, the global test environment as a service market can be bifurcated into small and medium enterprises and large enterprises. Currently, large enterprises exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global test environment as a service market include Accenture, Atos SE, CA Technologies, Capgemini, Cognizant, HCL Technologies Limited, HP Development Company, L.P., International Business Machines, Infosys Limited, KPIT Technologies, QA Infotech, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)