Terahertz Technologies Market Size, Share, Trends and Forecast by Type, Component, End Use Industry, and Region, 2025-2033

Terahertz Technologies Market Size and Share:

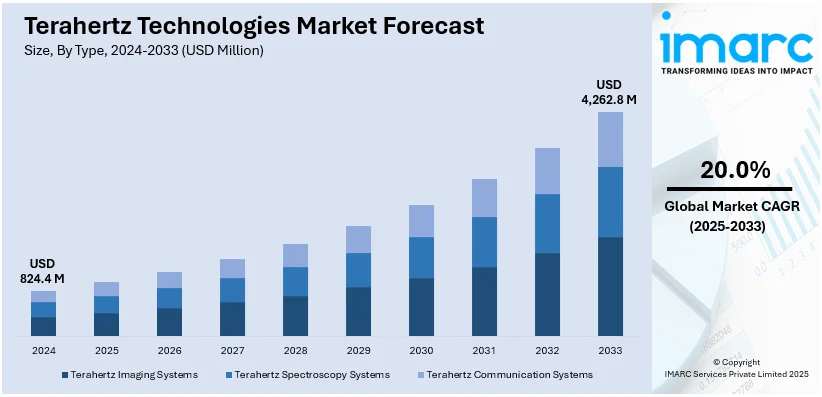

The global terahertz technologies market size was valued at USD 824.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,262.8 Million by 2033, exhibiting a CAGR of 20.0% during 2025-2033. North America currently dominates the terahertz technologies market share, holding a significant market share of over 40.8% in 2024, driven by well-established aerospace and energy industries, along with robust increase in research and development initiatives to launch new technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 824.4 Million |

|

Market Forecast in 2033

|

USD 4,262.8 Million |

| Market Growth Rate (2025-2033) | 20.0% |

The global terahertz technologies market is driven by advancements in research and development, leading to increased applications in sectors such as healthcare, security, telecommunications, and material science. The growing demand for non-invasive imaging and sensing technologies, especially in medical diagnostics and security screening, is a key factor. Additionally, the rise of terahertz-based communication systems and their potential to support high-speed wireless data transmission further accelerates market growth. Increased investment in terahertz research, along with advancements in semiconductor technology, is also contributing to the development of more efficient and cost-effective terahertz solutions, enhancing their adoption across various industries, thereby increasing the terahertz technologies market share.

The United States plays a pivotal role in the global terahertz technologies market, driven by its strong research and development capabilities. Leading universities, research institutions, and technology companies are at the forefront of terahertz innovations, fostering advancements in imaging, communication, and security applications. Furthermore, the growing demand for high-resolution, non-invasive diagnostic tools in healthcare and the increasing need for high-speed wireless communication networks contribute significantly to market growth in the U.S. Additionally, the country’s substantial investment in defense and security technologies supports the development and adoption of terahertz-based solutions, reinforcing its position as a key market player. For instance, in January 2025, the U.S. Department of Commerce signed a MoU with MACOM Technology Solutions Inc. to offer significant investment of USD 70 million in accordance with CHIPS and Science Act for the development of manufacturing facilities. MACOM will manufacture components that are integral for defense systems like ground-based or airborne radar systems.

Terahertz Technologies Market Trends:

Growing Adoption of Terahertz Imaging in Security and Healthcare

Terahertz imaging technology finds itself increasingly utilized within the realms of security and health care with this unique penetrability without the consequences of doing damage. Terahertz finds potential applications for its noninvasive detection of weapons and explosives at the security domain in enhancing safety procedures at an airport, public space protection, or defense of critical infrastructure, but its widespread implementation is supposed to increase by better portable versions with improved sensing sensitivity and significantly decreased false-alarm rates. Healthcare has seen the growing trend of applying terahertz imaging for early diagnosis. It allows non-invasive examination of the tissues whereby the conditions such as cancer or abnormalities in the skin and lungs are immediately spotted before they worsen to reduce fatal damage. This results in more accurate diagnoses and treatment, resulting in better patient outcomes. Growing demand for non-invasive, rapid, and accurate diagnostic tools makes further investments and innovations in terahertz imaging inevitable. In addition, August 2024 saw the Telecom Regulatory Authority of India propose the 'Tera Hertz Experimental Authorization,' which would allow experiments in the 95 GHz to 3 THz range for 6G technologies. This initiative supports research and development, involving academic institutions and telecom providers, underlining the broader potential of terahertz technology across various industries. The technology has now become the backbone of future healthcare and security applications, facilitating the sustained terahertz technologies market demand.

Expansion of Terahertz Communication Systems

This rising demand for wireless communication is made faster and more reliable through emerging THz technology as the most promising next-generation communication system. Terahertz waves fall within the range between microwave and infrared light frequencies. Since these can support extremely high-speed data transfer, they have high potential to support the high needs of 5G and beyond. Terahertz communication offers the potential to achieve data transmission speeds of up to 100 Gbps, far surpassing current 4G and 5G speeds. The rising requirements for low latency and high-bandwidth communication across applications like smart cities, high-definition media streaming, and the development of self-driving cars have boosted the exploration into THz-based communication systems. Terahertz communication may indeed support multi-gigabit data rates as well as terabit per second to help transfer data faster over short-to-medium distances. Although the technology is still in its infancy, the developments of THz devices, antennas, and modulation techniques are happening at a very fast pace, opening the door to further widespread adoption. The terahertz technologies market outlook reflects that the interest in ultra-fast wireless communication systems is pushing research and development efforts to bridge the gap associated with signal loss and bandwidth management in the THz frequency range.

Advancements in Terahertz Sensing for Material Characterization

The increasing application of terahertz sensing technology for material characterization is widely spread across different industries, including automotive, electronics, and pharmaceuticals. Since it does not destroy the sample during analysis, the THz sensing technology is appropriate for the inspection of materials and components without losing their integrity. In the automotive and electronics sectors, THz sensing is applied for inspecting composites and semiconductor devices for quality control in manufacturing and optimized performance of critical components. It is also employed for the investigation of material's structural integrity and detection of hidden defects with the aim of enhancing the reliability of the product. Notably, in August 2024, TeraView released a new sensor under its TeraCota family to measure the thickness, density, and loading of anode coatings for lithium-ion batteries used in electric vehicles and energy storage applications. This sensor, with less than 1% error, is rolled out globally to support multi-region production and lab quality assurance. In the pharmaceutical industry, terahertz spectroscopy has started gaining popularity as a tool in assessing the properties of drug formulations, such as polymorph identification and crystallinity studies, both vital to ensuring consistency and safety. The non-invasive and fast characteristics of terahertz sensing have made it more and more of an attractive tool for high precision and quality control in industries and production processes, consequently bolstering the terahertz technologies market growth.

Market Opportunity: Expanding Telecom Infrastructure in Developing Countries

Expanding telecom networks in developing countries can have a big positive impact. As technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data become more common, there is a growing need for smart devices and connected systems. These technologies rely on telecom networks to collect and share data, which helps improve cities and infrastructure. To support this, high-speed fiber optic networks are needed, as they can handle large amounts of data quickly and efficiently. The rollout of 5G and eventually 6G networks also requires fiber optic cables to ensure secure and fast data transmission. As a result, expanding fiber optic networks in developing countries will drive the market for optical communication equipment in the future.

Market Challenge: Security Risks of Optical Networks

Fiber optic networks, once considered very secure, are now facing new risks. Hacking into these networks used to be difficult, requiring advanced technology that only governments could access. But with the rise of cheaper hardware and software, hacking has become more accessible. Tools like optical/electrical converters and sniffer software can be used to intercept data from fiber optic networks, making it easier for hackers to steal information without detection. This growing security issue, called fiber hacking, is becoming more common and could lead to serious problems if not addressed.

Terahertz Technologies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global terahertz technologies market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, and end use industry.

Analysis by Type:

- Terahertz Imaging Systems

- Active System

- Passive System

- Terahertz Spectroscopy Systems

- Time Domain

- Frequency Domain

- Terahertz Communication Systems

As per the terahertz technologies market trends, terahertz imaging systems lead the market with around 46.5% of market share in 2024. Terahertz imaging systems represent a groundbreaking technology that is revolutionizing various industries, particularly in the defense and security sectors. These systems operate within the terahertz frequency range, which lies between microwave and infrared, offering unique capabilities for non-destructive imaging. By penetrating materials such as clothing, packaging, and other opaque substances, terahertz imaging enables the detection of concealed threats like weapons or explosives without physical contact. Moreover, the growing demand for safety and surveillance solutions has significantly boosted the adoption of these systems, making them a crucial tool for security personnel in airports, borders, and critical infrastructure. As the technology evolves, terahertz imaging systems continue to provide enhanced resolution and accuracy, fostering advancements in both detection and prevention strategies for security applications globally.

Analysis by Component:

- Terahertz Sources

- Terahertz Detectors

Based on the terahertz technologies market forecast, terahertz detectors lead the market in 2024. Terahertz detectors are essential components in the functioning of terahertz imaging systems, converting terahertz radiation into measurable signals. These detectors are highly sensitive and allow for the capture of fine details in various materials, which is particularly advantageous in security and medical applications. The global market for terahertz detectors is seeing significant growth, driven by their critical role in ensuring the performance of imaging systems. The detectors can be categorized into different types, including photoconductive antennas, bolometers, and Schottky diode detectors, each offering unique benefits in terms of speed, sensitivity, and frequency range. Additionally, the demand for more efficient and precise detectors is growing as the need for advanced security measures in airports, government buildings, and military sites increases. This rising need for high-performance terahertz detectors contributes to their expanding market share in both defense and non-defense applications.

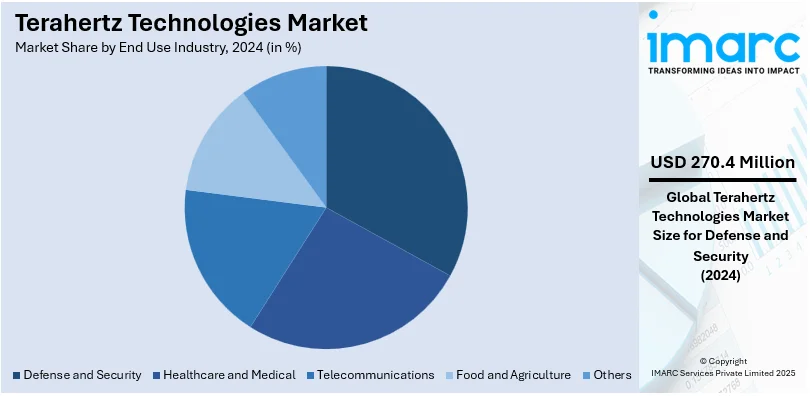

Analysis by End Use Industry:

- Healthcare and Medical

- Defense and Security

- Telecommunications

- Food and Agriculture

- Others

As the terahertz technologies market outlook, defense and security lead the market with around 32.8% of market share in 2024, driven by the escalating need for advanced surveillance and inspection technologies. Terahertz imaging systems provide a non-invasive solution for detecting concealed threats, such as weapons, explosives, and illicit substances, making them indispensable in high-security environments like airports, military installations, and border control. Furthermore, the ability of terahertz systems to penetrate various materials, including clothing and packaging, without causing harm or discomfort to individuals further strengthens their adoption. As global security concerns rise and governments prioritize protection against emerging threats, the demand for reliable, high-resolution detection systems continues to grow. Moreover, this trend ensures that the defense and security sector remains the dominant contributor to market expansion, with continuous investments in improving terahertz technologies to enhance operational efficiency and safety in critical security operations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.8%. Some of the factors driving the North America terahertz technologies market included significant growth in the aerospace and energy industries in North America which are considered to be the largest users of terahertz technologies. Additionally, the strong presence of companies in the region is driving innovation and growth in the terahertz technologies market. Moreover, North America has a strong research and development infrastructure, with many universities and research institutions conducting cutting-edge research in materials science and engineering, thereby further driving the terahertz technologies market. For instance, in July 2024, Viiva, a US-based company, launched Viiva Discovery Station in India, unveiling its terahertz technology. This move will facilitate the company in expanding its foothold in international markets.

Key Regional Takeaways:

United States Terahertz Technologies Market Analysis

In 2024, United States accounted for 74.90% of the market share in North America. The U.S. terahertz technologies market is currently expanding due to investment in defense, security, and industrial applications. According to an industry report, in 2023, the U.S. military incurred around USD 820.3 billion or around 13.3% of the country's total federal budget for that particular fiscal year, with a part devoted to the improvement of terahertz research in respect to security, communication, and detection technologies. There are also growing industrial and medical markets. The applications run from material characterization to medical imaging. Companies such as Toptica Photonics and Terasense are among the leaders that innovate terahertz solutions for industries. Government-led research, which includes agencies such as the NSF, is rapidly advancing development. Domestic production of terahertz components is increasing with rising demand.

Europe Terahertz Technologies Market Analysis

Terahertz technologies in Europe find application in areas of security, medical imaging, and communication systems. The ESA is also on board to contribute towards the growth of terahertz systems for purposes of communication as well as surveillance applications. For instance, the UK TARDiS project develops a terahertz astrophysics system intended for the International Space Station, whereas the LOCUS project focuses on the usage of terahertz technology intended for Earth observation. High-tech solutions for material analysis and non-destructive testing are gaining recognition across the manufacturing sectors. Top players like Menlo Systems and Thales Group are pushing these technologies forward, thus fueling the growth of the market. Strict regulations in the EU regarding data privacy and security have led to increased adoption of terahertz-based communication systems. Further, investments by European countries in R&D guarantee technological leadership and support the expanding role of the continent in global advancements in terahertz. Moreover, there is growing interest in communication satellites and innovative technologies, which will supplement the market growth. An industry report indicates that the satellite telecommunications sector is, by a large margin, the most significant space domain for the European satellite manufacturing sector, accounting for over 60% of satellite operations in Europe.

Asia Pacific Terahertz Technologies Market Analysis

Asia Pacific terahertz technologies market is booming with a great growth rate in defense, healthcare, and industrial applications. According to China's National Defense budget, the country's defense expenditure reached USD 230 billion in 2022, which has been allocated towards advanced technologies such as terahertz sensors for surveillance and security. India also focused on modernization of military technologies, which include terahertz-based systems in its 2023-2024 defense budget of USD 72.6 billion, as per reports. Terahertz imaging is being increasingly adopted in medical diagnostics, while the manufacturing sectors in Japan and South Korea invest in terahertz spectroscopy for quality control. Major local collaborations with global companies, including TeraView and Panasonic, are promoting innovation. Economic development in the region, as well as security concerns, is boosting demand for the latest terahertz solutions.

Latin America Terahertz Technologies Market Analysis

Latin America's terahertz technologies market is growing steadily, mainly due to defense investments and emerging industrial and healthcare applications. A regional industrial report indicates that Brazil allocated USD 21.8 billion in 2022 to modernize its defense arsenal, including investment in terahertz-based communication and security systems. Brazil's expanding healthcare sector is also adopting terahertz technologies for medical imaging, which is contributing to market expansion. Rising infrastructure development and digitalization in the region are driving the requirement for terahertz systems for industrial applications. Companies such as MIRS Corporation are at the forefront of developing sensors and imaging solutions based on the terahertz frequency range. Latin America focuses on local innovation and international partnerships, which further raises the competitive stature of the region in the international market.

Middle East and Africa Terahertz Technologies Market Analysis

In the Middle East and Africa, the market of terahertz technologies is largely influenced by growing defense spending, security, and medical applications. Military expenditure for Saudi Arabia, for instance, was at a level of USD 75,813.30 million in 2023, wherein part of such budget is meant for advanced surveillance technologies, including the terahertz-based systems, as per reports. In Africa, countries like South Africa are also now interested in these technologies for inspection of materials as well as security applications. Non-destructive testing and imaging technologies for security challenges, as well as developing infrastructure in this region, spur investment. Organizations like Santec Corporation and Aculon advance the development of terahertz solutions for regional markets. Innovations are also fostered by cooperation among government and the industries on the defense and industrial sides.

Competitive Landscape:

The competitive landscape is highlighted by the presence of several key players, including both established technology companies and emerging startups. Major firms are directing attention towards innovation, strategic partnerships, and research to enhance product performance and expand market reach. For instance, in April 2024, Fujitsu Ltd., NEC Corporation, NTT Corporation, and NTT DOCOO, INC. collaboratively announced to develop cutting-edge sub-terahertz device with an exceptional speed of 100 Gbps transmissions. Moreover, companies are developing advanced terahertz imaging systems and detectors, targeting industries such as defense, security, and healthcare. In addition, to maintain a competitive edge, players are investing in technological advancements, product diversification, and regional expansion. With the growing demand for non-invasive inspection technologies, competition is anticipated to intensify, further offering innovation and market consolidation.

The report provides a comprehensive analysis of the competitive landscape in the terahertz technologies market with detailed profiles of all major companies, including:

- Advantest Corporation

- Bakman Technologies LLC

- Batop GmbH

- Gentec Electro-Optics Inc.

- HÜBNER GmbH & Co KG

- Luna Innovations Inc.

- Menlo Systems GmbH

- Teraprobes Inc

- Terasense Group Inc.

- TeraView Limited

- TOPTICA Photonics AG.

Latest News and Developments:

- September 2024: Rohde & Schwarz presented an ultra-stable tunable THz system based on photonics for 6G at EuMW 2024 in Paris. This system was developed within the framework of the 6G-ADLANTIK project, which is applied to frequency comb technology for the generation of carrier frequencies beyond 500 GHz to contribute to the advanced research in next-generation wireless technologies.

- August 2024: TeraView recently released a new sensor for anode coating thickness, density, and loading for lithium-ion EV and energy storage applications. As part of its TeraCota family, the sensor presents less than 1% error and is rolled out globally in support of multi-region production and lab QA.

- August 2024: The Telecom Regulatory Authority of India released a statement calling on the government to allow experiments in the 95 GHz to 3 THz range for 6G technologies. The proposed 'Tera Hertz Experimental Authorization' would allow R&D, testing, and trials involving, among others, academic institutions and telecom providers.

- April 2024: TERASENSE expands its tunable THz wave sources line. Starting with a single model in the 70-77 GHz frequency range, the company now offers seven additional models from 50-75 GHz up to 330-500 GHz to address growing demand for scientific applications.

- January 2024: TOPTICA Photonics SAS has taken over direct sales and service operations in France. This strengthens its connection with French customers, enabling tailored consultations and specialized product development. The subsidiary will also distribute HighFinesse GmbH products, enhancing TOPTICA’s offerings for quantum technologies and metrology.

Terahertz Technologies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Components Covered | Terahertz Sources, Terahertz Detectors |

| End Use Industries Covered | Healthcare and Medical, Defense and Security, Telecommunications, Food and Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advantest Corporation, Bakman Technologies LLC, Batop GmbH, Gentec Electro-Optics Inc., HÜBNER GmbH & Co KG, Luna Innovations Inc., Menlo Systems GmbH, Teraprobes Inc, Terasense Group Inc., TeraView Limited and TOPTICA Photonics AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the terahertz technologies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global terahertz technologies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the terahertz technologies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The terahertz technologies market was valued at USD 824.4 Million in 2024.

IMARC Group estimates the market to reach USD 4,262.8 Million by 2033, exhibiting a CAGR of 20.0% during 2025-2033.

Key factors impacting the market encompass the magnifying requirement for leading-edge surveillance and security solutions, amplified investments in research and development initiatives, and the boosting need for non-invasive inspection services across main sectors such as defense, telecommunications, and healthcare. In addition, technological innovations and proliferating application areas foster the market expansion.

North America currently dominates the terahertz technologies market, accounting for a share exceeding 40.8%. This dominance is fueled by its robust research and development ventures, innovative technology deployment, and crucial position in sectors like telecommunications and healthcare.

Some of the major players in the terahertz technologies market include Advantest Corporation, Bakman Technologies LLC, Batop GmbH, Gentec Electro-Optics Inc., HÜBNER GmbH & Co KG, Luna Innovations Inc., Menlo Systems GmbH, Teraprobes Inc, Terasense Group Inc., TeraView Limited, TOPTICA Photonics AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)