Tennis Shoes Market Size, Share, Trends and Forecast by Playing Surface, Application, Distribution Channel, and Region, 2025-2033

Tennis Shoes Market Size and Share

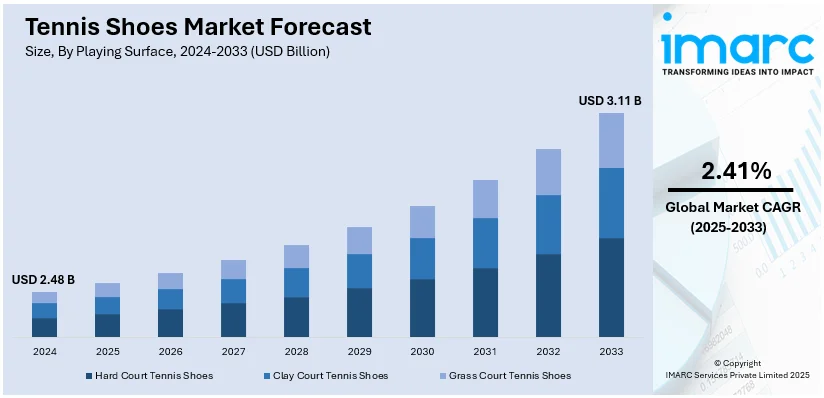

The global tennis shoes market size reached USD 2.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.11 Billion by 2033, exhibiting a growth rate (CAGR) of 2.41% during 2025-2033. North America currently dominates the market with a significant share of 24% in 2024. The market is being driven by the increased participation in tennis, growing investment in sports infrastructure, and supportive government initiatives. At present, North America holds the largest market share driven by the rising sports engagement and a cultural emphasis on health and fitness across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.48 Billion |

|

Market Forecast in 2033

|

USD 3.11 Billion |

| Market Growth Rate (2025-2033) | 2.41% |

The market is primarily driven by rising health consciousness and the increasing adoption of fitness-oriented lifestyles, which is leading to a higher demand for high-performance athletic footwear. Moreover, the growing popularity of tennis as both a professional sport and a recreational activity is expanding the consumer base, which is providing a boost to the tennis shoe market growth. Furthermore, continual advancements in technology are enabling manufacturers to develop innovative materials and designs, such as lightweight, durable, and eco-friendly options, thereby appealing to environmentally conscious consumers. For example, on January 9, 2025, ASICS launched the GEL-RESOLUTION™ X tennis shoe, emphasizing enhanced comfort, stability, and sustainability. The key features include FF BLAST™ PLUS ECO foam for superior cushioning, DYNAWALL™ technology for lateral stability, and the adjustable DYNALACING™ system for a tailored fit. In addition to this, the rising influence of athleisure trends, where sportswear is embraced as everyday fashion, further facilitates market expansion.

The market in the United States is experiencing significant growth due to the increasing emphasis on outdoor recreational activities and community sports programs. Additionally, the growing trend of customized and premium tennis shoes, offering personalized fit and enhanced performance features, is gaining popularity among affluent consumers. Besides this, the influence of professional tennis tournaments, endorsements by high-profile athletes, and collaborations with major brands are increasing the consumer interest in tennis shoes as aspirational products. For instance, on December 24, 2024, World No. 3 tennis player Coco Gauff unveiled two patriotic colorways of her New Balance Coco CG2 tennis shoes, featuring red, white, and blue designs with "USA" detailing on the heels. These special editions are intended for her participation in the United Cup. Also, a shift in consumer focus toward sustainable and ethically manufactured footwear is increasing the adoption of eco-friendly practices among manufacturers, which is also a significant growth-inducing factor for the market.

Tennis Shoes Market Trends:

Increasing Participation in Tennis

Tennis is witnessing a remarkable uptick in participation, which is largely attributed to a renewed interest in outdoor and individual sports following the easing of pandemic restrictions. In five years, there are 106 million participants. According to a survey released by the International Tennis Federation (ITF), the number of tennis players worldwide has surpassed 100 million for the first time. In regions like the U.S. and Europe, where sports culture is deeply ingrained, this revival is particularly pronounced. Additionally, the increase in tennis players is escalating tennis shoes market demand, as enthusiasts, new and returning, seek proper footwear that offers the necessary support and performance enhancements for playing. Moreover, the sport's growing popularity supports an entire industry, from equipment manufacturers to apparel and footwear companies, highlighting the interconnection between sports participation rates and sports-related consumer goods, thus positively influencing tennis shoes market growth.

Rising Investments in Sports Infrastructure

Governments globally are recognizing the importance of sports for health and community building, leading to increased investments in sports infrastructure, which is significantly shaping the tennis shoes market outlook. Additionally, in India, the Khelo India initiative is a prime example of governmental efforts to promote sports, which includes the development of new tennis courts and facilities. This push toward creating better sports infrastructure facilitates greater community engagement in sports and provides more opportunities for people to participate in tennis. The ripple effect of such initiatives is significant, increasing the demand for sports-specific gear, including tennis shoes. In the United States and Canada, state and local governments spent USD 33 Billion in public funds to build major-league sports stadiums and arenas between 1970 and 2020, with the median public contribution covering 73 percent of venue construction costs, according to recent estimates by sports economists. As new facilities become available, and access to sports like tennis expands, especially in emerging markets, the market for sports apparel and equipment also grows. This trend is expected to continue as more governments invest in sports as a strategy for enhancing public health and community development, which is influencing the tennis shoes market share.

Government Support for Sports Activities

Various national initiatives, such as Australia’s National Sports Plan and similar programs in the UK, aim to boost sports participation across the board. These government-backed plans often set concrete targets for increasing participation, which in turn catalyzes greater engagement in various sports, including tennis. For instance, in Australia, the National Sports Plan aims to get more people moving and supports the infrastructure and club systems necessary for sports like tennis. Similarly, the Ministry of Youth Affairs and Sports has been allocated INR 3397.32 crore (USD 393.24 Million) for FY 2023-24, an 11% increase over FY 2022-23, according to official government data from India. By 2025, the Chinese government wants the sports sector to reach RMB 5 trillion (USD 699.52 billion), according to sources. This governmental backing is crucial as it provides the necessary resources and facilities that encourage people to start and continue participating in sports. As more individuals take up tennis, the demand for equipment and apparel, specifically tennis shoes, sees a natural uplift. This effect underscores the vital role that public policy and support play in fostering active lifestyles and supporting related industries, which is surging the tennis shoes market share.

Tennis Shoes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global tennis shoes market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on playing surface, application, and distribution channel.

Analysis by Playing Surface:

- Hard Court Tennis Shoes

- Clay Court Tennis Shoes

- Grass Court Tennis Shoes

Hard court tennis shoes lead the market with around 51.0% of market share in 2024. Hard courts are the most common playing surface worldwide. They are famous for their durability and are highly used in professional tournaments and for recreational play. Hard-court tennis shoes are designed to provide improved performance. They deliver cushioning, support, and durability to bear the abrasiveness of the hard court. These shoes often feature robust outsoles with modified herringbone patterns for grip and wear resistance, making them suitable for high-impact movements. The continued rise in tennis participation and the popularity of hard-court tournaments worldwide contribute to steady demand for this category. Innovations in new material and technological innovations, like light yet durable soles and shock-absorbing midsoles, contribute to increased comfort and better performance by players, thereby reinforcing the need for hard-court tennis shoes in the market.

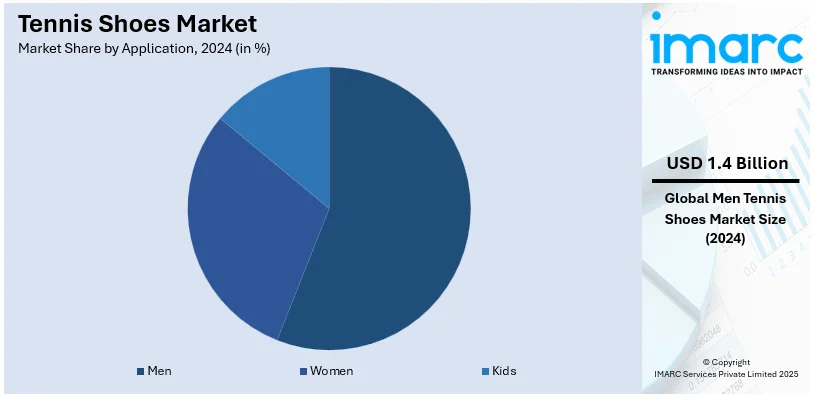

Analysis by Application:

- Men

- Women

- Kids

Men leads the market with around 55.6% of market share in 2024. Men account for the majority part of the market due to large participation levels among professionals and leisure tennis players. This category is increased by interest in the game at a global level, along with male icons in sports endorsement and growing penetration of sportswear and fitness within people's lifestyles. Men's tennis shoes are designed to be durable, comfortable, and performative, meeting the specific biomechanical needs and playing styles of men. Features such as enhanced lateral support, cushioning for high-impact movements, and durable outsoles tailored to various playing surfaces meet the needs of competitive and casual players. Moreover, male consumers often prioritize functionality alongside aesthetics, prompting manufacturers to innovate with trendy designs and advanced materials. This strong requirement establishes the significant influence that men have on the trend of the tennis shoe market and in its revenue generation.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores lead the market with around 64% of market share in 2024. These stores play a significant role in the market by providing exclusive product offerings and personalized customer experiences. These retailers focus on niche demands, offering designs that appeal to specific consumer preferences and fostering a sense of exclusivity. Their staff often possess specialized knowledge, enabling them to guide customers effectively in selecting products that meet their unique needs. Additionally, these stores frequently collaborate with premium brands, ensuring access to limited-edition releases and high-quality items. This approach not only strengthens their market position but also cultivates strong customer loyalty, setting them apart from mass-market retailers.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 24%. North America is an important region for the global tennis shoe market. The strong tennis culture, inflating disposable incomes, and wide participation in sports drive the market growth in the region. Major professional tennis tournaments and training facilities are located within the region, which fuels the consistent demand for high-performance footwear. Consumers in North America are majorly concerned about quality, technology, and style, which leads manufacturers to make innovations with modern cushioning systems, lightweight materials, and a design that looks good while keeping functionality. An increased focus on health and fitness further accelerates the rise of tennis shoes for sports and casual and athleisure wear. Well-entrenched specialty stores, e-commerce portals, and larger retail chains that provide easy market access, combined with the sustainable orientation of the region, add to North America's importance in the market.

Key Regional Takeaways:

United States Tennis Shoes Market Analysis

Based on the reports presented by the Tennis Industry Association, there were above 23 million tennis players recorded in 2022, which is driving this demand for tennis shoes in the United States of America. But all age categories are experiencing such development, whereby young people, and especially millennials, take the lead by driving the craving for fashionable but functional footwear. The athleisure trend has further boosted the popularity of tennis shoes off the court as manufacturers use partnerships with athletes and celebrities. According to an industry report, e-commerce accounts for more than 20% of sportswear sales, thereby increasing accessibility and customer reach. The performance-conscious consumer is attracted by innovations in sport technology such as light weight and cushioning technologies. The sport also benefits tennis shoemakers through community tennis initiatives and corporate wellness programs. As sustainability trends are fueling innovation, many consumers prefer eco-friendly and recyclable materials for footwear, making this the significant percentage in buyers.

Europe Tennis Shoes Market Analysis

The region's rich tradition of tennis and well-known events such as Wimbledon, the French Open, and the ATP World Tour are added advantages for the tennis shoe industry in Europe. Interest in tennis was also fueled by the fact that a significant number of the world's tennis event viewers in 2023 came from Europe. According to reports, 77% of Europeans watched sports on television, 52% of them played sports in the previous 12 months, and tennis is the second most popular sport in the region. Tennis Europe is the largest regional association of the International Tennis Federation, with over 20,000 youth players and 50 member countries in Europe. As for the engagement in tennis, it has grown since the pandemic, primarily among women who represent nearly 40% of the new entrants according to reports, who engage in it because of a greater awareness towards fitness and sporting outdoors. Therefore, with such a large majority of European customers seeking eco-friendly products, this increasing demand for environmentally friendly sports footwear has pushed companies to focus more on recyclable material usage and reduced carbon emission while manufacturing tennis shoes. The market is also fueled by the robust retail infrastructure of Europe, which is further supported by internet channels and makes tennis shoes easily accessible.

Asia Pacific Tennis Shoes Market Analysis

The market for tennis shoes is growing rapidly in the Asia-Pacific region due to increasing popularity of tennis and growing disposable incomes. Tennis participation has increased in countries like China, Japan, and India due to public and private expenditures in sports facilities. As quoted by iQiyi, which are the broadcasting partners of Women's Tennis Association for China, it has reportedly reached four million in 2014 and hit 39 million in 2017. Meanwhile, the market is also gaining ground as many around the globe follow the championship games held within the region. For example, the 2020 Australian Open Men's Final between Novak Djokovic and Dominic Thiem was viewed by a national peak of 2.668 million people with an average viewership of 2.043. Consumer interest in the sport and related merchandise has increased because of the increased importance of regional and international tournaments such as China Open and Japan Open. The athleisure movement is also gaining ground in cities. Tennis shoes have become a casual wear option for many, especially in this area. Some key distribution channels are e-commerce sites, where much of the area's footwear sales occur. Sport is becoming increasingly popular as a recreational activity among young populations, hence more market demand is being developed.

Latin America Tennis Shoes Market Analysis

There has been a surge in tennis participation in Latin America, particularly in Brazil and Argentina, who together have more than 50% of the region's tennis courts according to reports, which is fueling the demand for tennis shoes. Performance tennis footwear is witnessing high demand owing to the rising popularity of the sport due to events such as the Argentina Open and the Rio Open. Tennis is becoming an increasingly popular sport among the region's youth, who constitute more than 30% of the population according to reports. Urbanization has also contributed to increased demand for tennis shoes as a popular choice for athleisure and casual wear. Tennis shoes are now more widely available in Latin American nations due to the growing e-commerce penetration, which is growing at a significant rate annually. Moreover, marketing campaigns and sponsorship agreements by worldwide brands have increased awareness of high-performance tennis footwear.

Middle East and Africa Tennis Shoes Market Analysis

Growing investments in sports infrastructure and increased participation in sports are fueling the tennis shoe market in the Middle East and Africa (MEA). International tennis tournaments, such as the Dubai Duty-Free Tennis Championships, are hosted in countries like the United Arab Emirates, Saudi Arabia, and South Africa, and the sport is gaining interest globally. These tournaments have enhanced tennis involvement, especially among young people and foreigners. Premium tennis shoes have also become more costly due to growing disposable incomes, especially in Gulf Cooperation Council (GCC) countries. The increase in organized retail and e-commerce is also supporting wider product availability, which will be nearly USD 50 Billion for the Middle East as reported. With this awareness, there has been a rise in the market for tennis shoes, mainly in cities, where tennis is considered a form of fitness activity.

Competitive Landscape:

The market is highly competitive driven by innovation, consumer preference, and technology upgradation. The key focus of leading players is integrating performance-enhancing features like lightweight materials, superior grip, and shock absorption for professional and recreational players. The research and development (R&D) investments in the creation of sustainable and eco-friendly product lines are another important feature, as rising demands are witnessed in environmentally conscious footwear. Marketing strategies focus on athlete endorsements and various collaborations to enhance brand credibility. E-commerce amplifies the competition as it increases the avenues for smaller brands to reach people across various regions. Regional preferences for different designs and functionalities further shape the dynamic market landscape.

The report provides a comprehensive analysis of the competitive landscape in the tennis shoes market with detailed profiles of all major companies, including:

- Adidas AG

- ANTA Sports Products Limited

- ASICS Corporation

- Babolat

- Diadora S.p.A. (Geox S.p.a)

- FILA Holdings Corp.

- Lotto Sport Italia S.p.A.

- Mizuno Corporation

- New Balance Inc.

- Nike Inc.

- Reebok International Limited (Authentic Brands Group LLC)

- Xtep International Holdings Limited

- Yonex Co. Ltd.

Recent Developments:

- September 2024: Roger Federer unveiled a limited-edition collaboration featuring the ROGER Clubhouse Pro tennis shoes, presented in elegant ivory and evergreen hues.

- August 2024: Adidas introduced its FW24 New York Tennis Collection, leveraging motion capture technology to enhance flexibility and comfort.

- March 2023: K-Swiss, a renowned American tennis brand with a rich heritage, is excited to unveil its high-end footwear line in collaboration with Corridor, a New York-based men’s fashion label, showcased through a creative editorial in Racquet magazine. This unisex collection features the performance-oriented SpeedTrac tennis shoe priced at USD 140 and the vintage-inspired Classic 66 priced at USD 90, available in sizes US 3-12. In recent years, K-Swiss has strategically enhanced its presence in the tennis industry with several key initiatives.

Tennis Shoes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Playing Surfaces Covered | Hard Court Tennis Shoes, Clay Court Tennis Shoes and Grass Court Tennis Shoes |

| Applications Covered | Men, Women and Kids |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, ANTA Sports Products Limited, ASICS Corporation, Babolat, Diadora S.p.A. (Geox S.p.a), FILA Holdings Corp., Lotto Sport Italia S.p.A., Mizuno Corporation, New Balance Inc., Nike Inc., Reebok International Limited (Authentic Brands Group LLC), Xtep International Holdings Limited, Yonex Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, tennis shoes market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tennis shoes market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tennis shoes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tennis shoes market was valued at USD 2.48 Billion in 2024.

The tennis shoes market is projected to exhibit a CAGR of 2.41% during 2025-2033, reaching a value of USD 3.11 Billion by 2033.

The tennis shoes market is majorly driven by the increasing participation in tennis among individuals, the growing demand for lightweight and durable footwear, rising fitness trends, and continual advancements in shoe technology for enhanced performance and comfort.

North America currently dominates the tennis shoes market in 2024 with a significant share of 24%. The dominance is fueled by high tennis participation rates, advanced retail infrastructure, and strong consumer spending on sportswear.

Some of the major players in the tennis shoes market include Adidas AG, ANTA Sports Products Limited, ASICS Corporation, Babolat, Diadora S.p.A. (Geox S.p.a), FILA Holdings Corp., Lotto Sport Italia S.p.A., Mizuno Corporation, New Balance Inc., Nike Inc., Reebok International Limited (Authentic Brands Group LLC), Xtep International Holdings Limited, and Yonex Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)