Telerehabilitation Market Size, Share, Trends and Forecast by Component, Application, End User and Region, 2025-2033

Telerehabilitation Market Size and Trends:

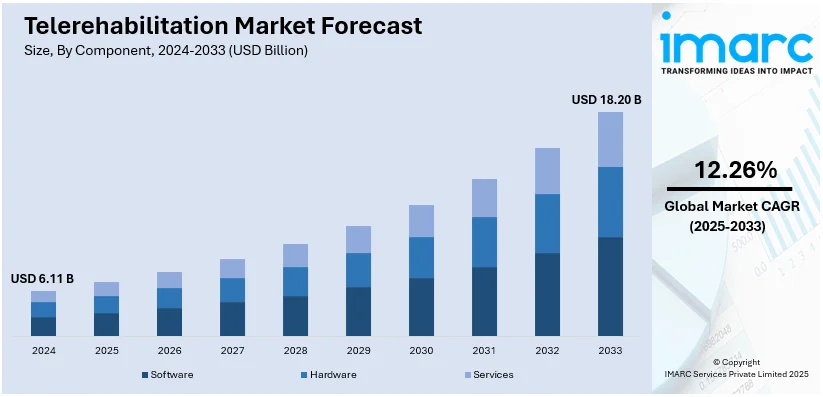

The global telerehabilitation market size reached USD 6.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.20 Billion by 2033, exhibiting a growth rate (CAGR) of 12.26% during 2025-2033. North America currently dominates the market, holding a significant market share of over 41.6% in 2024. The telerehabilitation market is witnessing significant demand due to the growing adoption of remote healthcare solutions, rising incidences of chronic diseases, and advancements in telecommunication technologies. Increasing focus on cost-effective and accessible rehabilitation services, especially for aging populations and patients in remote areas, further drives the market. The integration of artificial intelligence (AI) and wearable technologies is further improving patient engagement and recovery results.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.11 Billion |

|

Market Forecast in 2033

|

USD 18.20 Billion |

| Market Growth Rate (2025-2033) | 12.26% |

The market is primarily driven by the increasing prevalence of chronic diseases and physical disabilities, particularly among the aging population, which intensifies the demand for accessible and efficient rehabilitation services. Moreover, the widespread adoption of telehealth solutions is enabling healthcare providers to extend their reach, which is significantly contributing to market expansion. In addition to this, supportive government initiatives, such as reimbursement policies for telehealth services, are encouraging providers and patients to embrace telerehabilitation solutions. For instance, The TherapEase initiative, launched in December 2024, introduces a telerehabilitation platform leveraging artificial intelligence (AI) and computer vision to enhance physical rehabilitation. This innovative solution enables patients to perform therapeutic exercises at home while ensuring real-time feedback and personalized care. Aided by the COMPETE 2030 programme, it aims to improve accessibility, efficiency, and sustainability in healthcare, aligning with global digital health strategies.

The market in the United States is experiencing significant growth, fueled by a combination of technological advancements and demographic trends. Additionally, the increasing penetration of high-speed internet and the widespread adoption of smartphones and connected devices are enabling seamless virtual rehabilitation services, which is providing a boost to market growth. Furthermore, regulatory support and guidelines by the government are facilitating the overall market expansion. For example, on March 22, 2024, the American Physical Therapy Association (APTA) introduced its first clinical practice guideline (CPG) focused on telerehabilitation. This guideline provides evidence-based strategies for physical therapists and assistants to maximize the effectiveness of telehealth services while addressing policymaker and payer requirements. The recommendations stem from a review of 487 studies on telerehabilitation (2010–2022), narrowed to 45 randomized controlled trials, systematic reviews, comparative, and qualitative studies meeting inclusion criteria. It underscores the growing importance of telerehabilitation in delivering efficient, accessible patient care. Besides this, the growing focus on value-based healthcare in the U.S. is prompting providers to adopt solutions that improve outcomes while reducing costs, thereby making telerehabilitation an attractive option. In line with this, increasing awareness of the benefits of telerehabilitation among both patients and healthcare professionals has driven its integration into mainstream healthcare, particularly in areas like post-operative care and pediatric therapy.

Telerehabilitation Market Trends:

Increasing Prevalence of Chronic Diseases and Disabilities

The increasing incidences of chronic illnesses and disabilities are propelling the telerehabilitation market growth. In 2023, it was estimated that over 1.7 billion individuals worldwide suffered from a musculoskeletal disorder or handicap as per data by World Health Organization, many of whom needed ongoing rehabilitation care. There is a need for continuous rehabilitation in cases of chronic diseases such as stroke, which is the second leading cause of death globally, and cardiovascular disorders that have a reported 523 million patients world over by Harvard. Telerehabilitation is an affordable and easily accessible tool for people living in inaccessible, remote locations with far limited conventional rehabilitation facilities. These further fuels the need for home-based rehabilitation services because around 42% of persons in the United States have two or more chronic diseases, according to Centre for Disease Control and Prevention data.

Advancements in Telecommunication and Digital Technologies

Continual technological advancements in digital health platforms and telecommunications are enhancing the telerehabilitation market outlook. There are over 6.8 Billion smartphone users around the globe as of 2023, and reports claim that mobile health applications are quite common. Broadband has enabled high-speed internet access to over half of the global population, and it supports video consultations that run smoothly, and real-time monitoring. It facilitates activity monitoring, heart rate and gait pattern analysis, which are indispensable for most telerehabilitation programs. Also, it involves wearable technologies, such as smart watches and fitness tracking devices. Through artificial intelligence (AI) powered therapy as well as other virtual reality (VR) supported rehabilitative instruments, patient participation and efficacy is being elevated, which is supporting the growth of the market.

Rising Demand for Remote Healthcare Post-COVID-19

Patient preferences are shifting with the COVID-19 epidemic and there is an increased adoption of telehealth services which is leading to telerehabilitation market demand. According to data from Journal of Medical Internet Research, Telehealth usage jumped by over 300% during the pandemic, due to its safety and convenience. For routine follow-ups, including rehabilitation sessions, nearly half of patients preferred virtual care, according to a 2023 poll. In addition to this, age-related conditions such as Parkinson's disease and arthritis require continued rehabilitation support as the population is ageing, and according to the data by World Health Organization, this population is projected to double to 2.1 billion people aged 60 and older by 2050. The increasing population is addressed through remote rehabilitation programs, which reduce travel demands and disruptions in treatment continuity, especially for homebound or mobility-limited patients.

Telerehabilitation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telerehabilitation market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, application, and end user.

Analysis by Component:

- Software

- Hardware

- Services

Software leads the market with around 60.0% of market share in 2024. Software makes it possible to conduct tele-treatment activities via applications and platforms that allow video conferencing, virtual reality (VR), data tracking, and interactive exercises. Most advanced software possesses the ability to provide features like monitoring, personalized treatment plans driven by artificial intelligence (AI), and analysis of progress in rehabilitation programs. With the increased need for telemedicine services, especially in post-acute care and physical therapy, software helps to ensure patients have continuous care. It also helps providers manage more patients by reducing costs and improving outcomes. Its adaptability to diverse needs underlines its pivotal role in shaping the future of telerehabilitation services.

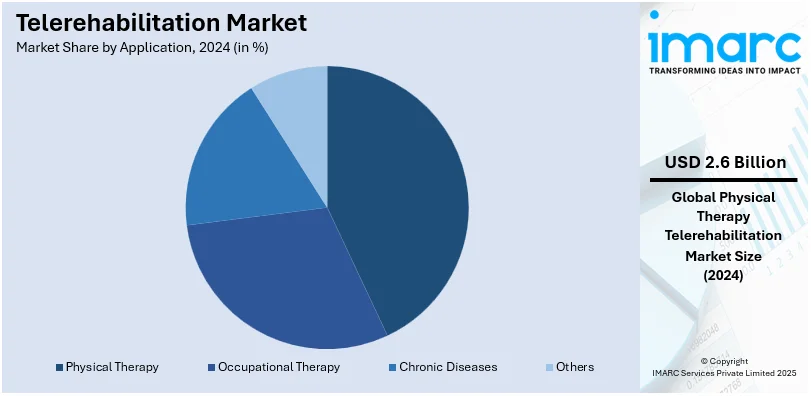

Analysis by Application:

- Occupational Therapy

- Physical Therapy

- Chronic Diseases

- Others

Physical therapy leads the market with around 42.2% of market share in 2024 due to the growing demand for accessible and efficient rehabilitation services. Patients can access guided therapy sessions, exercise routines, and professional evaluations through virtual platforms. This approach benefits people recovering from injuries, surgeries, or chronic conditions such as arthritis and stroke. Advanced tools, including motion-tracking technology and artificial intelligence (AI) based analytics, increase the accuracy of therapy plans by evaluating movements and offering real-time feedback. Telerehabilitation in physical therapy also helps to bridge the gap for patients in rural or underserved areas to ensure equitable access to care. It improves adherence to rehabilitation programs by reducing travel and enabling flexible scheduling, thus leading to better health outcomes.

Analysis by End User:

- Healthcare Providers

- Homecare

Based on the telerehabilitation market trends, home care leads the market in 2024 due to a shift towards patient-centric care and convenience. Telerehabilitation allows patients to access therapy sessions and recovery programs from the comfort of their homes, making it an ideal solution for people with mobility challenges or those living in remote areas. It reduces repeated hospital visits, thereby saving time and cost associated with them, and promotes compliance with the established exercise programs and regimens. For caregivers and family members, telerehabilitation services further increase involvement in the care of the patient, thus improving patient participation and support. More advanced devices, wearable sensors, and mobile applications ensure real-time tracking and monitoring alongside offering instant feedback for these interventions.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.6%. North America is a significant player in the telerehabilitation market, driven by advanced healthcare infrastructure, high digital adoption rates, and supportive regulatory frameworks. The region has high technological innovation due to the utilization of telemedicine platforms and other connected devices to provide remote rehabilitation services. There are various contributing factors, such as an aging population, increased cases of chronic diseases, and the increased demand for care at home, which boost this market. The region experiences a significant rise in investments in telehealth technology. Also, with reimbursement policies being supportive, more healthcare providers tend to opt for telerehabilitation. Additionally, North America's robust internet connectivity and high smartphone penetration enable seamless delivery of virtual rehabilitation programs.

Key Regional Takeaways:

United States Telerehabilitation Market Analysis

As per the telerehabilitation market forecast, the United States is a significant region in the North America industry, with a market share of 70.10%. Some of the drivers for the telerehabilitation industry in the United States are increasing healthcare costs, an aging population, and enhancement in the technology of telemedicine. In 2023, the U.S. Census Bureau estimated that 17% of the population was 65 years of age or older. This demographic is most susceptible to conditions that require rehabilitation, such as musculoskeletal disorders, arthritis, and stroke. Media reports have indicated that 30 million Americans are diagnosed with diabetes, making the growing number of chronic illnesses require distant care options. The federal programs that support the use of telerehabilitation platforms include Medicare reimbursement for telehealth services. Media reports have placed over 3.5 million sports-related injuries per year that create an upsurge of remote physical treatment solutions. Because services reach out to millions of veterans in isolated regions, the U.S. Department of Veterans Affairs has been at the forefront of promoting telerehabilitation. Other key factors supporting this market expansion are the strategic collaborations between companies such as Teladoc Health, which work towards forming AI-enabled systems with its health providers, thereby leading to improvement in patient care.

Europe Telerehabilitation Market Analysis

The major drivers of the telerehabilitation market in Europe are a well-established healthcare system and an aging population. As of 2023, nearly 21% of Europeans were 65 years of age or older, according to the data from the European Commission, with the biggest percentages seen in nations like Greece, Germany, and Italy. The need for such remote rehabilitation services has increased lately due to chronic ailments, including orthopedic disorders and cardiovascular diseases, the latter affecting as many as 60 million Europeans every year, according to data from the World Heart Federation. The European Union's eHealth Action Plan, with the promotion of the use of digital healthcare technologies, is supporting the growth of the market. Some of the leading countries implementing telehealth include the UK and Sweden, aided by government funding and public-private partnerships. These countries allow healthcare providers to recover expenses for services such as telerehabilitation platforms and other digital health solutions implemented under Germany's Digital Healthcare Act. The region further suffers from the rising figure of workplace injury; over 3 million accidents happen every year, which are reported as non-fatal. According to the European Commission, virtual reality, among the high technologies available, is increasingly adopted within rehabilitation schemes in Europe.

Asia Pacific Telerehabilitation Market Analysis

The telerehabilitation market share is expanding in Asia-Pacific due to the growing burden of chronic illnesses and the difficulties in accessing healthcare in rural areas. As per reports, more than 60% of people with diabetes worldwide live in this region, with China and India having the highest rates. According to data from the National Institute of Health. There is a need for telerehabilitation solutions because of the increasing number of stroke cases, particularly in Japan, where over 9-10 million people are expected to suffer from strokes each year. To fill the gap in healthcare between rural and urban regions, governments in countries such as Indonesia and India are investing heavily in telehealth infrastructure. For example, India's Ayushman Bharat scheme has integrated telemedicine facilities, thereby making remote rehabilitation more accessible. The expanding middle class, coupled with more than 80% smartphone penetration rates in cities, as per reports, encourages the use of the telerehabilitation platform. Wearable technology and apps for physical therapy are also increasing in popularity with modernization trends around the world, especially in a country like South Korea, where technological advancements are a trend. The5G technology deployment in most of the region further enhances the feasibility of real-time telerehabilitation services.

Latin America Telerehabilitation Market Analysis

The increasing incidence of chronic illnesses and the urgency of reducing healthcare disparities in this region serve as a propeller for the telerehabilitation market in Latin America. Both Brazil and Mexico, with the backing of public initiatives and private sector funding, have become the model to be followed for the adaptation of telehealth technologies. For instance, in 2022, Brazil initiated the "Digital Health Strategy," promoting telemedicine platforms. More than 50 million people in Latin America are suffering from musculoskeletal problems, according to research papers, and this calls for rehabilitation treatments. Digital healthcare technologies are gaining immense popularity with the growing middle class of the region, which constitutes more than 35% of the population, according to reports. The increasing incidence of sports injuries is also another factor that calls for remote physiotherapy treatments. As per reports, nearly 70% of people have internet access, and the increase in internet connectivity has made it easy for telerehabilitation platforms to grow. Collaboration between local organizations and international healthcare providers is also helping in creating solutions tailored to a given location, which is providing a boost to market growth.

Middle East and Africa Telerehabilitation Market Analysis

The growth of the telerehabilitation industry in the Middle East and Africa is being driven by urbanization, increasing investments in digital health infrastructure, and growing healthcare demands. Rehabilitation treatments are in high demand due to chronic diseases like diabetes, which affects nearly 25% of adults in the Gulf Cooperation Council (GCC) countries, as per reports. Telemedicine is gaining top priority through programs like Vision 2030 in Saudi Arabia and the UAE Health Strategy 2021 from the UAE, as these nations have set it as one of their prime concerns. Over 90% of people in cities of GCC are smartphone owners; hence, mobile health solutions usage is growing there. Telemedicine services, typically supported by NGOs and multilateral organizations, are helping to alleviate the problem of the limited availability of medical facilities in rural Africa. The rising 4G and 5G coverage in the region has made real-time telerehabilitation services now feasible. The market is also fueled by the increasing rate of road accidents, which have been identified as a leading source of disability in the region.

Competitive Landscape:

The telerehabilitation market is highly competitive, driven by innovative telehealth platforms and advanced rehabilitation technologies. Players in the market focus on enhancing user experience through artificial intelligence (AI) powered solutions, virtual reality (VR) integration, and real-time patient monitoring. Increasing partnerships with healthcare providers and expansion into untapped regions further fuel the competition. Regulatory compliance and data security remain critical priorities, shaping technological advancement and service offerings. The market competition is further characterized by increasing research and development (R&D) activities in responding to the diverse needs of patients; these include post-operative care or chronic disease management. Emphasis on cost-efficient solutions and individually tailored rehabilitation programs amplify competition.

The report provides a comprehensive analysis of the competitive landscape in the telerehabilitation market with detailed profiles of all major companies, including:

- American Well Corporation

- Care Innovations LLC

- Cisco Systems Inc.

- Hinge Health Inc.

- Humanus Corporation

- Included Health Inc.

- Jintronix.

- Koninklijike Philips N.V

- Neorehab

- NeuroTechR3 Inc.

Recent Developments:

- October 2024: At Ahmedabad's Sola Civil Hospital, Union Health Minister of India inaugurated the nation's first tele-rehabilitation centre. Children who get cochlear implants will receive assistance from the Tele-Rehabilitation Centre throughout their speech therapy sessions at District Early Intervention Centres (DEIC).

- June 2024: Digital Health Acquisition Corp. made a calculated decision to improve telehealth services, including telerehabilitation options, by completing its business combination with VSee Health, Inc.

Telerehabilitation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Applicatios Covered | Occupational Therapy, Physical Therapy, Chronic Diseases, Others |

| End Users Covered | Healthcare Providers, Homecare |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Well Corporation, Care Innovations LLC, Cisco Systems Inc., Hinge Health Inc., Humanus Corporation, Included Health Inc., Jintronix., Koninklijike Philips N.V, Neorehab, NeuroTechR3 Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, telerehabilitation market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global telerehabilitation market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telerehabilitation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telerehabilitation market was valued at USD 6.11 Billion in 2024.

The telerehabilitation market is projected to exhibit a CAGR of 12.26% during 2025-2033, reaching a value of USD 18.20 Billion by 2033.

The telerehabilitation market is driven by the rising prevalence of chronic conditions, advancements in telecommunication technology, growing adoption of virtual healthcare post-pandemic, and cost-effectiveness compared to traditional rehabilitation methods.

North America currently dominates the telerehabilitation market, accounting for a share of 41.6% in 2024. The dominance is fueled by widespread technology adoption, robust healthcare infrastructure, and increasing investment in telehealth services.

Some of the major players in the telerehabilitation market include American Well Corporation, Care Innovations LLC, Cisco Systems Inc., Hinge Health Inc., Humanus Corporation, Included Health Inc., Jintronix., Koninklijike Philips N.V, Neorehab, and NeuroTechR3 Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)