Telecom Power Systems Market Size, Share, Trends and Forecast Product Type, Component, Power Source, Grid Type, and Region, 2025-2033

Telecom Power Systems Market Size and Share:

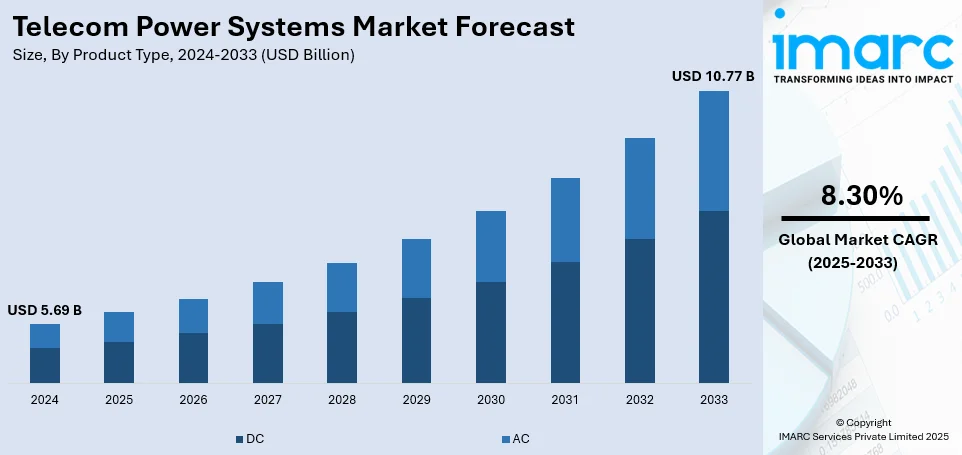

The global telecom power systems market size was valued at USD 5.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.77 Billion by 2033, exhibiting a CAGR of 8.30% during 2025-2033. North America currently dominates the market, holding 35.7% of the market share in 2024. The market is driven by the growing number of smart cities, as they leverage telecom power systems for data management, energy efficiency, and overall sustainability, increasing reliance on 5G technology, and rising adoption of green power.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.69 Billion |

| Market Forecast in 2033 | USD 10.77 Billion |

| Market Growth Rate (2025-2033) | 8.30% |

The global market is primarily driven by the growing demand for reliable energy solutions in the telecommunication sector due to the constant expansion of mobile network infrastructure. Furthermore, the rapid growth of advanced technologies such as 5G is raising the demand for strong power systems that ensure uninterrupted connectivity and thereby drives the growth of the market. In addition, the growing investments in rural telecommunication networks to bridge the digital divide are furthering the growth of the market. Additionally, the increasing interest in renewable energy sources for telecom power systems is boosting sustainability and driving the industry forward. In addition to this, the growing attention towards reducing operational expenses helps in the adoption of energy-efficient telecom power systems by providing cost-effective solutions to the market.

The United States stands out as a key regional market, driven by the widespread expansion of data centers in the country due to the increasing usage of cloud-based services. This, in turn, is creating a continuous requirement for efficient power systems. The rising adoption of hybrid power system, which integrates renewable sources with conventional energy sources for better efficiency, is another factor facilitating improved efficiency and acting as a significant market driver for the US. Furthermore, the increasing number of mutual collaborations between telecom operators and power system providers across the United States are providing a boost to the market.

Telecom Power Systems Market Trends:

Rising Trend of Smart Cities

According to the IMARC Group’s report, the global smart cities market reached USD 1,233.7 Billion in 2023. Smart cities incorporate the use of connected devices, sensors and data platforms in their functional models. This necessitates robust telecom infrastructure, including reliable power systems, to support seamless connectivity and data transmission. In addition, smart cities deploy extensive networks of IoT devices and sensors for various applications, such as traffic management, waste management, smart lighting, and environmental monitoring. These devices require constant connectivity, which, in turn, requires dependable telecom power systems. In addition, telecom power systems are a critical component that provides power to these networks to ensure their availability to serve the traffic demands.

Growing 5G connections

5G networks require the deployment of more small cells and base stations to support high-speed and low latency connections. Such expansion requires the installation of more telecom power systems to cater to the increasing number of network nodes. Moreover, 5G technology dissipates more power per data unit than previous generations owing to high frequency and increased processing demands. Telecom power systems are designed to address these higher energy requirements efficiently. Apart from this, various telecom operators are investing to transform the legacy infrastructure and build new infrastructure for 5G, which encompasses investing in better power systems for fulfilling new demands and reliability standards of 5G networks, thereby propelling the telecom power systems market revenue. As per an article published on the website of the National Telecommunications and Information Administration U.S. Department of Commerce in 2023, the global 5G connections are forecasted to reach 5.9 billion by the end of 2027.

Increasing Adoption of Green Power

Rising regulatory pressure to reduce carbon emissions and promote sustainability is encouraging telecom operators to adopt green power solutions, which, in turn, is driving the demand for telecom power systems that incorporate renewable energy sources, supporting compliance with environmental rules. Furthermore, renewable green power solutions like solar and wind power, offer long-term cost savings compared to traditional fossil fuel-based power generation. Telecom operators are motivated to invest in green power systems to lower operational costs and improve overall energy efficiency. Besides this, most telecom operators are focused on implementing CSR strategies aimed at making minimal environmental impact. Some of these initiatives include embracing green power systems for telecom infrastructure, which, in turn, fosters corporate image and stakeholder management. The IMARC Group’s report shows that the global green power market is expected to reach USD 160.7 Billion by 2032.

Telecom Power Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our telecom power systems market report has categorized the market based on product type, component, power source, and grid type.

Analysis by Product Type:

- DC

- AC

DC leads the market with around 62.3% of market share in 2024. DC systems are easily adaptable to renewable energy supplies, such as solar panels and windmills, to minimize operating expenses and adverse effects on the environment. Additionally, DC systems have lower energy losses than AC systems, thus making them more suitable to be installed in remote or off-grid locations, where telecom towers are often situated. In line with this, DC power systems are less complex in structure with fewer components prone to failure, thereby reducing maintenance requirements and downtime.

Analysis by Component:

- Rectifiers

- Converters

- Controllers

- Heat Management Systems

- Generators

- Others

Generator leads the market share in 2024. Generators are regarded as invaluable component to telecom structure due to the need for constant power to maintain the connectivity and functionality of structures. They act as a standby power source when the mains electricity is unavailable, essential in areas with poor or unreliable power grid infrastructure. Their ability to work in the fluctuating environments also strengthens their position in the market as they address different geographical and operational requirements of the telecom networks across the globe, thereby supporting the telecom power systems market growth.

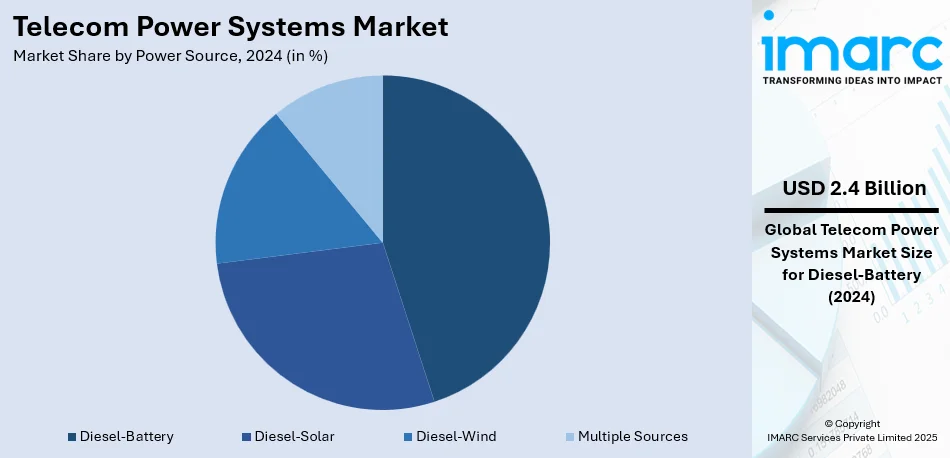

Analysis by Power Source:

- Diesel-Battery

- Diesel-Solar

- Diesel-Wind

- Multiple Sources

Diesel-battery leads the market share with 42.8% of the market share in 2024. Diesel-battery generators offer a strong solution, capable of generating vast amounts of power consistently. They serve as a primary source of energy, especially in regions with unreliable grid infrastructure or frequent power outages. Moreover, diesel generators can quickly respond to sudden increases in power demand, ensuring stability during peak usage periods. The integration of batteries complements this setup by providing backup power during generator startup times or as a temporary power source during fueling intervals, thereby bolstering the telecom power systems demand.

Analysis by Grid Type:

- On Grid

- Off Grid

- Bad Grid

Bad grid leads the market, with 38.7% of the market share in 2024. Numerous regions, especially in developing countries or remote areas, struggle with unreliable or unstable electricity grids. These grids may suffer from frequent power outages, voltage fluctuations, or inadequate infrastructure, making them unsuitable for powering critical telecom equipment consistently. As a result, telecom operators and infrastructure providers opt for alternative power solutions that can guarantee uninterrupted power supply, namely battery-assisted direct (BAD) current grids such as diesel generators, hybrid power systems, or fuel cells. These solutions are essential for maintaining the reliability and availability of telecom services, ensuring seamless communication even in areas with unreliable grid infrastructure.

Regional Analysis:

- North America

- Asia-Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share with 35.7%. North America emphasis on technological innovations and sustainability that accelerate the adoption of modern telecom power solutions, such as renewable energy-powered systems and energy-efficient technologies. Moreover, 5G networks in Mexico are designed to deliver significantly higher data speeds, lower latency, and enhanced connectivity, catering to an increasing demand for advanced telecommunications services. This technological advancement prompts telecom operators to invest in modern power solutions that can efficiently handle the increasing energy demands. An article published in 2023 on the website of the International Trade Administration (ITA) shows that 5G network is expected to account for around 43 percent in Mexico by 2032.

Key Regional Takeaways:

United States Telecom Power Systems Market Analysis

In 2024, the US accounted for around 84.40% of the total North America telecom power systems market. The US market size is increasing steadily due to the growing need for more reliable telecommunication infrastructure. According to the US Federal Communications Commission, the revenue generated by the telecom industry in 2023 exceeded USD 133 Billion, with much of it invested in the development of new networks and their respective power systems. More power systems will be required to make the 5G rollout efficient and sustainable. Leaders in this innovation include giants such as Caterpillar and Schneider Electric in power backup and energy efficiency. In fact, the growth is driven through the adoption of renewable sources of energy in telecom towers - solar-powered. Government policy focusing on broadband improvement in the countryside further fuels the demand for telecom power systems.

Europe Telecom Power Systems Market Analysis

Growth is experienced in the telecom power systems market in Europe as investment into network upgrades and sustainable energy solutions increases. According to a report on the EU's digital progress, telecommunications companies have been investing an average of EUR 50 Billion (USD 52.49 Billion) annually over the past decade to modernize networks and meet the growing demand for broadband-intensive digital services. This encompasses new technologies like 5G, IoT, and edge-cloud computing. In 2023, the EU was expected to cover an investment gap of over EUR 200 Billion (USD 209.96 Billion) to fulfil its 2030 Digital Decade connectivity objectives, and it highlights the significance of telecom infrastructure in improving economic growth and competitiveness. To achieve these, the investment has to be made in advanced fibre-based connectivity and 5G, along with a focus on sustainable market structures that motivate innovation for sustainable long-term viability of telecom power systems. Industry leaders Ericsson and Nokia are driving development efforts for the more efficient power system to facilitate 5G networks; this requires a supply of reliable power for high-demand services.

Asia Pacific Telecom Power Systems Market Analysis

The Asia Pacific telecom power systems market is growing rapidly, driven by technological advancements, and increasing demand for robust telecom and data center infrastructure. China's new pilot program, which allows 100% foreign ownership in data centers and value-added telecom services (VATS), directly impacts the telecom power systems market. The introduction of multinational companies such as Tesla and Apple to the market would see the rising need for telecom power systems. Telecom power systems will therefore be used more to serve the demands in high energy sectors that have come to incorporate cloud computing, artificial intelligence, and data storage. Expansion of data centers in key cities such as Beijing, Shanghai, Hainan, and Shenzhen will require state-of-the-art power solutions for uninterrupted service and to handle the energy-intensive nature of these facilities. This is in line with broader trends across the Asia Pacific region where the growing digital economy, the proliferation of telecom services, and advancements in 5G and AI are driving investments in reliable and efficient telecom power systems. There will be a growing need for power systems that support uninterrupted high-performance operation with minimum energy consumption for the telecom operators and data center providers as they scale up their infrastructure. The integration of renewable energy sources and smart grid technologies in telecom power systems is further going to support the region's pursuit towards sustainable and cost-effective energy solutions for both telecom and data sectors. In essence, the demand for telecom power systems in the Asia Pacific will be driven by China's opening up of its telecom and data sectors, as well as other regional efforts to modernize digital infrastructure.

Latin America Telecom Power Systems Market Analysis

The Latin American telecommunication market is expected to grow massively, with Brazil dominating the pack. According to International Trade Administration, in 2023, Brazil's telecom market is valued at USD 30.26 Billion and expected to increase to USD 40.82 Billion by 2028. With about 181 million internet users, Brazil ranks fifth in the world's digital population. Digitalization is further fast paced through the introduction of 5G, which will now have an impetus thanks to a USD 8.5 Billion spectrum auction estimated to give the economy an impact up to USD 1.2 Trillion in 2035, as per an industry report. Development and installation of 5G is predicted to spur developments involving Artificial Intelligence, big data, Cloud computing, Augmented reality and the Internet of Things within each business arena. In addition to 5G, Brazil’s ongoing investment in data centers, which accounts for roughly 50% of the region’s total, reinforces its leadership in regional telecom development. These infrastructure improvements support connectivity expansion, enabling greater access to digital services and enhancing overall productivity in the region.

Middle East and Africa Telecom Power Systems Market Analysis

Expansion in the digital economy and developing infrastructures are seen to cause an immense growth momentum in Middle Eastern telecom power systems. Recent study reports that average share of digital economy in region's GDP accounts for about 4.1%, with certain countries having 8%. This increasingly digital economy would be calling for more need for demand of telecom infrastructures along with power systems. As broadband adoption increases, especially in mobile broadband, further economic growth is expected. According to Internet Society, a 1% increase in mobile broadband adoption can increase GDP by 0.15%. Fiber-to-the-home (FTTH) deployments are going on at a fast pace in the UAE and Qatar, and nearly complete coverage is there in the nation, which improves telecom infrastructure to a great extent. Other countries, such as Egypt and Lebanon, have ambitious plans for broadband access expansion. For example, Telecom Egypt aims to provide 100% FTTC by mid-2020. In this regard, the need for reliable power systems to support an increased load from telecom networks further drives market growth in the region. Telecom operators in the Middle East are increasingly turning to renewable energy solutions and energy-efficient power systems to meet the growing demand for telecom services and reduce environmental impact.

Competitive Landscape:

The competitive landscape of the telecom power systems market is characterized by continuous innovations and the adoption of advanced technologies to meet the rising demand for energy-efficient solutions. Companies are investing in extensive research and development to introduce sustainable power systems tailored to evolving telecom infrastructure requirements. The market is witnessing intense competition, driven by increasing network expansions, the rollout of 5G, and the growing focus on renewable energy integration. Additionally, partnerships and strategic collaborations are emerging as key strategies to strengthen market presence and address diverse customer needs globally.

The report provides a comprehensive analysis of the competitive landscape in the telecom power systems market with detailed profiles of all major companies, including:

- Delta Electronics Inc.

- Eaton Corporation plc

- ABB Ltd.

- Huawei Technologies Co. Ltd.

- Schneider Electric SE

- Vertiv Group Corporation

- Cummins Inc.

- Myers Power Products Inc.

- Ascot Industrial S.r.l.

- Unipower

Recent Developments:

- November 2024: ACES and Radisys announced that they signed a Memorandum of Understanding (MOU) to co-develop 5G ORAN and Small Cell technologies. The collaboration centers on scalable 5G solutions for the Saudi and international markets, with a joint lab dedicated to testing and refinement of software. This goes in line with Saudi Vision 2030, to improve connectivity and network flexibility through open, interoperable telecom solutions.

- October 2024: Vertiv announced that they have signed a service provider agreement with the Sri Lankan engineering company VMJ Lanka. Through this deal, VMJ Lanka will provide authorized services for Vertiv's AC and DC power systems, increasing the support to the critical infrastructure in Sri Lanka. It focuses on offering quality service with technical know-how.

- June 2024: Huawei and the International Union for Conservation of Nature (IUCN) jointly hosted the 2024 Tech4Nature summit to promote innovation in information and communication technology (ICT) and nature conservation sectors.

- May 2024: Delta Electronics Inc., a global leader in power management and a provider of IoT-based smart green solutions, demonstrated its unique capabilities to enhance energy efficiency, cooling, and ICT infrastructure solutions for cloud to edge AI data centres at COMPUTEX TAIPEI 2024.

Telecom Power Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | DC, AC |

| Components Covered | Rectifiers, Converters, Controllers, Heat Management Systems, Generators, Others |

| Power Sources Covered | Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources |

| Grid Types Covered | On Grid, Off Grid, Bad Grid |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Delta Electronics Inc., Eaton Corporation plc, ABB Ltd., Huawei Technologies Co. Ltd., Schneider Electric SE, Vertiv Group Corporation, Cummins Inc., Myers Power Products Inc., Ascot Industrial S.r.l., Unipower, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom power systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global telecom power systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the telecom power systems industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Telecom power systems are energy solutions designed to supply consistent and reliable power to telecommunications infrastructure, including cell towers, data centers, and network equipment, ensuring seamless connectivity and functionality even in challenging conditions.

The telecom power systems market was valued at USD 5.69 Billion in 2024.

IMARC estimates the global Telecom power systems Market to exhibit a CAGR of 8.30% during 2025-2033.

The market is primarily driven by the rapid expansion of mobile networks, the adoption of 5G technology, increasing investments in rural telecom, and the shift towards renewable energy-based solutions for sustainability and cost efficiency.

In 2024, DC power systems represented the largest segment by product type, driven by their adaptability to renewable energy and efficiency in off-grid locations.

Generator leads the market share in 2024 since act as a standby power source when the mains electricity is unavailable, extremely essential in areas with poor or unreliable power grid infrastructure.

Diesel-battery systems lead the market by power source owing to their reliability in regions with unstable grids and ability to handle sudden power demands efficiently.

The bad grid is the leading segment by grid type, driven by the need for reliable alternatives in regions with inconsistent electricity supply.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global telecom power systems market include Delta Electronics Inc., Eaton Corporation plc, ABB Ltd., Huawei Technologies Co. Ltd., Schneider Electric SE, Vertiv Group Corporation, Cummins Inc., Myers Power Products Inc., Ascot Industrial S.r.l., and Unipower, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)