Telecom Network Management System Market Size, Share, Trends and Forecast by Component, Organization Size, Deployment Type, Vertical, and Region, 2025-2033

Telecom Network Management System Market Size and Share:

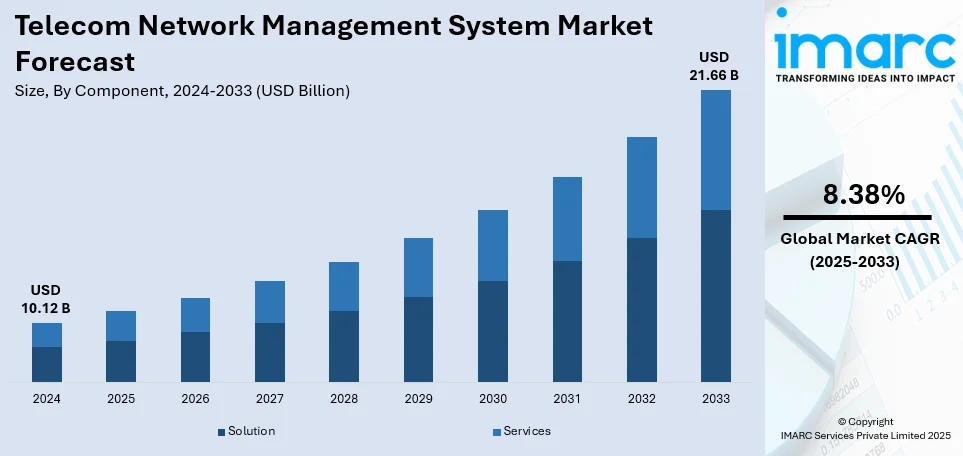

The global telecom network management system market size was valued at USD 10.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.66 Billion by 2033, exhibiting a CAGR of 8.38% during 2025-2033. North America currently dominates the market, holding a significant market share of 33.2% in 2024. The increasing demand for bandwidth optimization due to rising data traffic, real-time network monitoring and artificial intelligence (AI)-driven traffic management are propelling the market growth. Besides this, telecom network management system market share is driven by expanding 5G, Internet of Things (IoT), and cloud adoption requiring scalable and automated systems to prevent congestion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.12 Billion |

|

Market Forecast in 2033

|

USD 21.66 Billion |

| Market Growth Rate (2025-2033) | 8.38% |

The expansion of 5G, IoT, and cloud services generates massive amounts of data daily. Telecom operators require advanced solutions to manage bandwidth, optimize traffic flow, and prevent congestion. AI-driven analytics provide real-time insights, enabling predictive maintenance and proactive network issue resolution. Increasing connected devices compel telecom providers to enhance network monitoring and traffic management capabilities. Data-intensive applications like video streaming, gaming, and remote work drive network optimization requirements. Telecom companies are investing in scalable network management tools to accommodate growing data loads effectively. Real-time monitoring solutions improve network visibility, helping providers enhance service quality and reliability. Cybersecurity threats require robust data traffic management solutions to ensure secure data transmission. Regulatory compliance mandates encourage telecom firms to implement advanced network monitoring and security protocols. Network virtualization solutions improve scalability, enabling telecom operators to manage fluctuating data demands efficiently.

5G deployment is driving the United States telecom network management system market demand due to the increasing need for advanced monitoring solutions. Telecom operators require intelligent network management tools to handle high-speed, low latency 5G infrastructure efficiently. Real-time analytics optimize bandwidth allocation, ensuring seamless data transmission across expanding 5G networks. AI-driven automation improves network efficiency, reducing downtime and optimizing resource utilization. Rising mobile data usage necessitates scalable telecom management solutions for uninterrupted connectivity and performance. 5G-enabled IoT applications encourage telecom providers to invest in robust network monitoring and control systems. Edge computing expansion with 5G strengthens demand for real-time network analytics and security solutions. For instance, in February 2025, UScellular collaborated with Samsung to upgrade its 5G network in the Mid-Atlantic region. The deployment features Samsung’s 5G mmWave technology and virtualized Radio Access Network (vRAN) solutions. Compact Macro units, integrating baseband, radio, and antenna, enable fast installation. Operating on 28GHz and 39GHz bands, the upgrade enhances speed, latency, bandwidth, and energy efficiency. Moreover, telecom firms integrate SDN and NFV to enhance 5G network flexibility, scalability, and operational efficiency. Regulatory compliance mandates encourage telecom companies to adopt reliable 5G network management tools. Increased cybersecurity risks in 5G networks drive adoption of advanced security and threat detection solutions.

Telecom Network Management System Market Trends:

Shift towards cloud-based solutions

Telecom network management system is widely used to enhance Quality of Service (QoS) and Quality of Experience (QoE) for optimizing business operations. Broadcom reports that 64% of network teams have integrated AI-driven management tools. Cloud-based platforms enable telecom operators to manage networks remotely, reducing infrastructure costs and operational complexities. Service providers deploy cloud-based network management systems for real-time monitoring, automation, and predictive analytics. Cloud solutions support seamless integration with existing telecom infrastructure, improving efficiency and performance optimization. Increasing adoption of 5G and IoT accelerates demand for cloud-based network management tools and services. Telecom providers leverage cloud platforms for centralized data storage, improving accessibility and network security measures. Cloud-based network solutions offer real-time updates, ensuring compliance with evolving regulatory frameworks and industry standards. Additionally, rising Internet Protocol (IP) and cloud traffic worldwide also contribute to market expansion. Service providers are developing cost-effective network management system solutions for network function virtualization, broadband networks, and network orchestration.

Integration of Internet of Things (IoT)

The integration of existing networks with the Internet of Things (IoT) is driving the market. The global IoT market size reached USD 1,022.6 billion in 2024, highlighting its expanding influence on telecom network management systems. Telecom providers manage massive IoT device connections, requiring advanced network monitoring and optimization solutions. IoT-driven industries depend on seamless data transmission, compelling telecom operators to enhance network efficiency. Real-time IoT data requires low-latency networks, encouraging investment in advanced network management tools. AI-driven analytics optimize IoT traffic, improving bandwidth allocation and reducing network congestion. Smart cities and industrial IoT deployments demand robust telecom infrastructure with efficient network monitoring solutions. Telecom providers implement automation to manage IoT networks, ensuring seamless device connectivity and performance optimization. IoT sensors generate continuous data streams, necessitating intelligent network management for real-time processing. Predictive analytics in telecom networks helps prevent failures and ensures uninterrupted IoT device connectivity. Secure network management solutions are essential to protect IoT ecosystems from cyber threats and vulnerabilities.

Adoption of open RAN in 5G networks

Open RAN enables telecom operators to deploy vendor-neutral, interoperable network solutions, enhancing flexibility and cost-efficiency. The disaggregation of hardware and software allows for greater scalability and network optimization. AI-driven network management solutions are essential for monitoring, troubleshooting, and automating open RAN-based 5G deployments. Open RAN fosters competition among vendors, accelerating innovation in telecom network management technologies. The rise of cloud-native open RAN networks requires advanced management tools for seamless orchestration and automation. Telecom operators leverage open RAN to reduce dependency on proprietary solutions and lower capital expenditures. Network virtualization in open RAN-based 5G deployments increases the need for real-time monitoring and performance optimization. Government and regulatory support for open RAN adoption further fuels the market growth of intelligent network management solutions. Open RAN integration with edge computing enhances low-latency applications, requiring precise network control and optimization. Telecom providers require advanced security solutions to manage open RAN's distributed architecture effectively. In November 2024, Viettel introduced its in-house developed 5G Open RAN gNodeB, built in collaboration with Qualcomm. The initial rollout is active in Hanoi and Ha Nam provinces, with plans to deploy over 300 Open RAN sites by Q1 2025 and expand further across Vietnam and globally. The system leverages Qualcomm’s X100 5G RAN Accelerator Card and QRU100 5G RAN Platform, enhancing network capacity, performance, and energy efficiency.

Telecom Network Management System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom network management system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, organization size, deployment type, and vertical.

Analysis by Component:

- Solution

- Configuration Management

- Performance Management

- Security Management

- Fault Management

- Others

- Services

- Consulting

- Deployment and Integration

- Training, Support and Maintenance

Solutions stand as the largest component in 2024, holding 68.85% of the market. Companies prioritize software solutions that optimize network performance, ensure security, and manage infrastructure efficiently. These solutions integrate AI-driven analytics, automation, and cloud computing for seamless monitoring and control. Telecom operators require advanced tools for fault detection, performance tracking, and resource allocation across networks. Rising adoption of SDN and NFV increases the need for robust network management solutions. Vendors develop scalable and flexible software platforms catering to growing data traffic and 5G expansion. Rising cybersecurity threats drive telecom providers to implement comprehensive security solutions for network protection. Cloud-based network management solutions enhance remote access, reducing operational costs and simplifying infrastructure management. The rapid deployment of IoT devices further necessitates efficient network control and optimization solutions. Software solutions enable real-time data analytics, improving decision-making and service reliability. Regulatory compliance requirements mandate advanced solutions to monitor network activities and prevent disruptions. Continuous technological advancements make solutions indispensable for achieving high network efficiency and customer satisfaction. The rise in digital transformation initiatives accelerates the demand for intelligent network management software.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises dominate the market with 53.7% of market share in 2024. They require sophisticated management solutions to handle complex, multi-region networks efficiently. These enterprises prioritize real-time monitoring, ensuring minimal downtime and uninterrupted connectivity. Significant investments in 5G, IoT, and cloud computing drive their need for advanced network management systems. Scalability and security concerns make large businesses opt for robust and comprehensive telecom network management solutions. Network automation and AI-driven analytics help large organizations streamline operations and optimize network performance. Compliance with stringent regulatory frameworks necessitates sophisticated management solutions for security, transparency, and efficiency. High-volume data traffic within large enterprises requires effective bandwidth management and performance optimization. These organizations rely on predictive maintenance and AI-driven fault detection for proactive issue resolution. Large enterprises often operate multi-vendor networks, demanding seamless integration and centralized control. Cost-saving initiatives encourage investments in network management solutions for efficiency and automation. Continuous expansion into global markets drives demand for scalable telecom network management systems. Partnerships with solution providers enable customized network management tailored to enterprise-specific needs. Large-scale digital transformation efforts further increase reliance on advanced network monitoring and automation tools.

Analysis by Deployment Type:

- On-premises

- Cloud-based

On-premises lead the market with 55.9% of market share in 2024. Organizations prefer on-premises solutions for complete control over network infrastructure and sensitive data. Telecom operators prioritize security, ensuring critical network data remains within their controlled environment. Regulatory compliance requirements compel companies to opt for on-premises network management solutions. High initial investment costs are justified by enhanced security, reliability, and customization capabilities. Large enterprises manage extensive infrastructure, requiring robust on-premises solutions for efficient monitoring and operations. Integration with existing legacy systems remains a key driver for on-premises deployment preference. Reduced dependency on external cloud providers enhances reliability, performance, and operational control. Telecom operators require real-time network visibility, making on-premises solutions the preferred choice. Many businesses prioritize long-term cost savings over the lower upfront costs of cloud-based alternatives. Data privacy concerns further reinforce on-premises deployment among telecom providers handling sensitive information. The ability to customize software functionalities makes on-premises deployment more attractive for large-scale operations.

Analysis by Vertical:

- IT and Telecom

- BFSI

- Government

- Manufacturing

- Healthcare

- Transportation and Logistics

- Retail

- Media and Communication

- Others

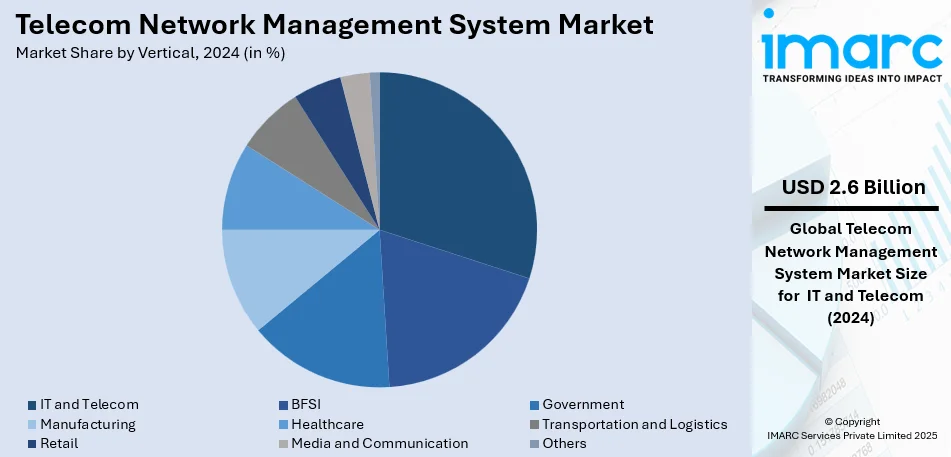

IT and telecom represent the largest market segment with 25.9% of market share in 2024. Telecom providers require network management solutions to ensure high performance, security, and seamless connectivity. The rise of 5G networks increases reliance on telecom network management solutions for efficiency and service optimization. IT companies prioritize network monitoring tools for uninterrupted data flow, cybersecurity, and digital operations. Increasing data traffic from cloud computing, IoT, and mobile networks strengthens demand for robust management systems. Telecom operators rely on network automation to lower operational costs and enhance service reliability. Real-time monitoring solutions enhance network security, reducing risks of cyberattacks and service disruptions. Growing investments in software-defined networking drive the need for scalable and intelligent network management. IT companies require efficient bandwidth management and performance optimization for smooth digital infrastructure operations. Telecom operators utilize AI-driven analytics for predictive maintenance and service quality improvements. Network congestion challenges encourage IT and telecom firms to adopt advanced traffic management solutions. Regulatory mandates for telecom service providers reinforce the adoption of compliant network monitoring tools.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 33.2%. High 5G adoption rates in the United States and Canada drive demand for network management solutions. Telecom operators invest significantly in AI-driven network optimization and predictive maintenance. The presence of major technology firms accelerates innovation and adoption of advanced management solutions. Strong regulatory frameworks enforce stringent network security, compliance, and performance monitoring requirements. Large enterprises in North America deploy sophisticated network management solutions for enhanced security and efficiency. Increasing IoT connectivity fuels demand for real-time network monitoring and automation tools. Cloud adoption across businesses strengthens the need for advanced telecom network management systems. Investment in SDN and NFV enhances network scalability, automation, and cost optimization strategies. The digital infrastructure initiatives in the US support network modernization and management technology adoption. Telecom operators prioritize cybersecurity solutions to prevent data breaches and service disruptions. Expansion of mobile networks and data centers reinforces the demand for intelligent management systems. As per the report published by the IMARC Group, the United States smartphone market size reached 154.3 Million Units in 2024. Moreover, North America’s highly competitive telecom sector drives continuous upgrades in network management technologies.

Key Regional Takeaways:

United States Telecom Network Management System Market Analysis

The United States hold 82.80% of the market share in North America. The US telecom network management system market growth is primarily influenced by the rapid implementation of 5G technologies and the increasing need for high-speed internet. As industries like healthcare, retail, and manufacturing undergo digital transformation, the need for efficient and scalable network infrastructures grows. The shift towards cloud-based solutions enhances flexibility, scalability, and cost-efficiency, promoting their adoption. Furthermore, the US is emerging as a leader in artificial intelligence (AI), with 4,633 AI startups from 2013 to 2022, including 524 new startups in 2022 alone, attracting USD 47 billion in non-governmental funding. This growth in AI innovation is significantly impacting the telecom sector, driving the integration of AI-powered automation and predictive analytics into network management system platforms. These technologies play a crucial role in optimizing network performance, lowering operational costs, and improving service delivery. Additionally, increasing concerns over cybersecurity encourages for the creation of more robust, real-time network monitoring and management systems. As mobile data traffic continues to surge, driven by growing demand and connected devices, telecom operators are increasingly adopting advanced network management system solutions to ensure seamless connectivity, minimize downtime, and deliver superior user experiences, which further propels the growth of the network management system market in the US.

Asia Pacific Telecom Network Management System Market Analysis

The Asia Pacific telecom market is expanding due to rapid technological advancements and growing telecom infrastructure. Countries like China and South Korea lead 5G adoption, with China exceeding 700 million 5G connections (41% of total) and South Korea reaching 31.3 million (48% of mobile connections), according to GSMA. Rising data traffic from IoT, smart technologies, and connected devices drives demand for network management system solutions. Governments in the region are investing heavily in digital transformation and smart city initiatives, accelerating the need for scalable, efficient telecom management. The complexity of managing multi-vendor, hybrid networks is pushing telecom operators toward AI-driven, automated network management system solutions. As 5G deployment continues, telecom providers are prioritizing real-time monitoring, predictive analytics, and network automation to optimize performance and reduce costs.

Europe Telecom Network Management System Market Analysis

The European market is growing due to 5G expansion and increasing demand for efficient network management. The EU’s digital agenda, focusing on connectivity and smart city initiatives, is accelerating network management system adoption. Telecom operators are adopting AI-driven automation and cloud-based solutions to enhance efficiency, minimize downtime, and deliver personalized services. In 2021, 29% of EU enterprises used IoT devices, primarily for security, highlighting the region’s growing reliance on connected technologies. Rising mobile data traffic, driven by increased connected devices and high-speed connectivity demand, necessitates advanced network management system solutions for managing complex telecom networks. Regulatory requirements like GDPR are compelling telecom firms to implement secure and scalable network management platforms. The adoption of Network Functions Virtualization (NFV) and Software-Defined Networking (SDN) is transforming telecom operations, requiring integrated, flexible solutions for seamless network management. These factors continue to drive Europe’s market expansion, reinforcing the need for automated, AI-powered telecom solutions.

Latin America Telecom Network Management System Market Analysis

The Latin America’s market for telecom network management system is expanding, driven by a rising mobile internet user base, projected to grow from 326 million (2018) to 422 million (2025). The region’s transition to 4G and 5G networks, alongside government-led digitalization initiatives, is accelerating network management system adoption. Increasing mobile data traffic is encouraging telecom operators to implement scalable, efficient, and cost-effective network management solutions. The growing need for enhanced network performance, reliability, and security further fuels market growth.

Middle East and Africa Telecom Network Management System Market Analysis

The market in the Middle East and Africa is expanding due to rapid 5G adoption and increasing telecom infrastructure investments. Saudi Arabia leads the region, surpassing 11.2 million 5G subscriptions by 2022, accounting for over 25% of the mobile sector. Rising mobile data usage and the demand for improved network performance and security are accelerating the adoption of advanced network management system solutions. Governments and telecom operators are investing in digital transformation initiatives, enhancing network efficiency and reliability. The region’s growing reliance on AI-driven automation and real-time monitoring solutions further fuels market growth. As telecom networks expand, the need for scalable, cost-effective, and automated network management system platforms continue to rise.

Competitive Landscape:

Key players are developing advanced solutions, integrating AI, automation, and cloud computing for seamless network performance and optimization. Companies focus on network function virtualization (NFV) and software-defined networking (SDN) to improve scalability, flexibility, and cost-effectiveness. Investment in 5G infrastructure and IoT-driven networks propels the demand for intelligent management solutions. Leading firms collaborate with telecom providers to offer customized network management services catering to specific operational requirements. Research and development (R&D) initiatives ensure continuous enhancement in security, reliability, and performance monitoring features. Expansion into emerging markets strengthens the presence of global network management solution providers. Strategic partnerships and acquisitions help companies broaden product portfolios and technological capabilities. For example, in May 2024, Dell Technologies and Ericsson have partnered strategically to support communications service providers (CSPs) in transitioning their radio access networks (RAN) to the cloud. The collaboration aims to help CSPs navigate network cloud and operations transformation, improving economics, agility, and reliability. Compliance with regulatory frameworks ensures robust network security and uninterrupted connectivity for telecom service providers.

The report provides a comprehensive analysis of the competitive landscape in the telecom network management system market with detailed profiles of all major companies, including:

- BMC Software Inc. (KKR and Co. Inc.)

- CA Inc. (Broadcom Inc.)

- Cisco Systems Inc.

- Dell Technologies Inc.

- Ericsson AB

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Juniper Networks Inc.

- NETSCOUT Systems Inc.

- Nokia Oyj

- Oracle Corporation

- Paessler AG

- Riverbed Technology Inc. (Thoma Bravo LLC)

- SolarWinds Corporation (Thoma Bravo LLC and Silver Lake)

- VIAVI Solutions Inc.

- ZTE Corporation

Latest News and Developments:

- September 2024: Airtel Business, the B2B division of Bharti Airtel, partnered with Cisco to introduce Airtel Software-Defined (SD) Branch, a cloud-based, fully managed network solution for enterprises. Powered by Cisco Meraki’s cloud-first platform, it provides centralized management of LAN, WAN, security, and connectivity across multiple branch locations. The solution enhances network efficiency, application performance, and operational flexibility, simplifying enterprise network management.

- July 2024: ZTE launched the Nebula Telecom Large Model to advance the development of highly autonomous networks. This system integrates model, platform, and applications, enabling cross-domain and single-domain collaboration through AI agents. It shifts network operations from “human+machine” to “machine+human”, enhancing automation and transforming telecom network management.

- February 2023: Huawei introduced its Digital Managed Network Solution to enhance carriers' B2B services and drive digital transformation, at MWC Barcelona 2023. The solution enables carriers to transition from Internet Service Providers (ISPs) to Managed Service Providers (MSPs) by offering Managed LAN, WAN, security, and Data Center Networking (DCN). As enterprise digitalization accelerates, SMEs face challenges in network assurance and real-time management due to limited resources, making managed network services essential for operational efficiency.

Telecom Network Management System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Deployment Types Covered | On-premises, Cloud-based |

| Verticals Covered | IT and Telecom, BFSI, Government, Manufacturing, Healthcare, Transportation and Logistics, Retail, Media and Communication, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | BMC Software Inc. (KKR and Co. Inc.), CA Inc. (Broadcom Inc.), Cisco Systems Inc., Dell Technologies Inc., Ericsson AB, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., International Business Machines Corporation, Juniper Networks Inc., NETSCOUT Systems Inc., Nokia Oyj, Oracle Corporation, Paessler AG, Riverbed Technology Inc. (Thoma Bravo LLC), SolarWinds Corporation (Thoma Bravo LLC and Silver Lake), VIAVI Solutions Inc. and ZTE Corporation, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, telecom network management system market outlook, and dynamics of the market from 2019-2033.

- The telecom network management system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom network management system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom network management system market was valued at USD 10.12 Billion in 2024.

The telecom network management system market is projected to exhibit a CAGR of 8.38% during 2025-2033, reaching a value of USD 21.66 Billion by 2033.

The telecom network management system market growth is driven by 5G deployment, rising data traffic, and increasing IoT adoption. Telecom operators require AI-driven automation, cloud-based solutions, and predictive analytics to optimize network performance. Growing cybersecurity concerns and regulatory compliance requirements compel companies toward advanced network management system solutions. Expanding edge computing and SDN/NFV adoption enhance network scalability and efficiency.

North America currently dominates the telecom network management system market, accounting for a share of 33.2% in 2024. The presence of major telecom providers and technology firms accelerates innovation in AI-driven automation, cloud-based solutions, and cybersecurity. Strong government regulations mandate secure, efficient network management, driving network management system adoption. Rising IoT and edge computing integration increases demand for real-time monitoring and predictive analytics.

Some of the major players in the telecom network management system market include BMC Software Inc. (KKR and Co. Inc.), CA Inc. (Broadcom Inc.), Cisco Systems Inc., Dell Technologies Inc., Ericsson AB, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., International Business Machines Corporation, Juniper Networks Inc., NETSCOUT Systems Inc., Nokia Oyj, Oracle Corporation, Paessler AG, Riverbed Technology Inc. (Thoma Bravo LLC), SolarWinds Corporation (Thoma Bravo LLC and Silver Lake), VIAVI Solutions Inc. and ZTE Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)