Telecom API Market Size, Share, Trends and Forecast by Type, User Type, Deployment, Industry Vertical, and Region, 2025-2033

Telecom API Market Size and Share:

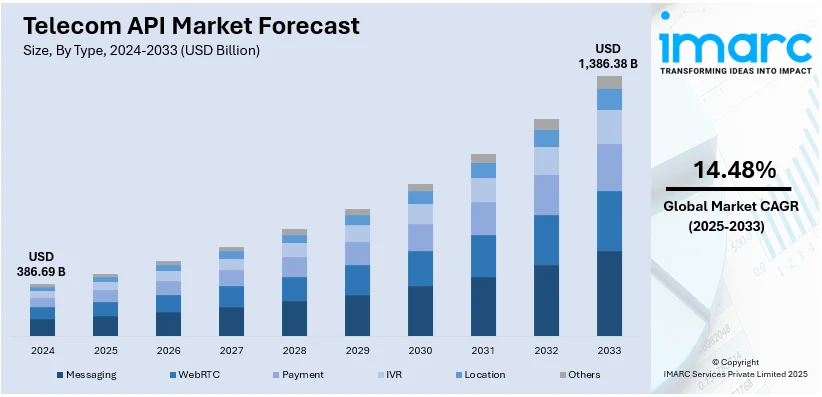

The global telecom API market size was valued at USD 386.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,386.38 Billion by 2033, exhibiting a CAGR of 14.48% from 2025-2033. North America currently dominates the market, holding a market share of over 30.2% in 2024. The North America’s telecom API market share is expanding, driven by the rising demand for mobile and internet services, rapid digital transformation, and advancements in 5G technology.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 386.69 Billion |

| Market Forecast in 2033 | USD 1,386.38 Billion |

| Market Growth Rate (2025-2033) | 14.48% |

The escalating need for seamless communication and connectivity solutions across industries is impelling the market growth. Businesses leverage application programming interfaces (APIs) for short message service (SMS), voice, video, and data services, enhancing user engagement and operational efficiency. Additionally, the rise in smartphone usage and mobile applications encourages API adoption, enabling real-time communication and personalized experiences. Technological advancements like 5G, Internet of Things (IoT), and cloud computing also drive the demand by requiring robust and scalable APIs for integration and functionality. APIs are critical for enhancing security through authentication protocols like two-factor authentication and providing efficient customer service through chatbots and virtual assistants. Moreover, the growing need for automation and digital transformation in sectors like BFSI, healthcare, and retail strengthens the market growth.

The United States has emerged as a major region in the telecom API market owing to many factors. The market is experiencing growth because of the escalating demand for advanced communication solutions and digital transformation across industries. The rapid adoption of 5G technology creates the need for robust APIs to enable high-speed and low-latency services. Increased smartphone penetration and the popularity of mobile applications also promote the use of APIs for SMS, voice, video, and data services, ensuring seamless connectivity. As per the information provided on the official website of Pew Research Center, 98% of Americans possess some form of cellphone in 2024. Moreover, businesses across sectors like BFSI, healthcare, and retail employ APIs to enhance user interactions, automate workflows, and provide personalized experiences. The growing importance of security, such as two-factor authentication and encrypted communications, also enables API adoption. In addition, an increase of cloud computing and IoT facilitates the integration and functionality of APIs in these technologies.

Telecom API Market Trends:

Rising Demand for Mobile Data

The increasing demand for mobile data is significantly supporting the growth of the market. The proliferation of smartphones, tablets, and other connected devices has led to a surge in mobile data usage. For example, as stated in a Forbes article, in 2023, the typical customer used 24.1 GB of mobile data each month. This indicates a 24% rise over a year, from 19.5 GB per user in 2022. As of December 2023, India had approximately 724 million and 131 Million subscribers for 4G and 5G data, respectively. Furthermore, the country had more than 796 million active devices that were 4G-capable, with nearly 134 million also capable of supporting 5G. Individuals and businesses alike rely heavily on mobile data for browsing, streaming, communication, and accessing cloud services.

Increasing Penetration of Smartphones

The rising smartphone penetration is offering a favorable telecom API market outlook. For instance, according to industrial reports, from 2024 to 2029, it was anticipated that the worldwide total of smartphone users would rise by 1.5 billion, reflecting an increase of 30.6%. Moreover, the smartphone user base is set to reach 6.4 Billion, marking a new peak in 2029. Smartphones rely on mobile applications for various functionalities, from communication methods like voice calls and messaging to productivity tools, entertainment, and IoT connectivity. Telecom APIs allow app developers to integrate features, such as SMS notifications, in-app calling, location-based services, and mobile payment functionalities seamlessly into their applications. These factors are further positively influencing the market.

Growing Need for Security

As digital communication becomes more integral to daily life and business operations, the demand for secure APIs that ensure data privacy and protection also increases. Telecom APIs that offer secure authentication, encryption, and compliance with regulations like GDPR are particularly valuable. For instance, in February 2024, in February 2024, Indonesia-based telecom operators Telkomsel, Indosat Ooredoo Hutchison, XL Axiata, and Smartfren introduced three Application Programming Interface (API) services- number verification, SIM swapping, and device location. These API services are aimed at improving security and client experience. Moreover, companies across industries like banking, healthcare, and retail employ telecom APIs to build trust with customers by safeguarding their data during online transactions or app usage. As regulations around data privacy tighten, businesses depend more on secure APIs to stay compliant, thereby bolstering the telecom API market growth.

Telecom API Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom API market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, user type, deployment, and industry vertical.

Analysis by Type:

- Messaging

- WebRTC

- Payment

- IVR

- Location

- Others

Messaging leads the market with 37.6% of the market share in 2024, due to its widespread use and critical role in communication across industries. Telecom APIs for messaging enable businesses to integrate SMS and rich communication services (RCS) into their applications for improving communication and customer engagement. Messaging APIs are widely used in sectors like e-commerce, banking, and healthcare for notifications, two-factor authentication, and marketing campaigns, driving their demand. The growing popularity of mobile applications and over-the-top (OTT) messaging platforms further encourages the adoption of messaging APIs to provide seamless, real-time communication. Businesses depend on messaging APIs for reliable and secure delivery of information to customers, ensuring high engagement and user satisfaction. With advancements in artificial intelligence (AI) and chatbots, messaging APIs are being integrated with intelligent systems for personalized and automated communication. The rising demand for omnichannel communication strategies and the need for efficient and scalable messaging solutions solidify messaging as the dominant segment in the market.

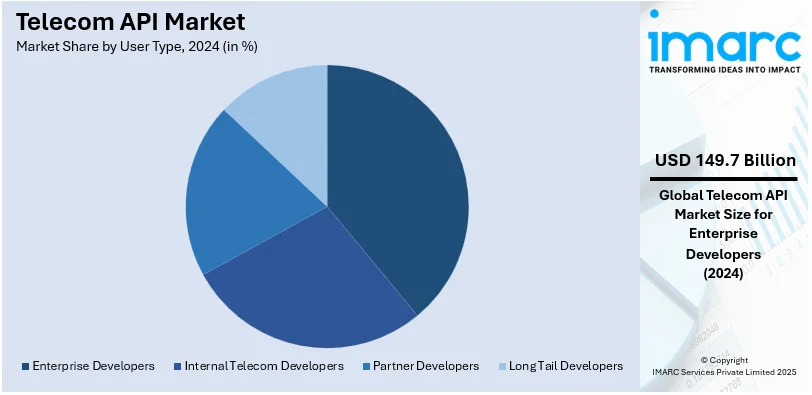

Analysis by User Type:

- Enterprise Developers

- Internal Telecom Developers

- Partner Developers

- Long Tail Developers

Enterprise developers lead the market with 38.7% of the market share in 2024. They enable the integration of APIs into business applications to enhance communication, efficiency, and customer engagement. These developers employ telecom APIs to build and customize solutions that enable SMS, voice, video, and data-sharing functionalities. Enterprises across industries like e-commerce, healthcare, and banking depend on these developers to implement APIs that support two-factor authentication, appointment reminders, customer notifications, and marketing campaigns. The rise of digital transformation within organizations drives the demand for enterprise developers to assimilate APIs into cloud-based and mobile applications, ensuring seamless communication and data management. Enterprise developers also play a crucial role in creating tailored solutions for IoT and smart device connectivity, further expanding API use cases. As businesses are engaged in improving operational efficiency and user experience, the reliance on telecom APIs and skilled enterprise developers grows.

Analysis by Deployment:

- On-premises

- Cloud-based

- Hybrid

Hybrid represents the largest segment. It combines the benefits of both on-premises and cloud-based solutions, offering flexibility, scalability, and enhanced security. Businesses choose hybrid deployments, as they allow sensitive data to be stored on-premises while leveraging the scalability and cost-effectiveness of cloud infrastructure for API operations. This setup is particularly appealing to industries like banking, healthcare, and telecommunications, where data security and regulatory compliance are critical. Hybrid deployment enables organizations to manage APIs locally while benefiting from cloud-based innovation and faster deployment cycles. It supports seamless integration of APIs across diverse platforms and networks, ensuring efficient communication and data exchange. Furthermore, the high adoption of 5G and IoT technologies enhances the need for robust and scalable API solutions, which hybrid deployment effectively addresses. By providing the best of both worlds, hybrid deployment emerges as the preferred choice in the market, meeting the telecom API market demand of businesses across sectors.

Analysis by Industry Vertical:

- BFSI

- Healthcare and Life Sciences

- Telecommunications and ITES

- Government and Public Sector

- Manufacturing, Consumer Goods and Retail

- Others

The BFSI sector extensively uses telecom APIs to enhance customer communication, authentication, and transaction security. APIs enable real-time SMS and voice alerts for transaction confirmations, account updates, and fraud detection. Financial institutions rely on telecom APIs for two-factor authentication and secure OTP delivery. APIs also streamline customer service by integrating chatbots and voice assistants into banking apps.

In the healthcare and life sciences sector, telecom APIs facilitate efficient patient-provider communication and streamline operations. APIs enable appointment reminders, telemedicine platforms, and real-time health monitoring via IoT devices. They enable secure messaging for sharing sensitive health data and provide support for emergency alerts and virtual consultations. Their role in supporting interoperability and data exchange makes them essential for the healthcare and life sciences sector.

Telecom and ITES industries employ telecom APIs for enhancing services as well as user experiences. APIs enable services like SMS, voice, video, and data-sharing integration across platforms. They support efficient call routing, customer relationship management (CRM), and real-time billing systems. These APIs also enhance network functionality by enabling 5G deployment and IoT connectivity. By streamlining operations and providing scalable communication solutions, telecom APIs allow telecommunications and ITES companies to deliver innovative and reliable services.

The government and public sector use telecom APIs to improve communication with citizens and enhance service delivery. APIs enable SMS alerts for public notifications, emergency updates, and service reminders. They also support e-governance platforms by integrating voice and video communication for virtual meetings and consultations. With a focus on digital transformation, telecom APIs help government agencies to optimize resource management and improve transparency.

In manufacturing, consumer goods, and retail sectors, telecom APIs streamline operations by enabling real-time communication and monitoring. APIs facilitate supply chain management by integrating IoT devices for predictive maintenance and inventory tracking. They also support automation by connecting machinery and systems and ensuring smooth production processes. APIs enable secure messaging for operational updates and employee coordination. APIs also offer chatbot and voice assistant functionalities, improving customer service.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 30.2%, enjoys the leading position in the market. The market is driven by its advanced telecom infrastructure and widespread adoption of next-generation technologies. The region is a hub for innovations in telecommunications, driven by the presence of leading telecom operators and technology providers who actively develop and adopt API solutions. The growing need for services, such as mobile payments, messaging, and cloud applications encourages the use of telecom APIs, enabling seamless integration and enhanced functionality for businesses and users. The United States’ high internet penetration and extensive use of mobile apps further catalyze the demand for APIs to improve app performance and connectivity. As per the information provided on the official website of the Pew Research Center, 96% percent of adults in the US report that they use the internet. Additionally, the rapid rollout of 5G networks supports the development of APIs that enable enhanced communication, IoT applications, and real-time data transmission. The region's regulatory environment, which promotes technological advancements and data security, also supports the market growth.

Key Regional Takeaways:

United States Telecom API Market Analysis

The United States hold 85.30% of the market share in North America. High smartphone penetration and robust investments in 5G infrastructures propel the market growth. Companies demand APIs that are capable of establishing seamless connectivity to apps. Cloud-based APIs and IoT integration further support the market growth, with Statista estimating that the IoT market in the US was valued at USD 421.28 Billion in 2023. Market leaders are continuously innovating to cater to the high expectations of users. Regulatory support through initiatives like the Open RAN initiative encourages the use of API-driven solutions in the development of 5G. The increase in mobile payment apps has led to the upsurge of APIs in the fintech domain. Apart from this, firms in industries, such as BFSI, healthcare, and retail utilize APIs to improve user interactions, streamline workflows, and deliver customized experiences. All of these factors position the US as the global leader in telecom API adoption and advancements.

Europe Telecom API Market Analysis

Increasing 5G adoption and the rise in demand for digital transformation are fueling the growth of the market. In this regard, the European Commission reported that 81% of households in the EU could access 5G coverage by 2023, thus increasing API use in healthcare, logistics, and retail. In 2022, according to industrial reports, The German government allocated USD 7.4 billion towards 5G expansion, consequently promoting additional services in the API-enabled sector. As of 2023, GSMA Intelligence reports that there are more than 200 million IoT connections in Europe, indicating a significant API opportunity from connected devices. Ericsson, Vodafone, and other top players are emphasizing real-time communications and also API-based network optimization development. Data-privacy-friendly legislation, such as GDPR, enhances the need for secure API solution development. This is further emphasized by government initiatives for research and development (R&D) efforts, supporting Europe as an innovation hub in telecom APIs.

Asia-Pacific Telecom API Market Analysis

The Asia-Pacific region is experiencing the exponential expansion of the market, as the penetration of smartphones increases alongside the large-scale rollouts of 5G. According to the China Internet Network Information Centre, as of December 2023, China had over 1.09 billion internet users, creating a significant need for applications based on APIs. In 2023, India designated USD 1.9 billion for the nation's digital infrastructure through its Digital India initiative, accelerating the adoption of APIs related to digital payments and e-governance. According to a GSMA report, Asia Pacific is set to account for 41% of mobile connections in the region by 2030, emphasizing API-driven connectivity. Industry leaders like Huawei and Reliance Jio are using APIs to make IoT and smart city projects better. Government-backed programs, such as South Korea's AI-focused 5G network investments also promote advanced API solutions and position the region as a key growth driver in the industry.

Latin America Telecom API Market Analysis

The Latin American market is growing, as mobile connectivity rises and digital transformation investments grow. An industrial report states that in early 2023, In Brazil, the total mobile connections climbed to approximately 221 Million, representing 102.4% of the population, suggesting a promising environment for API-driven applications. There is no specific budget allocation for Mexico in 2023, however, sustainable public spending has been stressed, and thus the government's pattern of spending is facilitative of growth in telecom infrastructure. Increasing demand for mobile banking and e-commerce applications has promoted the adoption of APIs in fintech, allowing for smooth integrations. Companies, such as Telefonica are advancing API-based solutions for digital transformation across the region. Public-private partnerships and supportive regulations further support the market growth. These factors position Latin America as an emerging player in the market.

Middle East and Africa Telecom API Market Analysis

The market in the Middle East and Africa is growing. Rising smartphone penetration, along with investments in 5G infrastructure, is contributing to this market growth. According to the GSMA, in 2022, smartphone penetration in the area hit 51%, driving the demand for APIs in mobile commerce and communication. ITA reports that Saudi Arabia invested over USD 24.8 billion into digital infrastructure in the past six years, boosting connectivity and mobile internet speeds to nearly twice the global average. Moreover, the country has planned to spend USD 15 billion to expand its 5G network as part of its digital transformation program. The adoption of API-based platforms in e-health and education in South Africa also reflects regional growth in innovative applications. For instance, local telecom operators like Etisalat have allied with global tech firms to create API-driven IoT and smart city solutions. Initiatives by governments in the expansion of digital connectivity, like Kenya's Digital Economy Blueprint, ensure continuous usage of APIs in the region and make it a promising contributor to the global landscape.

Competitive Landscape:

Key players focus on creating APIs that support voice, messaging, video, and data integration. These APIs help businesses to improve user engagement, optimize operations, and roll out new services seamlessly. Major telecom companies and software developers offer reliable API platforms that cater to industries like healthcare, retail, and BFSI. They are considerably financing R&D to keep up with advancements like 5G, IoT, and cloud computing, ensuring their APIs remain relevant and powerful. They team-up with enterprises to wager on innovations, making APIs more accessible and tailored to specific needs. Their APIs are designed to enhance functionalities, such as real-time communication, automation, and security, addressing the specific needs of industries undergoing digital transformation. For instance, in August 2024, Oracle collaborated with AT&T to utilize its 5G network and APIs, implementing cloud applications to enhance telehealth, utility management, and IoT device integration. Oracle's corporate communication platform features near real-time connection capabilities.

The report provides a comprehensive analysis of the competitive landscape in the telecom API market with detailed profiles of all major companies, including:

- Alcatel-Lucent S.A. (Nokia Corporation)

- AT&T Inc.

- Cisco Systems Inc

- Google LLC (Alphabet Inc.)

- Huawei Technologies Co. Ltd.

- Infobip Ltd

- LocationSmart

- Orange S.A.

- Twilio Inc.

- Verizon Communications Inc.

- Vonage Holdings Corp.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- September 2024: A dozen major telecom companies, including AT&T, Vodafone, and Reliance Jio, teamed-up with Ericsson in a joint venture for the sale of network APIs. This project has turned capabilities into a marketable resource that enhances an open access point into the industry's future. Ownership is equally shared between the operators and Ericsson.

- May 2024: Telecom Argentina and OSS provider Intraway intended to work together to create a platform enabling regional CSPs to generate revenue from their networks through Open APIs as part of the GSMA Open Gateway initiative.

- February 2024: NTT DOCOMO INC., Japan's mobile provider serving more than 89 million subscribers, selected AWS to commercially develop its nationwide 5G Open Radio Access Network (RAN) in Japan.

Telecom API Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Messaging, WebRTC, Payment, IVR, Location, Others |

| User Types Covered | Enterprise Developers, Internal Telecom Developers, Partner Developers, Long Tail Developers |

| Deployments Covered | On-premises, Cloud-based, Hybrid |

| Industry Verticals Covered | BFSI, Healthcare and Life Sciences, Telecommunications and ITES, Government and Public Sector, Manufacturing, Consumer Goods and Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcatel-Lucent S.A. (Nokia Corporation), AT&T Inc., Cisco Systems Inc, Google LLC (Alphabet Inc.), Huawei Technologies Co. Ltd., Infobip Ltd, LocationSmart, Orange S.A., Twilio Inc., Verizon Communications Inc., Vonage Holdings Corp, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom API market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom API market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom API industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom API market was valued at USD 386.69 Billion in 2024.

IMARC estimates the telecom API market to exhibit a CAGR of 14.48% during 2025-2033.

The rollout of 5G networks is driving the demand for telecom APIs to enable high-speed and low-latency communication services, improving user experiences and allowing new and innovative applications. Besides this, the surge in smartphone usage and mobile apps is creating the need for APIs to support services like messaging, voice, video, and data connectivity, which are crucial for seamless communication. Moreover, the increasing demand for automation in industries where APIs help to integrate business processes is impelling the market growth.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the telecom API market include Alcatel-Lucent S.A. (Nokia Corporation), AT&T Inc., Cisco Systems Inc, Google LLC (Alphabet Inc.), Huawei Technologies Co. Ltd., Infobip Ltd, LocationSmart, Orange S.A., Twilio Inc., Verizon Communications Inc., Vonage Holdings Corp, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)