Technical Foam Market Size, Share, Trends and Forecast by Product Form, Material, End Use Industry, and Region, 2025-2033

Technical Foam Market Size and Share:

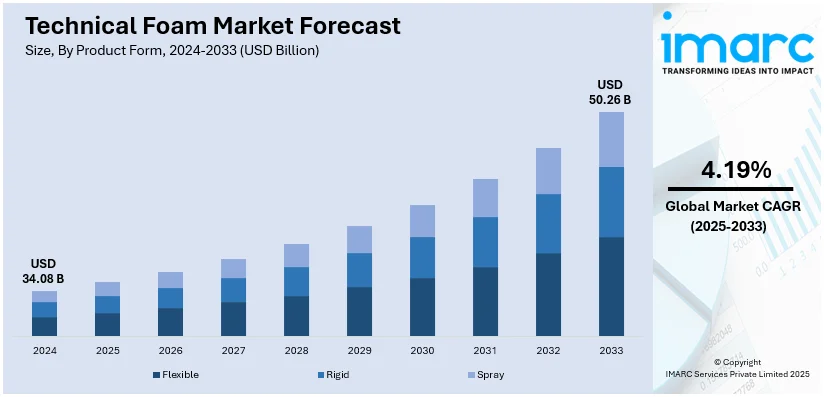

The global technical foam market size was valued at USD 34.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 50.26 Billion by 2033, exhibiting a CAGR of 4.19% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.2% in 2024. The technical foam market share is increasing in the Asia Pacific because of industrial expansion, rising automotive production, infrastructure development, growing consumer electronics demand, and higher investments in sustainable and high-performance materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.08 Billion |

|

Market Forecast in 2033

|

USD 50.26 Billion |

| Market Growth Rate (2025-2033) | 4.19% |

The growing use of technical foams in automobile interiors, seating, acoustic insulation, and gaskets is offering a favorable market outlook. The shift towards lightweight vehicles to enhance fuel efficiency and meet emission standards is accelerating foam adoption. These materials help reduce vibration, noise, and harshness, improving passenger comfort. Additionally, thermal and acoustic insulation in consumer electronics and home appliances is driving the technical foam market demand. Materials like silicone and polyurethane foams are used in laptops, smartphones, refrigerators, washing machines, and air conditioners to prevent overheating and improve energy efficiency. The rising demand for compact and lightweight electronic devices is encouraging innovations in foam-based protective solutions. Moreover, technical foams are critical in medical applications like wound care dressings, orthopedic supports, prosthetics, and bedding materials. Their properties, such as breathability, flexibility, and antimicrobial resistance, make them ideal for healthcare settings.

The United States is a crucial segment in the market, driven by the increasing focus on advanced wound management, which is driving the demand for high-performance medical foams. Innovations in foam dressings enhance patient comfort, improve healing efficiency, and support pressure injury prevention. Market players are also investing in new technologies to strengthen their presence in the healthcare sector. In 2024, Coloplast launched Biatain® Silicone Fit in the US, a silicone foam dressing designed for pressure injury prevention and wound management. The product, featuring 3DFit Technology, offers a secure, comfortable fit for patients and is available in 12 sizes for various wound care needs. Coloplast aims to expand its presence in the US advanced wound care market with this innovation.

Technical Foam Market Trends:

Growth in Automotive and Aerospace Industries

The technical foam market finds an important driver in the automotive and aerospace industries due to requirements for lighter weights to establish improved fuel efficiency, safety, and acoustical requirements. Technical foams are applied in automotive applications, such as insulation, seat cushions, headliners, and interior trim in different automotive applications, all applied for noise, vibration, and harshness (NVH) reduction. As car manufacturers seek to reduce vehicle weight to meet stringent fuel economy regulations, the use of lightweight foams for soundproofing and structural applications is expected to increase. In aerospace, technical foams are used in seat cushions, cabin insulation, and structural components where strength without weight addition is crucial. According to the FAA, the U.S. commercial fleet is expected to grow by 2.5% annually through 2035, which is expected to further stimulate demand for advanced foam materials in the aerospace sector. The growing importance of sustainability and energy efficiency pushes these industries toward high-performance foams that comply with regulatory requirements but also add to the reduction of carbon emissions in general.

Rising Demand for Sustainable Materials

The demand for sustainable materials in diverse industries is contributing to the technical foam market. According to an industrial report, the recycling rate for post-consumer recycled (PCR) PET in the United States increased to 16.2% in 2023, reflecting a broader trend toward adopting sustainable materials. This increase is prompting manufacturers to incorporate more recycled content in technical foams. Manufacturers are paying more attention to eco-friendly, recyclable, and renewable solutions. With increased global sustainability efforts, there has been a further push to decrease carbon footprints, and there is an inclination towards using material that adheres to environmental regulation. These materials, for example, include biobased-based foams based on plant polyols, presented as a substitute for the petrochemical- based foams. In fact, recycled materials from foam waste are increasingly gaining ground in many sectors, for instance, in packaging, building, and auto, where they seek to increase their recycling practices and circular economies. These sustainable materials not only address the needs of the environmentally aware consumer but also help companies adhere to regulations about waste management, emissions, and sustainability goals. Therefore, a greener product is likely to spur innovation and investment in making more eco-friendly technical foams.

Advancements in Customization and Performance Properties

Customization of technical foams is revolutionizing their applications in a broad spectrum of industries. As the demand for more specialized products grows among consumers, manufacturers are producing foams with tailored properties, such as improved thermal insulation, flame retardancy, moisture resistance, and electrical conductivity. Advanced foams in electronics are used for component protection, heat dissipation, and vibration damping in sensitive devices. Similarly, in medical applications, it is used technically with customized property for wound care, prosthetic, and support cushioning devices. The foam performance can therefore be customized, which is useful in sports devices where high-quality materials are called for to facilitate safety and comfort. With research and development in material science advancing, the production of more resilient, lighter-weight, and tougher foams increases their applicability in industrial as well as consumer products. In 2024, Dahsheng Chemical launched DURAPONTEX® Grip, a high-performance insole with slip-resistant technology designed to enhance athlete control and agility. The advanced foam offers superior grip in wet and dry conditions, making it ideal for sports requiring lateral movement. The product was unveiled at the ISPO Munich Show and supports sports like soccer, basketball, and football.

Technical Foam Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global technical foam market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product form, material, and end use industry.

Analysis by Product Form:

- Flexible

- Rigid

- Spray

Flexible leads the market with 58.7% of market share in 2024. Flexible represents the largest segment because of its superior adaptability, cushioning properties, and wide-ranging applications across industries. Its high resilience and shock absorption capabilities make it essential in automotive seating, interior trims, and noise-reduction components, enhancing passenger comfort and safety. In the construction sector, flexible foam is widely used in insulation, sealing, and soundproofing applications, contributing to energy efficiency and building comfort. The healthcare industry relies on it for medical mattresses, orthopedic supports, and advanced wound care dressings due to its breathability and pressure-relief properties. In consumer goods, flexible foam is a key material in furniture, bedding, and protective packaging, providing comfort and durability. Additionally, its lightweight structure and ease of customization allow manufacturers to develop specialized solutions for electronics, aerospace, and industrial applications. Ongoing innovations in eco-friendly and high-performance formulations further reinforce the dominance of flexible foam in the global market.

Analysis by Material:

- Elastomeric

- Polyurethane

- Polyethylene

- Others

Polyurethane represents the largest segment, holding 54.3% of market share in 2024. Polyurethane dominates the market owing to its superior versatility, durability, and performance across multiple industries. Its lightweight structure, excellent cushioning properties, and thermal and acoustic insulation make it indispensable in automotive seating, interior panels, and noise-dampening applications. The construction sector benefits from polyurethane foam’s high energy efficiency, as it provides superior insulation for walls, roofs, and HVAC systems. In the medical sector, polyurethane foams are employed in wound dressings, orthopedic supports, and bedding materials due to their breathability and comfort. The electronics industry also relies on polyurethane for protective packaging, vibration control, and thermal insulation in devices and appliances. Its ability to be formulated into flexible, rigid, or spray forms allows manufacturers to customize solutions for specific applications. Ongoing advancements in bio-based and recyclable polyurethane foams further strengthen its market position, aligning with sustainability trends and regulatory requirements in key industries.

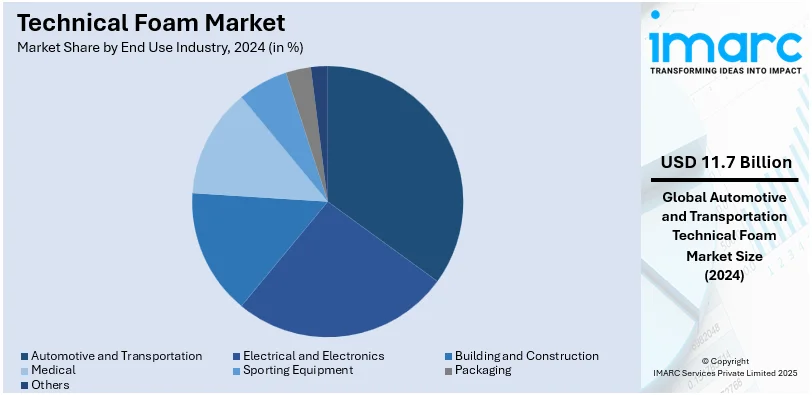

Analysis by End Use Industry:

- Automotive and Transportation

- Electrical and Electronics

- Building and Construction

- Medical

- Sporting Equipment

- Packaging

- Others

Automotive and transportation dominate the market, accounting 34.2% of market share in 2024. Automotive and transportation lead the market due to growing need for lightweight, high-performance materials that improve fuel efficiency, safety, and passenger comfort. Automakers are integrating advanced foams in vehicle interiors, seating, and acoustic insulation to reduce noise, vibration, and harshness (NVH), improving overall ride quality. The shift toward electric vehicles (EVs) is further driving the demand for thermal management foams used in battery insulation and fire protection. Additionally, foams play a critical role in impact absorption for enhanced crash safety, making them essential for compliance with stringent automotive safety regulations. The aerospace and railway sectors also rely on technical foams for vibration damping, fire-resistant cabin interiors, and lightweight structural components. Advancements in foam technology, including recyclable and bio-based alternatives, align with industry efforts to meet stringent emission standards and sustainability goals, reinforcing the dominance of the automotive and transportation sector in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific represents the largest segment, accounting 43.2%. Asia Pacific dominates the market because of the expanding automotive, construction, healthcare, and electronics industries. The region's strong automotive production is increasing the demand for lightweight foams that enhance fuel efficiency and noise reduction. In construction, rising investments in energy-efficient buildings drive the adoption of insulation foams for thermal management and fire resistance. The growing healthcare sector, driven by an aging population and advancements in medical devices, is catalyzing the demand for foam-based wound care products, orthopedic supports, and hospital bedding. Additionally, Asia Pacific is a global hub for consumer electronics manufacturing, with high demand for thermal and acoustic insulation foams in smartphones, laptops, and home appliances. For instance, in 2024, OPPO India launched the K12x 5G, a durable smartphone. It featured MIL-STD-810H military-grade certification, IP54 water resistance, and Splash Touch technology, while its robust design includes foam-based shock absorption for added protection.

Key Regional Takeaways:

United States Technical Foam Market Analysis

In North America, the market share for the United States was 84.80% of the total. The U.S. technical foam market is growing with its use in automotive, construction, and packaging industries. The U.S. manufacturing sector stood at about USD 2.3 trillion in 2023, which is 10.2% of the total U.S. GDP (U.S. Bureau of Economic Analysis). Automotive is the largest and most booming industry as the automotive sector is gaining its demand; in the U.S. alone, 2023 witnessed around 15.5 million units sold of new vehicles, a number which hasn't been witnessed since 2019. From around 13.9 million units in 2022, it shows the huge requirement of lightweight high-performance foams in the sectors of insulation and soundproofing, as per reports. Further, improvements in material science have been paving the way for tougher and more sustainable foams, thus driving technical foam market growth. Innovations by the major players, such as BASF and Dow Chemical, in the development of eco-friendly materials are well aligned with the rising environmental regulations. Efforts at domestic production have helped to minimize dependence on imports, and the U.S. has emerged as a significant market leader worldwide.

Europe Technical Foam Market Analysis

The European technical foam market is growing, with drivers from the construction and automotive sectors. In 2023, the European construction industry was indeed very challenging, but the total EU investment in construction was around EUR 1.683 trillion (USD 1.842 trillion), or 10.9% of the EU's GDP (FIEC Statistical Report 2024). Technical foams are crucial for insulation and energy efficiency applications, with green building initiatives boosting demand for sustainable materials. Major contributors to growth are from Germany, France, and Italy. Another driving force is the automotive industry. Electric vehicle manufacture is constantly increasing. In 2023, battery electric vehicles also covered 14.6% of the share in EU markets, showing a 37% rise over the same period last year, according to ACEA data. These sectors are leading to high growth in the European technical foam market, which is driven by innovations in sustainability.

Asia Pacific Technical Foam Market Analysis

Asia Pacific technical foam markets are growing because of the burgeoning industries of automobile, packaging, and electronics, etc. Based on the reports from the National Bureau of Statistics of China, automotive production of China has recorded 30.16 million units in 2023, demanding enormous soundproofing and insulation materials, technically in the shape of technical foam. Another such country is India. The country is investing more than ever in sustainable foam production. It has allocated USD 72.6 billion to advanced technologies in the 2023-2024 defense budget, which indirectly increases demand for high-performance foams. Growth in the e-commerce and consumer goods sectors also increased demand for foams in packaging. Eco-innovations will be the focal point for regional key players such as Asian subsidiaries of global firms like BASF and Huntsman to comply with stringent regulations. This makes the region a major driver in the global technical foam market.

Latin America Technical Foam Market Analysis

Latin American is expanding the market for technical foams, supported by the construction and automotive sectors. The Brazilian construction industry, in fact, was valued at an estimated BRL 439 billion (USD 89.57 billion) in 2022 according to a government report with technical foams playing important roles in applications such as insulations and soundproofing applications (IBGE). The automotive industry is also one of the largest contributors, with over 2.2 million vehicles manufactured in Brazil in 2023, though a 1.9% decrease from the previous year is seen due to new emission control regulations, as per an industry report. Increasing demand for electric vehicles and sustainable materials continues to propel the market forward in the region. With more companies adopting sustainable manufacturing practices, technical foams are now being highly used in this sector for energy-efficient and eco-friendly applications.

Middle East and Africa Technical Foam Market Analysis

The Middle East and Africa technical foam market is, therefore, primarily driven by developing infrastructure and automobile production. However, according to the UAE Ministry of Finance, the federal budget for 2022 stood at AED 58.931 billion (or USD 16.04 billion), out of which USD 0.60 billion was allocated to the Infrastructure and Economic Resources expenditure. Infrastructure spending - on construction as well as in increasing energy efficiency-this has infrastructure using technical foams in construction projects to cover various requirements ranging from insulation, which has increasingly significant relevance; meanwhile, expanding auto manufacturing lines worldwide and lately most particularly around UAE also require weight- reducing lightweight material solutions; on its turn, those sustainability investments related with the fast-moving "Smart cities" programs bring growing orders on high technological advancement in a respective area- technical foams again.

Competitive Landscape:

Key players in the market are focusing on product innovation, strategic acquisitions, and capacity expansion to strengthen their market position. They are developing advanced foam materials with improved thermal insulation, acoustic properties, and durability for automotive, construction, and electronics applications. Companies are also investing in sustainable foam solutions by incorporating bio-based and recyclable materials to align with environmental regulations. Partnerships with end-use industries are enabling tailored solutions to meet specific performance requirements. Research and development (R&D) efforts are targeting high-performance foams with enhanced resistance to heat, chemicals, and mechanical stress, ensuring long-term market competitiveness and compliance with evolving industry standards. In 2024, National Foam introduced the Universal®F3 Green 1%-3% AR-SFFF, the first UL-listed fluorine-free foam concentrate for Type II and Type III applications. It is designed for fuel tank and spill fires, offering superior performance with hydrocarbon and polar fuel fires. This innovation provides significant logistical advantages by reducing foam volume needed for large fires.

The report provides a comprehensive analysis of the competitive landscape in the technical foam market with detailed profiles of all major companies, including:

- Armacell

- BASF SE

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- Kaneka Corporation

- Recticel

- Saudi Basic Industries Corporation (Saudi Aramco)

- Sealed Air Corporation

- Sekisui Chemical Co. Ltd.

- Woodbridge

- Zotefoams Plc.

Latest News and Developments:

- December 2024: Dow announced the production of VORANOL™ WK5750 at its Freeport polyol plant. This polyether polyol enhances comfort in products like mattresses and furniture by enabling soft, hypersoft foams. Its versatility supports viscoelastic and high resiliency foam applications, offering improved reactivity, viscosity, and purity for superior performance.

- November 2024: Zotefoams announced that they will unveil fully recyclable Polypropylene (PP) and Thermoplastic Polyurethane (TPU) foams at Foam Expo Europe 2024. These closed-cell foams, made using Supercritical Foaming Technology, feature excellent resilience and low dielectric properties, furthering Zotefoams' commitment to sustainability, carbon reduction, and circular economy solutions.

- November 2024: Woodbridge announced a joint venture with Chengpeng to manufacture commercial and passenger seat foam. The new facility, located in Changzhou, China, will begin production in Q2 2025, expanding Woodbridge’s global presence and enhancing innovation for the automotive market.

- September 2024: Covestro Vietnam partnered with Far East Foam to introduce the first TDI CQ mass-balanced product with ISCC PLUS certification in the APAC region, excluding China. This marks a significant milestone in Covestro’s sustainability efforts.

- September 2024: BASF and Future Foam announced the launch of the first flexible foam for bedding made with 100% domestically produced BMB Lupranate® T 80 TDI, produced at BASF's Geismar, Louisiana site. This milestone emphasizes sustainability, with Future Foam using renewable feedstocks to reduce CO2 emissions and fossil resource usage.

Technical Foam Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Forms Covered | Flexible, Rigid, Spray |

| Materials Covered | Elastomeric, Polyurethane, Polyethylene, Others |

| End Use Industries Covered | Automotive and Transportation, Electrical and Electronics, Building and Construction, Medical, Sporting Equipment, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Armacell, BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, Kaneka Corporation, Recticel, Saudi Basic Industries Corporation (Saudi Aramco), Sealed Air Corporation, Sekisui Chemical Co. Ltd., Woodbridge, Zotefoams Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the technical foam market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global technical foam market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the technical foam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The technical foam market was valued at USD 34.08 Billion in 2024.

IMARC estimates the technical foam market to exhibit a CAGR of 4.19% during 2025-2033, reaching a value of USD 50.26 Billion by 2033.

The technical foam market is expanding due to rising demand in automotive, construction, electronics, and healthcare industries. Advancements in polyurethane, polyethylene, and silicone foams, coupled with sustainability initiatives and stringent safety regulations, are accelerating adoption across industrial and consumer applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the technical foam market include Armacell, BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, Kaneka Corporation, Recticel, Saudi Basic Industries Corporation (Saudi Aramco), Sealed Air Corporation, Sekisui Chemical Co. Ltd., Woodbridge and Zotefoams Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)