Technical Ceramic Market Size, Share, Trends and Forecast by Material Type, Product, End Use Industry, and Region, 2025-2033

Technical Ceramic Market Size and Share:

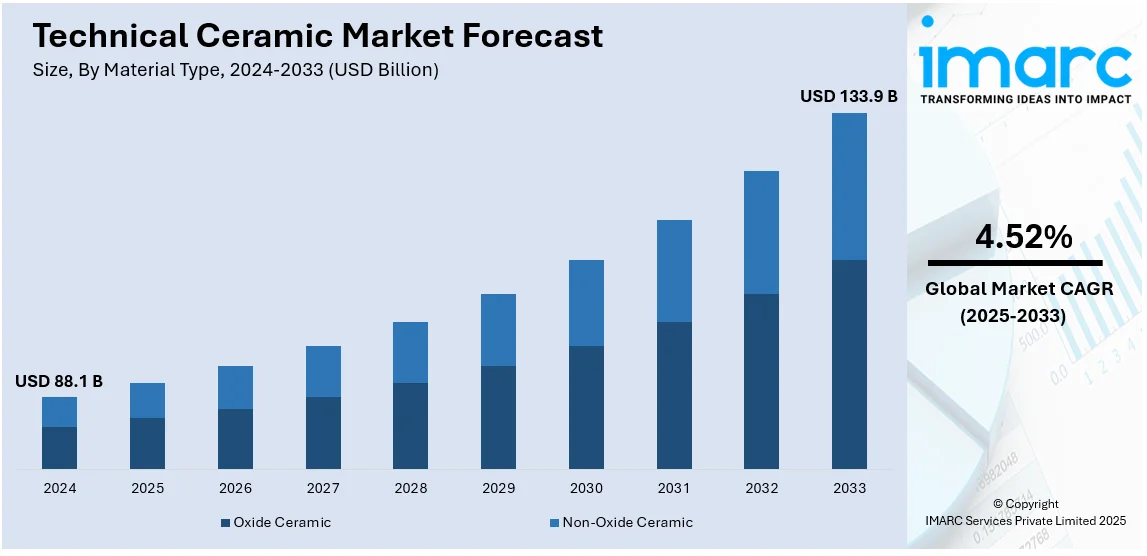

The global technical ceramic market size was valued at USD 88.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 133.9 Billion by 2033, exhibiting a CAGR of 4.52% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 42% in 2024. This expansion results from swift industrial progress, continuous technological innovation, and rising requirements across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 88.1 Billion |

|

Market Forecast in 2033

|

USD 133.9 Billion |

| Market Growth Rate (2025-2033) | 4.52% |

The main driver behind the technical ceramics market arises from the increasing need for high-performance materials in areas like electronics, automotive, and aerospace. With exceptional attributes such as resistance to extreme temperatures, superior electrical insulation, and high mechanical strength, technical ceramics are gaining prominence in applications requiring precision and durability. Moreover, as advanced manufacturing sectors continue to evolve, the demand for materials with enhanced resilience to harsh conditions and outstanding performance capabilities is rising. Meeting these new market demands with innovations in advanced ceramics is fueling the growth, and technical ceramics are playing an important role as a crucial factor in modern manufacturing and technology. For instance, in 2024, Mantec Technical Ceramics secured a six-figure deal to supply 600mm-long ceramic diffuser tubes and fittings for one of the largest public sector ozone plants in the Middle East.

The United States represents an important position as a global contributor to the market of technical ceramics, primarily attributed to a combination of innovation, sophisticated manufacturing capabilities, and a resilient industrial ecosystem. Major U.S. companies, therefore, dedicate large amounts in research and development for the establishment of high-performance ceramics, useful in industries related to aerospace, automotive, electronics, and health care. For example, in 2025, Aramco and CoorsTek Membrane Sciences collaborated to develop commercialized advanced metal-ceramic membrane technology to reduce carbon emissions in ethylene production by as much as 50% in decarbonization cost. The country has a well-established infrastructure that supports the production of advanced ceramics with special properties, such as high thermal resistance, electrical insulation, and mechanical strength. The country also accommodates a large number of suppliers and distributors of high-quality technical ceramics, which makes the material easily accessible to cope with the increasing demands of different spheres.

Technical Ceramic Market Trends:

Growing Adoption of Technical Ceramics in Construction and Infrastructure

Technical ceramics are increasingly substituting metals, polymers, and refractory materials due to their hardness, chemical stability, and high-temperature capability. This is one of the prime factors driving the growth of the market. Besides, these components serve applications in pump pistons, cylinder sleeves, rods, sealing mechanisms, valve components, spraying outlets, grinding elements, cutting tools, positioning pins, rotary cutters, bearings, and semiconductor wafers. Apart from this, advanced technical ceramics, including zirconium dioxide (ZrO2), aluminum oxide (Al2O3), silicon carbide (SiC), and silicon nitride (Si3N4) are used for industrial applications. This, including the increasing utilization of technical ceramics as construction material in mechanical parts, is therefore strengthening the market growth. According to reports, construction work increased from USD 9.7 Trillion in 2022 to USD 13.9 Trillion in 2037.

Increased Use of Technical Ceramics in Medical Devices

Technical ceramics are increasingly being used in the medical devices sector, particularly orthopedic applications like knee implants, which is growing significantly. For example, about 3.6 Million knee replacements were done worldwide in 2023. The selection of ceramics, such as zirconia and alumina, is seen in increased applications in knee implants, which have excellent resistance to wear, biocompatibility, and mechanical strength. These materials decrease friction and wear, two main problems in joint replacements, hence enhancing the longevity and performance of knee replacements. Advanced ceramic materials in knee implants are expected to rise with the increasing population of aging individuals and demand for joint replacement surgeries. Further development of better, lighter ceramics makes the innovations in medical device manufacturing improve patient outcomes and prolong the existence of implants.

Growing Adoption of Technical Ceramics in Aerospace and Automotive Applications

The aerospace and automotive industries are the biggest users of technical ceramics because of their high strength, lightweight nature, and high-temperature resistance. Ceramics in aerospace applications are used for turbine blades, heat shields, and other components in the engine where extreme conditions need to be met. In the automotive sector, ceramic components are increasingly being integrated, especially into electric vehicles, which improve battery performance, power electronics, and thermal management. For example, in July 2024, Kyocera introduced a new Peltier module that enhances cooling performance by 21% using advanced single-crystal growth element technology. These modules are crucial for temperature control in automotive applications, improving battery lifespan and passenger comfort. The innovation optimizes heat absorption, making it a valuable solution for energy-efficient thermal management. Kyocera continues expanding its technological advancements, also preparing to showcase its ceramic solutions at the ASEAN Ceramics Exhibition 2024. Both of these industries are moving toward sustainability and efficiency, and the demand for advanced ceramic materials will only grow more intense.

Technical Ceramic Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global technical ceramic market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, product, and end use industry.

Analysis by Material Type:

- Oxide Ceramic

- Non-Oxide Ceramic

Oxide ceramic stands as the largest material type in 2024. Oxide ceramics with excellent mechanical strength, high thermal stability, and resistance to corrosion are used largely in diverse industries. As materials offering exceptional properties for various applications, particularly in electronics, automotive, aerospace, and medical devices, these play a crucial role in manufacturing semiconductors and insulators. They are also essential for producing wear-resistant coatings and orthopedic implants. Their versatility, combined with the continuous developments in manufacturing technologies, guarantees oxide ceramics will continue to be the most in-demand material in the market due to their growing demands for high performance, reliability, and cost-effectiveness within various sectors.

Analysis by Product:

- Monolithic Ceramics

- Ceramic Coatings

- Ceramic Matrix Composites (CMC)

Monolithic ceramics leads the market with around 85% of the market share in 2024. Monolithic ceramics can be classified as single solid materials of outstanding mechanical strength, wear resistance, and thermal stability, therefore being quite in demand for extreme applications in industries that are considered demanding, for example, aerospace, automotive, and electronics. Its extreme temperature and hostile environment tolerance guarantee it to be present in critical components such as turbine blades, car engine parts, and electronic substrates. Industries such as electric vehicles, 5G technology, and semiconductor manufacturing continue to grow. Thus, the desire for monolithic ceramics persists, while these materials remain the material of choice: they are reliable, performant, and cost-effective in a wide range of applications.

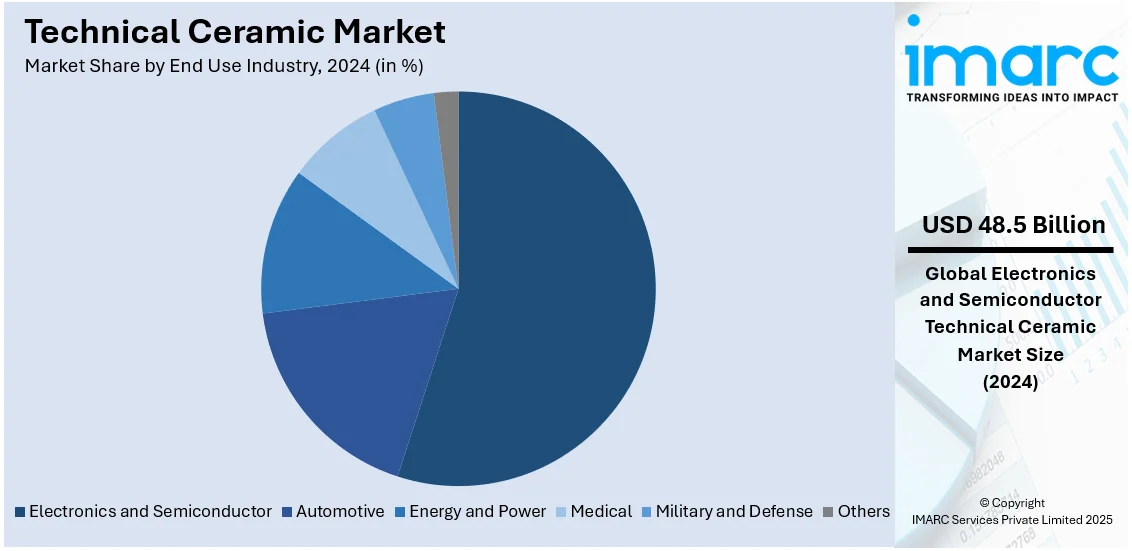

Analysis by End Use Industry:

- Electronics and Semiconductor

- Automotive

- Energy and Power

- Medical

- Military and Defense

- Others

Electronics and semiconductor leads the market with around 55% of the market share in 2024. This dominance is mainly supported by the growing demand for high-performance ceramics in manufacturing advanced electronic devices, semiconductors, and telecommunication systems. Technical ceramics play a crucial role in the electronics sector due to their superior heat dissipation, exceptional electrical resistance, and robust mechanical durability. Silicon nitride and other materials like alumina and zirconia are used in a broad application range, from capacitors and substrates to insulators and heat management parts. With technologies like 5G, artificial intelligence, and IoT ever advancing, there is anticipated growth in the market of this sector due to the need for durable, reliable, and efficient materials in electronics and semiconductors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42%. This leadership stems from rapid industrial growth and continuous technological advancements across China, Japan, South Korea, and India. These regions increasingly rely on advanced ceramics for applications in electronics, automotive, aerospace, and healthcare industries. With the production of semiconductors, electric vehicles, and consumer electronics going higher and higher, advanced ceramics are eventually being generated as an important application of Asia-Pacific. Infrastructure investment and manufacturing investment are major investments in the market, with great importance to innovation. As such, the market is growing even faster. Meanwhile, Asia-Pacific still dominates in both the production and consumption of technical ceramics.

Key Regional Takeaways:

United States Technical Ceramic Market Analysis

US accounts for 83.8% share of the market in North America. In the United States, the growing adoption of technical ceramics is closely tied to the increasing demand for energy-efficient solutions. This is primarily driven by the rapid expansion of HVAC businesses, which rely on high-performance materials to enhance energy conservation and sustainability. Reports indicate that as of 2024, there are 114,157 businesses in the US specializing in Heating & Air-Conditioning Contractors. Technical ceramics are valued for their durability, thermal stability, and resistance to wear, which make them ideal for components used in heating, ventilation, and air conditioning systems. As energy and power sectors evolve, the need for advanced materials to meet the stringent performance standards grows, further propelling the demand for technical ceramics. Moreover, their application in energy-efficient technologies such as heat exchangers and insulation components offer significant cost savings and environmental benefits, reinforcing their importance in these industries.

North America Technical Ceramic Market Analysis

The North American advanced ceramics sector is witnessing substantial expansion, fueled by rising demand from key industries, including aerospace, automotive, electronics, and healthcare. The region benefits from a strong industrial base, significant research and development investments, and advanced manufacturing capabilities, which facilitate the production of high-performance ceramics. These materials, known for their superior properties like thermal resistance, electrical insulation, and mechanical strength, are essential for applications requiring precision and durability. Key players in the market, including 3M, CoorsTek, and General Electric, are focusing on innovation to meet evolving industry needs. Additionally, regulatory efforts advocating for sustainability and energy conservation are driving the increased deployment of advanced ceramic technologies, significantly contributing to market growth across North America. For instance, in January 2025, The U.S. Defense Advanced Research Projects Agency (DARPA) announced that they are advancing the Intrinsically Tough and Affordable Ceramics Today (INTACT) project, focusing on atomic-scale toughening mechanisms to enhance ceramic materials with metallic-like ductility. This initiative aims to develop innovative ceramic materials with superior mechanical properties, facilitating breakthroughs in advanced material applications.

Asia Pacific Technical Ceramic Market Analysis

The growing use of technical ceramics in automotive applications stems from their ability to enhance vehicle performance, durability, and safety. As per the India Brand Equity Foundation, the automobile industry experienced a total equity FDI inflow of approximately USD 35.65 Billion from April 2000 to December 2023. Their exceptional durability and lightweight properties play a vital role in enhancing fuel efficiency and minimizing emissions. Ceramic-based brake systems, turbocharger rotors, and sensors are becoming increasingly prevalent, addressing the demand for advanced components in electric and hybrid vehicles. As vehicles integrate more electronic systems, technical ceramics find applications in circuit boards and thermal management solutions. Their superior heat resistance ensures reliability in demanding automotive environments, such as combustion chambers and exhaust systems. Additionally, the focus on lightweight materials in vehicle manufacturing drives the adoption of ceramics in structural components.

Europe Technical Ceramic Market Analysis

Technical ceramics are becoming increasingly vital in military and defense sectors, valued for their superior durability, reduced weight, and resilience under extreme environmental and operational conditions. As stated by the Aerospace, Security and Defence Industries Association of Europe, Europe's aerospace and defense sector saw a 10.1% increase in turnover in 2023, reaching around USD 316.5 Billion, following a 10.5% rise in 2022. Ceramic armors, for instance, offer superior defense against ballistic threats while ensuring personnel and vehicles retain mobility. Their use in advanced sensor systems improves target detection and surveillance capabilities. In missile systems and aerospace applications, ceramics contribute to thermal shielding and structural integrity under high-stress conditions. The increasing need for advanced materials that can perform reliably in harsh environments, including land, sea, and air operations, underscores the role of ceramics in enhancing defense technology. Furthermore, their integration into communication and electronic warfare systems ensures robust performance against electromagnetic interference. These varied uses underscore the essential role of technical ceramics in enhancing performance and reliability across multiple defense systems, ensuring superior operational efficiency.

Latin America Technical Ceramic Market Analysis

The rising adoption of technical ceramics in electronics and semiconductors is driven by the growing demand for compact, high-performance devices. For example, the US invested USD 500 million in the Latin American semiconductor sector over five years, aiming to enhance semiconductor ATP capabilities and also aid in the advancement of telecommunications networks. These substances provide exceptional heat and electricity resistance, which is essential for maintaining the dependability of microchips and printed circuit assemblies. Their use in substrates and packaging improves heat dissipation and signal integrity, meeting the stringent requirements of modern electronic systems. As miniaturization trends dominate the industry, technical ceramics enable the development of components with reduced size and increased efficiency. They also play a role in manufacturing equipment for semiconductor fabrication, where precision and resilience are paramount. As consumer electronics and smart technologies become more widespread, the need for sophisticated ceramic components is steadily increasing, reinforcing their significance within the industry.

Middle East and Africa Technical Ceramic Market Analysis

Technical ceramics are increasingly utilized in construction and real estate projects due to their durability, thermal resistance, and aesthetic versatility. Reports indicate that Saudi Arabia is experiencing swift expansion in its construction industry, featuring more than 5,200 projects in progress, amounting to USD 819 Billion. Ceramics application in tiles, sanitary ware, and architectural facades meets the demand for materials that combine functionality and design. In regions experiencing harsh climatic conditions, ceramic materials provide thermal insulation, contributing to improved energy efficiency in architectural structures. Their use in advanced construction techniques, including prefabricated components, supports faster project completion and cost savings. Additionally, the durability of ceramics against corrosion and wear extends their lifespan, minimizing long-term maintenance expenses. With the rapid expansion of infrastructure, advanced ceramics are essential in building sustainable and robust urban environments.

Competitive Landscape:

The competitive landscape of the technical ceramics market is characterized by a diverse range of global and regional players, each specializing in specific product categories such as advanced ceramics, structural ceramics, and electrical ceramics. Key market participants include established companies like CeramTec, CoorsTek, Morgan Advanced Materials, and Kyocera, which leverage advanced manufacturing technologies and extensive research and development capabilities. For instance, in November 2024, KYOCERA Fineceramics Europe GmbH announced that they have received the BSFZ seal for its advanced research and innovation in technical ceramics. The company also earned recognition the same year for developing a novel silicon nitride used in semiconductor testing. This high-strength material withstands extreme temperatures, ensuring precision in microchip testing. These companies are focused on innovation, expanding product portfolios, and enhancing performance characteristics to meet the increasing demands of industries such as aerospace, automotive, electronics, and healthcare. The market is also experiencing the rise of smaller, specialized firms providing customized solutions designed for distinct applications.

The report provides a comprehensive analysis of the competitive landscape in the technical ceramic market with detailed profiles of all major companies, including:

- 3M Company

- Bakony Technical Ceramics

- CeramTec GmbH

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Elan Technology

- General Electric Company

- KYOCERA Corporation

- Mantec Technical Ceramics Ltd.

- Morgan Advanced Materials plc

- NGK Spark Plug Co. Ltd.

- Rauschert GmbH

Latest News and Developments:

- December 2024: System Ceramics, a member of the Coesia Group, has introduced Infinity DRY, an innovative digital system for applying grit and powder. This advancement merges digital printing with dry powder usage to improve ceramic decoration, particularly on porcelain surfaces. Infinity DRY’s targeted operation facilitates accurate powder application, resulting in incredibly lifelike, three-dimensional patterns. The system's effectiveness guarantees clear, precise designs by eliminating surplus powder post-application.

- October 2024: KYOCERA Fineceramics Europe has enhanced its premium ceramic Starceram N3000 P by launching a new silicon nitride for functional evaluation of next-generation microchips. This substance is essential for evaluating microchips on silicon wafers with 'probe cards' that direct as many as 100,000 delicate contact needles. This advancement improves the precision and effectiveness of microchip testing.

- October 2024: Lithoz has introduced the Ceramic 3D Factory, a worldwide network leveraging its LCM technology to enhance accessibility to ceramic additive manufacturing. The initiative goes beyond just prototyping to include production, serving sectors such as aerospace, medical, and dental. In collaboration with global service providers, it seeks to satisfy the increasing need for high-quality technical ceramic components. This signifies an important transition toward scalable, industrial-quality ceramic AM solutions.

- June 2024: CeramTec launched Sinalit, a high-performance substance designed for tailored power modules. Tailored for automotive and power electronics uses, Sinalit provides excellent thermal conductivity along with electrical insulation. It is perfect for electric vehicles (EVs) and hybrid electric vehicles (HEVs), meeting industry needs for efficiency and longevity.

Technical Ceramic Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Oxide Ceramic, Non-Oxide Ceramic |

| Products Covered | Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites (CMC) |

| End Use Industries Covered | Electronics and Semiconductor, Automotive, Energy and Power, Medical, Military and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Bakony Technical Ceramics, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Elan Technology, General Electric Company, KYOCERA Corporation, Mantec Technical Ceramics Ltd., Morgan Advanced Materials plc, NGK Spark Plug Co. Ltd. and Rauschert GmbH. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the technical ceramic market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global technical ceramic market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the technical ceramic industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The technical ceramic market was valued at USD 88.1 Billion in 2024.

IMARC estimates the technical ceramic market to reach USD 133.9 Billion by 2033, exhibiting a CAGR of 4.52% during 2025-2033.

Key factors driving the technical ceramics market include increasing demand for high-performance materials in electronics, automotive, aerospace, and healthcare industries. Advancements in material science, the need for durable, heat-resistant components, and growing focus on sustainability and energy efficiency further propel the market’s growth across various sectors.

Asia Pacific currently dominates the market with 42% share, reflecting its strong economic growth, technological advancements, and expanding consumer base. This dominance is driven by rapid industrialization, increased investments, and a growing middle class, positioning the region as a key player in the global market landscape.

Some of the major players in the technical ceramic market include 3M Company, Bakony Technical Ceramics, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Elan Technology, General Electric Company, KYOCERA Corporation, Mantec Technical Ceramics Ltd., Morgan Advanced Materials plc, NGK Spark Plug Co. Ltd., Rauschert GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)