Taxi Market Size, Share, Trends and Forecast by Booking Type, Service Type, Vehicle Type, and Region, 2025-2033

Taxi Market Size and Share:

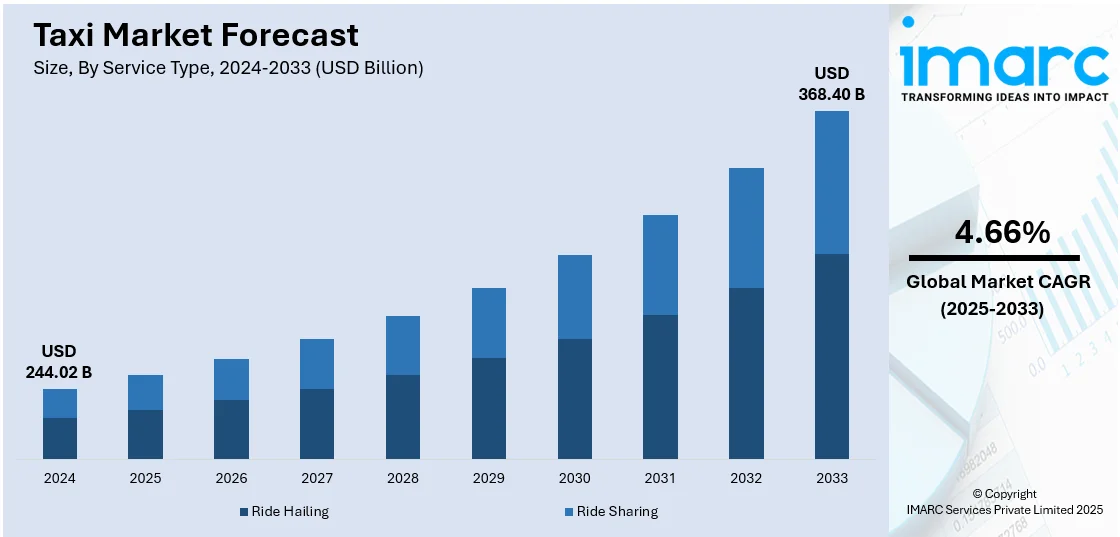

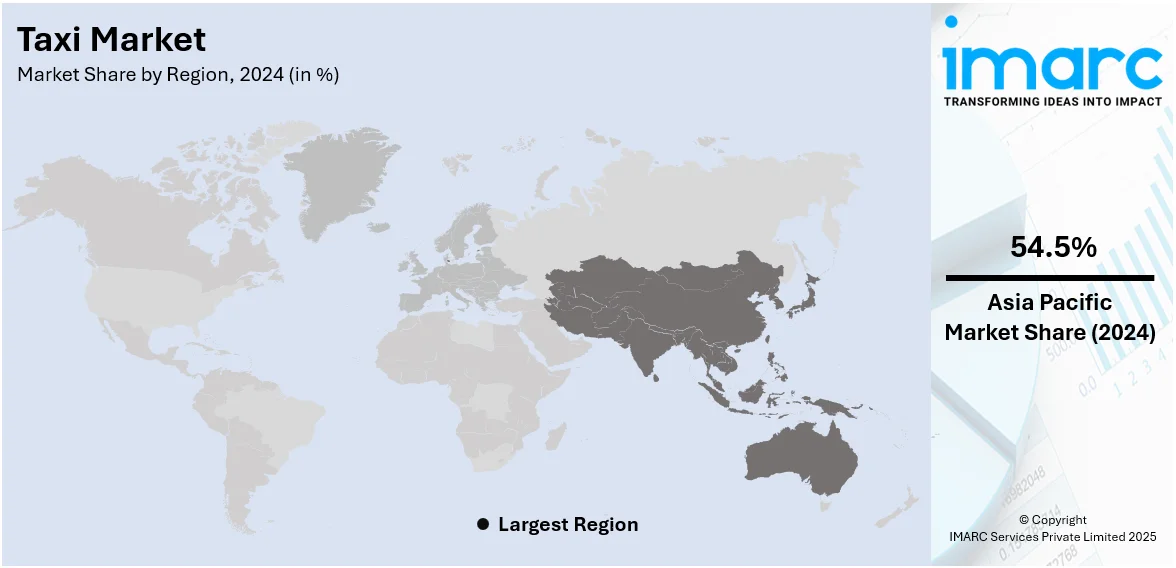

The global taxi market size was valued at USD 244.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 368.40 Billion by 2033, exhibiting a CAGR of 4.66% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 54.5% in 2024. The region's taxi market is driven by rapid urbanization, widespread adoption of ride-hailing apps, and increasing demand for convenient, flexible, and eco-friendly transportation options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 244.02 Billion |

|

Market Forecast in 2033

|

USD 368.40 Billion |

| Market Growth Rate (2025-2033) | 4.66% |

Expansion of cities and increasing population density has been amplifying the demand for comfortable and efficient means of transport. Taxis are one of the primary ways to travel around with comfort. Taxis offer flexible point-to-point services customized according to the requirements of the commuters in busy metropolitan areas. Growing population of working professionals and tourists in urban cities has created the demand for transport. Traffic congestion further amplifies the appeal of taxis, which typically offer quicker, more practical substitutes for private cars. In addition, ride-hailing apps increase the convenience with fast booking, optimized routes, and transparent pricing. For instance, in January 2024, YelowSoft introduced an in-app wallet for ride-hailing platforms, enabling seamless one-click payments, enhanced security, reduced transaction times, and loyalty programs to boost customer retention and streamline operations. Moreover, urban infrastructure limitations make taxis an ideal solution where public transport struggles to meet dynamic mobility demands.

To get more information on this market, Request Sample

The United States taxi market is driven by amplifying urbanization and the growing demand for convenient transportation options with the share of 88.4%. With growing cities, traffic congestion accelerates, providing a flexible alternative in taxis compared with private vehicles and public transports. The advent of high technology in taxi services has vastly improved the experience of the customer from ride-hailing apps and GPS integration to digital payment, which increases the easy accessibility and efficiency of getting a taxi service. As well, using electric or hybrid vehicles for taxi usage is also an element promoting sustainability and the reduction of carbon emissions. For example, in April 2023, Lyft expanded its “Green” mode to 14 major U.S. cities, enabling riders to request electric and hybrid vehicles directly via the app, supporting its 2030 all-electric fleet goal. Furthermore, government support for green initiatives and smart city projects further boosts the market. The rising preference for on-demand services, fueled by a tech-savvy population, continues to shape the growth trajectory of the U.S. taxi market.

Taxi Market Trends:

Increasing popularity of online taxi booking channels

The increasing popularity of online taxi booking channels is stimulating the taxi market share. The convenience offered by mobile applications and web platforms has revolutionized how passengers’ access and utilize taxi services. With just a few taps on their smartphones, users can effortlessly book a ride, track its real-time location, estimate arrival times, and make cashless payments. According to PWC, global cashless payment volumes are projected to surge over 80% from 2020 to 2025, reaching nearly 1.9 trillion transactions, transforming sectors like taxis by enabling faster, safer, and more inclusive digital transactions, especially in Asia-Pacific with a 109% growth rate. This streamlined process also enhances customer satisfaction and amplifies the number of potential users because it is a technological, digital service. Online booking also generates competition in the taxi service market and challenges its service providers to offer improved services, better customer services, and appropriate pricing to win in the market. A competitive market helps consumers as there is boosted competition for services provided to customers. As online taxi booking becomes a norm, it's shaping the way people view and interact with taxi services and, in turn, driving the taxi market growth of the whole industry.

Rising penetration of the Internet and smartphones

Growing penetration of the Internet and smartphones are further supporting this market. With rising adoption of these technologies, the benefits of ease and convenience hailing and booking taxis from mobile applications have been amplified. The wider and ready availability of smartphones and access to the Internet provides passengers anywhere and anytime the opportunity for quick access to taxi service. For instance, in 2024, 5.35 Billion people, or 66.2% of the global population, used the internet. This rising penetration significantly benefits the taxi industry, enhancing accessibility, ride-hailing app usage, and customer convenience. This accessibility fosters increased adoption among urban and rural populations, expanding the customer base. Passengers can easily download and use taxi apps, making the booking process very easy and reducing the need for manual interventions. Additionally, the integration of GPS technology in smartphones enables accurate tracking and real-time updates on the taxi's location, hence enhancing safety and convenience. For drivers, smartphones offer navigation tools that optimize routes and reduce travel time, hence improving customer experiences. The smartphone and internet connectivity in taxis have remodeled the taxi market into a consumer-centric and more efficient field. This will continue the trend as the technology permeates every daily activity in uprising ways to boost market.

Escalating demand for ride-sharing services

The rising demand for ride-sharing services is boosting the market. Ride-sharing platforms have changed the approach to transport for people and are offering an alternative to the traditional taxi services. According to reports, the global ride-sharing market, valued at USD 113 Billion in 2023, is projected to grow at a 16.20% CAGR, reaching USD 439.4 Billion by 2032, driven by rising app usage that enhances efficiency and profitability for taxi operators. The appeal of ridesharing lies in its cost-sharing model, which enables passengers to share rides and split expenses. This cost-efficiency attracts a broad spectrum of consumers, including those seeking economical travel options. Additionally, the convenience of making bookings through user-friendly applications has also escalated the demand. Another factor is a preference for environmentally conscious practices. Ride-sharing reduces individual vehicles on the road and consequently reduces carbon emissions with lesser environmental impact. That is a sustainability factor well-liked by passengers, who are environmentally conscious and actively seek ecofriendly modes of transportation. The widespread adaptation of ridesharing has stimulated competition making taxi service providers improve their service to remain competitive. Some of the improvements include improving vehicle quality, service reliability, and technological features. Thus, ridesharing continues to change the nature of commuting as its effect on the growth of taxis remains a significant and current influence.

Taxi Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global taxi market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on booking type, service type,and vehicle type.

Analysis by Booking Type:

- Online Booking

- Offline Booking

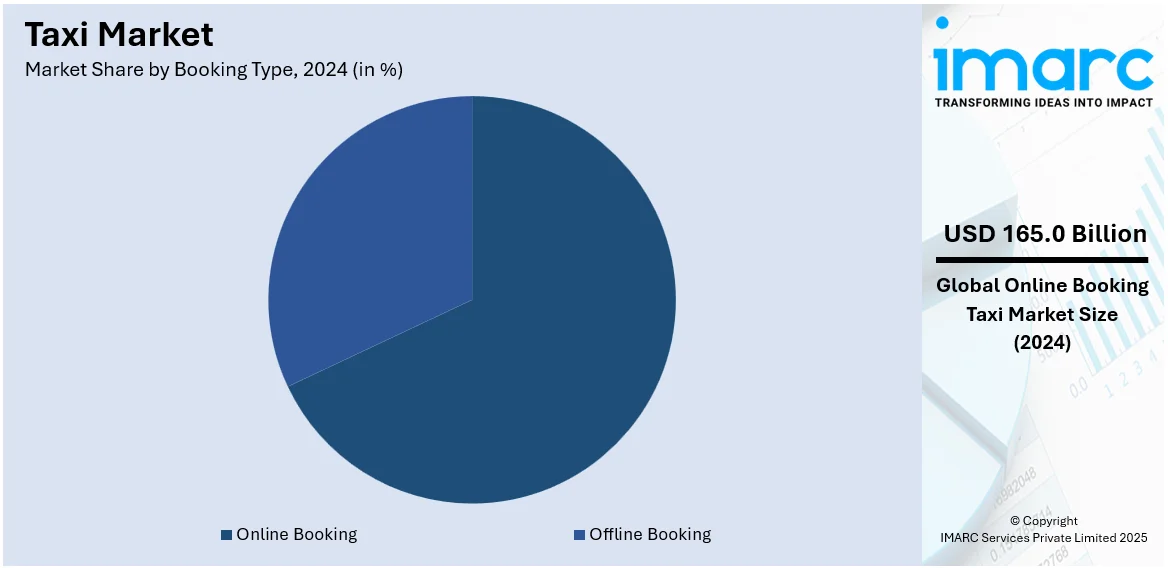

Online booking stand as the largest component in 2024, holding around 67.6% of the market. Online booking offers unmatched convenience and efficiency, allowing passengers to hail a ride using their smartphones or computers within seconds. The increasing reliance on digital platforms for various aspects of life has propelled online booking adoption in the taxi industry. Passengers can seamlessly schedule rides, track their arrival, and make cashless payments, streamlining the process. This user-friendly approach attracts a broader customer base, including tech-savvy individuals and those seeking hassle-free transportation solutions. Moreover, online booking systems enhance transparency, as users can view fare estimates and track the exact location of their chosen vehicle in real time. This level of transparency and control fosters consumer trust, encouraging repeated usage. As this segment continues to grow, taxi companies are focusing on refining their online booking interfaces, ensuring they remain user-centric and adaptable to changing preferences. Consequently, the online booking segment is a potent driver propelling the overall growth and evolution of the taxi market.

Analysis by Service Type:

- Ride Hailing

- Ride Sharing

Ride-hailing platforms have introduced a new level of convenience and flexibility, attracting a diverse range of passengers and meeting various travel needs. These services allow passengers to request rides on-demand through mobile applications, reducing wait times and reducing the need to flag down taxis on the street. This immediacy appeals to individuals seeking instant transportation solutions, whether for daily commutes, business trips, or leisure outings. The concept of ride-hailing has also created new earning opportunities for drivers, enabling flexible work arrangements and supplementary income streams. This has led to a larger pool of available drivers, further enhancing the convenience for passengers. In addition, the ride-hailing model promotes cashless transactions and transparent pricing, contributing to a secure and trustworthy experience for both passengers and drivers. The option to rate and review rides fosters accountability and quality improvements within the industry. As ride-hailing continues to evolve and expand into different markets, it remains a key contributor to the overall growth and dynamism of the taxi market, offering modern, efficient, and user-centric transportation solutions.

Analysis by Vehicle Type:

- Cars

- Motorcycle

- Others

Car leads the market with around 83.8% of market share in 2024. Cars are the cornerstone of taxi services, catering to passengers and travel preferences. The utilization of cars in the taxi industry offers passengers a comfortable and private travel experience, making them a preferred choice for individuals, families, and business travelers. The familiarity and ubiquity of cars contribute to their popularity as a convenient mode of point-to-point transportation. Furthermore, the introduction of modern amenities such as air conditioning, entertainment systems, and comfortable seating in taxi cars enhances the overall passenger experience. Many taxi companies are also focusing on maintaining a well-maintained and clean fleet of cars, further elevating customer satisfaction. Cars' flexibility to navigate various types of roads and access locations that might be challenging for larger vehicles adds to their appeal. They cater to urban and suburban travel needs, making them suitable for various passengers and trip purposes. As the taxi market continues to evolve with technological advancements, cars will remain a cornerstone of the industry, offering reliable, accessible, and efficient transportation services to individuals across diverse demographics.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 54.5%. The Asia Pacific region stands out as a significant driver of growth within the taxi market, fueled by urbanization, technological adoption, and changing consumer preferences. The region's densely populated cities and expanding urban areas have created a strong demand for efficient and accessible transportation options. Taxis, often equipped with modern amenities and user-friendly mobile apps, cater to this need by offering a convenient mode of point-to-point travel. Technological advancements have further accelerated market growth. Mobile apps allow passengers to easily book rides, track vehicles in real time, and make cashless payments. The region's strong smartphone penetration and tech-savvy population have contributed to the rapid adoption of these digital solutions. Additionally, rising middle-class populations in Asia Pacific countries have increased disposable incomes and greater mobility. As a result, taxi services are perceived as affordable, comfortable, and reliable transportation options for daily commutes and leisure travel. Government initiatives to improve urban mobility, reduce congestion, and address pollution have also boosted the appeal of taxis. As more individuals prioritize convenience and efficiency, and as infrastructure and technology continue to advance, the region is poised to sustain its role as a driving force in the market growth.

Key Regional Takeaways:

North America Taxi Market Analysis

North American taxi market is constantly growing with the rising need for on-demand transportation and improvement in ride-hailing technologies. Urbanization, among other factors, fuels a preference for flexible mobility options that drive the adoption of both traditional and app-based taxi services. Technological innovation such as AI-driven route optimization and digital payment integration has also helped to improve efficiency and enhance the customer experience. The rising environmental awareness is fuelling acceptance and growth of electric and hybrid vehicles. The other regulatory mechanisms favouring safety quality and servicing, however, govern the whole process. The higher competition remains on account of the public and other shared mobility models, with investment and regional developments by strategic companies that should help cushion such effects to the economy. The North American taxi market is continuously evolving with shifting consumer preferences and with changing technological and environmental scenarios.

United States Taxi Market Analysis

The taxi industry in this region is experiencing rapid evolution due to advancements in technology and urbanization. According to reports, the U.S. urban population grew by 6.4% from 2010 to 2020, now comprising 80% of the nation, fuelling demand for taxi services as increasing urbanization enhances accessibility and ride-hailing opportunities. Increased adoption of ride-hailing platforms has streamlined operations, offering passengers easy access to services via mobile apps. Integration of eco-friendly fleets is further driving demand as consumers seek sustainable options. Localized transportation policies aimed at reducing congestion are encouraging shared mobility. Moreover, rising tourism and business travel contribute to consistent demand for these services. Specific areas with high population density are seeing tailored solutions, such as premium and electric cabs, enhancing commuter experience. Infrastructure development around major transit hubs also plays a role, boosting the need for seamless first mile and last-mile connectivity. Accessibility improvements for differently abled individuals are being prioritized to meet regulatory requirements, increasing inclusivity and service scope.

Asia Pacific Taxi Market Analysis

The growing urban middle-class population, combined with improved affordability, is fuelling growth in this region's taxi industry. For instance, India's middle-class population is projected to surge from 432 Million in 2020-21 to 1.02 Billion by 2047, accounting for 61% of the population, boosting demand for taxi services as affordability and urban mobility needs rise. Increasing smartphone penetration facilitates widespread adoption of app-based services, simplifying the booking process for users. Expanding cities are witnessing a demand for convenient, reliable transportation as traffic congestion worsens. Local operators are diversifying fleets to include more electric and hybrid options, catering to environmentally conscious riders. Additionally, flexible payment options, including digital wallets, are enhancing convenience, and attracting a tech-savvy demographic. The availability of micro-mobility solutions, such as bikes integrated with taxi networks, is gaining popularity. High-density areas are exploring shared services to accommodate commuter volume efficiently, catering to both individual and group needs. This approach supports the region's environmental and infrastructural goals.

Europe Taxi Market Analysis

A strong emphasis on sustainability is driving the adoption of electric and low-emission fleets across this region. Regulatory support, including financial incentives for eco-friendly vehicles, encourages operators to upgrade their services. According to report by McKinsey, Germany's EV-charging demand is set to hit 43 TWh annually by 2030 in an accelerated scenario, with passenger cars comprising 55% of usage, boosting eco-friendly taxis demand. Expanding intermodal transportation networks align taxi services with buses, trains, and shared mobility platforms for enhanced convenience. The region's focus on enhancing tourism is another factor, with specialized fleets offering multilingual drivers and customizable itineraries. Moreover, operators are investing in real-time tracking and AI-based routing to improve efficiency and reduce idle times. Demand for premium and luxury services is on the rise, particularly among business travellers seeking comfort and privacy. Inclusive options for the elderly and differently abled individuals are also gaining traction, driven by regulatory requirements and social awareness.

Latin America Taxi Market Analysis

A rising preference for cost-effective transport options is fuelling demand for taxis in this region. Changing consumer habits, with a shift toward flexible and comfortable travel solutions, are key drivers of this growth. Innovative ride-hailing platforms are providing seamless access to taxi services, improving the overall user experience. Seasonal tourism plays a vital role in bolstering demand, as visitors seek accessible transportation to navigate local attractions. For instance, Brazil with 6.8 Million foreign tourists in 2024, surpassing the 2019 record by 500,000 visitors, fuelling demand in the taxi market through increased airport pickups and city commutes. Additionally, initiatives promoting cleaner vehicles are transforming the sector, aligning with evolving expectations around sustainability. Localized taxi systems are being modernized to address gaps in connectivity across specific zones, offering a convenient alternative where public transport solutions remain limited or inconsistent.

Middle East and Africa Taxi Market Analysis

The growth of the taxi industry in the Middle East and Africa is fuelled by the rising demand for efficient and affordable transportation solutions in densely populated areas. Expansion in residential and commercial real estate projects has led to increased movement between newly developed areas and urban centres, driving the need for reliable mobility options. According to reports, the UAE real estate market is set to hit approximately USD 707 Billion by 2024, driven by a 24.6% surge in high-net-worth individuals by 2025, boosting demand for luxury properties and increasing opportunities for the taxi market as urban mobility demand rises. Additionally, the emergence of app-based ride-hailing platforms caters to the tech-savvy population, improving accessibility and convenience. In regions with limited public transit options, taxis serve as an essential link for daily commutes. Furthermore, efforts to modernize transportation systems and adapt to digital transformations are shaping the taxi market's trajectory, reflecting changing mobility preferences.

Competitive Landscape:

The taxi market is highly competitive, where providers are enhancing services through advanced technologies and efforts toward sustainability. Many integrate electric and autonomous vehicles to meet environmental objectives while enhancing efficiency. The need for route optimization, dynamic pricing, and AI-driven tools has become vital in delivering better customer experiences and decreasing operational costs. Partnerships and localized offerings are increasingly used in order to address regional demands and extend market presence. Companies are also looking at hybrid and electric vehicle solutions to stay ahead in the space of meeting regulatory and consumer preferences. Strategic collaborations and acquisitions are thereby shaping the industry into diverse services with improved operational scalability to handle changing market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the taxi market with detailed profiles of all major companies, including:

- BlaBlaCar

- Bolt Technology

- Curb Mobility, LLC

- DiDi Global Inc.

- Dubai Taxi Company PJSC

- Freenow

- Gett

- Gojek

- Grab Holdings Inc.

- Lyft, Inc.

- Nihon Kotsu Co., Ltd.

- Ola Electric Mobility Pvt Ltd. (ANI Technologies Pvt. Ltd.)

- Uber Technologies Inc.

Latest News and Developments:

- August 2024: The Pan Car App, a taxi booking service, has been introduced in Kangra, Himachal Pradesh. Developed by local youth, the app allows users to book taxis from their homes, streamlining transportation in the region. Launched by Tourism Corporation Chairman R S Bali, the app is hailed as a step towards self-employment and tech-driven economic growth. Bali emphasized the state government’s commitment to adopting modern technology for public convenience. This innovation is expected to save time and reduce the need to visit taxi stands.

- March 2024: Xanh SM Laos has launched its electric taxi service in Savannakhet, following successful operations in Vientiane and Vang Vieng. The expansion aligns with its mission to promote sustainable transport and environmental preservation. Fares in Savannakhet start at around approximately USD 0.90. The company aims to increase eco-friendly travel options in the "Land of a Million Elephants." This move further solidifies Xanh SM's role in Laos' green transport evolution.

- March 2024: Waymo, a Google spinoff, is rolling out its robotaxi service in Los Angeles, offering free rides to select users starting Thursday. About 50,000 people have already signed up for the driverless ride-hailing experience. The service features Jaguar I-PACE vehicles and plans to phase in paid fares later. Expansion to Austin is expected later this year. The launch highlights growing interest in autonomous urban transportation solutions.

- January 2024: The Assam government has launched 'Baayu,' India's first 100% electric app-based bike taxi service, developed with Bikozee Ecotech. Transport Minister Parimal Suklabaidya unveiled this eco-friendly initiative, expected to create 5,000 jobs under Assam's Aggregator Rules 2022. Baayu aims to cut carbon emissions and save approximately USD 8.8 Million annually in fuel costs. This decentralized service marks a significant shift towards sustainable transportation. The project reinforces Assam's commitment to green mobility solutions.

- January 2024: Dubai Taxi Corporation (DTC) has launched a new service allowing people of determination (POD) with non-motor disabilities to book regular taxis via the "DTC App." The service aims to enhance accessibility and quality of life, driven by DTC's commitment to social responsibility. Users can avail themselves of a 50% discount, similar to the dedicated POD service, by using the Sanad card. This initiative reflects DTC's goal to boost happiness and convenience for POD in Dubai.

Taxi Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Online Booking, Offline Booking |

| Service Types Covered | Ride Hailing, Ride Sharing |

| Vehicle Types Covered | Cars, Motorcycle, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BlaBlaCar, Bolt Technology, Curb Mobility, LLC, DiDi Global Inc., Dubai Taxi Company PJSC, Freenow, Gett, Gojek, Grab Holdings Inc., Lyft, Inc., Nihon Kotsu Co., Ltd., Ola Electric Mobility Pvt Ltd. (ANI Technologies Pvt. Ltd.), Uber Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the taxi market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global taxi market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the taxi industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A taxi is a vehicle used for public transportation, offering on-demand rides to passengers for a fee. Operated by licensed drivers, taxis provide flexible, point-to-point travel services within cities and towns. They are hailed through traditional street pickups, designated taxi stands, or modern ride-hailing apps, serving as a convenient and reliable option for individuals seeking quick and personalized transportation.

The taxi market was valued at USD 244.02 Billion in 2024.

IMARC estimates the global taxi market to exhibit a CAGR of 4.66% during 2025-2033.

The global taxi market is driven by increasing urbanization, rising demand for convenient transportation, and advancements in ride-hailing technology. Growth in disposable income and a preference for on-demand services further boost market expansion. Additionally, the shift toward eco-friendly vehicles, such as electric and hybrid taxis, and government initiatives promoting sustainable urban mobility are fueling the market's growth.

In 2024, online booking represented the largest segment by booking type, driven by widespread smartphone adoption, user-friendly apps, and the demand for convenient, real-time booking with transparent pricing options.

Ride hailing leads the market by service type owing to its flexibility, ease of access, and integration with advanced technologies like GPS and digital payment systems, ensuring seamless and efficient travel experiences.

Car is the leading segment by vehicle type, driven by its affordability, availability, and suitability for diverse needs, including urban commutes and long-distance travel, making it the preferred choice for passengers globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global taxi market include BlaBlaCar, Bolt Technology, Curb Mobility, LLC, DiDi Global Inc., Dubai Taxi Company PJSC, Freenow, Gett, Gojek, Grab Holdings Inc., Lyft, Inc., Nihon Kotsu Co., Ltd., Ola Electric Mobility Pvt Ltd. (ANI Technologies Pvt. Ltd.), Uber Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)