Tanzania Mobile Money Market Size, Share, Trends and Forecast by Technology, Business Model, and Transaction Type, 2025-2033

Tanzania Mobile Money Market Size and Share:

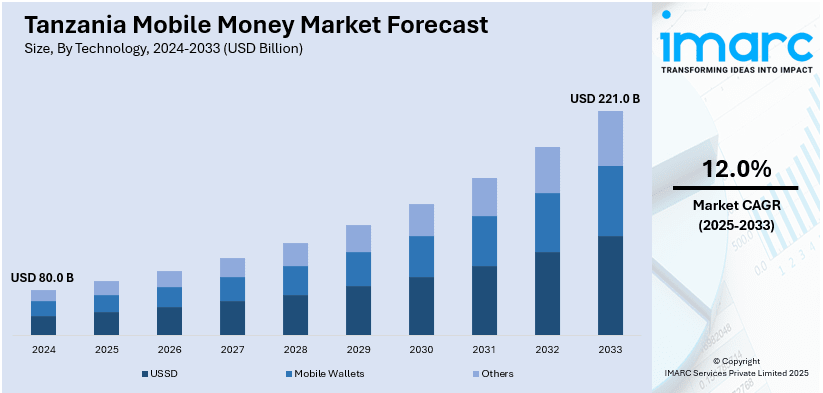

The Tanzania mobile money market size was valued at USD 80.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 221.0 Billion by 2033, exhibiting a CAGR of 12.0% during 2025-2033. The market is driven by high mobile phone adoption, limited banking access, and supportive regulations. Affordable smartphones and mobile internet expansion enhance digital financial inclusion. Demand for convenient, low-cost transactions fuels growth, especially among unbanked populations. Agent networks and business adoption enhance accessibility, while partnerships with financial institutions introduce micro-loans and insurance. Rising digital literacy is also augmenting the Tanzania mobile money market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 80.0 Billion |

|

Market Forecast in 2033

|

USD 221.0 Billion |

| Market Growth Rate (2025-2033) | 12.0% |

The mobile money market in Tanzania is primarily driven by the widespread adoption of mobile phones and the limited access to traditional banking services, especially in rural areas. A large section of the population uses mobile money services. It is an important tool to conduct activities such as payments, transfers, and savings on platforms such as M-Pesa. Also, a conducive regulatory environment by the government is encouraging growth by fostering innovation and competition among service providers. Tanzania witnessed an impressive 55.8 Million mobile money accounts in 2023, due to a significant 116.2% growth since 2019. In 2023, the number of mobile financial transactions grew 76.6% year-on-year to 5.3 Billion transactions, driven by an increase in mobile subscriptions to 76.6 Million. The market is largely dominated by Vodacom's M-Pesa, Tigo Pesa, and Airtel Money, which collectively cover 89% of the market share. Additionally, the increasing penetration of affordable smartphones and mobile internet is expanding the reach of mobile money, enabling more users to access digital financial services conveniently and securely.

To get more information on this market, Request Sample

The growing demand for convenient and low-cost financial solutions among Tanzania’s unbanked and underbanked populations is majorly driving the market. Mobile money offers a faster, safer, and more accessible alternative to cash transactions, which is driving its popularity for everyday use. Businesses are also adopting mobile payments, further contributing to Tanzania mobile money market growth. The rise of agent networks is enhancing accessibility, allowing users to deposit, withdraw, and transfer money easily. Furthermore, strategic partnerships between mobile money providers and financial institutions have introduced new services, such as micro-loans and insurance, thereby increasing financial inclusion. Microfinance institutions (MFIs) play a crucial role in fostering the growth of small and medium-sized enterprises (SMEs) in Tanzania. An industry report indicates that Tier II microfinance service providers extended loans to 4.14 Million MSMEs in 2023. The total value of loans provided by these institutions saw a significant increase of 39.15% in 2023. These factors, combined with rising digital literacy, continue to propel Tanzania’s mobile money market forward.

Tanzania Mobile Money Market Trends:

Widespread Mobile Money Adoption

Tanzania’s mobile money market is experiencing significant growth, driven by the country's widespread use of mobile phones. As of December 2022, Tanzania had over 40 Million mobile money accounts, with the GSMA reporting that 64% of adults in the country use mobile phones for financial transactions. This trend is fueled by the extensive coverage of mobile networks, which allows users from both urban and rural areas to access mobile money services. The adoption rate of mobile money services has also risen significantly, from 60% of the population in 2017 to 72% in 2023, showcasing increasing trust in mobile financial services as a convenient alternative to traditional banking.

Introduction of Mobile Money Interoperability

A significant Tanzania mobile money market trend is the introduction of interoperability between rival mobile money services. As the first country in Africa to implement this feature, Tanzania has significantly improved the accessibility of mobile financial services. The availability of Tanzania's payment systems (TISS, TACH, TIPS) in 2024, for example, was maintained at an excellent level of 99.85%, and the efficiency of digital financial services improved. Bank of Tanzania introduced a fee cap on interbank transactions and enhanced consumer protections through regulation of digital lending practices and banning surcharges at merchant locations. Likewise, they registered a considerable increase in Electronic Fund Transfer (EFT) transactions, suggesting mobile money adoption. Interoperability allows users to transfer funds seamlessly across different mobile money platforms, increasing convenience and promoting financial inclusion. This shift enhances the user experience and strengthens the mobile money ecosystem by making services more versatile, leading to a greater number of active users and increasing the Tanzania mobile money market demand.

Expansion of Financial Services Beyond Basic Transactions

Mobile money services in Tanzania have transformed beyond simple money transfers to encompass a wide range of financial offerings. These include microloans, mobile insurance, and even hospitalization covers, which are accessible via mobile phones. This shift has been pivotal in attracting new users and increasing the number of mobile money accounts. According to industry reports, the growth of mobile money in Tanzania is largely attributed to the provision of such innovative financial products. For instance, the World Bank, in its new Tanzania Country Partnership Framework (CPF) for FY2025-FY2029, aims to enhance the country’s financial management and stimulate private sector development. This initiative aims to help in poverty alleviation and promote financial inclusion. The program draws from more than USD 9 Billion in previous CPF funding, aiming to cover sectors such as infrastructure, education, and financial services (including mobile money solutions). The framework also leverages USD 400 Million in investments from the International Finance Corporation (IFC) and USD 151 Million in guarantees from the Multilateral Investment Guarantee Agency (MIGA) to spur financial and digital services across Tanzania. With these services, mobile money platforms are positioning themselves as essential tools for personal financial management, offering savings, insurance, and credit to individuals previously underserved by traditional financial institutions.

Tanzania Mobile Money Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Tanzania mobile money market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, business model, and transaction type.

Analysis by Technology:

- USSD

- Mobile Wallets

- Others

USSD stands as the largest component in 2024, holding around 77.0% of the market due to its accessibility, reliability, and low data requirements. Unlike applications that require smartphones, USSD technology works well with basic feature phones, an attractive feature in a country such as Tanzania, with a significant unbanked and rural population with low-level smartphone access. Additionally, the nature of transactions through a short code (no need for an internet connection) makes it accessible, even in areas that have low connectivity. Mobile money services rely on USSD for key operations, including cash deposits, withdrawals, and P2P transfers, further entrenching its position in the market. Moreover, USSD is suitable for transaction processing in real-time; it is cheap, and it is often used for low-value transactions. Even as mobile applications and QR code payments gain traction, USSD's universal compatibility and user-friendliness keep it ahead in the market. Also, the regulatory endorsement of USSD-based services adds weight to its position as the dominant mobile money solution across the country.

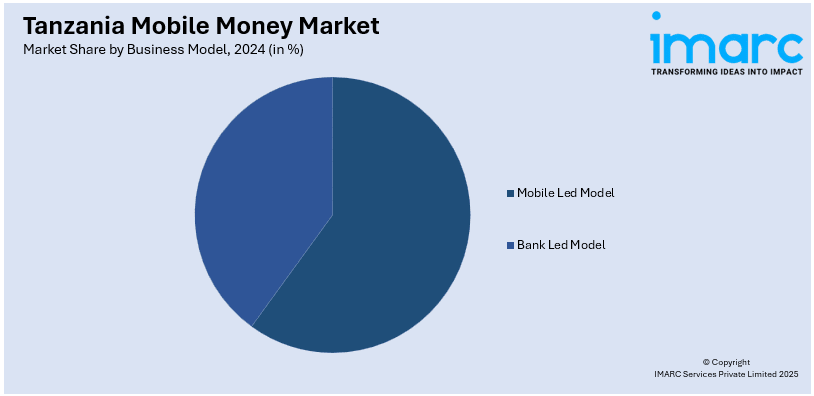

Analysis by Business Model:

- Mobile Led Model

- Bank Led Model

Mobile led model leads the market with around 83.2% of market share in 2024, primarily due to the central role of telecom operators in driving financial inclusion. Vodacom (M-Pesa), Airtel Money, and Tigo Pesa leverage their large cell phone infrastructure and vast agent distribution to enable seamless transactions in areas that lack connectivity or access to normal banking. Unlike bank-driven models which require a formal banking infrastructure, mobile-driven services leverage simple USSD codes as well as basic mobile devices that are used by many unbanked individuals in Tanzania, making it more accessible. Strong brand loyalty, high customer uptake, and innovative offerings such as micro-loans and bill payment services—also benefit telecom operators. The model also benefits from favorable government policies that encourage interoperability and competition. Thus, the mobile-led design becomes the backbone of Tanzania's mobile money ecosystem and offers affordability, convenience and scalability to consumers.

Analysis by Transaction Type:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

Peer to peer leads the market with around 27.8% of market share in 2024, driven by the widespread need for quick and secure money transfers among individuals. This sector benefits from the country's high reliance on cheap remittances, from cities to rural areas, between family members, and the ability to do instant transactions without cash. With low transaction fees, a commonly accepted user interface through USSD, and widespread agent networks for cash-in and cash-out services, M-Pesa and similar peer-to-peer (P2P)-based services offer widely accessible options. Moreover, the increasing trend of the informal economy can be attributed to reliance on small-scale commerce and direct payments between individuals. However, with technological advancements that encompass a wider range of mobilities beyond the traditional means of banking, P2P transfers have become the preferred method for daily financial transactions, ultimately defining them as the industry leaders under Tanzania's mobile money umbrella. Similarly, supportive regulations that encourage interoperability also allow for a smooth transfer between different service providers, enabling more widespread adoption.

Competitive Landscape:

The competitive landscape of the market demonstrates a high level of competition among key players, which is well-supported by their initiatives to expand their service portfolio to capture maximum market share. Leading providers continue investing heavily in broadening their agent networks to improve access, particularly in rural areas where inclusion is still limited. Many companies are rolling out new products, such as microloans, savings accounts, and insurance, as ways of expanding their revenue streams beyond basic transactions. There has also been a strong push towards interoperability that ensures people can seamlessly transfer across networks and provides better convenience for customers in general. Providers are also leveraging technology upgrades, including improved USSD platforms and smartphone apps, creating a positive Tanzania mobile money market outlook. Furthermore, strategies focused on competitive pricing, including lower transaction fees and loyalty incentives, are being utilized to draw in and keep customers. Collaborations with merchants, utility providers, and government entities enhance the integration of the ecosystem, rendering mobile money essential for everyday financial transactions.

The report provides a comprehensive analysis of the competitive landscape in the Tanzania mobile money market with detailed profiles of all major companies, including:

- M-Pesa (Vodacom Tanzania Limited)

- Tigo Tanzania (MIC Tanzania Public Limited Company)

- Airtel Money Tanzania Limited

Latest News and Developments:

- October 2024: Airtel Tanzania partnered with Remitly to improve money transfers via mobile money services. The collaboration allowed customers to send funds directly to Airtel Tanzania wallets, ensuring faster access. This initiative expanded financial accessibility for over 19 million users across Tanzania. The partnership strengthened Remitly’s presence in the growing Tanzanian remittance market.

- October 2024: The Multilateral Investment Guarantee Agency (MIGA), part of World Bank Group Guarantees, issued a guarantee to The Rise Fund for its investment in Airtel Money Tanzania. This was part of a USD 180 Million commitment to support Airtel Money projects across Africa. The guarantee covered risks including war, expropriation, and transfer restrictions for 3.2 years. It marked MIGA’s first contract in Tanzania since 2014, promoting financial inclusion.

- August 2024: Binance introduced the One Click Buy and Sell (OCBS) feature, enabling users in Tanzania and other African countries to trade crypto using mobile money. This integration, developed with Transfi, expanded fiat on-ramp/off-ramp options. The feature aimed to enhance accessibility and convenience for crypto enthusiasts.

- July 2024: Tanzanian fintech firm NALA secured USD 40 Million in a Series A round to expand its B2B payment platform, Rafiki. Acrew Capital led the investment, joined by DST Global, Norrsken22, and HOF Capital. NALA, which previously raised USD 10 Million in 2022, enables users to send money via mobile money and banks across 11 African markets. The expansion was driven by user demand for greater financial control.

- March 2024: UK fintech Unlimit secured a PSP license from the Bank of Tanzania to expand its payments services in the country. The company planned to introduce business payments, merchant services, outbound payments, and mobile money solutions. This followed its approvals in Nigeria and Kenya, strengthening its African expansion. UK fintech Unlimit aimed to remove trade barriers and enhance financial connectivity in Tanzania.

Tanzania Mobile Money Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, Others |

| Companies Covered | M-Pesa (Vodacom Tanzania Limited), Tigo Tanzania (MIC Tanzania Public Limited Company), Airtel Money Tanzania Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Tanzania mobile money market from 2019-2033.

- The Tanzania mobile money market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Tanzania mobile money industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Tanzania mobile money market was valued at USD 80.0 Billion in 2024.

IMARC estimates the Tanzania mobile money market to exhibit a CAGR of 12.0% during 2025-2033, reaching a value of USD 221.0 Billion by 2033.

The market is driven by widespread mobile phone adoption, limited banking access, supportive regulations, affordable smartphones, expanding mobile internet, rising digital literacy, and the growing demand for convenient, low-cost financial solutions, particularly among unbanked and underbanked populations.

Peer to Peer accounted for the largest Tanzania mobile money transaction type market share in 2024, holding around 27.8% of the market.

Some of the major players in the Tanzania mobile money market include M-Pesa (Vodacom Tanzania Limited), Tigo Tanzania (MIC Tanzania Public Limited Company), and Airtel Money Tanzania Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)