Tampon Market Size, Share, Trends and Forecast by by Type, Material, Distribution Channel, and Region, 2025-2033

Tampon Market Size and Share:

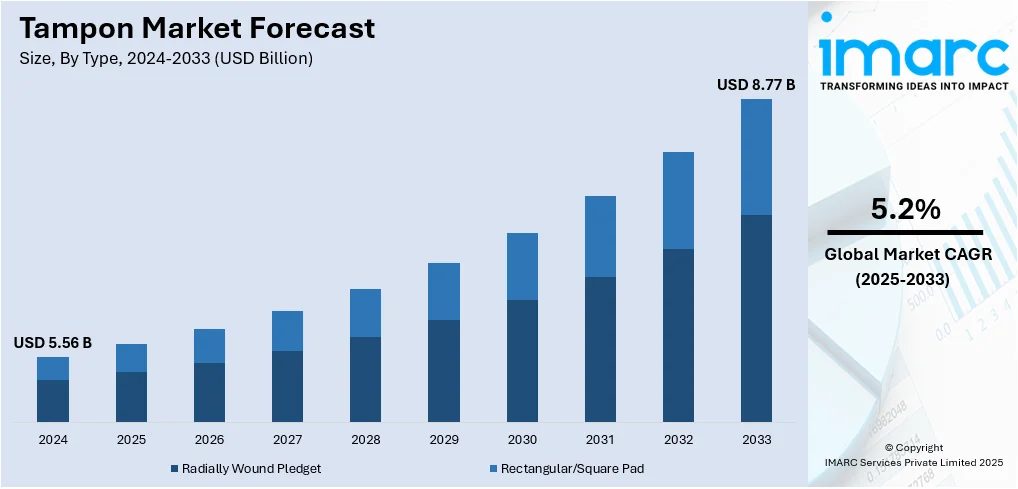

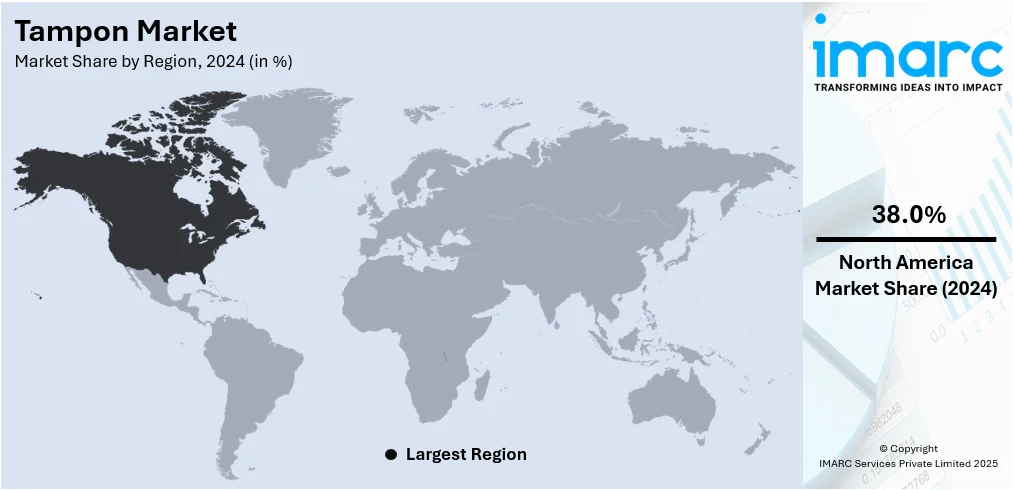

The global tampon market size was valued at USD 5.56 Billion in 2024. The market is projected to reach USD 8.77 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. North America currently dominates the market, holding a market share of over 38.0% in 2024. The market is fueled by widespread awareness, advanced retail infrastructure, and demand for organic personal care products. At the global level, the market is growing as a result of increased female labor force participation, better menstrual health education, and a desire for discreet travel-friendly products. Government programs and developments in sustainable materials further accelerate adoption. The increased emphasis on environmental safety, convenience, and health continues to influence demand and solidify the overall global tampon market share.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.56 Billion |

|

Market Forecast in 2033

|

USD 8.77 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

Globally, heightened awareness regarding menstrual hygiene and the growing focus on individual well-being are driving the demand for tampons. With more women opting for formal jobs, physical activities, and active lifestyles, there has been a heightened need for convenient, subtle, and efficient menstrual products. Tampons provide a convenient solution, enabling mobility, increased wear time, and protection while engaging in physical activity. In developed and emerging markets alike, government programs and education campaigns are assisting in breaking taboos on menstruation, stimulating product use among various age groups. Furthermore, health influencers and social media have also helped induce more public discussion of menstrual health, further de-stigmatizing. With consumers seeking hygiene, comfort, and independence, the market for tampons is reaping the rewards of close alignment with contemporary values. This continued shift in beliefs and habit drives steady expansion globally, turning tampons into a choice of convenience for millions of women in search of reliability and hygiene through their menstrual cycle. In April 2025, the Indian Ministry of Health partnered with several NGOs to launch the “Swasthya Sakhi” campaign aimed at distributing free tampons in rural schools and colleges, underscoring the government’s commitment to improving menstrual hygiene and expanding access to modern feminine care products.

To get more information on this market, Request Sample

Within the United States, the surging consumer trend toward organic and sustainable menstrual products is a major force defining the tampon market. According to the sources, in April of 2024, USA Track & Field joined with period care brand August to provide 100% cotton menstrual hygiene products to Team USATF athletes through 2025. Moreover, organic and sustainable tampons represented 83.80% of overall United States tampon market size in 2024, illustrating heightened interest in chlorine-free, biodegradable, and sustainably sourced products. Consumers in America are more critically reviewing the ingredients of products and choosing items that contain no chlorine, fragrances, or synthetic components. This shift is driven by heightened concern for long-term health effects and environmental stewardship. Moreover, women of all ages are looking for products that are in line with their own values and wellness objectives. Physical activity and exercise participation by women has also increased in the U.S. market, driving further demand for tampons because they are convenient to use while moving. With amplified mainstream adoption of sustainable living, the use of organic tampons continues to grow, fueling the category's standing in the larger United States menstrual care market.

Tampon Market Trends:

Growth in Workforce Driving Demand for Tampons

The global rise in women's workforce participation is a key driver fueling the growing demand for tampons. In 2024, women made up 41.2% of the world's workers, a substantial shift in gender roles and economic participation. This rise has augmented the demand for discreet, portable, and effective menstrual hygiene products during extended workdays or travel. Tampons provide an uninterrupted experience whereby women can easily take care of their menstrual requirements without interrupting their daily routines. With more women filling physically demanding or mobile job positions, the demand for tampons is also on the rise. In addition, shifting societal attitudes towards menstruation are promoting open communication and acceptance, facilitating access to and use of such products by working women. The intersection of economic activity, lifestyle demands, and heightening awareness of health is contributing to a consistent increase in the use of tampons, particularly among urban businesswomen who place importance on convenience and functionality.

Government Policies Facilitating Hygiene Access

Government programs in many nations are playing a strong role in tampon uptake through recognizing menstrual hygiene as a public health matter. The Scottish Government's Period Products Free Provision Act is an example of this trend in providing free, universal access to products such as pads and tampons. Such programs are being introduced all over the world, particularly in schools, public centers, and poor communities. The policies intend to decrease period poverty and raise awareness among young girls and women. By removing the cost of menstrual care, governments are promoting a culture of hygiene equity and dignity. Public distribution programs and campaigns not just enhance access to the product but also normalize the use of tampons among various socioeconomic segments. As menstrual hygiene becomes a part of health policy, there are new opportunities for market growth that manufacturers can capitalize on. Government support is therefore revolutionizing the tampon market by enhancing accessibility, lowering stigma, and affirming the role of menstrual wellness.

Health and Sustainability Driving Innovation

The movement towards health-oriented and sustainable living is redefining consumer behavior around menstrual hygiene, resulting in growing demand for organic and sustainable tampons. These are products without synthetic chemicals, fragrances, and pesticides, which are what women prefer as safer and more eco-friendly options. The industry is seeing increased innovation with biodegradable materials and plant-based fibers to meet the sustainability objectives. Women who are into fitness, sports, and other active regimens favor tampons because they are comfortable and leak-proof, which provides confidence while in action. As dialogues about environmental footprint and ingredient traceability intensify, organic tampon use is highly growing in markets. Concurrently, increasing investment in women's health is driving innovation and awareness for tampons, with estimates that women's health as a market is set to be a USD 1 trillion economic opportunity through 2040. This convergence of individual well-being, planetary stewardship, and product innovation is transforming the global tampon market and building long-term customer loyalty.

Tampon Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tampon market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, and distribution channel.

Analysis by Type:

- Radially Wound Pledget

- Rectangular/Square Pad

The radially wound pledget tampons represented 79.8% of the world market in 2024 and were the leading product type among consumers. Their popularity stems from their enhanced absorbency, stability, and comfort. This configuration spreads evenly on insertion, creating stronger leakage protection, particularly for women with busy or active lifestyles. Additionally, radially wound pledgets have a broad availability in different absorbencies, thus appropriateness in accommodating differing levels of menstrual flow. Ease of insertion and removal is also inherent in the design, furthered to ensure user satisfaction and repeat purchases. Their suitability with organic and hypoallergenic materials has also further contributed towards their popularity with consumers interested in maintaining healthy lifestyles. With further development of tampon technology, the emphasis lies in increasing the structural efficiency of radially wound products without loss of comfort and safety. The high market preference shows the continued dependence on this format as a safe, high-performance solution for menstrual health requirements.

Analysis by Material:

- Cotton

- Rayon

- Blended

Blended-material tampons took a 35.0% market share worldwide in 2024 due to consumer demand for a balanced performance and price. Blended tampons usually consist of cotton and artificial fibers like rayon, providing an optimal blend of comfort, absorbency, and structural stability. Such a composition of the material allows for stable shape retention when used and ensures effective fluid containment, minimizing leakage risk. The low cost of blended tampons makes them affordable across different socioeconomic categories further helping them gain acceptance. Though 100% organic cotton tampons are now being recognized, most consumers still prefer blended types due to their performance benefits and wider availability. The manufacturers also enhance the sustainability of blended materials by incorporating biodegradable content and reducing the use of processing chemicals. With safety and environmental issues on the rise, demand for responsibly sourced, skin-friendly mixes will continue to be stable, supporting the material's continued relevance in the tampon space.

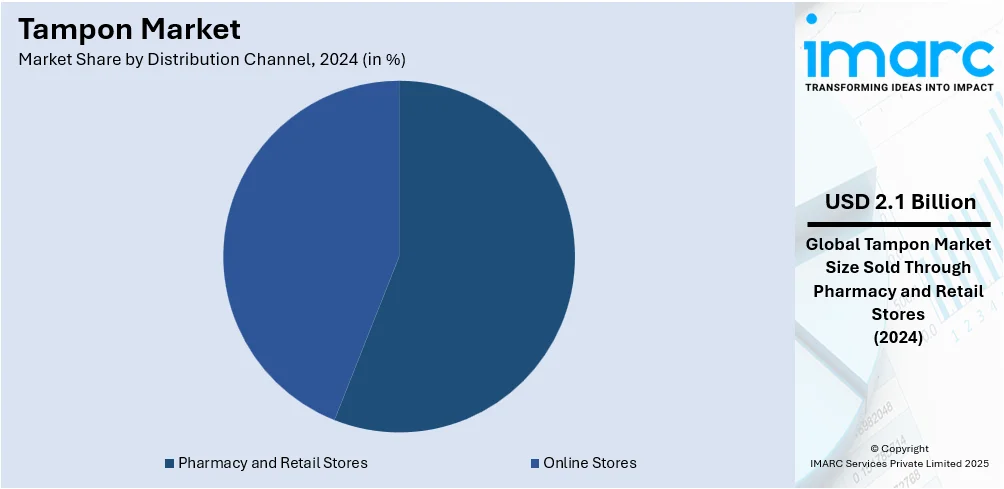

Analysis by Distribution Channel:

- Pharmacy and Retail Stores

- Online Stores

In 2024, 37.5% of tampons were sold through pharmacies and retail stores, making this the leading point of purchase. The appeal of this sector comes from its convenience, variety, and consumer confidence in retail settings for health and wellness. Physical stores benefit with the convenience of ready availability and the possibility of comparing various brands, sizes, and formulations at one point. Shoppers are often inclined to prefer face-to-face advice or clear packaging details, which physical retail settings allow. Pharmacies are also at the center of providing sound, controlled products, bolstering consumer trust. While internet shopping continues to gain traction, retail chains and pharmacies are still necessary for impulse buys and routine requirements. Plus, in-store promotion and pharmacist suggestions shape purchasing decisions. Convenience, visibility, and perceived safety of this distribution system continue to propel strong performance, keeping it an integral channel in the menstrual hygiene products industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America had a 38.0% market share of the world tampon market in 2024, an indication of dominance in product uptake, knowledge, and innovation within the region. The large market share is influenced by high hygiene standards, robust retail channels, and a developed consumer base with access to numerous menstrual solutions. The U.S. and Canada, in specific, have seen mounting demand for organic and sustainable tampons driven by rising health awareness and regulatory clarity. Growing active lifestyles, women's participation in sports, and cultural acceptability of menstrual well-being further augment the region's high growth. Period poverty relief initiatives by governments and NGOs, including workplace and school distribution schemes, also help fuel market growth. In addition, the region is also at the center of product innovation, with various companies launching biodegradable packaging, organic packaging materials, and applicator-free designs. This marriage of sophisticated consumer behavior and sound supply chains guarantees the region will continue leading in global tampon sales.

Key Regional Takeaways:

United States Tampon Market Analysis

The United States tampon market is growing at a steady pace, fueled by growing awareness regarding menstrual hygiene and a focus on sustainable personal care products. The growth is being driven by the growing adoption of biodegradable and organic tampons, thanks to environmentally aware consumers. Further, the presence of tampons in multiple retail channels, such as online and subscription services, is enhancing accessibility and convenience. The U.S. government invested USD 12.5 Billion into women's health research in 2024, as per a report, and this is expected to drive improvements and outreach in public health in menstrual care. Education on menstrual health in schools and public health campaigns is also further mainstreaming the use of tampons, especially among the younger population. Greater participation in sports and an active lifestyle is also promoting the use of tampons compared to other feminine hygiene products. Technical innovation in product design, for example, compact and unobtrusive applicators, is improving comfort levels for users and drawing in new consumers. In addition, positive government policies supporting menstrual equity are driving greater availability of tampons in public toilets, educational institutions, and workplaces. Manufacturers are putting investment behind brand approaches emphasizing inclusivity and convenience, appealing to varied consumer groups.

Europe Tampon Market Analysis

The European tampon market is experiencing strong growth, fueled by the presence of an established healthcare infrastructure and growing interest in menstrual health. Demands in the region are driven by high demand for high-quality, dermatologically tested products that provide greater safety and comfort. The popularity of clean, minimalist formulations with transparent ingredients is further enhancing consumers' confidence and fueling demand for chemical-free tampons. Moreover, the growth in health and wellness trends has been driving the demand for tampons with enhanced features, including pH balancing and odor control. Mass public health initiatives to destigmatize menstruation are fueling open discussions on menstrual hygiene, further propelling the market. For example, the 2022 budget law in Italy lowered the VAT rate from 22 % to 10 % on tampons and absorbent products, aimed at protection of feminine hygiene. Urban consumers are gravitating toward travel-friendly and compact formats of tampons, fueling product innovation.

Asia Pacific Tampon Market Analysis

Asia Pacific's tampon market is growing steadily due to heightening awareness about contemporary menstrual hygiene methods and increasing participation of females in the workforce. According to a 2024 report, 71.6% of Indian women find social media informative on periods, indicating the power of digital platforms in shaping menstrual health conversations across the region. The influence of these platforms is playing a crucial role in educating consumers about tampon use and safety. Urbanization and rising disposable incomes are prompting a shift from traditional products to more convenient options like tampons. Increased fitness among young women is also fueling tampon preference, especially in terms of convenience during exercise. Word of mouth from social media influencers and localized education campaigns are highly breaking down social barriers to trial among virgin users. Furthermore, the growth of e-commerce channels is enhancing product availability in tier 1 and tier 2 cities.

Latin America Tampon Market Analysis

The Latin American tampon market is on the march, fueled by changing social attitudes and heightened female health awareness. With conversations surrounding menstrual hygiene becoming increasingly mainstream, there is an increasingly large acceptance of tampons as a hygienic and convenient alternative. Rising investments by nongovernmental organizations and local health authorities in women's health education are generating greater awareness of the benefits of tampons. Urban middle-class consumers are increasingly looking for modern, cozy menstrual care options that fit hectic lifestyles. The region has progressed from a 62% urbanization ratio in 1980 to 81% in 2011 and is projected to reach 89% by 2050. Cultural trends toward body positivity and self-care are validating consumer curiosity around varied menstrual products. The spread of contemporary retail platforms and focused promotion campaigns is also helping with broadened market reach.

Middle East and Africa Tampon Market Analysis

The Middle East and Africa tampon market is experiencing incremental growth with the help of enhanced access to healthcare facilities and changing attitudes towards menstrual health. Based on the General Authority for Statistics, workforce participation among women has surpassed 36 percent, demonstrating the region's focus on building opportunities and independence, which in turn drives demand for practical feminine care solutions. Increased activity by health-oriented NGOs and community programs is developing awareness and acceptance of tampons among young women. The impact of e-education and wellness-oriented websites is also inspiring educated menstrual care decisions. Urban consumers, especially in city centers, are increasingly using tampons for convenience during traveling and physical exercise.

Competitive Landscape:

The global tampon market's competitive environment is typified by ongoing innovation, product diversity, and strategic expansion in key markets. Key industry players emphasize product performance improvement by means of innovative materials, better absorbency, and eco-friendly design. Increased demand for organic and biodegradable tampons has prompted firms to make investments in environmentally friendly production methods and certifications to address increasing consumer demands. Product differentiation by applicator type, package forms, and absorbency levels is enabling brands to address a wide range of user requirements and preferences. In developed markets, value-added attributes like chemical-free formulations and comfort-oriented designs are taking center stage. At the same time, in developing economies, greater awareness and affordability initiatives are widening the consumer base. Retail relationships, online promotions, and e-commerce enhancement are also enhancing brand visibility and reach. As lifestyle habits and health awareness among consumers are changing, competition is growing, which is driving innovation, quality levels, and customer-driven strategies throughout the tampon market.

The report provides a comprehensive analysis of the competitive landscape in the tampon market with detailed profiles of all major companies, including:

- Cora, Corman S.p.A

- Cotton High Tech S.L.

- Edgewell Personal Care Company

- Johnson & Johnson

- Kimberly-Clark Corporation

- Lil-Lets UK Ltd (Premier FMCG (Pty) Ltd)

- The Procter & Gamble Company

- TZMO SA

- Unicharm Corporation

Latest News and Developments:

- May 2025: Stayfree introduced tampons in India through a partnership with o.b., featuring Dynamic Fit technology and SilkTouch cover for improved comfort and absorption. The digital campaign, created with DDB Mudra, aimed to debunk tampon myths and promote adoption via influencer collaborations and health expert endorsements across YouTube and Instagram.

- March 2025: Stanford alumni launched Sequel tampons, designed with spiral grooves for enhanced leakage protection, and partnered with Stanford Athletics, the first NCAA tampon collaboration. Targeting athletes, Sequel expanded into women’s sports leagues, leveraging brand ambassadors and performance validation to build a strong presence in the competitive tampon innovation landscape.

- February 2025: Vyld launched Kelpon, the first tampon made from seaweed, emphasizing sustainability and safety verified by independent labs. Deployed at events, gyms, coworking spaces, and offices across Germany, Kelpon earned rapid adoption. Partnerships with dispenser providers Periodically enabled widespread access, while user enthusiasm highlighted the demand for eco-conscious menstrual care.

Tampon Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Radially Wound Pledget, Rectangular/Square Pad |

| Materials Covered | Cotton, Rayon, Blended |

| Distribution Channels Covered | Pharmacy and Retail Stores, Online Stores |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cora, Corman S.p.A, Cotton High Tech S.L., Edgewell Personal Care Company, Johnson & Johnson, Kimberly-Clark Corporation, Lil-Lets UK Ltd (Premier FMCG (Pty) Ltd), The Procter & Gamble Company, TZMO SA and Unicharm Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tampon market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tampon market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tampon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tampon market was valued at USD 5.56 Billion in 2024.

The tampon market is projected to exhibit a CAGR of 5.2% during 2025-2033, reaching a value of USD 8.77 Billion by 2033.

Significant drivers of the tampon market are rising awareness of menstrual hygiene, higher female workforce participation, and increased demand for inconspicuous, travel-sized hygiene products. Government programs, product innovations in organic and eco-friendly materials, and wider retail and online distribution networks are also driving worldwide market growth and consumer take-up.

North America currently dominates the tampon market, accounting for a share of 38.0%. The market at present with a share of 38.0%. It is led by strong healthcare infrastructure, high awareness among consumers, extensive distribution of products, and strong organic and eco-friendly tampon product presence. Menstrual health programs backed by the government and a strong active lifestyle trend also help maintain the region's market dominance.

Some of the major players in the tampon market include Cora, Corman S.p.A, Cotton High Tech S.L., Edgewell Personal Care Company, Johnson & Johnson, Kimberly-Clark Corporation, Lil-Lets UK Ltd (Premier FMCG (Pty) Ltd), The Procter & Gamble Company, TZMO SA and Unicharm Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)