Takaful Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

Takaful Market Size and Share:

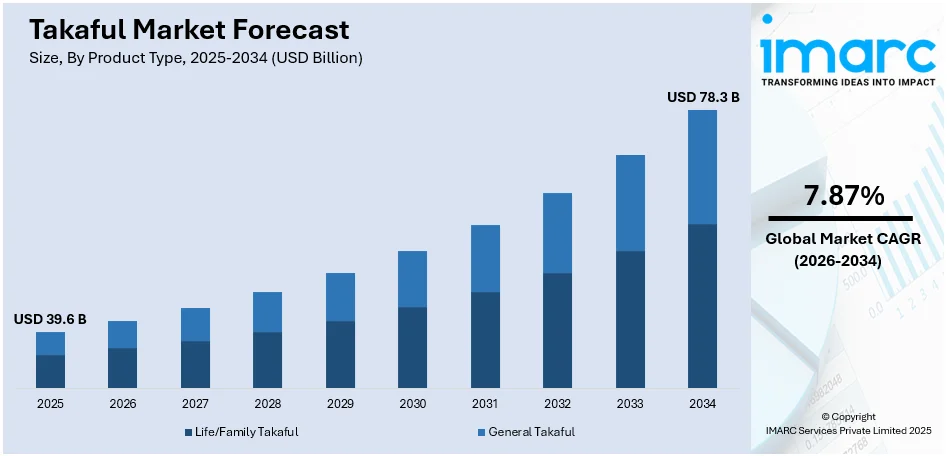

The global takaful market size was valued at USD 39.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 78.3 Billion by 2034, exhibiting a CAGR of 7.87% during 2026-2034. Gulf Cooperation Council (GCC) currently dominates the market, holding a significant market share of 85% in 2025. The market is experiencing growth because of the rising global Muslim population and increasing awareness about Islamic finance among individuals. Besides this, the takaful market share is influenced by the introduction of supportive governmental policies, continual technological advancements, and economic development in Islamic countries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 39.6 Billion |

|

Market Forecast in 2034

|

USD 78.3 Billion |

| Market Growth Rate (2026-2034) | 7.87% |

Innovative product offerings are deeply driving the market by addressing various customer needs and increasing accessibility. The companies are introducing takaful products like family takaful, health takaful, and micro-takaful for catering to different market segments. This type of product caters to the long-term requirements of family protection and certain necessities, such as affordable coverage for low-income groups. Micro-takaful is essential for the low-income group, as it provides coverage at cost-effective tariffs with flexible terms. Companies are incorporating technology within takaful products, which now offer digital management of policies and claims processing. Health takaful is gaining traction as people demand affordable, Shariah-compliant medical solutions. Family takaful is becoming sought after because it emphasizes long-term saving and protection for people who require family protection. Personalized coverage options are now being offered to suit individual preferences and expand market reach. Short-term takaful policies are also being introduced to accommodate customers who may require temporary coverage.

To get more information on this market Request Sample

The cultural shift toward sustainability is significantly driving the United States takaful market demand by aligning ethical principles with customer values. The takaful risk-sharing, ethical model resonates with people becoming more conscious about ethical sustainability factors. Takaful operates based on the principles of mutual cooperation, fairness, and social responsibility, which make it an attractive choice for sustainable investors. Today, many people are focusing on investments that deliver positive social and environmental impacts, which takaful provides. The increasing demand for green financial products in the US is motivating the insurance companies to innovate with ethical options. According to the statistics released by the IMARC Group the United States green technology and sustainability market size reached USD 6.5 Billion in 2024. In addition, takaful's transparency and shared risk factor attract people who want to steer clear of traditional profit-oriented insurance systems. The increased awareness about ethical finance is leading to rising demand for Shariah-compliant insurance, which aligns with sustainability goals. The US market's increasing focus on corporate responsibility is compelling takaful providers to adopt more socially responsible and ethical practices. Takaful's principles promote community welfare and social justice, which are highly valued in today's customer-driven, sustainability-focused market.

Takaful Market Trends:

Growing Muslim population

The increasing Muslim population worldwide is a key driver of the takaful market. Reports suggest that the global Muslim population is projected to grow by approximately 35% over the next two decades, from 1.6 billion in 2010 to 2.2 billion by 2030. This demographic shift increases the demand for Sharia-compliant financial products, including insurance. As the Muslim population grows, particularly in regions like the Middle East, Southeast Asia, and Africa, there is a corresponding rise in the need for takaful services. This demographic trend not only broadens the customer base but also encourages financial institutions to develop and offer takaful products. The unique features of this insurance concept, such as risk-sharing and the absence of interest (riba), gambling (maisir), and uncertainty (gharar), align well with the values and financial practices of the Muslim community. Therefore, the increasing Muslim population directly contributes to the growth and expansion of the takaful market.

Government support and regulatory frameworks

The takaful industry is receiving strong support from various governments, particularly in countries with significant Muslim populations. Governments are creating favorable regulatory frameworks to encourage market development, which is crucial for the industry’s growth. These frameworks are designed to ensure takaful operations comply with Sharia principles while maintaining the broader insurance market's standards and stability. Such regulatory backing not only validates takaful operations but also enhances investor confidence, a critical factor for sustaining growth in the sector. Additionally, in several regions, governments are actively promoting takaful by raising public awareness and integrating it into national financial inclusion strategies. This governmental support plays a pivotal role in expanding the market’s reach and influence. For example, in India, the government is preparing to allow 100% foreign direct investment (FDI) in insurance, an increase from the current 74% limit. The insurance sector in India comprises 24 life insurance companies, 26 general insurers, six standalone health insurers, and one reinsurer, indicating a dynamic and growing market. This government backing is instrumental in shaping the takaful industry’s future.

Continual technological advancements

The rise of digital platforms and mobile applications is improving customer engagement and simplifying the policy purchase process. Artificial intelligence (AI) is being utilized for underwriting, claims processing, and customer service, improving accuracy and efficiency. Takaful providers are increasingly adopting blockchain technology for transparent, secure, and efficient transactions in the insurance ecosystem. The use of data analytics is allowing companies to better understand customer needs, tailoring products accordingly. Technology is also enabling the automation of administrative tasks, reducing operational costs and improving profit margins. Cloud-based solutions are helping takaful companies scale their operations while minimizing infrastructure costs. The integration of big data and AI-driven algorithms allows insurers to offer more personalized, cost-effective solutions to customers. Digitalization is also enabling seamless integration with Islamic banks, expanding distribution channels for takaful products. As customers become more tech-savvy, they demand more convenient, efficient, and transparent insurance solutions, catalyzing takaful operators to innovate.

Takaful Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global takaful market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type.

Analysis by Product Type:

- Life/Family Takaful

- General Takaful

General takaful stand as the largest component in 2025, holding 85.6% of the market. Many governments in Islamic-majority countries mandate motor insurance, influencing General takaful adoption. Businesses and individuals are seeking Shariah-compliant protection for assets, inducing property takaful growth. The rising cost of healthcare services is encouraging demand for takaful-based health insurance solutions. Infrastructure development in GCC and Southeast Asia is increasing demand for engineering and construction-related takaful products. Corporate clients are purchasing General takaful for business risk management, ensuring protection against unforeseen losses. The growth of small and medium enterprises (SMEs) is further expanding demand for business-related takaful solutions. Digital transformation is enhancing General takaful distribution, making policies more accessible through online platforms and mobile apps. Increasing awareness about ethical and interest-free insurance alternatives is driving General takaful adoption among individuals and businesses. Government initiatives and regulatory frameworks supporting takaful expansion are strengthening General takaful’s market growth. Multinational insurers are partnering with local takaful operators, increasing product innovation and competition.

Regional Analysis:

- Gulf Cooperation Council (GCC)

- Southeast Asia

- Africa

- Others

In 2025, Gulf Cooperation Council (GCC) accounted for the largest market share of 85%. Governing agencies of Saudi Arabia, UAE, and Kuwait mandate health and motor takaful, ensuring widespread adoption. Large-scale infrastructure projects are driving demand for construction-related takaful, strengthening market growth. A high percentage of Muslim population and strong preference for Shariah-compliant solutions impels takaful market growth. GCC countries have a well-developed regulatory framework, providing a stable environment for takaful operators and investors. The presence of major takaful providers in the region increases competition and product innovation. High disposable income levels enable people to invest in family and medical takaful policies, expanding market size. Islamic banks and financial institutions actively promote takaful, integrating it with broader Islamic finance offerings. Governments and regulators are introducing supportive policies, encouraging market expansion and investor participation. For example, in December 2024, Takaful Emarat increased its capital by AED 185 million through a rights issue. This raised its total capital to AED 210.65 million, enhancing financial stability. The capital hike is part of takaful Emarat’s strategy to support sustainable growth within the takaful market. This move strengthens its ability to offer more comprehensive Shariah-compliant insurance solutions. Besides this, the strong penetration of digital insurance platforms is improving accessibility and customer engagement. Economic diversification efforts are driving the insurance sector, fostering takaful market growth. GCC’s strategic location and expanding expatriate population are further increasing demand for takaful products.

Key Regional Takeaways:

United States Takaful Market Analysis

The United States market is driven by growing Muslim population, which is increasing demand for Shariah-compliant insurance products, including life and health takaful. Awareness campaigns and efforts by Islamic financial institutions are educating beneficiaries about takaful options. The demand for ethical, interest-free financial solutions aligns well with the values of takaful. The US regulatory environment is evolving to accommodate Islamic finance, though some challenges remain. Market players are introducing digital platforms to enhance accessibility and make takaful more competitive with conventional insurance. Strategic partnerships with Islamic banks are enabling easier distribution of takaful products in the region. The growing immigrant Muslim population is seeking financial products that adhere to Islamic principles. Product diversification in health and motor insurance is set to propel the market's growth. Government support for Islamic finance plays a pivotal role in expanding the market share of takaful. While the United States remains a niche market, its growth prospects are significant due to evolving regulatory frameworks.

Gulf Cooperation Council (GCC) Takaful Market Analysis

The GCC market is growing at a robust pace due to various socio-economic and regulatory factors. Strong Islamic ethos in the region is playing a central role in the widespread acceptance of Shariah-compliant financial products, including takaful. The proactive measures taken by the GCC governments to diversify their economies beyond oil are leading to the promotion of Islamic finance, enhancing the adoption of takaful solutions. In turn, rising disposable incomes, together with a growing middle-class population, is impacting demand for family takaful products, mainly for life and health coverage. Mandatory health insurance schemes implemented in Saudi Arabia and the UAE further propel the growth of the market. Young and savvy in technology, the GCC's population is a force behind demand for digital takaful offerings and added propels the insurers to invest in online distribution and digital platforms. The region's high expatriate population is providing scope for creating customized takaful products for its specific requirements. According to reports, 41.6% of Saudi Arabia's population are expatriates, adding more muscles and ethos to Saudi Arabian workforce and culture. Partnerships between takaful operators and traditional insurers are driving product innovation and broadening customer outreach, which is strengthening market growth.

Southeast Asia Takaful Market Analysis

The market in Southeast Asia is growing steadily, underpinned by the region’s large Muslim population and favorable regulatory frameworks promoting Islamic finance. Reports state that Indonesia has the largest Muslim population, with over 242 million Muslims residing in the country. Countries, such as Malaysia and Indonesia, are spearheading growth through comprehensive policies and incentives to support the takaful sector. A significant increase in financial literacy among the Muslim population, combined with rising awareness of the ethical principles of takaful, is driving higher adoption rates in the region. Besides this, Southeast Asia’s rapidly expanding middle class and rising disposable income is catalyzing the need for family takaful, including life and health insurance products. Governing agencies and financial institutions in the region are actively fostering partnerships and collaborations to integrate takaful into broader financial inclusion agendas. Digital transformation in financial services is another critical driver, enabling easier access to takaful products through mobile apps and online platforms. The emphasis on micro-takaful offerings, aimed at low-income households, is also expanding the market by addressing affordability barriers.

Africa Takaful Market Analysis

The Africa region market is gaining momentum because of the continent's sizeable Muslim population and increasing demand for Shariah-compliant financial solutions. Governments and financial authorities in countries like Nigeria, Kenya, and South Africa, are implementing supportive policies to integrate takaful into their broader economic development agendas. In line with this, rising awareness about Islamic finance principles among African customers, particularly in underserved and rural areas, is fostering greater trust and adoption of takaful products. Besides this, economic growth and urbanization across Africa are contributing to higher income levels, leading to increased demand for family takaful offerings, especially in life and health insurance. Reports indicate that urbanization rates in Africa vary, with Southern Africa at around 60%, Northern Africa at 50%, Central and West Africa ranging between 40% and 48%, and East Africa at 27%. Moreover, technological advancements including the proliferation of mobile banking and digital platforms, are making takaful more accessible to a wider audience, overcoming traditional distribution challenges. Micro-takaful solutions targeted at low-income populations are particularly significant, addressing affordability and promoting financial inclusion. Collaborations between local takaful operators and international insurers are driving product innovation and enhancing operational efficiency.

Competitive Landscape:

Key players are developing Shariah-compliant insurance solutions, ensuring adherence to Islamic principles and appealing to Muslim customers. Companies are investing in digital platforms and AI-driven solutions, improving accessibility and operational efficiency. They collaborate with Islamic banks and financial institutions, integrating takaful with broader Islamic finance services. Governments and regulators are supporting key players with favorable policies, ensuring industry growth and compliance. Reinsurers are offering Retakaful (Islamic reinsurance) solutions, mitigating risks and enhancing financial stability for takaful operators. Distribution channels are expanding through bancassurance, online platforms, and mobile applications, increasing customer reach. Training institutions are providing expertise in Islamic finance, developing skilled professionals to strengthen the takaful sector. Companies are engaging in customer education initiatives, raising awareness about takaful benefits and driving adoption. Strategic partnerships are fostering innovation and diversification, introducing specialized products like family, medical, and micro-takaful. To cater this demand, in May 2024, Salama, a leading takaful provider, expanded its UAE operations by opening a new office in Abu Dhabi. This move aims to enhance customer service, drive innovation, and improve operational efficiency. The expansion reinforces Salama’s commitment to providing Shariah-compliant insurance solutions, strengthening its presence in the growing takaful market across the region.

The report provides a comprehensive analysis of the competitive landscape in the takaful market with detailed profiles of all major companies, including:

- Abu Dhabi National Takaful Co. PSC

- Amana Takaful (Maldives) PLC

- Etiqa (Malayan Banking Berhad)

- Great Eastern Takaful Berhad

- HSBC Amanah Malaysia Berhad

- Prudential BSN Takaful Berhad

- Qatar Islamic Insurance Company

- Salama Islamic Arab Insurance Company

- Standard Chartered Bank

- Syarikat Takaful Brunei Darussalam Sdn Bhd

- Syarikat Takaful Malaysia

- Takaful Emarat

- The Islamic Insurance Co

- Zurich Malaysia

Latest News and Developments:

- January 2025: Etiqa Insurance Pte Ltd. introduced Singapore's first takaful insurance product in over ten years, aiming to address the gap in Shariah-compliant funds. The insurance arm of Malaysia's Maybank Group launched Invest Future; an investment-linked product designed to align with Islamic principles while supporting wealth accumulation.

- January 2025: In partnership with Etiqa Insurance, CEBUANA Lhuillier Insurance Brokers launched the first takaful product in the Philippines. This product is tailored to meet the unique needs of the Islamic community while fostering inclusivity and financial empowerment for Filipinos from all backgrounds.

- November 2024: The Malaysian Takaful Association (MTA) introduced its Hijrah27 framework, aiming to expand the reach of takaful in Malaysia, with a focus on underserved sectors like micro, small, and medium enterprises (MSMEs). The initiative is designed to enhance public awareness and increase access to takaful products while positioning the industry for growth alongside other leading Islamic finance hubs in the region.

- March 2024: FWD Group Holdings Limited revealed that it has completed an additional investment to acquire a 21% stake in FWD Takaful Berhad, bringing its total holding to 70%. The continuing 30% is owned by the Employees Provident Fund, with JAB Capital Berhad not holding any shares after the transaction.

Takaful Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life/Family Takaful, General Takaful |

| Regions Covered | Gulf Cooperation Council (GCC), Southeast Asia, Africa, Others |

| Companies Covered | Abu Dhabi National Takaful Co. PSC, Amana Takaful (Maldives) PLC, Etiqa (Malayan Banking Berhad), Great Eastern Takaful Berhad, HSBC Amanah Malaysia Berhad, Prudential BSN Takaful Berhad, Qatar Islamic Insurance Company, Salama Islamic Arab Insurance Company, Standard Chartered Bank, Syarikat Takaful Brunei Darussalam Sdn Bhd, Syarikat Takaful Malaysia, Takaful Emarat, The Islamic Insurance Co, Zurich Malaysia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, takaful market outlook, and dynamics of the market from 2020-2034.

- The takaful market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the takaful industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The takaful market was valued at USD 39.6 Billion in 2025.

The takaful market is projected to exhibit a CAGR of 7.87% during 2026-2034, reaching a value of USD 78.3 Billion by 2034.

The takaful market growth is driven by rising awareness about ethical investments and socially responsible finance and expanding demand for Shariah-compliant products. Technological advancements are enhancing accessibility, efficiency, and customer engagement. The increasing focus on family protection, health coverage, and customized insurance products also drives demand.

Gulf Cooperation Council (GCC) currently dominates the takaful market, accounting for a share of 85% in 2025. Countries like Saudi Arabia, UAE, and Kuwait have established supportive regulations that fuels takaful market growth. The high demand for Shariah-compliant products coupled with the region's economic diversification and rapid urbanization further influences market expansion. Government initiatives and strong customer awareness also contribute to takaful's growth.

Some of the major players in the takaful market include Abu Dhabi National Takaful Co. PSC, Amana Takaful (Maldives) PLC, Etiqa (Malayan Banking Berhad), Great Eastern Takaful Berhad, HSBC Amanah Malaysia Berhad, Prudential BSN Takaful Berhad, Qatar Islamic Insurance Company, Salama Islamic Arab Insurance Company, Standard Chartered Bank, Syarikat Takaful Brunei Darussalam Sdn Bhd, Syarikat Takaful Malaysia, Takaful Emarat, The Islamic Insurance Co, Zurich Malaysia, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)