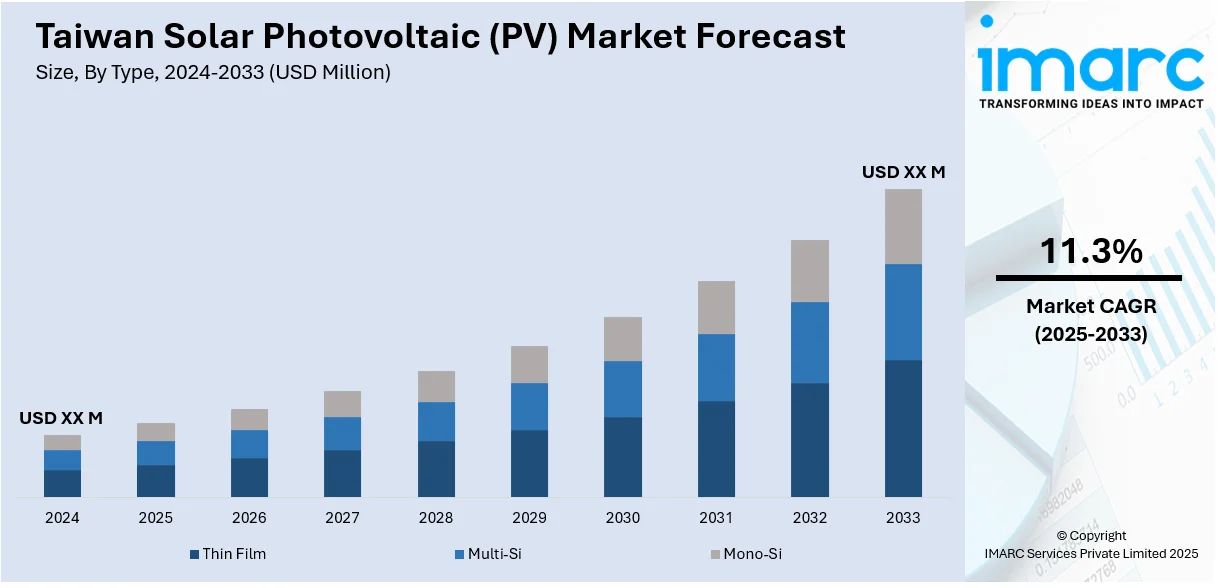

Taiwan Solar Photovoltaic (PV) Market Report by Type (Thin Film, Multi-Si, Mono-Si), Grid Type (On-Grid, Off-Grid), Deployment (Ground-mounted, Rooftop Solar), End User (Residential, Commercial, Utility), and Region 2025-2033

Taiwan Solar Photovoltaic (PV) Market Overview:

The Taiwan solar photovoltaic (PV) market size is projected to exhibit a growth rate (CAGR) of 11.3% during 2025-2033. The market is propelled by increasing government incentives and support, high solar irradiance, corporate renewable energy procurement, grid parity achievement, increasing electricity demand, significant technological advancements in solar PV, and growing environmental awareness and public support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 11.3% |

Taiwan Solar Photovoltaic (PV) Market Trends:

Land Availability and Agricultural Integration

The integration of solar PV with agricultural activities, along with the wide availability of agricultural land is a crucial factor driving the solar PV market in Taiwan. According to Central Intelligence Agency (CIA), as of 2018, Taiwan possessed 22.7% of agricultural land. Taiwan has been innovative in utilizing available land for dual purposes, such as combining solar power generation with agricultural practices. This approach, known as "agrivoltaics," allows farmers to install solar panels on their fields without compromising crop production. The Taiwanese government has supported this by offering incentives for agrivoltaic projects, which have become increasingly popular. This integration of agriculture and solar energy maximizes land use efficiency, attracts investments in rural areas, and drives the expansion of solar PV installations across the country. In addition to increasing land use efficiency, agrivoltaics offers financial benefits to farmers by providing an additional income stream from solar energy production, making it a sustainable and profitable solution. The dual-use approach also helps to mitigate the impact of extreme weather conditions on crops, as solar panels can offer partial protection from excessive sunlight and heavy rainfall. This method has gained traction in the rural regions of Taiwan, where local governments and agricultural cooperatives are actively promoting the adoption of agrivoltaic systems.

Increasing Electricity Demand

The increasing electricity demand of Taiwan is another significant driver of the solar PV market. As the economy of the region grows, so does its energy consumption. To meet this growing demand, Taiwan is turning to renewable energy sources, particularly solar PV, to diversify its energy mix and reduce reliance on imported fossil fuels. According to PwC Taiwan, Taiwan’s solar generation reached 12.9 billion kWh, holding almost 48% of the total renewable energy generation in 2023. The focus of the government on energy security and sustainability aligns with the expansion of solar energy infrastructure. The growing electricity demand is pushing the need for additional solar PV installations, particularly in industrial and commercial sectors, which are significant consumers of electricity in Taiwan. Moreover, the energy requirements of the industrial sector are driving the adoption of large-scale solar PV projects. As the manufacturing and technology industries of Taiwan expand, companies are increasingly seeking sustainable energy solutions to power their operations. This shift is a response to the growing electricity demand and also a strategic move to enhance energy independence and mitigate the risks associated with fluctuating fossil fuel prices. Furthermore, the commercial sector is also investing in solar PV systems to reduce operational costs and meet corporate sustainability goals. Retail chains, office complexes, and other commercial entities are installing rooftop solar panels and participating in solar power purchase agreements (PPAs), further boosting the demand for solar PV installations.

Government Incentives and Support

The Taiwanese government has played a significant role in driving the growth of the solar photovoltaic (PV) market through various incentives and support mechanisms. The government has implemented the Renewable Energy Development Act, which aims to increase the share of renewable energy in energy mix of Taiwan. This includes a strong focus on solar energy, where the government offers attractive feed-in tariffs (FITs) for solar PV projects, guaranteeing higher returns on investment. This growth is partly due to government subsidies and the simplified approval process for solar projects. The incentives are designed to encourage both utility-scale and rooftop solar installations, making solar energy a more viable option for businesses and households.

Taiwan Solar Photovoltaic (PV) Market News:

- July 2024: Google invested in Taiwan's New Green Power, potentially purchasing up to 300 megawatts of renewable energy to reduce its carbon emissions and those of its suppliers. This move supports Taiwan's goal of 20 GW solar capacity by 2025 and 80 GW by 2050.

Taiwan Solar Photovoltaic (PV) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, grid type, deployment, and end user.

Type Insights:

- Thin Film

- Multi-Si

- Mono-Si

The report has provided a detailed breakup and analysis of the market based on the type. This includes thin film, multi-Si, and mono-Si.

Breakup by Grid Type:

- On-Grid

- Off-Grid

A detailed breakup and analysis of the market based on the grid type have also been provided in the report. This includes on-grid and off-grid.

Breakup by Deployment:

- Ground-mounted

- Rooftop Solar

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes ground-mounted and rooftop solar.

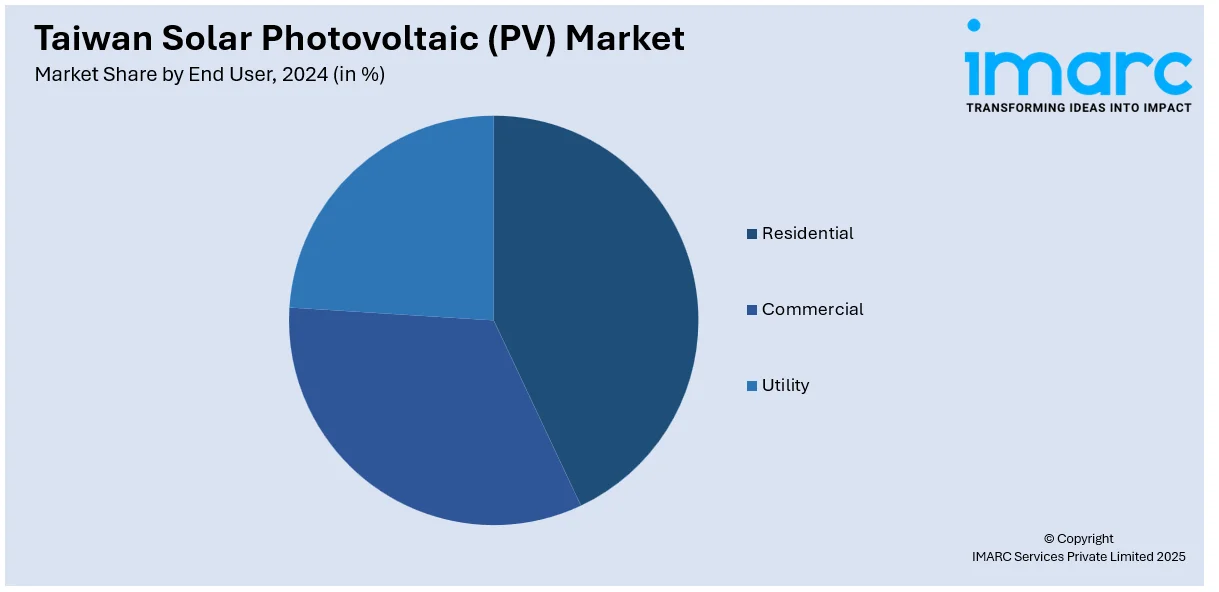

End User Insights:

- Residential

- Commercial

- Utility

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and utility.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Solar Photovoltaic (PV) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Thin Film, Multi-Si, Mono Si |

| Grid Types Covered | On-Grid, Off-Grid |

| Deployments Covered | Ground-Mounted, Rooftop Solar |

| End Users Covered | Residential, Commercial, Utility |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan solar photovoltaic (PV) market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan solar photovoltaic (PV) market on the basis of type?

- What is the breakup of the Taiwan solar photovoltaic (PV) market on the basis of grid type?

- What is the breakup of the Taiwan solar photovoltaic (PV) market on the basis of deployment?

- What is the breakup of the Taiwan solar photovoltaic (PV) market on the basis of end user?

- What are the various stages in the value chain of the Taiwan solar photovoltaic (PV) market?

- What are the key driving factors and challenges in the Taiwan solar photovoltaic (PV)?

- What is the structure of the Taiwan solar photovoltaic (PV) market and who are the key players?

- What is the degree of competition in the Taiwan solar photovoltaic (PV) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan solar photovoltaic (PV) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan solar photovoltaic (PV) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan solar photovoltaic (PV) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)