Tablet Market Size, Share, Trends and Forecast by Product, Operating System, Screen Size, End User, Distribution Channel, and Region, 2025-2033

Tablet Market Size and Share:

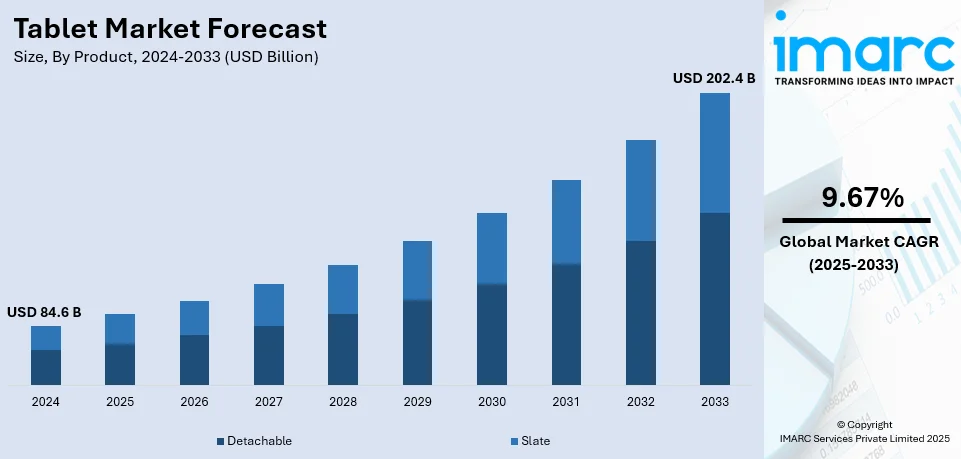

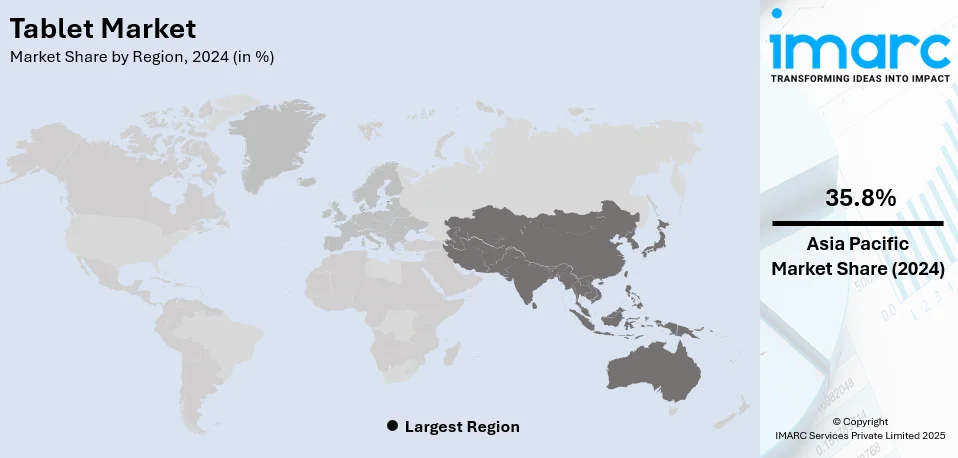

The global tablet market size was valued at USD 84.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 202.4 Billion by 2033, exhibiting a CAGR of 9.67% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.8% in 2024. The tablet market share is driven by rising demand for remote work, online learning, and entertainment, along with advancements in 5G connectivity, AI-powered features, and stylus support. Increasing enterprise adoption, affordability, and improved battery life further fuel global market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.6 Billion |

| Market Forecast in 2033 | USD 202.4 Billion |

| Market Growth Rate (2025-2033) | 9.67% |

The market is seeing steady growth due to adding demand for remote work, online education, and digital entertainment. With the rise of flexible work arrangements, professionals seek movable, high- performance devices that offer a balance between laptops and smartphones. Tablets equipped with 5G connectivity, AI- powered features, and enhanced battery life have become essential for productivity and flawless communication. The surge in learning has also contributed to demand expansion, as students and educators count on tablets for interactive assignments, digital handbooks, and virtual classrooms. Also, entertainment consumption, including videotape streaming, gaming, and e-books, has driven demand for high- resolution screens and bettered processing power. Enterprises are decreasingly espousing tablets for business operations, point- of- sale systems, and fieldwork, farther boosting the tablet market demand. The vacuity of affordable models and premium devices with stylus support caters to different consumer requirements. As technology advances, tablets continue to evolve, strengthening their position in the global market.

The United States has emerged as a key regional market for tablets driven by adding demand for remote work, online education, and digital entertainment. As cold-blooded work models become more common, professionals seek movable, high- performance devices that offer flexibility and flawless connectivity. Tablets with 5G, AI- powered productivity tools, and stylus support are gaining favor among business users and students. The rise of e-learning platforms and digital classrooms has further fueled tablet acceptance, with schools and universities integrating tablets into their class. Also, streaming services, mobile gaming, and content consumption habits are boosting consumer demand for larger, high- resolution displays and enhanced processing power. Manufacturers are also launching affordable models with longer battery life, feeding a broader audience. Government initiatives to bridge the digital divide by delivering tablets for students and low- income homes are farther driving market expansion. With nonstop invention, the U.S. tablet market is poised for sustained growth.

Tablet Market Trends:

Technological Advancements

Innovations in display technology, such as higher resolutions, improved color accuracy, and enhanced refresh rates, contribute to a visually captivating user experience. The global interactive display market size reached USD 48.7 Billion in 2024. Additionally, the integration of powerful processors and efficient graphics chips enables tablets to handle resource-intensive tasks seamlessly, from video editing to gaming. Extended battery life, achieved through optimized power management systems, further enhances the usability of tablets for extended periods without requiring frequent recharging. These advancements collectively drive consumer interest in acquiring tablets with the latest features, encouraging manufacturers to compete in delivering cutting-edge devices.

Rise in Remote Work and Learning

Tablets offer an accessible and portable platform for attending virtual meetings, piercing digital knowledge stuff, and uniting on projects. Their versatility allows users to switch seamlessly between productivity tasks and multimedia consumption, making them precious tools for both professionals and scholars. According to industry checks, 91% of worldwide workers want to work remotely, either full- time or nearly full- time. With the elasticity to be used anywhere with an internet connection, tablets address the need for remote connectivity and engagement, assuring continuity in work and education despite physical distance.

Increased Digital Content Consumption

The consumption of digital content, ranging from streaming videos to e-books and interactive apps, has witnessed significant growth. According to industry figures, the worldwide internet user base has grown by 151 Million to 5.52 Billion. Tablets provide an ideal medium for such activities due to their larger screens and tactile interfaces. Users can comfortably enjoy multimedia content, read e-books with enhanced readability, and engage with interactive applications for literacy and entertainment. The tablet's form factor bridges the gap between smartphones and traditional computers, feeding to individualities seeking an immersive experience for content consumption. As digital content continues to accelerate, the demand for tablets as devoted devices for media consumption remains robust, contributing to sustained market growth.

Tablet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tablet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, operating system, screen size, end user, and distribution channel.

Analysis by Product:

- Detachable

- Slate

Detachable tablets hold the presiding position as it offer users the flexibility of a tablet and the productivity of a laptop in a single device. This hybrid design allows the screen to be detached from the keyboard, enabling users to switch between tablet mode for content consumption and laptop mode for content creation and productivity tasks. The appeal of detachable tablets lies in their capability to feed to different requirements. Professionals appreciate the convenience of a compact device for on- the- go work, while students find them useful for both study and entertainment. The detachable tablet's ability to seamlessly transform between modes addresses the demands of modern users who require adaptability in their digital tools. Furthermore, detachable tablets often boast advanced features like powerful processors, stylus support, and high-resolution displays, enhancing their appeal to creative professionals and those seeking enhanced performance. As remote work and flexible lifestyles continue to influence consumer preferences, the detachable tablet segment is well-positioned to capitalize on these trends, contributing to its status as the largest product segment in the tablet market.

Analysis by Operating System:

- Android

- iOS

- Windows

Android leads the market with 64.5% as it has the advantage of being an open- source platform, enabling a wide range of manufacturers to embrace and customize it for their devices. This has led to a different ecosystem of Android- powered tablets offered by various brands at different price points, feeding to a broad diapason of consumers. Also, Android's elasticity and resilience contribute to its popularity. The operating system supports a vast array of operations and offers flawless integration with Google services, making it an charming choice for users who are formerly invested in the Google ecosystem. The vacuity of the Google Play Store, with its expansive collection of apps, farther enhances the appeal of Android tablets. Furthermore, Android's global presence and affordability make it particularly attractive in emerging markets, where budget-conscious consumers seek feature-rich devices. As Android continues to evolve and adapt to changing user needs, its position as the largest segment in the tablet market is likely to persist, fueled by its versatility, accessibility, and widespread adoption.

Analysis by Screen Size:

- 8’’

- 8’’ and Above

Tablets with screens measuring 8 inches and above dominate the market as they offer users a more immersive visual experience compared to smaller counterparts, making them ideal for activities like watching videos, reading e-books, and browsing the internet. This screen size category accommodates a diverse range of use cases. Professionals find larger screens conducive to multitasking, data analysis, and content creation, making them valuable tools for productivity. Additionally, the increased screen real estate enhances the user experience for applications that require precision and detail, such as design or gaming. Furthermore, as tablets become more versatile and capable of replacing traditional laptops, a larger screen size becomes essential for tasks that demand a spacious interface. The "8" and above" segment caters to this demand without sacrificing the portability that tablets are known for.

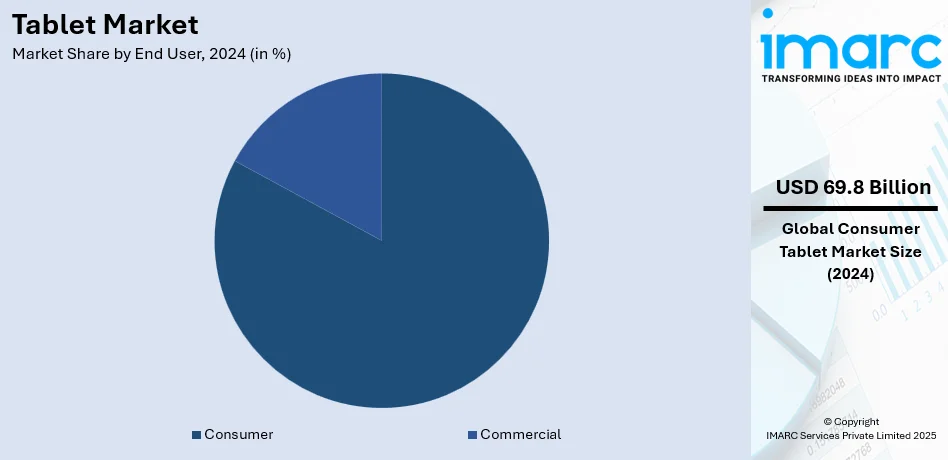

Analysis by End User:

- Consumer

- Commercial

Consumer leads the market with 82.5% in 2024. Tablets have evolved from niche productivity tools to versatile devices that cater to a wide range of consumer needs. Consumers across demographics find value in tablets for various applications such as entertainment, communication, education, and personal productivity. For entertainment enthusiasts, tablets provide a portable platform for streaming videos, playing games, and reading e-books. The intuitive touchscreen interface enhances the experience of interacting with multimedia content. Additionally, tablets are embraced by students as interactive learning aids, offering access to educational apps, digital textbooks, and online resources. The "consumer" segment is also fueled by professionals who require a balance between mobility and productivity. Tablets are convenient tools for business on the go, enabling tasks like email management, presentations, and content creation. The integration of accessories like detachable keyboards and stylus pens further extends their usability for professional tasks. Furthermore, the affordability and variety of tablets cater to a wide spectrum of budgets and preferences. This inclusivity makes tablets accessible to a vast consumer base, from tech-savvy individuals to those new to digital devices.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with 60.0% in 2024. Traditional retail channels, such as physical stores and authorized resellers, offer consumers a tangible and personalized shopping experience. Customers can interact with the devices, seek expert advice from sales staff, and make informed decisions based on firsthand impressions. Offline distribution also fosters immediate gratification, allowing customers to purchase and take home the product on the same day. This is particularly valuable for consumers who prioritize convenience and want to avoid waiting for shipping or delivery. Moreover, the offline segment is a preferred choice for individuals who may not be as familiar with online shopping or who have concerns about the security of digital transactions. The physical presence of a store provides a sense of trust and reliability that can be reassuring to such customers. Additionally, tablets are often seen as high-value items, and customers may prefer the assurance of in-person interactions when making such a purchase.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.8%. Asia Pacific’s vast and diverse population, coupled with rising disposable incomes, drives substantial consumer demand for electronic devices like tablets. Rapid urbanization and a growing middle class contribute to increased technology consumption in various aspects of daily life, including education, entertainment, and work. Furthermore, the Asia Pacific region showcases a robust digital ecosystem, with a strong emphasis on mobile connectivity and digital transformation. The prevalence of digital content consumption, online education, and e-commerce activities align well with the functionalities offered by tablets. In addition, the region's diverse geography and cultural landscape create a fertile ground for manufacturers to introduce a wide range of tablet offerings, catering to different preferences and price points.

Key Regional Takeaways:

United States Tablet Market Analysis

The United States holds 86.20% share of tablet market in North America. The market is experiencing significant growth, driven by the increasing demand for portable and multifunctional devices in personal and professional settings. According to industry sources, as of August 2023, 12.2% of U.S. workers were entirely remote, accelerating the demand for gadgets that provide mobility, performance, and simplicity of use. Tablets, with their portability and ability to seamlessly integrate with remote work tools, have become a preferred choice for professionals working from home or on the go. The growing shift toward hybrid work models has further increased tablet adoption, as these devices are ideal for video conferencing, collaborative work, and content consumption. Moreover, technological advancements in tablet features, including enhanced display quality, faster processing speeds, and extended battery life, continue to drive tablet market growth. The rise of cloud-based applications and digital content also plays a significant role in boosting tablet demand, as these devices provide an efficient platform for managing and accessing these services. With the expansion of 5G connectivity, future tablet models are expected to offer faster data speeds and more reliable connections, further fueling market growth and solidifying tablets as essential tools for remote workers in the U.S.

Asia Pacific Tablet Market Analysis

The tablet market in the Asia-Pacific (APAC) region is experiencing significant growth, driven by increasing digital adoption across sectors such as business, education, and entertainment. One of the key factors boosting demand is the rapid rise of the middle class. According to the World Economic Forum, 2 billion Asians were considered middle-class in 2020, with forecasts showing the number might rise to 3.5 billion by 2030. This expanding consumer base is fueling the demand for affordable yet high-performing devices like tablets. In countries such as India, China, and Japan, tablets are becoming essential tools for both education and business. The growing adoption of e-learning, particularly in emerging markets, is driving tablet usage as an affordable and portable solution for students. Furthermore, as the region's middle class increasingly seeks digital content for entertainment, tablets are gaining popularity as devices for gaming, streaming, and social media. In addition, the growing affordability of tablets, driven by intense competition among manufacturers, is making these devices accessible to a broader segment of consumers. As 5G connectivity rolls out across the region, the demand for tablets with faster internet capabilities is expected to further accelerate, making them an indispensable part of daily life for many.

Europe Tablet Market Analysis

The tablet market in Europe is experiencing substantial growth, driven by the increasing demand for mobile devices across various sectors, particularly education, business, and entertainment. One of the significant factors influencing this growth is the rise of e-learning. According to IMARC Group, the Europe e-learning market size is projected to reach USD 76.3 Billion in 2024 and is expected to grow to USD 194.9 Billion by 2033, with a CAGR of 10.7% from 2025 to 2033. This surge in e-learning adoption is boosting the demand for portable devices like tablets, which offer a convenient and affordable solution for students and professionals alike. Tablets are increasingly being used for online education, providing an interactive and accessible learning experience. The rise of remote work and hybrid learning models has further fueled tablet adoption, as these devices are ideal for video conferencing, virtual collaboration, and content consumption. Additionally, the growing popularity of streaming services and gaming is driving tablet usage for entertainment purposes. Technological advancements, such as enhanced display quality, faster processors, and the integration of 5G connectivity, are expected to further propel tablet adoption. With the ongoing shift toward digital services and the increasing importance of sustainability, the tablet market in Europe is poised for continued growth in the coming years.

Latin America Tablet Market Analysis

The tablet market in Latin America is primarily driven by increasing smartphone penetration, growing interest in education and e-learning, and rising disposable incomes. According to reports, urbanization in Latin American countries has reached around 80%, a higher rate than most other regions. This urban growth is fostering greater digital device adoption, with tablets emerging as an affordable, efficient tool for both students and professionals. As a result, demand for portable devices with multimedia capabilities continues to rise, especially in countries like Brazil and Mexico, where digital learning and remote work are becoming more prevalent.

Middle East and Africa Tablet Market Analysis

The tablet market in the Middle East and Africa is driven by rapid technological advancements and increasing reliance on mobile computing devices. In the Middle East, urbanization is advancing steadily, with the World Bank reporting that the Middle East and North Africa (MENA) is already 64% urbanized. This growth is fostering demand for devices that facilitate remote work, e-learning, and digital content consumption. Tablets, with their portability and functionality, have become essential for professionals and students alike. In Africa, the expanding internet connectivity and rising mobile device usage in education and business are driving the region's tablet market growth.

Competitive Landscape:

Key players are integrating AI-powered features, 5G connectivity, and high-refresh-rate displays to enhance user experience. Apple’s M-series chips in iPads and Samsung’s AMOLED displays provide superior speed and visuals, making tablets suitable for professionals, gamers, and content creators. AI-driven capabilities, such as real-time transcription, predictive typing, and improved battery management, are further improving usability. Besides, manufacturers are launching a mix of premium, mid-range, and budget-friendly tablets to attract various market segments. High-end models like the iPad Pro and Galaxy Tab S9 target business users, while affordable options like Amazon Fire tablets appeal to students and casual users. Moreover, companies are optimizing tablets to work seamlessly within their ecosystem of devices, encouraging brand loyalty. Features like Apple’s Continuity, Samsung DeX, and Microsoft Surface’s Windows integration enhance productivity by allowing effortless transitions between devices. These efforts are creating a favorable tablet market outlook.

The report provides a comprehensive analysis of the competitive landscape in the tablet market with detailed profiles of all major companies, including:

- Acer Inc.

- Apple Inc.

- ASUSTek Computer Inc.

- Dell Technologies Inc.

- Hewlett-Packard Company

- Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co., Ltd.)

- Lenovo Group Limited

- Microsoft Corporation

- Nokia Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

Latest News and Developments:

- January 2025: Xiaomi has announced the Pad 7 tablet in India, which uses the Qualcomm Snapdragon 7 Plus Gen 3 SoC. The gadget includes a Nano Texture Display version that reduces glare and reflection for better viewing. It runs on HyperOS 2, which is based on Android 15, and incorporates AI-driven features aimed at increasing productivity. Xiaomi has also unveiled new accessories, including the Pad 7 Cover, Focus Pen, and Focus Keyboard.

- September 2024: Samsung unveiled the Galaxy Tab S10 Ultra and the Galaxy Tab S10 Plus, the first Android tablets with AI functions. The new models have 12.4-inch and 14.6-inch AMOLED panels with a 120Hz refresh rate and an anti-reflective coating, similar to the Galaxy S24 Ultra. Notably, the Galaxy Tab S10 series lacks an 11-inch model.

- August 2024: Infinix has announced its first tablet, the Infinix XPAD, which boasts impressive hardware and AI capabilities. The smartphone has a textured pattern finish on the back, which houses a square camera module. The XPAD comes in blue, black, and gold, with two RAM configurations—4GB and 8GB—and storage options of 128GB and 256GB.

- August 2024: Poco has introduced its first tablet, the Poco Pad 5G, in India, after making its global debut in May. The tablet has a 12.1-inch 2.5K LCD display consisting a 120Hz refresh rate that supports Dolby Vision. It is also TÜV Rheinland approved and coated with Corning Gorilla Glass. The introduction of 5G connectivity addresses the needs of the Indian market.

- May 2024: Daylight Computer has launched a new tablet optimized for reading, writing, and productivity. The tablet was designed by Anjan Katta, the company's founder, to treat his own ADHD issues. Its goal is to reduce distractions and encourage a more focused workplace. Unlike standard tablets, the Daylight Tablet provides a more streamlined user experience, gaining attention in Silicon Valley for its novel approach to increasing productivity.

Tablet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Detachable, Slate |

| Operating Systems Covered | Android, IOS, Windows |

| Screen Sizes Covered | 8’’, 8’’ and Above |

| End Users Covered | Consumer, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acer Inc., Apple Inc., ASUSTek Computer Inc., Dell Technologies Inc., Hewlett-Packard Company, Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co., Ltd.), Lenovo Group Limited, Microsoft Corporation, Nokia Corporation, Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Xiaomi Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tablet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tablet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tablet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tablet market was valued at USD 84.6 Billion in 2024.

The tablet market is estimated to exhibit a CAGR of 9.67% during 2025-2033.

The significant technological advancements, growing trend of remote work and online education, increasing digital content consumption, digital transformation of healthcare settings, rapid growth in e-commerce, and growing popularity of multimedia content are some of the major factors propelling the market.

Asia Pacific currently dominates the market driven by increasing digital adoption across various sectors such as education, business, and entertainment.

Some of the major players in the tablet market include Acer Inc., Apple Inc., ASUSTek Computer Inc., Dell Technologies Inc., Hewlett-Packard Company, Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co., Ltd.), Lenovo Group Limited, Microsoft Corporation, Nokia Corporation, Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Xiaomi Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)