Table Butter Market in India Size, Share, Trends and Forecast by Sector and Region, 2025-2033

Table Butter Market in India Size and Share:

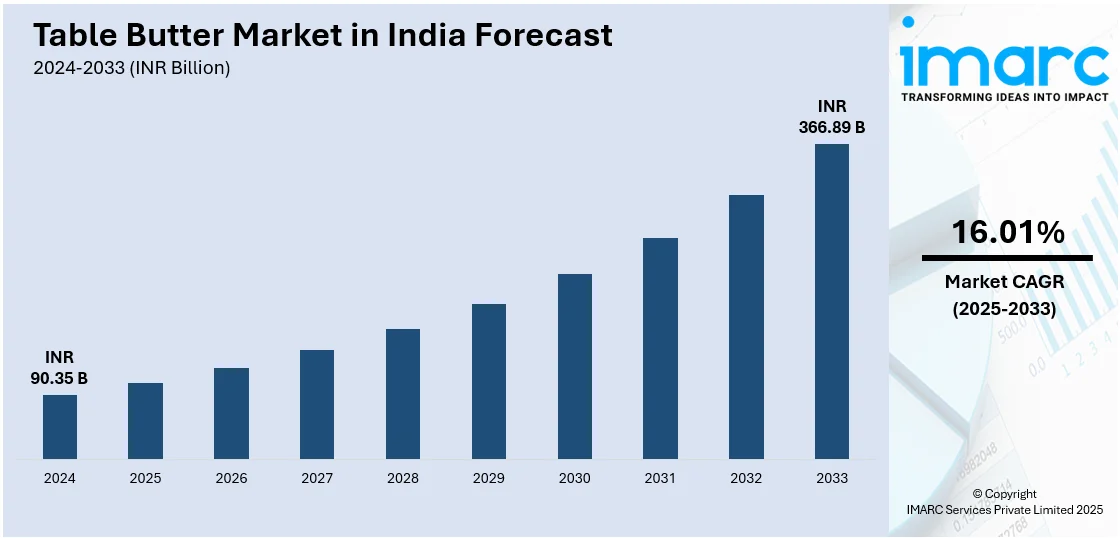

The table butter market in India size was valued at INR 90.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 366.89 Billion by 2033, exhibiting a CAGR of 16.01% from 2025-2033. The market is expanding due to rising urbanization, growing disposable incomes and increased demand for premium and high-quality butter. Innovations in packaging and a focus on sustainability are driving growth with both traditional retail and e-commerce channels boosting accessibility across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 90.35 Billion |

|

Market Forecast in 2033

|

INR 366.89 Billion |

| Market Growth Rate (2025-2033) | 16.01% |

The Indian table butter market is dominated by growing demand for dairy products, which is boosted by increasing disposable incomes, dietary changes, and urbanization. According to the Economic Survey 2023-24, over 40% of India's population is projected to be urban by 2030 as reported by NITI Aayog. The Periodic Labour Force Survey (2020-21) reveals that 55% are internal migrants with 18.9% migrating from rural to urban areas and 15.9% from urban to urban. Extensive applications of table butter in households, bakeries and the foodservice sector are fueling growth in the market. Growing demand for Western food culture is raising consumption of butter in packaged foods, bakery items and ready-to-eat meals. The growth in online grocery sites and retail networks has enhanced access to products thereby increasing sales.

To get more information on this market, Request Sample

Health-conscious consumers are also shaping market trends with demand increasing for organic, unsalted and fortified butter alternatives. The increasing preference for natural dairy foods over margarine and artificially made spreads is another major growth driver. Government policies promoting dairy farming and self-reliance in terms of butter production also augment market growth. For instance, in February 2025, the Uttar Pradesh government announced its plans to expand the cow protection and dairy initiatives sheltering over 12.43 lakh destitute cows and raising daily maintenance from ₹30 to ₹50. Key measures include training for 8,000 youth as 'paravets,' reduced semen costs from ₹700 to ₹100 and 520 mobile veterinary units for livestock healthcare. The growing impact of high-end and artisanal butter brands with distinctive flavors and textures is redesigning consumer behavior and driving India table butter market growth.

Table Butter Market in India Trends:

Ecommerce and Modern Retail Growth

The rise of ecommerce and modern retail is significantly boosting the table butter market in India making it more accessible to consumers across urban and rural areas. According to the data published by the India Brand Equity Foundation, the Indian online grocery market is projected to reach US$ 26.93 billion by 2027 expanding from US$ 3.95 billion in FY21. The ecommerce industry could grow to US$ 325 billion by 2030 with a GMV of US$ 60 billion in FY23 and a 31% CAGR in social commerce by 2025. Online grocery platforms offer convenient ordering, discounts and doorstep delivery increasing butter sales. Supermarkets and hypermarkets are expanding their dairy sections showcasing a variety of butter options including organic, unsalted and flavored varieties.

Rising Focus on Sustainability

The growing sustainability focus in the table butter market reflects consumers’ preference for brands that prioritize responsible sourcing, eco-friendly packaging, and ethical dairy farming. As awareness about environmental impact rises, consumers are opting for butter produced using sustainable farming practices that reduce carbon footprints and support animal welfare. Additionally, eco-friendly packaging, such as biodegradable or recyclable materials, is gaining traction. As part of the growing emphasis on product authenticity and quality, government initiatives are also addressing the issue of adulteration in dairy products. For instance, in September 2024, the Uttarakhand government launched a campaign to combat adulteration in desi ghee and butter following Union Health Ministry directives. Under Deputy Commissioner inspections were conducted in Garhwal and Kumaon Divisions with samples collected from four brands in Haldwani. This trend is driving brands to adopt greener practices, meeting consumer demand for both quality and environmental responsibility.

Packaging Innovation

Packaging innovation in the table butter market is focusing on convenience and sustainability. Brands are increasingly introducing smaller single-serve portions that offer ease of use particularly for busy households and on-the-go consumers. For instance, in October 2023, iD Fresh Food announced the launch of the innovative iD Twist and Spread Butterstick designed for easy and mess-free butter spreading. Inspired by a glue stick the 50 gm pack contains fresh, preservative-free butter that softens quickly. It is convenient for storage and travel enhancing daily kitchen experiences. There is a growing emphasis on ecofriendly packaging with many companies opting for recyclable or biodegradable materials to reduce environmental impact. These innovations not only improve consumer convenience but also align with the rising demand for sustainable products helping brands meet the expectations of environmentally conscious buyers.

Table Butter Market in India Segmentation:

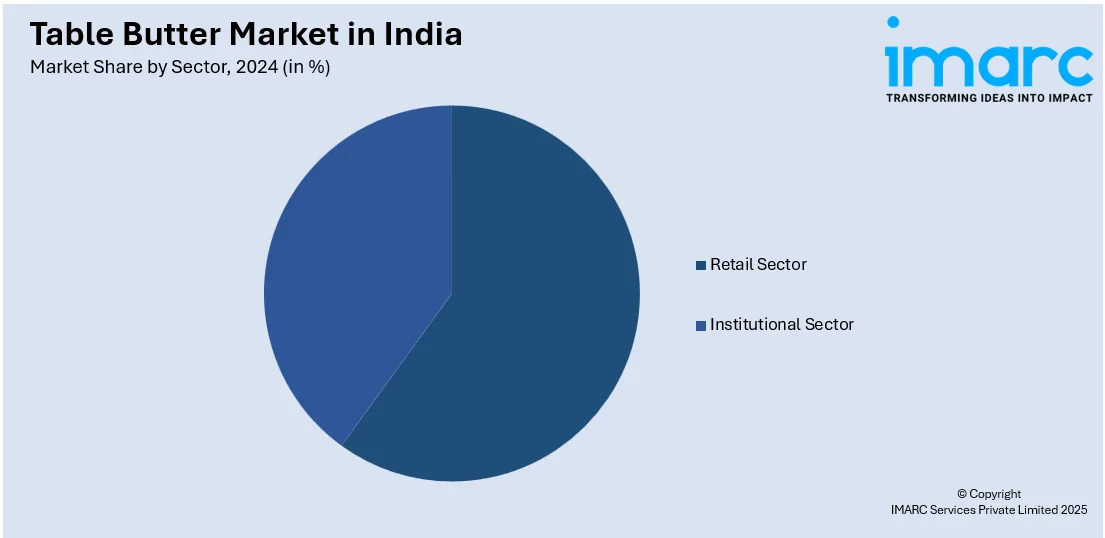

IMARC Group provides an analysis of the key trends in each segment of the table butter market in India, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector.

Analysis by Sector:

- Retail Sector

- Institutional Sector

The retail industry holds the majority table butter market in India share due to increasing consumer demand for easy-to-use and high-quality dairy products. Supermarkets, hypermarkets and organized retail chains are increasing their reach and butter is now easily available to urban and rural consumers. Organized retail has led the growth of premium, flavor and green butter products. The online shopping portals have further increased butter sales with the ease of online booking and doorstep delivery being favored by consumers.

Regional Analysis:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Maharashtra leads the table butter market in India with its vast urban population, high disposable incomes and extensive coverage of dairy production hubs. Mumbai and Pune cities experience high demand for mass-market butter and premium butter driven by the growing middle class and urbanization. The state's strong retail infrastructure including supermarkets and online offers easy access to butter products. Maharashtra's well-established foodservice sector including hotels and restaurants, also sustains the state's market leadership.

Competitive Landscape:

The table butter market in India is highly competitive with both domestic and international players vying for market share. Established brands dominate the market offering a wide range of products including salted, unsalted and flavored butter to cater to diverse consumer preferences. Innovation in packaging such as convenient single-serve portions and ecofriendly materials is a key strategy to attract consumers. Companies are focusing on premium offerings targeting health-conscious and urban consumers. The market is further fueled by the growing retail sector, ecommerce platforms and increasing consumer demand for natural, high-quality and sustainable butter products.

The report provides a comprehensive analysis of the competitive landscape in the table butter market in India with detailed profiles of all major companies, including:

- GCMMF

- KMF

- TN Cooperative

- Mother Dairy

Latest News and Developments:

- In July 2024 Mother Dairy announced that it is targetting a ₹17,000 crore turnover for FY25, anticipating a 13% growth driven by increased demand for dairy and edible oils. The company achieved a ₹15,000 crore revenue last fiscal, marking over 40% growth in three years. It plans to launch 30 new products and expand processing capacities in Nagpur and Gujarat.

- In March 2024, Amul, the renowned Indian dairy brand announced its plans to launch its fresh milk products in the U.S. for the first time partnering with the Michigan Milk Producers Association. With operations backed by 36,000 farmers Amul aims to become a global leader in dairy, supported by Prime Minister’s vision.

- In August 2023, Sid’s Farm announced the launch of a new salted butter range including Cow and Buffalo Butter. Available in Hyderabad and Bengaluru the products are free from antibiotics, preservatives and hormones, reflecting the brand's commitment to pure, healthy dairy offerings.

Table Butter Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Kg |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Retail Sector, Institutional Sector |

| Regions Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

| Companies Covered | GCMMF, KMF, TN Cooperative, Mother Dairy |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the table butter market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the table butter market in India.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the table butter market in India and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The table butter market in India was valued at INR 90.35 Billion in 2024.

The market growth is driven by rising urbanization, increasing disposable incomes, changing dietary habits, and growing demand for premium and high-quality butter. Additionally, innovations in packaging, the rising popularity of sustainable practices, and e-commerce growth are boosting accessibility and consumer reach.

IMARC estimates the table butter market to exhibit a CAGR of 16.01% from 2025-2033, reaching INR 366.89 Billion by 2033.

The Retail Sector accounted for the largest share in the table butter market in India, driven by the increasing consumer demand for convenient, high-quality butter products available in supermarkets, hypermarkets, and online platforms.

Some of the major key players include, GCMMF, KMF, TN Cooperative, Mother Dairy, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)