Synthetic Leather Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Synthetic Leather Market Size and Share:

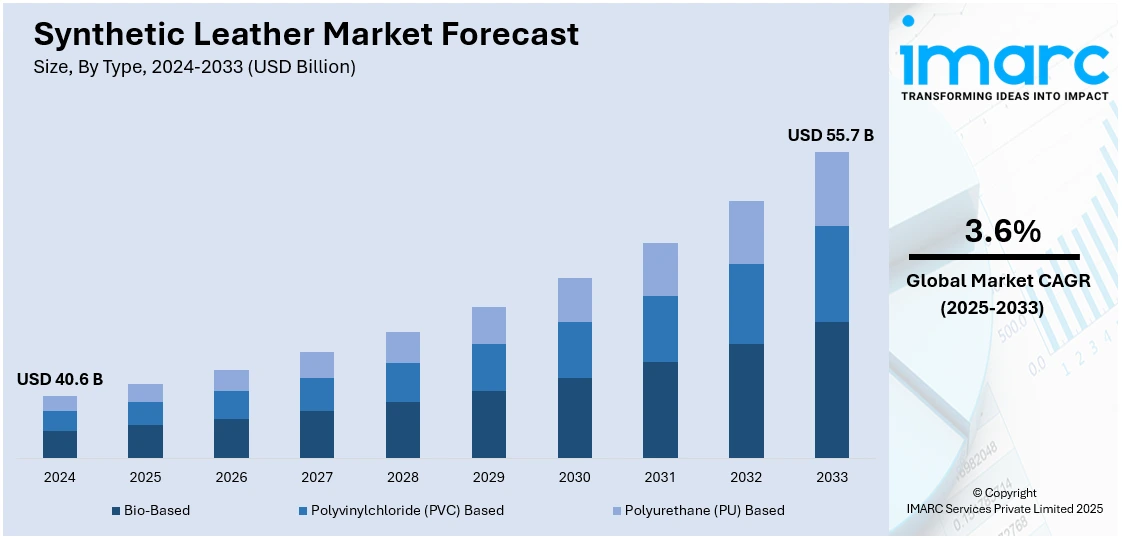

The global synthetic leather market size was valued at USD 40.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.7 Billion by 2033, exhibiting a CAGR of 3.6% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 44.6% in 2024. The continuous advancements in manufacturing technologies, cost-effectiveness and versatility of synthetic leather, expanding retail channels, and the escalating demand for sustainable alternatives, are some of the factors driving the market across Asia Pacific.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.6 Billion |

| Market Forecast in 2033 | USD 55.7 Billion |

| Market Growth Rate (2025-2033) | 3.6% |

The increasing demand for cost- and environment-friendly alternatives to true leather from different industries, such as auto, fashion, footwear, and furniture is driving the market growth. Consumer preference for cruelty-free and eco-friendly items is driving the adoption of synthetic leather, especially among vegan and environmentally oriented consumers. Besides this, advances in manufacturing technology have improved the quality, strength, and appearance of synthetic leather, making it a worthy competitor to natural leather.

Increased automobile production, particularly in developing nations, is fueling the demand for synthetic leather for vehicle interiors because of its low cost and easy maintenance. For instance, the production of passenger vehicles in India, reached 23,28,329 units during January 2024 as per the India Brand Equity Foundation (IBEF). Moreover, strict laws and growing awareness about animal welfare and environmental sustainability are encouraging manufacturers to introduce bio-based and recycled synthetic leather. Moreover, the growing e-commerce sector and changing fashion trends also are major factors driving the demand for synthetic leather products worldwide.

The United States has emerged as a key regional market for synthetic leather. Increasing demand for cruelty-free, economical, and sustainable alternatives to leather across the region are driving the market growth. In November 2024, UNCAGED Innovations, a startup engaged in the development of novel biomaterials, introduced ELEVATE, a luxury leather alternative, made using plant-based materials. Such innovations, in confluence with consumer advocacy for ethical practices, are expanding the opportunities for vegan and cruelty-free product offerings in the region.

Synthetic Leather Market Trends:

Rising Demand for Sustainable Alternatives

The escalating demand for sustainable and animal-friendly alternatives to traditional leather is among the primary factors driving the synthetic leather market. Besides this, the shifting consumer preferences towards eco-friendly variants, on account of the increasing environmental concerns, are acting as a significant growth-inducing factor. Moreover, the inflating investments in bio-based materials, recycled content, and closed-loop processes are positively influencing the synthetic leather market statistics. For instance, in India, 100% FDI is allowed for the manufacturing of leather products through an automatic route. Between April and September, the cumulative foreign direct investment (FDI) inflow in the case of the leather, leather goods, and pickers industries were USD 218.69 Million.

Advancements in Manufacturing Technologies

The continuous innovations and advancements in manufacturing technologies to improve the durability, texture, and overall quality of synthetic leather are positively influencing the market growth. Moreover, the growing popularity of digital printing, 3D modeling, and computer-aided design (CAD) to create customizable, high-performance materials is also stimulating the synthetic leather industry. For instance, BASF Southeast Asia has joined the ZDHC Foundation as a “Contributor” in its Chemical Industry category. The partnership with the Foundation and its extensive pool of experts from organizations in the textile, apparel, leather and footwear industry underlines BASF’s commitment to being an industry leader in driving sustainable chemistry, innovation and best practices. Additionally, Haptex is the first BASF material solution that has received the ECO PASSPORT by OEKO-TEX certification for the production of synthetic leather.

Cost-effectiveness and Versatility

The extensive utilization of synthetic leather in clothing, footwear, and automotive sectors, owing to its versatility and cost-effectiveness, is primarily driving the market growth. For example, the world population is increasing annually, leading to a rise in the textile industry. China is the world's leading producer and exporter of raw textiles and garments. Moreover, the growing popularity of synthetic leather in the automotive sector for seating, dashboard covers, door panels, and trim components to provide durability, aesthetic appeal, and cost advantages is further propelling the synthetic leather market demand. For instance, In October, Pecca Group Bhd, located in Malaysia, announced the purchase of PT Gemilang Maju Kencana, an Indonesian upholstery leather wrapping and car seat cover manufacturer. GMK is also looking for commercial and marketing cooperation from MPI's founder in order to increase its footprint in Indonesia. Although Indonesia sells more automobiles than any other Southeast Asian market, the country is projected to be a major development engine for Pecca as it expands its overseas footprint in the upholstery seat covers in the automotive sector.

Synthetic Leather Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global synthetic leather market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Bio-Based

- Polyvinylchloride (PVC) Based

- Polyurethane (PU) Based

Polyurethane (PU) based stand as the largest component in 2024, holding around 63.6% of the market. According to the report, polyurethane (PU) based represented the largest segment. The growing popularity of polyurethane-based leather across various industries, such as fashion, automotive, and furnishings is primarily driving the market growth. For instance, BASF launched ten variations of Haptex 2.0 – a new and improved series of innovative polyurethane (PU) solutions to produce synthetic leather. Enhanced with a higher peel strength, anti-yellowing, and high abrasion performance properties, Haptex 2.0 enables designers to achieve high performance and the desired appearance of applications using synthetic leather across different industries, such as furniture, footwear, automotive, apparel, and accessories. Additionally, without using any organic solvents, synthetic leather made with Haptex 2.0 meets stringent VOC standards.

Analysis by Application:

- Clothing

- Bags

- Shoes

- Purses and Wallets

- Accessories

- Car Interiors

- Belts

- Sports Goods

- Others

Shoes lead the market in 2024. The shifting consumer preferences toward cruelty-free and eco-friendly synthetic leather shoe options, on account of the rising environmental concerns, is stimulating the market growth. Besides this, the ongoing technological advancements in manufacturing processes to enhance the durability, quality, and aesthetic appeal of shoes are also positively influencing the synthetic leather industry. For instance, several international reports suggest that India's leather and footwear industry will be US$ 90 Billion. Over the next 6-7 years, this sector will offer an additional 20 lakh jobs.

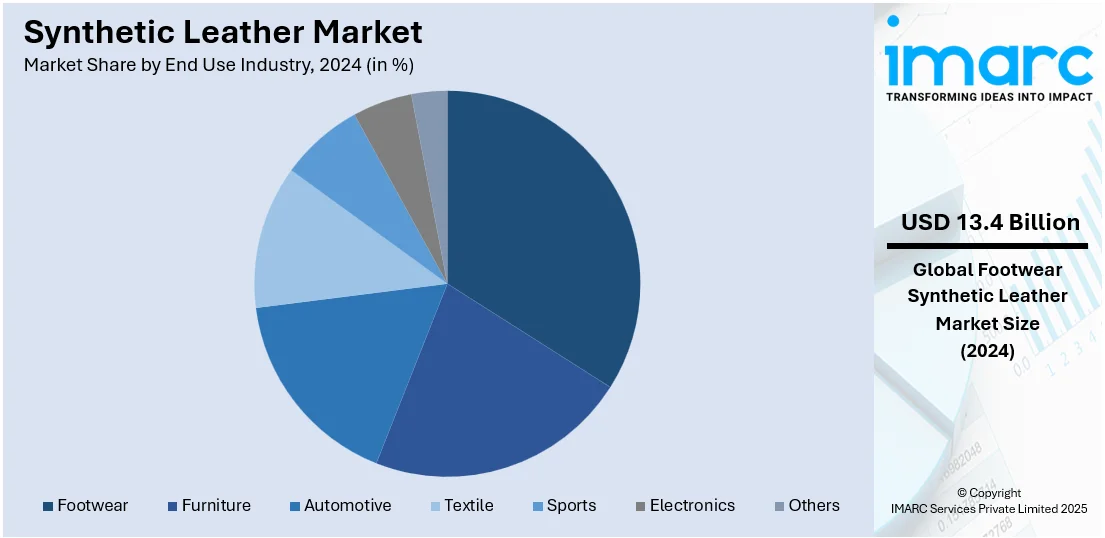

Analysis by End Use Industry:

- Footwear

- Furniture

- Automotive

- Textile

- Sports

- Electronics

- Others

Footwear leads the market with around 32.9% of market share in 2024. The evolving consumer preferences and the incorporation of synthetic leather into various designs and textures are positively influencing the market growth. Moreover, the expanding e-commerce platforms that provide customers with a wide range of footwear options are also stimulating the synthetic leather market dynamics.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 44.6%. According to the report, Asia Pacific accounted for the largest market share, owing to the increasing population and the inflating disposable income levels that allow consumers to spend on fashion and automotive industries. Moreover, the ongoing innovations and advancements in production technologies enable the manufacturing of high-quality synthetic leather, which are also contributing to the growth of the market in the region. For instance, according to Invest India, Ministry of Commerce and Industry, India, the textile industry in the country contributes 12% in the export earnings of the country, which was USD 14 Billion, and it is expected to grow by 7.6% to reach USD 23.3 Billion by 2027.

Key Regional Takeaways:

United States Synthetic Leather Market Analysis

In 2024, the United States accounts for over 73.40% of the synthetic leather market in North America. The United States synthetic leather market is driven by the tendency of consumers, particularly the fashion and automobile industries, to increasingly choose animal-free and sustainable materials. The larger automobile manufacturers are, therefore including synthetic leather into the automotive interior design because they focus on lightweight materials that are strong and cost-effective to enhance fuel efficiency and contribute to strict environmental regulations. Synthetic leather has become an attractive option as an alternative to natural leather due to the growing demand for low-maintenance and aesthetic upholstery products. Improved technologies in polyurethane (PU) and polyvinyl chloride (PVC) have allowed the manufacture of synthetic leather that simulates the look and feel and durability of real leather, thus further boosting acceptance. Simultaneously, increasing ethical and cruelty-free production awareness is transforming consumer purchasing behavior, as consumers keep on seeking alternatives that are in line with their values. Companies utilize e-commerce platforms to increase awareness and distribute new synthetic leather products to the more tech-savvy consumers who increasingly shop online. The American Community Survey indicates that in 2021, some 97 percent of 3- to 18-year-olds had home internet access. In addition, the growth in the shoemaking industry is another factor that boosts the demand for artificial leather to create long-lasting and trendy shoes, thereby meeting consumers' demand for cheap yet weather-resistant footwear. Together, these aspects reflect a dynamic change in the scenario of the U.S. synthetic leather market.

Asia Pacific Synthetic Leather Market Analysis

The Asia-Pacific synthetic leather market is growing rapidly due to changing demand patterns and industry dynamics. Suppliers are now focusing on sustainable innovation as a way to deal with a new trend of environment-friendly, sustainable alternatives for genuine leather. Urbanization is very rapid, leading to higher demands for low-cost fashionable interior solutions in automobile and furniture applications, which prefer the durability and cost-effectiveness provided by synthetic leather. As reported by UN Habitat, the average urbanization rate of China stood at 59.6% in the year 2018, while Zhejiang Province exceeded 68% and Guizhou Province 46%. As the segment to be targeted turns younger and trend-conscious for cruelty-free products, the fashion and footwear industries are increasingly using synthetic leather. Advances in technology are making synthetic leather closer to resembling natural leather in texture, appearance, and performance, thus increasing its acceptance in premium applications. Stringent government regulations related to the use of animal-derived products are in place within this region, thereby driving demand for synthetic alternatives. Local manufacturers also increase production capacity as well as diversify product portfolios to meet the high demand within the country and for export. The rapidly growing middle class in China and India is fueling the automotive and consumer goods industries, making synthetic leather even more widely adopted. This trend has begun to change the face of the market, as players seek sustainability and innovation in capturing new opportunities.

Europe Synthetic Leather Market Analysis

Currently, demand in the automotive sector in Europe is driving the synthetic leather market forward as it uses lightweight materials to help reduce carbon emissions and enhance fuel efficiency. Fashion is one of the active users of synthetic leather in clothing, accessories, and shoes as it satisfies the need of most consumers who seek vegan and cruelty-free alternatives. The growing demand for synthetic leather as upholstery material among furniture manufacturers is also based on factors like its durability, cost-effectiveness, and easy maintenance. In an attempt to promote sustainability, European regulatory bodies are now urging the businesses to create bio-based and recyclable synthetic leather products. Companies are leveraging advanced technologies to improve product quality, focusing on innovations such as improved breathability and enhanced texture to mimic natural leather closely. Additionally, the e-commerce sector is currently expanding its reach, providing consumers with access to a wide variety of synthetic leather products, further fuelling market growth. According to the International Trade Administration, Europe is the third biggest retail ecommerce market globally, with total revenues of USD 631.9 billion. Rising awareness about the environmental impact of natural leather production is continuously influencing consumer behaviour, with many opting for eco-friendly alternatives. Industries are also responding to stringent regulations regarding harmful chemicals, leading to a shift towards water-based and solvent-free production processes, which are gaining significant traction across the region.

Latin America Synthetic Leather Market Analysis

The synthetic leather market in Latin America is currently experiencing growth driven by several specific factors. Manufacturers are increasingly focusing on producing cost-effective alternatives to genuine leather, appealing to a price-sensitive consumer base. Automotive companies are adopting synthetic leather to meet the rising demand for lightweight and durable materials, which is aligning with regional fuel efficiency and sustainability trends. Fashion brands are actively expanding their portfolios with synthetic leather products, as consumers are showing a growing preference for cruelty-free and vegan options in their purchases. At the same time, regulatory bodies in various Latin American countries are implementing stricter policies on environmental compliance, prompting industries to shift toward eco-friendly materials like polyurethane-based synthetic leather. Technological advancements are enhancing the quality and durability of synthetic leather, which is helping it gain acceptance in high-performance applications such as furniture and footwear. Additionally, the e-commerce sector is playing a pivotal role by promoting diverse synthetic leather products to a wider audience, particularly in underserved markets. According to the International Trade Administration, Mexico is positioned among the top five countries in the world in terms of eCommerce retail growth rate. There were 63 Million Mexican eCommerce users in 2022, an increase of 5.5 Million over 2021. Local manufacturers are also capitalizing on abundant raw material availability and competitive labor costs to scale up production, meeting both domestic and export demand effectively. These dynamic trends are collectively shaping the growth trajectory of synthetic leather in Latin America.

Middle East and Africa Synthetic Leather Market Analysis

The synthetic leather market in the Middle East and Africa is experiencing growth driven by several region-specific factors. Rising urbanization and an expanding middle-class population are increasing demand for affordable and stylish alternatives to genuine leather, particularly in furniture, automotive, and footwear applications. According to the UN Habitat, the Republic of South Africa is one of the most urbanized countries in Africa with around 67% of its population living in urban areas. Governments across the region are implementing stringent regulations against the environmental impacts of animal-based leather production, pushing industries toward eco-friendly synthetic alternatives. Additionally, automotive manufacturers are incorporating synthetic leather in vehicle interiors to meet the rising consumer preference for durable, low-maintenance, and cost-effective materials. The fashion industry is actively promoting synthetic leather products to cater to the younger demographic seeking cruelty-free and trend-conscious designs. Furthermore, advancements in synthetic leather production technologies, such as bio-based polyurethane, are enabling manufacturers to address sustainability concerns while delivering high-quality products. Local industries are also capitalizing on the availability of raw materials and lower production costs to boost regional output and exports. The hospitality sector is increasingly adopting synthetic leather for upholstery and interior design due to its resistance to wear and ease of cleaning, aligning with the demand for high-performance materials. These factors collectively are shaping the ongoing expansion of the synthetic leather market in the Middle East and Africa.

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the synthetic leather market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- DuPont Tate & Lyle Bio Products Company LLC

- FILWEL Co. Ltd. (Air Water Inc.)

- H.R. Polycoats Pvt. Ltd.

- Kuraray Co. Ltd.

- Mayur Uniquoters Limited

- Nan Ya Plastics Corporation

- San Fang Chemical Industry Co. Ltd.

- Teijin Limited

- Zhejiang Hexin Holdings Co. Ltd.

Latest News and Developments:

- January 2024: BASF Monomers Division and Xuchuan Chemical, an important partner in the isocyanates value chain, held a ceremony to commemorate their strategic cooperation on bio-mass balanced (BMB) Methylene Diphenyl Di-isocyanate (MDI) in synthetic leather applications. By leveraging BASF's expertise in bio-mass balanced (BMB) MDI production and Xuchuan Chemical's extensive network in the synthetic leather value chain, the primary goal of this collaboration is to reduce carbon emissions in the production of polyurethanes for the industry.

Synthetic Leather Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bio-Based, Polyvinylchloride (PVC) Based, Polyurethane (PU) Based |

| Applications Covered | Clothing, Bags, Shoes, Purses and Wallets, Accessories, Car Interiors, Belts, Sports Goods, Others |

| End Use Industries Covered | Footwear, Furniture, Automotive, Textile, Sports, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, Zhejiang Hexin Holdings Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the synthetic leather market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global synthetic leather market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the synthetic leather industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Synthetic leather is a man-made material designed to mimic the appearance and texture of genuine leather. It is typically made from polymers such as polyurethane (PU) or polyvinyl chloride (PVC), offering a durable, cost-effective, and environmentally friendly alternative to animal-derived leather.

The global synthetic leather market was valued at USD 40.6 Billion in 2024.

IMARC estimates the global synthetic leather market to exhibit a CAGR of 3.6% during 2025-2033.

Some of the factors driving the global synthetic leather market are the increasing demand for sustainable and cruelty-free alternatives to genuine leather, development in manufacturing technologies, and increasing applications in automotive, fashion, footwear and furniture industries.

According to the report, polyurethane (PU) based represented the largest segment by type, driven by its superior flexibility, durability, and eco-friendliness compared to polyvinyl chloride (PVC), making it more versatile across various industries.

Shoes represent the leading segment by application due to their high global demand, cost-efficiency, durability, and wide adoption in both fashion and athletic footwear.

Footwear holds the maximum number of shares due to its high demand for durable, lightweight, and cost-effective materials that offer design flexibility and low maintenance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global synthetic leather market include Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, Zhejiang Hexin Holdings Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)