Synthetic Biology Market Size, Share, Trends and Forecast by Product, Technology, Application, and Region, 2025-2033

Synthetic Biology Market Size and Share:

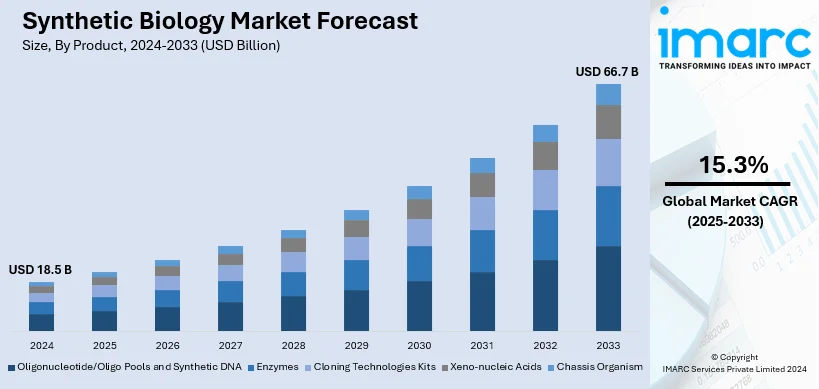

The global synthetic biology market size was valued at USD 18.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 66.7 Billion by 2033, exhibiting a CAGR of 15.3% from 2025-2033. North America currently dominates the market, holding a market share of over 41.8% in 2024. The dominance of North America can be attributed to robust biotechnology infrastructure, increasing investments in research operations, and supportive government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 66.7 Billion |

| Market Growth Rate (2025-2033) | 15.3% |

At present, the rising focus on bio-based alternatives for fuel, chemicals, and materials, which drives interest in engineered biological systems, represents one of the key factors impelling the market growth. In addition, the increasing use of synthetic biology for drug discovery, personalized medicine, and therapeutic development, including cancer treatments and vaccines, is propelling the market growth. Apart from this, innovations in gene synthesis, next-generation sequencing, and genome editing technologies are enhancing the ability to design and construct new biological parts and systems, expanding the applications of synthetic biology across various industries. Artificial intelligence (AI) and machine learning (ML) tools are accelerating the design process for synthetic biology applications. Predictive modeling, data analysis, and automation streamline the creation of synthetic pathways and improve the efficiency of experiments. In addition, governing bodies worldwide are recognizing the potential of synthetic biology and are implementing policies to support its development. This includes funding for research, streamlined regulatory frameworks, and initiatives promoting bio-manufacturing and biosecurity.

The United States has emerged as a key region in the market, mainly due to a well-established biotechnology sector, with access to cutting-edge research facilities and skilled professionals, enabling innovation in synthetic biology. Additionally, the increasing focus on precision medicine and engineered therapeutics, including gene therapies and synthetic vaccines, is strengthening the market growth. Furthermore, the rising emphasis on bio-based alternatives in energy, agriculture, and materials aligns with the nation’s sustainability goals, encouraging adoption. Besides this, the growing focus on innovative user products that merge aesthetics with advanced genetic engineering highlights synthetic biology's potential to create novel applications, driving market demand and public interest. For instance, in 2024, Light Bio launched bioluminescent petunias, genetically engineered with fungal genes, allowing them to glow continuously without external aids. The glowing "Firefly Petunia," priced at $29, showcases the potential of synthetic biology to merge nature and technology. The plants are now available in the US, with 50,000 units released.

Synthetic Biology Market Trends:

Advancements in gene editing technologies

At present, various techniques like CRISPR-Cas9 are capable of improving the field of biology research by enabling precise and efficient manipulation of genetic material, strengthening the synthetic biology market demand. Researchers are designing, editing, and engineering DNA sequences with exceptional accuracy, facilitating the creation of intricate synthetic organisms customized according to specific functions. This innovation is opening new avenues for the development of novel aspects, like disease treatment through gene therapies and creation of bioengineered organisms capable of producing valuable compounds such as enzymes and biofuels, thus aiding in market expansion. According to the Centers for Disease Control and Prevention, in the United States in 2021, 1,777,566 new cancer cases were reported. Moreover, The World Health Organization (WHO) released groundbreaking recommendations for the global governance of human genome editing, emphasizing safety, efficacy, and ethics.

Demand for sustainable solutions

The rising demand for sustainable and environment-friendly solutions across various industries is propelling the synthetic biology market growth. Synthetic biology presents various new avenues for sectors to fulfill their demands to reduce the environmental impact of their operations. In line with this, the production of bioplastics extracted from renewable resources and the development of biofuels with reduced carbon emissions aligning with the global push towards sustainability are contributing to the market growth. Apart from this, synthetic biology is capable of creating microbes for bioremediation which is a method to detoxify contaminants or help clean up the environment and address various urgent ecological complications. Furthermore, synthetic biology is revolutionizing the sustainability efforts of the beauty sector. According to Invest India, the Indian government allows 100% FDI in single-brand retail and 51% in multi-brand retail, which has opened the door for international beauty brands to enter and expand in the Indian market. To address these challenges, synthetic biology modifies microorganism DNA to create sustainable materials. The synthetic biology market price reflects rapid growth due to innovation and diverse applications.

Collaborative ecosystem and investment

The collaborative synergy between academia, industry, and government entities fosters a conducive environment for research operations within the synthetic biology field. Collaborations facilitate the exchange of knowledge, assets, and perspectives, thus quickening the rate of invention. Governing authorities frequently provide grants and funds to assist research endeavors, while established businesses and startups work together to pool resources for ground-breaking ventures that promote market growth. For instance, in 2023, the Synthetic Biology for Growth program was established by the UK research councils following recommendations on synthetic biology research and investment from the UK government. A budget of USD 126.48 Million was passed for this particular research. In addition to this, the surge in venture capital investments in biotechnology startups injects vital capital into the field, nurturing the growth of nascent ideas into tangible products and synthetic biology market application. This collaborative ecosystem sustains a cycle of research, innovation, and commercialization, propelling the global synthetic biology market forward. Additionally, the future of the synthetic biology market promises unparalleled innovation, sustainability solutions, and expansive growth potential. Companies, such as Algal Bio utilize a diverse array of strains to innovate novel solutions, while startups like Basecamp Research employ machine learning (ML) to decipher the design principles of nature for synthetic protein engineering.

Synthetic Biology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global synthetic biology market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, application.

Analysis by Product:

- Oligonucleotide/Oligo Pools and Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-nucleic Acids

- Chassis Organism

Oligonucleotide/oligo pools and synthetic DNA hold the biggest market share, around 35.5% in 2024. Oligonucleotide/oligo pools and synthetic DNA is the largest segment, driven by its widespread application in gene synthesis, therapeutic development, and biotechnology research. Oligonucleotides are critical for processes like PCR, sequencing, and gene editing, while synthetic DNA supports advancements in synthetic biology by enabling the creation of customized genetic constructs. The rising adoption of gene-editing technologies like CRISPR-Cas9 and the growing demand for synthetic genes in personalized medicine and vaccine development is positively influencing the market growth. Moreover, the growing adoption of oligo pools in high-throughput screening and functional genomics research has enhanced its position in the market. This area also sees advantages from innovations in DNA synthesis technologies, enhancing effectiveness and cutting down on manufacturing expenses, thus increasing accessibility to researchers and biotech firms. With synthetic biology growing in healthcare, agriculture, and industries, it is set to remain a top player in the market.

Analysis by Technology:

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Others

PCR technology is the largest segment, with a market share of 30.3% in 2024. PCR technology is pivotal in synthetic biology, offering precise amplification of specific DNA sequences essential for cloning, gene editing, and functional genomics. This accuracy enables the creation of synthetic constructs and engineered organisms, forming the foundation for advancements in biotechnology. Recent innovations, including digital and real-time PCR, enhance the technique’s sensitivity, efficiency, and speed, making it indispensable in diagnostics, biomanufacturing, and high-throughput screening. In diagnostics, PCR facilitates the detection of genetic markers and engineered sequences, improving the accuracy of disease identification and monitoring. Biomanufacturing relies on PCR for validating genetic constructs used in producing bio-based materials, enzymes, and therapeutics. High-throughput screening leverages its speed and precision to assess genetic modifications and functional assays at scale. As synthetic biology continues to grow, PCR’s evolving capabilities remain critical, supporting innovations across research, industrial processes, and medical applications, driving breakthroughs in bioengineering and biotechnology.

Analysis by Application:

- Healthcare

- Clinical

- Non-Clinical/Research

- Non-Healthcare

- Biotech Crops

- Specialty Chemicals

- Bio-Fuels

- Others

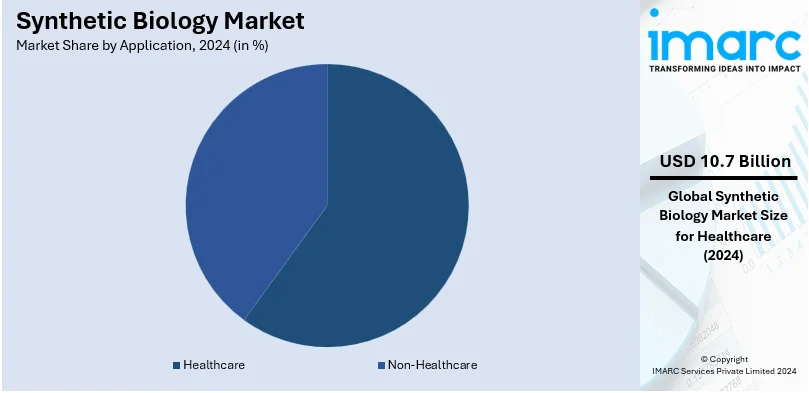

Healthcare accounts for the majority of the market share, around 57.5% in 2024. Healthcare (clinical and non-clinical/research) is a crucial segment in the market. Clinically, synthetic biology is transforming personalized medicine through advanced gene therapies, synthetic vaccines, and engineered cell therapies designed to treat conditions like cancer, autoimmune disorders, and rare genetic diseases. These innovations enable precise, patient-specific treatments with improved outcomes and reduced side effects. In research, synthetic biology accelerates drug discovery, functional genomics, and disease modeling by utilizing synthetic DNA and engineered organisms to replicate complex biological systems. This approach enhances the understanding of disease mechanisms and facilitates the development of targeted therapeutics. Synthetic biology also plays a pivotal role in diagnostics, introducing cutting-edge biosensors, CRISPR-based assays, and DNA-based tests that provide rapid, accurate detection of diseases and pathogens. The growing integration of synthetic biology in healthcare underscores its potential to revolutionize treatment paradigms, research methodologies, and diagnostic tools, addressing both current and emerging medical challenges.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.8%. North America leads the market due to its sophisticated biotechnology capabilities, increasing research investments, and significant participation of major market stakeholders. The area is advantaged by established academic and research institutions, promoting innovation in synthetic biology applications in healthcare, agriculture, and industry. Government policies and initiatives that provide support, such as funding for research and development in synthetic biology, also contribute to the rapid growth of the market. The region's emphasis on environmental sustainability is supported by the growing need for sustainable options such as biofuels, bioplastics, and engineered crops. North America dominates the market in healthcare innovations, especially in gene therapies, synthetic vaccines, and diagnostics. The strong venture capital sector also supports the development of synthetic biology technologies for commercial use. The U.S. National Science Foundation (NSF) revealed a $15 million grant in 2024 to create the iBioFoundry at the University of Illinois Urbana-Champaign. The center combines synthetic biology, AI, and robotics to progress biomanufacturing, fostering advancements in fields such as protein engineering and sustainable technologies. Its goal is to function as a central point for researchers and industry stakeholders to work together.

Key Regional Takeaways:

United States Synthetic Biology Market Analysis

The synthetic biology market in the United States is rapidly expanding as advancements in gene editing technologies, such as CRISPR-Cas9, are transforming the biotechnology landscape. Researchers are developing novel techniques for designing and constructing new biological parts, systems, and organisms, driving innovation across industries. Companies are increasingly adopting synthetic biology to enhance the production of biofuels, chemicals, and pharmaceuticals, contributing to sustainable manufacturing processes. According to the Energy Information Administration (EIA), in 2022, United States produced 15,361 Million gallons of fuel ethanol. Investment in biotechnology startups and research initiatives is growing, supported by both venture capital and government funding, creating a thriving ecosystem for innovation. At the same time, regulatory bodies are actively establishing frameworks to address the complexities of synthetic biology, which is fostering a more predictable environment for companies to operate in. The integration of artificial intelligence (AI) and machine learning (ML) in synthetic biology is accelerating research and development, enabling quicker identification of viable biological solutions. Collaborations between academic institutions, research labs, and the private sector are intensifying, speeding up the commercialization of synthetic biology products. Furthermore, consumer demand for sustainable and eco-friendly products is pushing industries like agriculture, healthcare, and environmental management to incorporate synthetic biology into their operations, positioning the U.S. as a leader in the global synthetic biology market.

Europe Synthetic Biology Market Analysis

The synthetic biology market in Europe is experiencing rapid growth as innovative advancements in genetic engineering, CRISPR technology, and gene synthesis are being increasingly adopted across various sectors. Researchers and companies are continually developing new bio-based solutions for industries such as healthcare, agriculture, and energy. According to Eurostat, the EU's agricultural industry created gross value added of USD 237.5 Billion in 2023. As the demand for sustainable alternatives to traditional chemical processes and fossil fuels intensifies, businesses are continuously investing in synthetic biology to create more efficient, eco-friendly production methods. Additionally, governments in the region are prioritizing green and bio-based technologies, providing favorable regulations, funding, and incentives to drive innovation. There is also an ongoing focus on improving personalized medicine, with synthetic biology enabling the development of advanced therapies and vaccines. The growing need for high-performance bio-manufacturing processes and more resilient crops is pushing the market further, as agricultural companies are continually utilizing synthetic biology to enhance crop yield and pest resistance. Moreover, the increasing demand for bioplastics and biodegradable materials is accelerating the adoption of synthetic biology solutions, as manufacturers are exploring more sustainable, bio-based materials for packaging and products. As a result, collaborations among biotech firms, academic institutions, and industry leaders are continually expanding the scope and impact of synthetic biology across Europe.

Asia Pacific Synthetic Biology Market Analysis

The synthetic biology market in the Asia Pacific region is currently experiencing rapid growth due to several specific factors. Companies are increasingly focusing on developing sustainable bio-based solutions to address regional challenges, such as food security and environmental pollution. In particular, governments are supporting research and development initiatives in synthetic biology by providing funding and regulatory frameworks that encourage innovation in fields like biofuels, agricultural biotechnology, and bioplastics. According to the Ministry of Power, ethanol distillation capacities of molasses-based distilleries grew two times, and the number of distilleries increased by 50% during 2017-2022 across India. Many businesses are adopting synthetic biology to enhance crop yield and improve pest resistance, responding to the region’s increasing agricultural demands. At the same time, there is a rising interest in developing novel therapeutics and vaccines, especially in response to the growing healthcare needs in emerging markets. Companies are also leveraging synthetic biology to create advanced biomaterials, such as biodegradable plastics, which align with the region's shift toward more sustainable manufacturing practices. In addition, the growing availability of gene-editing tools and platforms is enabling researchers to push the boundaries of synthetic biology applications, including in the bio-manufacturing and chemical industries. As the region’s biotech ecosystem matures, partnerships between academia, government, and private companies are expanding, driving further progress in synthetic biology innovation and application.

Latin America Synthetic Biology Market Analysis

The synthetic biology market in Latin America is rapidly expanding as regional governments and private sectors are heavily investing in research and development initiatives. Countries like Brazil and Argentina are establishing robust biotechnology hubs, facilitating collaborations between academic institutions and startups, which are actively developing innovative synthetic biology solutions. Local agricultural challenges, including pest management and crop diseases, are driving the adoption of synthetic biology in developing more resilient and sustainable agricultural practices. At the same time, the healthcare sector is witnessing significant advancements, with biotech firms exploring personalized medicine and gene therapies to address prevalent diseases. According to Diabetes Atlas, in 2021, the number of people affected with diabetes in Brazil include 15,733.6 (1,000s). With increasing demand for biofuels and sustainable chemicals, Latin American countries are focusing on using synthetic biology to reduce their reliance on traditional petroleum-based products. Additionally, regional regulations are progressively becoming more favorable, providing a conducive environment for synthetic biology applications to thrive. The rising consumer preference for eco-friendly and sustainable products is accelerating the growth of bio-based alternatives in industries such as cosmetics, food, and materials. As investments in infrastructure and technology continue to increase, Latin America is emerging as a key player in the global synthetic biology market, positioning itself as a leader in the development and commercialization of biotechnological innovations.

Middle East and Africa Synthetic Biology Market Analysis

The synthetic biology market in the Middle East and Africa is experiencing growth as governments and private sectors are increasingly investing in biotechnology and innovation-driven industries. Countries in the region, such as the UAE and Saudi Arabia, are focusing on diversifying their economies beyond oil by prioritizing biotechnology, genomics, and renewable energy solutions, which are driving the demand for synthetic biology. According to the Ministry of Energy and Infrastructure, in 2023, the UAE achieved a remarkable growth of 70 per cent in installed renewable energy capacity. Research institutions and universities are collaborating with industries to develop cutting-edge technologies in fields like healthcare, agriculture, and energy. The ongoing development of bio-manufacturing and genetically engineered products is further driving the sector. Additionally, the Middle East and Africa are witnessing rising agricultural challenges, such as water scarcity and soil degradation, which are prompting the adoption of synthetic biology solutions to improve crop yields and create drought-resistant plants. The region's growing interest in personalized medicine and precision healthcare is accelerating research in synthetic biology, as countries work toward addressing the rising burden of chronic diseases and genetic disorders. Regulatory frameworks are evolving to support biotechnology innovations, with governments setting policies to boost synthetic biology’s commercialization. All these factors are actively driving the synthetic biology market in the Middle East and Africa, creating a fertile ground for investments, partnerships, and technological advancements.

Competitive Landscape:

Key players in the market are focusing on expanding their portfolios through research operations, partnerships, and acquisitions. They are investing in innovative gene-editing tools, synthetic DNA technologies, and advanced bioengineering platforms to address the growing demands in healthcare, agriculture, and environmental applications. Companies are also enhancing their manufacturing capacities to meet the increased need for synthetic biology products globally. Many are adopting collaborative strategies with academic institutions and biotech firms to accelerate technological advancements. Regulatory compliance and sustainable production are other focal points, as businesses aim to align with international standards and market trends for long-term growth. In 2024, Integrated DNA Technologies (IDT) launched Rapid Genes, a next-generation gene synthesis solution offering NGS-verified clonal genes delivered in as little as five business days. This innovation accelerates drug discovery by providing ready-to-use circular DNA with transparent pricing and expanded manufacturing capabilities. The release enhances IDT's synthetic biology portfolio to support pharmaceutical research and genomics advancements.

The report provides a comprehensive analysis of the competitive landscape in the synthetic biology market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Amyris Inc.

- Codexis Inc.

- Danaher Corporation

- Eurofins Scientific

- GenScript Biotech Corporation

- Illumina Inc.

- Merck KGaA

- New England Biolabs

- Synthego Corporation

- Thermo Fisher Scientific Inc.

- Twist Bioscience

- Viridos Inc.

Latest News and Developments:

- May 2024: Integrated DNA Technologies (IDT) expanded its synthetic biology operations with the opening of a new 25,000 ft2 site in Coralville, IA. Moreover, the two-story building will be dedicated to the manufacturing of IDT synthetic biology products.

- December 2023: The Allen Institute, the Chan Zuckerberg Initiative and the University of Washington announced the launch of the Seattle Hub for Synthetic Biology. This landmark collaboration will build new technologies to record the history of cells over time.

Synthetic Biology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Oligonucleotide/Oligo Pools and Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids, Chassis Organism |

| Technologies Covered | NGS Technology, PCR Technology, Genome Editing Technology, Bioprocessing Technology, Others |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Amyris Inc., Codexis Inc., Danaher Corporation, Eurofins Scientific, GenScript Biotech Corporation, Illumina Inc., Merck KGaA, New England Biolabs, Synthego Corporation, Thermo Fisher Scientific Inc., Twist Bioscience, Viridos Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the synthetic biology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global synthetic biology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the synthetic biology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Synthetic biology is a multidisciplinary field that involves designing and engineering biological systems and organisms to perform specific functions not found in nature. It combines principles from biology, engineering, computer science, and chemistry to reprogram or construct genetic material and biological systems.

The synthetic biology market was valued at USD 18.5 Billion in 2024.

IMARC estimates the global synthetic biology market to exhibit a CAGR of 15.3% during 2025-2033.

The global synthetic biology market is driven by advancements in genetic engineering tools, increasing demand for sustainable bio-based products, and rising investments in research operations. Applications in medicine, agriculture, and environmental solutions, coupled with the adoption of CRISPR and DNA synthesis technologies, are strengthening the market growth.

In 2024, Oligonucleotide/oligo pools and synthetic DNA represented the largest segment by product, driven by their critical role in gene synthesis, therapeutics development, and advancements in personalized medicine and genetic research.

In 2024, PCR technology represented the largest segment by technology, driven by its precision in DNA amplification, widespread use in diagnostics, gene editing, and advancements in digital and real-time PCR techniques.

Healthcare leads the market by application owing to its transformative impact on personalized medicine, advanced gene therapies, innovative diagnostics, and cutting-edge research in drug discovery and disease modeling.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global synthetic biology market include Agilent Technologies Inc., Amyris Inc., Codexis Inc., Danaher Corporation, Eurofins Scientific, GenScript Biotech Corporation, Illumina Inc., Merck KGaA, New England Biolabs, Synthego Corporation, Thermo Fisher Scientific Inc., Twist Bioscience, Viridos Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)