Synthetic Aperture Radar Market Report by Component (Antenna, Receiver, Transmitter), Mode (Single Mode, Multi-Mode), Frequency Band (X Band, L Band, C Band, S Band, K, Ku, Ka Band, VHF/UHF Band, and Others), Platform (Airborne, Ground), Application (Defense, Commercial), and Region 2026-2034

Market Overview:

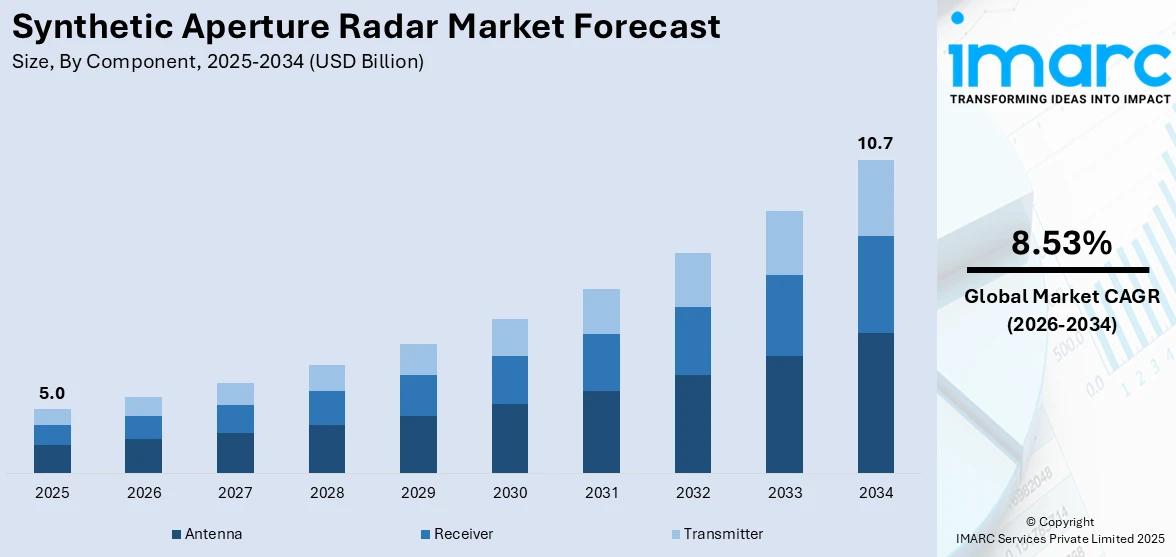

The global synthetic aperture radar market size reached USD 5.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.7 Billion by 2034, exhibiting a growth rate (CAGR) of 8.53% during 2026-2034. The escalating demand for Earth observation and remote sensing capabilities, widespread adoption of SAR systems in commercial sectors like agriculture and mining, and rising geopolitical tensions and security concerns are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.0 Billion |

|

Market Forecast in 2034

|

USD 10.7 Billion |

| Market Growth Rate 2026-2034 | 8.53% |

Synthetic aperture radar (SAR) is a remote sensing technology that facilitates earth observation and environmental monitoring for defense and disaster management. It operates by emitting microwave signals towards the surface of the earth and capturing the reflected signals to create high-resolution images. It can produce images regardless of weather conditions or daylight. It relies on microwave frequencies, allowing it to penetrate clouds, rain, and darkness. It can determine the elevation of surface features, making it ideal for topographic mapping and terrain analysis. It also assists in crop monitoring, soil moisture estimation, and yield prediction.

To get more information on this market Request Sample

The widespread adoption of SAR systems in commercial sectors like agriculture and mining is offering a favorable market outlook. Additionally, the rising utilization of SAR technology in the construction industry for various purposes, such as land surveying and structural monitoring, is positively influencing the market. Apart from this, increasing investments in space technologies, especially small satellite constellations are strengthening the growth of the market. Furthermore, the rising use of SAR systems in small, cost-effective satellites to generate high-resolution earth observation data is augmenting the market growth. Moreover, the integration of SAR technology with the Internet of Things (IoT) is offering enhanced real-time monitoring capabilities for disaster management and making SAR systems more versatile.

Synthetic Aperture Radar Market Trends/Drivers:

Increasing demand for earth observation and remote sensing

The rising demand for Earth observation and remote sensing capabilities represents one of the key factors positively influencing the market. SAR technology provides the unique advantage of all-weather and day-and-night imaging, making it invaluable for monitoring environmental changes, disaster management, and defense applications. Additionally, the growing concerns about climate change and the frequent occurrence of natural disasters are strengthening the growth of the market. Apart from this, governing authorities and organizations worldwide are investing in SAR systems to enhance their ability to monitor and respond to these challenges. Furthermore, the widespread adoption of SAR in agriculture, forestry, and urban planning due to its ability to capture high-resolution, three-dimensional (3D) images of the surface of the earth is offering a favorable market outlook.

Technological advancements in radar system

Ongoing advancements in radar systems represent one of the major factors stimulating the market growth. These innovations include the development of smaller and more cost-effective SAR sensors, the miniaturization of SAR payloads for small satellites, and improvements in image processing algorithms. Apart from this, the easy accessibility of SAR in is driving its adoption across different sectors, including smaller governments, research institutions, and commercial entities. Furthermore, the depreciating cost of SAR data acquisition and processing is offering lucrative opportunities to startups and entrepreneurs to enter the market and develop innovative applications. Additionally, the integration of SAR with other remote sensing technologies, such as optical and infrared sensors, is enhancing the capabilities of hybrid systems, further driving market growth.

Government initiatives and public-private partnership

The rising geopolitical tensions and security concerns are driving the demand for SAR in defense and intelligence applications. Additionally, nations are increasingly recognizing the strategic importance of SAR for monitoring activities in remote and sensitive regions. Apart from this, the rising awareness about the ability of SAR to detect and track moving objects, including ships, aircraft, and ground vehicles, is expanding its applications for border security, maritime surveillance, and reconnaissance missions. Moreover, various countries are focusing on strengthening their security and surveillance capabilities and are continuously investing in SAR systems and associated infrastructure. Furthermore, international collaborations and partnerships are leading to the development of joint satellite constellations and data-sharing agreements.

Synthetic Aperture Radar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on component, mode, frequency band, platform and application.

Breakup by Component:

- Antenna

- Receiver

- Transmitter

Antenna accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes antenna, receiver, and transmitter. According to the report, antenna represented the largest segment as its performance directly impacts the quality of SAR images. Additionally, a highly efficient antenna enables better target detection and image accuracy, which are pivotal in applications like surveillance, disaster management, and earth observation. Apart from this, antennas are subjected to rigorous testing and quality assurance measures due to their vital role in SAR systems. Apart from this, the trend towards miniaturization and system integration is making antennas more complex and specialized. Moreover, the driving approach to make SAR systems more compact without compromising on performance is leading to the development of advanced antennas that can perform multiple functions efficiently. Besides this, the growing focus on multi-band and multi-mode capabilities to serve diverse applications is driving the need for more sophisticated antennas.

Breakup by Mode:

- Single Mode

- Multi-Mode

Multi-mode holds the largest share in the industry

A detailed breakup and analysis of the market based on the mode has also been provided in the report. This includes single mode and multi-mode. According to the report, multi-mode accounted for the largest market share as it offers enhanced versatility and adaptability, allowing users to switch between different operational modes based on the specific requirements of various applications. Additionally, multi-mode SAR systems provide various types of radar images and scan SAR, all within a single system. The availability of different modes within one system allows for greater flexibility in disaster response and environmental monitoring for defense and intelligence activities. This broad applicability increases the demand for multi-mode SAR systems, thereby contributing to their large market share. Furthermore, advancements in software and data analytics are making it easier to switch between different modes and interpret the resulting data effectively.

Breakup by Frequency Band:

- X Band

- L Band

- C Band

- S Band

- K, Ku, Ka Band

- VHF/UHF Band

- Others

The report has provided a detailed breakup and analysis of the market based on the frequency band. This includes X band, L band, C band, S band, K, Ku, Ka band, VHF/UHF band, and others.

X-band SAR systems operate at higher frequencies, generally ranging from 8 to 12 GHz. They are primarily used for high-resolution imaging in applications, such as surveillance, reconnaissance, and geological mapping.

L-band SAR ranges from 1 to 2 GHz and is known for its all-weather, all-time capabilities. Its lower frequency allows better penetration through clouds, rain, and vegetation, making it ideal for environmental and forestry applications.

C-band operates between 4 and 8 GHz and is commonly used for ground and marine radar systems. It offers a balanced mix of resolution and penetration capabilities, making it versatile for applications like weather monitoring and earth observation.

The S-band ranges between 2 and 4 GHz and is often employed in radar systems for weather and air traffic control. It provides moderate resolution and has the capability to penetrate through light rain or mist, making it useful for less-than-ideal weather conditions.

These higher-frequency bands (K: 18-27 GHz, Ku: 12-18 GHz, Ka: 27-40 GHz) are generally used for specialized applications requiring extremely high-resolution imaging. These bands are susceptible to atmospheric interference but excel in fine-detail imaging tasks due to their shorter wavelengths.

The VHF (30-300 MHz) and UHF (300-1000 MHz) bands offer the highest levels of penetration but at the cost of image resolution. They are commonly used in applications requiring subsurface imaging, such as geological exploration and soil moisture assessment.

Breakup by Platform:

- Airborne

- Ground

Airborne exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes airborne and platform. According to the report, airborne accounted for the largest market share due to its ability to deliver high-resolution, real-time imaging across vast geographical areas. Additionally, airborne SAR can be deployed quickly and adapted to various mission profiles. This ability to rapidly adjust to changing circumstances makes airborne SAR ideal for time-sensitive operations like search and rescue missions, emergency response, and military applications. Airborne systems can be easily integrated into existing air fleets, providing an additional layer of capability without requiring extensive infrastructure changes. Apart from this, airborne systems are more budget-friendly, especially for short-term or specific projects. This makes them a preferred choice for various clients like government agencies and private organizations, who require high-quality imaging solutions but have budget constraints.

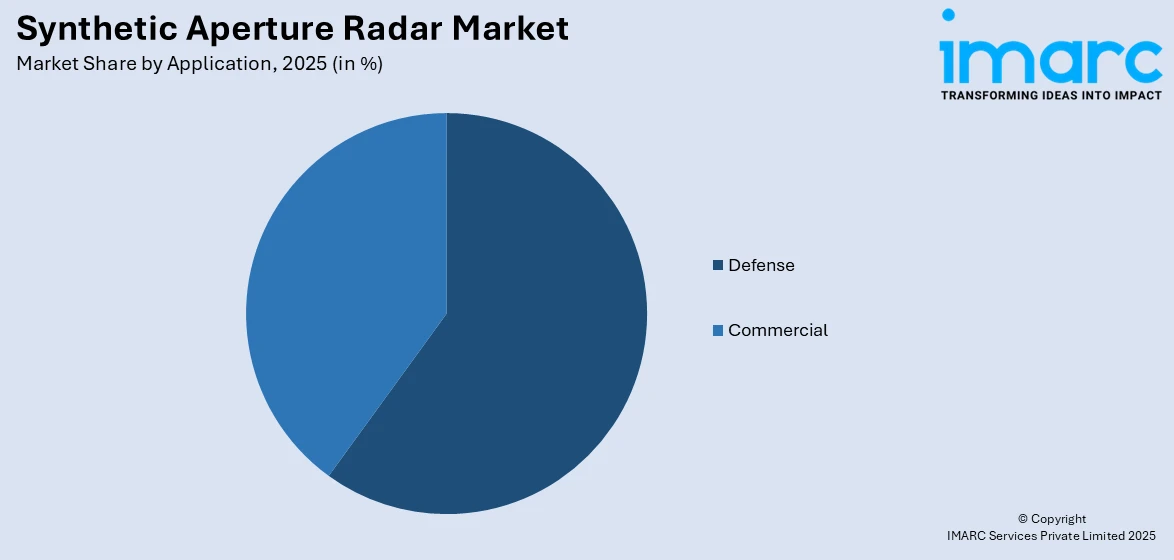

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Defense

- Commercial

Defense dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes defense and commercial. According to the report, defense represented the largest segment as national defense and security agencies are the main consumers of SAR technology due to its advanced surveillance capabilities. SAR can provide high-resolution images irrespective of weather conditions and light availability, making it invaluable for military reconnaissance and intelligence missions. Furthermore, the rising geopolitical tensions and the increasing focus on border security are contributing to the growing demand for SAR in defense. Many countries are investing heavily in their defense budgets, particularly in advanced technologies that offer an edge in surveillance and intelligence. This has led to an increase in procurement contracts for SAR systems, further augmenting their market share in defense.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest synthetic aperture radar market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share since the region is home to some of the leading tech companies and research institutions specializing in radar technology and data analytics. This robust ecosystem promotes collaborative efforts, further fueling technological advancements in SAR. Additionally, North America has diverse and complex requirements for high-quality, reliable SAR systems. These geopolitical responsibilities drive the need for advanced capabilities. Apart from this, the availability of a highly skilled workforce in radar technologies, data analytics, and related fields in North America supports the efficient development, deployment, and utilization of SAR systems. This human capital advantage accelerates research and development (R&D) and practical applications. Moreover, North America, particularly the United States, invests heavily in research and development (R&D) for synthetic aperture radar (SAR) technology.

Competitive Landscape:

Companies are heavily investing in R&D to create more advanced, efficient, and versatile radar systems that offer high-resolution imaging capabilities, better data analytics, and greater operational flexibility. Additionally, many SAR companies are forming partnerships with overseas entities, acquiring smaller firms with specialized technologies, and participating in international tenders and contracts. Apart from this, they are working on miniaturizing their radar systems without compromising on performance. This allows for broader applications, including integration into smaller aircraft and portable ground stations. Moreover, they are investing in ensuring their products meet the stringent standards set by governmental and international regulatory bodies.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Airbus U.S. Space & Defense, Inc.

- Aselsan A.S

- BAE Systems

- General Atomics

- IAI

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Maxar Technologies

- Metasensing

- Northrop Grumman

- Thales Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In February 2023, Thales Group and Schiebel was awarded a contract by the UK Ministry of Defence to deliver a game-changing rotary wing Uncrewed Air System (UAS) to provide a protective ‘eye in the sky’ capability for Royal Navy warships.

- In June 2022, Airbus SE announced that it had finished the third instrument for the Sentinel-1 satellite series, featuring a world premiere of a new separation mechanism that will help avoid space debris.

- In August 2023, The Defense Advanced Research Projects Agency (DARPA) awarded BAE Systems plc FAST LabsTM research and development organization a $14 million contract for the Massive Cross Correlation (MAX) program.

Synthetic Aperture Radar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Antenna, Receiver, Transmitter |

| Modes Covered | Single Mode, Multi-Mode |

| Frequency Bands Covered | X Band, L Band, C Band, S Band, K, Ku, Ka Band, VHF/UHF Band, Others |

| Platforms Covered | Airborne, Ground |

| Applications Covered | Defense, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airbus U.S. Space & Defense, Inc., Aselsan A.S, BAE Systems, General Atomics, IAI, L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Maxar Technologies, Metasensing, Northrop Grumman, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the synthetic aperture radar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global synthetic aperture radar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the synthetic aperture radar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global synthetic aperture radar market was valued at USD 5.0 Billion in 2025.

We expect the global synthetic aperture radar market to exhibit a CAGR of 8.53% during 2026-2034.

The growing utilization of synthetic aperture radar satellites for surveillance, reconnaissance, and precision targeting, owing to the rising geopolitical tensions and increasing security concerns, is primarily driving the global synthetic aperture radar market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries, thereby limiting the demand for synthetic aperture radars.

Based on the component, the global synthetic aperture radar market has been divided into antenna, receiver, and transmitter. Among these, antenna currently exhibits a clear dominance in the market.

Based on the mode, the global synthetic aperture radar market can be categorized into single mode and multi-mode. Currently, multi-mode holds the majority of the global market share.

Based on the platform, the global synthetic aperture radar market has been segmented into airborne and ground, where airborne platform represents the largest market share.

Based on the application, the global synthetic aperture radar market can be bifurcated into defense and commercial. Currently, the defense sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global synthetic aperture radar market include Airbus U.S. Space & Defense, Inc., Aselsan A.S, BAE Systems, General Atomics, IAI, L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Maxar Technologies, Metasensing, Northrop Grumman, and Thales Group.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)