Switzerland Freight and Logistics Market Report by Logistics Function (Courier, Express and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Others), End Use Industry (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Region 2026-2034

Switzerland Freight and Logistics Market Overview:

The Switzerland freight and logistics market size reached USD 10.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.37% during 2026-2034. The market is majorly driven by the expansion of e-commerce, advancements in infrastructure, and significant improvements in technology. Additionally, Switzerland's strategic location in Europe and its well-established trade relationships further boosts the market growth. Government initiatives promoting sustainable and efficient logistics practices also contribute significantly to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.4 Billion |

| Market Forecast in 2034 | USD 20.4 Billion |

| Market Growth Rate 2026-2034 | 7.37% |

Access the full market insights report Request Sample

Switzerland Freight and Logistics Market Trends:

Strategic Geographic Location

Switzerland's strategic geographic location serves as a key driver for its freight and logistics market due to its central position in Europe. This unique placement makes it a pivotal crossroads for overland routes connecting various parts of Europe. Moreover, the extensive and well-maintained transport infrastructure, including roads, railways, and airports, supports efficient cross-border transportation and distribution of goods, further improving the country’s capability to serve as a logistical intersection in the region. For instance, in July 2023, MBS Logistics Group launched its inaugural branch in Zurich, Switzerland. This key development underscores MBS's dedication to serving its expanding customer base in Switzerland and propels its worldwide growth ambitions. Named MBS Logistics AG, the new branch is strategically located at Zurich airport and will provide a comprehensive suite of air, sea, and road freight forwarding services.

Robust Growth of E-commerce

The robust growth of e-commerce represents a significant driver for Switzerland's freight and logistics market because the surge in online shopping significantly increases the demand for efficient delivery systems. As consumers and businesses increasingly turn to online platforms for buying and selling goods, logistics companies experience a necessity to expand and adapt their networks to handle a higher volume of packages and ensure prompt deliveries. This shift requires not only more sophisticated and extensive distribution channels, but also enhanced warehousing and last-mile delivery solutions. According to an article published in Mail Boxes in 2021, between 2017 and 2021, the revenue from the sale of physical goods surged from 15.19 million to 24.83 million, nearly doubling in just four years. This significant rise in the e-commerce sector highlights positive growth opportunities for the market. Furthermore, based on the trend observed from 2017 to 2021, revenues are expected to soar to just under 50 million by the end of 2025, effectively doubling the figures from 2021 within the same four-year period. Furthermore, the demand for reverse logistics services to manage returns adds another layer of complexity and opportunity for growth within the logistics sector, making e-commerce a pivotal factor in shaping the logistics landscape in Switzerland. For instance, in May 2024, Swiss WorldCargo, the air freight division of SWISS, Switzerland's premier airline, has expanded its collaboration with cargo.one, the foremost digital platform for booking air cargo. As of May 23, 2024, this partnership will enable freight forwarders to quickly and effortlessly access Swiss WorldCargo's services across Europe, Asia, and the Americas via cargo.one. Both organizations are committed to improving the digital customer journey by offering freight forwarders precise and readily bookable content on air freight markets.

Switzerland Freight and Logistics Market News:

- In September 2023, Scan Global Logistics acquired Belglobe in Switzerland to expand its global presence across 48 countries. By integrating Belglobe, SGL gains direct access to the central procurement and supply chain management of multinational companies. Additionally, Switzerland's strategic location near major European markets like Germany, France, Italy, and Austria enhances its capability for efficient goods distribution across the continent.

- In May 2024, Swiss WorldCargo announced the opening of a new flight route between Zurich and Toronto, Canada, marking a significant expansion of its long-haul network. This new destination will be jointly served by SWISS and Swiss WorldCargo. The introduction of Toronto into its international network aims to enhance the connectivity between Canadian and European economies, cultures, and societies, strengthening ties between these crucial regions.

- In June 2023, Geodis, a France-based transportation and logistics services company, completed the acquisition of the Swiss freight forwarding company, ITS – International Transport & Shipping Ltd. The aim of this acquisition is to expand the range of services offered to customers by leveraging a broader geographic market.

Switzerland Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Logistics Function Insights:

To get detailed segment analysis of this market Request Sample

- Courier, Express and Parcel

- By Destination Type

- Domestic

- International

- By Destination Type

- Freight Forwarding

- By Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- By Mode of Transport

- Freight Transport

- By Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- By Mode of Transport

- Warehousing and Storage

- By Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- By Temperature Control

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel [by destination type (domestic and international)], freight forwarding [by mode of transport (air, sea and inland waterways, and others)], freight transport [by mode of transport (air, pipelines, rail, road, and sea and inland waterways)], warehousing and storage [by temperature control (non-temperature controlled and temperature controlled)], and others.

End Use Industry Insights:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

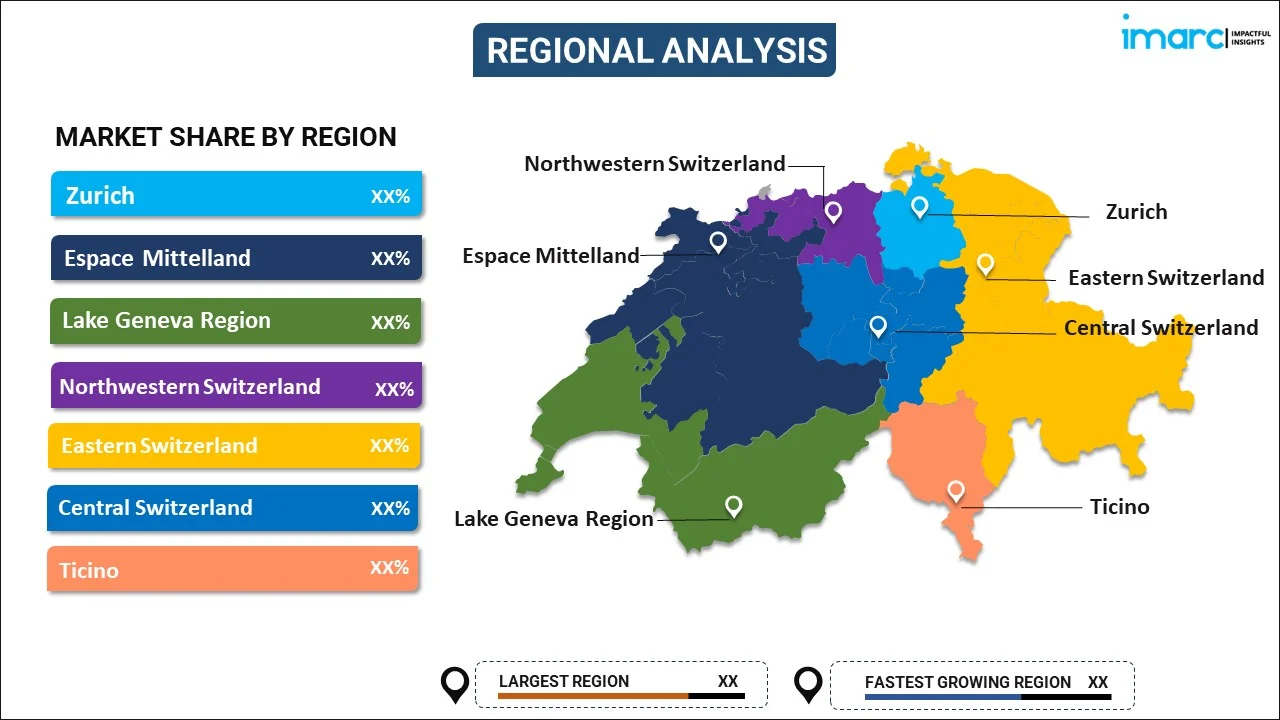

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

The report has also provided a comprehensive analysis of all the major regional markets, which include Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Switzerland Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Switzerland freight and logistics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Switzerland freight and logistics market?

- What is the breakup of the Switzerland freight and logistics market on the basis of logistics function?

- What is the breakup of the Switzerland freight and logistics market on the basis of end use industry?

- What are the various stages in the value chai of the Switzerland freight and logistics market?

- What are the key driving factors and challenges in the Switzerland freight and logistics?

- What is the structure of the Switzerland freight and logistics market and who are the key players?

- What is the degree of competition in the Switzerland freight and logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland freight and logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)