Switzerland Electric Vehicle Market Size, Share, Trends and Forecast by Component, Propulsion Type, Vehicle Type, and Region, 2026-2034

Switzerland Electric Vehicle Market Summary:

The Switzerland electric vehicle market size was valued at USD 1.81 Billion in 2025 and is projected to reach USD 9.14 Billion by 2034, growing at a compound annual growth rate of 19.73% from 2026-2034.

The Switzerland e-vehicle market is growing rapidly, given the swift transition towards environmentally supported transport solutions in the country. The Switzerland government’s strong support for environmentally sustainable practices, combined with a robust spending power amidst the population, makes it the most favorable environment for e-vehicle adoption. Switzerland’s geographically centered location in Europe, with a robust charging infrastructure, will continue to boost public confidence in e-transport solutions.

Key Takeaways and Insights:

- By Component: Battery cells and packs dominate the market with a share of 29% in 2025, representing the largest value component in electric vehicles due to their critical role in determining vehicle range, performance, and overall cost structure.

- By Propulsion Type: Battery Electric Vehicle (BEV) leads the market with a share of 61% in 2025, driven by advancing battery technology, expanding charging infrastructure, and growing consumer preference for zero-emission transportation solutions.

- By Vehicle Type: Passenger vehicles represent the largest segment with a market share of 75% in 2025, reflecting strong consumer demand for personal electric mobility across various price segments and vehicle categories.

- Key Players: The Switzerland electric vehicle market shows a competitive landscape with global automakers, specialized EV manufacturers, and component suppliers, all playing a key role in driving innovation, technology development, and value creation across the electric mobility ecosystem.

Switzerland's electric vehicle market benefits from a confluence of favorable factors that position the nation as a leading European market for electric mobility. The federal government's Electromobility Roadmap initiative, extended to 2030, demonstrates sustained commitment to achieving ambitious electrification targets through coordinated public-private collaboration. According to reports, in January 2025 a recent milestone in the market shows that fully electric and plug-in hybrid cars together accounted for about 28% of new vehicle registrations in Switzerland in 2024, underscoring growing consumer and fleet interest in electrified mobility. The country's clean electricity grid, predominantly powered by hydroelectric and renewable sources, maximizes the environmental benefits of electric vehicle adoption. Additionally, cantonal tax incentives, vehicle registration fee reductions, and exemptions from heavy vehicle charges for electric trucks create compelling economic advantages for both individual consumers and commercial fleet operators.

Switzerland Electric Vehicle Market Trends:

Advancement in Battery Technology and Energy Density

The Switzerland electric vehicle market is advancing through notable improvements in battery technology, including higher energy density, faster charging, and longer lifespans. In 2025, Swiss research bodies and industry collaborators completed the CircuBAT project, establishing circular economy models for automotive lithium-ion batteries. These innovations enhance driving range, shorten charging times, lower replacement costs, and support sustainability, reinforcing electric vehicles’ competitiveness against conventional mobility options.

Expansion of High-Power Charging Infrastructure

The Switzerland electric vehicle market is advancing rapidly through expanded charging infrastructure across highways and cities. In 2024, the Swiss Federal Roads Office awarded contracts to develop high-power motorway charging hubs, strengthening nationwide fast-charging availability. Alongside private investors, public tenders, and energy firms are building premium charging stations. This expansion reduces range anxiety, supports long-distance travel, and improves the overall practicality of electric vehicle adoption.

Integration of Vehicle-to-Grid Technology

Switzerland is advancing as a leader in bidirectional charging, supported by regulations enabling vehicle-to-grid solutions. The Federal Act on Secure Electricity Supply allows compensation for electricity fed back into the grid, improving economic viability for EV owners. In December 2024, a Swiss Federal Office of Energy–backed pilot deployed 50 Honda e vehicles across 40 car-sharing sites, proving EVs can support grid stability and function as mobile energy storage assets.

Market Outlook 2026-2034:

The Switzerland electric vehicle market demonstrates exceptional growth potential as the nation advances toward its decarbonization objectives and sustainable mobility targets. Continued innovations in battery technology, expansion of charging infrastructure, and supportive regulatory frameworks are expected to sustain strong market momentum throughout the forecast period. The collaborative efforts under the extended Electromobility Roadmap, combined with expanding model availability across all vehicle segments and price points, position Switzerland as a leading European market for electric vehicle adoption. The market generated a revenue of USD 1.81 Billion in 2025 and is projected to reach a revenue of USD 9.14 Billion by 2034, growing at a compound annual growth rate of 19.73% from 2026-2034.

Switzerland Electric Vehicle Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Battery Cells and Packs |

29% |

|

Propulsion Type |

Battery Electric Vehicle (BEV) |

61% |

|

Vehicle Type |

Passenger Vehicles |

75% |

Component Insights:

To get detailed segment analysis of this market, Request Sample

- Battery Cells and Packs

- Fuel Stack

- On-Board Charger

- Electric Motor

- Brake, Wheel and Suspension

- Body and Chassis

- Others

The battery cells and packs dominate with a market share of 29% of the total Switzerland electric vehicle market in 2025.

The battery cells and packs segment commands the largest share among electric vehicle components, reflecting its fundamental importance to vehicle functionality, performance, and cost structure. Battery systems are the single most valuable component in electric vehicles and directly define many key attributes important to consumers, such as driving range, acceleration performance, and charging time. The ongoing transition toward higher energy density cells and advanced battery management systems continues to drive innovation and investment in this segment.

Significant investment globally in the manufacturing capacity expansion and technology development by the leading cell manufacturers underpins substantial growth in the battery cells and packs segment. Incremental improvements in energy density and cycle life via advances in lithium-ion chemistry, such as the adoption of nickel-rich cathodes and silicon-enhanced anodes, are translating into better vehicle specifications. The emergence of solid-state battery technology promises transformational improvements in medium-term performance, while declining cell costs driven by manufacturing scale continue to reduce overall vehicle prices and expand market accessibility.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Battery Electric Vehicle (BEV) leads with a share of 61% of the total Switzerland electric vehicle market in 2025.

The battery electric vehicle (BEV) segment continues to lead the Swiss market, driven by strong consumer demand for zero-emission, low-maintenance vehicles. According to reports, over 4,400 BEVs were registered, representing around 22.2% of new car registrations, underscoring growing adoption in the passenger vehicle market. The nationwide expansion of public charging infrastructure, including high-power fast chargers along key routes, has alleviated range anxiety and enabled convenient long-distance travel.

The dominant position of battery electric vehicles is further reinforced by Switzerland's clean electricity grid, predominantly powered by hydroelectric and renewable sources, which maximizes the environmental advantages of electric propulsion. Vehicle manufacturers continue expanding their BEV portfolios with models across all segments from compact city cars to premium sport utility vehicles, providing consumers with diverse options aligned with their preferences and requirements. Government initiatives supporting bidirectional charging technology create additional value propositions for BEV owners, enabling participation in grid stabilization services and energy trading opportunities that enhance the economic attractiveness of battery electric vehicle ownership.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

The passenger vehicles dominate with a market share of 75% of the total Switzerland electric vehicle market in 2025.

The passenger vehicles segment maintains its overwhelming leadership position in the Switzerland electric vehicle market, reflecting the strong consumer appetite for personal electric mobility solutions. Swiss households demonstrate increasing preference for electric passenger cars across sedan, hatchback, and sport utility vehicle categories, driven by superior driving experiences, significantly lower operating costs, and genuine environmental consciousness. The availability of diverse model options from premium manufacturers to mainstream brands enables consumers to select vehicles precisely aligned with their lifestyle requirements and budgetary considerations.

The sustained growth of the passenger vehicle segment benefits from comprehensive dealer networks, established after-sales service infrastructure, and increasingly competitive leasing arrangements offered by automotive distributors throughout Switzerland. Consumers increasingly view electric vehicles as primary transportation solutions rather than secondary vehicles, indicating market maturation and growing confidence in electric mobility for all driving needs. The segment continues to benefit from cantonal tax exemptions, reduced registration fees, and favorable insurance terms that enhance the total cost of ownership advantage over conventional internal combustion engine alternatives, accelerating the transition toward electrified personal transportation.

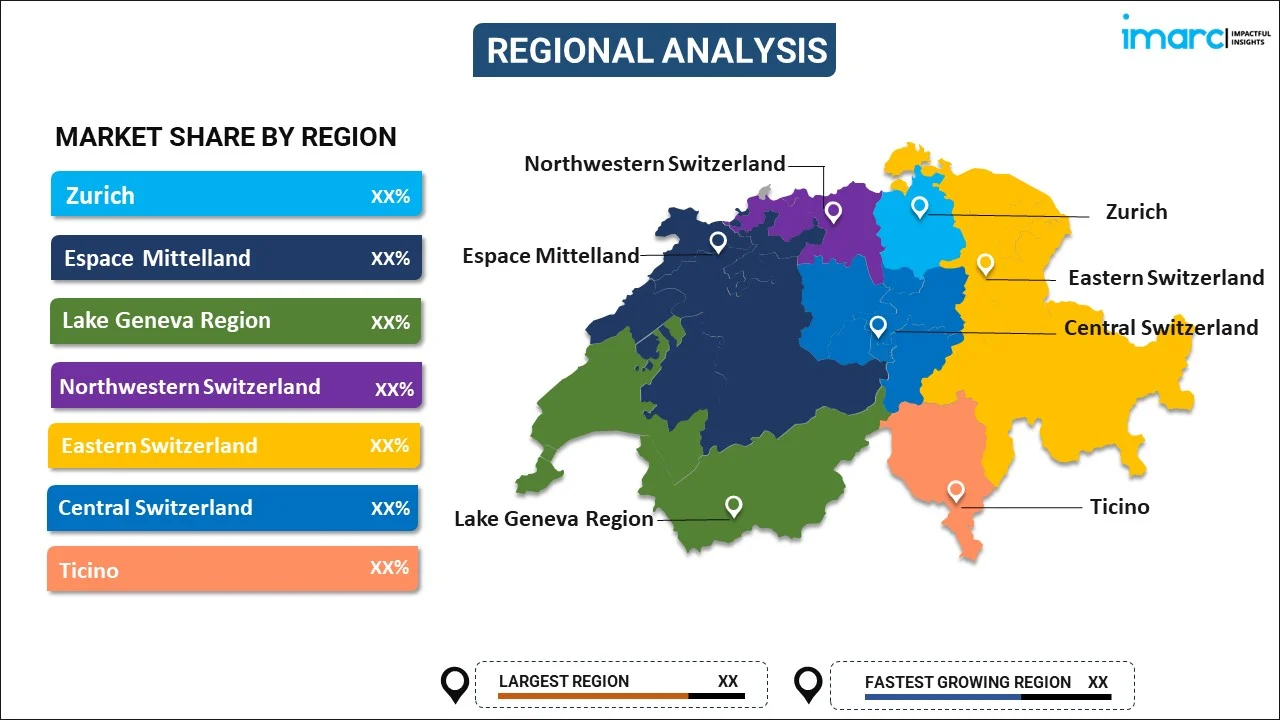

Regional Insights:

To get detailed segment analysis of this market, Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich sets the pace in the EV market, which is fueled by the country’s high per-capital income, strong awareness about sustainability, and widespread charging infrastructure. This region enjoys forward-thinking city administration, company fleet adoption, and a general use of premium electric cars.

The adoption of electric vehicles by Espace Mittelland is encouraged by equal development of rural and urban regions, along with increasing charging infrastructure. Supportive factors include government support, increasing awareness concerning environment protection, and adoption of electric vehicles by transporters for regional commute operations.

The Lake Geneva Region displays high adoption levels for electric vehicles due to the involvement of international organizations, high purchasing power, and tough environmental targets. Large cities such as Geneva and Lausanne support low-emission transportation through the use of incentives, broad recharging infrastructure networks, and growing integration with electric vehicles into public or private transportation fleets.

Northwestern Switzerland’s electric vehicle market benefits from industrial strength, cross-border mobility, and sustainability-driven corporate policies. Proximity to Germany and France supports technology transfer and infrastructure development, while businesses and households increasingly adopt electric vehicles to meet emission reduction and energy transition targets.

Eastern Switzerland demonstrates gradual electric vehicle growth, supported by regional sustainability programs and improving charging accessibility. Smaller cities and rural areas increasingly adopt electric vehicles for daily mobility, while local utilities and municipalities invest in renewable-powered charging solutions to encourage wider acceptance.

Central Switzerland’s electric vehicle adoption is driven by tourism, environmental preservation priorities, and supportive cantonal policies. Expanding charging infrastructure along transport corridors and tourist destinations encourages electric vehicle use among residents and visitors, reinforcing the region’s transition toward cleaner and more sustainable mobility.

Ticino’s electric vehicle market is influenced by cross-border commuting, mild climate, and strong renewable energy availability. Increasing charging infrastructure, supportive incentives, and growing environmental awareness among residents and tourists are accelerating electric vehicle adoption across urban centers and scenic routes.

Market Dynamics:

Growth Drivers:

Why is the Switzerland Elecreic Vehivle Market Growing?

Strategic Expansion of Charging Infrastructure

The Switzerland electric vehicle market is rapidly expanding, fueled by major investments in charging infrastructure. In 2024, Swiss Post and Fenaco launched PowerUp, a joint venture to establish a nationwide fast-charging network, starting with 50 locations by mid‑2025 and ultimately reaching 300, powered entirely by renewable electricity. Public and private stakeholders are deploying high-power chargers along highways and at commercial, residential, and hotel locations. This expansion alleviates range anxiety, enhances daily and long-distance EV usability, and, guided by the government’s Electromobility Roadmap, transforms the overall ownership experience.

Stringent Emission Regulations and Carbon Reduction Targets

The Switzerland electric vehicle market is being driven by stricter emission regulations and ambitious carbon reduction goals at federal and cantonal levels. In January 2025, new passenger cars must meet an average CO₂ limit of 93.6 g/km, aligning with EU standards and encouraging importers to prioritize EVs. Complementary measures, including the Climate and Innovation Act, low-emission zones, and preferential EV parking, create structural incentives for electric propulsion, accelerating adoption and supporting the country’s long-term transportation decarbonization objectives while fostering innovation, sustainable mobility solutions, and broader societal transition toward climate-friendly transport systems.

High Environmental Awareness and Consumer Preference Shifts

The Switzerland electric vehicle market is strongly supported by high environmental awareness and shifting consumer preferences toward sustainable products. A 2024 survey found that 54 % of Swiss respondents aged 60–79 cited environmental friendliness as their main reason for choosing an EV, highlighting sustainability’s influence on purchase decisions. Growing cultural emphasis on climate-conscious choices, coupled with corporate fleet transitions and urban adoption trends, drives organic market demand and accelerates EV uptake across demographics supporting innovation, infrastructure expansion, and long-term decarbonization goals in the transportation sector.

Market Restraints:

What Challenges the Switzerland Electric Vehicle Market is Facing?

Limited Charging Access for Residential Tenants

The Switzerland electric vehicle market faces constraints from limited home charging access for residential tenants, who constitute a substantial portion of the national population. The predominance of multi-unit apartment buildings in Swiss housing stock creates significant challenges for installing private charging infrastructure, as decisions typically require consensus among multiple property stakeholders. This structural barrier particularly impacts urban residents who may otherwise represent ideal electric vehicle adopters, limiting market expansion potential among this important demographic segment.

Reintroduction of Federal Import Tax on Electric Vehicles

The reintroduction of the standard four percent import tax on electric vehicles in 2024 has created market headwinds by increasing acquisition costs for consumers. This policy shift eliminated a significant financial advantage that previously supported electric vehicle adoption, potentially deterring price-sensitive buyers from transitioning to electric mobility. The tax reinstatement represents a notable departure from earlier supportive policies that contributed substantially to strong market growth in preceding years.

Limited Affordable Model Availability

The Switzerland electric vehicle market experiences constraints from the relatively limited availability of affordable electric vehicle models compared to conventional alternatives in similar price categories. While premium and mid-range segments offer increasingly diverse options, the entry-level segment presents fewer choices that meet Swiss consumer expectations for quality, features, and performance. This gap restricts market penetration among budget-conscious consumers and delays the full democratization of electric mobility across all income segments.

Competitive Landscape:

The Switzerland electric vehicle market is a dynamic competitive landscape comprising well-established global automobile manufacturers, pure-play electric vehicle specialists, and component suppliers competing aggressively within the value chain. Such is the competitive scenario that on the supply side, product development is extremely aggressive, where various manufacturers keep launching new models in both passenger vehicles and commercial vehicle categories to meet the evolving consumer needs and demands for regulations. Distribution partnerships again form critical levers for market access, as several major groups of automotive companies establish a dedicated electric vehicle sales channel and comprehensive after-sales service networks. Strategic partnerships of vehicle manufacturers with charging infrastructure providers and energy firms create integrated mobility solutions that further enhance the all-round customer value proposition. Price competition increases as the scale of production improves and the cost of batteries decreases, while manufacturers also differentiate by offering more innovative technologies, increasing driving ranges, and enhancing charging speeds.

Recent Developments:

- In September 2025, Chinese electric vehicle maker XPENG Motors has officially announced its entry into Switzerland, alongside Austria, Hungary, Slovenia, and Croatia. The company plans to launch its G6 and G9 electric SUVs in Switzerland in 2025, with a gradual expansion of sales and service networks through 2026.

Switzerland Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Cells and Packs, Fuel Stack, On-board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, Others |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland electric vehicle market size was valued at USD 1.81 Billion in 2025.

The Switzerland electric vehicle market is expected to grow at a compound annual growth rate of 19.73% from 2026-2034 to reach USD 9.14 Billion by 2034.

Battery cells and packs dominated the market with a 29% share, reflecting their critical importance in determining vehicle range, performance, and overall cost structure as the single most valuable component in electric vehicles.

Key factors driving the Switzerland electric vehicle market include strategic expansion of charging infrastructure, stringent emission regulations and carbon reduction targets, high environmental awareness among consumers, and continuous technological advancements in battery efficiency and vehicle performance.

Major challenges include limited charging access for residential tenants in multi-unit buildings, the reintroduction of import taxes on electric vehicles, insufficient affordable model availability in the entry-level segment, and the need for continued infrastructure investment to support growing adoption rates.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)