Switzerland Alcoholic Drinks Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2025-2033

Switzerland Alcoholic Drinks Market Size and Share:

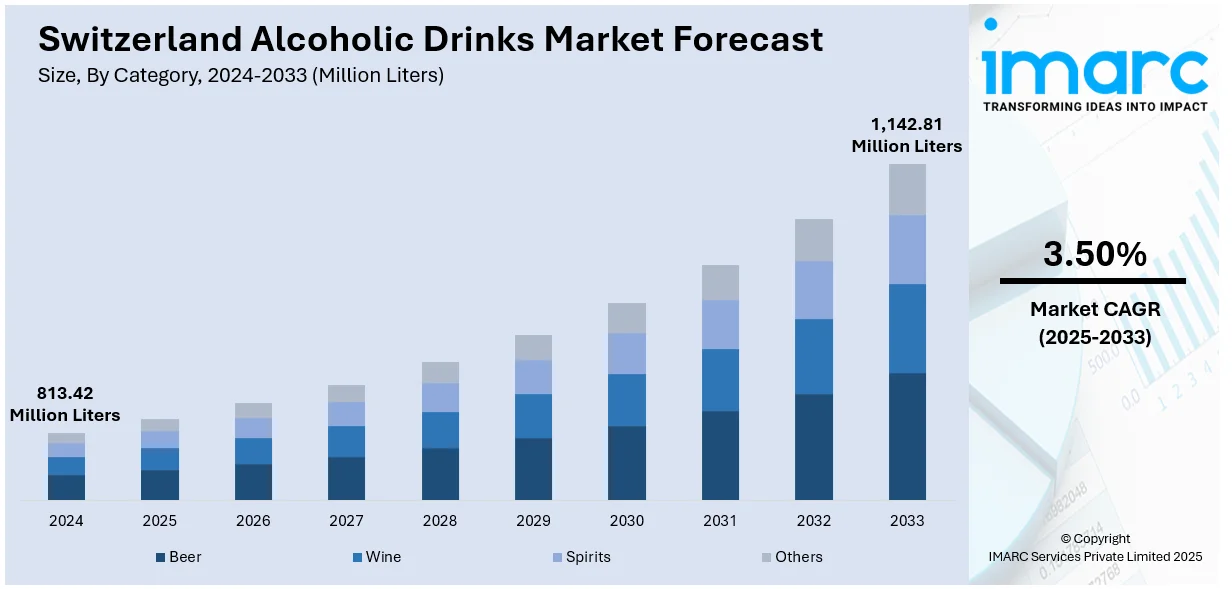

The Switzerland alcoholic drinks market size reached at 813.42 Million Liters in 2024. Looking forward, IMARC Group estimates the market to reach 1,142.81 Million Liters by 2033, exhibiting a CAGR of 3.50% from 2025-2033. The Switzerland alcoholic drinks market share is propelled by the increasing consumer demand for premium and craft alcoholic beverages, the rising popularity of low-alcohol and non-alcoholic drink options, the growing trend of health-conscious drinking and organic beverages, expanding tourism that is boosting the demand for local Swiss spirits, and innovation in product offerings and packaging, attracting younger consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 813.42 Million Liters |

| Market Forecast in 2033 | 1,142.81 Million Liters |

| Market Growth Rate (2025-2033) | 3.50% |

An increase in preference for diverse, premium beverages in cities is driving the Switzerland alcoholic drinks market growth. Urban consumers are increasingly becoming choosy about quality and seeking something unique while drinking, thereby boosting the growth of craft beers, wines, and specialty drinks. According to industry reports, 74.4% of the total population in Switzerland lives in urban areas in 2025. In addition to this, urban development and craft beer breweries are also playing an important role in the growth of the beer market since more consumers seek unique small-batch brews in order to avoid mass-produced ones. This shift toward premiumization is a key market driver.

Besides this, as per the Switzerland alcoholic drinks market forecast, the growing emphasis on experiential drinking and tasting experiences is also driving the industry growth. The focus on experiences creates an encouragement to visit vineyards and distilleries, attend tastings, and seek special releases. The expansion of e-commerce allows easy access to a broad product range, giving consumers the opportunity to explore premium and local beverages from their homes. As per a report published by the IMARC Group, the Switzerland e-commerce market is projected to grow at a CAGR of 14.50% during 2024-2032. In addition to this, partnerships with local restaurants, bars, and hotels to provide unique drinks and pairings have also expanded the reach alcoholic drinks.

Switzerland Alcoholic Drinks Market Trends:

Increasing demand for premium products

Major reasons influencing the Switzerland alcohol market outlook include the demand for premium as well as craft alcoholic drinks. Swiss consumers are becoming highly inclined toward high-quality products. They favor local beers, spirits, and other fine wines for personal consumption, often preferring newer flavors, which is particularly prominent among younger consumers. Expansion is also achieved via the rise in craft breweries, distilleries, and vineyards across Switzerland as premium alcoholic beverages are increasingly found to be signs of culture and quality, with a strong stress on locally sourced ingredients for production. As a result, premium alcoholic drinks entice Swiss customers to pay more for good quality, driving the Switzerland alcohol market prices.

Rise of health-consciousness and low-alcohol options

The Switzerland alcohol market trends indicate that the health consciousness of Swiss consumers is significantly influencing the industry. Demand for low-alcohol and alcohol-free alternatives is rising. As individuals become more health-conscious and consider the health damage that excessive intake of alcohol poses, they increasingly prefer lighter alcohol alternatives that they can indulge in without the negative after-effects of alcohol. This has resulted in greater popularity of beers, wines, and spirits with low alcohol volumes, as well as alcohol-free variants that mimic the flavor and experience of their traditional, alcoholic counterparts. Growing interest in wellbeing and fitness, as well as wanting to moderate, is driving many beverage producers to innovate and deliver healthier, reduced-calorie drinks to meet consumer demand, supporting market growth.

Strong tourism and hospitality industry

The tourism and hospitality sector in Switzerland is having a positive impact on the Switzerland alcoholic drinks market demand. The country is famous for its natural landscapes, luxurious resorts, and cultural experiences. Consequently, Switzerland attracts millions of tourists annually, and many of them try out the local wines, spirits, and beers. Both domestic and international travelers are targeted to consume more liquor by restaurants and bar businesses, along with the hospitality industry of Switzerland. Moreover, due to wine tourism, Switzerland has succeeded in attracting travelers through wine tasting at vineyards. Many wine regions, including the Valais and Vaud, have emerged over time in this country. The interaction of tourism with local alcohol consumption culture increases the demand for alcoholic drinks in both local and imported alcoholic drinks by the Swiss market.

Switzerland Alcoholic Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Switzerland alcoholic drinks market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on category, alcoholic content, flavor, packaging type, and distribution channel.

Analysis by Category:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

- Others

Beer is a dominant segment within the Switzerland alcohol drinks market due to the nation's brewing culture and a heightened preference for artisanal and high-end beers. The number of consumers interested in different beer styles and local brews has picked up in the country. Moreover, small breweries are opening more outlets that promote diversity in flavor profiles and styles of beers. Such trends in the craft beer scene are helping to boost the overall beer segment.

The market of Switzerland alcoholic drinks has seen significant contributions from wine, where established wine-producing regions such as Valais and Vaud take a major share. The country has managed to position Swiss wines, primarily white, as popular wines domestically and abroad, mainly through varieties such as Chasselas. Interest in premium and organic segments of wines, further bolstered by wine tourism, also supports market growth, catering to more sophisticated consumers.

The spirits segment in Switzerland is expanding steadily due to the demand for high-quality and artisanal products. Schnapps, gin, and whisky are the leading spirits in the market, but there is also a focus on unique and small-batch productions in local distilleries. Premium and craft spirits have experienced growth due to consumer demand for authenticity and quality. Furthermore, cocktail culture and mixology have further elevated the spirits market.

Analysis by Alcoholic Content:

- High

- Medium

- Low

The Switzerland alcoholic drinks market for high alcohol content is driven by the demand for spirits such as whisky, vodka, and strong liquors as consumers seek stronger, more intense beverages. It benefits from an increasing trend toward premium and artisanal spirits, as well as the growth in cocktail culture, which boosts consumption of higher alcohol content beverages.

The medium alcohol segment, which comprises wine and a few beers, is a big share of the Switzerland market. In wines, alcohol levels range between 11% to 15%, and in craft beers, around 4% to 7% alcohol by volume (ABV), which caters to consumer preference for more balanced drinks. These drinks provide a relatively moderate experience in drinking, which is desirable for social gatherings.

The low alcohol level segment is also witnessing growth, fueled by the rapidly increasing health concerns of the Swiss population. Low-level alcohol beer and wine, without added spirits, substitute the traditional alcoholic variants. Consumers choose them for social gatherings to minimize the negative effects of alcohol. Because of this market shift, producers are continuously innovating such lighter drinking product options.

Analysis by Flavor:

- Unflavored

- Flavored

The unflavored segment holds a dominating share in the market for alcoholic drinks in Switzerland. This can be attributed to the traditional appeal of natural, unaltered beverages such as wines, beers, and classic spirits. Consumers value the authenticity and craftsmanship behind such products, particularly in the wine and craft beer categories, which center on the quality of ingredients and the pure flavor profiles without added flavoring or additives.

Flavored alcoholic beverages are drawing high popularity in Switzerland, especially among youngsters seeking more daring and varied drinking. Flavored spirits such as gin with botanicals, flavored vodkas, and ready-to-drink cocktails are gaining preference. Increased mixology interests further drive these trends, given the uniqueness of flavors and newer taste combinations that appeal to those seeking customized alcoholic beverages.

Analysis by Packaging Type:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Due to premium perception and the preservation of the taste and quality of alcoholic beverages, glass bottles remain in the dominating position in the Switzerland alcoholic drinks market. In wine and spirits, along with high-end beer packaging, consumers prefer the aesthetic and recyclable quality of glass. They also relate glass products to higher-quality goods, thus the preference of consumers for glass is more among premium and craft products.

Tins have become a favorite in the Switzerland alcoholic drinks market, particularly for beer and ready-to-drink cocktails. According to consumers, tin is lightweight, durable, and portable, offering convenience. Hence, this increases demand. It is also more environmentally friendly than plastic. As a result, demand for premium and craft beers packaged in tin has increased over time.

Plastic bottles in the market account for a much smaller share but are used in several products, mostly at the lower end of the price spectrum and in mass-market products. They are very convenient and portable, thus attractive for outdoor consumption or casual drinking. Demand for plastic packaging, however, has been going down due to increasing concerns about the environment, with consumers preferring environmentally friendly and recyclable materials such as glass and tin.

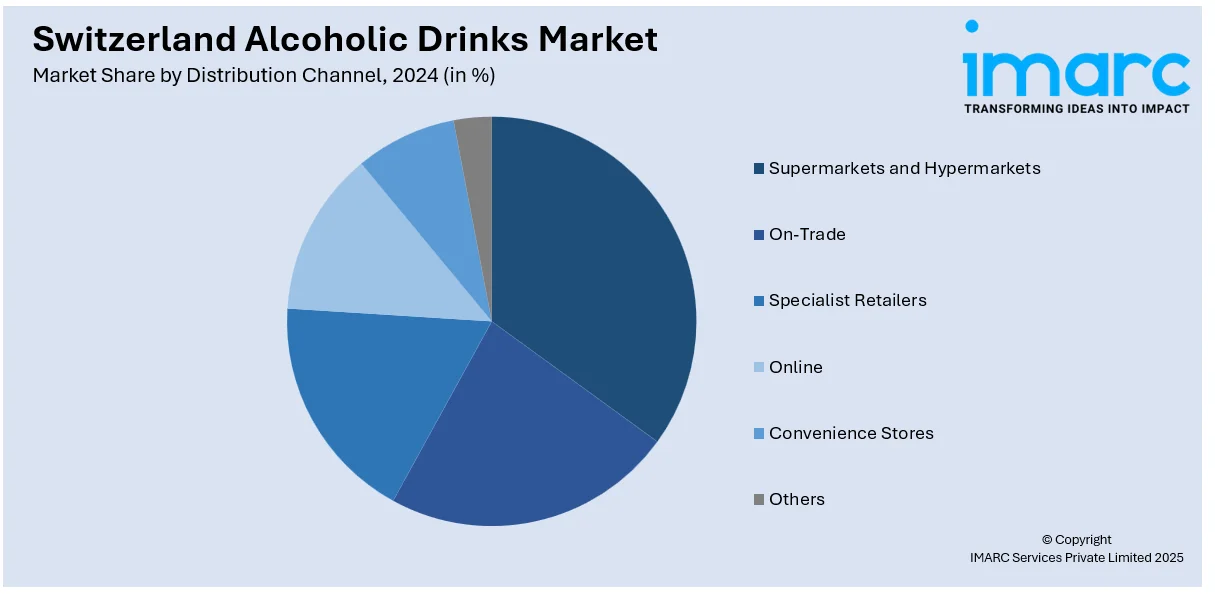

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

Supermarkets and hypermarkets hold a large share in the alcohol distribution channels in Switzerland, given their high availability throughout the country, which are accessible for daily use. They save time, are affordable and conveniently located, and offer products to a broad consumer base. They also provide popular brands, promotions, and deals, making them the most preferred destination for buying alcoholic drinks.

The on-trade segment includes bars, restaurants, and hotels, which are highly important for Switzerland's alcoholic drinks market. This is mainly because alcoholic beverages are commonly bought by consumers in social channels, where points of sale offer extensive ranges of wines, spirits, and cocktails. Consumers are also increasingly seeking to dine out and socialize in unique environments and among premium products and are thus attracted to the on-trade environment to consume their alcoholic drinks.

Specialist retailers, which include wine bars and small-scale liquor stores, serve their consumers premium and niche products. They are meant for consumers in search of the very best, high-quality products, often combined with expert advice and selective choices. This segment caters to wine connoisseurs as well as to aficionados of craft beers and drinks.

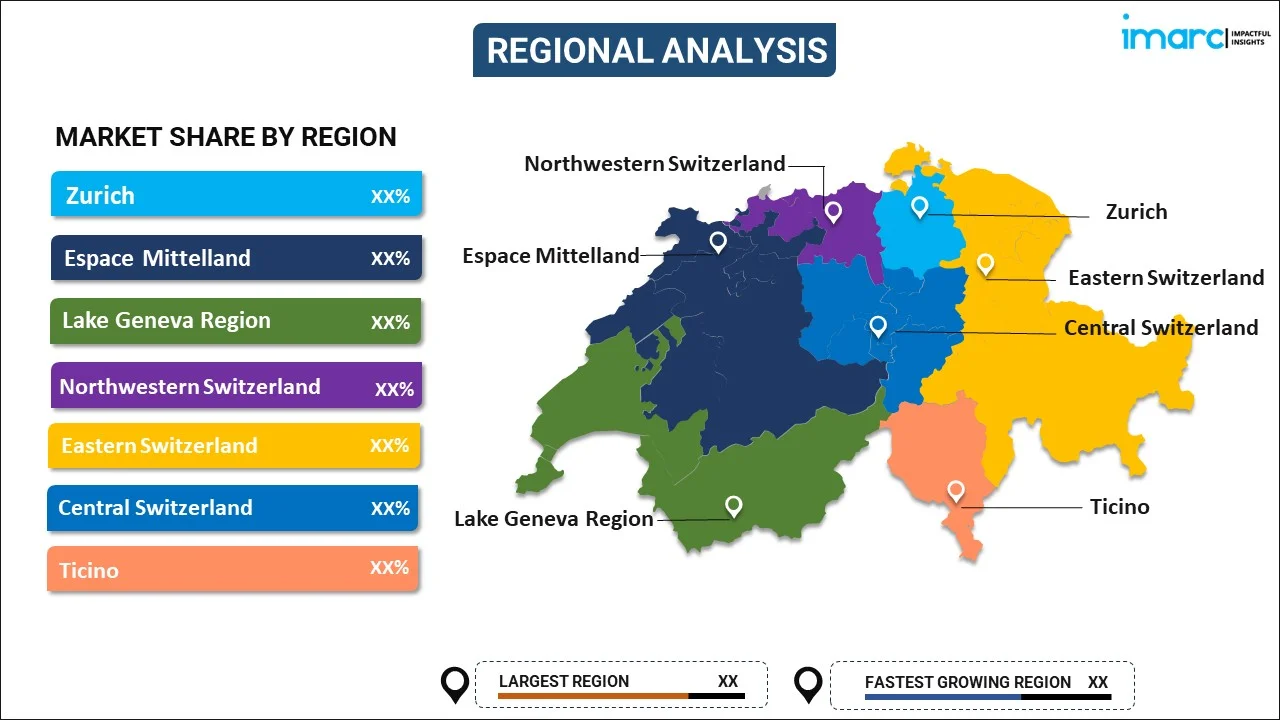

Regional Analysis:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich is the largest and most prominent region in the Switzerland alcoholic drinks market, which is driven by its status as a major financial hub and cultural center. The city's nightlife, fine-dining restaurants, and bars create a high demand for premium and mass-market alcoholic beverages. Furthermore, Zurich's cosmopolitan environment creates a variety of drinking habits, thereby increasing the market.

Espace Mittelland is known for its agricultural and industrial base that contributes significantly to the Switzerland alcoholic drinks market. Espace Mittelland is heavily focused on local Swiss wines, particularly from the canton of Bern. Consumer demand in Espace Mittelland is a mix of traditional preferences for local spirits and beers, as well as an increasing interest in premium beverages.

The Lake Geneva Region is a major wine-producing area, specifically in Vaud and Valais. The production from these areas constitutes a sizeable portion of Switzerland's alcoholic beverages market. These vineyards boost local and tourism-based demand for fine wines in the region. Further, their proximity to France leads to influences of a heterogeneous market of wine and spirits with France, alongside local wines of the region.

Competitive Landscape:

Key players in the Switzerland alcoholic drinks market are leading growth with product innovation, sustainability efforts, and strategic partnerships. Many different companies are introducing lines of premium and craft beverages to meet the increasing demand for unique, high-quality offerings. Moreover, they are focusing on sustainability by embracing eco-friendly packaging as well as using locally sourced ingredients to attract environmentally conscious consumers. Additionally, several players are introducing low-alcohol and alcohol-free equivalents, capturing the rising trend of being health-conscious. Strategically tied arrangements with the hospitality and tourism sectors and engaging marketing campaigns emphasizing Swiss heritage and craftsmanship are also bringing those brands closer to the market, attracting more consumer interest.

The report provides a comprehensive analysis of the competitive landscape in the Switzerland alcoholic drinks market with detailed profiles of all major companies.

Latest News and Developments:

- 27 November 2024: Whisky.de, one of the forerunners in the online whiskey purchasing space, has recently expanded its operations into Switzerland with its extensive product selection and exceptional customer service. With this expansion, Swiss consumers now have access to the wide selection of Whisky.de spirits, along with the convenience of getting them delivered straight to their homes.

- 24 September 2024: Infinium Spirits, a leading spirits brand based in San Diego, has greatly increased the distribution of Templeton, its primary whiskey label. The company has entered into partnerships with numerous distributors to make available its range of rye, Bourbon, and other whiskeys throughout Europe. This includes Switzerland, where Infinium is collaborating with Glen Fahrn to distribute its products.

- 19 June 2024: Swiss spirits startup 9 Meadows has announced its expansion into new markets and is seeking distribution partners for the same. The brand, which is presently available in Switzerland and Germany, is now focusing on the United States, the United Kingdom, Spain, and France, and seeking partners in the same regions.

- 20 March 2024: Brauerei Locher AG, the leading private brewery brand in Switzerland, has completed the acquisition of Chopfab Boxer, a renowned producer of craft beers. With this acquisition, Locher has become the main stakeholder in Chopfab Boxer.

- 27 February 2024: To maintain tradition in Switzerland, the Swiss Senate is regranting licenses to private and small manufacturers of distilled alcoholic beverages, such as grappa and schnapps. Furthermore, licenses that were revoked or temporarily renewed toward the end of 2020 will become valid again.

- 13 March 2023: Brauerei Locher has introduced the first Swiss whiskey that uses IoT-based blockchain technologies in its packaging. By utilizing a smartphone to scan the electronic NFC seal built into the bottle, individuals can obtain all information about that that specific whiskey bottle anytime. This technology effectively eliminates the possibility of counterfeiting exclusive whiskey bottles.

Switzerland Alcoholic Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Liters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavours Covered | Unflavoured, Flavoured |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland alcoholic drinks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Switzerland alcoholic drinks market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland alcoholic drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Switzerland alcoholic drinks market was volumed at 813.42 Million Liters in 2024.

The increasing popularity of Swiss wines, particularly among international consumers, rising demand for sustainable and eco-friendly production practices, growth in craft beer breweries and local beer varieties, expanding social drinking culture, particularly in urban areas, and greater focus on experiential drinking experiences are the primary factors driving the growth of the Switzerland alcoholic drinks market.

IMARC estimates the Switzerland alcoholic drinks market to exhibit a CAGR of 3.50% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)