Swine Healthcare Market Size, Share, Trends and Forecast by Product, Disease, Route of Administration, Distribution Channel, and Region, 2025-2033

Swine Healthcare Market Size and Share:

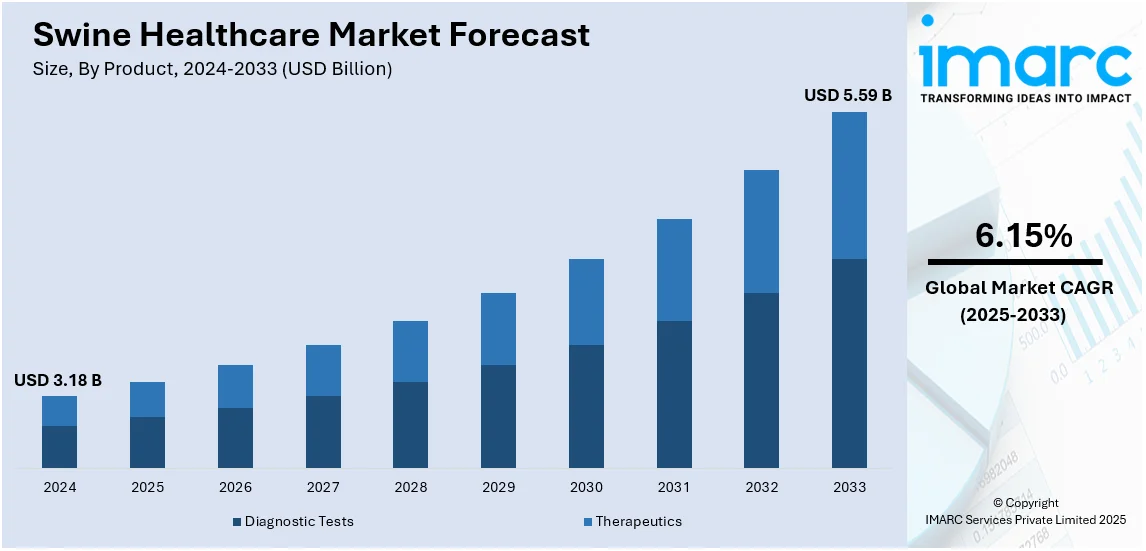

The global swine healthcare market size was valued at USD 3.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.59 Billion by 2033, exhibiting a CAGR of 6.15% from 2025-2033. North America currently dominates the market, holding a market share of over 38.0% in 2024. The swine healthcare market share is growing due to the increasing dependence on swine products, a significant increase in commercial swine farming and export activities, and growing awareness regarding pork-transmitted diseases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.18 Billion |

|

Market Forecast in 2033

|

USD 5.59 Billion |

| Market Growth Rate (2025-2033) | 6.15% |

The swine healthcare market growth is attributed to the increasing pork consumption, growing awareness about animal health, and veterinary medicine advancements. Thus, the market encompasses pharmaceuticals, vaccines, feed additives, and diagnostic products relating to the prevention and treatment of diseases in pigs. The major drivers involve the rising prevalence of swine diseases like African swine fever, among others, and thus more investment toward preventing these diseases. The imposition of stringent biosecurity measures by governments and regulatory bodies in almost every corner of the globe is driving demand for the market. Advances in technology, like precision livestock farming and AI-based diagnostics, are also revolutionizing swine health care. Growing concerns about antibiotic resistance have sparked more research on alternative treatments such as probiotics and herbal feed additives. The global market for swine healthcare is expanding steadily, influenced by the increased pig farming activities in Asia-Pacific and North America. Companies will focus on new product development and strategic partnerships to make their presence better in the markets. Sustainable and disease-resistant livestock are receiving more attention today, and so the swine healthcare industry has a bright scope for continuous growth, ensuring more productivity and proper care of the animals.

The United States has emerged as a key regional market for swine healthcare, driven by increasing pork production, increased cases of disease outbreaks, and improved veterinary health care. The sector mainly comprises pharmaceuticals, vaccines, feed additives, and diagnostic solutions to ensure pig health and productivity. The major push factors are the presence of diseases such as PRRS and ASF, which require more investment in biosecurity and preventive healthcare. In addition, stricter regulations by the FDA on the use of antibiotics are accelerating the need for alternative solutions such as probiotics and precision nutrition. AI-based diagnostics and precision farming technologies are further changing the face of swine healthcare. The market leaders are making investments in R&D and strategic partnerships to make their product portfolios more robust. The U.S. is a global leader in pork production. In addition to innovation in the disease management practice, sustainable farm practice, and better veterinary intervention, the market will continue growing.

Swine Healthcare Market Trends:

Rising demand for swine healthcare due to disease prevalence

The increasing prevalence of diseases related to swine health will drive demand in the market. Swine flu, salmonella, mycoplasma hyopneumoniae, and classical swine fever (CSF) have become significant hazards to both livestock and human health conditions. Consequently, awareness about preventing and controlling these diseases has led to an increasing demand for vaccines, antibiotics, and diagnostic equipment. Government programs have also promoted market growth through swine disease control and management; subsidies and research funding are some of the key elements that help control the diseases. Diagnostic imaging and laboratory testing have also been improved, which has led to early treatment and control of infections so that fewer losses are incurred to swine farmers. As per the National Center for Biotechnology Information, the rising global pig production by 140% since the 1960s and necessity have therefore increased the need for strong healthcare measures to ensure the sustainability of the pork industry. Due to zoonotic diseases' rising concerns, R&D efforts continue to improve vaccine efficacy and pave a path to more resilient and disease-free swine.

Growing commercial pig farming and pork consumption

In rapid expansion, commercial pig farming has a significant role in boosting the swine healthcare demand, driven by the ongoing rising demand for pork in the international market, which continues to go with the farm that invests and seeks health services for herds to boost and optimize its production. According to the reports the consumption rate of pork standing at 112.6 Kilotons in 2024, it is expected to rise to 129 kilotons by 2031, however, primarily with the aim of disease prevention and livestock management. With the intensification of pig farming operations, biosecurity measures such as vaccination, disinfection protocols, and nutritional supplements are paramount to preventing outbreaks and ensuring sustainable production. Further, the swine industry's export orientation, which demands superior, disease-free pork, encourages the adoption of sophisticated veterinary care through genetic enhancement and precision livestock farming. Animal welfare and disease control measures have been very strict in most countries involved in exporting. As pork is one of the most consumed protein sources globally, there will be an increasing need for holistic swine healthcare solutions in line with industry growth.

Advancements in veterinary technology and swine disease management

Veterinary healthcare technological advancement is shaping the swine healthcare market trends by providing better means of disease prevention, diagnosis, and treatment. The increasing implementation of diagnostic imaging and laboratory testing in veterinary hospitals is driving the need for diagnostic tools and related items, which may be used in early disease detection and, consequently, its management. Innovations such as precision medicine, AI-driven monitoring systems, and automated feeding solutions boost livestock health and productivity. Extensive R&D has been conducted on the vaccine development phase of swine flu and CSF, which has brought more effective forms of immunization, thereby lessening the attacks and economic losses due to disease. Telemedicine increased data-driven animal farming, and livestock management has also allowed farmers to make better-informed decisions concerning animal health and welfare. Organic and antibiotic-free pork production is creating innovation in alternative healthcare solutions, such as probiotics and herbal remedies. As globalization pushes diseases into new regions more quickly than ever before, governments and industry leaders are investing in the latest veterinary technology to protect food, preserve animal welfare standards, and maintain swine growth.

Swine Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global swine healthcare market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, disease, route of administration, and distribution channel.

Analysis by Product:

- Diagnostic Tests

- Enzyme Linked Immuno-Sorbent Assay (ELISA)

- Rapid Immuno Migration (RIM)

- Agar Gel Immuno-Diffusion (AGID)

- Polymerase Chain Reaction (PCR)

- Diagnostic Imaging

- Others

- Therapeutics

- Vaccines

- Parasiticides

- Anti-infectives

- Feed Additives

- Others

Therapeutics is the largest segment due to the prevalence of swine disease and increased utilization of veterinary pharmaceuticals in animal healthcare. Antibiotics, antiparasitics, and anti-inflammatory drugs are also employed extensively to prevent and control bacterial infections, parasites, and inflammatory diseases in pigs, which in return directly enhances the health and productivity of a herd. Alternative therapeutics such as phytogenic additives, probiotics, and immunostimulants, which have seen increased popularity in the market due to increasing concern over AMR, also fuel the shift in the trend of innovative therapeutics that build immunity and strengthen overall swine health. Growing investment in precision livestock farming and AI-driven drug development is driving growth in the market. Major players are working on developing targeted therapeutics with minimal side effects to improve the efficacy of treatment.

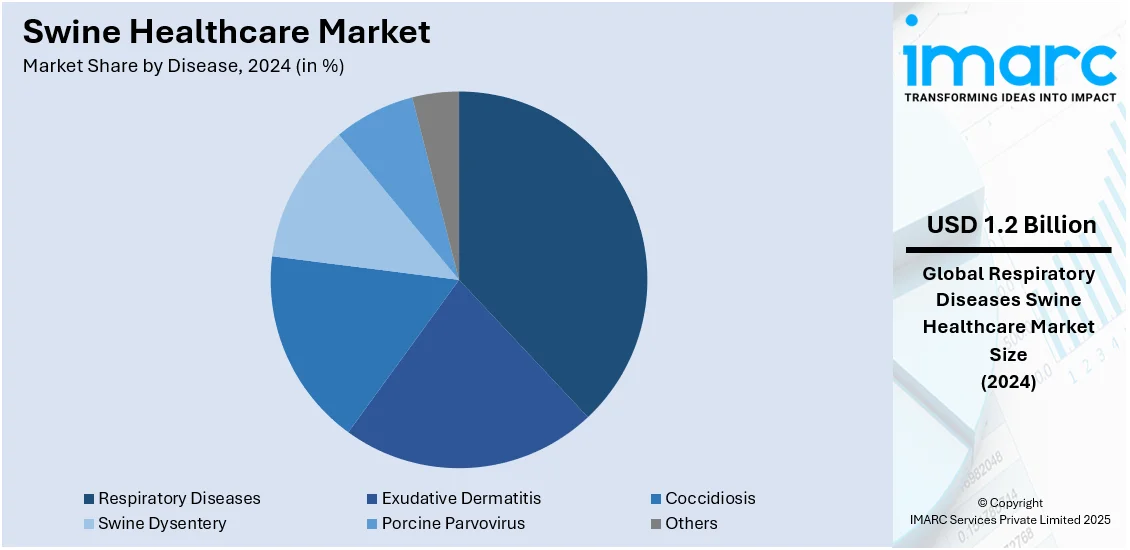

Analysis by Disease:

- Exudative Dermatitis

- Coccidiosis

- Respiratory Diseases

- Swine Dysentery

- Porcine Parvovirus

- Others

Respiratory diseases account for the largest share. Mycoplasma pneumonia, swine influenza, pig reproductive and respiratory syndrome (PRRS), and other respiratory illnesses significantly affect swine production by causing reduced growth rates, increased mortality, and higher treatment costs. The broad prevalence of PRRS and the impact of this economically important disease have prompted a massive need for appropriate vaccines, antibiotics, and antiviral medicines. The shift of focus in preventing early-stage detection has raised interest in incorporating the latest available diagnostic tools in conjunction with various forms of farm-level biosecurity practices. Additionally, climate variations and increasing swine farm densities have contributed to the rapid spread of airborne respiratory pathogens, further escalating the demand for disease management solutions. The rising emphasis on precision medicine and targeted treatments has led to the development of next-generation vaccines and therapeutic strategies to combat respiratory illnesses.

Analysis by Route of Administration:

- Injectable

- Oral

Injectables represent a significant market due to their high efficacy, rapid absorption, and precise dosage delivery. Several vaccines, antibiotics, and anti-inflammatory drugs are administered through injection to initiate rapid therapeutic action. This is primarily seen with the operation of large-scale pig farming, where outbreaks of the diseases have to be contained speedily. Injectable solutions are also used with critical diseases like PRRS and African swine fever (ASF). Oral medications, comprising medicated feed additives, tablets, and liquid formulations, have been used frequently for long-term disease management and preventive care. Oral administration has the advantage of being less cumbersome, especially when dealing with larger herds. It minimizes stress and labor costs associated with handling pigs to administer injections. Feed-grade antibiotics, probiotics, and nutritional supplements are critical to maintaining gut health, building immunities, and preventing bacterial infections. The rise in antimicrobial resistance has compelled the market further toward natural and probiotic oral solutions. Although injectables still account for the largest portion of oral animal health products due to their efficacy, oral is fast emerging as an alternative as feed technology advances and other therapeutics such as antimicrobials and vaccines become more readily available.

Analysis by Distribution Channel:

- Veterinary Hospitals

- Retail Pharmacy

- Online Pharmacy

Growth in demand for professional consultation, high-end diagnostic services, and advanced treatment is boosting the veterinary hospital market. For swine producers, veterinary hospitals provide specialized care, disease diagnosis, and access to prescription-based treatments, hence higher survival rates and farm productivity. Retail pharmacy is an important access point for easy availability of OTC veterinary medicines, feed supplements, and preventive healthcare products. These pharmacies are targeting small- and medium-scale swine farmers who need routine medications without necessarily requiring veterinary supervision. The retail channels for antibiotics, vitamins, dewormers, and vaccines ensure that these products are distributed and available widely. Online pharmacies are growing in popularity as veterinary healthcare is increasingly digitalized, and home delivery is convenient. Market access has been improved through e-commerce platforms for prescription and non-prescription drugs, feed additives, and healthcare products. Online channels also offer competitive pricing, purchases in bulk, and a larger product portfolio. With increasing internet penetration and telemedicine adoption, online pharmacies will be expected to have a greater market share in the future.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest market with a share of 38.0%. This mainly resulted in dominance within the region due to high pork production levels, advanced veterinary infrastructure, and stringent biosecurity regulations. The U.S. is one of the world's largest pork producers, which naturally invests huge resources in disease prevention, precision farming, and veterinary pharmaceuticals. Increasing cases of PRRS, ASF, and other infectious diseases have put pressure on stakeholders to adopt preventive healthcare measures, including vaccines, biosecurity programs, and improvements in farm management practices. The need for regulatory bodies like the FDA and USDA ensures monitoring of antibiotic use and strict adherence to high standards of animal health. In addition, major pharmaceutical firms and research institutions are based in the region which would further hasten the development of state-of-the-art swine healthcare products. Innovation through AI-driven diagnostics, monitoring of disease in real-time, and sustainable farming solutions further fuel market growth.

The animal healthcare market in Europe is driven by strict animal welfare regulations, modern veterinary infrastructure, and rising demand for antibiotic-free pork. The top pork producers include Germany, Spain, and Denmark, which invest heavily in biosecurity measures and strategies to prevent diseases. The growing concern of African Swine Fever (ASF) has stimulated vaccine development and early disease detection technologies. The EU ban on antibiotic growth promoters has spurred the use of probiotics, phytogenic additives, and precision nutrition solutions, which focus on sustainability.

Asia-Pacific is the global leader in pork production, and the major producers are China, Vietnam, and India. Fast industrial pig farming expansion has created a high risk of disease and increased the need for vaccines, diagnostics, and biosecurity solutions. ASF and PRRS outbreaks have resulted in increased investments in early detection technologies and genetic improvements. Increased consumer demand for safe, quality pork products has also led to governments tightening the use of antibiotics, thereby driving the market for natural feed additives and alternative therapeutics.

Latin America, which is dominated by Brazil, Mexico, and Argentina, is seeing a significant rise in swine production and exports, thus making the need for better disease management solutions imperative. Swine respiratory diseases and parasitic infections are recurrent, leading to a huge demand for vaccines, parasiticides, and PCR-based diagnostics. Governments are expanding vaccination programs and promoting biosecurity protocols to protect the industry. The rising export market to Asia and Europe has increased the focus on quality standards and disease-free certification, pushing investments in advanced veterinary services and precision livestock farming.

The Middle East & Africa swine healthcare market is relatively small however, as pig farming has been increasing lately in South Africa and parts of North Africa. The region continues to face such challenges as poor access to veterinary services, bad disease surveillance, and low uptake of modern health solutions. Increasing investments in livestock infrastructure and biosecurity programs improve the control of diseases. As the region focuses on improving food security and lowering its dependence on pork imports, the demand for cost-effective vaccines, diagnostic tests, and alternative feed solutions rises.

Key Regional Takeaways:

United States Swine Healthcare Market Analysis

In 2024, the United States held a share of 85.70% of the swine healthcare market in North America due to growing reliance on pork products. USDA indicates that US pork production will be expected at 12.8 Million Tons in 2024, hence marking a growth of 3.1% above 2023. Since pork remains the main protein, its usage and demand are up, raising its health demand from swine. The more people consume pork, the more demand to keep up their health requires healthy swine that are given quality healthcare through solutions. This is particularly critical in large-scale commercial farming operations where maintaining optimal swine health is essential for economic stability. As pork prices rise in line with the growing demand, farmers and industry stakeholders are increasingly investing in health management practices for swine to mitigate diseases, ensure high-quality meat production, and enhance overall productivity. Besides that, improvements in swine healthcare technologies and practices, combined with better veterinary care, have also spurred more acceptance. Healthier animals are the key to keeping and increasing pork production to respond to the increasingly large market demands.

Europe Swine Healthcare Market Analysis

In Europe, increased swine healthcare adoption is strongly influenced by increasing awareness about pork-transmitted diseases. For example, the Member States reported 1929 outbreaks of ASF in 2023. That was five times more than reports from 2022. This is particularly due to the spread and outbreak of ASF in Croatia, which reported 1124 outbreaks, or 58% of total EU outbreaks. Due to the health risks posed by the consumption of infected pork products, regulations have become stricter, and the importance of maintaining optimal swine health has increased. These diseases, such as zoonotic pathogens, can have serious impacts on the health of the animals and on public health. There is a growing demand for safe, disease-free pork as consumer awareness increases, thus driving the need for advanced healthcare management for swine. Awareness has also brought about government and private sector initiatives focused on health standards in the swine industry. Farmers and vets are more interested in investing their time and effort in preventive measures, vaccination programs, and sound disease control techniques to minimize disease transmission risks. Stakeholders with such proactive considerations address the matter of both the welfare of the animals and public health safety, therefore ensuring a more reliable and safer pork supply.

Asia Pacific Swine Healthcare Market Analysis

The swine healthcare uptake in the Asia-Pacific region is driven by the increasing growth of online pharmacy services. For example, Walmart-owned Flipkart has also ventured into the e-pharmacy space that boasts more than 50 platforms offering services to nearly 22,000 pin codes across the country. Increasing internet penetration and a shift toward digital platforms have made it easier for farmers and breeders to access veterinary medicines and healthcare solutions. This growth in online pharmacy services has made it easier for stakeholders in the swine farming industry to access a wider range of swine healthcare products, including medications, vaccines, and supplements. The availability of these products online ensures timely interventions and better management of swine health, particularly in rural and remote areas. Moreover, the increasing number of local and international online platforms offering veterinary products has made the procurement process much easier, cost-effective, and accessible. The region is seeing a growing demand for pork; therefore, the adoption of swine healthcare is very important to enhance animal welfare, productivity, and overall supply chain efficiency, hence creating a healthier and more resilient industry.

Latin America Swine Healthcare Market Analysis

The increasing pork-eating population in Latin America is strongly related to the increasing disposable incomes and is directly connected to the total disposable income growth in Latin America, which is expected to be around 60% between 2021 and 2040. With people entering the middle class and experiencing greater financial security, the demand for meat products, such as pork, rises. This shift in dietary habits is coupled with a growing interest in the health and quality assurance of pork production. Swine health becomes an issue of importance as farmers want to continue supplying the increased demand while at the same time keeping up quality standards. Improving access to health care for swine would be necessary for the prevention of diseases, enhancing productivity, and improving animal welfare under intensified production efforts. The economic growth in the region is encouraging stakeholders to adopt better healthcare practices, which improve swine productivity and cater to consumer concerns about food safety and quality. This trend is boosting the overall development of the swine healthcare sector.

Middle East and Africa Swine Healthcare Market Analysis

The adoption of swine healthcare in the Middle East and Africa is driven by the improving animal healthcare infrastructure. For example, in 2022 there will be approximately 1,200 licensed veterinarians across the UAE. Investments in veterinary services, research facilities, and healthcare training programs contribute to a more robust system for managing the health of swine populations. As agriculture develops and evolves, access to professional veterinary care, swine-specific healthcare solutions, and measures for disease prevention are becoming more widespread. This would have implications for small and medium-scale farmers, as improved healthcare also leads to increases in animal productivity and farm profitability. An enhanced animal healthcare infrastructure ensures better monitoring of animal health, more effective disease management, and improved biosecurity practices, all critical to the growth of the swine industry in the region.

Competitive Landscape:

Leading companies in the swine healthcare market are highly invested in product innovation, strategic partnerships, and geographic expansion to drive their market presence. One of the most significant trends is the adoption of precision livestock farming (PLF), where companies are integrating AI-driven disease detection, IoT-based monitoring, and real-time health analytics to enhance disease management. Another trend is the use of mRNA and recombinant vaccines, which have proven to be more effective in immunizing against viral infections such as PRRS and African Swine Fever (ASF). The regulatory reforms that limit the use of antibiotics are boosting the demand for probiotics, phytogenic feed additives, and immunostimulants as alternative solutions. Mergers and acquisitions also shape the industry, as companies expand their portfolios to include biologics, gene-editing technologies, and rapid diagnostic solutions. The focus on biosecurity, sustainability, and disease outbreaks intensifies, innovation efforts among market players will create a positive swine healthcare market outlook.

The report provides a comprehensive analysis of the competitive landscape in the swine healthcare market with detailed profiles of all major companies, including:

- Boehringer Ingelheim International GmbH

- Ceva Animal Health Inc.

- Elanco

- IDEXX Laboratories Inc.

- Innovative Diagnostic

- Merck & Co. Inc.

- Phibro Animal Health Corporation

- Vetoquinol

- Virbac Corporation

- Zoetis Inc.

Latest News and Developments:

- January 2025: Godrej Agrovet has unveiled a new range of scientifically developed pig feed, Godrej Pride Hog, to enhance pig health, immunity, and growth. The feed coming under Starter, Grower, and Finisher variants helps ensure tailored nutrition at various stages of a pig's lifecycle. Further, the company organized a roundtable in Guwahati with industry leaders to deliberate on preventive measures for African Swine Fever (ASF) and best practices for farm management.

- September 2024: The European Medicines Agency has given Merck Animal Health marketing permission for the swine intradermal vaccination PORCILIS® PCV M Hyo ID. The vaccination provides defense against Mycoplasma hyopneumoniae (M. hyo) and Porcine Circovirus Type 2 (PCV2), two serious swine illnesses. It is administered using IDAL® device technology to ensure efficient and animal-friendly administration. The vaccine will be launched in the European market in Q1 2025.

- July 2024: ThaMa-Vet has released two new automatic swine syringes onto the veterinary market, which should improve the accuracy of vaccination for swine. The syringes have fixed dosage accuracy and a transparent barrel, making administration precise and easy to use. Swine, susceptible to human influenza and classical swine fever, among others, will enjoy the benefits of such advancements in vaccination technology. The new syringes should make swine vaccination easier, improve biosecurity, and improve animal health.

- April 2024: Pradofloxacin injectable (Pradalex; Elanco) received FDA approval to treat certain respiratory conditions in pigs and cattle. This antibiotic solution, which targets infections including Mannheimia haemolytica and Mycoplasma bovis, is recommended for bovine respiratory disease (BRD) in calves for less than one year. The medication can only be administered as a single injection by veterinarians with a license. For other types of cattle, such as those older than one year or less than two months, it has not been approved.

- April 2024: Phibro Animal Health Corporation and Zoetis Inc. announced that they have reached a final deal whereby Phibro would pay around $350 Million to acquire Zoetis' portfolio of medicated feed additives, including swine products. The deal, expected to close in the second half of 2024, includes over 37 product lines, six manufacturing sites, and more than 300 Zoetis employees. The acquisition should improve Phibro's offering in swine, thereby boosting animal care and nutrition and decreasing the risk of disease.

Swine Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Diagnostic Tests, Therapeutics |

| Diseases Covered | Exudative Dermatitis, Coccidiosis, Respiratory Diseases, Swine Dysentery, Porcine Parvovirus, and Others |

| Route of Administrations Covered | Injectable, Oral |

| Distribution Channels Covered | Veterinary Hospitals, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boehringer Ingelheim International GmbH, Ceva Animal Health Inc., Elanco, IDEXX Laboratories Inc., Innovative Diagnostic, Merck & Co. Inc., Phibro Animal Health Corporation, Vetoquinol, Virbac Corporation, Zoetis Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the swine healthcare market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global swine healthcare market.

- The study maps the leading, and the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the swine healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The swine healthcare market was valued at USD 3.18 Billion in 2024.

The swine healthcare market is estimated to exhibit a CAGR of 6.15% during 2025-2033.

The market is driven by the increasing dependence on swine products, a significant increase in commercial swine farming and export activities, and growing awareness regarding pork-transmitted diseases.

North America currently dominates the market due to high pork production levels, advanced veterinary infrastructure, and stringent biosecurity regulations.

Some of the major players in the swine healthcare market include Boehringer Ingelheim International GmbH, Ceva Animal Health Inc., Elanco, IDEXX Laboratories Inc., Innovative Diagnostic, Merck & Co. Inc., Phibro Animal Health Corporation, Vetoquinol, Virbac Corporation, Zoetis Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)