Sweet Biscuit Market Size, Share, Trends and Forecast by Product Type, Source, Distribution Channel, and Region, 2025-2033

Sweet Biscuit Market Size and Share:

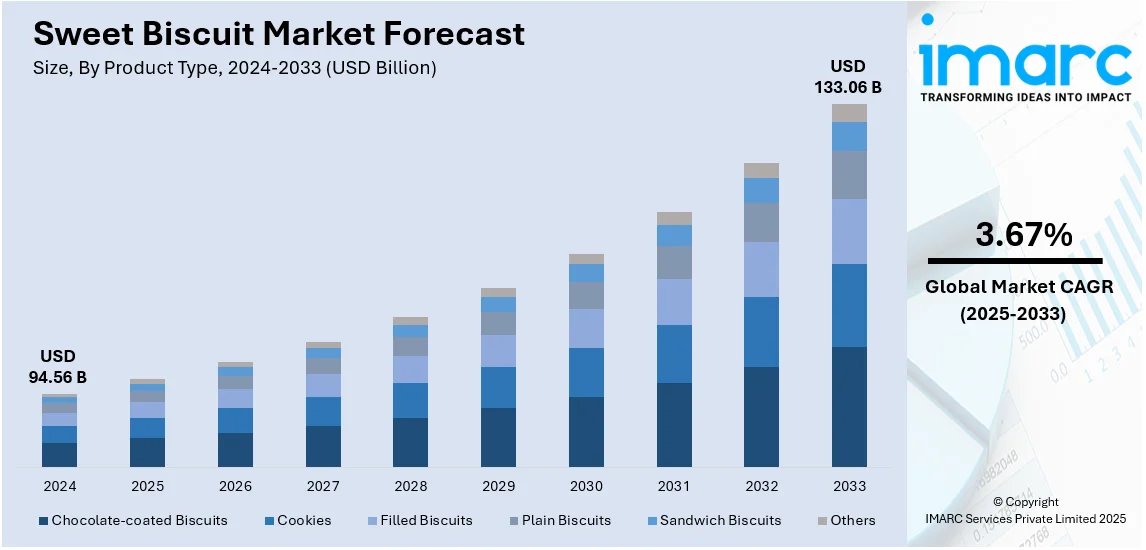

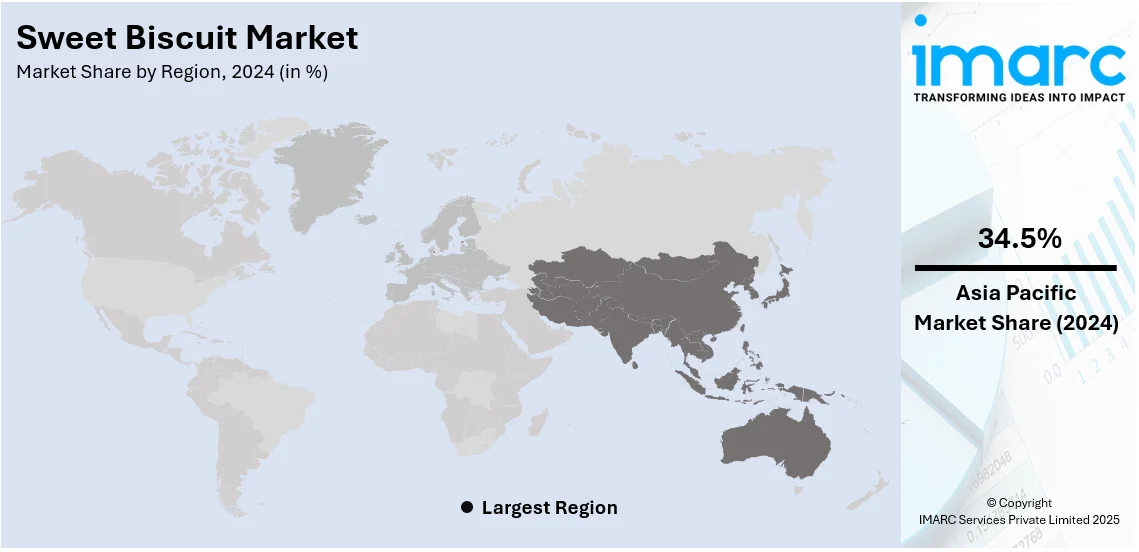

The global sweet biscuit market size was valued at USD 94.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 133.06 Billion by 2033, exhibiting a CAGR of 3.67% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 34.5% in 2024. The sweet biscuit market share in Asia Pacific region is growing because of a strong snacking culture, diverse flavor preferences, expanding retail networks, and rising demand for healthier biscuit options. Local brands and frequent product innovations further contribute to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 94.56 Billion |

|

Market Forecast in 2033

|

USD 133.06 Billion |

| Market Growth Rate 2025-2033 | 3.67% |

The increasing pace of modern lifestyles is encouraging consumers to seek quick and convenient snack options. Sweet biscuits, being pre-packaged and easy to carry, fit perfectly into this trend. Busy professionals, students, and travelers prefer biscuits as they require no preparation and can be consumed anytime, anywhere. Moreover, manufacturers are constantly introducing new flavors, textures, and formats to differentiate their products. This includes fusion flavors, premium ingredients, and indulgent options such as chocolate-filled or fruit-infused biscuits. Additionally, limited-edition and seasonal launches create excitement, encouraging repeat purchases. Besides this, the availability of sweet biscuits across different retail channels, including supermarkets, convenience stores, hypermarkets, and online platforms is increasing their reach. E-commerce channels are further enabling direct-to-consumer (D2C) sales, allowing brands to introduce exclusive online-only products and subscription-based purchases.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by product innovation and strategic launches. Brands are introducing unique flavors, textures, and formats to attract consumers seeking indulgent yet convenient snacks. Limited-edition releases, holiday-themed treats, and expanded retail availability through both physical stores and online platforms enhance accessibility, driving sales and strengthening brand engagement. For example, in 2023, Nutella launched two new products in the US to celebrate World Nutella Day, including Nutella B-Ready, a crispy wafer filled with Nutella and puffed wheat crisps, and Nutella Biscuits, golden biscuits with a Nutella center. These products were available in stores nationwide and online.

Sweet Biscuit Market Trends:

Rising Demand for Convenience Food

The expanding convenience food sector is greatly fueling the growth of the sweet biscuit market. As reported by IMARC, the worldwide convenience food market was valued at USD 484.6 billion in 2023. In the future, IMARC Group anticipates the market will attain USD 782.7 billion by 2032, showing a growth rate (CAGR) of 5.47% from 2024 to 2032. Sweet biscuits fit this trend exceptionally well, providing pre-packaged, single-serve options that are easily transportable and edible without any need for preparation, making them a great option for working professionals, students, and commuters. Furthermore, the growth of busy lifestyles and escalating urban development has resulted in greater demand for convenient, energy-boosting snacks. New developments like protein-rich, gluten-free, and organic biscuits are expanding consumer attraction. E-commerce platforms are enhancing sales by offering convenient access to a wide range of products with home delivery. These factors are expected to propel the sweet biscuit market share in the coming years.

Surging E-Commerce Users

The rising number of e-commerce users is significantly driving the growth of the sweet biscuit market. For instance, according to reports, by 2029, e-commerce users are estimated to total 501.6 Million. User penetration is expected to reach 22.1% in 2024, with a rise to 34.0% by 2029. The ARPU (average revenue per user) is estimated to be INR 14,121. E-commerce platforms allow consumers to shop for sweet biscuits at any time, from anywhere, providing a level of convenience that physical stores are unable to match. As more people turn to online shopping for everyday groceries and snacks, sweet biscuits have become a popular item due to their portability and long shelf life. These factors further positively influence the sweet biscuit market forecast.

Product Innovations

Producers are consistently innovating by launching new flavors, textures, and formats to meet changing consumer preferences. The addition of local tastes like peanut, green tea (matcha), spices, mango, and chocolate has struck a chord with consumers seeking distinctive snacking experiences. Furthermore, companies are utilizing seasonal and exclusive product launches to generate enthusiasm and boost revenue. For example, in June 2024, Insomnia Cookies introduced a summer collection inspired by international flavors. The "Summer Abroad Sweets" event showcases a Peanut Miso Ramen Classic cookie, a delightful blend of sweet, salty, and crunchy elements infused with Japanese-inspired tastes, thus increasing the sweet biscuit market revenue. Various brands are also adopting fusion flavors, merging traditional and modern ingredients to attract a variety of tastes. Health-aware consumers are increasingly boosting the demand for snacks that feature natural ingredients, lower sugar content, and added health benefits, leading manufacturers to revise products for clearer labeling.

Sweet Biscuit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sweet biscuit market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, and distribution channel.

Analysis by Product Type:

- Chocolate-coated Biscuits

- Cookies

- Filled Biscuits

- Plain Biscuits

- Sandwich Biscuits

- Others

Plain biscuits stand as the largest component in 2024, holding 34.3% of the market. Plain biscuits are generally more affordable than other types of biscuits, such as cream-filled or chocolate-coated varieties. Their low price point makes them accessible to a wider audience. Moreover, they are highly versatile and can be eaten on their own or paired with other foods like tea, coffee, jam, butter, or cheese. Their neutral flavor makes them suitable for both sweet and savory pairings, appealing to a wide range of consumer preferences. Additionally, plain biscuits are often perceived as a healthier option because of their simpler ingredient lists, lower sugar content, and absence of artificial additives, attracting health-conscious consumers. Their long shelf life and ease of storage further contribute to their popularity, making them a staple in households, restaurants, and cafeterias. The rising demand for budget-friendly, convenient, and adaptable snacks continues to drive their market dominance.

Analysis by Source:

- Wheat

- Oats

- Millets

- Others

Wheat leads the market with 54.5% of the market share in 2024. According to the sweet biscuit market forecast report, the growing consumer awareness about the importance of healthy eating and balanced diets is catalyzing the demand for wheat biscuits, which are often positioned as a healthier option because of their higher content of fiber, vitamins, and minerals compared to refined flour biscuits. Moreover, the growing demand for high-fiber foods is a significant driver for wheat biscuits. Fiber is associated with improved digestive health and has become an important consideration for consumers aiming to maintain a balanced diet. Additionally, wheat biscuits appeal to consumers seeking natural and clean-label products, as they are often free from artificial additives and preservatives. The increasing popularity of whole grain and multigrain variants, coupled with endorsements from health professionals, is further supporting the market growth.

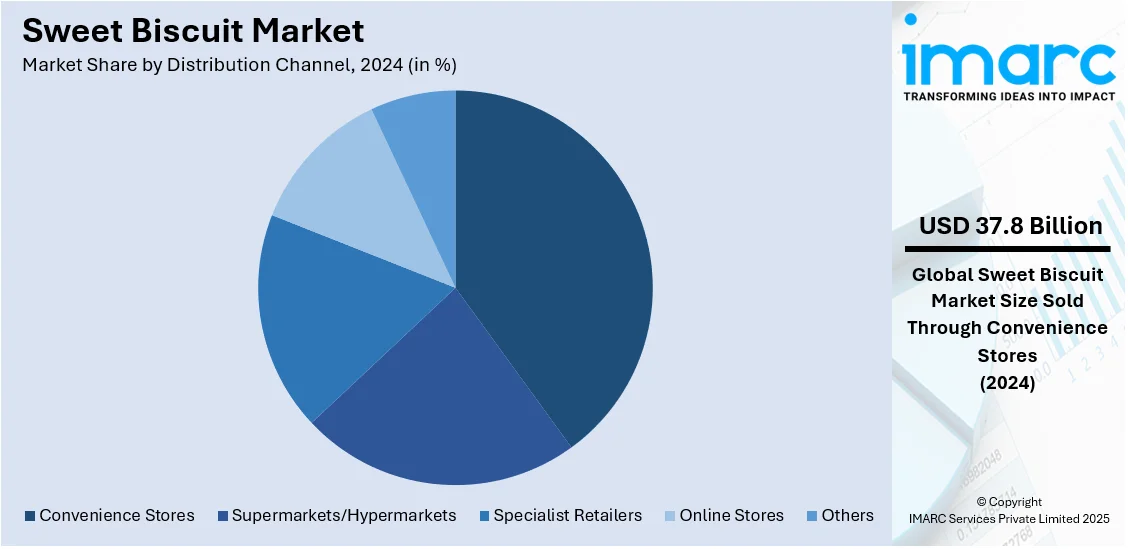

Analysis by Distribution Channel:

- Supermarkets/Hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Stores

- Others

Convenience stores represent the largest segment, accounting for 40.0% of market share in 2024. According to the sweet biscuit market outlook report, convenience stores are well-positioned to cater to the growing demand for on-the-go snacks, especially in urban areas where consumers seek quick, portable, and ready-to-eat (RTE) options. Sweet biscuits, being easy to carry, individually packaged, and available in single-serving sizes, are an ideal snack for people who are looking for quick treat while commuting, working, or running errands. Additionally, convenience stores benefit from high foot traffic, strategic locations near workplaces, schools, and transportation hubs, and extended operating hours, making them an accessible option for impulse purchases. Many stores are expanding their product offerings with healthier, organic, and premium biscuit options to attract a broader consumer base. Promotional discounts, bundling strategies, and loyalty programs further drive sales in this segment, strengthening the position of convenience stores in the sweet biscuit market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 34.5%. According to the sweet biscuit market statistics, the expansion of the middle class in countries, such as China, India, Indonesia, etc., is driving demand for sweet biscuits. Middle-class consumers are increasingly opting for branded and premium products that offer better quality, taste, and variety. Moreover, the rapid growth of e-commerce platforms in Asia Pacific has significantly boosted sweet biscuit sales. For instance, according to IMARC, the India e-commerce market size reached USD 92.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 259.0 Billion by 2032, exhibiting a growth rate (CAGR) of 29.3% during 2024-2032. Consumers in the region, especially in China and India, are increasingly turning to online shopping for groceries and snacks, including sweet biscuits.

Key Regional Takeaways:

United States Sweet Biscuit Market Analysis

In North America, the market portion held by the United States was 86.70% of the overall total. The United States sees a rise in sweet biscuit consumption, driven by the expanding e-commerce sector, making these products more accessible to consumers. For instance, in 2024 US e-commerce sales reached USD 1.192 Trillion, which is more than double what they were five years prior: USD 571.088 Billion in 2019. The convenience of online shopping enables brands to reach a broader audience, catering to diverse taste preferences and dietary needs. Subscription-based snack boxes and direct-to-consumer models further enhance engagement, fostering brand loyalty. Digital marketing strategies, including targeted ads and influencer collaborations, amplify product visibility. Mobile apps and fast delivery services streamline purchases, encouraging impulse buys. Innovative packaging designed for efficient shipping reduces breakage, ensuring quality upon delivery. The rise of online grocery platforms strengthens distribution networks, offering competitive pricing and bulk purchase options. Discounts, seasonal promotions, and personalized recommendations drive repeat purchases. Social media trends and viral campaigns further contribute to market expansion. As digital payments and fintech solutions advance, seamless transactions enhance customer experiences, making online channels an essential driver for market growth in the region.

Europe Sweet Biscuit Market Analysis

Europe witnesses steady growth in sweet biscuit consumption, supported by the expanding food processing sector, which enables continuous innovation in flavors, textures, and nutritional profiles. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. The development of advanced manufacturing techniques enhances efficiency, ensuring consistent product quality. Investment in automated production lines facilitates large-scale output, meeting rising consumer demand. Reformulation efforts align with evolving health-conscious preferences, introducing reduced-sugar and gluten-free varieties. Collaboration with ingredient suppliers fosters the use of sustainable and natural components, appealing to eco-conscious buyers. Efficient logistics and streamlined supply chains improve distribution efficiency, reducing lead times. Market competition encourages brands to differentiate through unique formulations, driving innovation. Increased research and development spending accelerates new product launches, catering to dynamic consumer preferences. Expansion of private-label offerings in supermarkets complements this trend, providing cost-effective alternatives.

Asia Pacific Sweet Biscuit Market Analysis

Asia-Pacific experiences increasing sweet biscuit sales, largely influenced by the expansion of supermarkets and hypermarkets. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is a 3.88% increase from 2023. These retail formats provide a one-stop shopping experience, attracting consumers with diverse product assortments and competitive pricing. Strategic store placements enhance brand visibility, influencing purchasing decisions. Promotional campaigns, in-store sampling, and loyalty programs encourage repeat purchases. The growing trend of private-label sweet biscuits in hypermarkets offers cost-effective alternatives, broadening consumer choices. Supermarket chains expand into smaller cities, increasing accessibility and catering to evolving preferences. Seasonal demand surges during festive occasions, boosting overall sales. Bulk packaging options appeal to cost-conscious buyers, reinforcing sustained demand. Partnerships between manufacturers and retailers ensure consistent stock availability, reducing supply chain disruptions. Increased shelf space for premium and health-conscious varieties accommodates shifting dietary trends.

Latin America Sweet Biscuit Market Analysis

Latin America experiences rising sweet biscuit demand, fueled by increasing disposable income, allowing consumers to explore a wider range of options beyond basic staples. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Affordability remains a key consideration, with both premium and budget-friendly varieties witnessing demand growth. Improved financial stability encourages households to allocate spending toward indulgent snacks, including different flavors and healthier alternatives. Expanding middle-class segments contribute to market expansion, with urbanization further influencing purchasing patterns. Shifting consumer preferences emphasize convenience, favoring individually packed formats suited for on-the-go consumption.

Middle East and Africa Sweet Biscuit Market Analysis

Middle East and Africa sees growing sweet biscuit adoption due to surging demand for premium biscuits, primarily driven by increasing tourism. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. Hospitality sectors, including hotels, airlines, and cafés, incorporate high-quality offerings to enhance guest experiences. Tourists seeking local delicacies and international flavors boost product sales, reinforcing premium segment growth. Luxury packaging and unique flavors appeal to souvenir buyers, strengthening market appeal. Upscale dining establishments integrate artisanal varieties, catering to evolving tastes.

Competitive Landscape:

Major players in the market are focusing on product development to attract a wider consumer base. For instance, in 2024, Popeyes introduced new dessert items, including Chocolate Chip Biscuits and Apple Caramel Cheesecake. The Chocolate Chip Biscuits reimagined their classic buttermilk biscuits with chocolate chips and icing, blending nostalgia with indulgence. Alongside such innovations, companies are launching healthier recipes with increased fiber, lower sugar, and functional ingredients to appeal to health-conscious consumers. They are also expanding their portfolios with premium, organic, and gluten-free options, addressing diverse dietary preferences. Businesses are enhancing their distribution networks by expanding e-commerce, partnering with convenience stores, and utilizing direct-to-consumer (D2C) platforms. Marketing tactics focus on online campaigns, celebrity partnerships, and loyalty initiatives to boost brand awareness. Sustainability efforts, such as recyclable packaging and ethically sourced materials, are gaining momentum as businesses adapt to changing consumer demands. Moreover, mergers, acquisitions, and partnerships with local manufacturers are being sought to enhance market presence and bolster competitive standing.

The report provides a comprehensive analysis of the competitive landscape in the sweet biscuit market with detailed profiles of all major companies, including:

- Bahlsen GmbH & CO. KG

- Britannia Industries

- Ferrero International S.A.

- ITC Limited

- Lotus Bakeries Corporate

- Mondelēz International group

- Parle Products Pvt. Ltd

- The Campbell Company

- Unibic Foods India Private Limited

- Yildiz Holding

Latest News and Developments:

- January 2025: pladis launched McVitie’s Gold Billions Chocolate & Hazelnut, expanding its popular biscuit range. The new variant, featuring crisp wafers and hazelnut cream coated in golden caramel chocolate, is exclusive to the UK Impulse channel for six months from January 2025. This addition follows the success of McVitie’s Gold Billions, now a £5m brand in on-the-go sweet biscuits.

- October 2024: FBC launched its Christmas 2024 biscuit range, featuring new Merryland White Chocolate Chip Minis and Fox’s Fabulous Half Coated Winter Spiced Cookies. The Merryland Minis, priced at £1.75, follow strong white chocolate sales growth. Fox’s Winter Spiced Cookies will be available soon at £2.50.

- July 2024: Pladis introduced McVitie's Signature, a premium snacking line with three new types. Caramel Chocolate Rounds, a caramel encased by a crunchy biscuit and milk chocolate; Chocolate Caramel Biscuits, a golden-baked biscuit topped with caramel, coated in milk chocolate and topped with biscuit crumbs; and Chocolate Cream Swirls, a chocolate cream filling inside a crunchy, patterned biscuit.

- July 2024: Fox’s Burton’s Companies (FBC UK), a UK manufacturer of Premium Treats, introduced two new Dark Chocolate products: Fox’s Fabulous Half-Coated Dark Chocolate Cookies and Fox’s Fabulous Chocolatey Dark Chocolate.

- June 2024: Insomnia Cookies launched an international-inspired summer range. The "Summer Abroad Sweets" celebration features a Peanut Miso Ramen Classic cookie, a sweet, salty, and crunchy concoction filled with Japanese-inspired flavors.

Sweet Biscuit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Chocolate-coated Biscuits, Cookies, Filled Biscuits, Plain Biscuits, Sandwich Biscuits, Others |

| Sources Covered | Wheat, Oats, Millets, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bahlsen GmbH & CO. KG, Britannia Industries, Ferrero International S.A., ITC Limited, Lotus Bakeries Corporate, Mondelēz International group, Parle Products Pvt. Ltd, The Campbell Company, Unibic Foods India Private Limited, Yildiz Holding, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sweet biscuit market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sweet biscuit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sweet biscuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sweet biscuit market was valued at USD 94.56 Billion in 2024.

The sweet biscuit market is projected to exhibit a CAGR of 3.67% during 2025-2033, reaching a value of USD 133.06 Billion by 2033.

The sweet biscuit market is driven by increasing demand for convenient, on-the-go snacks, rising health consciousness, and product innovations such as high-fiber, organic, and protein-enriched biscuits. The growing number of retail channels, including e-commerce and convenience stores, are offering a favorable market outlook. Seasonal flavors, premium offerings, and marketing strategies also enhance consumer engagement.

Asia Pacific currently dominates the sweet biscuit market, accounting for a share of 34.5%. The dominance of the region is because of a strong snacking culture, diverse flavor preferences, expanding retail networks, and rising demand for healthier biscuit options. Local brands and frequent product innovations further support the market growth.

Some of the major players in the sweet biscuit market include Bahlsen GmbH & CO. KG, Britannia Industries, Ferrero International S.A., ITC Limited, Lotus Bakeries Corporate, Mondelez International group, Parle Products Pvt. Ltd, The Campbell Company, Unibic Foods India Private Limited, Yildiz Holding, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)