Sustainable Tire Market Size, Share, Trends and Forecast by Material Type, Vehicle Type, and Region, 2025-2033

Sustainable Tire Market Size and Share:

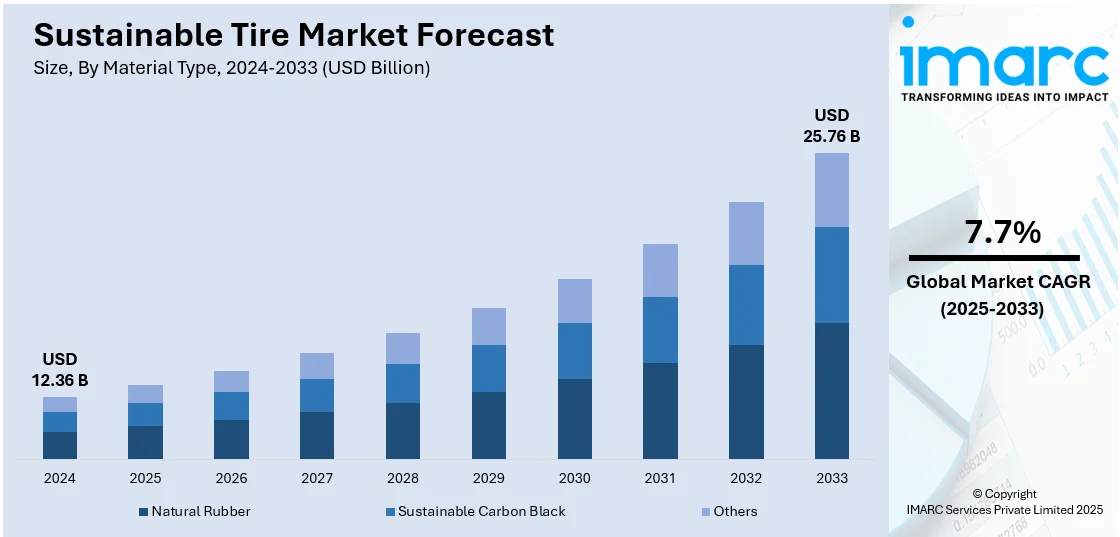

The global sustainable tire market size was valued at USD 12.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.76 Billion by 2033, exhibiting a CAGR of 7.7% from 2025-2033. Asia Pacific dominated the market, holding a market share of over 40.7% in 2024. This dominance is attributed to rising vehicle demand, supportive government sustainability policies, expanding manufacturing capacities, and increased consumer environmental awareness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.36 Billion |

| Market Forecast in 2033 | USD 25.76 Billion |

| Market Growth Rate 2025-2033 | 7.7% |

The sustainable tire market is increasingly witnessing growth in product adoption with significantly higher eco-friendly material content, driven by manufacturers' commitment to environmental goals, stricter regulatory standards, and growing consumer preference for green mobility solutions. For example, in March 2024, GRI introduced its next-generation sustainable specialty tires, including the GREEN XLR EARTH series and ULTIMATE GREEN XT, featuring up to 93.5% sustainable material content. The launch, held at The GREEN IMPACT 2024 event in Sri Lanka, showcased GRI's dedication to sustainability and innovation in the specialty tire industry.

Governments and industry associations in the U.S. are increasingly prioritizing legislation that promotes tire innovation, road safety, and environmental stewardship. Modernizing existing regulations encourages manufacturers to develop sustainable tire technologies, addressing environmental issues and aligning the tire sector with broader sustainability goals and evolving consumer preferences for eco-friendly products. For instance, in February 2024, the U.S. Tire Manufacturers Association (USTMA) announced its legislative priorities for 2024, focusing on policies to enhance road safety, promote tire innovation, and support environmental stewardship. The association emphasized the need for modernizing regulations to foster innovation and address environmental challenges within the tire manufacturing sector.

Sustainable Tire Market Trends:

Growth in Circular Tire Recycling Initiatives

Collaboration among industry leaders, research organizations, and government authorities is intensifying, aiming to accelerate the adoption of circular tire recycling practices. Such cooperation highlights the urgency of advancing sustainable recycling markets, reducing tire waste, enhancing resource efficiency, and fostering innovation to align the industry with increasingly stringent environmental policies and consumer expectations. For instance, in May 2024, the U.S. Tire Manufacturers Association (USTMA) and the Scrap Tire Research and Education Foundation announced the 2024 Tire Recycling Conference. The event aimed to unite industry leaders and government officials to accelerate growth in sustainable, circular tire recycling markets across the United States.

Advancements in Airless Tire Technologies

Innovations in puncture-free, airless tire solutions are gaining momentum, enabling vehicles to operate safely at higher speeds and loads. These developments reduce maintenance needs and enhance safety, significantly benefiting autonomous and electric vehicles. The industry increasingly embraces airless designs to meet sustainability targets by lowering tire waste and extending product lifespans. In March 2025, Bridgestone and Michelin announced advancements in puncture-free tire technology, developing airless tires capable of supporting vehicles at higher speeds and weights. These innovations aim to enhance safety and reduce maintenance costs, particularly benefiting autonomous vehicles by eliminating the risk of punctures.

Increased Cross-Border Collaboration in Tire Waste Management

Efforts to sustainably manage scrap tires are accelerating through enhanced international collaboration among environmental agencies, governments, and industry stakeholders. Initiatives involving targeted grants, coordinated cleanup programs, and circular disposal strategies underscore a collective focus on minimizing environmental impacts, promoting resource efficiency, and driving the adoption of best practices in sustainable tire waste management globally. In February 2024, the U.S. Environmental Protection Agency (EPA) hosted a webinar titled "Circular Strategies for the Sustainable Management of Scrap Tires." The session connected various initiatives across borders to address scrap tire management, highlighting grants and cleanup efforts aimed at promoting sustainable practices in tire disposal.

Sustainable Tire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sustainable tire market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type and vehicle type.

Analysis by Material Type:

- Natural Rubber

- Natural Rubber

- Synthetic Rubber

- Recycled Rubber

- Sustainable Carbon Black

- Others

- Bio-based Oils

- Recycled Polyester and Nylon

- Lignin

In 2024, natural rubber led the market by material type, with 47.5% of the market share, primarily due to its renewable origin, biodegradability, and superior performance attributes, including elasticity and durability. Its widespread adoption results from increased demand for eco-friendly materials, driven by consumer preferences for sustainable products, regulatory support encouraging renewable resources, and manufacturers' ongoing efforts to reduce the environmental footprint of tire production.

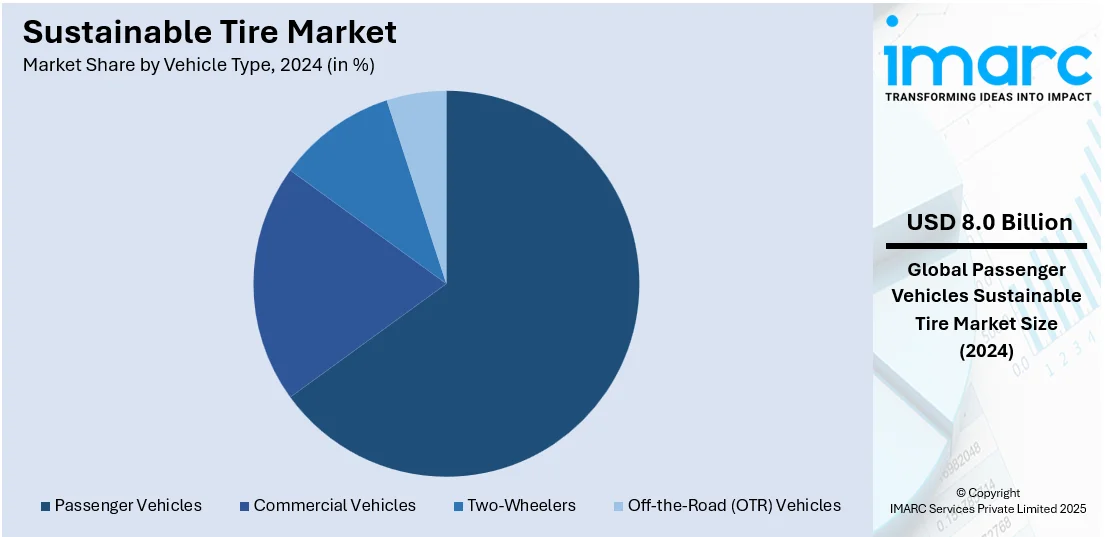

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Off-the-Road (OTR) Vehicles

In 2024, passenger vehicles led the market by vehicle type, with 64.6% of the market share. This growth is driven by increasing consumer demand for fuel-efficient, eco-friendly vehicles, stringent emission regulations, and the rising adoption of electric vehicles. Automakers are prioritizing sustainable materials in tire production to meet environmental goals and appeal to environmentally conscious buyers.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific led the market by region, holding 40.7% of the market share. Asia Pacific dominates the market due to rapid industrialization, expanding automotive production, and rising demand for eco-friendly vehicles. Government regulations promoting sustainability, increasing electric vehicle adoption, and the presence of major tire manufacturers further contributed to the region's leadership in the market.

Key Regional Takeaways:

United States Sustainable Tire Market Analysis

In 2024, the United States accounted for 86.7% of the market share in North America. The shift toward eco-conscious operations is gaining momentum in the tire distribution sector. Companies are increasingly investing in facilities powered by renewable energy, incorporating solar panels and energy-efficient systems to minimize environmental impact. This approach aligns with broader sustainability goals, focusing on reducing carbon footprints and promoting responsible business practices. With operations set to launch in the coming years, these initiatives underscore the growing commitment to environmentally friendly logistics within the tire industry. In September 2024, Continental announced plans to build its first fully owned tire distribution center in Texas. The facility would incorporate renewable energy sources like solar panels and adopt energy-efficient technologies. As part of the company's commitment to reducing its carbon footprint, these efforts align with its broader goals for environmental responsibility in the tire industry. This initiative supports the sustainable tire market by promoting eco-friendly operations. The facility is expected to commence operations in 2026.

Europe Sustainable Tire Market Analysis

The sustainable tire market in Europe is increasingly embracing sustainable practices by incorporating renewable and recycled materials in production. Companies are also introducing advanced digital monitoring technologies to extend tire lifespan and enhance performance. These initiatives aim to reduce environmental impact, align with carbon neutrality goals, and promote responsible resource use. With a focus on minimizing waste and optimizing product efficiency, the sector is making significant strides toward environmentally conscious mobility solutions. In June 2024, Pirelli highlighted its commitment to sustainability at Tire Cologne 2024, showcasing innovations that reduce environmental impact. The company presented tires made with high percentages of renewable and recycled materials, aligning with its carbon neutrality goals. Additionally, Pirelli demonstrated advancements in digital monitoring technologies to enhance tire longevity and performance. These efforts reflect the company's focus on minimizing resource consumption and promoting sustainable mobility in the tire industry.

Asia Pacific Sustainable Tire Market Analysis

In Asia Pacific, companies are increasingly adopting circular economy practices by obtaining certifications for sustainable manufacturing. The focus is on using renewable and recycled materials, reducing carbon footprints, and promoting responsible sourcing. This shift supports eco-friendly mobility solutions, aligning with global goals for carbon neutrality and resource conservation in the automotive sector. In February 2025, Bridgestone earned ISCC PLUS Certification for its Taiwan and Vietnam plants, enhancing its role in the sustainable tire market. The certification supports Bridgestone’s goal of using 100% sustainable materials by 2050. This achievement strengthens its commitment to circular economy initiatives, providing eco-friendly solutions and contributing to a greener mobility ecosystem across the Asia Pacific region.

Latin America Sustainable Tire Market Analysis

The agricultural sector in Latin America is embracing eco-friendly tire solutions with a focus on reducing environmental impact. Tires made from recycled and bio-based materials improve fuel efficiency, reduce carbon emissions, and enhance performance. This shift supports both electric and traditional machinery, contributing to more sustainable and resource-efficient farming practices. In April 2024, Trelleborg Tires introduced its most sustainable tire, TM1 ECO POWER, at Agrishow 2024 in Brazil. Made with 65% recycled and bio-based materials, it offers 47% lower rolling resistance and improved traction. Designed for electric and traditional tractors, it enhances efficiency, supporting sustainable agriculture and reducing environmental impact.

Middle East Sustainable Tire Market Analysis

Companies in the Middle East are forming long-term partnerships to drive eco-friendly tire production. With support from government funds and technology licensing, these collaborations promote the use of sustainable materials and efficient manufacturing processes. This shift accelerates the growth of greener solutions in the automotive sector, particularly in emerging markets. In March 2024, Blatco entered a strategic partnership with Kumho and Misong Tech to advance sustainable tire production in Saudi Arabia. Supported by the Saudi Public Investment Fund, the collaboration involves a 20-year technology license agreement. This initiative aims to enhance eco-friendly manufacturing practices, contributing to the region’s growing sustainable tire market.

Africa Sustainable Tire Market Analysis

The mining industry in Africa is adopting eco-friendly initiatives to minimize environmental impact. Programs focused on tire retreading and repair extend product life, reduce raw material consumption, and lower carbon emissions. These efforts align with broader sustainability goals, promoting resource efficiency and reducing the environmental footprint of mining operations. In June 2024, Kal Tire’s Mining Tire Group introduced the Maple Program in Africa, helping mining companies reduce carbon emissions and save resources through tire retreading and repairs. Certified under a maple leaf rating, the initiative encourages sustainability in mining operations by extending tire life, reducing raw material use, and lowering CO2 emissions.

Competitive Landscape:

The sustainable tire market is experiencing significant growth, driven by recent product launches, strategic partnerships, and advancements in research and development. Manufacturers are increasingly introducing eco-friendly tires made from renewable and recycled materials, aiming to reduce environmental impact and enhance performance. Collaborations between tire companies and automotive manufacturers are becoming common, focusing on integrating sustainable tires into new vehicle models. Government initiatives and funding are also propelling the adoption of green technologies in tire production. Overall, the emphasis on sustainability is fostering innovation and reshaping industry practices.

The report provides a comprehensive analysis of the competitive landscape in the sustainable tire market with detailed profiles of all major companies, including:

- Evonik Industries AG

- Solvay

- Cabot Corporation

- Birla Carbon

- Orion

- GRP LTD

- Genan Holding A/S

- Lehigh Technologies, Inc.

- Groupe Michelin

- Bridgestone

- Continental AG

- Pirelli

- Hankook Tire

- Toyo Tire

Latest News and Developments:

- February 2025: Connecticut's Environment Committee advanced legislation requiring tire retailers to establish drop-off points for used tires. This initiative aims to curb illegal tire dumping and promote recycling efforts within the state. By facilitating proper disposal, the measure seeks to enhance environmental sustainability and reduce waste. The proposed bill mandates that tire dealers provide accessible collection sites for consumers to return their used tires responsibly.

- February 2025: LANXESS introduced Vulkanox HS Scopeblue, a sustainable rubber additive made from over 55% renewable raw materials. This antioxidant effectively shields tires from oxygen and heat, enhancing their lifespan. Produced at an ISCC PLUS-certified facility in Germany, it offers a carbon footprint more than 30% lower than traditional versions. Tire manufacturers can seamlessly integrate this additive without altering existing production processes.

- January 2025: Solvay and Hankook signed a memorandum of understanding to develop circular silica for tire production utilizing bio-based and waste materials. This collaboration merges Solvay's expertise in silica with Hankook's manufacturing capabilities to promote sustainable tire manufacturing. The initiative aims to enhance tire performance while advancing environmental responsibility in the automotive industry.

- September 2024: Liberty Tire Recycling released its 2023 ESG Report, highlighting significant sustainability achievements. The company recycled over 1.5 million metric tons of material, diverting nearly 80% of collected tires from landfills and advancing toward its zero waste by 2030 goal. Energy efficiency measures and fleet optimization reduced their carbon footprint. Additionally, Liberty reported a 62% decrease in OSHA recordable incidents since 2010 and engaged in over 500 community cleanup events.

- May 2024: The U.S. Tire Manufacturers Association (USTMA) launched the Tire Recycling Foundation, aiming to recycle 100% of end-of-life tires into circular, sustainable markets. The foundation set ambitious research initiatives with fundraising targets of USD 300,000 in 2025 and USD 2-3 Million in 2026 to support sustainable tire recycling solutions.

Sustainable Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Off-the-Road (OTR) Vehicles |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sustainable tire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sustainable tire market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sustainable tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sustainable tire market was valued at USD 12.36 Billion in 2024.

The sustainable tire market is projected to exhibit a CAGR of 7.7% during 2025-2033, reaching a value of USD 25.76 Billion by 2033

Key factors driving the sustainable tire market include increasing environmental concerns, stringent government regulations on emissions, growing adoption of electric vehicles, advancements in eco-friendly materials, and consumer preference for fuel-efficient, durable, and recyclable tires.

Asia Pacific currently dominates the sustainable tire market, accounting for a share of 40.7% in 2024. Robust automotive production, rapid urbanization, and rising electric vehicle adoption drive Asia Pacific's dominance in the sustainable tire market. Government policies promoting sustainability, increasing consumer awareness, and investments in eco-friendly tire technologies further support the region's market dominance.

Some of the major players in the sustainable tire market include Evonik Industries AG, Solvay, Cabot Corporation, Birla Carbon, Orion, GRP LTD, Genan Holding A/S, Lehigh Technologies, Inc., Groupe Michelin, Bridgestone, Continental AG, Pirelli, Hankook Tire, Toyo Tire, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)