Surimi Market Size, Share, Trends and Forecast by Packaging, Source, Distribution Channel, and Region, 2025-2033

Surimi Market Size and Share:

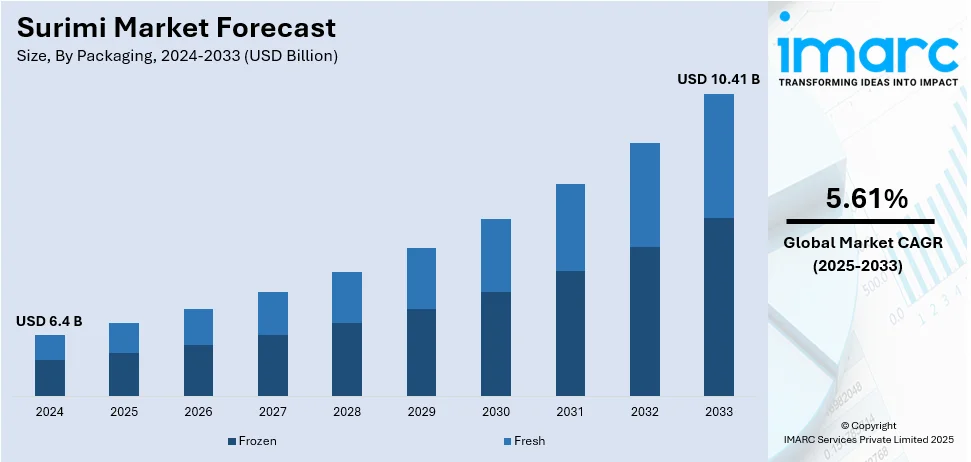

The global surimi market size was valued at USD 6.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.41 Billion by 2033, exhibiting a CAGR of 5.61% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 63.0% in 2024. The rising demand for seafood across the globe, increasing consumer awareness regarding various product health benefits, and the recent development of advanced production methods represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.4 Billion |

|

Market Forecast in 2033

|

USD 10.41 Billion |

| Market Growth Rate (2025-2033) | 5.61% |

Major drivers for the global surimi industry lie in consumer demand for high protein, convenient, and cost-effective food. The surimi market is further driven by rising health consciousness and seafood-based preferences. Its versatility in different food purposes, mainly involving imitation ready-to-eat foods, seafood, and snacks, is broadening its consumer base in multiple regions. Moreover, strides in production methodologies and new product launches, primarily encompassing plant-derived surimi, are opening up wider markets. In addition to this, the escalating emphasis on environmentally friendly methods and sustainable sourcing also fosters the market growth significantly, especially in nations with more stringent environmental policies and heightening customer requirement for responsibly sourced products.

The United States has been exhibiting a crucial role in the global surimi industry, mainly propelled by an elevated requirement for seafood-based products and protein-abundant, convenient substitutes. Surimi is comprehensively utilized in snacks, prepared foods, and imitation seafood, especially in the foodservice segment. The industry is also bolstered by heightening customer appeal for sustainable, healthy, and reduced-calorie food options. Key players in the U.S. focus on innovation, introducing diverse surimi products and plant-based alternatives. Additionally, strict food safety regulations and a well-established processing infrastructure support the growth of surimi consumption across the country, with a strong emphasis on quality and sustainability. For instance, in December 2024, Kyokuyo Co., Ltd. announced the completion of its production plant in the U.S. The facility will be dedicated to surimi and will aim to cater to the specific customers’ demand in the nation

Surimi Market Trends:

Growing demand for processed and convenience food products

As modern consumers' lives are becoming increasingly hectic, there is a growing trend for quick and easy-to-make meals. For instance, approximately 70 percent of the American diet consists of processed foods. Surimi-based items, such as imitation crab and fish sticks, are frequently pre-cooked and need no preparation, making them ideal for consumers seeking quick lunch options. Surimi is utilized in a wide variety of ready to eat (RTE) and ready to cook (RTC) items that fall neatly under the convenience meal category. These goods meet the expectations of consumers who desire nutritious and flavorful meals without having to spend a lot of time cooking, which is driving the demand for surimi. Surimi-based goods are growing in popularity as the worldwide packaged food industry is expanding, because of its long shelf life and ease of storing. Their versatility in meals like sushi, salads, and sandwiches is making them staples in households looking for variety in their quick meals.

Health benefits and nutritional value

Surimi is high in protein yet low in fat and calories, making it an appealing choice for health-conscious consumers. For instance, 60% Americans revealed that the content they explore via social media related to food and nutrition has prompted healthier lifestyle. Surimi, an enticing alternative to traditional meats and shellfish, is becoming increasingly popular as individuals are embracing high-protein and low-fat diets for weight management and muscle maintenance. This is especially crucial currently, as people are becoming more aware about the benefits of balanced eating. As people are becoming more aware about the negative health consequences of processed and high-calorie meats, surimi provides a healthier option. It has the texture and flavor of seafood, such as crab, lobster, and shrimp, but contains fewer calories and cholesterol. This makes surimi an appealing alternative for people trying to minimize their intake of harmful fats and processed meals while maintaining taste.

Rising seafood prices

As the cost of popular seafood items like as crab, lobster, shrimp, and fish is rising owing to overfishing, scarcity, and environmental concerns, surimi is developing as a more economical alternative. For instance, the FAO Fish Price Index averaged 112.8 points in December 2024, reflecting a 5.2 percent increase (+5.5 points) from November 2024. Surimi, which has the texture and flavor of these more expensive seafood dishes, offers consumers an affordable alternative. This price advantage makes surimi very appealing to budget-conscious consumers and food service industries, particularly in areas where seafood is a dietary mainstay but is becoming expensive. Environmental challenges like overfishing, climate change, and harsher fishing laws are resulting in dwindling seafood stocks and higher seafood costs. Surimi is frequently created from underutilized fish species, such as Alaskan pollock or Pacific whiting, which are more abundant and sustainable.

Surimi Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Surimi market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging, source, and distribution channel.

Analysis by Packaging:

- Frozen

- Fresh

Frozen stand as the largest packaging in 2024, holding around 68.2% of the market, due to its extended shelf life, convenience, and ability to retain texture and nutritional value. The freezing process preserves the functional properties of surimi, making it ideal for long-term storage and global trade. Manufacturers prefer frozen surimi as it ensures consistent quality and facilitates large-scale production of value-added seafood products such as imitation crab, fish balls, and fish cakes. Foodservice providers and seafood processors widely use frozen surimi for its ease of handling and reduced spoilage risk. Additionally, advancements in freezing technologies, such as cryogenic and individually quick frozen (IQF) methods, enhance product stability and maintain freshness. Growing consumer demand for ready-to-cook seafood options further supports the segment’s expansion. The increasing global seafood trade and the need for efficient supply chain logistics reinforce the dominance of frozen packaging in the surimi market.

Analysis by Source:

- Tropical

- Alaska Pollock

- Pacific Whiting

- Silver Carp

- Others

Tropical leads the market with around 60.3% of market share in 2024, due to their year-round availability and suitability for processing. Species such as threadfin bream, croaker, and lizardfish are widely used for surimi production, offering high gel strength and desirable textural properties. Their abundance in Southeast Asia, India, and South America supports a stable and cost-effective supply chain. The use of tropical fish in surimi production enables manufacturers to meet growing demand while reducing dependency on traditional cold-water species such as Alaskan pollock. Additionally, technological advancements in processing techniques improve protein extraction efficiency, maximizing yield from tropical fish species. Sustainability concerns and efforts to utilize underutilized fish resources further drive the adoption of tropical species in surimi production. The segment’s growth is supported by increasing investments in fishery management and responsible sourcing practices to ensure long-term supply.

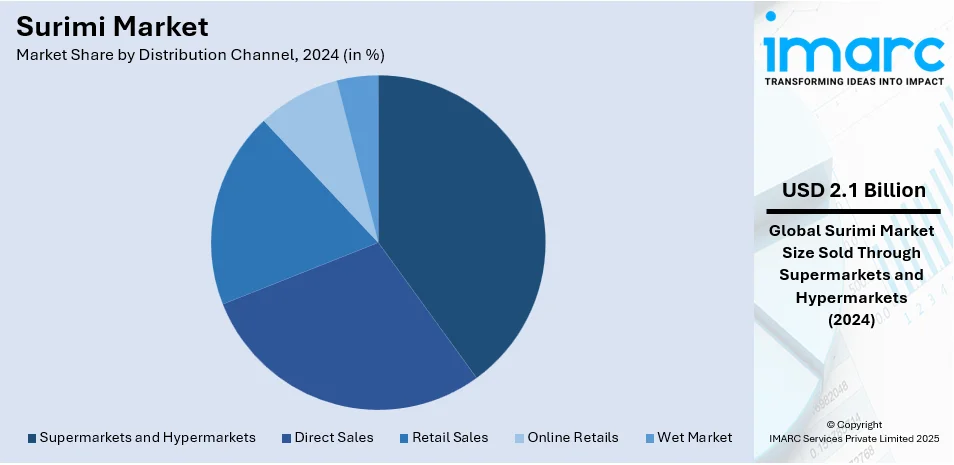

Analysis by Distribution Channel:

- Direct Sales

- Retail Sales

- Supermarkets and Hypermarkets

- Online Retails

- Wet Market

Supermarkets and hypermarkets lead the market with around 33.5% of market share in 2024, due to their extensive retail networks and ability to offer a wide range of surimi-based products. Consumers prefer these outlets for their accessibility, product variety, and assurance of quality. Retail chains leverage advanced cold storage infrastructure to maintain product freshness, ensuring consistent availability of frozen and refrigerated surimi products. Promotional strategies such as discounts, in-store sampling, and private-label offerings further enhance consumer engagement. The rise of organized retail in emerging markets strengthens the segment, as supermarkets expand into urban and semi-urban regions. Additionally, partnerships between surimi manufacturers and retail chains improve product visibility and market penetration. Growing consumer preference for convenient, protein-rich seafood options supports demand through this distribution channel, reinforcing its position as the leading segment in surimi retail sales.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 63.0%. In the Asia-Pacific region, surimi adoption has gained traction due to the increasing number of supermarkets and hypermarkets. According to reports, there are approximately 66,225 supermarkets in India as of January 23, 2025, which is an 3.88% increase from 2023. These retail outlets provide customers with easy availability of intensive variety of surimi products, contributing to increased consumption. The rise of organized retail in countries within the region has not only made surimi more accessible but also introduced a wider range of surimi-based innovations. As modern retail outlets expand and evolve, the range of surimi options, from traditional preparations to new flavor-infused varieties, grows. The focus on convenience, affordability, and the growing trend of ready-to-eat meals has bolstered surimi’s position in the retail space. Supermarkets and hypermarkets also play a critical role in driving consumer awareness through product placements and in-store promotions, which further amplify surimi’s visibility. The availability of surimi at these large-scale retail locations aligns with the region's growing appetite for value-added food products, making surimi a viable choice for many consumers.

Key Regional Takeaways:

United States Surimi Market Analysis

In 2024, United States accounted for 88.20% of the market share in North America. The surimi market is witnessing significant expansion, particularly impacted by the elevating need for processed and convenience food products. As per the National Health and Nutrition Examination Survey, consumption of ultra-processed food is responsible for 57% of energy intake on a daily basis amongst adults and 67% amongst youth demographic in the United States. In the United States, consumers' busy lifestyles have resulted in a heightened preference for quick, easy-to-prepare meals, leading to the growing popularity of surimi. This demand is further fuelled by consumers’ increasing awareness of surimi as a versatile and affordable seafood product. Surimi’s incorporation into a variety of food categories, including snacks, salads, and sandwiches, makes it an attractive option for consumers seeking convenience without compromising on taste or nutritional value. The rise of ready-to-eat meals and frozen foods has created an avenue for surimi to expand its presence, with its shelf stability and versatility making it a preferred ingredient. Furthermore, the wide availability of surimi-based products in supermarkets, alongside their cost-effective pricing, has accelerated adoption. The increasing reliance on processed foods and the demand for healthier alternatives are further enhancing surimi's market penetration.

North America Surimi Market Analysis

North America holds a notable share of the global surimi market, influenced by growing customer demand for convenient and high-protein food options. The region benefits from a well-established seafood processing industry and increasing adoption of surimi-based products in both retail and foodservice sectors. For instance, industry reports suggested that seafood industry across the U.S. will grow to USD 69.95 Billion by the year 2032. Surimi is particularly popular in prepared meals, seafood imitation products, and snacks, catering to diverse consumer preferences. In addition to this, rising awareness of the health benefits of seafood and protein-rich diets supports market growth. The U.S. and Canada are key contributors to this market, with a focus on innovation, product diversification, and meeting stringent food safety and quality standards. The expanding availability of plant-based surimi alternatives is also influencing market dynamics in North America.

Europe Surimi Market Analysis

In Europe, surimi adoption is experiencing growth due to the proliferation of online retail as well as e-commerce channels. According to industry reports, Europe has emerged as the third largest retail ecommerce industry worldwide, with total revenues of USD 631.9 Billion. 9.31% of the annual growth rate for revenues will result to USD 902.3 Billion in retail ecommerce sales across Europe by the year 2027. The easy availability as well as convenience of online shopping have made it easier for customers to explore and procure surimi products, contributing to a broader market reach. Online platforms offer detailed product information, reviews, and convenient delivery options, which attract consumers seeking quality seafood products without visiting physical stores. E-commerce also enables retailers to present a wide variety of surimi options, from ready-to-eat snacks to gourmet offerings, appealing to diverse customer preferences. This trend is especially significant with the reference to COVID-19 pandemic, where the reliance on online shopping has accelerated across many European nations. Furthermore, online sales platforms facilitate greater competition, which drives price competitiveness and offers consumers more affordable surimi options. The convenience of home delivery, coupled with growing consumer demand for healthier, ready-to-eat meals, has enhanced surimi’s popularity as an ideal food choice. Online shopping platforms, alongside an increasing awareness of surimi's versatility, are strengthening its market presence in Europe.

Latin America Surimi Market Analysis

In Latin America, surimi's growing popularity can be attributed to the rising disposable income, which enables more consumers to access and afford a variety of food products, including surimi. According to reports, Latin America's total disposable income is anticipated to elevate by nearly 60% from 2021 to the year 2040. As income levels rise, there is a noticeable shift in consumption patterns, with more consumers opting for processed and convenience foods like surimi. This change in purchasing behavior is further amplified by an increasing preference for nutritious yet affordable seafood alternatives. As a result, surimi has gained traction due to its cost-effectiveness compared to other seafood options. The growing ability of the middle class to purchase value-added food products, alongside the increased awareness of surimi’s health benefits, has positively influenced the demand for surimi. This trend is expected to continue, with surimi becoming a more common household food item.

Middle East and Africa Surimi Market Analysis

In the Middle East and Africa, surimi adoption is driven by the growing tourism industry. As more international visitors flock to the region, the demand for diverse culinary experiences has resulted to an elevation in the availability of seafood-based dishes, including surimi. For instance, Dubai hosted 14.96 Million overnight visitors during January-October 2024, marking an 8% elevation compared to the same period in 2023, highlighting a strong growth in tourism. Tourists, often seeking familiar, accessible, and convenient food options, help drive the popularity of surimi, which is known for its versatility and ease of preparation. Additionally, the hospitality sector's increasing incorporation of surimi in hotel menus and restaurants caters to international tastes and preferences. The growing tourism sector has, therefore, indirectly contributed to the rise of surimi consumption, positioning it as an appealing product in the food and beverage industry.

Competitive Landscape:

The competitive landscape is highlighted by the robust establishment of crucial players currently emphasizing on product enhancements, tactical collaborations, and geographic expansion. Major firms dominate the market by emphasizing on the development of diverse surimi-based products to cater to varying consumer preferences, including plant-based alternatives. Additionally, competitive strategies involve improving supply chain efficiency, enhancing production capabilities, and adhering to stringent food safety standards. Moreover, the market is also witnessing increased investments in sustainable fishing practices, addressing growing environmental concerns while maintaining product quality and consumer trust. Besides this, new governmental bills and policies are also steering the competition by fostering increase in company sales and revenue. For instance, in February 2025, seafood specialized firms Waterbase, Apex Frozen Food, and Avanti Feeds stocks elevated by 8.4% post Budget 2025 proposed by the government of India, with nation planning to lower basic custom duty on surimi to 5% that was earlier 30%.

The report provides a comprehensive analysis of the competitive landscape in the surimi market with detailed profiles of all major companies, including:

- American Seafoods Group

- Apitoon Group

- Aquamar Inc (Lm Foods LLC)

- Gadre Marine Pvt. Ltd.

- Glacier Fish Company LLC

- Ocean Food Company Ltd.

- OceanFood Sales Ltd.

- Pacific Seafood Group

- Russian Fishery Company LLC

- Seaprimexco Vietnam

- Thong Siek Global

- Trident Seafoods Corporation

- Viciunai Group

Latest News and Developments:

- September 2024: Viciunai Group has launched a new surimi product, "Big Stick," into the UK retail market, now available in Asda and ALDI stores. The 60g surimi sticks, initially sold at ALDI's "Food To Go" stands, cater to the growing demand for convenient snacks in English-speaking countries. This innovative product is designed for quick lunches, joining other grab-and-go items like sandwiches and salads. Viciunai's market expertise enabled the creation of this tailored product to meet evolving consumer needs.

- June 2024: Japan’s Suzuhiro Kamaboko has launched a premium surimi powder targeting upscale Asian restaurants. The product achieves a gel strength of 600-800 by simply adding water and stirring for one to two minutes. This innovation offers a high-quality, convenient alternative to traditional surimi. Suzuhiro aims to enhance texture and efficiency in premium seafood dishes.

- March 2024: Aquamar® unveiled new heat-and-eat shellfish innovations at Seafood Expo North America 2024, including offerings inspired by traditional Italian and Spanish dishes. These easy-to-prepare, refrigerated products, like Steamed Mussels with Tomato and Garlic, expand Aquamar’s portfolio of surimi and seafood solutions. Attendees can preview these innovations at Aquamar's booth and sample them at the Wave Makers' Zone on March 11.

- March 2024: Japan's Maruha Nichiro, the prominent global seafood company, announced acquisition of a 10% stake in Kibun Foods, a surimi producer, with investment JPY 2.8 Billion. This acquisition aims to foster joint development of new surimi-based products. The strategic move reflects Maruha Nichiro's focus on expanding its seafood portfolio. Kibun Foods is known for its expertise in surimi production, enhancing the partnership.

- July 2024: Russia has announced plans to triple its surimi production by 2028, aiming for 163,000 tons, up from 47,000 tons in 2023. This ambitious growth is part of Russia's strategy to boost its seafood industry. The expansion aims to meet rising domestic and international demand for surimi. The increase in production is expected to strengthen Russia's position in the global surimi market.

Surimi Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Frozen, Fresh |

| Sources Covered | Tropical, Alaska Pollock, Pacific Whiting, Silver Carp, Others |

| Distribution Channels Covered | Direct Sales, Retail Sales, Supermarkets and Hypermarkets, Online Retails, Wet Market |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Seafoods Group, Apitoon Group, Aquamar Inc (Lm Foods LLC), Gadre Marine Pvt. Ltd., Glacier Fish Company LLC, Ocean Food Company Ltd., OceanFood Sales Ltd., Pacific Seafood Group, Russian Fishery Company LLC, Seaprimexco Vietnam, Thong Siek Global, Trident Seafoods Corporation, Viciunai Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the surimi market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global surimi market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the surimi industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surimi market was valued at USD 6.4 Billion in 2024.

IMARC estimates the surimi market to reach USD 10.41 Billion by 2033, exhibiting a CAGR of 5.61% during 2025-2033.

Key factors driving the market encompass heightening need for protein-rich, convenient food products, amplified health consciousness, and the notable increase popularity of plant-based and seafood substitutes. In addition, surimi’s adaptability in processing, cost-efficiency, and prolonged shelf life facilitates the comprehensive utilization across global markets.

Asia Pacific currently dominates the surimi market, accounting for a share exceeding 63.0%. This dominance is fueled by robust seafood consumption culture, well-established processing infrastructure, and elevated requirement for surimi-based products in nations such as China, Japan, and South Korea.

Some of the major players in the surimi market include American Seafoods Group, Apitoon Group, Aquamar Inc (Lm Foods LLC), Gadre Marine Pvt. Ltd., Glacier Fish Company LLC, Ocean Food Company Ltd., OceanFood Sales Ltd., Pacific Seafood Group, Russian Fishery Company LLC, Seaprimexco Vietnam, Thong Siek Global, Trident Seafoods Corporation, Viciunai Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)