Surgical Drainage Devices Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

Surgical Drainage Devices Market Size and Trends:

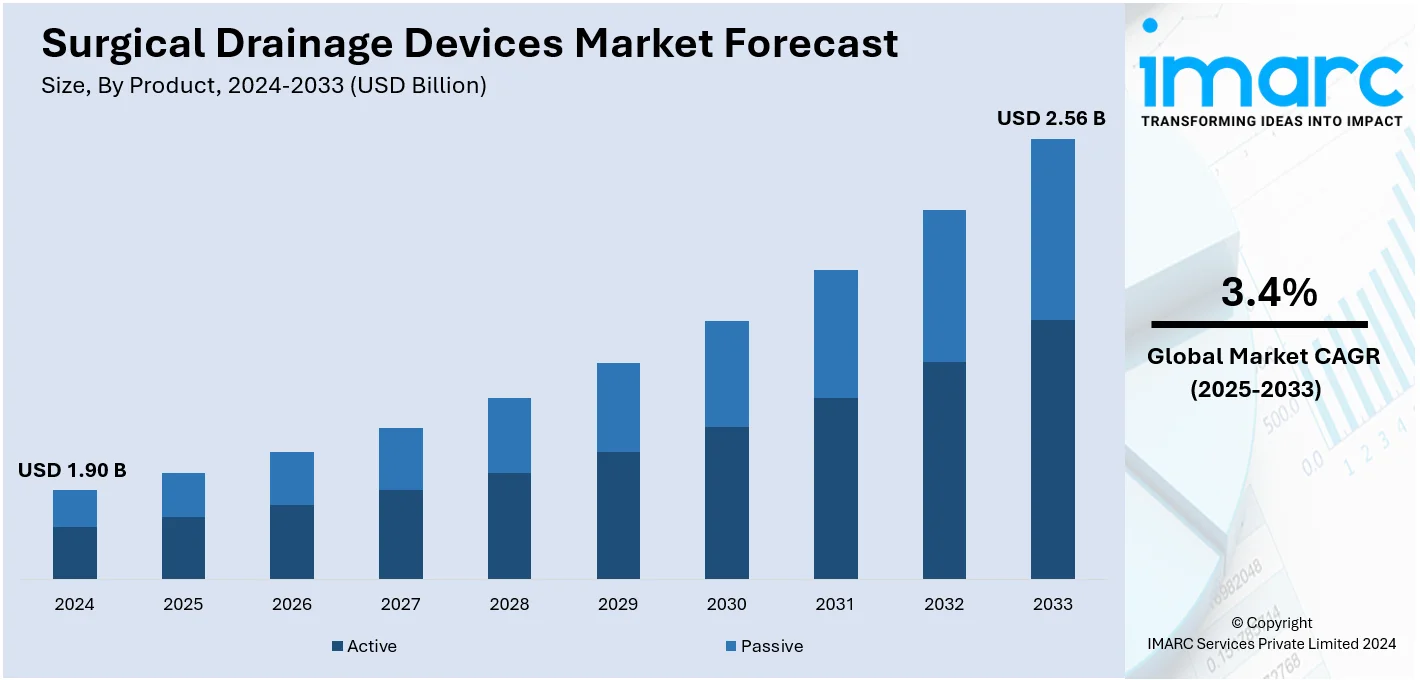

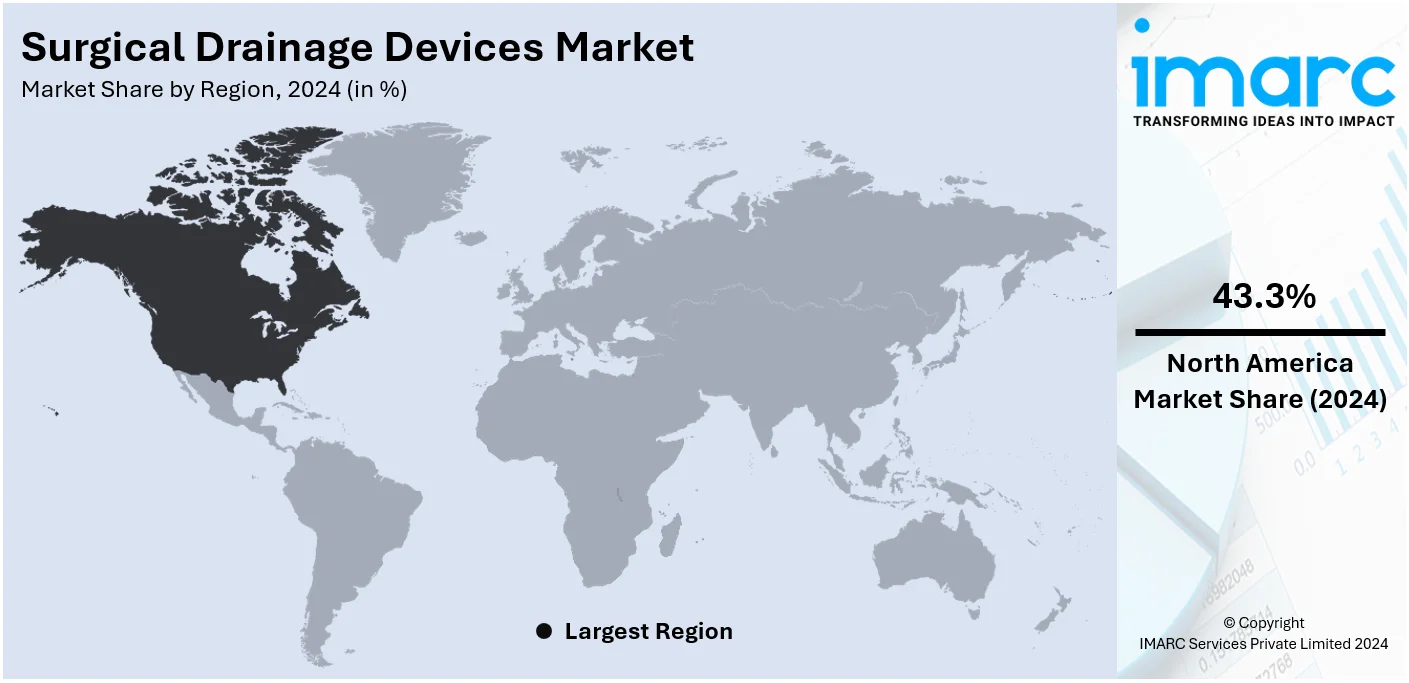

The global surgical drainage devices market size was valued at USD 1.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.56 Billion by 2033, exhibiting a CAGR of 3.4% from 2025-2033. North America currently dominates the market, holding a market share of over 43.3% in 2024. The growing number of procedures related to the chest, breast, abdominal, lymph node, and thyroid is boosting the surgical drainage devices market share in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.90 Billion |

|

Market Forecast in 2033

|

USD 2.56 Billion |

| Market Growth Rate 2025-2033 | 3.4% |

The global surgical drainage devices market is expanding due to the increasing incidence of chronic diseases and a higher volume of surgeries being performed globally. Improvements in healthcare systems, especially in developing countries, have enhanced access to surgical treatments, driving the need for reliable drainage solutions. Furthermore, the rising elderly population, which often requires surgical interventions for age-related health conditions, plays a significant role in the market's growth. Technological advancements in drainage systems, including the development of innovative, minimally invasive (MI) devices, are enhancing patient outcomes and driving adoption. Furthermore, heightened awareness about post-operative care and the critical role of drainage devices in preventing complications, such as infections and fluid accumulation, is fueling the surgical drainage devices market growth.

The United States is emerging as a key market, with 75.70% of the total share, driven by an increasing number of surgical procedures and a rising prevalence of chronic diseases. The market's growth is also fueled by the aging population, which results in a greater demand for surgeries that require drainage devices. Moreover, progress in medical technology and rising healthcare investments further drive the expansion of the market. The U.S. healthcare expenditure grew by 9.7% in 2020, enhancing the development of new healthcare facilities and the adoption of advanced surgical equipment. Together, these factors contribute to the growing demand for surgical drainage devices in the United States.

Which Factors are Propelling Surgical Drainage Devices Demand?

The World Health Organization (WHO) estimates that the population aged 60 and older will double by 2050. This significant demographic shift has resulted in a growing prevalence of age-related health issues, such as neurological disorders, vision impairments, and cardiovascular diseases. Consequently, there has been a notable rise in the demand for surgical procedures globally. Currently, approximately 310 million surgical procedures are performed annually, with this number anticipated to grow further. The rising volume of surgeries naturally elevates the demand for surgical drainage devices. The rising number of surgical procedures can also be attributed to the growing prevalence of lifestyle factors such as alcohol consumption and smoking. These habits are closely linked to various health complications, including organ damage, cancer, and cardiovascular diseases, which often necessitate surgical intervention. WHO reports that alcohol consumption globally accounts for 26%, while smoking is at 22.3%. These habits have led to a surge in cancer-related surgeries, many of which require surgical drainage devices, thereby boosting market growth. Additionally, the increasing global preference for minimally invasive surgeries (MIS) has significantly influenced the rise in surgical procedures. MIS techniques are favored for their benefits, including reduced recovery times, minimal scarring, and lower risk of complications, making them an attractive option for both patients and healthcare providers. Since surgical drainage devices are integral to such surgeries, their demand continues to rise. Additionally, medical tourism is expanding in countries like India, Brazil, Turkey, and Malaysia, where surgeries are offered at significantly lower costs under professional medical care. Patients from the United States and Europe often travel to these countries for affordable procedures. For instance, a laparoscopic surgery in India costs between $500 and $1,100, compared to $5,000 to $10,000 in the United States. This growing trend is anticipated to further fuel the expansion of the surgical drainage devices market in these regions, as the demand for effective post-surgical care solutions continues to rise.

Surgical Drainage Devices Market Trends:

Advancements in Minimally Invasive Surgical Procedures

Technological progress in minimally invasive surgery (MIS) has driven the development of surgical drainage devices that reduce patient trauma. In addition, these devices are now more efficient at facilitating fluid drainage without the need for large incisions, resulting in faster recovery times, less pain, and a reduced risk of complications. For instance, in May 2024, the Thopaz+ digital chest drainage system by Medela highlighted ongoing improvements in cardiothoracic surgery, where digital systems have transformed post-operative management. This is positively influencing the surgical drainage devices market share.

Increasing Demand for Patient-Specific Drainage Solutions

The growing focus on personalized medicine has driven innovation in patient-specific surgical drainage devices. Tailored drainage solutions help accommodate individual anatomical variations and specific conditions, optimizing post-operative outcomes while reducing discomfort and ensuring more effective and accurate fluid management. For instance, in April 2024, IIT Roorkee partnered with UnivLabs Technologies to develop biodegradable ureteral stents for urology. This innovation in surgical drainage devices aims to reduce complications like infections and eliminate the need for follow-up surgeries, marking a significant advancement in patient care and medical technology. This is escalating the surgical drainage devices market demand.

Innovation in Reducing Post-Surgical Complications

Surgical drainage devices are continually evolving to minimize the risk of post-surgical complications, such as infections and fluid retention. In contrast, improved materials and designs now enhance sterility, drainage efficiency, and ease of use, helping prevent common issues like leakage and reducing the need for additional interventions or surgeries. For instance, in February 2024, FUJIFILM India launched the ALOKA ARIETTA 850, a cutting-edge endoscopic ultrasound system, at Fortis Hospital, Bengaluru, India. This technology advances minimally invasive procedures like bile duct drainage and pseudocyst management, thereby improving patient care in gastrointestinal surgeries and therapies and expanding the surgical drainage devices market share.

Surgical Drainage Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global surgical drainage devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use.

Analysis by Product:

- Active

- Passive

As per the surgical drainage devices market trends, in 2024, the active segment has nearly an 79.8% share over the whole market share. The dominance of the active segment is due to the fact that active drainage systems are more effective in managing post-operative fluid accumulation and minimizing complications like infections. Active devices contain a suction mechanism with which fluid is precisely removed. Patient outcomes are better when compared to passive devices. Other drivers of widespread adoption include the development of portable and automated drainage systems, which offer greater convenience to both healthcare providers and patients. The increased use of complex surgeries and heightened awareness of effective post-operative care also contribute to the dominance of the active segment in the global market for surgical drainage devices.

Analysis by Application:

- Cardio-Thoracic Surgeries

- Neurosurgery Procedures

- Abdominal Surgery

- Orthopedics

- Others

In 2024, cardio-thoracic surgeries are expected to capture the largest share of the surgical drainage devices market, representing around 26.7%. This leadership is driven by the high prevalence of cardiovascular and thoracic conditions requiring surgical interventions, such as coronary artery bypass grafting, heart valve replacement, and lung resections. Surgical drainage devices are critical in these procedures to prevent fluid buildup, control bleeding, and minimize post-operative complications like infections and pleural effusion. The increasing adoption of advanced drainage systems tailored for cardio-thoracic applications, coupled with a rise in the aging population prone to such conditions, is creating a positive surgical drainage devices market outlook. Additionally, ongoing advancements in minimally invasive cardio-thoracic surgeries enhance the utilization of drainage devices, solidifying their market dominance in this segment.

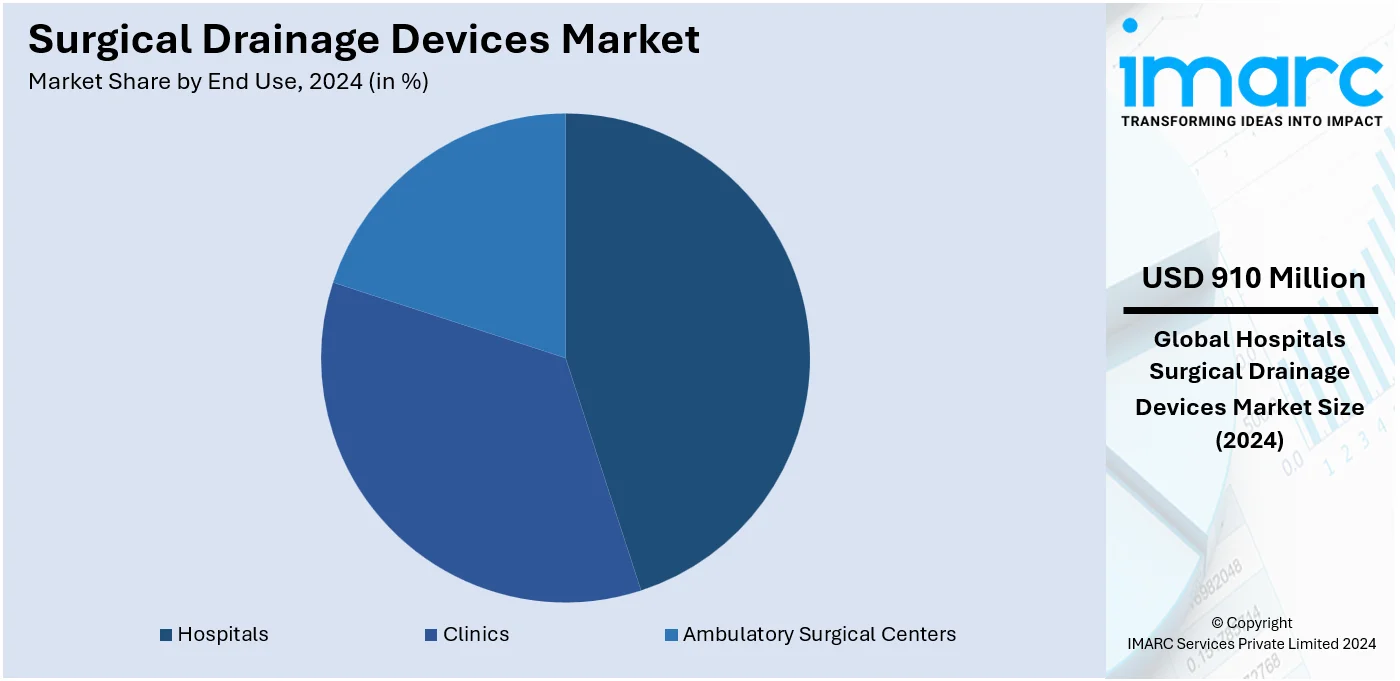

Analysis by End Use:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

In 2024, hospitals have the largest market share of approximately 47.9% of the total surgical drainage devices market. This significant share is primarily driven by the high volume of surgeries performed in hospitals. The scope varies from general surgeries to cardio-thoracic and orthopedic interventions. The high-end medical equipment and expertise make hospitals the primary destination for post-operative care related to surgical drainage. In addition to the broad applicability of these devices, their use in facilities that are available with ICU services and specific recovery services has provided much support. Growing healthcare expenditures and upgrading infrastructure of hospitals across developing nations further promote high-tech drainage systems. Moreover, a dominant trend is also experienced in terms of hospitals end usage, leading them to occupy a majority market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the surgical drainage devices market forecast, in 2024, North America is seen to be dominating the global market for surgical drainage devices, taking up more than 43.3% of the market share. This dominance can be attributed to the region's advanced healthcare infrastructure, high volumes of surgical procedures, and substantial healthcare spending. Additionally, the rising prevalence of chronic conditions like cardiovascular diseases and cancer, along with an aging population, fuels the demand for surgical treatments and the corresponding need for drainage devices. In addition, the massive penetration of state-of-the-art technologies and minimally invasive practices improve the use of high-end drainage systems. Favorable reimbursement policies and the presence of leading market players in the U.S. and Canada also contribute to regional growth. Ongoing advancements in medical research and development further reinforce North America's status as the largest market.

Key Regional Takeaways:

United States Surgical Drainage Devices Market Analysis

Advancements in the U.S. surgical drainage devices market is seen in the light of increased surgical procedures and innovation in medical technology. A research article states that nearly 40 to 50 million surgical procedures take place in the U.S. every year, which fuels demand for effective drainage systems. Growing adoption of advanced post-operative care devices and better reimbursement policies have also added impetus to market growth. Medtronic and B. are the two major players. Braun Medical leads the market with its innovation in minimally invasive devices. The U.S. medical device manufacturing industry is also expanding, thereby underlining robust production capabilities for surgical drainage systems. Government initiatives to improve access and quality of healthcare also fuel market expansion, while increased awareness of post-surgical complications ensures constant demand for drainage devices specific to particular surgical needs.

Europe Surgical Drainage Devices Market Analysis

The European market for surgical drainage devices is rapidly increasing because Europe has an ageing population and increased cases of chronic diseases. According to Eurostat, 21.3% of Europe's population was over 65 in 2023, which matches a higher population seeking surgical treatment. Germany, the UK, and France remain at the helm of the surgical market, majorly influenced by health infrastructure spending and advancements within the drainage category. As reported by an industry report, Germany topped the list of healthcare spending among EU countries in 2022 with Euro 489 billion (USD 522 billion), followed by France at Euro 314 billion (USD 335 billion), with innovation in medical devices. Strong regulatory standards within Europe guarantee a high-quality and reliable drainage system, thus upholding market confidence. Some of the key companies are ConvaTec and Coloplast, both of which have the objective of developing products that are not only user-friendly but also economical. The collaboration among hospitals and medical device manufacturers brings the advanced surgical drainage technologies to their doorstep much sooner.

Asia Pacific Surgical Drainage Devices Market Analysis

The Asia Pacific region is experiencing rapid growth in surgical drainage devices, led by increased health care expenditure and rising surgical demands. HealthAffairs.org reported that in 2023, China spent USD 4.9 trillion on health care. The country remains committed to building its medical infrastructure. India is also in a phase of significant growth for surgical interventions as it allocated health care spending worth USD 10.9 billion for 2024-25. Sustained growth of surgical procedure volumes in Japan and other Asian nations enhances demand for the product. Regional partnership between domestic producers and foreign organizations helps develop locally relevant drainage equipment tailored to the country's health requirements. The initiative of China under "Healthy China 2030" facilitates accessibility to the best surgical technologies around the world and makes Asia-Pacific the potential leader in the global market of surgical drainage equipment.

Latin America Surgical Drainage Devices Market Analysis

The Latin American surgical drainage devices market is growing continuously, mainly with the increase in surgical interventions and improvements in health care. In 2020, industrial reports indicate that there were more than 16.6 million procedures performed in Colombia and Mexico, while Brazil continues to grow: oncological surgeries experienced an annual rise of about 4.4% between 2016 and 2021. These results reflect a gradual increase in surgical drainage systems requirement in the area. Government-backed healthcare reforms and the increased private investments in healthcare add to the market growth. The largest economy in the region, Brazil, invested USD 161 billion in healthcare in 2022 in upgrading hospitals and surgical equipment, as per reports. Cardinal Health and Teleflex are riding the wave and expanding their footprints in the region to tap into the growing need for advanced drainage solutions.

Middle East and Africa Surgical Drainage Devices Market Analysis

The market for surgical drainage devices in the Middle East and Africa is on the rise, influenced by increasing healthcare investment and the growing incidence of chronic diseases that require surgical intervention. The International Trade Administration estimated that in 2022, the expenditure on healthcare would be around USD 36.8 billion in Saudi Arabia, with a focus on developing state-of-the-art medical facilities, including sophisticated drainage systems. The largest market share holder in the African region is South Africa, and government and private initiatives are tackling surgical site infection rates. Other countries like the UAE and Egypt are also encouraging medical tourism and fueling demand for innovative drainage solutions. Companies such as Johnson & Johnson and Stryker expand their footprint by capitalizing on emerging opportunities in the region and international partnerships make high-quality devices more accessible. Economic challenges, therefore, remain steady in growing the market.

Competitive Landscape:

The global surgical drainage devices market is highly competitive with several leading companies vying to gain more market share through innovation and strategic initiatives. The key companies in the market are driven by their vast product portfolios, extensive global reach, and high R&D investments. These companies focus on developing advanced, minimally invasive drainage systems to meet evolving patient needs and improve surgical outcomes. Mergers, acquisitions, and partnering are common strategies for obtaining better market positions and access new technologies. In addition, the increasing demand from emerging markets has led companies to increase regional presence and strengthen distribution networks. Entrants and smaller firms contribute by introducing low-cost and innovative solutions, raising the competition pace.

The report provides a comprehensive analysis of the competitive landscape in the surgical drainage devices market with detailed profiles of all major companies, including:

- Acelity L.P. Inc. (3M Company)

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Cardinal Health Inc.

- Cook Group Incorporated

- Johnson & Johnson

- Medela AG

- Medtronic plc

- Smith & Nephew plc

- Stryker Corporation

- Teleflex Incorporated

Latest News and Developments:

- June 2024: B. Braun Interventional Systems introduced the ACCEL All-Purpose and Biliary Drainage Catheters, featuring TrueGlide Hydrophilic Coating. They are designed to promote patient comfort by improving fluid drainage and smooth percutaneous insertion.

- May 2024: The Thopaz+ digital chest drainage system by Medela highlighted ongoing improvements in cardiothoracic surgery, where digital systems have transformed post-operative management.

- April 2024: IIT Roorkee partnered with UnivLabs Technologies to develop biodegradable ureteral stents for urology. This innovation in surgical drainage devices aims to reduce complications like infections and eliminate the need for follow-up surgeries.

- February 2024: FUJIFILM India launched the ALOKA ARIETTA 850, a cutting-edge endoscopic ultrasound system, at Fortis Hospital, Bengaluru, India.

Surgical Drainage Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Active, Passive |

| Applications Covered | Cardio-Thoracic Surgeries, Neurosurgery Procedures, Abdominal Surgery, Orthopedics, Others |

| End Uses Covered | Hospitals, Clinics, Ambulatory Surgical Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acelity L.P. Inc. (3M Company), B. Braun Melsungen AG, Becton Dickinson and Company, Cardinal Health Inc., Cook Group Incorporated, Johnson & Johnson, Medela AG, Medtronic plc, Smith & Nephew plc, Stryker Corporation, Teleflex Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the surgical drainage devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global surgical drainage devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the surgical drainage devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Surgical drainage devices are medical instruments used to remove fluids, blood, or pus from a surgical site or body cavity to prevent infection and promote healing. These devices are typically employed after surgeries involving chest, abdominal, or orthopedic procedures, ensuring effective post-operative care and reducing complications.

The surgical drainage devices market was valued at USD 1.90 Billion in 2024.

IMARC Group estimates the market to reach USD 2.56 Billion by 2033, exhibiting a CAGR of 3.4% from 2025-2033.

The key factors driving market growth include the rising number of surgical procedures, especially in areas such as chest, breast, and abdominal surgeries, along with the increasing adoption of minimally invasive technologies and advanced drainage solutions for improved patient outcomes.

In 2024, the active segment represented the largest segment by product, driven by the efficiency and effectiveness of active drainage systems in preventing complications like infections and fluid accumulation.

Cardio-thoracic surgeries lead the market by application owing to the high number of procedures requiring drainage, such as heart surgeries and lung resections, which involve the removal of fluids and prevent infections.

The hospital segment is the leading segment by end use, driven by the high volume of surgeries performed in hospitals, along with access to advanced technologies and specialized post-operative care.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global surgical drainage devices market include Acelity L.P. Inc. (3M Company), B. Braun Melsungen AG, Becton Dickinson and Company, Cardinal Health Inc., Cook Group Incorporated, Johnson & Johnson, Medela AG, Medtronic plc, Smith & Nephew plc, Stryker Corporation, Teleflex Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)